Growth of Semi-conductor Industry to Drive Thin Wafer Processing and Dicing Equipment Market

Electronic packaging has proven effective in a variety of applications due to expanding attempts to make it more beneficial for the packaging of electronic components. There has been an increased demand for electronic good, which has geerated increased demand for its packaging. Hence, these reasons are propelling the semiconductor and IC packaging industry forward, which, in turn, is likely to boost growth of the global thin wafer processing and dicing equipment market in the forthcoming years.

Increased demand for electronic items has driven the need for packaging of electronic goods, and consumer demands for new electronic device features have risen. Smart gadgets have already gained over electronics sector as a result of the growth of IoT and linked devices. Aside from smartphones, linked wearable gadgets are projected to gain popularity. End-users are constantly seeking extremely smooth surfaces and smaller wafers to integrate RFIDs easily into consumer electronics as well as identity solutions, such as smart cards and identification badges.

Rising Demand for Ultra-thin Thicknesses to Spell Growth of the Market

Grinding is now the most practical thinning procedure used in semiconductor applications, lowering thickness of wafer diameter from around 750 μm to 120 μm. However, owing to the stress of high-volume manufacture, silicon wafers smaller than 100 μm become highly flexible and difficult to shrink further utilizing traditional grinding procedures.

Wafer back grinding equipment is becoming more and more automated, which is likely to assist in obtaining higher degree of quality and lowering wafer thicknesses to even lesser than 0.050 mm. In order to attain such ultra-thin thicknesses, it is essential to make use of a diamond grit-grinding wheel. As a result, the thicknesses of all background targets are using ultra-fine grind wheels, which is likely to support expansion of the global thin wafer processing and dicing equipment market.

Additional methods, such as chemical-mechanical planarization (CMP), are necessary to eliminate edge chipping and microcracking created by the normal grinding procedure in various applications such as logic and memory.

The semiconductor market in Asia-Pacific is estimated to be one of fastest developing in the world. Increasing initiatives by the Indian government, such as Make in India, and the Chinese government's Vision 2020, are drawing more international attention to set up local production facilities. The recent rise in customs duty on imported gadgets is tempting corporations like Apple to start local manufacturing operations in India.

The recent increase in the demand for portable communication devices, such as smartphones, memory cards, smart card, and various computing devices has boosted the global market for thin wafer processing and dicing equipment substantially. In 2015, the global market for thin wafer processing and dicing equipment garnered US$388.9 mn in revenues, which, with an expected CAGR of 6.80% between 2016 and 2024, is likely to increase to US$692.5 mn by the end of 2024.

The rising awareness about the attributes and benefits of thin wafer processing and dicing equipment, such as better electrical performance and reduced production cost of the device, is likely to support the growth of this market significantly over the next few years.

Blade dicing, plasma dicing, and laser dicing are the three main dicing technologies utilized in wafer processing and dicing equipment. Among these, blade dicing, which is traditional dicing technology, has acquired the leading the global market and is predicted to remain dominant over the period of the forecast.

Laser dicing technology, however, is likely to prove to be more lucrative for manufacturers in the near future due to low operating cost and kerf loss, leading to an increased production of chips. Various attributes, such as high-speed dicing and superior breakage strength is also projected to add to the popularity of laser dicing, reflecting greatly on its demand over the next few years.

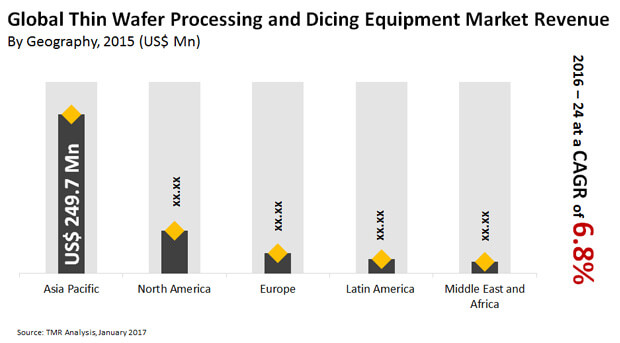

North America, the Middle East and Africa, Europe, Latin America, Asia Pacific are the key regional markets for thin wafer processing and dicing equipment. Asia Pacific dominated the global market with a share of 64.2% in 2015 and is anticipated to remain leading over the forthcoming years, thanks to the increasing uptake of thin wafer processing and dicing equipment in small consumer electronics devices, specifically in mobile phones, and several other devices used for communication and computing.

