Analysts’ Viewpoint on the Tool Bags Market

Demand for tool bags is rising across the globe due to their lightweight properties, large storage capacity, and versatility. Polyester and nylon are popular materials used in the manufacture of tool storage bags owing to their durability, cost-effectiveness, and moisture resistance. Demand for tool bags is increasing among individual customers and the industrial sector. Fabric tool bags commonly feature polyvinyl chloride (PVC) coating on one or both sides for additional waterproofing. As a result, the adoption of PVC is increasing in small-size tool bags, pouches, zippers, etc. Tool bag manufacturers are striving to reach a wide base of customers through various distribution channels.

Tool bag is an essential equipment for electricians, plumbers, carpenters, technicians, and other maintenance workers. Tool bags are used to store and carry tools, making it easy to have everything in one place. They can be either open or zipped, depending on the nature of the task. Key players operating in the market are continuously introducing new bags with additional features such as wide pockets for convenient storage, thermoformed cushioned EVA back pad, and waterproof polypropylene plastic base with telescoping LED lighted handle. These features are designed to help workers perform their tasks efficiently in all working environments. The global tool bags market is primarily driven by the addition of convenient features, and growth of end-use industries and the home improvement market.

Demand for tool bags has been rising among the millennial population due to the growth in DIY projects trend. Around 73% of millennials are inclined toward DIY projects. The number of DIY home improvement projects has increased in countries such as the U.S., Germany, Japan, Canada, Great Britain, and France. Rise in home renovation activities in developing countries is also driving the market for tool bags. Increase in consumer interest in gardening, carpentry, and small-scale home or vehicle repair activities is also expected to fuel the market.

The global construction industry is expected to grow by US$ 4 Trn between 2020 and 2030. China, India, the U.S., and Indonesia are projected to account for 60% of the overall growth. Rise in population and increase in disposable income of the people are boosting the demand for residential and commercial buildings. Various housing policies, low interest on loans, and increasing population are key factors driving the residential segment. Rise in sale of new homes coupled with increase in renovation of existing properties is anticipated to boost the tool bags market during the forecast period.

Tool bags are light weight and possess an increased storage capacity. They are also versatile and available in different sizes and shapes. Tote bags are available in open top and close top designs. This provides customers an additional option to make a choice depending on their tools and frequency of usage. Open tote bags provide easy accessibility of tools; hence, they are significantly popular in the tool bags market. Tote bags have extra space to manage tools, while pooches, tool cases, and messenger bags are compact for small tools. Consequently, demand for tote bags is high. Demand for tool bags and tool storage bags is expected to rise in the near future due to the growth of the end-use market.

Increase in number of residential renovation projects and significant growth of the construction industry have created employment opportunities for technicians and professionals. Electricians, carpenters, plumbers, HVAC workers, mechanics, welders, and other general contractors are highly dependent on tool bags for their daily activities. Demand for their services is increasing not only from the residential segment but also from commercial & industrial segments. Urbanization is also expected to generate growth opportunities for these technicians and professionals. Rise in trend of DIY is anticipated to fuel the demand for tool bags in the residential segment. Residents mostly purchase small and compact tool storage products such as tool pouches, messenger bags, etc., which can be stored easily. On the other hand, commercial and industrial users purchase large storage /heavy-duty tool bags, as they have to work with multiple large or heavier tools. Demand for rolling bags is increasing among industrial end-users due to their easy mobility.

North America is the leading region of the global tool bags market. The U.S. dominates the tool bags market in the region. It is followed by Canada. Changing geopolitical conditions have led to an increase in spending on various industries to strengthen the regional economy. Countries in North America are likely to offer lucrative opportunities for several manufacturers entering the tool bags market. Tote bags & tool backpacks, polyester & nylon, and individuals are the dominant segments of the market in North America.

Europe and Asia Pacific are the fastest growing markets for tool bags. Increase in demand for home improvement projects, rise in trend of DIY, growth of commercial spaces, and expansion of the construction sector are major factors driving the tool bags market in Asia Pacific. Changing attitude of customers in developing countries, such as the shift from normal bags used to store tools to tool bags; rise in FDI; and increase in investments by governments in major end-use industries are also estimated to boost the global market.

Tool bags is a part of the tool storage market. The market is highly fragmented owing to the presence of several global and regional players. Companies are spending significantly on research and development activities. Expansion of product portfolios, geographical presence, and mergers & acquisitions are the key strategies adopted by prominent players.

