Analyst Viewpoint

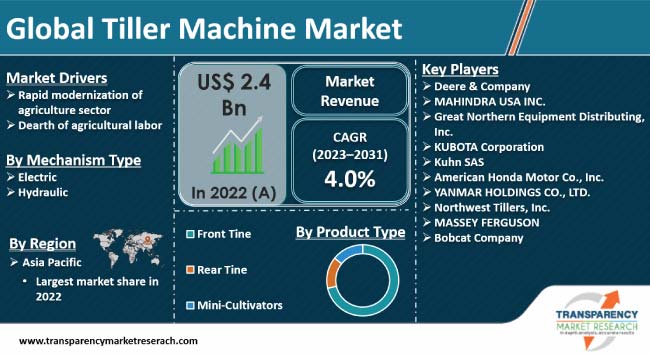

Surge in global population and rise in demand for food are necessitating the adoption of automation and industrial machinery in food production processes. Thus, rapid modernization of the agriculture sector is boosting the tiller machine industry size. Focus on fuel efficiency and precision farming is also contributing to market expansion. Additionally, dearth of agricultural labor, especially in developed countries, is augmenting tiller machine market dynamics.

Prominent players operating in the global tiller machine market are investing substantially in technological advancements in farming equipment to improve their product portfolio and cater to the rising demand from the agriculture sector. They are also following the latest tiller machine industry trends and introducing highly efficient machines that help reduce the time and effort taken for various farming activities.

Tiller machines, also referred to as cultivators, are essential components of modern agriculture. These machines are designed to prepare the soil for planting by breaking it up, mixing the organic matter, and creating a loose blend ready for cultivation.

Tiller machines are available in several sizes and configurations, ranging from small garden tills to industrial-scale tractor-mounted models. These machines primarily consist of rotating blades called tines that dig into the soil, modifying and churning it for further farming operations.

Tiller machines are utilized in everyday modern farming activities due to their enhanced efficiency, and the ability to improve soil structure and control weed growth. The current tiller machine market scenario is rife with opportunities for innovations such as integration of GPS and remote monitoring systems.

Rise in global population and the resultant increase in demand for food necessitate the need for efficient and sustainable farming practices to improve food security and maintain global equilibrium.

Technological advancements offer a chance to gradually shift toward precision farming that integrated with technologies such as sensors and satellite data to improve production efficiency and optimize resource management.

As per the Food and Agriculture Organization (FAO), by 2050, global food production needs to increase by over 60% to feed a population of nearly 9.3 billion people. In countries such as India, more than half of the land is arable and nearly 50% of the labor market is directly or indirectly related to the agriculture sector.

Tiller machines assist farmers in running a smooth, controlled, and precise farming operation. High focus on fuel efficiency aligns with wider concerns around energy saving and resource management in the farming community. This is creating immense tiller machine business opportunities for companies operating in the landscape.

Demand for electrical and hybrid tillers, which align with sustainable goals of several governments, is rising across the globe. Adoption of such machines makes it easier for farmers to avail subsidies. This is fostering market development.

Developed countries such as the U.S., Canada, France, Italy, and Spain are experiencing a lack of agricultural labor owing to rapid urbanization, aging rural population, and shift toward white-collar jobs.

According to the American Farm Bureau Federation, nearly 2.4 million farm jobs need to be filled every year; however, there is a significant decline in worker availability year after year.

In contrast, emerging economies such as India, China, Vietnam, and Thailand, despite having a larger labor force, are prioritizing efficiency and productivity in agriculture.

This rise in focus on agricultural automation and machinery is critical to reaching an elevated level of food security, as the world gets ready to deal with climate change-led disruptions in the supply chain and extreme weather conditions that may hamper crop yield. This is likely to augment the tiller machine market revenue in the near future.

Asia Pacific held the largest tiller machine market share in 2022. China is a major manufacturing hub in Asia Pacific. The Government of China is focused on constant mechanized innovations for crops such as rice, wheat, potato, and sugarcane. Growth in industrial machinery and automotive sectors, propelled by the availability of cheap labor and easy access to fertile land, is driving market statistics in the region.

