Analyst Viewpoint

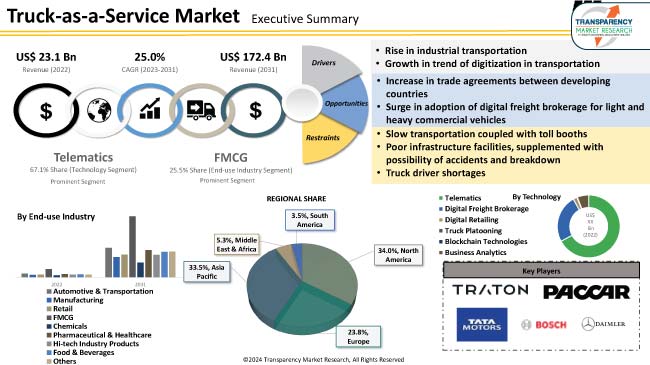

Rise in industrial transportation and growth in trend of digitization in transportation are propelling the truck-as-a-service market size. Increase in trade agreements between developing countries and surge in adoption of digital freight brokerage for light and heavy commercial vehicles are also boosting the demand for truck-as-a-service solutions.

Truck-as-a-service is cost-effective for door-to-door service owing to improved road infrastructure. The level of use and even ownership of business assets are impacted by the digitization employed in freight brokerage. Vendors are partnering with other companies to expand their market reach, accelerate fleet electrification, and offer cost-efficient solutions.

Truck-as-a-service deals with the transportation of goods in consumer goods, chemicals, and industrial sectors through roadways. It includes various solutions and services such as telematics, blockchain, insurance, connectivity, infotainment, leasing & financing, and scheduled maintenance.

Digital transformation in the trucking sector is providing a platform for various stakeholders to build service and solution-based revenue models. The integration of Machine Learning (ML) and Artificial Intelligence (AI) is projecting new opportunities to explore solutions to challenges such as road safety, traffic control, and other elements of transportation. Furthermore, the increasing integration of telematics devices is providing consumers with services beyond tracking, from prognostics to asset management to driver behavior management and beyond.

The popularity of less-than-load (LTL) systems around a decade ago was majorly due to an increased interest in large distribution center models, wherein trucks entered from one side and left from the other side. However, the last couple of years witnessed the revival of the less-than-load sector, primarily driven by the boom of the e-commerce sector and significant penetration of automation in factories across the globe. This, in turn, is boosting the truck-as-a-service market value.

Evolving manufacturing models coupled with high demand from the LTL side is projected to boost LTL transportation in the near future. Demand for efficient LTL transportation is estimated to be driven by a rise in the number of smaller shipments due to the expansion of the e-commerce sector. The truck-as-a-service market landscape is expected to gain significant momentum as major companies, including Uber, Amazon, Google, and Tesla, have started investing resources in this field. The expanding market landscape is estimated to move the spotlight toward the basics of freight trucking such as human interactions to monitor freight trucking systems and the role of freight trucks in the development of economies.

Rise in penetration of technology in transportation services, including dynamic routing, trailer tracking, and collision mitigation technology, helps monitor the real time data. Such technologies aid drivers to avoid unnecessary roads and conserve fuel. Automatic optimization means that routes are flexible and take weather, traffic, or other real-world obstacles into account. Thus, rise in digitalization in transportation is augmenting the truck-as-service market revenue.

Surge in the demand for e-tailing trade and business transactions is due to independent access to online trade portals for sellers or buyers, and ever-inflating costs of products available in retail shops. Favorable government regulations, rise in regional GDPs, and per capita expenditure are other factors augmenting the e-tailing market across the globe, which increase the utilization of truck transportation.

According to the latest truck-as-a-service market trends, the telematics technology segment held major share in 2022. Telematics allows OEMs to save time and money, as well as reduces the complexity of software development and Quality Assurance (QA) processes. The preference for OTA updates is growing amongst automakers as it enables automakers to exchange data between multiple electronic control units through OEM’s cloud server using flexible and modular computing platforms as well as maintain data integrity through telematics gateways.