Key players operating in the global tool bags market are Milwaukee Electric Tool Corporation, Klein Tools, Inc., Stanley Black & Decker, Inc., Custom Leathercraft Manufacturing LLC, Carhartt, Inc., Sortimo International GmbH, IRONLAND, Veto Pro Pac LLC., Bucket Boss, and Quanzhou Journey Bags Co., Ltd.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 515.2 Mn |

|

Market Forecast Value in 2031 |

US$ 842.8 Mn |

|

Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Mn for Value & Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

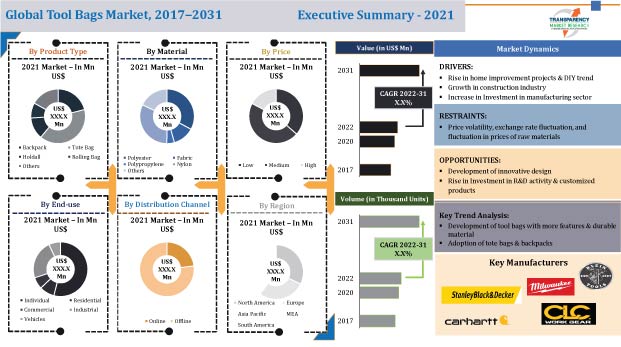

The tool bags market stood at US$ 515.2 Mn in 2021.

The market size of tool bags is expected to reach US$ 842.8 Mn in 2031.

The tool bags market is estimated to expand at a CAGR of 5.1% by 2031.

Rise in usage of tool bags by maintenance workers, increase in DIY and home improvement projects, and growth of the construction industry are key factors driving the tool bags market.

The individuals segment accounted for approximately 54% share of the global tool bags market in 2021.

North America is an attractive region for vendors, while Asia Pacific would create significant opportunities during the forecast period.

Milwaukee Electric Tool Corporation, Klein Tools, Inc., Stanley Black & Decker, Inc., Custom Leathercraft Manufacturing LLC, Carhartt, Inc., Sortimo International GmbH, IRONLAND, Veto Pro Pac LLC., Bucket Boss, and Quanzhou Journey Bags Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Material Analysis

5.8. Global Tool Bags Market Analysis and Forecast, 2017‒2031

5.8.1. Market Value Projections (US$ Mn)

5.8.2. Market Volume Projections (Thousand Units)

6. Global Tool Bags Market Analysis and Forecast, by Product Type

6.1. Global Tool Bags Market Size (US$ Mn) (Thousand Units), by Product Type, 2017‒2031

6.1.1. Backpack

6.1.2. Tote Bag

6.1.3. Holdhall

6.1.4. Rolling Bag

6.1.5. Others (Messenger Bag, Pouches, etc.)

6.2. Incremental Opportunity, by Product Type

7. Global Tool Bags Market Analysis and Forecast, by Material

7.1. Global Tool Bags Market Size (US$ Mn) (Thousand Units), by Material, 2017‒2031

7.1.1. Polyester

7.1.2. Fabric

7.1.3. Polypropylene

7.1.4. Nylon

7.1.5. Others (Leather, Rubber, PVC, etc.)

7.2. Incremental Opportunity, by Material

8. Global Tool Bags Market Analysis and Forecast, by Price

8.1. Global Tool Bags Market Size (US$ Mn) (Thousand Units), by Price, 2017‒2031

8.1.1. Low

8.1.2. Medium

8.1.3. High

8.2. Incremental Opportunity, by Price

9. Global Tool Bags Market Analysis and Forecast, by End-use

9.1. Global Tool Bags Market Size (US$ Mn) (Thousand Units), by End-use, 2017‒2031

9.1.1. Individual

9.1.2. Residential

9.1.3. Commercial

9.1.4. Industrial

9.1.5. Vehicles

9.2. Incremental Opportunity, by End-use

10. Global Tool Bags Market Analysis and Forecast, by Distribution Channel

10.1. Global Tool Bags Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017‒2031

10.1.1. Online

10.1.1.1. Company-owned Websites

10.1.1.2. E-commerce Websites

10.1.2. Offline

10.1.2.1. Direct Sales

10.1.2.2. Indirect Sales

10.2. Incremental Opportunity, by Distribution Channel

11. Global Tool Bags Market Analysis and Forecast, by Region

11.1. Global Tool Bags Market Size (US$ Mn) (Thousand Units), by Region, 2017‒2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, by Region

12. North America Tool Bags Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Tool Bags Market Size (US$ Mn) (Thousand Units), by Product Type, 2017‒2031

12.2.1. Backpack

12.2.2. Tote Bag

12.2.3. Holdhall

12.2.4. Rolling Bag

12.2.5. Others (Messenger Bag, Pouches, etc.)

12.3. Tool Bags Market Size (US$ Mn) (Thousand Units), by Material, 2017‒2031

12.3.1. Polyester

12.3.2. Fabric

12.3.3. Polypropylene

12.3.4. Nylon

12.3.5. Others (Leather, Rubber, PVC, etc.)

12.4. Tool Bags Market Size (US$ Mn) (Thousand Units), by Price, 2017‒2031

12.4.1. Low

12.4.2. Medium

12.4.3. High

12.5. Tool Bags Market Size (US$ Mn) (Thousand Units), by End-use, 2017‒2031

12.5.1. Individual

12.5.2. Residential

12.5.3. Commercial

12.5.4. Industrial

12.5.5. Vehicles

12.6. Tool Bags Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017‒2031

12.6.1. Online

12.6.1.1. Company-owned Websites

12.6.1.2. E-commerce Websites

12.6.2. Offline

12.6.2.1. Direct Sales

12.6.2.2. Indirect Sales

12.7. Tool Bags Market Size (US$ Mn) (Thousand Units), by Country and Sub-region, 2017‒2031

12.7.1. U.S.

12.7.2. Canada

12.7.3. Rest of North America

12.8. Incremental Opportunity Analysis

13. Europe Tool Bags Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Tool Bags Market Size (US$ Mn) (Thousand Units), by Product Type, 2017‒2031