Along with this, the growing usage of these instruments in semiconductors is also projected to boost this regional market in the years to come. China, Taiwan, and Japan have emerged as the main domestic markets for thin wafer and dicing equipment in this region on account of providing lucrative opportunities to the manufacturers of thin wafer processing and dicing equipment.

North America, which held the second position in 2015, is also expected to witness a healthy rise in the valuation of its market by the end of 2024. The swift technological advancements in consumer electronic devices, in a bid to develop state-of-art smart home devices and wearables, are anticipated to fuel the demand for small integrated circuits, which in turn, is expected to influence the uptake of thin wafers, consequently, boosting the demand for thin wafer processing and dicing equipment over the forthcoming years.

EV Group, Lam Research Corp, Plasma-Therm LLC, DISCO Corp., Tokyo Electron Ltd., Advanced Dicing Technologies, Suzhou Delphi Laser Co. Ltd., SPTS Technologies Ltd., Tokyo Seimitsu Co. Ltd., and Panasonic Corp. are some of the leading producers of thin wafer processing and dicing equipment across the world.

Growing Prominence of Electronics Packaging to Boost Thin Wafer Processing and Dicing Equipment Market

Electronic packaging has become beneficial in a number of uses as a result of increased attempts to make it extremely valuable due to the tremendous demand for electronic products as a result of growing usage. Greater demand for electronic goods is likely to drive the electronic packaging industry forward, and consumer demands for novel features integrated into electronic devices have risen. This factor is likely to support growth of the global thin wafer processing and dicing equipment market in the years to come.

Smart devices have swept over most of the electronics industry as a result of the explosive proliferation of connected and IoT devices, which is likely to work in favor of the global thin wafer processing and dicing equipment market. Aside from smartphones, various connected wearable devices are anticipated to benefit the market in the near future. End users are demanding increasingly thinner wafers and ultra-smooth surfaces to incorporate RFIDs seamlessly into identity solutions, such as smart cards and identification tags and various electronic products.

Demand to Ride on the Back of its Low Cost of Operation and Low Kerf Loss to Drive Market

The three primary dicing methods employed in the global thin wafer processing and dicing equipment market comprise laser dicing, plasma dicing, and blade dicing. Blade dicing is a conventional dicing method, has taken the lead in the global market and is expected to continue to do so over the forecast era.

However, because of its low cost of operation and low kerf loss, this dicing technology is anticipated to prove to be more profitable for market participants in the near future, resulting in an increased production of chips. Various features, such as superior breakage strength and high-speed dicing, are expected to boost popularity of laser dicing, resulting in a significant increase in demand over the next few years. Grinding is actually the most practical method of thinning utilized in semiconductor applications, decreasing thickness of wafers' diameter from an average of 750 μm to 120 μm. However, owing to the pressure of high-volume manufacturing, silicon wafers smaller than 100 µm get quite fragile and difficult to minimize further utilizing conventional methods of grinding.

The Thin Wafer Processing and Dicing Equipment Market is studied from 2016 – 2024

Thin Wafer Processing and Dicing Equipment Market to expand at a CAGR of 6.80% during the forecast period 2024

Asia Pacific is growing at the highest CAGR over 2016- 2024

EV Group, Lam Research Corp, Plasma-Therm LLC, DISCO Corp., Tokyo Electron Ltd., Advanced Dicing Technologies, Suzhou Delphi Laser Co. Ltd., SPTS Technologies Ltd., Tokyo Seimitsu Co. Ltd., and Panasonic Corp. are some of the leading producers of thin wafer processing and dicing equipment across the world

Thin Wafer Processing and Dicing Equipment Market is expected to rise to US$692.5 Mn by 2024

