Analysts’ Viewpoint

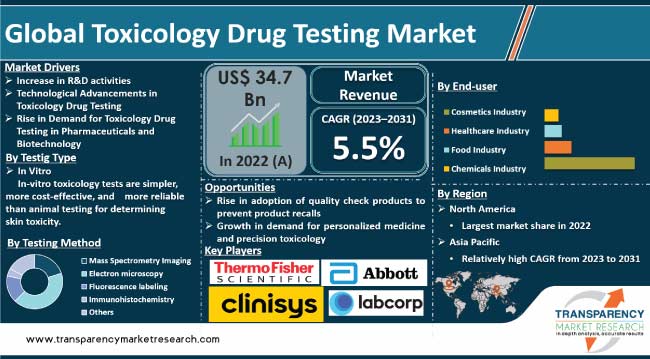

Increasing R&D activities, technological advancements in toxicology drug testing, and rise in demand for toxicology drug testing in pharmaceuticals and biotechnology companies globally are estimated to boost the toxicology drug testing market outlook in the coming years. Emerging landscape post the COVID-19 pandemic led to shift in healthcare priorities and testing patterns. Demand for drug testing remained essential; however, the landscape underwent changes.

The pandemic spotlighted mental health and substance use issues, emphasizing the need for comprehensive drug testing. Innovations in remote and rapid testing gained traction, adapting to the evolving healthcare landscape. Telemedicine and digital platforms played pivotal roles in facilitating testing and result delivery. Moreover, regulatory adjustments and policy shifts shaped testing requirements and protocols. Laboratories and testing facilities adapted to new safety measures, ensuring accurate and secure sample collection and analysis.

Toxicology drug testing is a process that involves analyzing biological samples, such as urine, blood, saliva, or hair, to detect the presence of drugs or their metabolites. It is an essential tool used in various fields, including healthcare, workplace safety, forensic investigations, sports, addiction treatment, and pharmaceutical research. The toxicology drug testing market is poised for growth, which is estimated to offer significant opportunities for manufacturers to capitalize on this trend.

Technological advancements in toxicology drug testing, increasing R&D activities in pharmaceutical companies, and rise in demand for toxicology drug testing in pharmaceuticals and biotechnology companies across the globe are key factors driving the toxicology drug testing industry.

For instance, according to the IFPMA's 2021 study, the annual R&D expenditure of the biopharmaceutical business is 7.3 times more than that of the aerospace and defense industries; 6.5 times higher than that of the chemicals industry; and 1.5 times higher than that of the software and computer services industry. The aforementioned source also stated that the biopharmaceutical sector spend US$ 196,000 Mn in 2021, and US$ 213,000 Mn in 2024. Consequently, growth of the studied market is being fueled by rising R&D in the biopharmaceutical industry for the creation of pharmaceutical products.

The market under study is expanding as a result of recent technical advancements made by industry participants and researchers. For instance, CN Bio, an organ-on-a-chip (OOC) firm, introduced the PhysioMimix "in-a-box" reagent kit for non-alcoholic steatohepatitis (NASH) in April 2022. NASH is a condition for which there are currently no regulatory-approved therapies.

The PhysioMimix micro-physiological systems (MPS) from CN Bio and the NASH-in-a-box (NIAB) kit offer researchers the ability to get physiologically pertinent insights into the mechanism of disease, human therapeutic efficacy, and safety toxicity. These advancements are predicted to boost toxicology drug testing market expansion. However, longer time for sample testing and regulatory issues regarding approval of healthcare molecule are hampering market growth.

On the contrary, growing adoption of quality check products to prevent product recalls and growing demand for personalized medicine and precision toxicology are estimated to offer significant toxicology drug testing market opportunities during the forecast period.

Increasing prevalence of drug abuse and the need for workplace and clinical drug monitoring have been boosting the toxicology drug testing market value for the last few years. However, the COVID-19 pandemic has had a notable impact on this market.

