Analysts’ Viewpoint on Market Scenario

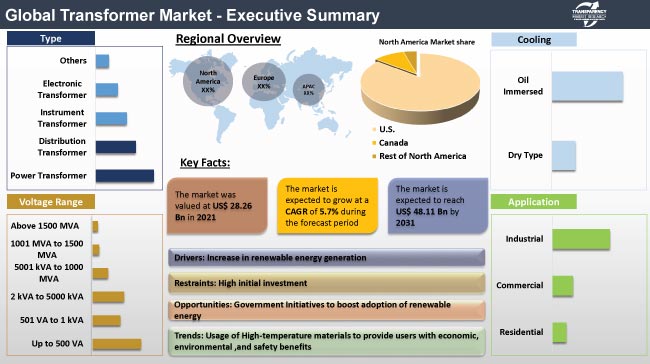

Rise in adoption of renewable energy and increase in demand for continuous and reliable electricity supply are driving the global transformer market size. Companies in the market are focusing on high-growth industries such as oil & gas, automotive & transportation, and metals & mining to expand their business post the peak of the COVID-19 pandemic.

Continuous technological innovations in electronic transformers are expected to fuel the market during the forecast period. Key players in the market are developing light weight and compact transformers with improved safety, increased capacity, and lower energy losses. They are also developing industry-specific transformers, such as arc furnace transformers and rectifier transformers, primarily to differentiate their products from competitors.

Transformer is a device that converts electric energy from one alternating current circuit to one or more other circuits by increasing (stepping up) or decreasing (stepping down) the voltage. Power transformers, distribution transformers, instrument transformers, and electronic transformers are some of the types of transformers available in the market. Transformers are used in various applications such as power generation, distribution, transmission, and usage. They are employed in various residential and industrial applications, primarily in distribution and regulation of power over long distances.

The operation principle of all types of transformers designed for different applications such as electromagnetic induction is the same, while their applications vary depending on system requirements. Novel approaches in technology are expected to drive the future of the transformer industry. These approaches include the usage of high-temperature materials to provide users with a variety of economic, environmental, and safety benefits.

Depletion of fossil fuels and rise in implementation of government regulations to promote the adoption of renewable energy are expected to propel the demand for transformer during the forecast period. Rise in power consumption and increase in public-private investment in the renewable energy sector are also contributing to market growth. In the renewable sector, transformer is used to convert direct current (DC) power generated by an energy-harvesting device to alternating current (AC) electricity for usage in homes, businesses, and electrical grid environments.

According to the International Energy Agency (IEA), the usage of renewable energy rose by 3% in 2020, while demand for all other fuels decreased. Solar PV and wind power are significant contributors to the demand for renewable energy. China alone accounted for nearly half of the global increase in renewable electricity, followed by the U.S., the EU, and India, in 2021. Renewable energy has been the fastest-growing energy source in the U.S. over the last few decades. In 2020, renewables accounted for about 20% of utility-scale electricity generation in the country, with hydropower (7.3%) and wind power (8.4%) constituting the majority of the share.

Rapid industrialization and urbanization is significantly contributing to the rise in demand for power in developing economies. Additionally, increase in infrastructure expenditure in Asia Pacific has led to a surge in energy consumption. According to the IEA, demand for electricity in Asia Pacific increased by approximately 8% in 2021, up from 2% in 2020. This rise in demand for energy was primarily driven by China and India; the two countries recorded an increase of 10% in 2021.

According to the National Energy Administration (NEA), total power consumed in China reached 8.31 trillion kilowatt-hours (kWh) in 2021. The figure represented 14.7% growth from that in 2019, bringing the two-year average rise to 7.1%. However, high initial investment is expected to restrain the global market.

In terms of type, the global transformer market has been segmented into power transformer, distribution transformer, instrument transformer, electronic transformer, and others. The power transformer segment contributed approximately 40% share of the global market in 2021, owing to the rise in adoption of renewable energy such as solar and wind power and increase in demand for micro-grid operations. Power transformer is primarily used in power generation and transmission to step up or step down voltage. It is employed in several industries including metal & mining and oil & gas.

Based on cooling, the global transformer market has been classified into dry type and oil immersed. The oil immersed segment held the largest share of nearly 67% of the global market 2021. Oil immersed transformer is used in power distribution and electrical substations. It has a higher standard of energy efficiency; as a result, it has a longer lifespan than the dry type.

