Analyst Viewpoint

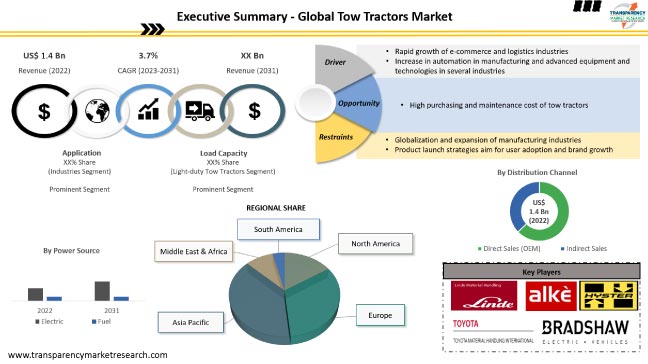

Rapid growth of e-commerce and logistics industries is driving the global tow tractors market. Increase in export and import of commodities is fueling the warehousing and logistics industry, which in turn is propelling market expansion. Traditional growth-driven sectors such as manufacturing and agriculture are propelling demand for tow tractors. Furthermore, surge in automation in manufacturing and advanced equipment & technologies in several industries is likely to bolster the global market size during the forecast period.

Government initiatives and investment in infrastructural development offer lucrative opportunities to market players. Manufacturers are focusing on implementing advanced technologies to develop tow tractors that are cost effective, more flexible to operate, and make material handling easier, faster, and safer.

Tow tractors are energy efficient vehicles that are used in the transportation of goods and loads in warehouses, distribution centers, industries, and several other places. Towing tractors offer safety and high efficiency for picking and transportation operations of various types of goods such as stacked goods or unstacked goods, and roller caged goods.

Tow tractors are usually used in small stocking spaces, narrow passages, steep slopes, and uneven surfaces, which makes transportation economical and more convenient. These tractors can double the productivity of the work area and reduce delivery time and operating costs. Compared to forklifts, tow tractors can also handle various loads from light to heavy loads more safely and efficiently.

Expansion of e-commerce and retail business across the globe is boosting demand for warehouses that require tow tractors in order to transport pallets and pedestrians in the warehouse.

Rise in trend of online shopping has increased demand for advanced material handling equipment in warehouses. E-commerce and third-party logistics companies are increasingly adopting tow tractors in warehouses and distribution centers for quick movement of goods.

The logistics industry is experiencing rapid transformation; emerging technologies are carving the future of logistics, including incorporation of GPS, automated material handling equipment, and biometrics. Additionally, the Internet of Things has the potential to transfer data through networks, while ensuring safety and security.

Therefore, the rise in the number of distribution centers and warehouses across the world is expected to drive the global tow tractors market growth during the forecast period. Furthermore, tow tractors offer optimized transportation operations and easy storage in distribution centers and warehouses.

Industry 4.0 is a holistic automation, business information, and manufacturing execution architecture to improve industry with the integration of all aspects of production and commerce across company boundaries for greater efficiency.

Rise in automation in industries across the globe, which have extensive multidisciplinary engineering and project management experience in fixed plant, mobile plant, autonomous mining and manufacturing, is expected to bolster autonomous tow tractors market demand.

Most industries are striving to develop tow tractors with ultra-capacitors in order to increase efficiency. Ultra-capacitors enhance the battery system, thereby extending the life of battery operated tow tractor.

Development of decentralized supply chain could provide stability to operations and reduce external dependencies. Retailers and third-party dealers in the auto industry must focus their supply chain to only work with partners who also stand by similar principles. Increase in automation mostly with advanced equipment and technologies in several industries to enhance productivity is projected to drive the tow tractors industry.

Based on product type, the rider-seated towing tractors segment dominated the global tow tractors market demand, in terms of revenue, in 2022. Rise in industry trend toward comfort and safety of workers is propelling demand for rider-seated towing tractors across the globe.

Dominance of rider-seated tow tractors is ascribed to high demand in airports and industries, which require tow tractors with heavier load carrying capacity and for longer distance.