The pandemic has led to a shift in healthcare priorities, with resources and focus primarily directed toward managing and containing the spread of the virus. Non-essential medical procedures, including drug testing, were temporarily put on hold, or reduced, in many healthcare settings. This led to a decline in the demand for toxicology drug testing during the pandemic.

Based on testing type, the in vitro segment accounted for largest global toxicology drug testing market share in 2022. This is attributed to rising use of in-vitro toxicology tests to determine skin toxicity, as they are simpler, more cost-effective, and more reliable than animal testing. Regulations enacted on toxicity assessment of cosmetics are also driving the demand for in-vitro dermal toxicity testing.

In terms of end-user, healthcare industry segment accounted for a notable share in 2022. Under healthcare segment, pharmaceutical & biotechnology companies segment further held a dominant market share. Toxicity testing is frequently used to examine the pharmacokinetic characteristics of pharmaceuticals. Toxicology testing requires assays for both new and generic medications. Toxicology assays are required in various fields including genotoxicity, safety pharmacology, absorption, distribution, metabolism, and excretion (ADME). Demand for in-vitro testing techniques is also estimated to increase due to the ongoing development and research for new pharmaceuticals as well as the candidate drug pipeline.

The diagnostics segment is estimated to expand at a rapid pace during the forecast due to rising number of diagnostic devices. The COVID-19 pandemic also pushed the diagnostic segment to develop innovative solutions for virus detection. Moreover, companies provide a comprehensive diagnostics product line for detection of therapeutic drug monitoring, long-term alcohol abuse, and point-of-care drug testing, thereby boosting the segment.

In terms of region, North America held a dominant market share of toxicology drug testing in 2022. This is attributed to the rise in demand for toxicological drug screening in pharmaceuticals and biotechnology in the region. Growing research and development (R&D) activities in the region are helping to detect toxicity levels in the human body at early stages.

Furthermore, the presence of a well-established pharmaceutical industry in the region, the high R&D expenditure, the strong presence of major service providers, and the growing trend of outsourcing analytical testing by pharmaceutical and biopharmaceutical companies in the region are major factors that are likely to positively influence the toxicology drug testing market outlook in the next few years.

As per the toxicology drug testing market forecast, Asia Pacific is expected to witness market expansion during the forecast period. This is ascribed to the rise of CROs, increase in consumer concern over product safety, and expansion of pharmaceutical drug pipeline in the region. Additionally, several countries in APAC are emerging as a lucrative hubs for drug development and clinical research due to their sizable potential pool, cost advantage, high participant, retention rate in clinical trial, and continually evolving regulatory framework.

The toxicology drug testing market report concludes with the company profiles section that includes key information about major players. Companies focus on strategies, such as new product launches, mergers, and partnerships & collaborations, to compete in the marketplace. Key toxicology drug testing companies include TDAL Labs, Thermo Fisher Scientific Inc., Abbott, Clinisys, Inc., Laboratory Corporation of America Holdings, SLUCARE, Icahn School of Medicine at Mount Sinai, Keystone Lab, Shimadzu Scientific Instruments, and Ganesh Diagnostic & Imaging Centre Pvt. Ltd.

Key players in the toxicology drug testing market report have been profiled based on various parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

| Attribute | Details |

|---|---|

|

Size Value in 2022 |

US$ 34.7 Bn |

|

Forecast (Value) in 2031 |

More than US$ 55.7 Bn |

|

Compound Annual Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 34.7 Bn in 2022.

It is projected to reach a value of around US$ 55.9 Bn by 2031.

The market is anticipated to grow at a CAGR of 5.5% from 2023 to 2031.

Increase in R&D activities, technological advancements in toxicology drug testing, and rise in demand for toxicology drug testing in pharmaceuticals and biotechnology companies

The in vitro segment accounted for largest share in 2022.

North America is expected to account for the largest share from 2023 to 2031.