The oil in oil immersed transformer acts as a cooling agent, keeping the machine's heat under control. When using an oil immersed transformer, the heat created by the coil and iron core is transported first to the insulating oil and then to the cooling medium. Siemens Energy is one of the key players providing oil immersed transformers. It offers FITformer Fluid-immersed Distribution Transformers for superior reliability, efficiency, and environmental performance.

Asia Pacific dominated the global transformer market in 2021, due to rapid industrialization in the region. The market in the region is also expected to record the fastest growth rate during the forecast period, owing to the substantial increase in demand for electricity in China, Japan, and India.

North America held the second largest share of nearly 31% of the global market in 2021. Growth of the market in the region can be ascribed to the presence of key players and early adoption of advanced technologies in the power industry. The U.S. constituted the largest share of the market in North America in 2021, led by the rise in investments in R&D of novel transformers in the country. Demand for transformer is higher in Middle East & Africa than that in South America; however, the market in South America is estimated to grow at a faster pace compared to that in Middle East & Africa.

The global transformer market is consolidated, with a small number of large-scale vendors controlling majority of the share. Key players in the transformer manufacturing industry are investing significantly in comprehensive research and development of new products. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by players. Eaton, GE, Hitachi Energy Ltd., HYUNDAI ELECTRIC & ENERGY SYSTEMS CO., LTD., Kirloskar Electric Company, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Schneider Electric, Siemens Energy, TDK Corporation, and Toshiba Energy Systems & Solutions Corporation are prominent entities operating in this market. The global transformer market report concludes with key insights in the large power transformers market, transformer monitoring systems (TMS) market, and distribution transformer market.

Each of these players has been profiled in the transformer market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 28.26 Bn |

|

Market Forecast Value in 2031 |

US$ 48.11 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 28.26 Bn in 2021.

The global market is expected to grow at a CAGR of 5.7% by 2031.

The market is expected to reach US$ 48.11 Bn by 2031.

The U.S. recorded approximately 24% share of the global transformer market in 2021.

The power transformer segment is expected to hold approximately 40% share of the global market during the forecast period.

Increase in generation of renewable energy and rise in demand for energy in developing economies.

Asia Pacific is a more lucrative region in the market.

Eaton, GE, Hitachi Energy Ltd., HYUNDAI ELECTRIC & ENERGY SYSTEMS CO., LTD., Kirloskar Electric Company, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Schneider Electric, Siemens Energy, TDK Corporation, and Toshiba Energy Systems & Solutions Corporation.

1. Preface

1.1. Market Introduction

1.2. Market and Segment Definitions

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Transformer Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Scenario

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Power Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Trend Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Transformer Market Analysis By Type

5.1. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Type, 2017–2031

5.1.1. Power Transformer

5.1.2. Distribution Transformer

5.1.3. Instrument Transformer

5.1.4. Electronic Transformer

5.1.5. Others

5.2. Market Attractiveness Analysis, By Type

6. Transformer Market Analysis By Voltage Range

6.1. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Voltage Range, 2017–2031

6.1.1. Up to 500 VA

6.1.2. 501 VA to 1 kVA

6.1.3. 2 kVA to 5000 kVA

6.1.4. 5001 kVA to 1000 MVA

6.1.5. 1001 MVA to 1500 MVA

6.1.6. Above 1500 MVA

6.2. Market Attractiveness Analysis, By Voltage Range

7. Transformer Market Analysis By Cooling

7.1. Transformer Market Size (US$ Bn) Analysis & Forecast, By Cooling, 2017–2031

7.1.1. Dry Type

7.1.2. Oil Immersed

7.2. Market Attractiveness Analysis, By Cooling

8. Transformer Market Analysis By Phase

8.1. Transformer Market Size (US$ Bn) Analysis & Forecast, By Phase, 2017–2031

8.1.1. Single Phase

8.1.2. Three Phase

8.2. Market Attractiveness Analysis, By Phase

9. Transformer Market Analysis By Application

9.1. Transformer Market Size (US$ Bn) Analysis & Forecast, By Application, 2017–2031

9.1.1. Residential

9.1.2. Commercial

9.1.3. Industrial

9.1.3.1. Automotive & Transportation

9.1.3.2. Oil & Gas

9.1.3.3. Aerospace & Defense

9.1.3.4. Metal & Mining

9.1.3.5. IT & Telecommunication

9.1.3.6. Chemicals

9.1.3.7. Others

9.2. Market Attractiveness Analysis, By Application

10. Transformer Market Analysis and Forecast, By Region

10.1. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Region, 2017–2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, By Region