Under the PM Kisan Samman Yojana, farmers in India can avail an 80% subsidy on the purchase of agricultural equipment. According to the Ministry of Agriculture and Rural Affairs, the Government of China has allocated about US$ 2.0 Bn to support 1.21 million rural households in their purchase of nearly 1.41 million pieces of farming machines and tools.

The tiller machine industry in North America and Europe is projected to grow at a steady pace during the forecast period due to continued modernization of farming techniques in these regions. Countries such as the U.S., Canada, France, and Italy are known for increased adoption of mechanized farming equipment that helps boost production.

Prominent manufacturers of tiller machines are investing significantly in advancements in the garden tiller machinery market and cultivation tiller machinery market to enhance the functionality of farming machinery components.

Constant adoption of better tool designs and features to extend the scope of applications and meet the rising demand from the evolving agriculture sector is one of the key strategies adopted by the leading tiller machine market manufacturers.

Deere & Company, MAHINDRA USA INC., Great Northern Equipment Distributing, Inc., KUBOTA Corporation, Kuhn SAS, American Honda Motor Co., Inc., YANMAR HOLDINGS CO., LTD., Northwest Tillers, Inc., MASSEY FERGUSON, and Bobcat Company are key players operating in this industry.

These companies have been profiled in the tiller machine market report based on parameters such as company overview, business strategies, product portfolio, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 2.4 Bn |

| Market Forecast Value in 2031 | US$ 3.5 Bn |

| Growth Rate (CAGR) | 4.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2031 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 2.4 Bn in 2022

It is projected to grow at a CAGR of 4.0% from 2023 to 2031

Rapid modernization of the agriculture sector and dearth of agricultural labor

The front tine accounted for the largest share in 2022

Asia Pacific was the leading region in 2022

Deere & Company, MAHINDRA USA INC., Great Northern Equipment Distributing, Inc., KUBOTA Corporation, Kuhn SAS, American Honda Motor Co., Inc., YANMAR HOLDINGS CO., LTD., Northwest Tillers, Inc., MASSEY FERGUSON, and Bobcat Company

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Technological Overview Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Regulatory Framework

5.10. Global Tiller Machine Market Analysis and Forecast, 2017–2031

5.10.1. Market Value Projections (US$ Mn)

6. Global Tiller Machine Market Analysis and Forecast, by Product Type

6.1. Tiller Machine Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

6.1.1. Front Tine

6.1.2. Rear Tine

6.1.3. Mini-cultivators

6.2. Incremental Opportunity, by Product Type

7. Global Tiller Machine Market Analysis and Forecast, by Mechanism Type

7.1. Tiller Machine Market Size (US$ Mn) Forecast, by Mechanism Type, 2017–2031

7.1.1. Electric

7.1.2. Hydraulic

7.2. Incremental Opportunity, by Mechanism Type

8. Global Tiller Machine Market Analysis and Forecast, by Tilling Width (Inches)

8.1. Tiller Machine Market Size (US$ Mn) Forecast, Tilling Width (Inches), 2017–2031

8.1.1. 9

8.1.2. 14

8.1.3. 15

8.1.4. 16

8.1.5. 17

8.1.6. 20

8.1.7. 21

8.1.8. 24

8.1.9. 26

8.1.10. 36

8.2. Incremental Opportunity, by Tilling Width (Inches)

9. Global Tiller Machine Market Analysis and Forecast, by Power Capacity

9.1. Tiller Machine Market Size (US$ Mn) Forecast, Power Capacity, 2017–2031

9.1.1. Under 25 HP

9.1.2. 25 to 40 HP

9.1.3. 40 to 60 HP

9.1.4. 60 to 80 HP

9.2. Incremental Opportunity, by Power Capacity

10. Global Tiller Machine Market Analysis and Forecast, by Region

10.1. Tiller Machine Market Size (US$ Mn) Forecast, by Region, 2017–2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Tiller Machine Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Brand Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supplier Side