TDAL Labs, Thermo Fisher Scientific Inc., Abbott, Clinisys, Inc., and Laboratory Corporation of America Holdings.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Toxicology Drug Testing Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Toxicology Drug Testing Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Regulatory Scenario by Region/Globally

5.3. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global Toxicology Drug Testing Market Analysis and Forecast, by Testing Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Testing Type, 2017-2031

6.3.1. In Vitro

6.3.2. In Vivo

6.3.3. In Silico

6.4. Market Attractiveness Analysis, by Testing Type

7. Global Toxicology Drug Testing Market Analysis and Forecast, by Testing Method

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Testing Method, 2017-2031

7.3.1. Mass Spectrometry Imaging

7.3.2. Electron Microscopy

7.3.3. Fluorescence Labeling

7.3.4. Immunohistochemistry

7.3.5. Others

7.4. Market Attractiveness Analysis, by Testing Method

8. Global Toxicology Drug Testing Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2017-2031

8.3.1. Drug Development

8.3.2. Substance Abuse and Addiction

8.3.3. Therapeutic Drug Monitoring

8.3.4. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Toxicology Drug Testing Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2017-2031

9.3.1. Cosmetics Industry

9.3.2. Healthcare Industry

9.3.2.1. Hospital and Clinics

9.3.2.2. Diagnostic Laboratories

9.3.2.3. Pharmaceutical & Biotechnology Companies

9.3.2.4. Others

9.3.3. Food Industry

9.3.4. Chemicals Industry

9.4. Market Attractiveness Analysis, by End-user

10. Global Toxicology Drug Testing Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017-2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Country/Region

11. North America Toxicology Drug Testing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Testing Type, 2017-2031

11.2.1. In Vitro

11.2.2. In Vivo

11.2.3. In Silico

11.3. Market Value Forecast, by Testing Method, 2017-2031

11.3.1. Mass Spectrometry Imaging

11.3.2. Electron Microscopy

11.3.3. Fluorescence Labeling

11.3.4. Immunohistochemistry

11.3.5. Others

11.4. Market Value Forecast, by Application, 2017-2031

11.4.1. Drug Development

11.4.2. Substance Abuse and Addiction

11.4.3. Therapeutic Drug Monitoring

11.4.4. Others

11.5. Market Value Forecast, by End-user, 2017-2031

11.5.1. Cosmetics Industry

11.5.2. Healthcare Industry

11.5.2.1. Hospital and Clinics

11.5.2.2. Diagnostic Laboratories

11.5.2.3. Pharmaceutical & Biotechnology Companies

11.5.2.4. Others

11.5.3. Food Industry

11.5.4. Chemicals Industry

11.6. Market Value Forecast, by Country/Sub-region, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Testing Type

11.7.2. By Testing Method

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country/Sub-region

12. Europe Toxicology Drug Testing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Testing Type, 2017-2031

12.2.1. In Vitro

12.2.2. In Vivo

12.2.3. In Silico

12.3. Market Value Forecast, by Testing Method, 2017-2031

12.3.1. Mass Spectrometry Imaging

12.3.2. Electron Microscopy

12.3.3. Fluorescence Labeling

12.3.4. Immunohistochemistry

12.3.5. Others

12.4. Market Value Forecast, by Application, 2017-2031

12.4.1. Drug Development

12.4.2. Substance Abuse and Addiction

12.4.3. Therapeutic Drug Monitoring

12.4.4. Others

12.5. Market Value Forecast, by End-user, 2017-2031

12.5.1. Cosmetics Industry

12.5.2. Healthcare Industry

12.5.2.1. Hospital and Clinics

12.5.2.2. Diagnostic Laboratories

12.5.2.3. Pharmaceutical & Biotechnology Companies

12.5.2.4. Others

12.5.3. Food Industry

12.5.4. Chemicals Industry

12.6. Market Value Forecast, by Country/Sub-region, 2017-2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Testing Type

12.7.2. By Testing Method

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Toxicology Drug Testing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Testing Type, 2017-2031