11. North America Transformer Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Type, 2017–2031

11.3.1. Power Transformer

11.3.2. Distribution Transformer

11.3.3. Instrument Transformer

11.3.4. Electronic Transformer

11.3.5. Others

11.4. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Voltage Range, 2017–2031

11.4.1. Up to 500 VA

11.4.2. 501 VA to 1 kVA

11.4.3. 2 kVA to 5000 kVA

11.4.4. 5001 kVA to 1000 MVA

11.4.5. 1001 MVA to 1500 MVA

11.4.6. Above 1500 MVA

11.5. Transformer Market Size (US$ Bn) Analysis & Forecast, By Cooling, 2017–2031

11.5.1. Dry Type

11.5.2. Oil Immersed

11.6. Transformer Market Size (US$ Bn) Analysis & Forecast, By Phase, 2017–2031

11.6.1. Single Phase

11.6.2. Three Phase

11.7. Transformer Market Size (US$ Bn) Analysis & Forecast, By Application, 2017–2031

11.7.1. Residential

11.7.2. Commercial

11.7.3. Industrial

11.7.3.1. Automotive & Transportation

11.7.3.2. Oil & Gas

11.7.3.3. Aerospace & Defense

11.7.3.4. Metal & Mining

11.7.3.5. IT & Telecommunication

11.7.3.6. Chemicals

11.7.3.7. Others

11.8. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.8.1. The U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Market Attractiveness Analysis

11.9.1. By Type

11.9.2. By Voltage Range

11.9.3. By Cooling

11.9.4. By Phase

11.9.5. By Application

11.9.6. By Country/Sub-region

12. Europe Transformer Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Type, 2017–2031

12.3.1. Power Transformer

12.3.2. Distribution Transformer

12.3.3. Instrument Transformer

12.3.4. Electronic Transformer

12.3.5. Others

12.4. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Voltage Range, 2017–2031

12.4.1. Up to 500 VA

12.4.2. 501 VA to 1 kVA

12.4.3. 2 kVA to 5000 kVA

12.4.4. 5001 kVA to 1000 MVA

12.4.5. 1001 MVA to 1500 MVA

12.4.6. Above 1500 MVA

12.5. Transformer Market Size (US$ Bn) Analysis & Forecast, By Cooling, 2017–2031

12.5.1. Dry Type

12.5.2. Oil Immersed

12.6. Transformer Market Size (US$ Bn) Analysis & Forecast, By Phase, 2017–2031

12.6.1. Single Phase

12.6.2. Three Phase

12.7. Transformer Market Size (US$ Bn) Analysis & Forecast, By Application, 2017–2031

12.7.1. Residential

12.7.2. Commercial

12.7.3. Industrial

12.7.3.1. Automotive & Transportation

12.7.3.2. Oil & Gas

12.7.3.3. Aerospace & Defense

12.7.3.4. Metal & Mining

12.7.3.5. IT & Telecommunication

12.7.3.6. Chemicals

12.7.3.7. Others

12.8. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.8.1. The U.K.

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Market Attractiveness Analysis

12.9.1. By Type

12.9.2. By Voltage Range

12.9.3. By Cooling

12.9.4. By Phase

12.9.5. By Application

12.9.6. By Country/Sub-region

13. Asia Pacific Transformer Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Type, 2017–2031

13.3.1. Power Transformer

13.3.2. Distribution Transformer

13.3.3. Instrument Transformer

13.3.4. Electronic Transformer

13.3.5. Others

13.4. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Voltage Range, 2017–2031