In terms of power source, the electric segment accounted for the largest global tow tractors market share in 2022. The trend is projected to continue throughout the forecast period. Rise in awareness about environment protection across the globe and enactment of stringent emission norms are the major factors boosting the electric segment.

Preference for electric tow tractors is increasing in the industrial application for material handling operations due to advantages such as environmental friendliness, cost effectiveness, enhanced efficiency & productivity, noise reduction, flexibility, and adaptability.

As per market research, Asia Pacific accounted for major share in 2020. Rapid industrialization in countries such as China, India, Japan, and South Korea is contributing to the demand for tow tractors. Increase in automation across the manufacturing sector and introduction of industry 4.0 in various industries are likely to boost the tow tractors market in Asia Pacific.

According to market analysis, North America and Europe held significant share in 2022. This is ascribed to increase in e-commerce and logistics industry in the regions. Increase in trade of goods and rise in warehousing activities; and stringent regulations regarding carbon emissions by governments across countries such as Germany, the U.K., and France are likely to augment the tow tractors market in the regions in the next few years.

The market in Middle East & Africa and Latin America is projected to expand at a moderate pace due to restrained growth in the end-use industries and warehousing in the regions.

The global tow tractors market is consolidated, with the presence of a large number of manufacturers controlling significant share. Major manufacturers are focused on increasing market presence through investment in R&D activities for the development of electric tow tractors to be future ready. Expansion of product portfolio and new product launches are the major strategies adopted by key players.

Alke, Bradshaw Electric Vehicles, Clark Material Handling USA, Eagle Tugs, Godrej Material Handling, Helge Nyberg AB, Hyster, Hangcha Forklift, JBT AeroTech, Jungheinrich AG, Kalmar Motor AB, Komatsu, Linde Material Handling, MULAG Fahrzeugwerk, Nakanishi Metal Works Co., Ltd., Toyota Material Handling, TREPEL Airport Equipment GmbH, The Raymond Corporation, Taylor-Dunn, and Zhengzhou Yutong Heavy Industry Co., Ltd. are the prominent players in the market.

Each of these players has been profiled in the tow tractors market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 1.4 Bn |

| Forecast (Value) in 2031 | US$ 1.9 Bn |

| Growth Rate (CAGR) | 3.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross-segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profile |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It is valued at US$ 1.4 Bn in 2022

It is expected to grow at a CAGR of 3.7% by 2031.

It is expected to reach US$ 1.9 Bn by 2031.

Rapid growth of e-commerce & logistics industries and increase in automation in manufacturing and advanced equipment & technologies

The electric power source segment accounted for majority share in 2022.

Asia Pacific is anticipated to be the highly lucrative region.

Alke, Bradshaw Electric Vehicles, Clark Material Handling USA, Eagle Tugs, Godrej Material Handling, Helge Nyberg AB, Hyster, Hangcha Forklift, JBT AeroTech, Jungheinrich AG, Kalmar Motor AB, Komatsu, Linde Material Handling, MULAG Fahrzeugwerk, Nakanishi Metal Works Co., Ltd., Toyota Material Handling, TREPEL Airport Equipment GmbH, The Raymond Corporation, Taylor-Dunn, and Zhengzhou Yutong Heavy Industry Co., Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding the Buying Process of the Customers

1.2.4. Preferred Sales & Marketing Strategy

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Definition / Scope / Limitations

2.2. Macro-Economic Factors

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. Impact Factors: Tow Tractors

3.1. Emergence of Electric Tow Tractors

4. Global Tow Tractors Market, by Product Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Product Type

4.2.1. Pedestrian Towing Tractors

4.2.2. Stand-in Towing Tractors

4.2.3. Rider-seated Towing Tractors

5. Global Tow Tractors Market, by Load Capacity

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Tow Tractor Market Size Analysis & Forecast, 2017-2031, by Load Capacity