According to the latest truck-as-a-service market analysis, the FMCG end-use industry segment held major share in 2022. The Fast Moving Consumer Goods (FMCG) sector is dependent on timely and reliable transportation of perishable goods to consumers and retailers. Truck-as-a-services provide solutions for complexity in logistics management, vehicle capacity usage, fleet management, and temperature management for better transport of goods.

According to the latest truck-as-a-service industry insights, North America accounted for major share in 2022, followed by Asia Pacific. Rapid expansion of small and medium-scale industries, vast geographical expanse, well-developed transportation infrastructure, and presence of strong technology providers are driving the market dynamics of the region. Furthermore, expansion in logistics, warehouse, and manufacturing industries is contributing to the truck-as-a-service market share in North America.

Rise in population is fueling the consumption and supply of food and other goods. Furthermore, economic expansion in China, Japan, and India has led to a surge in transport volumes of commodities. These factors are contributing to the truck-as-a-service market growth in Asia Pacific.

The global industry is fragmented, with a higher number of manufacturers controlling the market share. Major companies are adopting newer technologies to expand their service portfolio. Robert Bosch GmbH, Continental AG, Daimler AG, Fleet Advantage LLC, Toyota Group, Inseego Corporation, Masternaut Limited, Microlise Group Ltd., Mix Telematics International (PTY) Ltd., OCTO Telematics Ltd., Omnitracs, LLC, PACCAR Inc., PTC, Inc., Tata Motors, TomTom Telematics BV, Traton Group, Trimble Inc., Trukky, Verizon, Volkswagen Commercial Vehicles, AB Volvo, ZF Friedrichshafen AG, and Zonar Systems, Inc. are key players operating in the truck-as-a-service market.

Each of these players has been profiled in the truck-as-a-service market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 (Base Year) | US$ 23.1 Bn |

| Market Forecast Value in 2031 | US$ 172.4 Bn |

| Growth Rate (CAGR) | 25.0% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, industry trend analysis, etc. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 23.1 Bn in 2022

It is projected to advance at a CAGR of 25.0% from 2023 to 2031

It is estimated to reach US$ 172.4 Bn by the end of 2031

Rise in industrial transportation and growth in trend of digitization in transportation

The telematics segment held the largest share in 2022

North America is a highly lucrative region

Robert Bosch GmbH, Continental AG, Daimler AG, Fleet Advantage LLC, Toyota Group, Inseego Corporation, Masternaut Limited, Microlise Group Ltd., Mix Telematics International (PTY) Ltd., OCTO Telematics Ltd., Omnitracs, LLC, PACCAR Inc., PTC, Inc., Tata Motors, TomTom Telematics BV, Traton Group, Trimble Inc., Trukky, Verizon, Volkswagen Commercial Vehicles, AB Volvo, ZF Friedrichshafen AG, and Zonar Systems, Inc.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding Buying Process of Customers

1.2.4. Preferred Sales & Marketing Strategy

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Definition / Scope / Limitations

2.2. Macro-Economic Factors

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.6.1. Paradigm Shift from Product to Services

2.6.2. Evolution of New Business Models

2.6.3. Evolution of New Business Models

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. Impact Factors: Truck-as-a-Service