11.5. Tiller Machine Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

11.5.1. Front Tine

11.5.2. Rear Tine

11.5.3. Mini-cultivators

11.6. Tiller Machine Market Size (US$ Mn) Forecast, by Mechanism Type, 2017–2031

11.6.1. Electric

11.6.2. Hydraulic

11.7. Tiller Machine Market Size (US$ Mn) Forecast, by Tilling Width (Inches)- 2017–2031

11.7.1. 9

11.7.2. 14

11.7.3. 15

11.7.4. 16

11.7.5. 17

11.7.6. 20

11.7.7. 21

11.7.8. 24

11.7.9. 26

11.7.10. 36

11.8. Tiller Machine Market Size (US$ Mn) Forecast, by Power Capacity- 2017–2031

11.8.1. Under 25 HP

11.8.2. 25 to 40 HP

11.8.3. 40 to 60 HP

11.8.4. 60 to 80 HP

11.9. Tiller Machine Market Size (US$ Mn) Forecast, by Country - 2017–2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Tiller Machine Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supplier Side

12.5. Tiller Machine Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

12.5.1. Front Tine

12.5.2. Rear Tine

12.5.3. Mini-cultivators

12.6. Tiller Machine Market Size (US$ Mn) Forecast, by Mechanism Type, 2017–2031

12.6.1. Electric

12.6.2. Hydraulic

12.7. Tiller Machine Market Size (US$ Mn) Forecast, by Tilling Width (Inches), 2017–2031

12.7.1. 9

12.7.2. 14

12.7.3. 15

12.7.4. 16

12.7.5. 17

12.7.6. 20

12.7.7. 21

12.7.8. 24

12.7.9. 26

12.7.10. 36

12.8. Tiller Machine Market Size (US$ Mn) Forecast, by Power Capacity, 2017–2031

12.8.1. Under 25 HP

12.8.2. 25 to 40 HP

12.8.3. 40 to 60 HP

12.8.4. 60 to 80 HP

12.9. Tiller Machine Market Size (US$ Mn) Forecast, by Country, 2017–2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Tiller Machine Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supplier Side

13.5. Tiller Machine Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

13.5.1. Front Tine

13.5.2. Rear Tine

13.5.3. Mini-cultivators

13.6. Tiller Machine Market Size (US$ Mn) Forecast, by Mechanism Type, 2017–2031

13.6.1. Electric

13.6.2. Hydraulic

13.7. Tiller Machine Market Size (US$ Mn) Forecast, by Tilling Width (Inches), 2017–2031

13.7.1. 9

13.7.2. 14

13.7.3. 15

13.7.4. 16

13.7.5. 17

13.7.6. 20

13.7.7. 21

13.7.8. 24

13.7.9. 26

13.7.10. 36

13.8. Tiller Machine Market Size (US$ Mn) Forecast, by Power Capacity, 2017–2031

13.8.1. Under 25 HP

13.8.2. 25 to 40 HP

13.8.3. 40 to 60 HP

13.8.4. 60 to 80 HP

13.9. Tiller Machine Market Size (US$ Mn) Forecast, by Country, 2017–2031

13.9.1. India

13.9.2. China

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & South Africa Tiller Machine Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supplier Side

14.5. Tiller Machine Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

14.5.1. Front Tine

14.5.2. Rear Tine

14.5.3. Mini-cultivators

14.6. Tiller Machine Market Size (US$ Mn) Forecast, by Mechanism Type, 2017–2031

14.6.1. Electric

14.6.2. Hydraulic

14.7. Tiller Machine Market Size (US$ Mn) Forecast, by Tilling Width (Inches), 2017–2031

14.7.1. 9

14.7.2. 14

14.7.3. 15

14.7.4. 16

14.7.5. 17

14.7.6. 20

14.7.7. 21

14.7.8. 24

14.7.9. 26

14.7.10. 36

14.8. Tiller Machine Market Size (US$ Mn) Forecast, by Power Capacity, 2017–2031

14.8.1. Under 25 HP

14.8.2. 25 to 40 HP

14.8.3. 40 to 60 HP

14.8.4. 60 to 80 HP

14.9. Tiller Machine Market Size (US$ Mn) Forecast, by Country, 2017–2031

14.9.1. GCC

14.9.2. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Tiller Machine Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supplier Side