13.4.1. Up to 500 VA

13.4.2. 501 VA to 1 kVA

13.4.3. 2 kVA to 5000 kVA

13.4.4. 5001 kVA to 1000 MVA

13.4.5. 1001 MVA to 1500 MVA

13.4.6. Above 1500 MVA

13.5. Transformer Market Size (US$ Bn) Analysis & Forecast, By Cooling, 2017–2031

13.5.1. Dry Type

13.5.2. Oil Immersed

13.6. Transformer Market Size (US$ Bn) Analysis & Forecast, By Phase, 2017–2031

13.6.1. Single Phase

13.6.2. Three Phase

13.7. Transformer Market Size (US$ Bn) Analysis & Forecast, By Application, 2017–2031

13.7.1. Residential

13.7.2. Commercial

13.7.3. Industrial

13.7.3.1. Automotive & Transportation

13.7.3.2. Oil & Gas

13.7.3.3. Aerospace & Defense

13.7.3.4. Metal & Mining

13.7.3.5. IT & Telecommunication

13.7.3.6. Chemicals

13.7.3.7. Others

13.8. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.8.1. China

13.8.2. Japan

13.8.3. India

13.8.4. South Korea

13.8.5. ASEAN

13.8.6. Rest of Asia Pacific

13.9. Market Attractiveness Analysis

13.9.1. By Type

13.9.2. By Voltage Range

13.9.3. By Cooling

13.9.4. By Phase

13.9.5. By Application

13.9.6. By Country/Sub-region

14. Middle East and Africa Transformer Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Type, 2017–2031

14.3.1. Power Transformer

14.3.2. Distribution Transformer

14.3.3. Instrument Transformer

14.3.4. Electronic Transformer

14.3.5. Others

14.4. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Voltage Range, 2017–2031

14.4.1. Up to 500 VA

14.4.2. 501 VA to 1 kVA

14.4.3. 2 kVA to 5000 kVA

14.4.4. 5001 kVA to 1000 MVA

14.4.5. 1001 MVA to 1500 MVA

14.4.6. Above 1500 MVA

14.5. Transformer Market Size (US$ Bn) Analysis & Forecast, By Cooling, 2017–2031

14.5.1. Dry Type

14.5.2. Oil Immersed

14.6. Transformer Market Size (US$ Bn) Analysis & Forecast, By Phase, 2017–2031

14.6.1. Single Phase

14.6.2. Three Phase

14.7. Transformer Market Size (US$ Bn) Analysis & Forecast, By Application, 2017–2031

14.7.1. Residential

14.7.2. Commercial

14.7.3. Industrial

14.7.3.1. Automotive & Transportation

14.7.3.2. Oil & Gas

14.7.3.3. Aerospace & Defense

14.7.3.4. Metal & Mining

14.7.3.5. IT & Telecommunication

14.7.3.6. Chemicals

14.7.3.7. Others

14.8. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East and Africa

14.9. Market Attractiveness Analysis

14.9.1. By Type

14.9.2. By Voltage Range

14.9.3. By Cooling

14.9.4. By Phase

14.9.5. By Application

14.9.6. By Country/Sub-region

15. South America Transformer Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Type, 2017–2031

15.3.1. Power Transformer

15.3.2. Distribution Transformer

15.3.3. Instrument Transformer

15.3.4. Electronic Transformer

15.3.5. Others

15.4. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Voltage Range, 2017–2031

15.4.1. Up to 500 VA

15.4.2. 501 VA to 1 kVA

15.4.3. 2 kVA to 5000 kVA

15.4.4. 5001 kVA to 1000 MVA

15.4.5. 1001 MVA to 1500 MVA

15.4.6. Above 1500 MVA

15.5. Transformer Market Size (US$ Bn) Analysis & Forecast, By Cooling, 2017–2031

15.5.1. Dry Type

15.5.2. Oil Immersed

15.6. Transformer Market Size (US$ Bn) Analysis & Forecast, By Phase, 2017–2031

15.6.1. Single Phase

15.6.2. Three Phase

15.7. Transformer Market Size (US$ Bn) Analysis & Forecast, By Application, 2017–2031

15.7.1. Residential

15.7.2. Commercial

15.7.3. Industrial

15.7.3.1. Automotive & Transportation

15.7.3.2. Oil & Gas

15.7.3.3. Aerospace & Defense

15.7.3.4. Metal & Mining

15.7.3.5. IT & Telecommunication

15.7.3.6. Chemicals

15.7.3.7. Others

15.8. Transformer Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Market Attractiveness Analysis

15.9.1. By Type

15.9.2. By Voltage Range

15.9.3. By Cooling

15.9.4. By Phase

15.9.5. By Application

15.9.6. By Country/Sub-region

16. Competition Assessment

16.1. Global Transformer Market Competition Matrix - a Dashboard View

16.1.1. Global Transformer Market Company Share Analysis, by Value (2021)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. Eaton

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. GE

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. Hitachi Energy Ltd.