13.2.1. Backpack

13.2.2. Tote Bag

13.2.3. Holdhall

13.2.4. Rolling Bag

13.2.5. Others (Messenger Bag, Pouches, etc.)

13.3. Tool Bags Market Size (US$ Mn) (Thousand Units), by Material, 2017‒2031

13.3.1. Polyester

13.3.2. Fabric

13.3.3. Polypropylene

13.3.4. Nylon

13.3.5. Others (Leather, Rubber, PVC, etc.)

13.4. Tool Bags Market Size (US$ Mn) (Thousand Units), by Price, 2017‒2031

13.4.1. Low

13.4.2. Medium

13.4.3. High

13.5. Tool Bags Market Size (US$ Mn) (Thousand Units), by End-use, 2017‒2031

13.5.1. Individual

13.5.2. Residential

13.5.3. Commercial

13.5.4. Industrial

13.5.5. Vehicles

13.6. Tool Bags Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017‒2031

13.6.1. Online

13.6.1.1. Company-owned Websites

13.6.1.2. E-commerce Websites

13.6.2. Offline

13.6.2.1. Direct Sales

13.6.2.2. Indirect Sales

13.7. Tool Bags Market Size (US$ Mn) (Thousand Units), by Country and Sub-region, 2017‒2031

13.7.1. Germany

13.7.2. France

13.7.3. Great Britain

13.7.4. Italy

13.7.5. Rest of Europe

13.8. Incremental Opportunity Analysis

14. Asia Pacific Tool Bags Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. COVID-19 Impact Analysis

14.4. Key Trends Analysis

14.4.1. Supply side

14.4.2. Demand Side

14.5. Price Trend Analysis

14.5.1. Weighted Average Selling Price (US$)

14.6. Tool Bags Market Size (US$ Mn) (Thousand Units), by Product Type, 2017‒2031

14.6.1. Backpack

14.6.2. Tote Bag

14.6.3. Holdhall

14.6.4. Rolling Bag

14.6.5. Others (Messenger Bag, Pouches, etc.)

14.7. Tool Bags Market Size (US$ Mn) (Thousand Units), by Material, 2017‒2031

14.7.1. Polyester

14.7.2. Fabric

14.7.3. Polypropylene

14.7.4. Nylon

14.7.5. Others (Leather, Rubber, PVC, etc.)

14.8. Tool Bags Market Size (US$ Mn) (Thousand Units), by Price, 2017‒2031

14.8.1. Low

14.8.2. Medium

14.8.3. High

14.9. Tool Bags Market Size (US$ Mn) (Thousand Units), by End-use, 2017‒2031

14.9.1. Individual

14.9.2. Residential

14.9.3. Commercial

14.9.4. Industrial

14.9.5. Vehicles

14.10. Tool Bags Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017‒2031

14.10.1. Online

14.10.1.1. Company-owned Websites

14.10.1.2. E-commerce Websites

14.10.2. Offline

14.10.2.1. Direct Sales

14.10.2.2. Indirect Sales

14.11. Tool Bags Market Size (US$ Mn) (Thousand Units), by Country and Sub-region, 2017‒2031

14.11.1. China

14.11.2. India

14.11.3. Japan

14.11.4. Rest of Asia Pacific

14.12. Incremental Opportunity Analysis

15. Middle East & Africa Tool Bags Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. COVID-19 Impact Analysis

15.4. Key Trends Analysis

15.4.1. Supply side

15.4.2. Demand Side

15.5. Price Trend Analysis

15.5.1. Weighted Average Selling Price (US$)

15.6. Tool Bags Market Size (US$ Mn) (Thousand Units), by Product Type, 2017‒2031

15.6.1. Backpack

15.6.2. Tote Bag

15.6.3. Holdhall

15.6.4. Rolling Bag

15.6.5. Others (Messenger Bag, Pouches, etc.)

15.7. Tool Bags Market Size (US$ Mn) (Thousand Units), by Material, 2017‒2031

15.7.1. Polyester

15.7.2. Fabric

15.7.3. Polypropylene

15.7.4. Nylon

15.7.5. Others (Leather, Rubber, PVC, etc.)

15.8. Tool Bags Market Size (US$ Mn) (Thousand Units), by Price, 2017‒2031

15.8.1. Low

15.8.2. Medium

15.8.3. High

15.9. Tool Bags Market Size (US$ Mn) (Thousand Units), by End-use, 2017‒2031

15.9.1. Individual

15.9.2. Residential

15.9.3. Commercial

15.9.4. Industrial

15.9.5. Vehicles

15.10. Tool Bags Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017‒2031

15.10.1. Online

15.10.1.1. Company-owned Websites

15.10.1.2. E-commerce Websites

15.10.2. Offline

15.10.2.1. Direct Sales

15.10.2.2. Indirect Sales