15.5. Tiller Machine Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

15.5.1. Front Tine

15.5.2. Rear Tine

15.5.3. Mini-cultivators

15.6. Tiller Machine Market Size (US$ Mn) Forecast, by Mechanism Type, 2017–2031

15.6.1. Electric

15.6.2. Hydraulic

15.7. Tiller Machine Market Size (US$ Mn) Forecast, by Tilling Width (Inches), 2017–2031

15.7.1. 9

15.7.2. 14

15.7.3. 15

15.7.4. 16

15.7.5. 17

15.7.6. 20

15.7.7. 21

15.7.8. 24

15.7.9. 26

15.7.10. 36

15.8. Tiller Machine Market Size (US$ Mn) Forecast, by Power Capacity, 2017–2031

15.8.1. Under 25 HP

15.8.2. 25 to 40 HP

15.8.3. 40 to 60 HP

15.8.4. 60 to 80 HP

15.9. Tiller Machine Market Size (US$ Mn) Forecast, by Country, 2017–2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), by Company, (2022)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Deere & Company

16.3.1.1. Company Overview

16.3.1.2. Sales Area

16.3.1.3. Geographical Presence

16.3.1.4. Revenue

16.3.1.5. Strategy & Business Overview

16.3.2. MAHINDRA USA INC.

16.3.2.1. Company Overview

16.3.2.2. Sales Area

16.3.2.3. Geographical Presence

16.3.2.4. Revenue

16.3.2.5. Strategy & Business Overview

16.3.3. Great Northern Equipment Distributing, Inc.

16.3.3.1. Company Overview

16.3.3.2. Sales Area

16.3.3.3. Geographical Presence

16.3.3.4. Revenue

16.3.3.5. Strategy & Business Overview

16.3.4. KUBOTA Corporation

16.3.4.1. Company Overview

16.3.4.2. Sales Area

16.3.4.3. Geographical Presence

16.3.4.4. Revenue

16.3.4.5. Strategy & Business Overview

16.3.5. Kuhn SAS

16.3.5.1. Company Overview

16.3.5.2. Sales Area

16.3.5.3. Geographical Presence

16.3.5.4. Revenue

16.3.5.5. Strategy & Business Overview

16.3.6. American Honda Motor Co., Inc.

16.3.6.1. Company Overview

16.3.6.2. Sales Area

16.3.6.3. Geographical Presence

16.3.6.4. Revenue

16.3.6.5. Strategy & Business Overview

16.3.7. YANMAR HOLDINGS CO., LTD.

16.3.7.1. Company Overview

16.3.7.2. Sales Area

16.3.7.3. Geographical Presence

16.3.7.4. Revenue

16.3.7.5. Strategy & Business Overview

16.3.8. Northwest Tillers, Inc.

16.3.8.1. Company Overview

16.3.8.2. Sales Area

16.3.8.3. Geographical Presence

16.3.8.4. Revenue

16.3.8.5. Strategy & Business Overview

16.3.9. MASSEY FERGUSON

16.3.9.1. Company Overview

16.3.9.2. Sales Area

16.3.9.3. Geographical Presence

16.3.9.4. Revenue

16.3.9.5. Strategy & Business Overview

16.3.10. Bobcat Company

16.3.10.1. Company Overview

16.3.10.2. Sales Area

16.3.10.3. Geographical Presence

16.3.10.4. Revenue

16.3.10.5. Strategy & Business Overview

16.3.11. Other Key Players

16.3.11.1. Company Overview

16.3.11.2. Sales Area

16.3.11.3. Geographical Presence

16.3.11.4. Revenue

16.3.11.5. Strategy & Business Overview

17. Go to Market Strategy

18. Identification of Potential Market Spaces

19. Prevailing Market Risks

20. Understanding Buying Process of Customers

21. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Tiller Machine Market Value (US$ Mn), by Product Type, 2017-2031

Table 2: Global Tiller Machine Market Value (US$ Mn), by Mechanism Type, 2017-2031

Table 3: Global Tiller Machine Market Value (US$ Mn), by Tilling Width (Inches), 2017-2031