13.2.1. In Vitro

13.2.2. In Vivo

13.2.3. In Silico

13.3. Market Value Forecast, by Testing Method, 2017-2031

13.3.1. Mass Spectrometry Imaging

13.3.2. Electron Microscopy

13.3.3. Fluorescence Labeling

13.3.4. Immunohistochemistry

13.3.5. Others

13.4. Market Value Forecast, by Application, 2017-2031

13.4.1. Drug Development

13.4.2. Substance Abuse and Addiction

13.4.3. Therapeutic Drug Monitoring

13.4.4. Others

13.5. Market Value Forecast, by End-user, 2017-2031

13.5.1. Cosmetics Industry

13.5.2. Healthcare Industry

13.5.2.1. Hospital and Clinics

13.5.2.2. Diagnostic Laboratories

13.5.2.3. Pharmaceutical & Biotechnology Companies

13.5.2.4. Others

13.5.3. Food Industry

13.5.4. Chemicals Industry

13.6. Market Value Forecast, by Country/Sub-region, 2017-2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Testing Type

13.7.2. By Testing Method

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Toxicology Drug Testing Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Testing Type, 2017-2031

14.2.1. In Vitro

14.2.2. In Vivo

14.2.3. In Silico

14.3. Market Value Forecast, by Testing Method, 2017-2031

14.3.1. Mass Spectrometry Imaging

14.3.2. Electron Microscopy

14.3.3. Fluorescence Labeling

14.3.4. Immunohistochemistry

14.3.5. Others

14.4. Market Value Forecast, by Application, 2017-2031

14.4.1. Drug Development

14.4.2. Substance Abuse and Addiction

14.4.3. Therapeutic Drug Monitoring

14.4.4. Others

14.5. Market Value Forecast, by End-user, 2017-2031

14.5.1. Cosmetics Industry

14.5.2. Healthcare Industry

14.5.2.1. Hospital and Clinics

14.5.2.2. Diagnostic Laboratories

14.5.2.3. Pharmaceutical & Biotechnology Companies

14.5.2.4. Others

14.5.3. Food Industry

14.5.4. Chemicals Industry

14.6. Market Value Forecast, by Country/Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Testing Type

14.7.2. By Testing Method

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Toxicology Drug Testing Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Testing Type, 2017-2031

15.2.1. In Vitro

15.2.2. In Vivo

15.2.3. In Silico

15.3. Market Value Forecast, by Testing Method, 2017-2031

15.3.1. Mass Spectrometry Imaging

15.3.2. Electron Microscopy

15.3.3. Fluorescence Labeling

15.3.4. Immunohistochemistry

15.3.5. Others

15.4. Market Value Forecast, by End-user, 2017-2031

15.4.1. Drug Development

15.4.2. Substance Abuse and Addiction

15.4.3. Therapeutic Drug Monitoring

15.4.4. Others

15.5. Market Value Forecast, by Application, 2017-2031

15.5.1. Cosmetics Industry

15.5.2. Healthcare Industry

15.5.2.1. Hospital and Clinics

15.5.2.2. Diagnostic Laboratories

15.5.2.3. Pharmaceutical & Biotechnology Companies

15.5.2.4. Others

15.5.3. Food Industry

15.5.4. Chemicals Industry

15.6. Market Value Forecast, by Country/Sub-region, 2017-2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Testing Type

15.7.2. By Testing Method

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (By Tier and Size of Companies)

16.2. Market Share Analysis, by Company (2022)

16.3. Company Profiles

16.3.1. TDAL Labs

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Thermo Fisher Scientific Inc.

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Abbott

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Icahn School of Medicine at Mount Sinai

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Clinisys, Inc.

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Laboratory Corporation of America Holdings

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. SLUCARE

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Keystone Lab

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Shimadzu Scientific Instruments

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Ganesh Diagnostic & Imaging Centre Pvt. Ltd.