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. HYUNDAI ELECTRIC & ENERGY SYSTEMS CO., LTD.

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. Kirloskar Electric Company

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. Mitsubishi Electric Corporation

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. Rockwell Automation, Inc.

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. Schneider Electric

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. Siemens Energy

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. TDK Corporation

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. Toshiba Energy Systems & Solutions Corporation

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

18. Recommendation

18.1. Opportunity Assessment

18.1.1. By Type

18.1.2. By Voltage Range

18.1.3. By Cooling

18.1.4. By Phase

18.1.5. By Application

18.1.6. By Region

List of Tables

Table 1: Global Transformer Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 2: Global Transformer Market Size & Forecast, By Type, Volume (Thousand Units), 2017-2031

Table 3: Global Transformer Market Size & Forecast, By Voltage Range, Value (US$ Bn), 2017-2031

Table 4: Global Transformer Market Size & Forecast, By Voltage Range, Volume (Thousand Units), 2017-2031

Table 5: Global Transformer Market Size & Forecast, By Cooling, Value (US$ Bn), 2017-2031

Table 6: Global Transformer Market Size & Forecast, By Phase, Value (US$ Bn), 2017-2031

Table 7: Global Transformer Market Size & Forecast, By Application, Value (US$ Bn), 2017-2031

Table 8: Global Transformer Market Size & Forecast, By Industrial, Value (US$ Bn), 2017-2031

Table 9: Global Transformer Market Size & Forecast, By Region, Value (US$ Bn), 2017-2031

Table 10: Global Transformer Market Size & Forecast, By Region, Volume (Thousand Units), 2017-2031

Table 11: North America Transformer Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 12: North America Transformer Market Size & Forecast, By Type, Volume (Thousand Units), 2017-2031

Table 13: North America Transformer Market Size & Forecast, By Voltage Range, Value (US$ Bn), 2017-2031

Table 14: North America Transformer Market Size & Forecast, By Voltage Range, Volume (Thousand Units), 2017-2031

Table 15: North America Transformer Market Size & Forecast, By Cooling, Value (US$ Bn), 2017-2031

Table 16: North America Transformer Market Size & Forecast, By Phase, Value (US$ Bn), 2017-2031

Table 17: North America Transformer Market Size & Forecast, By Application, Value (US$ Bn), 2017-2031

Table 18: North America Transformer Market Size & Forecast, By Industrial, Value (US$ Bn), 2017-2031

Table 19: North America Transformer Market Size & Forecast, By Country Value (US$ Bn), 2017-2031

Table 20: North America Transformer Market Size & Forecast, By Country Volume (Thousand Units), 2017-2031

Table 21: Europe Transformer Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 22: Europe Transformer Market Size & Forecast, By Type, Volume (Thousand Units), 2017-2031

Table 23: Europe Transformer Market Size & Forecast, By Voltage Range, Value (US$ Bn), 2017-2031

Table 24: Europe Transformer Market Size & Forecast, By Voltage Range, Volume (Thousand Units), 2017-2031

Table 25: Europe Transformer Market Size & Forecast, By Cooling, Value (US$ Bn), 2017-2031

Table 26: Europe Transformer Market Size & Forecast, By Phase, Value (US$ Bn), 2017-2031

Table 27: Europe Transformer Market Size & Forecast, By Application, Value (US$ Bn), 2017-2031

Table 28: Europe Transformer Market Size & Forecast, By Industrial, Value (US$ Bn), 2017-2031

Table 29: Europe Transformer Market Size & Forecast, By Country Value (US$ Bn), 2017-2031

Table 30: Europe Transformer Market Size & Forecast, By Country Volume (Thousand Units), 2017-2031

Table 31: Asia Pacific Transformer Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 32: Asia Pacific Transformer Market Size & Forecast, By Type, Volume (Thousand Units), 2017-2031

Table 33: Asia Pacific Transformer Market Size & Forecast, By Voltage Range, Value (US$ Bn), 2017-2031

Table 34: Asia Pacific Transformer Market Size & Forecast, By Voltage Range, Volume (Thousand Units), 2017-2031

Table 35: Asia Pacific Transformer Market Size & Forecast, By Cooling, Value (US$ Bn), 2017-2031

Table 36: Asia Pacific Transformer Market Size & Forecast, By Phase, Value (US$ Bn), 2017-2031