15.11. Tool Bags Market Size (US$ Mn) (Thousand Units), by Country and Sub-region, 2017‒2031

15.11.1. GCC

15.11.2. South Africa

15.11.3. Rest of Middle East & Africa

15.12. Incremental Opportunity Analysis

16. South America Tool Bags Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. COVID-19 Impact Analysis

16.4. Key Trends Analysis

16.4.1. Supply side

16.4.2. Demand Side

16.5. Price Trend Analysis

16.5.1. Weighted Average Selling Price (US$)

16.6. Tool Bags Market Size (US$ Mn) (Thousand Units), by Product Type, 2017‒2031

16.6.1. Backpack

16.6.2. Tote Bag

16.6.3. Holdhall

16.6.4. Rolling Bag

16.6.5. Others (Messenger Bag, Pouches, etc.)

16.7. Tool Bags Market Size (US$ Mn) (Thousand Units), by Material, 2017‒2031

16.7.1. Polyester

16.7.2. Fabric

16.7.3. Polypropylene

16.7.4. Nylon

16.7.5. Others (Leather, Rubber, PVC, etc.)

16.8. Tool Bags Market Size (US$ Mn) (Thousand Units), by Price, 2017‒2031

16.8.1. Low

16.8.2. Medium

16.8.3. High

16.9. Tool Bags Market Size (US$ Mn) (Thousand Units), by End-use, 2017‒2031

16.9.1. Individual

16.9.2. Residential

16.9.3. Commercial

16.9.4. Industrial

16.9.5. Vehicles

16.10. Tool Bags Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017‒2031

16.10.1. Online

16.10.1.1. Company-owned Websites

16.10.1.2. E-commerce Websites

16.10.2. Offline

16.10.2.1. Direct Sales

16.10.2.2. Indirect Sales

16.11. Tool Bags Market Size (US$ Mn) (Thousand Units), by Country and Sub-region, 2017‒2031

16.11.1. Brazil

16.11.2. Rest of South America

16.12. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Competition Dashboard

17.2. Market Share Analysis % (2021)

17.3. Company Profiles [Company Overview, Product Type Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

17.3.1. Milwaukee Electric Tool Corporation

17.3.1.1. Company Overview

17.3.1.2. Product Type Portfolio

17.3.1.3. Financial Information

17.3.1.4. (Subject to Data Availability)

17.3.1.5. Business Strategies / Recent Developments

17.3.2. Klein Tools, Inc.

17.3.2.1. Company Overview

17.3.2.2. Product Type Portfolio

17.3.2.3. Financial Information

17.3.2.4. (Subject to Data Availability)

17.3.2.5. Business Strategies / Recent Developments

17.3.3. Stanley Black & Decker, Inc.

17.3.3.1. Company Overview

17.3.3.2. Product Type Portfolio

17.3.3.3. Financial Information

17.3.3.4. (Subject to Data Availability)

17.3.3.5. Business Strategies / Recent Developments

17.3.4. Custom Leathercraft Manufacturing LLC

17.3.4.1. Company Overview

17.3.4.2. Product Type Portfolio

17.3.4.3. Financial Information

17.3.4.4. (Subject to Data Availability)

17.3.4.5. Business Strategies / Recent Developments

17.3.5. Carhartt, Inc.

17.3.5.1. Company Overview

17.3.5.2. Product Type Portfolio

17.3.5.3. Financial Information

17.3.5.4. (Subject to Data Availability)

17.3.5.5. Business Strategies / Recent Developments

17.3.6. Sortimo International GmbH

17.3.6.1. Company Overview

17.3.6.2. Product Type Portfolio

17.3.6.3. Financial Information

17.3.6.4. (Subject to Data Availability)

17.3.6.5. Business Strategies / Recent Developments

17.3.7. IRONLAND

17.3.7.1. Company Overview

17.3.7.2. Product Type Portfolio

17.3.7.3. Financial Information

17.3.7.4. (Subject to Data Availability)

17.3.7.5. Business Strategies / Recent Developments

17.3.8. Veto Pro Pac LLC.

17.3.8.1. Company Overview

17.3.8.2. Product Type Portfolio

17.3.8.3. Financial Information

17.3.8.4. (Subject to Data Availability)

17.3.8.5. Business Strategies / Recent Developments

17.3.9. Bucket Boss

17.3.9.1. Company Overview

17.3.9.2. Product Type Portfolio

17.3.9.3. Financial Information

17.3.9.4. (Subject to Data Availability)

