Analysts’ Viewpoint on Thoracic Drainage Devices Market Scenario

At the beginning of the 21st century, cardiothoracic surgery was arguably the most successful of all medical specialties. Emerging economies, including China, India, South Korea, Brazil, Russia, South Africa, and Turkey, provide significant opportunities for prominent companies in the thoracic drainage devices market owing to their massive population, specifically in China and India. However, the price factor is a concern in the economies mentioned above.

The COVID-19 pandemic has presented considerable opportunities in the global thoracic drainage devices market. Demand for chest wall drainage devices or thoracic drainage devices is increasing due to the surge in incidence of respiratory diseases and cardiovascular diseases during the pandemic. Key players operating in the thoracic drainage devices market should focus on continued investment in advancements in thoracic drainage devices to introduce innovative products in the market.

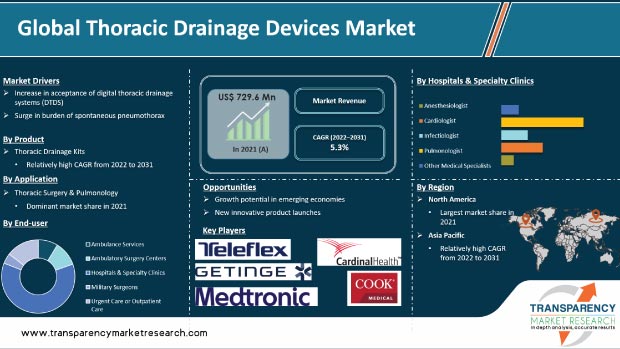

Thoracic or chest drainage helps maintain proper respiratory function and hemodynamic stability by removing air, fluid, or blood from around the heart or lungs. Thoracic drainage systems are primarily utilized in intensive care units (ICUs), emergency departments, and operating rooms. Increase in the acceptance of digital thoracic drainage systems (DTDS), rise in prevalence of CVDs globally, and surge in burden of spontaneous pneumothorax are major factors driving the global thoracic drainage devices market. DTDS is a safe, comfortable, and well-tolerated by patients. Moreover, DTDS helps reduce or eliminate the cost of hospital stay. Novel inventions in thoracic drainage systems are expected to propel the market in the next few years. For instance, in January 2020, Centese, Inc., a developer of advanced drainage systems, announced the completion of the 1st clinical study of its ‘Thoraguard digital drainage system’ used in cardiovascular surgery, at Stanford University Medical Center. Thoraguard is the 1st surgical drainage device to provide automated clog clearance without requiring human intervention, and digitally measures and displays hourly drainage volume and trends to facilitate clinical decision-making after cardiac surgery. Some of the commercially available products in the digital chest drainage devices market are Thopaz (Medela AG), Drentech (REDAX), and Digivent (Millicore AB).

Spontaneous pneumothorax is a one of the major health issues across the globe. Spontaneous pneumothorax is caused due to air in the chest cavity, which can resolve itself; however, most often requires hospital admission and urgent medical care. In a military warfare setting, around 13% to 15% of penetrating wounds related to the thoracic cavity require thoracic intervention including a thoracic catheter. According to an article published in the Canadian Respiratory Journal, in March 2017, primary spontaneous pneumothorax is more common in men than women. This condition occurs in 7.4 to 18 per 100,000 men each year and 1.2 to 6 per 100,000 women. Additionally, incidence of spontaneous pneumothorax is increasing gradually. Various research studies estimate that more than 2 million spontaneous pneumothorax occur globally every year.

Globally, as of August 2022, there have been over 585.0 million confirmed cases of COVID-19, including around 6.4 million deaths, reported to World Health Organization (WHO). However, researches revealed that thoracic drainage systems can significantly help reduce massive spread of COVID-19. Patients suffering from COVID-19 are at high risk of developing acute respiratory distress syndrome (ARDS) needing invasive mechanical ventilation. Furthermore, Barotrauma in COVID-19 patients often leads to pneumothorax, which requires chest tube placement (thoracostomy). Additionally, German Health Alliance (GHA) members, including B. Braun, ATMOS MedizinTechnik GmbH & Co. KG, Getinge, and Dräger, have witnessed a notable increase in the demand for their products, such as thoracic drainage system, from across the world since the beginning of 2020. For instance, ATMOS MedizinTechnik GmbH & Co. KG, an innovative medical device company, announced that production is running at full speed, as product groups such as drainage systems can save lives in the COVID-19 chaos.

