Global Tourniquet Market: Overview

Tourniquets have popularly been used in orthopedic and plastic surgeries related to the limb. Their use among clinicians is driven by the adoption of potentially efficacious blood occlusion technologies in clinical practices. The rising prevalence of severe limb injuries, fueled by the rising number of road accidents in various developing regions, is a prominent factor fortifying the demand for tourniquets. The market is also benefitting from substantial governmental spending on healthcare focusing on emergency care systems in several emerging economies and the presence of a robust healthcare in developed countries.

Furthermore, constant technological advances, notably in reusable tourniquets, is expected to accentuate the overall market. Moreover, the advent of safe and highly functional systems that also offer automatic controls, even in inclement weather conditions, is expected to fuel the growth of the market.

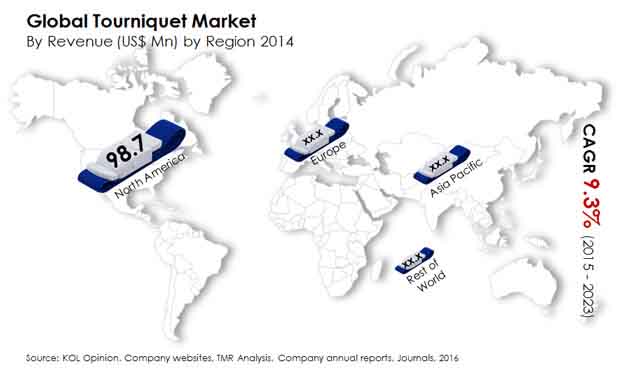

The global tourniquet market was worth US$184.6 million in 2014 and is prognosticated to reach a valuation of US$408.6 million by 2023 end. During the forecast period of 2015–2023, the global market is projected to rise at a handsome CAGR of 9.3%.

Demand for Disposable Tourniquet Cuffs to Rise at Dominant Pace, Reusable Ones Still High On Popularity

The key product types comprise tourniquet system and tourniquet cuffs; the latter is further bifurcated into disposable and reusable ones. Of the two tourniquet cuffs, reusable ones have been enjoying wide popularity, attributed to their durability, use on multiple patients after disinfection, and cost-effectiveness. The segment is anticipated to expand at a CAGR of 9.1% during 2015–2023. Various concerns of infection and complications from the improper use of reusable tourniquets have gained worrying proportions in recent times. These are being addressed by constant industry efforts by framing better and clearer clinical guidelines.

Meanwhile, the disposable tourniquet cuffs is expected to emerge as an attractive pace, garnering the leading CAGR of 9.9% over the assessment period. The market for tourniquet systems is estimated to reach a worth of US$240.2 million by 2023 end.

Based on application, the market is segmented into arm cuffs and leg cuffs. The key end users comprise hospitals, physician/clinicians, and non-institutional.

Asia Pacific to present Potentially Attractive Growth Prospects in Coming Years

Geographically, the global tourniquet market is segmented into North America, Europe, Asia Pacific, and Rest of the World (RoW). Of all the segments, North America led the pack with a major share of 53.5% in 2014. The dominance of the regional market can be attributed to the substantial uptake in the healthcare system in treating traumatic orthopedic injuries. A massive rise in road accidents in various parts of the region in the recent years is a key factor accentuating the demand. Furthermore, relentless efforts by governments in key countries in the region to create awareness about the safe use of tourniquet systems. In addition, the advent of technologically-advanced tourniquet cuffs and their efficacy as a first-line therapy in controlling hemorrhage has also catalyzed the growth of the regional market.

This is trailed by Europe and the regional market accounted for the global share of 18.4% in 2014. The presence of a robust emergency healthcare infrastructure in the region is a noteworthy factor fueling the growth.

However, Asia Pacific (APAC) is likely to account for highly lucrative avenues over the forecast period. A burgeoning middle class population, coupled with the vastly rising spending capacity, is a notable factor bolstering the demand for advanced trauma care for limb surgeries. This in turn is opening up promising prospects in this regional market and is projected to rise at a CAGR of 9.9% over the forecast period. The substantially rising number of hospitals and laboratory settings is also expected to accentuate the regional market. In addition, the entry of several big medical device manufacturers in the region in recent years has created lucrative avenues. Furthermore, the adoption of modern blood occlusion technologies in traumatic centers in various emerging economies also augurs well for the regional market.