5.2.1. Light-duty Tow Tractors

5.2.2. Medium-duty Tow Tractors

5.2.3. Heavy-duty Tow Tractors

6. Global Tow Tractors Market, by Distribution Channel

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Sales Channel

6.2.1. Direct Sales

6.2.2. Indirect Sales

7. Global Tow Tractors Market, by Power Source

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Power Source

7.2.1. Electric

7.2.2. Fuel

8. Global Tow Tractors Market, by Application

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Application

8.2.1. Railway Stations

8.2.2. Airports

8.2.3. Supermarkets

8.2.4. Industries

8.2.5. Warehouses

8.2.6. Others (distribution centers, military cargo stations, etc.)

9. Global Tow Tractors Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Tow Tractor Market Size Analysis & Forecast, 2017-2031, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Tow Tractors Market

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. North America Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Product Type

10.2.1. Pedestrian Towing Tractors

10.2.2. Stand-in Towing Tractors

10.2.3. Rider-seated Towing Tractors

10.3. North America Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Load Capacity

10.3.1. Light-duty Tow Tractors

10.3.2. Medium-duty Tow Tractors

10.3.3. Heavy-duty Tow Tractors

10.4. North America Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Sales Channel

10.4.1. Direct Sales

10.4.2. Indirect Sales

10.5. North America Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Power Source

10.5.1. Electric

10.5.2. Fuel

10.6. North America Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Application

10.6.1. Railway Stations

10.6.2. Airports

10.6.3. Supermarkets

10.6.4. Industries

10.6.5. Warehouses

10.6.6. Others (distribution centers, military cargo stations, etc.)

10.7. Key Country Analysis – North America Tow Tractors Market Size Analysis & Forecast, 2017-2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Mexico

11. Europe Tow Tractors Market

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Europe Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Product Type

11.2.1. Pedestrian Towing Tractors

11.2.2. Stand-in Towing Tractors

11.2.3. Rider-seated Towing Tractors

11.3. Europe Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Load Capacity

11.3.1. Light-duty Tow Tractors

11.3.2. Medium-duty Tow Tractors

11.3.3. Heavy-duty Tow Tractors

11.4. Europe Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Sales Channel

11.4.1. Direct Sales

11.4.2. Indirect Sales

11.5. Europe Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Power Source

11.5.1. Electric

11.5.2. Fuel

11.6. Europe Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Application

11.6.1. Railway Stations

11.6.2. Airports

11.6.3. Supermarkets

11.6.4. Industries

11.6.5. Warehouses

11.6.6. Others (distribution centers, military cargo stations, etc.)

11.7. Key Country Analysis – Europe Tow Tractors Market Size Analysis & Forecast, 2017-2031

11.7.1. Germany

11.7.2. U.K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Countries

11.7.7. Russia & CIS

11.7.8. Rest of Europe

12. Asia Pacific Tow Tractors Market

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Asia Pacific Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Product Type

12.2.1. Pedestrian Towing Tractors

12.2.2. Stand-in Towing Tractors

12.2.3. Rider-seated Towing Tractors

12.3. Asia Pacific Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Load Capacity

12.3.1. Light-duty Tow Tractors

12.3.2. Medium-duty Tow Tractors

12.3.3. Heavy-duty Tow Tractors

12.4. Asia Pacific Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Sales Channel

12.4.1. Direct Sales

12.4.2. Indirect Sales

12.5. Asia Pacific Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Power Source

12.5.1. Electric

12.5.2. Fuel

12.6. Asia Pacific Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Application

12.6.1. Railway Stations

12.6.2. Airports

12.6.3. Supermarkets

12.6.4. Industries

12.6.5. Warehouses

12.6.6. Others (distribution centers, military cargo stations, etc.)

12.7. Key Country Analysis – Asia Pacific Tow Tractors Market Size Analysis & Forecast, 2017-2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa Tow Tractors Market

13.1. Market Snapshot

13.1.1. Introduction, Definition, and Key Findings

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. Middle East & Africa Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Product Type