17.3.9.5. Business Strategies / Recent Developments

17.3.10. Quanzhou Journey Bags Co., Ltd.

17.3.10.1. Company Overview

17.3.10.2. Product Type Portfolio

17.3.10.3. Financial Information

17.3.10.4. (Subject to Data Availability)

17.3.10.5. Business Strategies / Recent Developments

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.1.1. Product Type

18.1.2. Material

18.1.3. Price

18.1.4. End-use

18.1.5. Distribution Channel

18.1.6. Region

18.2. Understanding the Procurement Process of the End-users

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1 : Global Tool Bags Marketby Product Type, Thousand Units 2017‒2031

Table 2 : Global Tool Bags Marketby Product Type, US$ Mn 2017‒2031

Table 3 : Global Tool Bags Marketby Material, Thousand Units,2017‒2031

Table 4 : Global Tool Bags Marketby Material, US$ Mn 2017‒2031

Table 5 : Global Tool Bags Marketby Price, Thousand Units,2017‒2031

Table 6 : Global Tool Bags Marketby Price, US$ Mn 2017‒2031

Table 7 : Global Tool Bags Marketby End-use, Thousand Units,2017‒2031

Table 8 : Global Tool Bags Marketby End-use, US$ Mn 2017‒2031

Table 9 : Global Tool Bags Marketby Sales Channel, Thousand Units,2017‒2031

Table 10 : Global Tool Bags Marketby Sales Channel, US$ Mn 2017‒2031

Table 11 : Global Tool Bags Marketby Region, Thousand Units,2017‒2031

Table 12 : Global Tool Bags Marketby Region, US$ Mn 2017‒2031

Table 13 : North America Tool Bags Marketby Product Type, Thousand Units 2017‒2031

Table 14 : North America Tool Bags Marketby Product Type, US$ Mn 2017‒2031

Table 15 : North America Tool Bags Marketby Material, Thousand Units,2017‒2031

Table 16 : North America Tool Bags Marketby Material, US$ Mn 2017‒2031

Table 17 : North America Tool Bags Marketby Price, Thousand Units,2017‒2031

Table 18 : North America Tool Bags Marketby Price, US$ Mn 2017‒2031

Table 19 : North America Tool Bags Marketby End-use, Thousand Units,2017‒2031

Table 20 : North America Tool Bags Marketby End-use, US$ Mn 2017‒2031

Table 21 : North America Tool Bags Marketby Sales Channel, Thousand Units,2017‒2031

Table 22 : North America Tool Bags Marketby Sales Channel, US$ Mn 2017‒2031

Table 23 : North America Tool Bags Marketby Country and Sub-region, Thousand Units,2017‒2031

Table 24 : North America Tool Bags Marketby Country and Sub-region, US$ Mn 2017‒2031

Table 25 : Europe Tool Bags Marketby Product Type, Thousand Units 2017‒2031

Table 26 : Europe Tool Bags Marketby Product Type, US$ Mn 2017‒2031

Table 27 : Europe Tool Bags Marketby Material, Thousand Units,2017‒2031

Table 28 : Europe Tool Bags Marketby Material, US$ Mn 2017‒2031

Table 29 : Europe Tool Bags Marketby Price, Thousand Units,2017‒2031

Table 30 : Europe Tool Bags Marketby Price, US$ Mn 2017‒2031

Table 31 : Europe Tool Bags Marketby End-use, Thousand Units,2017‒2031

Table 32 : Europe Tool Bags Marketby End-use, US$ Mn 2017‒2031

Table 33 : Europe Tool Bags Marketby Sales Channel, Thousand Units,2017‒2031

Table 34 : Europe Tool Bags Marketby Sales Channel, US$ Mn 2017‒2031

Table 35 : Europe Tool Bags Marketby Country and Sub-region, Thousand Units,2017‒2031

Table 36 : Europe Tool Bags Marketby Country and Sub-region, US$ Mn 2017‒2031

Table 37 : Asia Pacific Tool Bags Marketby Product Type, Thousand Units 2017‒2031

Table 38 : Asia Pacific Tool Bags Marketby Product Type, US$ Mn 2017‒2031

Table 39 : Asia Pacific Tool Bags Marketby Material, Thousand Units,2017‒2031

Table 40 : Asia Pacific Tool Bags Marketby Material, US$ Mn 2017‒2031

Table 41 : Asia Pacific Tool Bags Marketby Price, Thousand Units,2017‒2031

Table 42 : Asia Pacific Tool Bags Marketby Price, US$ Mn 2017‒2031

Table 43 : Asia Pacific Tool Bags Marketby End-use, Thousand Units,2017‒2031

Table 44 : Asia Pacific Tool Bags Marketby End-use, US$ Mn 2017‒2031

Table 45 : Asia Pacific Tool Bags Marketby Sales Channel, Thousand Units,2017‒2031