Table 4: Global Tiller Machine Market Value (US$ Mn), by Power Capacity, 2017-2031

Table 5: Global Tiller Machine Market Value (US$ Mn), by Region, 2017-2031

Table 6: North America Tiller Machine Market Value (US$ Mn), by Product Type, 2017-2031

Table 7: North America Tiller Machine Market Value (US$ Mn), by Mechanism Type, 2017-2031

Table 8: North America Tiller Machine Market Value (US$ Mn), by Tilling Width (Inches), 2017-2031

Table 9: North America Tiller Machine Market Value (US$ Mn), by Power Capacity, 2017-2031

Table 10: North America Tiller Machine Market Value (US$ Mn), by Country & Sub-Region, 2017-2031

Table 11: Europe Tiller Machine Market Value (US$ Mn), by Product Type, 2017-2031

Table 12: Europe Tiller Machine Market Value (US$ Mn), by Mechanism Type, 2017-2031

Table 13: Europe Tiller Machine Market Value (US$ Mn), by Tilling Width (Inches), 2017-2031

Table 14: Europe Tiller Machine Market Value (US$ Mn), by Power Capacity, 2017-2031

Table 15: Europe Tiller Machine Market Value (US$ Mn), by Country & Sub-Region, 2017-2031

Table 16: Asia Pacific Tiller Machine Market Value (US$ Mn), by Product Type, 2017-2031

Table 17: Asia Pacific Tiller Machine Market Value (US$ Mn), by Mechanism Type, 2017-2031

Table 18: Asia Pacific Tiller Machine Market Value (US$ Mn), by Tilling Width (Inches), 2017-2031

Table 19: Asia Pacific Tiller Machine Market Value (US$ Mn), by Power Capacity, 2017-2031

Table 20: Asia Pacific Tiller Machine Market Value (US$ Mn), by Country & Sub-Region, 2017-2031

Table 21: Middle East & Africa Tiller Machine Market Value (US$ Mn), by Product Type, 2017-2031

Table 22: Middle East & Africa Tiller Machine Market Value (US$ Mn), by Mechanism Type, 2017-2031

Table 23: Middle East & Africa Tiller Machine Market Value (US$ Mn), by Tilling Width (Inches), 2017-2031

Table 24: Middle East & Africa Tiller Machine Market Value (US$ Mn), by Power Capacity, 2017-2031

Table 25: Middle East & Africa Tiller Machine Market Value (US$ Mn), by Country & Sub-Region, 2017-2031

Table 26: South America Tiller Machine Market Value (US$ Mn), by Product Type, 2017-2031

Table 27: South America Tiller Machine Market Value (US$ Mn), by Mechanism Type, 2017-2031

Table 28: South America Tiller Machine Market Value (US$ Mn), by Tilling Width (Inches), 2017-2031

Table 29: South America Tiller Machine Market Value (US$ Mn), by Power Capacity, 2017-2031

Table 30: South America Tiller Machine Market Value (US$ Mn), by Country & Sub-Region, 2017-2031

List of Figures

Figure 1: Global Tiller Machine Market Value (US$ Mn), by Product Type, 2017-2031

Figure 2: Global Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 3: Global Tiller Machine Market Value (US$ Mn), by Mechanism Type, 2017-2031

Figure 4: Global Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Mechanism Type, 2023-2031

Figure 5: Global Tiller Machine Market Value (US$ Mn), by Tilling Width (Inches), 2017-2031

Figure 6: Global Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Tilling Width (Inches), 2023-2031

Figure 7: Global Tiller Machine Market Value (US$ Mn), by Power Capacity, 2017-2031

Figure 8: Global Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Power Capacity, 2023-2031

Figure 9: Global Tiller Machine Market Value (US$ Mn), by Region, 2017-2031

Figure 10: Global Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 11: North America Tiller Machine Market Value (US$ Mn), by Product Type, 2017-2031

Figure 12: North America Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 13: North America Tiller Machine Market Value (US$ Mn), by Mechanism Type, 2017-2031

Figure 14: North America Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Mechanism Type, 2023-2031