3.1. Emergence of Electric Commercial Vehicles

4. Global Truck-as-a-Service Market, By Technology

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By Technology

4.2.1. Telematics

4.2.1.1. Over-the-Air (OTA) Updates

4.2.2. Digital Freight Brokerage

4.2.3. Digital Retailing

4.2.3.1. Omnichannel Retailing

4.2.4. Truck Platooning

4.2.4.1. Autonomous Driving Technologies

4.2.5. Blockchain Technologies

4.2.6. Business Analytics

5. Global Truck-as-a-Service Market, By End-use Industry

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By End-use Industry

5.2.1. Automotive & Transportation

5.2.2. Manufacturing

5.2.3. Retail

5.2.4. FMCG

5.2.5. Chemicals

5.2.6. Pharmaceutical & Healthcare

5.2.7. Hi-tech Industry Products

5.2.8. Food & Beverages

5.2.9. Others

6. Global Truck-as-a-Service Market, By Region

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By Region

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East & Africa

6.2.5. South America

7. North America Truck-as-a-Service Market

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. North America Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By Technology

7.2.1. Telematics

7.2.1.1. Over-the-Air (OTA) Updates

7.2.2. Digital Freight Brokerage

7.2.3. Digital Retailing

7.2.3.1. Omnichannel Retailing

7.2.4. Truck Platooning

7.2.4.1. Autonomous Driving Technologies

7.2.5. Blockchain Technologies

7.2.6. Business Analytics

7.3. North America Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By End-use Industry

7.3.1. Automotive & Transportation

7.3.2. Manufacturing

7.3.3. Retail

7.3.4. FMCG

7.3.5. Chemicals

7.3.6. Pharmaceutical & Healthcare

7.3.7. Hi-tech Industry Products

7.3.8. Food & Beverages

7.3.9. Others

7.4. Key Country Analysis – North America Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031

7.4.1. U.S.

7.4.2. Canada

7.4.3. Mexico

8. Europe Truck-as-a-Service Market

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Europe Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By Technology

8.2.1. Telematics

8.2.1.1. Over-the-Air (OTA) Updates

8.2.2. Digital Freight Brokerage

8.2.3. Digital Retailing

8.2.3.1. Omnichannel Retailing

8.2.4. Truck Platooning

8.2.4.1. Autonomous Driving Technologies

8.2.5. Blockchain Technologies

8.2.6. Business Analytics

8.3. Europe Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By End-use Industry

8.3.1. Automotive & Transportation

8.3.2. Manufacturing

8.3.3. Retail

8.3.4. FMCG

8.3.5. Chemicals

8.3.6. Pharmaceutical & Healthcare

8.3.7. Hi-tech Industry Products

8.3.8. Food & Beverages

8.3.9. Others

8.4. Key Country Analysis – Europe Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031

8.4.1. Germany

8.4.2. U.K.

8.4.3. France

8.4.4. Italy

8.4.5. Spain

8.4.6. Nordic Countries

8.4.7. Russia & CIS

8.4.8. Rest of Europe

9. Asia Pacific Truck-as-a-Service Market

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Asia Pacific Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By Technology

9.2.1. Telematics

9.2.1.1. Over-the-Air (OTA) Updates

9.2.2. Digital Freight Brokerage

9.2.3. Digital Retailing

9.2.3.1. Omnichannel Retailing

9.2.4. Truck Platooning

9.2.4.1. Autonomous Driving Technologies

9.2.5. Blockchain Technologies

9.2.6. Business Analytics

9.3. Asia Pacific Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By End-use Industry

9.3.1. Automotive & Transportation

9.3.2. Manufacturing

9.3.3. Retail

9.3.4. FMCG

9.3.5. Chemicals

9.3.6. Pharmaceutical & Healthcare

9.3.7. Hi-tech Industry Products

9.3.8. Food & Beverages

9.3.9. Others

9.4. Key Country Analysis – Asia Pacific Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031

9.4.1. China

9.4.2. India

9.4.3. Japan

9.4.4. ASEAN Countries

9.4.5. South Korea

9.4.6. ANZ

9.4.7. Rest of Asia Pacific

10. Middle East & Africa Truck-as-a-Service Market

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Middle East & Africa Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By Technology