In December 2020, Medela LLC, a prominent supplier of breastfeeding accessories and medical vacuum technology, had announced that the filtration system of its ‘Thopaz+ Digital Chest Drainage and Monitoring System’ efficiently blocks passage of aerosolized viral particles, such as SARS-CoV-2. Therefore, respiratory diseases including COVID-19 are expected to open new opportunities in the global thoracic drainage devices market during the forecast period.

In terms of product, the thoracic drainage systems segment held the largest global thoracic drainage devices market share in 2021. The trend is expected to continue during the forecast period owing to increase in demand for thoracic drainage systems in hospitals, urgent care centers, and ambulatory surgery centers. Furthermore, adoption of tube thoracostomy procedures and mobility of thoracic drainage products has increased. It is possible to withdraw drainage sooner in case of digital thoracic drainage system and thereby, discharge patients earlier.

The thoracic drainage kits segment is likely to gain market share during the forecast period owing to higher consumption of chest drainage kit and repetitive use of venous drainage device of the chest wall, or thoracic/chest drainage kit; rising demand for minimally invasive surgeries, high burden of cardiovascular diseases, and increase in burden of spontaneous pneumothorax.

Pleural drainage catheter, also known as thoracic drainage catheter or chest tube or thoracic drainage tube, is a sterile tube that includes a number of drainage holes and is inserted into the pleural space. Demand for thoracic drainage catheter or the chest drainage catheter market in countries in Europe such as the U.S., Germany, and France is increasing due to rise in cardiac and thoracic surgical procedures. In a military warfare setting, around 13% to 15% of penetrating wounds are related to the thoracic cavity, which accounts for around 30% of combat deaths requiring thoracic intervention, including a thoracic drainage catheter.

Thoracic drainage catheter is primarily used for closed chest tube thoracostomies. Cardinal Health, Inc. provides ARGYLE Trocar Catheters (a thoracic trocar catheter) are sterile, single use, disposable devices that consist of a surgically sharp trocar and a clear polyvinyl chloride (PVC) thoracic catheter.

Based on application, the thoracic surgery & pulmonology segment accounted for significant share of the global thoracic drainage devices market in 2021, as thoracic drainage devices are widely used in minimally invasive thoracic surgical procedures for the treatment of pneumothorax, pleural effusions, and empyema disorders. An article in the Journal of Thoracic Disease stated that thoracic surgery is one of the most rapidly developing specialties in all of surgery – both technically and technologically. Currently, around 530,000 general thoracic surgeries are performed yearly in the U.S. by around 4,000 cardiothoracic surgeons.

In terms of end-user, the ambulatory surgery centers segment is expected to register the highest CAGR of 6.7% during the forecast period. ASCs have the ability to improve quality and customer service while simultaneously reducing costs. The ASC vertical is ahead of the curve in identifying favorable avenues for improving healthcare delivery.

The hospitals & specialty clinics segment held the largest share of the global thoracic drainage devices market in 2021. This is ascribed to a surge in the number of hospitals & specialty clinics globally, comparatively higher performance of cardiothoracic surgeries and adoption of thoracic drainage devices in these settings. According to the American Hospital Association (AHA), the U.S. had about 5,564 hospitals in 2017, which increased to 6,093 currently.

The global thoracic drainage devices market forecast during the forecast period reveals that North America is likely to dominate the market due to increase in R&D expenditure, high adoption of novel, improved devices; early availability of advanced technologies; significant spending on healthcare; and the presence of sophisticated healthcare infrastructure and key market participants in the U.S. and Canada. Becton, Dickinson and Company, Teleflex Incorporated, Smiths Medical, Cook Medical, and Cardinal Health, Inc. have a strong presence in the U.S., which is contributing to market growth in North America.

Asia Pacific is likely to gain market share during the forecast period due to larger cardiovascular disease patient population, increase in the geriatric population, developing healthcare infrastructure, and surge in medical tourism. Moreover, increase in interest of key international companies in expanding their production bases and product portfolio across countries in Asia and Southeast Asia, such as South Korea, Malaysia, India, and China due to high population density, is expected to propel the market in the region during the forecast period.