Chapter 01 Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

Chapter 02 Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

Chapter 03 Executive Summary

3.1. Executive Summary

Chapter 04 Market Dynamics

4.1. Overview

4.2. Drivers and Restraints Snapshot Analysis

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity Analysis

4.3. Thinning and Packaging Constraints

4.4. Advanced Packaging Trends Impacting Thinning and Dicing Needs

4.5. Porter’s Five Forces Analysis

Chapter 05 Thin Wafer Processing and Dicing Equipment Market Analysis, by Application

5.1. Introduction

5.2. Global Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Application

5.3. Global Thin Wafer Processing and Dicing Equipment Market Forecast, by Application

5.4. Global Thin Wafer Processing and Dicing Equipment Market Forecast, by Application

5.5. Global Thin Wafer Processing and Dicing Equipment Market: Attractiveness Analysis

Chapter 06 Thin Wafer Processing and Dicing Equipment Market Analysis, by Technology

6.1. Introduction

6.2. Global Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Dicing Technology

6.3. Global Thin Wafer Processing and Dicing Equipment Market Forecast, by Dicing Technology

6.4. Global Thin Wafer Processing and Dicing Equipment Market Forecast, by Dicing Technology

6.5. Global Thin Wafer Processing and Dicing Equipment Market: Attractiveness Analysis

Chapter 07 Thin Wafer Processing and Dicing Equipment Market Analysis, by Wafer Thickness

7.1. Introduction

7.2. Global Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Wafer Thickness

7.3. Global Thin Wafer Processing and Dicing Equipment Market Forecast, by Wafer Thickness

7.4. Global Thin Wafer Processing and Dicing Equipment Market: Attractiveness Analysis

Chapter 08 Thin Wafer Processing and Dicing Equipment Market Analysis, by Region

8.1. Geographical Scenario

8.2. Global Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Region

8.3. Global Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Region

8.4. Global Thin Wafer Processing and Dicing Equipment Market: Attractiveness Analysis

Chapter 09 North America Thin Wafer Processing and Dicing Equipment Market Analysis

9.1. Key Trends Analysis

9.2. North America Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Application

9.3. North America Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Application

9.4. North America Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Wafer Thickness

9.5. North America Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Wafer Thickness

9.6. North America Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Dicing Technology

9.7. North America Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Dicing Technology

9.8. North America Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Country

9.9. North America Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Country

Chapter 10 Europe Thin Wafer Processing and Dicing Equipment Market Analysis

10.1. Key Trends Analysis

10.2. Europe Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Application

10.3. Europe Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Application

10.4. Europe Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Wafer Thickness

10.5. Europe Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Wafer Thickness

10.6. Europe Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Dicing Technology

10.7. Europe Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Dicing Technology

10.8. Europe Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Country

10.9. Europe Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Country

Chapter 11 Asia Pacific Thin Wafer Processing and Dicing Equipment Market Analysis

11.1. Key Trends Analysis

11.2. Asia Pacific Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Application

11.3. Asia Pacific Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Application

11.4. Asia Pacific Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Wafer Thickness

11.5. Asia Pacific Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Wafer Thickness

11.6. Asia Pacific Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Dicing Technology

11.7. Asia Pacific Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Dicing Technology

11.8. Asia Pacific Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Country

11.9. Asia Pacific Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Country

Chapter 12 Middle- East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market Analysis

12.1. Key Trends Analysis

12.2. Middle- East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Application

12.3. Middle- East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Application

12.4. Middle- East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Wafer Thickness

12.5. Middle- East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Wafer Thickness

12.6. Middle- East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Dicing Technology

12.7. Middle- East and Africa (MEA)Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Dicing Technology

12.8. Middle- East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Country

12.9. Middle- East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Country

Chapter 13 Latin America Thin Wafer Processing and Dicing Equipment Market Analysis

13.1. Key Trends Analysis

13.2. Latin America Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Application

13.3. Latin America Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Application

13.4. Latin America Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Wafer Thickness

13.5. Latin America Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Wafer Thickness

13.6. Latin America Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Dicing Technology

13.7. Latin America Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Dicing Technology

13.8. Latin America Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Country

13.9. Latin America Thin Wafer Processing and Dicing Equipment Market Revenue Analysis, by Country

Chapter 14 Company Profiles

14.1 Competitive Land Scape

14.2. EV Group

14.2.1. Company Details (HQ, Foundation Year, Employee Strength)

14.2.2. Market Presence, By Segment and Geography

14.2.3. Strategic Overview

14.2.4. SWOT analysis

14.2.5. Strategic Overview

14.3. Lam Research Corporation

14.3.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.2. Market Presence, By Segment and Geography

