Analyst Viewpoint

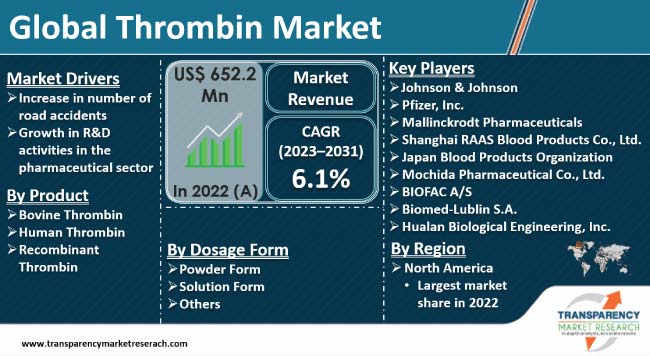

Increase in number of road accidents due to growth in traffic and availability of medical facilities in emergencies is fostering the thrombin market growth. Thrombin helps control heavy blood loss during surgeries, thereby allowing surgeons to operate patients efficiently. Furthermore, increase in prevalence of inherited blood coagulation diseases is driving the demand for thrombin. Healthcare professionals prefer thrombin due to its procoagulant properties.

Rise in R&D activities in the pharmaceutical sector for drug development to treat inherited blood-related disorders and government initiatives to improve availability of medical facilities in developing regions are generating lucrative thrombin market opportunities. Leading players in the market are focusing on new drug development strategies to meet the surge in demand for thrombin from healthcare organizations.

Thrombin is a serine protease blood plasma protein used to convert fibrinogen to soluble fibrin. Thrombin helps catalyze the blood coagulation process with its unique molecule functions; as a procoagulant, it activates platelets through its receptor on platelets. Thrombin is used to control excessive bleeding and clotting during medical surgeries. Additionally, thrombin is used in diagnostic centers & clinics in several applications, such as coagulation assays, defibrination of blood or plasma, and clotting factor tests.

Bovine thrombin, human thrombin, and recombinant thrombin are major types of thrombin utilized in medical surgeries and diagnostic centers. Bovine thrombin is an enzyme that converts fibrinogen to fibrin. It is used in the defibrination of plasma to produce serum matrixes to be used as standards and controls. Human thrombin is a sterile solution containing highly purified human thrombin to activate clotting. Human thrombin is indicated as an aid to hemostasis during minor bleeding from small venules and capillaries.

Thrombin is employed to control excessive blood flow during complex surgeries to treat severe injuries and trauma. Increase in number of road accidents and injuries is fueling market statistics. Thrombin is utilized in safer hemostatic conditions and postoperative complications to ensure faster recovery from traumas. Road accidents are increasing due to the negligence on roads and non-adherence to road safety rules. According to the thrombin market forecast, growth in hospitalizations due to road accidents is projected to fuel market development.

According to the World Health Organization, every year around 1.3 billion people die due to road traffic crashes. Approximately 20 to 50 million people suffer from non-fatal injuries, with many incurring a disability. Increase in investments by governments for quick hospitalization post-accidents is increasing the number of surgeries, thereby driving the use of thrombin.

Companies in the drug development industry are investing in research and development activities to provide appropriate treatments for blood-related diseases or disorders. Thrombin is a crucial element used to treat several blood coagulation disorders, such as Von Willebrand disease, hypercoagulable states, hemophilia, and deep venous thrombosis. Increase in R&D activities by companies operating in the pharmaceutical sector to launch new drugs for these disorders is boosting the thrombin market revenue.

Vitro study, protein-structure analysis, coagulation research, and medical & biochemical research are ongoing market trends in bovine-derived thrombin products. Rise in demand for bovine thrombin in the diagnostics sector for clotting factor tests, coagulation assays, and defibrination of blood or plasma, is fueling market dynamics.

As per the thrombin market analysis, North America accounted for largest share in 2022. Road safety concerns due to growth in traffic across the region is likely to increase the number of accidents that occur due to lack of traffic management. Well-established healthcare infrastructure in the region ensures immediate treatment and easy access to required medical facilities in case of emergencies. Thus, growth in number of road accidents and availability of treatment options are major factors bolstering the thrombin industry share. As per data published by Forbes, a total of 35,766 fatal car accidents occurred on roadways in the United States in 2020. Another 1,593,390 accidents resulted in injuries leading to severe disabilities among people.