The market report concludes with the company profiles section that includes key information about the major players in the global thoracic drainage devices market. Market participants focus on strategies such as new product launches, mergers & acquisitions (M&As), and public and private partnerships to strengthen their market position. Medtronic plc, Becton, Dickinson and Company (BD), Getinge AB, Teleflex Incorporated, Sterimed Group, ICU medical (Smiths Medical), Cook Medical, Cardinal Health, Inc., Vygon SA, Utah Medical Products, Inc., ATMOS MedizinTechnik GmbH & Co. KG, and Sinapi Biomedical are the prominent players operating in the global market.

Each of these players has been profiled in the thoracic drainage devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 729.6 Mn |

|

Market Forecast Value in 2031 |

More than US$ 1.23 Bn |

|

Compound Annual Growth Rate (CAGR) |

5.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global thoracic drainage devices market was valued at US$ 729.6 Mn in 2021.

The global thoracic drainage devices market is projected to reach more than US$ 1.23 Bn by 2031.

The global thoracic drainage devices market is anticipated to grow at a CAGR of 5.3% from 2022 to 2031.

Increase in acceptance of digital thoracic drainage systems (DTDS), rise in prevalence of CVDs globally, and surge in burden of spontaneous pneumothorax.

The thoracic drainage systems segment accounted for more than 59.0% share of the global thoracic drainage devices market in 2021.

North America is expected to account for major share of the global thoracic drainage devices market during the forecast period.

Medtronic plc, Becton, Dickinson and Company (BD), Getinge AB, Teleflex Incorporated, Sterimed Group, ICU medical (Smiths Medical), Cook Medical, Cardinal Health, Inc., Vygon SA, Utah Medical Products, Inc., ATMOS MedizinTechnik GmbH & Co. KG, and Sinapi Biomedical.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Thoracic Drainage Devices Market

4. Market Overview

4.1. Product Overview

4.2. Global Thoracic Drainage Devices Market Size (US$ Mn) Forecast, 2017-20231

4.3. Global Thoracic Drainage Devices Market Outlook

4.4. Porter's Five Forces Analysis

4.5. Global Thoracic Drainage Devices Market - Product Pricing Analysis

4.6. Global Thoracic Drainage Devices Market - Pricing Analysis for Thoracic Drainage Procedures, by Application

4.7. Global Thoracic Drainage Devices Market - Number of Procedures, by Application, 2017–2031

4.8. Key Mergers & Acquisitions in Medical Device Industry

4.9. PESTLE Analysis

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.2. Drivers

5.3. Restraints

5.4. Opportunities

6. Global Thoracic Drainage Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Pleural Drainage Catheters

6.3.2. Secured Needles

6.3.3. Unsecured Needles

6.3.4. Thoracic Drainage Kits

6.3.5. Thoracic Drainage Systems

6.3.6. Trocar Drains

6.4. Market Attractiveness Analysis, by Product

7. Global Thoracic Drainage Devices Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Cardiac Surgery

7.3.2. General Intensive Care & Emergency Medicine

7.3.3. Infectious Diseases

7.3.4. Military/Damage Control/Disaster Medicine

7.3.5. Oncology & Pain Management

7.3.6. Thoracic Surgery & Pulmonology

7.4. Market Attractiveness Analysis, by Application

8. Global Thoracic Drainage Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Ambulance Services

8.3.2. Ambulatory Surgery Centers

8.3.3. Hospitals & Specialty Clinics

8.3.3.1. Anesthesiologist

8.3.3.2. Cardiologist

8.3.3.3. Infectiologist

8.3.3.4. Pulmonologist

8.3.3.5. Other Medical Specialists

8.3.4. Military Surgeons

8.3.5. Urgent Care or Outpatient Care

8.4. Market Attractiveness Analysis, by End-user

9. Global Thoracic Drainage Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Thoracic Drainage Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Pleural Drainage Catheters

10.2.2. Secured Needles

10.2.3. Unsecured Needles

10.2.4. Thoracic Drainage Kits

10.2.5. Thoracic Drainage Systems

10.2.6. Trocar Drains

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Cardiac Surgery

10.3.2. General Intensive Care & Emergency Medicine

10.3.3. Infectious Diseases

10.3.4. Military/Damage Control/Disaster Medicine

10.3.5. Oncology & Pain Management

10.3.6. Thoracic Surgery & Pulmonology

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Ambulance Services

10.4.2. Ambulatory Surgery Centers

10.4.3. Hospitals & Specialty Clinics

10.4.3.1. Anesthesiologist

10.4.3.2. Cardiologist

10.4.3.3. Infectiologist

10.4.3.4. Pulmonologist

10.4.3.5. Other medical specialists

10.4.4. Military Surgeons

10.4.5. Urgent Care or Outpatient Care

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Thoracic Drainage Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Pleural Drainage Catheters