14.3.3. Strategic Overview

14.3.4. SWOT analysis

14.3.5. Strategic Overview

14.4. DISCO Corporation

14.4.1. Company Details (HQ, Foundation Year, Employee Strength)

14.4.2. Market Presence, By Segment and Geography

14.4.3. Strategic Overview

14.4.4. SWOT analysis

14.4.5. Strategic Overview

14.5. Plasma-Therm, LLC

14.5.1. Company Details (HQ, Foundation Year, Employee Strength)

14.5.2. Market Presence, By Segment and Geography

14.5.3. Strategic Overview

14.5.4. SWOT analysis

14.5.5. Strategic Overview

14.6. Tokyo Electron Ltd.

14.6.1. Company Details (HQ, Foundation Year, Employee Strength)

14.6.2. Market Presence, By Segment and Geography

14.6.3. Strategic Overview

14.6.4. SWOT analysis

14.6.5. Strategic Overview

14.7. Advanced Dicing Technologies

14.7.1. Company Details (HQ, Foundation Year, Employee Strength)

14.7.2. Market Presence, By Segment and Geography

14.7.3. Strategic Overview

14.7.4. SWOT analysis

14.7.5. Strategic Overview

14.8. SPTS Technologies Ltd.

14.8.1. Company Details (HQ, Foundation Year, Employee Strength)

14.8.2. Market Presence, By Segment and Geography

14.8.3. Strategic Overview

14.8.4. SWOT analysis

14.8.5. Strategic Overview

14.9. Suzhou Delphi Laser Co. Ltd.

14.9.1. Company Details (HQ, Foundation Year, Employee Strength)

14.9.2. Market Presence, By Segment and Geography

14.9.3. Strategic Overview

14.9.4. SWOT analysis

14.9.5. Strategic Overview

14.10. Panasonic Corporation

14.10.1. Company Details (HQ, Foundation Year, Employee Strength)

14.10.2. Market Presence, By Segment and Geography

14.10.3. Strategic Overview

14.10.4. SWOT analysis

14.10.5. Strategic Overview

14.11. Tokyo Seimitsu Co. Ltd.

14.11.1. Company Details (HQ, Foundation Year, Employee Strength)

14.11.2. Market Presence, By Segment and Geography

14.11.3. Strategic Overview

14.11.4. SWOT analysis

14.11.5. Strategic Overview

List of Tables

Table 1 Global Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Application, 2015 – 2024

Table 2 Global Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Dicing Technology, 2015 – 2024

Table 3 Global Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Wafer Thickness, 2015 – 2024

Table 4 Global Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Region, 2015 – 2024

Table 5 North America Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Application, 2015 – 2024

Table 6 North America Wafer Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Wafer Thickness, 2015 – 2024

Table 7 North America Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Dicing Technology, 2015 – 2024

Table 8 North America Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Country, 2015 – 2024

Table 9 Europe Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Application, 2015 – 2024

Table 10 Europe Wafer Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Wafer Thickness, 2015 – 2024

Table 11 Europe Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Dicing Technology, 2015 – 2024

Table 12 Europe Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Country, 2015 – 2024

Table 13 Asia Pacific Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Application, 2015 – 2024

Table 14 Asia Pacific Wafer Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Wafer Thickness, 2015 – 2024

Table 15 Asia Pacific Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Dicing Technology, 2015 – 2024

Table 16 Asia Pacific Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Country, 2015 – 2024

Table 17 Middle-East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Application, 2015 – 2024

Table 18 Middle-East and Africa (MEA) Wafer Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Wafer Thickness, 2015 – 2024

Table 19 Middle-East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Dicing Technology, 2015 – 2024

Table 20 Middle-East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Country, 2015 – 2024

Table 21 Latin America Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Application, 2015 – 2024

Table 22 Latin America Wafer Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Wafer Thickness, 2015 – 2024

Table 23 Latin America Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Dicing Technology, 2015 – 2024

Table 24 Latin America Thin Wafer Processing and Dicing Equipment Market Revenue (USD Mn) and Forecast, by Country, 2015 – 2024