Table 46 : Asia Pacific Tool Bags Marketby Sales Channel, US$ Mn 2017‒2031

Table 47 : Asia Pacific Tool Bags Marketby Country and Sub-region, Thousand Units,2017‒2031

Table 48 : Asia Pacific Tool Bags Marketby Country and Sub-region, US$ Mn 2017‒2031

Table 49 : Middle East & Africa Tool Bags Marketby Product Type, Thousand Units 2017‒2031

Table 50 : Middle East & Africa Tool Bags Marketby Product Type, US$ Mn 2017‒2031

Table 51 : Middle East & Africa Tool Bags Marketby Material, Thousand Units,2017‒2031

Table 52 : Middle East & Africa Tool Bags Marketby Material, US$ Mn 2017‒2031

Table 53 : Middle East & Africa Tool Bags Marketby Price, Thousand Units,2017‒2031

Table 54 : Middle East & Africa Tool Bags Marketby Price, US$ Mn 2017‒2031

Table 55 : Middle East & Africa Tool Bags Marketby End-use, Thousand Units,2017‒2031

Table 56 : Middle East & Africa Tool Bags Marketby End-use, US$ Mn 2017‒2031

Table 57 : Middle East & Africa Tool Bags Marketby Sales Channel, Thousand Units,2017‒2031

Table 58 : Middle East & Africa Tool Bags Marketby Sales Channel, US$ Mn 2017‒2031

Table 59 : Middle East & Africa Tool Bags Marketby Country and Sub-region, Thousand Units,2017‒2031

Table 60 : Middle East & Africa Tool Bags Marketby Country and Sub-region, US$ Mn 2017‒2031

Table 61 : South America Tool Bags Marketby Product Type, Thousand Units 2017‒2031

Table 62 : South America Tool Bags Marketby Product Type, US$ Mn 2017‒2031

Table 63 : South America Tool Bags Marketby Material, Thousand Units,2017‒2031

Table 64 : South America Tool Bags Marketby Material, US$ Mn 2017‒2031

Table 65 : South America Tool Bags Marketby Price, Thousand Units,2017‒2031

Table 66 : South America Tool Bags Marketby Price, US$ Mn 2017‒2031

Table 67 : South America Tool Bags Marketby End-use, Thousand Units,2017‒2031

Table 68 : South America Tool Bags Marketby End-use, US$ Mn 2017‒2031

Table 69 : South America Tool Bags Marketby Sales Channel, Thousand Units,2017‒2031

Table 70 : South America Tool Bags Marketby Sales Channel, US$ Mn 2017‒2031

Table 71 : South America Tool Bags Marketby Country and Sub-region, Thousand Units,2017‒2031

Table 72 : South America Tool Bags Marketby Country and Sub-region, US$ Mn 2017‒2031

List of Figures

Figure 1: Global Tool Bags Market Projections, by Product Type, Thousand Units,2017‒2031

Figure 2: Global Tool Bags Market Projections, by Product Type, US$ Mn 2017‒2031

Figure 3: Global Tool Bags Market, Incremental Opportunity, by Product Type, US$ Mn 2022‒2031

Figure 4: Global Tool Bags Market Projections, by Material, Thousand Units,2017‒2031

Figure 5: Global Tool Bags Market Projections, by Material, US$ Mn 2017‒2031

Figure 6: Global Tool Bags Market, Incremental Opportunity, by Material, US$ Mn 2022‒2031

Figure 7: Global Tool Bags Market Projections, by Price, Thousand Units,2017‒2031

Figure 8: Global Tool Bags Market Projections, by Price, US$ Mn 2017‒2031

Figure 9: Global Tool Bags Market, Incremental Opportunity, by Price, US$ Mn 2022‒2031

Figure 10: Global Tool Bags Market Projections, by End-use, Thousand Units,2017‒2031

Figure 11: Global Tool Bags Market Projections, by End-use, US$ Mn 2017‒2031

Figure 12: Global Tool Bags Market, Incremental Opportunity, by End-use, US$ Mn 2022‒2031

Figure 13: Global Tool Bags Market Projections, by Sales Channel, Thousand Units,2017‒2031

Figure 14: Global Tool Bags Market Projections, by Sales Channel, US$ Mn 2017‒2031

Figure 15: Global Tool Bags Market, Incremental Opportunity, by Sales Channel, US$ Mn 2022‒2031

Figure 16: Global Tool Bags Market Projections, by Region, Thousand Units,2017‒2031

Figure 17: Global Tool Bags Market Projections, by Region, US$ Mn 2017‒2031

Figure 18: Global Tool Bags Market, Incremental Opportunity, by Region, US$ Mn 2022‒2031

Figure 19: North America Tool Bags Market Projections, by Product Type, Thousand Units2017‒2031

Figure 20: North America Tool Bags Market Projections, by Product Type, US$ Mn 2017‒2031

Figure 21: North America Tool Bags Market, Incremental Opportunity, by Product Type, US$ Mn 2022‒2031