11.2.2. Secured Needles

11.2.3. Unsecured Needles

11.2.4. Thoracic Drainage Kits

11.2.5. Thoracic Drainage Systems

11.2.6. Trocar Drains

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Cardiac Surgery

11.3.2. General Intensive Care & Emergency Medicine

11.3.3. Infectious Diseases

11.3.4. Military/Damage Control/Disaster Medicine

11.3.5. Oncology & Pain Management

11.3.6. Thoracic Surgery & Pulmonology

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Ambulance Services

11.4.2. Ambulatory Surgery Centers

11.4.3. Hospitals & Specialty Clinics

11.4.3.1. Anesthesiologist

11.4.3.2. Cardiologist

11.4.3.3. Infectiologist

11.4.3.4. Pulmonologist

11.4.3.5. Other medical specialists

11.4.4. Military Surgeons

11.4.5. Urgent Care or Outpatient Care

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Thoracic Drainage Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Pleural Drainage Catheters

12.2.2. Secured Needles

12.2.3. Unsecured Needles

12.2.4. Thoracic Drainage Kits

12.2.5. Thoracic Drainage Systems

12.2.6. Trocar Drains

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Cardiac Surgery

12.3.2. General Intensive Care & Emergency Medicine

12.3.3. Infectious Diseases

12.3.4. Military/Damage Control/Disaster Medicine

12.3.5. Oncology & Pain Management

12.3.6. Thoracic Surgery & Pulmonology

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Ambulance Services

12.4.2. Ambulatory Surgery Centers

12.4.3. Hospitals & Specialty Clinics

12.4.3.1. Anesthesiologist

12.4.3.2. Cardiologist

12.4.3.3. Infectiologist

12.4.3.4. Pulmonologist

12.4.3.5. Other medical specialists

12.4.4. Military Surgeons

12.4.5. Urgent Care or Outpatient Care

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Thoracic Drainage Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Pleural Drainage Catheters

13.2.2. Secured Needles

13.2.3. Unsecured Needles

13.2.4. Thoracic Drainage Kits

13.2.5. Thoracic Drainage Systems

13.2.6. Trocar Drains

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Cardiac Surgery

13.3.2. General Intensive Care & Emergency Medicine

13.3.3. Infectious Diseases

13.3.4. Military/Damage Control/Disaster Medicine

13.3.5. Oncology & Pain Management

13.3.6. Thoracic Surgery & Pulmonology

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Ambulance Services

13.4.2. Ambulatory Surgery Centers

13.4.3. Hospitals & Specialty Clinics

13.4.3.1. Anesthesiologist

13.4.3.2. Cardiologist

13.4.3.3. Infectiologist

13.4.3.4. Pulmonologist

13.4.3.5. Other medical specialists

13.4.4. Military Surgeons

13.4.5. Urgent Care or Outpatient Care

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Thoracic Drainage Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Pleural Drainage Catheters