List of Figures

Figure 1 Market Segmentation

Figure 2 Research Methodology

Figure 3 Market Snapshot

Figure 4 Drivers and Restraints Snapshot Analysis

Figure 5 Opportunity Analysis

Figure 6 Porter’s Five Forces Analysis

Figure 7 Global Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 8 Global Logic and Memory Market Revenue (USD Mn), 2015 – 2024

Figure 9 Global MEMS Market Revenue (USD Mn), 2015 – 2024

Figure 10 Global Power Device Market Revenue (USD Mn), 2015 – 2024

Figure 11 Global RFID Market Revenue (USD Mn), 2015 – 2024

Figure 12 Global CMOS Image Sensor Market Revenue (USD Mn), 2015 – 2024

Figure 13 Market Attractiveness Analysis, by Application, 2015

Figure 14 Global Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Dicing Technology, 2015 and 2024

Figure 15 Global Blade Dicing Technology Market Revenue (USD Mn), 2015 – 2024

Figure 16 Global Laser Dicing Technology Market Revenue (USD Mn), 2015 – 2024

Figure 17 Global Plasma Dicing Technology Market Revenue (USD Mn), 2015 – 2024

Figure 18 Market Attractiveness Analysis, by Dicing Technology, 2015

Figure 19 Global Wafer Processing and Dicing Equipment Market Value Share Analysis, by Wafer Thickness, 2015 and 2024

Figure 20 Global 750 μm Thick Wafer Market Revenue (USD Mn), 2015 – 2024

Figure 21 Global 120 μm Thick Wafer Market Revenue (USD Mn), 2015 – 2024

Figure 22 Global 50 μm Thick Wafer Market Revenue (USD Mn), 2015 – 2024

Figure 23 Market Attractiveness Analysis, by Wafer Thickness, 2015

Figure 24 Geographical Scenario

Figure 25 Global Thin Wafer Processing and Dicing Equipment Market Value Share Analysis, by Region, 2015 and 2024

Figure 26 Market Attractiveness Analysis, by Region, 2015

Figure 27 North America Thin Wafer Processing and Dicing Equipment Market Value Share Analysis by Application, 2015 and 2024

Figure 28 North America Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Wafer Thickness, 2015 and 2024

Figure 29 North America Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Dicing Technology, 2015 and 2024

Figure 30 North America Thin Wafer Processing and Dicing Equipment Market Value Share Analysis by Country, 2015 and 2024

Figure 31 Europe Thin Wafer Processing and Dicing Equipment Market Value Share Analysis by Application, 2015 and 2024

Figure 32 Europe Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Wafer Thickness, 2015 and 2024

Figure 33 Europe Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Dicing Technology, 2015 and 2024

Figure 34 Europe Thin Wafer Processing and Dicing Equipment Market Value Share Analysis by Country, 2015 and 2024

Figure 35 Asia Pacific Thin Wafer Processing and Dicing Equipment Market Value Share Analysis by Application, 2015 and 2024

Figure 36 Asia Pacific Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Wafer Thickness, 2015 and 2024

Figure 37 Asia Pacific Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Dicing Technology, 2015 and 2024

Figure 38 Asia Pacific Thin Wafer Processing and Dicing Equipment Market Value Share Analysis by Country, 2015 and 2024

Figure 39 Middle-East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market Value Share Analysis by Application, 2015 and 2024

Figure 40 Middle-East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Wafer Thickness, 2015 and 2024

Figure 41 Middle-East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Dicing Technology, 2015 and 2024

Figure 42 Middle-East and Africa (MEA) Thin Wafer Processing and Dicing Equipment Market Value Share Analysis by Country, 2015 and 2024

Figure 43 Latin America Thin Wafer Processing and Dicing Equipment Market Value Share Analysis by Application, 2015 and 2024

Figure 44 Latin America Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Wafer Thickness, 2015 and 2024

Figure 45 Latin America Thin Wafer Processing and Dicing Equipment Market, Value Share Analysis, by Dicing Technology, 2015 and 2024

Figure 46 Latin America Thin Wafer Processing and Dicing Equipment Market Value Share Analysis by Country, 2015 and 2024