Furthermore, increase in prevalence of inherited blood disorders, such as hemophilia, is propelling the market value. According to the World Federation of Hemophilia, approximately 11,790 patients with Hemophilia A and 3,026 patients with Hemophilia B were diagnosed in the United States in 2020.

Partnerships, new product launches, innovation in production lines, and research & development activities are major strategies adopted by leading market players. Capabilities to invest in innovative product development methodologies allow companies to deliver high-quality and efficient treatment to patients. Pharmaceutical companies invest substantially in conducting clinical trials to ensure efficiency of drugs and evaluate correct dosage according to the severity of disease and the patient’s condition.

Some of the leading companies in the industry are Johnson & Johnson, Pfizer, Inc., Mallinckrodt Pharmaceuticals, Shanghai RAAS Blood Products Co., Ltd., Japan Blood Products Organization, Mochida Pharmaceutical Co., Ltd., BIOFAC A/S, Biomed-Lublin S.A., and Hualan Biological Engineering, Inc.

These companies are profiled in the thrombin market report based on parameters such as company overview, financial overview, business segments, product portfolio, business strategies, and key developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 652.2 Mn |

| Market Forecast (Value) in 2031 | US$ 1.1 Bn |

| Growth Rate (CAGR) | 6.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn/Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 652.2 Mn in 2022

It is projected to register a CAGR of 6.1% from 2023 to 2031

Increase in number of road accidents and growth in R&D activities in the pharmaceutical sector

North America was the most lucrative region in 2022

Johnson & Johnson, Pfizer, Inc., Mallinckrodt Pharmaceuticals, Shanghai RAAS Blood Products Co., Ltd., Japan Blood Products Organization, Mochida Pharmaceutical Co., Ltd., BIOFAC A/S, Biomed-Lublin S.A., and Hualan Biological Engineering, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Thrombin Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Thrombin Market Analysis and Forecasts, 2023–2031

5. Key Insights

5.1. Current Trends in Thrombin

5.2. Technological advancements in Thrombin

5.3. COVID-19 Impact Analysis

6. Global Thrombin Market Analysis and Forecasts, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2023–2031

6.3.1. Bovine Thrombin

6.3.2. Human Thrombin

6.3.3. Recombinant Thrombin

6.4. Market Attractiveness Analysis, by Product

7. Global Thrombin Market Analysis and Forecasts, by Dosage Form

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Dosage Form, 2023–2031

7.3.1. Powder Form

7.3.2. Solution Form

7.3.3. Others

7.4. Market Attractiveness Analysis, by Dosage Form

8. Global Thrombin Market Analysis and Forecasts, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2023–2031

8.3.1. Hospitals

8.3.2. Diagnostic Centers & Clinics

8.3.3. Academic & Research Institutes

8.4. Market Attractiveness Analysis, by End-user

9. Global Thrombin Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Thrombin Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2023–2031

10.2.1. Bovine Thrombin

10.2.2. Human Thrombin

10.2.3. Recombinant Thrombin

10.3. Market Value Forecast, by Dosage Form, 2023–2031

10.3.1. Powder Form

10.3.2. Solution Form

10.3.3. Others

10.4. Market Value Forecast, by End-user, 2023–2031

10.4.1. Hospitals

10.4.2. Diagnostic Centers & Clinics

10.4.3. Academic & Research Institutes

10.5. Market Value Forecast, by Country, 2023–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Dosage Form

10.6.3. By End-user

10.6.4. By Country

11. Europe Thrombin Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2023–2031

11.2.1. Bovine Thrombin

11.2.2. Human Thrombin

11.2.3. Recombinant Thrombin

11.3. Market Value Forecast, by Dosage Form, 2023–2031

11.3.1. Powder Form

11.3.2. Solution Form

11.3.3. Others

11.4. Market Value Forecast, by End-user, 2023–2031

11.4.1. Hospitals

11.4.2. Diagnostic Centers & Clinics

11.4.3. Academic & Research Institutes

11.5. Market Value Forecast, by Country/Sub-region, 2023–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Dosage Form

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Thrombin Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2023–2031

12.2.1. Bovine Thrombin

12.2.2. Human Thrombin

12.2.3. Recombinant Thrombin

12.3. Market Value Forecast, by Dosage Form, 2023–2031

12.3.1. Powder Form

12.3.2. Solution Form

12.3.3. Others

12.4. Market Value Forecast, by End-user, 2023–2031

12.4.1. Hospitals

12.4.2. Diagnostic Centers & Clinics

12.4.3. Academic & Research Institutes

12.5. 12.5. Market Value Forecast, by Country/Sub-region, 2023–2031

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Dosage Form

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Thrombin Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2023–2031