14.2.2. Secured Needles

14.2.3. Unsecured Needles

14.2.4. Thoracic Drainage Kits

14.2.5. Thoracic Drainage Systems

14.2.6. Trocar Drains

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Cardiac Surgery

14.3.2. General Intensive Care & Emergency Medicine

14.3.3. Infectious Diseases

14.3.4. Military/Damage Control/Disaster Medicine

14.3.5. Oncology & Pain Management

14.3.6. Thoracic Surgery & Pulmonology

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Ambulance Services

14.4.2. Ambulatory Surgery Centers

14.4.3. Hospitals & Specialty Clinics

14.4.3.1. Anesthesiologist

14.4.3.2. Cardiologist

14.4.3.3. Infectiologist

14.4.3.4. Pulmonologist

14.4.3.5. Other medical specialists

14.4.4. Military Surgeons

14.4.5. Urgent Care or Outpatient Care

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Teleflex Incorporated

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.2. Medtronic

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. Strategic Overview

15.3.2.5. SWOT Analysis

15.3.3. Cook Medical

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Strategic Overview

15.3.3.4. SWOT Analysis

15.3.4. ICU medical (Smiths Medical)

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. Strategic Overview

15.3.4.5. SWOT Analysis

15.3.5. Cardinal Health, Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. Strategic Overview

15.3.5.5. SWOT Analysis

15.3.6. Becton Dickinson and Company

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.7. Getinge AB

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. Strategic Overview

15.3.7.5. SWOT Analysis

15.3.8. Stermid Group

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.9. Vygon SA

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.10. Utah Medical Products, Inc.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.11. ATMOS MedizinTechnik GmbH & Co. KG

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.12. Sinapi Biomedical

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. SWOT Analysis

List of Tables

Table 01: Global Thoracic Drainage Devices Market - Number of Procedures Forecast, by Application, 2017–2031

Table 02: Global Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 03: Global Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 05: Global Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Hospitals & Specialty Clinics, 2017–2031

Table 06: Global Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 08: North America Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 09: North America Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 10: North America Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Hospitals & Specialty Clinics, 2017–2031

Table 11: North America Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 12: Europe Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 13: Europe Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 14: Europe Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: Europe Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Hospitals & Specialty Clinics, 2017–2031

Table 16: Europe Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 18: Asia Pacific Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 19: Asia Pacific Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Asia Pacific Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Hospitals & Specialty Clinics, 2017–2031

Table 21: Asia Pacific Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Latin America Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Latin America Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Latin America Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 25: Latin America Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Hospitals & Specialty Clinics, 2017–2031

Table 26: Latin America Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Middle East & Africa Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 28: Middle East & Africa Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 29: Middle East & Africa Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 30: Middle East & Africa Thoracic Drainage Devices Market Value (US$ Mn) Forecast, by Hospitals & Specialty Clinics, 2017–2031

List of Figures

Figure 01: Global Thoracic Drainage Devices (CKD) Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Thoracic Drainage Devices Market Value Share, by Product (2021)

Figure 03: Global Thoracic Drainage Devices Market Value Share, by Application (2021)

Figure 04: Global Thoracic Drainage Devices Market Value Share, by End-user (2021)

Figure 05: Global Thoracic Drainage Devices Market Value Share, by Country/Region (2021)

Figure 06: Global Thoracic Drainage Devices Market Analysis and Forecast, by Product, 2021 and 2031

Figure 07: Global Thoracic Drainage Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 08: Global Thoracic Drainage Devices Market (US$ Mn), by Pleural Drainage Catheters, 2017–2031

Figure 09: Global Thoracic Drainage Devices Market (US$ Mn), by Secured Needles, 2017-2031

Figure 10: Global Thoracic Drainage Devices Market (US$ Mn), by Unsecured Needles, 2017-2031

Figure 11: Global Thoracic Drainage Devices Market (US$ Mn), by Thoracic Drainage Kits, 2017-2031

Figure 12: Global Thoracic Drainage Devices Market (US$ Mn), by Thoracic Drainage Systems, 2017-2031

Figure 13: Global Thoracic Drainage Devices Market (US$ Mn), by Trocar Drains, 2017-2031

Figure 14: Global Thoracic Drainage Devices Market Analysis and Forecast, by Application, 2021 and 2031

Figure 15: Global Thoracic Drainage Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 16: Global Thoracic Drainage Devices Market (US$ Mn), by Cardiac Surgery, 2017–2031

Figure 17: Global Thoracic Drainage Devices Market (US$ Mn), by General Intensive Care & Emergency Medicine, 2017-2031

Figure 18: Global Thoracic Drainage Devices Market (US$ Mn), by Infectious Diseases, 2017-2031

Figure 19: Global Thoracic Drainage Devices Market (US$ Mn), by Military/Damage Control/Disaster Medicine, 2017-2031

Figure 20: Global Thoracic Drainage Devices Market (US$ Mn), by Oncology & Pain Management, 2017-2031

Figure 21: Global Thoracic Drainage Devices Market (US$ Mn), by Thoracic Surgery & Pulmonology, 2017-2031

Figure 22: Global Thoracic Drainage Devices Market Analysis and Forecast, by End-user, 2021 and 2031

Figure 23: Global Thoracic Drainage Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 24: Global Thoracic Drainage Devices Market (US$ Mn), by Ambulance Services, 2017–2031