Figure 22: North America Tool Bags Market Projections, by Material, Thousand Units,2017‒2031

Figure 23: North America Tool Bags Market Projections, by Material, US$ Mn 2017‒2031

Figure 24: North America Tool Bags Market, Incremental Opportunity, by Material, US$ Mn 2022‒2031

Figure 25: North America Tool Bags Market Projections, by Price, Thousand Units,2017‒2031

Figure 26: North America Tool Bags Market Projections, by Price, US$ Mn 2017‒2031

Figure 27: North America Tool Bags Market, Incremental Opportunity, by Price, US$ Mn 2022‒2031

Figure 28: North America Tool Bags Market Projections, by End-use, Thousand Units,2017‒2031

Figure 29: North America Tool Bags Market Projections, by End-use, US$ Mn 2017‒2031

Figure 30: North America Tool Bags Market, Incremental Opportunity, by End-use, US$ Mn 2022‒2031

Figure 31: North America Tool Bags Market Projections, by Sales Channel, Thousand Units,2017‒2031

Figure 32: North America Tool Bags Market Projections, by Sales Channel, US$ Mn 2017‒2031

Figure 33: North America Tool Bags Market, Incremental Opportunity, by Sales Channel, US$ Mn 2022‒2031

Figure 34: North America Tool Bags Market Projections, by Country and Sub-region, Thousand Units,2017‒2031

Figure 35: North America Tool Bags Market Projections, by Country and Sub-region, US$ Mn 2017‒2031

Figure 36: North America Tool Bags Market, Incremental Opportunity, by Country and Sub-region, US$ Mn 2022‒2031

Figure 37: Europe Tool Bags Market Projections, by Product Type, Thousand Units2017‒2031

Figure 38: Europe Tool Bags Market Projections, by Product Type, US$ Mn 2017‒2031

Figure 39: Europe Tool Bags Market, Incremental Opportunity, by Product Type, US$ Mn 2022‒2031

Figure 40: Europe Tool Bags Market Projections, by Material, Thousand Units,2017‒2031

Figure 41: Europe Tool Bags Market Projections, by Material, US$ Mn 2017‒2031

Figure 42: Europe Tool Bags Market, Incremental Opportunity, by Material, US$ Mn 2022‒2031

Figure 43: Europe Tool Bags Market Projections, by Price, Thousand Units,2017‒2031

Figure 44: Europe Tool Bags Market Projections, by Price, US$ Mn 2017‒2031

Figure 45: Europe Tool Bags Market, Incremental Opportunity, by Price, US$ Mn 2022‒2031

Figure 46: Europe Tool Bags Market Projections, by End-use, Thousand Units,2017‒2031

Figure 47: Europe Tool Bags Market Projections, by End-use, US$ Mn 2017‒2031

Figure 48: Europe Tool Bags Market, Incremental Opportunity, by End-use, US$ Mn 2022‒2031

Figure 49: Europe Tool Bags Market Projections, by Sales Channel, Thousand Units,2017‒2031

Figure 50: Europe Tool Bags Market Projections, by Sales Channel, US$ Mn 2017‒2031

Figure 51: Europe Tool Bags Market, Incremental Opportunity, by Sales Channel, US$ Mn 2022‒2031

Figure 52: Europe Tool Bags Market Projections, by Country and Sub-region, Thousand Units,2017‒2031

Figure 53: Europe Tool Bags Market Projections, by Country and Sub-region, US$ Mn 2017‒2031

Figure 54: Europe Tool Bags Market, Incremental Opportunity, by Country and Sub-region, US$ Mn 2022‒2031

Figure 55: Asia Pacific Tool Bags Market Projections, by Product Type, Thousand Units2017‒2031

Figure 56: Asia Pacific Tool Bags Market Projections, by Product Type, US$ Mn 2017‒2031

Figure 57: Asia Pacific Tool Bags Market, Incremental Opportunity, by Product Type, US$ Mn 2022‒2031

Figure 58: Asia Pacific Tool Bags Market Projections, by Material, Thousand Units,2017‒2031

Figure 59: Asia Pacific Tool Bags Market Projections, by Material, US$ Mn 2017‒2031

Figure 60: Asia Pacific Tool Bags Market, Incremental Opportunity, by Material, US$ Mn 2022‒2031

Figure 61: Asia Pacific Tool Bags Market Projections, by Price, Thousand Units,2017‒2031

Figure 62: Asia Pacific Tool Bags Market Projections, by Price, US$ Mn 2017‒2031

Figure 63: Asia Pacific Tool Bags Market, Incremental Opportunity, by Price, US$ Mn 2022‒2031

Figure 64: Asia Pacific Tool Bags Market Projections, by End-use, Thousand Units,2017‒2031

Figure 65: Asia Pacific Tool Bags Market Projections, by End-use, US$ Mn 2017‒2031

Figure 66: Asia Pacific Tool Bags Market, Incremental Opportunity, by End-use, US$ Mn 2022‒2031