10.2.1. Telematics

10.2.1.1. Over-the-Air (OTA) Updates

10.2.2. Digital Freight Brokerage

10.2.3. Digital Retailing

10.2.3.1. Omnichannel Retailing

10.2.4. Truck Platooning

10.2.4.1. Autonomous Driving Technologies

10.2.5. Blockchain Technologies

10.2.6. Business Analytics

10.3. Middle East & Africa Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By End-use Industry

10.3.1. Automotive & Transportation

10.3.2. Manufacturing

10.3.3. Retail

10.3.4. FMCG

10.3.5. Chemicals

10.3.6. Pharmaceutical & Healthcare

10.3.7. Hi-tech Industry Products

10.3.8. Food & Beverages

10.3.9. Others

10.4. Key Country Analysis – Middle East & Africa Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031

10.4.1. GCC

10.4.2. South Africa

10.4.3. Turkey

10.4.4. Rest of Middle East & Africa

11. South America Truck-as-a-Service Market

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. South America Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By Technology

11.2.1. Telematics

11.2.1.1. Over-the-Air (OTA) Updates

11.2.2. Digital Freight Brokerage

11.2.3. Digital Retailing

11.2.3.1. Omnichannel Retailing

11.2.4. Truck Platooning

11.2.4.1. Autonomous Driving Technologies

11.2.5. Blockchain Technologies

11.2.6. Business Analytics

11.3. South America Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031, By End-use Industry

11.3.1. Automotive & Transportation

11.3.2. Manufacturing

11.3.3. Retail

11.3.4. FMCG

11.3.5. Chemicals

11.3.6. Pharmaceutical & Healthcare

11.3.7. Hi-tech Industry Products

11.3.8. Food & Beverages

11.3.9. Others

11.4. Key Country Analysis – South America Truck-as-a-Service Market Size Analysis & Forecast, 2017-2031

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Competitive Landscape

12.1. Company Share Analysis/ Brand Share Analysis, 2022

12.2. Company Analysis for each player Company Overview, Company Footprints, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis

13. Company Profile/ Key Players

13.1. Robert Bosch GmbH

13.1.1. Company Overview

13.1.2. Company Footprints

13.1.3. Product Portfolio

13.1.4. Competitors & Customers

13.1.5. Subsidiaries & Parent Organization

13.1.6. Recent Developments

13.1.7. Financial Analysis

13.2. Continental AG

13.2.1. Company Overview

13.2.2. Company Footprints

13.2.3. Product Portfolio

13.2.4. Competitors & Customers

13.2.5. Subsidiaries & Parent Organization

13.2.6. Recent Developments

13.2.7. Financial Analysis

13.3. Daimler AG

13.3.1. Company Overview

13.3.2. Company Footprints

13.3.3. Product Portfolio

13.3.4. Competitors & Customers

13.3.5. Subsidiaries & Parent Organization

13.3.6. Recent Developments

13.3.7. Financial Analysis

13.4. Fleet Advantage LLC

13.4.1. Company Overview

13.4.2. Company Footprints

13.4.3. Product Portfolio

13.4.4. Competitors & Customers

13.4.5. Subsidiaries & Parent Organization

13.4.6. Recent Developments

13.4.7. Financial Analysis

13.5. Toyota Group

13.5.1. Company Overview

13.5.2. Company Footprints

13.5.3. Product Portfolio

13.5.4. Competitors & Customers

13.5.5. Subsidiaries & Parent Organization

13.5.6. Recent Developments

13.5.7. Financial Analysis

13.6. Inseego Corporation

13.6.1. Company Overview

13.6.2. Company Footprints

13.6.3. Product Portfolio

13.6.4. Competitors & Customers

13.6.5. Subsidiaries & Parent Organization

13.6.6. Recent Developments

13.6.7. Financial Analysis

13.7. Masternaut Limited

13.7.1. Company Overview

13.7.2. Company Footprints

13.7.3. Product Portfolio

13.7.4. Competitors & Customers

13.7.5. Subsidiaries & Parent Organization

13.7.6. Recent Developments

13.7.7. Financial Analysis

13.8. Microlise Group Ltd.

13.8.1. Company Overview

13.8.2. Company Footprints

13.8.3. Product Portfolio

13.8.4. Competitors & Customers

13.8.5. Subsidiaries & Parent Organization

13.8.6. Recent Developments

13.8.7. Financial Analysis

13.9. Mix Telematics International (PTY) Ltd.

13.9.1. Company Overview

13.9.2. Company Footprints

13.9.3. Product Portfolio

13.9.4. Competitors & Customers

13.9.5. Subsidiaries & Parent Organization

13.9.6. Recent Developments

13.9.7. Financial Analysis

13.10. OCTO Telematics Ltd.

13.10.1. Company Overview

13.10.2. Company Footprints

13.10.3. Product Portfolio

13.10.4. Competitors & Customers

13.10.5. Subsidiaries & Parent Organization

13.10.6. Recent Developments

13.10.7. Financial Analysis

13.11. Omnitracs, LLC

13.11.1. Company Overview

13.11.2. Company Footprints

13.11.3. Product Portfolio

13.11.4. Competitors & Customers

13.11.5. Subsidiaries & Parent Organization

13.11.6. Recent Developments

13.11.7. Financial Analysis

13.12. PACCAR Inc.

13.12.1. Company Overview

13.12.2. Company Footprints

13.12.3. Product Portfolio

13.12.4. Competitors & Customers

13.12.5. Subsidiaries & Parent Organization

13.12.6. Recent Developments

13.12.7. Financial Analysis

13.13. PTC, Inc.

13.13.1. Company Overview

13.13.2. Company Footprints

13.13.3. Product Portfolio

13.13.4. Competitors & Customers

13.13.5. Subsidiaries & Parent Organization

13.13.6. Recent Developments

13.13.7. Financial Analysis

13.14. Tata Motors

13.14.1. Company Overview

13.14.2. Company Footprints

13.14.3. Product Portfolio

13.14.4. Competitors & Customers

13.14.5. Subsidiaries & Parent Organization

13.14.6. Recent Developments

13.14.7. Financial Analysis

13.15. TomTom Telematics BV

13.15.1. Company Overview

13.15.2. Company Footprints

13.15.3. Product Portfolio

13.15.4. Competitors & Customers

13.15.5. Subsidiaries & Parent Organization

13.15.6. Recent Developments

13.15.7. Financial Analysis

13.16. Traton Group

13.16.1. Company Overview

13.16.2. Company Footprints

13.16.3. Product Portfolio

13.16.4. Competitors & Customers

13.16.5. Subsidiaries & Parent Organization

13.16.6. Recent Developments

13.16.7. Financial Analysis

13.17. Trimble Inc.

13.17.1. Company Overview

13.17.2. Company Footprints

13.17.3. Product Portfolio

13.17.4. Competitors & Customers

13.17.5. Subsidiaries & Parent Organization

13.17.6. Recent Developments

13.17.7. Financial Analysis

13.18. Trukky

13.18.1. Company Overview

13.18.2. Company Footprints

13.18.3. Product Portfolio

13.18.4. Competitors & Customers

13.18.5. Subsidiaries & Parent Organization

13.18.6. Recent Developments

13.18.7. Financial Analysis

13.19. Verizon

13.19.1. Company Overview

13.19.2. Company Footprints

13.19.3. Product Portfolio

13.19.4. Competitors & Customers

13.19.5. Subsidiaries & Parent Organization

13.19.6. Recent Developments

13.19.7. Financial Analysis

13.20. Volkswagen Commercial Vehicles

13.20.1. Company Overview

13.20.2. Company Footprints

13.20.3. Product Portfolio

13.20.4. Competitors & Customers

13.20.5. Subsidiaries & Parent Organization

13.20.6. Recent Developments

13.20.7. Financial Analysis

13.21. AB Volvo

13.21.1. Company Overview

13.21.2. Company Footprints

13.21.3. Product Portfolio

13.21.4. Competitors & Customers

13.21.5. Subsidiaries & Parent Organization

13.21.6. Recent Developments

13.21.7. Financial Analysis

13.22. ZF Friedrichshafen AG

13.22.1. Company Overview

13.22.2. Company Footprints

13.22.3. Product Portfolio

13.22.4. Competitors & Customers

13.22.5. Subsidiaries & Parent Organization

13.22.6. Recent Developments

13.22.7. Financial Analysis

13.23. Zonar Systems, Inc.