13.2.1. Pedestrian Towing Tractors

13.2.2. Stand-in Towing Tractors

13.2.3. Rider-seated Towing Tractors

13.3. Middle East & Africa Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Load Capacity

13.3.1. Light-duty Tow Tractors

13.3.2. Medium-duty Tow Tractors

13.3.3. Heavy-duty Tow Tractors

13.4. Middle East & Africa Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Sales Channel

13.4.1. Direct Sales

13.4.2. Indirect Sales

13.5. Middle East & Africa Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Power Source

13.5.1. Electric

13.5.2. Fuel

13.6. Middle East & Africa Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Application

13.6.1. Railway Stations

13.6.2. Airports

13.6.3. Supermarkets

13.6.4. Industries

13.6.5. Warehouses

13.6.6. Others (Distribution Centers, Military Cargo Stations, etc.)

13.7. Key Country Analysis – Middle East & Africa Tow Tractors Market Size Analysis & Forecast, 2017-2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America Tow Tractors Market

14.1. Market Snapshot

14.1.1. Introduction, Definition, and Key Findings

14.1.2. Market Growth & Y-o-Y Projections

14.1.3. Base Point Share Analysis

14.2. South America Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Product Type

14.2.1. Pedestrian Towing Tractors

14.2.2. Stand-in Towing Tractors

14.2.3. Rider-seated Towing Tractors

14.3. South America Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Load Capacity

14.3.1. Light-duty Tow Tractors

14.3.2. Medium-duty Tow Tractors

14.3.3. Heavy-duty Tow Tractors

14.4. South America Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Sales Channel

14.4.1. Direct Sales

14.4.2. Indirect Sales

14.5. South America Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Power Source

14.5.1. Electric

14.5.2. Fuel

14.6. South America Tow Tractors Market Size Analysis & Forecast, 2017-2031, by Application

14.6.1. Railway Stations

14.6.2. Airports

14.6.3. Supermarkets

14.6.4. Industries

14.6.5. Warehouses

14.6.6. Others (Distribution Centers, Military Cargo Stations, etc.)

14.7. Key Country Analysis – South America Tow Tractors Market Size Analysis & Forecast, 2017-2031

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Company Analysis for each player

Company Overview, Company Footprints, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis

16. Company Profile/ Key Players

16.1. Alke

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Product Portfolio

16.1.4. Competitors & Customers

16.1.5. Subsidiaries & Parent Organization

16.1.6. Recent Developments

16.1.7. Financial Analysis

16.2. Bradshaw Electric Vehicles

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Product Portfolio

16.2.4. Competitors & Customers

16.2.5. Subsidiaries & Parent Organization

16.2.6. Recent Developments

16.2.7. Financial Analysis

16.3. Clark Material Handling USA

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Product Portfolio

16.3.4. Competitors & Customers

16.3.5. Subsidiaries & Parent Organization

16.3.6. Recent Developments

16.3.7. Financial Analysis

16.4. Eagle Tugs

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Product Portfolio

16.4.4. Competitors & Customers

16.4.5. Subsidiaries & Parent Organization

16.4.6. Recent Developments

16.4.7. Financial Analysis

16.5. Godrej Material Handling

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Product Portfolio

16.5.4. Competitors & Customers

16.5.5. Subsidiaries & Parent Organization

16.5.6. Recent Developments

16.5.7. Financial Analysis

16.6. Helge Nyberg AB

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Product Portfolio

16.6.4. Competitors & Customers

16.6.5. Subsidiaries & Parent Organization

16.6.6. Recent Developments

16.6.7. Financial Analysis

16.7. Hyster

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Product Portfolio

16.7.4. Competitors & Customers

16.7.5. Subsidiaries & Parent Organization

16.7.6. Recent Developments

16.7.7. Financial Analysis

16.8. Hangcha Forklift

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Product Portfolio

16.8.4. Competitors & Customers

16.8.5. Subsidiaries & Parent Organization

16.8.6. Recent Developments

16.8.7. Financial Analysis

16.9. JBT AeroTech

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Product Portfolio

16.9.4. Competitors & Customers

16.9.5. Subsidiaries & Parent Organization

16.9.6. Recent Developments

16.9.7. Financial Analysis

16.10. Jungheinrich AG

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Product Portfolio

16.10.4. Competitors & Customers

16.10.5. Subsidiaries & Parent Organization

16.10.6. Recent Developments

16.10.7. Financial Analysis

16.11. Kalmar Motor AB

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Product Portfolio

16.11.4. Competitors & Customers

16.11.5. Subsidiaries & Parent Organization

16.11.6. Recent Developments

16.11.7. Financial Analysis

16.12. Komatsu

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Product Portfolio

16.12.4. Competitors & Customers

16.12.5. Subsidiaries & Parent Organization

16.12.6. Recent Developments

16.12.7. Financial Analysis

16.13. Linde Material Handling

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Product Portfolio

16.13.4. Competitors & Customers

16.13.5. Subsidiaries & Parent Organization

16.13.6. Recent Developments

16.13.7. Financial Analysis

16.14. Nakanishi Metal Works Co., Ltd.

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Product Portfolio

16.14.4. Competitors & Customers

16.14.5. Subsidiaries & Parent Organization

16.14.6. Recent Developments

16.14.7. Financial Analysis

16.15. Toyota Material Handling

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Product Portfolio

16.15.4. Competitors & Customers

16.15.5. Subsidiaries & Parent Organization

16.15.6. Recent Developments

16.15.7. Financial Analysis

16.16. TREPEL Airport Equipment GmbH

16.16.1. Company Overview

16.16.2. Company Footprints

16.16.3. Product Portfolio

16.16.4. Competitors & Customers

16.16.5. Subsidiaries & Parent Organization

16.16.6. Recent Developments

16.16.7. Financial Analysis

16.17. The Raymond Corporation

16.17.1. Company Overview

16.17.2. Company Footprints

16.17.3. Product Portfolio

16.17.4. Competitors & Customers

16.17.5. Subsidiaries & Parent Organization

16.17.6. Recent Developments

16.17.7. Financial Analysis

16.18. Taylor-Dunn

16.18.1. Company Overview

16.18.2. Company Footprints

16.18.3. Product Portfolio

16.18.4. Competitors & Customers

16.18.5. Subsidiaries & Parent Organization

16.18.6. Recent Developments

16.18.7. Financial Analysis

16.19. Zhengzhou Yutong Heavy Industry Co., Ltd.

16.19.1. Company Overview

16.19.2. Company Footprints

16.19.3. Product Portfolio

16.19.4. Competitors & Customers

16.19.5. Subsidiaries & Parent Organization

16.19.6. Recent Developments

16.19.7. Financial Analysis

List of Tables

Table 1: Global Tow Tractors Market Volume (Thousand Units) Forecast, by Product Type, 2017‒2031

Table 2: Global Tow Tractors Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 3: Global Tow Tractors Market Volume (Thousand Units) Forecast, by Load Capacity, 2017‒2031

Table 4: Global Tow Tractors Market Value (US$ Mn) Forecast, by Load Capacity, 2017‒2031

Table 5: Global Tow Tractors Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 6: Global Tow Tractors Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 7: Global Tow Tractors Market Volume (Thousand Units) Forecast, by Power Source, 2017‒2031

Table 8: Global Tow Tractors Market Value (US$ Mn) Forecast, by Power Source, 2017‒2031

Table 9: Global Tow Tractors Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 10: Global Tow Tractors Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 11: Global Tow Tractors Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Table 12: Global Tow Tractors Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 13: North America Tow Tractors Market Volume (Thousand Units) Forecast, by Product Type, 2017‒2031

Table 14: North America Tow Tractors Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 15: North America Tow Tractors Market Volume (Thousand Units) Forecast, by Load Capacity, 2017‒2031

Table 16: North America Tow Tractors Market Value (US$ Mn) Forecast, by Load Capacity, 2017‒2031

Table 17: North America Tow Tractors Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 18: North America Tow Tractors Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 19: North America Tow Tractors Market Volume (Thousand Units) Forecast, by Power Source, 2017‒2031

Table 20: North America Tow Tractors Market Value (US$ Mn) Forecast, by Power Source, 2017‒2031

Table 21: North America Tow Tractors Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 22: North America Tow Tractors Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 23: North America Tow Tractors Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 24: North America Tow Tractors Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 25: Europe Tow Tractors Market Volume (Thousand Units) Forecast, by Product Type, 2017‒2031

Table 26: Europe Tow Tractors Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 27: Europe Tow Tractors Market Volume (Thousand Units) Forecast, by Load Capacity, 2017‒2031