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. Other Players

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Portfolio

16.3.11.3. Financial Overview

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

List of Tables

Table 01: Global Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Testing Type, 2017-2031

Table 02: Global Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Testing Method, 2017-2031

Table 03: Global Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 04: Global Toxicology Drug Testing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 05: Global Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Healthcare Industry, 2017-2031

Table 06: Global Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 07: North America Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Testing Type, 2017-2031

Table 08: North America Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Testing Method, 2017-2031

Table 09: North America Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 10: North America Toxicology Drug Testing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 11: North America Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Healthcare Industry, 2017-2031

Table 12: North America Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 13: Europe Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Testing Type, 2017-2031

Table 14: Europe Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Testing Method, 2017-2031

Table 15: Europe Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 16: Europe Toxicology Drug Testing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 17: Europe Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Healthcare Industry, 2017-2031

Table 18: Europe Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 19: Asia Pacific Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Testing Type, 2017-2031

Table 20: Asia Pacific Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Testing Method, 2017-2031

Table 21: Asia Pacific Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 22: Asia Pacific Toxicology Drug Testing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 23: Asia Pacific Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Healthcare Industry, 2017-2031

Table 24: Asia Pacific Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 25: Latin America Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Testing Type, 2017-2031

Table 26: Latin America Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Testing Method, 2017-2031

Table 27: Latin America Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 28: Latin America Toxicology Drug Testing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 29: Latin America Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Healthcare Industry, 2017-2031

Table 30: Latin America Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 31: Middle East & Africa Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Testing Type, 2017-2031

Table 32: Middle East & Africa Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Testing Method, 2017-2031

Table 33: Middle East & Africa Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 34: Middle East & Africa Toxicology Drug Testing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 35: Middle East & Africa Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Healthcare Industry, 2017-2031

Table 36: Middle East & Africa Toxicology Drug Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01: Global Toxicology Drug Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Toxicology Drug Testing Market Value Share Analysis, by Testing Type, 2022 and 2031

Figure 03: Global Toxicology Drug Testing Market Attractiveness Analysis, by Testing Type, 2023-2031

Figure 04: Global Toxicology Drug Testing Market Revenue (US$ Mn), by In Vitro, 2017-2031

Figure 05: Global Toxicology Drug Testing Market Revenue (US$ Mn), by In Vivo, 2017-2031

Figure 06: Global Toxicology Drug Testing Market Revenue (US$ Mn), by In Silico, 2017-2031

Figure 07: Global Toxicology Drug Testing Market Value Share Analysis, by Testing Method, 2022 and 2031

Figure 08: Global Toxicology Drug Testing Market Attractiveness Analysis, by Testing Method, 2023-2031

Figure 09: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Mass Spectrometry Imaging, 2017-2031

Figure 10: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Electron Microscopy, 2017-2031

Figure 11: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Fluorescence Labeling, 2017-2031

Figure 12: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Immunohistochemistry, 2017-2031

Figure 13: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Others, 2017-2031

Figure 14: Global Toxicology Drug Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 15: Global Toxicology Drug Testing Market Attractiveness Analysis, by Application, 2023-2031

Figure 16: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Drug Development, 2017-2031

Figure 17: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Substance Abuse and Addiction, 2017-2031

Figure 18: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Therapeutic Drug Monitoring, 2017-2031

Figure 19: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Others, 2017-2031

Figure 20: Global Toxicology Drug Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 21: Global Toxicology Drug Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 22: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Cosmetics Industry, 2017-2031

Figure 23: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Healthcare Industry, 2017-2031

Figure 24: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Food Industry, 2017-2031

Figure 25: Global Toxicology Drug Testing Market Revenue (US$ Mn), by Chemicals Industry, 2017-2031

Figure 26: Global Toxicology Drug Testing Market Value Share Analysis, by Region, 2022 and 2031

Figure 27: Global Toxicology Drug Testing Market Attractiveness Analysis, by Region, 2023-2031

Figure 28: North America Toxicology Drug Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 29: North America Toxicology Drug Testing Market Value Share Analysis, by Testing Type, 2022 and 2031

Figure 30: North America Toxicology Drug Testing Market Attractiveness Analysis, by Testing Type, 2023-2031

Figure 31: North America Toxicology Drug Testing Market Value Share Analysis, by Testing Method, 2022 and 2031

Figure 32: North America Toxicology Drug Testing Market Attractiveness Analysis, by Testing Method, 2023-2031

Figure 33: North America Toxicology Drug Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 34: North America Toxicology Drug Testing Market Attractiveness Analysis, by Application, 2023-2031

Figure 35: North America Toxicology Drug Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 36: North America Toxicology Drug Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 37: North America Toxicology Drug Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 38: North America Toxicology Drug Testing Market Attractiveness Analysis, by Country, 2023-2031