13.23.1. Company Overview

13.23.2. Company Footprints

13.23.3. Product Portfolio

13.23.4. Competitors & Customers

13.23.5. Subsidiaries & Parent Organization

13.23.6. Recent Developments

13.23.7. Financial Analysis

13.24. Other Key Players

13.24.1. Company Overview

13.24.2. Company Footprints

13.24.3. Product Portfolio

13.24.4. Competitors & Customers

13.24.5. Subsidiaries & Parent Organization

13.24.6. Recent Developments

13.24.7. Financial Analysis

List of Tables

Table 1: Global Truck-as-a-Service Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 2: Global Truck-as-a-Service Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 3: Global Truck-as-a-Service Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 4: North America Truck-as-a-Service Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 5: North America Truck-as-a-Service Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 6: North America Truck-as-a-Service Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 7: Europe Truck-as-a-Service Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 8: Europe Truck-as-a-Service Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 9: Europe Truck-as-a-Service Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 10: Asia Pacific Truck-as-a-Service Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 11: Asia Pacific Truck-as-a-Service Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 12: Asia Pacific Truck-as-a-Service Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 13: Middle East & Africa Truck-as-a-Service Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 14: Middle East & Africa Truck-as-a-Service Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 15: Middle East & Africa Truck-as-a-Service Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 16: South America Truck-as-a-Service Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 17: South America Truck-as-a-Service Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 18: South America Truck-as-a-Service Market Value (US$ Mn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Truck-as-a-Service Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 2: Global Truck-as-a-Service Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 3: Global Truck-as-a-Service Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Figure 4: Global Truck-as-a-Service Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2023-2031

Figure 5: Global Truck-as-a-Service Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 6: Global Truck-as-a-Service Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023-2031

Figure 7: North America Truck-as-a-Service Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 8: North America Truck-as-a-Service Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 9: North America Truck-as-a-Service Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Figure 10: North America Truck-as-a-Service Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2023-2031

Figure 11: North America Truck-as-a-Service Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 12: North America Truck-as-a-Service Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 13: Europe Truck-as-a-Service Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 14: Europe Truck-as-a-Service Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 15: Europe Truck-as-a-Service Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Figure 16: Europe Truck-as-a-Service Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2023-2031

Figure 17: Europe Truck-as-a-Service Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 18: Europe Truck-as-a-Service Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 19: Asia Pacific Truck-as-a-Service Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 20: Asia Pacific Truck-as-a-Service Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 21: Asia Pacific Truck-as-a-Service Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Figure 22: Asia Pacific Truck-as-a-Service Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2023-2031

Figure 23: Asia Pacific Truck-as-a-Service Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 24: Asia Pacific Truck-as-a-Service Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 25: Middle East & Africa Truck-as-a-Service Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 26: Middle East & Africa Truck-as-a-Service Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 27: Middle East & Africa Truck-as-a-Service Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Figure 28: Middle East & Africa Truck-as-a-Service Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2023-2031

Figure 29: Middle East & Africa Truck-as-a-Service Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 30: Middle East & Africa Truck-as-a-Service Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 31: South America Truck-as-a-Service Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 32: South America Truck-as-a-Service Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 33: South America Truck-as-a-Service Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Figure 34: South America Truck-as-a-Service Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2023-2031

Figure 35: South America Truck-as-a-Service Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 36: South America Truck-as-a-Service Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031