Table of Content

1. Preface

1.1. Report Description

1.2. Market Segmentation

1.3. Research Methodology

2. Executive Summary

2.1. Global Tourniquet Market, Estimates and Forecast, By Revenue, 2013–2023 (US$ Mn)

2.2. Global Tourniquet Market, by Product, 2014 (US$ Mn)

2.3. Global Tourniquet Market, by Application, 2014 (US$ Mn)

2.4. Global Tourniquet Market, by End User, 2014 (US$ Mn)

2.5. Global Market Share by Geography, 2014 and 2023 (Value %)

2.6. Tourniquet Market Snapshot

3. Tourniquet Market - Industry Analysis

3.1. Introduction

3.2. Market Drivers

3.3. Constant rise in road accidents globally leading to serious limb injuries

3.4. Increased health care expenditure globally

3.5. Restraints

3.6. Low adoption rate of tourniquet cuffs due to associated risk of infection

3.7. Opportunity

3.8. Emerging economies to offer sustained growth opportunities

3.9. Porter’s Five Forces Analysis

3.10. Regulatory Scenario

3.11. Heat Map Analysis

4. Market Segmentation - By Product

4.1. Introduction

4.2. Global Tourniquet Systems Market Revenue, (US$ Mn), 2013–2023

4.3. Global Tourniquet Cuffs Market Revenue, (US$ Mn), 2013–2023

4.3.1. Global Disposable Cuffs Market Revenue, (US$ Mn), 2013–2023

4.3.2. Global Reusable Cuffs Market Revenue, (US$ Mn), 2013–2023

5. Market Segmentation - By Application

5.1. Introduction

5.2. Global Arm Cuffs Market Revenue, (US$ Mn), 2013–2023

5.3. Global Leg Cuffs Market Revenue, (US$ Mn), 2013–2023

6. Market Segmentation - By End User

6.1. Introduction

6.2. Global Hospitals Market Revenue, (US$ Mn), 2013–2023

6.3. Global Physician/Clinic Market Revenue, (US$ Mn), 2013–2023

6.4. Global Non-institutional Market Revenue, (US$ Mn), 2013–2023

7. Market Segmentation - By Region

7.1. Introduction

7.2. Global Tourniquet Market: Regional Overview

7.3. North America Tourniquet Devices Market Overview

7.4. US Tourniquet Market Overview

7.5. Canada Tourniquet Market Overview

7.6. Europe Tourniquet Market Overview

7.7. Germany Tourniquet Market Overview

7.8. UK Tourniquet Market Overview

7.9. Rest of Europe Tourniquet Market Overview

7.10. Asia Pacific Tourniquet Market Overview

7.11. China Tourniquet Market Overview

7.12. Japan Tourniquet Market Overview

7.13. Rest of Asia Pacific Tourniquet Market Overview

7.14. Rest of the World Tourniquet Market Overview

7.15. Latin America Tourniquet Market Overview

7.16. RoW Tourniquet Market Overview

8. Recommendations

8.1. Invest in rigorous R&D initiatives

8.2. Focus on developing economies

8.3. Focus on inorganic growth through mergers and acquisitions

9. Company Profiles

9.1. Delfi Medical Innovation, Inc.

9.2. Hammarplast Medical AB

9.3. Pyng Medical Corporation

9.4. Stryker Corporation

9.5. ulrich Medical

9.6. VBM Medizintechnik GmbH

9.7. Zimmer Biomet Holdings, Inc.

List of Tables

TABLE 1: Executive Summary: Tourniquet Market Snapshot

TABLE 2: Heat Map Analysis: Global Tourniquet Market, by Key Players

TABLE 3: Global Tourniquet Market Estimates and Forecast, by Product Type, (US$ Mn), 2013–2023

TABLE 4: Global Tourniquet Market, by Application, (US$ Mn), 2013–2023

TABLE 5: Global Tourniquet Market Estimates and Forecast, by End-user, (US$ Mn), 2013–2023

TABLE 6: Global Tourniquet Market Revenue, by Geography, (US$ Mn), 2013–2023

TABLE 7: North America Tourniquet Market, by Country, (US$ Mn), 2013–2023

TABLE 8: Europe Tourniquet Market, (US$ Mn), 2013–2023

TABLE 9: Asia Pacific Tourniquet Market, (US$ Mn), 2013–2023

TABLE 10: Rest of the World Tourniquet Market Revenue, (US$ Mn), 2013–2023

List of Figures

FIG. 1 Market Segmentation: Tourniquet Market

FIG. 2 Global Tourniquet Market, Estimates and Forecast, By Revenue, (US$ Mn), 2013–2023

FIG. 3 Global Tourniquet Market, by Product, (US$ Mn), 2014

FIG. 4 Global Tourniquet Market, by Application, (US$ Mn), 2014

FIG. 5 Global Tourniquet Market, by End-user, (US$ Mn), 2014

FIG. 6 Global Tourniquet Market, by Geography, 2014 and 2023 (Value %)

FIG. 7 Automatic Tourniquet Machine and Cuffs

FIG. 8 Porter’s Five Forces Analysis

FIG. 9 Global Tourniquet Systems Market Revenue, (US$ Mn), 2013–2023

FIG. 10 Global Tourniquet Cuffs Market Revenue, (US$ Mn), 2013–2023

FIG. 11 Global Disposable Cuffs Market Revenue, (US$ Mn), 2013–2023

FIG. 12 Global Reusable Cuffs Market Revenue, (US$ Mn), 2013–2023

FIG. 13 Global Arm Cuffs Market Revenue, (US$ Mn), 2013–2023

FIG. 14 Global Leg Cuffs Market Revenue, (US$ Mn), 2013–2023

FIG. 15 Global Hospitals End-user Market Revenue, (US$ Mn), 2013–2023

FIG. 16 Global Physician/Clinic End-user Market Revenue, (US$ Mn), 2013–2023

FIG. 17 Global Non-institutional End-user Market Revenue, (US$ Mn), 2013–2023

FIG. 18 U.S. Tourniquet Market Revenue, (US$ Mn), 2013–2023

FIG. 19 Canada Tourniquet Market Revenue, (US$ Mn), 2013–2023

FIG. 20 Germany Tourniquet Market Revenue, (US$ Mn), 2013–2023

FIG. 21 U.K. Tourniquet Market Revenue, (US$ Mn), 2013–2023

FIG. 22 Rest of Europe Tourniquet Market Revenue, (US$ Mn) , 2013–2023

FIG. 23 China Tourniquet Market Revenue, (US$ Mn), 2013–2023

FIG. 24 Japan Tourniquet Market Revenue, (US$ Mn), 2013–2023

FIG. 25 Rest of Asia Pacific Tourniquet Market Revenue, (US$ Mn), 2013–2023

FIG. 26 Latin America Tourniquet Market Revenue, (US$ Mn), 2013–2023

FIG. 27 Rest of the World (RoW) Tourniquet Market Revenue, (US$ Mn), 2013–2023

FIG. 28 Financial Details: (US$ Mn), 2012–2014

FIG. 29 Financial Details: (US$ Mn), 2012–2014

FIG. 30 Financial Details: (US$ Mn), 2012–2014