Table 37: Asia Pacific Transformer Market Size & Forecast, By Application, Value (US$ Bn), 2017-2031

Table 38: Asia Pacific Transformer Market Size & Forecast, By Industrial, Value (US$ Bn), 2017-2031

Table 39: Asia Pacific Transformer Market Size & Forecast, By Country Value (US$ Bn), 2017-2031

Table 40: Asia Pacific Transformer Market Size & Forecast, By Country Volume (Thousand Units), 2017-2031

Table 41: Middle East & Africa Transformer Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 42: Middle East & Africa Transformer Market Size & Forecast, By Type, Volume (Thousand Units), 2017-2031

Table 43: Middle East & Africa Transformer Market Size & Forecast, By Voltage Range, Value (US$ Bn), 2017-2031

Table 44: Middle East & Africa Transformer Market Size & Forecast, By Voltage Range, Volume (Thousand Units), 2017-2031

Table 45: Middle East & Africa Transformer Market Size & Forecast, By Cooling, Value (US$ Bn), 2017-2031

Table 46: Middle East & Africa Transformer Market Size & Forecast, By Phase, Value (US$ Bn), 2017-2031

Table 47: Middle East & Africa Transformer Market Size & Forecast, By Application, Value (US$ Bn), 2017-2031

Table 48: Middle East & Africa Transformer Market Size & Forecast, By Industrial, Value (US$ Bn), 2017-2031

Table 49: Middle East & Africa Transformer Market Size & Forecast, By Country Value (US$ Bn), 2017-2031

Table 50: Middle East & Africa Transformer Market Size & Forecast, By Country Volume (Thousand Units), 2017-2031

Table 51: South America Transformer Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 52: South America Transformer Market Size & Forecast, By Type, Volume (Thousand Units), 2017-2031

Table 53: South America Transformer Market Size & Forecast, By Voltage Range, Value (US$ Bn), 2017-2031

Table 54: South America Transformer Market Size & Forecast, By Voltage Range, Volume (Thousand Units), 2017-2031

Table 55: South America Transformer Market Size & Forecast, By Cooling, Value (US$ Bn), 2017-2031

Table 56: South America Transformer Market Size & Forecast, By Phase, Value (US$ Bn), 2017-2031

Table 57: South America Transformer Market Size & Forecast, By Application, Value (US$ Bn), 2017-2031

Table 58: South America Transformer Market Size & Forecast, By Industrial, Value (US$ Bn), 2017-2031

Table 59: South America Transformer Market Size & Forecast, By Country Value (US$ Bn), 2017-2031

Table 60: South America Transformer Market Size & Forecast, By Country Volume (Thousand Units), 2017-2031

List of Figures

Figure 01: Global Transformer Market Share Analysis, by Region

Figure 02:Global Transformer Price Trend Analysis (Average Price, Thousand US$)

Figure 03: Global Transformer Market, Value (US$ Bn), 2017-2031

Figure 04: Global Transformer Market, Volume (Thousand Units), 2017-2031

Figure 05: Global Transformer Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 06: Global Transformer Market Share Analysis, by Type, 2022 and 2031

Figure 07: Global Transformer Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 08: Global Transformer Market Size & Forecast, By Voltage Range, Revenue (US$ Bn), 2017-2031

Figure 09: Global Transformer Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 10: Global Transformer Market Attractiveness, By Voltage Range, Value (US$ Bn), 2022-2031

Figure 11: Global Transformer Market Size & Forecast, By Cooling, Revenue (US$ Bn), 2017-2031

Figure 12: Global Transformer Market Share Analysis, by Cooling, 2022 and 2031

Figure 13: Global Transformer Market Attractiveness, By Cooling, Value (US$ Bn), 2022-2031

Figure 14: Global Transformer Market Size & Forecast, By Phase, Revenue (US$ Bn), 2017-2031

Figure 15: Global Transformer Market Share Analysis, by Phase, 2022 and 2031

Figure 16: Global Transformer Market Attractiveness, By Phase, Value (US$ Bn), 2022-2031

Figure 17: Global Transformer Market Size & Forecast, By Application, Revenue (US$ Bn), 2017-2031

Figure 18: Global Transformer Market Share Analysis, by Application, 2022 and 2031

Figure 19: Global Transformer Market Attractiveness, By Application, Value (US$ Bn), 2022-2031