Figure 67: Asia Pacific Tool Bags Market Projections, by Sales Channel, Thousand Units,2017‒2031

Figure 68: Asia Pacific Tool Bags Market Projections, by Sales Channel, US$ Mn 2017‒2031

Figure 69: Asia Pacific Tool Bags Market, Incremental Opportunity, by Sales Channel, US$ Mn 2022‒2031

Figure 70: Asia Pacific Tool Bags Market Projections, by Country and Sub-region, Thousand Units,2017‒2031

Figure 71: Asia Pacific Tool Bags Market Projections, by Country and Sub-region, US$ Mn 2017‒2031

Figure 72: Asia Pacific Tool Bags Market, Incremental Opportunity, by Country and Sub-region, US$ Mn 2022‒2031

Figure 73: Middle East & Africa Tool Bags Market Projections, by Product Type, Thousand Units2017‒2031

Figure 74: Middle East & Africa Tool Bags Market Projections, by Product Type, US$ Mn 2017‒2031

Figure 75: Middle East & Africa Tool Bags Market, Incremental Opportunity, by Product Type, US$ Mn 2022‒2031

Figure 76: Middle East & Africa Tool Bags Market Projections, by Material, Thousand Units,2017‒2031

Figure 77: Middle East & Africa Tool Bags Market Projections, by Material, US$ Mn 2017‒2031

Figure 78: Middle East & Africa Tool Bags Market, Incremental Opportunity, by Material, US$ Mn 2022‒2031

Figure 79: Middle East & Africa Tool Bags Market Projections, by Price, Thousand Units,2017‒2031

Figure 80: Middle East & Africa Tool Bags Market Projections, by Price, US$ Mn 2017‒2031

Figure 81: Middle East & Africa Tool Bags Market, Incremental Opportunity, by Price, US$ Mn 2022‒2031

Figure 82: Middle East & Africa Tool Bags Market Projections, by End-use, Thousand Units,2017‒2031

Figure 83: Middle East & Africa Tool Bags Market Projections, by End-use, US$ Mn 2017‒2031

Figure 84: Middle East & Africa Tool Bags Market, Incremental Opportunity, by End-use, US$ Mn 2022‒2031

Figure 85: Middle East & Africa Tool Bags Market Projections, by Sales Channel, Thousand Units,2017‒2031

Figure 86: Middle East & Africa Tool Bags Market Projections, by Sales Channel, US$ Mn 2017‒2031

Figure 87: Middle East & Africa Tool Bags Market, Incremental Opportunity, by Sales Channel, US$ Mn 2022‒2031

Figure 88: Middle East & Africa Tool Bags Market Projections, by Country and Sub-region, Thousand Units,2017‒2031

Figure 89: Middle East & Africa Tool Bags Market Projections, by Country and Sub-region, US$ Mn 2017‒2031

Figure 90: Middle East & Africa Tool Bags Market, Incremental Opportunity, by Country and Sub-region, US$ Mn 2022‒2031

Figure 91: South America Tool Bags Market Projections, by Product Type, Thousand Units2017‒2031

Figure 92: South America Tool Bags Market Projections, by Product Type, US$ Mn 2017‒2031

Figure 93: South America Tool Bags Market, Incremental Opportunity, by Product Type, US$ Mn 2022‒2031

Figure 94: South America Tool Bags Market Projections, by Material, Thousand Units,2017‒2031

Figure 95: South America Tool Bags Market Projections, by Material, US$ Mn 2017‒2031

Figure 96: South America Tool Bags Market, Incremental Opportunity, by Material, US$ Mn 2022‒2031

Figure 97: South America Tool Bags Market Projections, by Price, Thousand Units,2017‒2031

Figure 98: South America Tool Bags Market Projections, by Price, US$ Mn 2017‒2031

Figure 99: South America Tool Bags Market, Incremental Opportunity, by Price, US$ Mn 2022‒2031

Figure 100: South America Tool Bags Market Projections, by End-use, Thousand Units,2017‒2031

Figure 101: South America Tool Bags Market Projections, by End-use, US$ Mn 2017‒2031

Figure 102: South America Tool Bags Market, Incremental Opportunity, by End-use, US$ Mn 2022‒2031

Figure 103: South America Tool Bags Market Projections, by Sales Channel, Thousand Units,2017‒2031

Figure 104: South America Tool Bags Market Projections, by Sales Channel, US$ Mn 2017‒2031

Figure 105: South America Tool Bags Market, Incremental Opportunity, by Sales Channel, US$ Mn 2022‒2031

Figure 106: South America Tool Bags Market Projections, by Country and Sub-region, Thousand Units,2017‒2031

Figure 107: South America Tool Bags Market Projections, by Country and Sub-region, US$ Mn 2017‒2031

Figure 108: South America Tool Bags Market, Incremental Opportunity, by Country and Sub-region, US$ Mn 2022‒2031