Figure 25: Global Thoracic Drainage Devices Market (US$ Mn), by Ambulatory Surgery Centers, 2017-2031

Figure 26: Global Thoracic Drainage Devices Market (US$ Mn), by Hospitals & Specialty Clinics, 2017-2031

Figure 27: Global Thoracic Drainage Devices Market (US$ Mn), by Military Surgeons, 2017-2031

Figure 28: Global Thoracic Drainage Devices Market (US$ Mn), by Urgent Care or Outpatient Care, 2017-2031

Figure 29: Global Thoracic Drainage Devices Market Analysis and Forecast, by Region, 2021 and 2031

Figure 30: Global Thoracic Drainage Devices Market Attractiveness Analysis, by Region, 2022–2031

Figure 31: North America Thoracic Drainage Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: North America Thoracic Drainage Devices Market Analysis and Forecast, by Product, 2021 and 2031

Figure 33: North America Thoracic Drainage Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 34: North America Thoracic Drainage Devices Market Analysis and Forecast, by Application, 2021 and 2031

Figure 35: North America Thoracic Drainage Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 36: North America Thoracic Drainage Devices Market Analysis and Forecast, by End-user, 2021 and 2031

Figure 37: North America Thoracic Drainage Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 38: North America Thoracic Drainage Devices Market Analysis and Forecast, by Country, 2021 and 2031

Figure 39: North America Thoracic Drainage Devices Market Attractiveness Analysis, by Country, 2022–2031

Figure 40: Europe Thoracic Drainage Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 41: Europe Thoracic Drainage Devices Market Analysis and Forecast, by Product, 2021 and 2031

Figure 42: Europe Thoracic Drainage Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 43: Europe Thoracic Drainage Devices Market Analysis and Forecast, by Application. 2021 and 2031

Figure 44: Europe Thoracic Drainage Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 45: Europe Thoracic Drainage Devices Market Analysis and Forecast, by End-user, 2021 and 2031

Figure 46: Europe Thoracic Drainage Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 47: Europe Thoracic Drainage Devices Market Analysis and Forecast, by Country/Sub-region, 2021 and 2031

Figure 48: Europe Thoracic Drainage Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 49: Asia Pacific Thoracic Drainage Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 50: Asia Pacific Thoracic Drainage Devices Market Analysis and Forecast, by Product, 2021 and 2031

Figure 51: Asia Pacific Thoracic Drainage Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 52: Asia Pacific Thoracic Drainage Devices Market Analysis and Forecast, by Application 2021 and 2031

Figure 53: Asia Pacific Thoracic Drainage Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 54: Asia Pacific Thoracic Drainage Devices Market Analysis and Forecast, by End-user, 2021 and 2031

Figure 55: Asia Pacific Thoracic Drainage Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 56: Asia Pacific Thoracic Drainage Devices Market Analysis and Forecast, by Country/Sub-region, 2021 and 2031

Figure 57: Asia Pacific Thoracic Drainage Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 58: Latin America Thoracic Drainage Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 59: Latin America Thoracic Drainage Devices Market Analysis and Forecast, by Product, 2021 and 2031

Figure 60: Latin America Thoracic Drainage Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 61: Latin America Thoracic Drainage Devices Market Analysis and Forecast, by Application 2021 and 2031

Figure 62: Latin America Thoracic Drainage Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 63: Latin America Thoracic Drainage Devices Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 64: Latin America Thoracic Drainage Devices Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 65: Latin America Thoracic Drainage Devices Market Analysis and Forecast, by Country/Sub-region, 2021 and 2031

Figure 66: Latin America Thoracic Drainage Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 67: Middle East & Africa Thoracic Drainage Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 68: Middle East & Africa Thoracic Drainage Devices Market Analysis and Forecast, by Product, 2021 and 2031

Figure 69: Middle East & Africa Thoracic Drainage Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 70: Middle East & Africa Thoracic Drainage Devices Market Analysis and Forecast, by Application 2021 and 2031

Figure 71: Middle East & Africa Thoracic Drainage Devices Market Attractiveness Analysis, by Application, 2022–2031

Figure 72: Middle East & Africa Thoracic Drainage Devices Market Analysis and Forecast, by End-user, 2021 and 2031

Figure 73: Middle East & Africa Thoracic Drainage Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 74: Global Thoracic Drainage Device Market Share Analysis/Ranking, by Company, 2021