Table 28: Europe Tow Tractors Market Value (US$ Mn) Forecast, by Load Capacity, 2017‒2031

Table 29: Europe Tow Tractors Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 30: Europe Tow Tractors Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 31: Europe Tow Tractors Market Volume (Thousand Units) Forecast, by Power Source, 2017‒2031

Table 32: Europe Tow Tractors Market Value (US$ Mn) Forecast, by Power Source, 2017‒2031

Table 33: Europe Tow Tractors Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 34: Europe Tow Tractors Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 35: Europe Tow Tractors Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017‒2031

Table 36: Europe Tow Tractors Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Table 37: Asia Pacific Tow Tractors Market Volume (Thousand Units) Forecast, by Product Type, 2017‒2031

Table 38: Asia Pacific Tow Tractors Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 39: Asia Pacific Tow Tractors Market Volume (Thousand Units) Forecast, by Load Capacity, 2017‒2031

Table 40: Asia Pacific Tow Tractors Market Value (US$ Mn) Forecast, by Load Capacity, 2017‒2031

Table 41: Asia Pacific Tow Tractors Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 42: Asia Pacific Tow Tractors Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 43: Asia Pacific Tow Tractors Market Volume (Thousand Units) Forecast, by Power Source, 2017‒2031

Table 44: Asia Pacific Tow Tractors Market Value (US$ Mn) Forecast, by Power Source, 2017‒2031

Table 45: Asia Pacific Tow Tractors Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 46: Asia Pacific Tow Tractors Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 47: Asia Pacific Tow Tractors Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017‒2031

Table 48: Asia Pacific Tow Tractors Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Table 49: Middle East & Africa Tow Tractors Market Volume (Thousand Units) Forecast, by Product Type, 2017‒2031

Table 50: Middle East & Africa Tow Tractors Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 51: Middle East & Africa Tow Tractors Market Volume (Thousand Units) Forecast, by Load Capacity, 2017‒2031

Table 52: Middle East & Africa Tow Tractors Market Value (US$ Mn) Forecast, by Load Capacity, 2017‒2031

Table 53: Middle East & Africa Tow Tractors Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 54: Middle East & Africa Tow Tractors Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 55: Middle East & Africa Tow Tractors Market Volume (Thousand Units) Forecast, by Power Source, 2017‒2031

Table 56: Middle East & Africa Tow Tractors Market Value (US$ Mn) Forecast, by Power Source, 2017‒2031

Table 57: Middle East & Africa Tow Tractors Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 58: Middle East & Africa Tow Tractors Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 59: Middle East & Africa Tow Tractors Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017‒2031

Table 60: Middle East & Africa Tow Tractors Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Table 61: South America Tow Tractors Market Volume (Thousand Units) Forecast, by Product Type, 2017‒2031

Table 62: South America Tow Tractors Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 63: South America Tow Tractors Market Volume (Thousand Units) Forecast, by Load Capacity, 2017‒2031

Table 64: South America Tow Tractors Market Value (US$ Mn) Forecast, by Load Capacity, 2017‒2031

Table 65: South America Tow Tractors Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 66: South America Tow Tractors Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 67: South America Tow Tractors Market Volume (Thousand Units) Forecast, by Power Source, 2017‒2031

Table 68: South America Tow Tractors Market Value (US$ Mn) Forecast, by Power Source, 2017‒2031

Table 69: South America Tow Tractors Market Volume (Thousand Units) Forecast, by Application, 2017‒2031

Table 70: South America Tow Tractors Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 71: South America Tow Tractors Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017‒2031

Table 72: South America Tow Tractors Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 1: Global Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Figure 2: Global Tow Tractors Market, Incremental Opportunity, by Product Type, Value (US$ Mn), 2023‒2031

Figure 3: Global Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, Load Capacity, 2017‒2031

Figure 4: Global Tow Tractors Market, Incremental Opportunity, by Load Capacity, Value (US$ Mn), 2023‒2031

Figure 5: Global Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 6: Global Tow Tractors Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 7: Global Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Power Source, 2017‒2031

Figure 8: Global Tow Tractors Market, Incremental Opportunity, by Power Source, Value (US$ Mn), 2023‒2031