Figure 39: North America Toxicology Drug Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 40: Europe Toxicology Drug Testing Market Value Share Analysis, by Testing Type, 2022 and 2031

Figure 41: Europe Toxicology Drug Testing Market Attractiveness Analysis, by Testing Type, 2023-2031

Figure 42: Europe Toxicology Drug Testing Market Value Share Analysis, by Testing Method, 2022 and 2031

Figure 43: Europe Toxicology Drug Testing Market Attractiveness Analysis, by Testing Method, 2023-2031

Figure 44: Europe Toxicology Drug Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 45: Europe Toxicology Drug Testing Market Attractiveness Analysis, by Application, 2023-2031

Figure 46: Europe Toxicology Drug Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 47: Europe Toxicology Drug Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 48: Europe Toxicology Drug Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 49: Europe Toxicology Drug Testing Market Attractiveness Analysis, by Country, 2023-2031

Figure 50: Europe Toxicology Drug Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 51: Asia-Pacific Toxicology Drug Testing Market Value Share Analysis, by Testing Type, 2022 and 2031

Figure 52: Asia-Pacific Toxicology Drug Testing Market Attractiveness Analysis, by Testing Type, 2023-2031

Figure 53: Asia-Pacific Toxicology Drug Testing Market Value Share Analysis, by Testing Method, 2022 and 2031

Figure 54: Asia-Pacific Toxicology Drug Testing Market Attractiveness Analysis, by Testing Method, 2023-2031

Figure 55: Asia-Pacific Toxicology Drug Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 56: Asia-Pacific Toxicology Drug Testing Market Attractiveness Analysis, by Application, 2023-2031

Figure 57: Asia-Pacific Toxicology Drug Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 58: Asia-Pacific Toxicology Drug Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 59: Asia-Pacific Toxicology Drug Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 60: Asia-Pacific Toxicology Drug Testing Market Attractiveness Analysis, by Country, 2023-2031

Figure 61: Asia-Pacific Toxicology Drug Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 62: Latin America Toxicology Drug Testing Market Value Share Analysis, by Testing Type, 2022 and 2031

Figure 63: Latin America Toxicology Drug Testing Market Attractiveness Analysis, by Testing Type, 2023-2031

Figure 64: Latin America Toxicology Drug Testing Market Value Share Analysis, by Testing Method, 2022 and 2031

Figure 65: Latin America Toxicology Drug Testing Market Attractiveness Analysis, by Testing Method, 2023-2031

Figure 66: Latin America Toxicology Drug Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 67: Latin America Toxicology Drug Testing Market Attractiveness Analysis, by Application, 2023-2031

Figure 68: Latin America Toxicology Drug Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 69: Latin America Toxicology Drug Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 70: Latin America Toxicology Drug Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 71: Latin America Toxicology Drug Testing Market Attractiveness Analysis, by Country, 2023-2031

Figure 72: Latin America Toxicology Drug Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 73: Middle East & Africa Toxicology Drug Testing Market Value Share Analysis, by Testing Type, 2022 and 2031

Figure 74: Middle East & Africa Toxicology Drug Testing Market Attractiveness Analysis, by Testing Type, 2023-2031

Figure 75: Middle East & Africa Toxicology Drug Testing Market Value Share Analysis, by Testing Method, 2022 and 2031

Figure 76: Middle East & Africa Toxicology Drug Testing Market Attractiveness Analysis, by Testing Method, 2023-2031

Figure 77: Middle East & Africa Toxicology Drug Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 78: Middle East & Africa Toxicology Drug Testing Market Attractiveness Analysis, by Application, 2023-2031

Figure 79: Middle East & Africa Toxicology Drug Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 80: Middle East & Africa Toxicology Drug Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 81: Middle East & Africa Toxicology Drug Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 82: Middle East & Africa Toxicology Drug Testing Market Attractiveness Analysis, by Country, 2023-2031

Figure 83: Middle East & Africa Toxicology Drug Testing Market Value (US$ Mn) Forecast, 2017-2031