Figure 20: Global Transformer Market Size & Forecast, By Region, Revenue (US$ Bn), 2017-2031

Figure 21: Global Transformer Market Share Analysis, by Region, 2022 and 2031

Figure 22: Global Transformer Market Attractiveness, By Region, Value (US$ Bn), 2022-2031

Figure 23: North America Transformer Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 24: North America Transformer Market Share Analysis, by Type, 2022 and 2031

Figure 25: North America Transformer Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 26: North America Transformer Market Size & Forecast, By Voltage Range, Revenue (US$ Bn), 2017-2031

Figure 27: North America Transformer Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 28: North America Transformer Market Attractiveness, By Voltage Range, Value (US$ Bn), 2022-2031

Figure 29: North America Transformer Market Size & Forecast, By Cooling, Revenue (US$ Bn), 2017-2031

Figure 30: North America Transformer Market Share Analysis, by Cooling, 2022 and 2031

Figure 31: North America Transformer Market Attractiveness, By Cooling, Value (US$ Bn), 2022-2031

Figure 32: North America Transformer Market Size & Forecast, By Phase, Revenue (US$ Bn), 2017-2031

Figure 33: North America Transformer Market Share Analysis, by Phase, 2022 and 2031

Figure 34: North America Transformer Market Attractiveness, By Phase, Value (US$ Bn), 2022-2031

Figure 35: North America Transformer Market Size & Forecast, By Application, Revenue (US$ Bn), 2017-2031

Figure 36: North America Transformer Market Share Analysis, by Application, 2022 and 2031

Figure 37: North America Transformer Market Attractiveness, By Application, Value (US$ Bn), 2022-2031

Figure 38: North America Transformer Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 39: North America Transformer Market Share Analysis, by Country 2022 and 2031

Figure 40: North America Transformer Market Attractiveness, By Country Value (US$ Bn), 2022-2031

Figure 41: Europe Transformer Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 42: Europe Transformer Market Share Analysis, by Type, 2022 and 2031

Figure 43: Europe Transformer Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 44: Europe Transformer Market Size & Forecast, By Voltage Range, Revenue (US$ Bn), 2017-2031

Figure 45: Europe Transformer Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 46: Europe Transformer Market Attractiveness, By Voltage Range, Value (US$ Bn), 2022-2031

Figure 47: Europe Transformer Market Size & Forecast, By Cooling, Revenue (US$ Bn), 2017-2031

Figure 48: Europe Transformer Market Share Analysis, by Cooling, 2022 and 2031

Figure 49: Europe Transformer Market Attractiveness, By Cooling, Value (US$ Bn), 2022-2031

Figure 50: Europe Transformer Market Size & Forecast, By Phase, Revenue (US$ Bn), 2017-2031

Figure 51: Europe Transformer Market Share Analysis, by Phase, 2022 and 2031

Figure 52: Europe Transformer Market Attractiveness, By Phase, Value (US$ Bn), 2022-2031

Figure 53: Europe Transformer Market Size & Forecast, By Application, Revenue (US$ Bn), 2017-2031

Figure 54: Europe Transformer Market Share Analysis, by Application, 2022 and 2031

Figure 55: Europe Transformer Market Attractiveness, By Application, Value (US$ Bn), 2022-2031

Figure 56: Europe Transformer Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 57: Europe Transformer Market Share Analysis, by Country 2022 and 2031

Figure 58: Europe Transformer Market Attractiveness, By Country Value (US$ Bn), 2022-2031

Figure 59: Asia Pacific Transformer Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 60: Asia Pacific Transformer Market Share Analysis, by Type, 2022 and 2031

Figure 61: Asia Pacific Transformer Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 62: Asia Pacific Transformer Market Size & Forecast, By Voltage Range, Revenue (US$ Bn), 2017-2031

Figure 63: Asia Pacific Transformer Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 64: Asia Pacific Transformer Market Attractiveness, By Voltage Range, Value (US$ Bn), 2022-2031

Figure 65: Asia Pacific Transformer Market Size & Forecast, By Cooling, Revenue (US$ Bn), 2017-2031

Figure 66: Asia Pacific Transformer Market Share Analysis, by Cooling, 2022 and 2031

Figure 67: Asia Pacific Transformer Market Attractiveness, By Cooling, Value (US$ Bn), 2022-2031