13.2.1. Bovine Thrombin

13.2.2. Human Thrombin

13.2.3. Recombinant Thrombin

13.3. Market Value Forecast, by Dosage Form, 2023–2031

13.3.1. Powder Form

13.3.2. Solution Form

13.3.3. Others

13.4. Market Value Forecast, by End-user, 2023–2031

13.4.1. Hospitals

13.4.2. Diagnostic Centers & Clinics

13.4.3. Academic & Research Institutes

13.5. Market Value Forecast, by Country/Sub-region, 2023–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Dosage Form

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Thrombin Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2023–2031

14.2.1. Bovine Thrombin

14.2.2. Human Thrombin

14.2.3. Recombinant Thrombin

14.3. Market Value Forecast, by Dosage Form, 2023–2031

14.3.1. Powder Form

14.3.2. Solution Form

14.3.3. Others

14.4. Market Value Forecast, by End-user, 2023–2031

14.4.1. Hospitals

14.4.2. Diagnostic Centers & Clinics

14.4.3. Academic & Research Institutes

14.5. Market Value Forecast, by Country/Sub-region, 2023–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Dosage Form

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Johnson & Johnson

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Strategic Overview

15.3.1.5. SWOT Analysis

15.3.2. Pfizer, Inc.

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Strategic Overview

15.3.2.5. SWOT Analysis

15.3.3. Mallinckrodt Pharmaceuticals

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Strategic Overview

15.3.3.5. SWOT Analysis

15.3.4. Shanghai RAAS Blood Products Co., Ltd.

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Strategic Overview

15.3.4.5. SWOT Analysis

15.3.5. Japan Blood Products Organization

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Strategic Overview

15.3.5.5. SWOT Analysis

15.3.6. Mochida Pharmaceutical Co., Ltd.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Strategic Overview

15.3.6.5. SWOT Analysis

15.3.7. BIOFAC A/S

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Strategic Overview

15.3.7.5. SWOT Analysis

15.3.8. Biomed-Lublin S.A.

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Strategic Overview

15.3.8.5. SWOT Analysis

15.3.9. Hualan Biological Engineering, Inc.

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Strategic Overview

15.3.9.5. SWOT Analysis

List of Tables

Table 01: Global Thrombin Market Value (US$ Mn) Forecast, by Product, 2023–2031

Table 02: Global Thrombin Market Value (US$ Mn) Forecast, by Dosage Form, 2023–2031

Table 03: Global Thrombin Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 04: Global Thrombin Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 05: North America Thrombin Market Value (US$ Mn) Forecast, by Product, 2023–2031

Table 06: North America Thrombin Market Value (US$ Mn) Forecast, by Dosage Form, 2023–2031

Table 07: North America Thrombin Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 08: North America Thrombin Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 09: Europe Thrombin Market Value (US$ Mn) Forecast, by Product, 2023–2031

Table 10: Europe Thrombin Market Value (US$ Mn) Forecast, by Dosage Form, 2023–2031

Table 11: Europe Thrombin Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 12: Europe Thrombin Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 13: Asia Pacific Thrombin Market Value (US$ Mn) Forecast, by Product, 2023–2031

Table 14: Asia Pacific Thrombin Market Value (US$ Mn) Forecast, by Dosage Form, 2023–2031

Table 15: Asia Pacific Thrombin Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 16: Asia Pacific Thrombin Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 17: Latin America Thrombin Market Value (US$ Mn) Forecast, by Product, 2023–2031

Table 18: Latin America Thrombin Market Value (US$ Mn) Forecast, by Dosage Form, 2023–2031

Table 19: Latin America Thrombin Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 20: Latin America Thrombin Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 21: Middle East & Africa Thrombin Market Value (US$ Mn) Forecast, by Product, 2023–2031

Table 22: Middle East & Africa Thrombin Market Value (US$ Mn) Forecast, by Dosage Form, 2023–2031

Table 23: Middle East & Africa Thrombin Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 24: Middle East & Africa Thrombin Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

List of Figures

Figure 01: Global Thrombin Market Value (US$ Mn) Forecast, 2023–2031

Figure 02: Global Thrombin Market Value Share Analysis, by Product, 2022 and 2031

Figure 03: Global Thrombin Market Attractiveness Analysis, by Product, 2023–2031

Figure 04: Global Thrombin Market Value Share Analysis, by Dosage Form 2022 and 2031