Figure 9: Global Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 10: Global Tow Tractors Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 11: Global Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Region, 2017‒2031

Figure 12: Global Tow Tractors Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023‒2031

Figure 13: North America Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Figure 14: North America Tow Tractors Market, Incremental Opportunity, by Product Type, Value (US$ Mn), 2023‒2031

Figure 15: North America Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, Load Capacity, 2017‒2031

Figure 16: North America Tow Tractors Market, Incremental Opportunity, by Load Capacity, Value (US$ Mn), 2023‒2031

Figure 17: North America Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 18: North America Tow Tractors Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 19: North America Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Power Source, 2017‒2031

Figure 20: North America Tow Tractors Market, Incremental Opportunity, by Power Source, Value (US$ Mn), 2023‒2031

Figure 21: North America Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 22: North America Tow Tractors Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 23: North America Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 24: North America Tow Tractors Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 25: Europe Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Figure 26: Europe Tow Tractors Market, Incremental Opportunity, by Product Type, Value (US$ Mn), 2023‒2031

Figure 27: Europe Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, Load Capacity, 2017‒2031

Figure 28: Europe Tow Tractors Market, Incremental Opportunity, by Load Capacity, Value (US$ Mn), 2023‒2031

Figure 29: Europe Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 30: Europe Tow Tractors Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 31: Europe Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Power Source, 2017‒2031

Figure 32: Europe Tow Tractors Market, Incremental Opportunity, by Power Source, Value (US$ Mn), 2023‒2031

Figure 33: Europe Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 34: Europe Tow Tractors Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 35: Europe Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Figure 36: Europe Tow Tractors Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 37: Asia Pacific Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Figure 38: Asia Pacific Tow Tractors Market, Incremental Opportunity, by Product Type, Value (US$ Mn), 2023‒2031

Figure 39: Asia Pacific Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, Load Capacity, 2017‒2031

Figure 40: Asia Pacific Tow Tractors Market, Incremental Opportunity, by Load Capacity, Value (US$ Mn), 2023‒2031

Figure 41: Asia Pacific Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 42: Asia Pacific Tow Tractors Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 43: Asia Pacific Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Power Source, 2017‒2031

Figure 44: Asia Pacific Tow Tractors Market, Incremental Opportunity, by Power Source, Value (US$ Mn), 2023‒2031

Figure 45: Asia Pacific Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 46: Asia Pacific Tow Tractors Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 47: Asia Pacific Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Figure 48: Asia Pacific Tow Tractors Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 49: Middle East & Africa Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Figure 50: Middle East & Africa Tow Tractors Market, Incremental Opportunity, by Product Type, Value (US$ Mn), 2023‒2031

Figure 51: Middle East & Africa Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, Load Capacity, 2017‒2031

Figure 52: Middle East & Africa Tow Tractors Market, Incremental Opportunity, by Load Capacity, Value (US$ Mn), 2023‒2031

Figure 53: Middle East & Africa Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 54: Middle East & Africa Tow Tractors Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 55: Middle East & Africa Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Power Source, 2017‒2031

Figure 56: Middle East & Africa Tow Tractors Market, Incremental Opportunity, by Power Source, Value (US$ Mn), 2023‒2031

Figure 57: Middle East & Africa Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 58: Middle East & Africa Tow Tractors Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 59: Middle East & Africa Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Figure 60: Middle East & Africa Tow Tractors Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 61: South America Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Figure 62: South America Tow Tractors Market, Incremental Opportunity, by Product Type, Value (US$ Mn), 2023‒2031

Figure 63: South America Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, Load Capacity, 2017‒2031

Figure 64: South America Tow Tractors Market, Incremental Opportunity, by Load Capacity, Value (US$ Mn), 2023‒2031

Figure 65: South America Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 66: South America Tow Tractors Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 67: South America Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Power Source, 2017‒2031

Figure 68: South America Tow Tractors Market, Incremental Opportunity, by Power Source, Value (US$ Mn), 2023‒2031

Figure 69: South America Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 70: South America Tow Tractors Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023‒2031

Figure 71: South America Tow Tractors Market Volume (Thousand Units) & Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Figure 72: South America Tow Tractors Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2023‒2031