Figure 68: Asia Pacific Transformer Market Size & Forecast, By Phase, Revenue (US$ Bn), 2017-2031

Figure 69: Asia Pacific Transformer Market Share Analysis, by Phase, 2022 and 2031

Figure 70: Asia Pacific Transformer Market Attractiveness, By Phase, Value (US$ Bn), 2022-2031

Figure 71: Asia Pacific Transformer Market Size & Forecast, By Application, Revenue (US$ Bn), 2017-2031

Figure 72: Asia Pacific Transformer Market Share Analysis, by Application, 2022 and 2031

Figure 73: Asia Pacific Transformer Market Attractiveness, By Application, Value (US$ Bn), 2022-2031

Figure 74: Asia Pacific Transformer Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 75: Asia Pacific Transformer Market Share Analysis, by Country 2022 and 2031

Figure 76: Asia Pacific Transformer Market Attractiveness, By Country Value (US$ Bn), 2022-2031

Figure 77: Middle East & Africa Transformer Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 78: Middle East & Africa Transformer Market Share Analysis, by Type, 2022 and 2031

Figure 79: Middle East & Africa Transformer Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 80: Middle East & Africa Transformer Market Size & Forecast, By Voltage Range, Revenue (US$ Bn), 2017-2031

Figure 81: Middle East & Africa Transformer Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 82: Middle East & Africa Transformer Market Attractiveness, By Voltage Range, Value (US$ Bn), 2022-2031

Figure 83: Middle East & Africa Transformer Market Size & Forecast, By Cooling, Revenue (US$ Bn), 2017-2031

Figure 84: Middle East & Africa Transformer Market Share Analysis, by Cooling, 2022 and 2031

Figure 85: Middle East & Africa Transformer Market Attractiveness, By Cooling, Value (US$ Bn), 2022-2031

Figure 86: Middle East & Africa Transformer Market Size & Forecast, By Phase, Revenue (US$ Bn), 2017-2031

Figure 87: Middle East & Africa Transformer Market Share Analysis, by Phase, 2022 and 2031

Figure 88: Middle East & Africa Transformer Market Attractiveness, By Phase, Value (US$ Bn), 2022-2031

Figure 89: Middle East & Africa Transformer Market Size & Forecast, By Application, Revenue (US$ Bn), 2017-2031

Figure 90: Middle East & Africa Transformer Market Share Analysis, by Application, 2022 and 2031

Figure 91: Middle East & Africa Transformer Market Attractiveness, By Application, Value (US$ Bn), 2022-2031

Figure 92: Middle East & Africa Transformer Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 93: Middle East & Africa Transformer Market Share Analysis, by Country 2022 and 2031

Figure 94: Middle East & Africa Transformer Market Attractiveness, By Country Value (US$ Bn), 2022-2031

Figure 95: South America Transformer Market Size & Forecast, By Type, Revenue (US$ Bn), 2017-2031

Figure 96: South America Transformer Market Share Analysis, by Type, 2022 and 2031

Figure 97: South America Transformer Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 98: South America Transformer Market Size & Forecast, By Voltage Range, Revenue (US$ Bn), 2017-2031

Figure 99: South America Transformer Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 100: South America Transformer Market Attractiveness, By Voltage Range, Value (US$ Bn), 2022-2031

Figure 101: South America Transformer Market Size & Forecast, By Cooling, Revenue (US$ Bn), 2017-2031

Figure 102: South America Transformer Market Share Analysis, by Cooling, 2022 and 2031

Figure 103: South America Transformer Market Attractiveness, By Cooling, Value (US$ Bn), 2022-2031

Figure 104: South America Transformer Market Size & Forecast, By Phase, Revenue (US$ Bn), 2017-2031

Figure 105: South America Transformer Market Share Analysis, by Phase, 2022 and 2031

Figure 106: South America Transformer Market Attractiveness, By Phase, Value (US$ Bn), 2022-2031

Figure 107: South America Transformer Market Size & Forecast, By Application, Revenue (US$ Bn), 2017-2031

Figure 108: South America Transformer Market Share Analysis, by Application, 2022 and 2031

Figure 109: South America Transformer Market Attractiveness, By Application, Value (US$ Bn), 2022-2031

Figure 110: South America Transformer Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 111: South America Transformer Market Share Analysis, by Country 2022 and 2031

Figure 112: South America Transformer Market Attractiveness, By Country Value (US$ Bn), 2022-2031