Figure 05: Global Thrombin Market Attractiveness Analysis, by Dosage Form, 2023–2031

Figure 06: Global Thrombin Market Value Share Analysis, by End-user, 2022 and 2031

Figure 07: Global Thrombin Market Attractiveness Analysis, by End-user, 2023–2031

Figure 08: Global Thrombin Market Value Share Analysis, by Region, 2022 and 2031

Figure 09: Global Thrombin Market Attractiveness Analysis, by Region, 2023–2031

Figure 10: North America Thrombin Market Value (US$ Mn) Forecast, 2023–2031

Figure 11: North America Thrombin Market Value Share Analysis, by Product, 2022 and 2031

Figure 12: North America Thrombin Market Attractiveness Analysis, by Product, 2023–2031

Figure 13: North America Thrombin Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 14: North America Thrombin Market Attractiveness Analysis, by Dosage Form, 2023–2031

Figure 15: North America Thrombin Market Value Share Analysis, by End-user, 2022 and 2031

Figure 16: North America Thrombin Market Attractiveness Analysis, by End-user, 2023–2031

Figure 17: North America Thrombin Market Value Share Analysis, by Country, 2022 and 2031

Figure 18: North America Thrombin Market Attractiveness Analysis, by Country, 2023–2031

Figure 19: Europe Thrombin Market Value (US$ Mn) Forecast, 2023–2031

Figure 20: Europe Thrombin Market Value Share Analysis, by Product, 2022 and 2031

Figure 21: Europe Thrombin Market Attractiveness Analysis, by Product, 2023–2031

Figure 22: Europe Thrombin Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 23: Europe Thrombin Market Attractiveness Analysis, by Dosage Form, 2023–2031

Figure 24: Europe Thrombin Market Value Share Analysis, by End-user, 2022 and 2031

Figure 25: Europe Thrombin Market Attractiveness Analysis, by End-user, 2023–2031

Figure 26: Europe Thrombin Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 27: Europe Thrombin Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 28: Asia Pacific Thrombin Market Value (US$ Mn) Forecast, 2023–2031

Figure 29: Asia Pacific Thrombin Market Value Share Analysis, by Product, 2022 and 2031

Figure 30: Asia Pacific Thrombin Market Attractiveness Analysis, by Product, 2023–2031

Figure 31: Asia Pacific Thrombin Market Value Share Analysis, by Dosage Form 2022 and 2031

Figure 32: Asia Pacific Thrombin Market Attractiveness Analysis, by Dosage Form, 2023–2031

Figure 33: Asia Pacific Thrombin Market Value Share Analysis, by End-user, 2022 and 2031

Figure 34: Asia Pacific Thrombin Market Attractiveness Analysis, by End-user, 2023–2031

Figure 35: Asia Pacific Thrombin Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 36: Asia Pacific Thrombin Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 37: Latin America Thrombin Market Value (US$ Mn) Forecast, 2023–2031

Figure 38: Latin America Thrombin Market Value Share Analysis, by Product, 2022 and 2031

Figure 39: Latin America Thrombin Market Attractiveness Analysis, by Product, 2023–2031

Figure 40: Latin America Thrombin Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 41: Latin America Thrombin Market Attractiveness Analysis, by Dosage Form, 2023–2031

Figure 42: Latin America Thrombin Market Value Share Analysis, by End-user, 2022 and 2031

Figure 43: Latin America Thrombin Market Attractiveness Analysis, by End-user, 2023–2031

Figure 44: Latin America Thrombin Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 45: Latin America Thrombin Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 46: Middle East & Africa Thrombin Market Value (US$ Mn) Forecast, 2023–2031

Figure 47: Middle East & Africa Thrombin Market Value Share Analysis, by Product, 2022 and 2031

Figure 48: Middle East & Africa Thrombin Market Attractiveness Analysis, by Product, 2023–2031

Figure 49: Middle East & Africa Thrombin Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 50: Middle East & Africa Thrombin Market Attractiveness Analysis, by Dosage Form, 2023–2031

Figure 51: Middle East & Africa Thrombin Market Value Share Analysis, by End-user, 2022 and 2031

Figure 52: Middle East & Africa Thrombin Market Attractiveness Analysis, by End-user, 2023–2031

Figure 53: Middle East & Africa Thrombin Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 54: Middle East & Africa Thrombin Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 55: Global Thrombin Market Share Analysis, by Company, 2022