Figure 15: North America Tiller Machine Market Value (US$ Mn), by Tilling Width (Inches), 2017-2031

Figure 16: North America Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Tilling Width (Inches), 2023-2031

Figure 17: North America Tiller Machine Market Value (US$ Mn), by Power Capacity, 2017-2031

Figure 18: North America Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Power Capacity , 2023-2031

Figure 19: North America Tiller Machine Market Value (US$ Mn), by Country & Sub-Region, 2017-2031

Figure 20: North America Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Country & Sub-Region 2023-2031

Figure 21: Europe Tiller Machine Market Value (US$ Mn), by Product Type, 2017-2031

Figure 22: Europe Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 23: Europe Tiller Machine Market Value (US$ Mn), by Mechanism Type, 2017-2031

Figure 24: Europe Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Mechanism Type, 2023-2031

Figure 25: Europe Tiller Machine Market Value (US$ Mn), by Tilling Width (Inches), 2017-2031

Figure 26: Europe Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Tilling Width (Inches), 2023-2031

Figure 27: Europe Tiller Machine Market Value (US$ Mn), by Power Capacity, 2017-2031

Figure 28: Europe Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Power Capacity, 2023-2031

Figure 29: Europe Tiller Machine Market Value (US$ Mn), by Country & Sub-Region, 2017-2031

Figure 30: Europe Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Country & Sub-Region 2023-2031

Figure 31: Asia Pacific Tiller Machine Market Value (US$ Mn), by Product Type, 2017-2031

Figure 32: Asia Pacific Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 33: Asia Pacific Tiller Machine Market Value (US$ Mn), by Mechanism Type, 2017-2031

Figure 34: Asia Pacific Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Mechanism Type, 2023-2031

Figure 35: Asia Pacific Tiller Machine Market Value (US$ Mn), by Tilling Width (Inches), 2017-2031

Figure 36: Asia Pacific Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Tilling Width (Inches), 2023-2031

Figure 37: Asia Pacific Tiller Machine Market Value (US$ Mn), by Power Capacity, 2017-2031

Figure 38: Asia Pacific Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Power Capacity, 2023-2031

Figure 39: Asia Pacific Tiller Machine Market Value (US$ Mn), by Country & Sub-Region, 2017-2031

Figure 40: Asia Pacific Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Country & Sub-Region 2023-2031

Figure 41: Middle East & Africa Tiller Machine Market Value (US$ Mn), by Product Type, 2017-2031

Figure 42: Middle East & Africa Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 43: Middle East & Africa Tiller Machine Market Value (US$ Mn), by Mechanism Type, 2017-2031

Figure 44: Middle East & Africa Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Mechanism Type, 2023-2031

Figure 45: Middle East & Africa Tiller Machine Market Value (US$ Mn), by Tilling Width (Inches), 2017-2031

Figure 46: Middle East & Africa Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Tilling Width (Inches), 2023-2031

Figure 47: Middle East & Africa Tiller Machine Market Value (US$ Mn), by Power Capacity, 2017-2031

Figure 48: Middle East & Africa Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Power Capacity, 2023-2031

Figure 49: Middle East & Africa Tiller Machine Market Value (US$ Mn), by Country & Sub-Region, 2017-2031

Figure 50: Middle East & Africa Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Country & Sub-Region, 2023-2031

Figure 51: South America Tiller Machine Market Value (US$ Mn), by Product Type, 2017-2031

Figure 52: South America Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 53: South America Tiller Machine Market Value (US$ Mn), by Mechanism Type, 2017-2031

Figure 54: South America Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Mechanism Type, 2023-2031

Figure 55: South America Tiller Machine Market Value (US$ Mn), by Tilling Width (Inches), 2017-2031

Figure 56: South America Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Tilling Width (Inches), 2023-2031

Figure 57: South America Tiller Machine Market Value (US$ Mn), by Power Capacity, 2017-2031

Figure 58: South America Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Power Capacity, 2023-2031

Figure 59: South America Tiller Machine Market Value (US$ Mn), by Country & Sub-Region, 2017-2031

Figure 60: South America Tiller Machine Market Incremental Opportunity (US$ Mn), Forecast, by Country & Sub-Region, 2023-2031