Injection molding consultants are making generous efforts to help companies in the Thailand injection molded plastics market address industry-wide challenges caused by the novel coronavirus (COVID-19) pandemic. For instance, John Bozzelli - a veteran injection molding consultant and trainer has urged popular news outlets to spread the message regarding his availability for injection molding consultation services to help manufacturers tackle the challenges thrown by the COVID-19 pandemic. Delayed shipments and volatility in raw material availability are key problems that manufacturers are strategizing to overcome during the crisis.

Manufacturers have raised concerns to troubleshoot problems associated with production speeds, as many plants are partially or completely shut down amidst the COVID-19 crisis. Consultants are bolstering their credibility by charging extra fee for their services, which are channelized toward charity. As such, manufacturers are abiding by the regulations suggested by local authorities to contain the spread of the novel virus. These factors are expected to drive the Thailand injection molded plastics market during the forecast period.

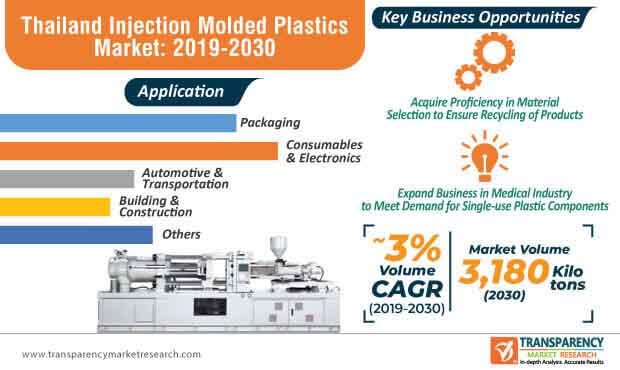

Breakthrough innovations in injection molding machines are making an impression on plastic product manufacturers. Strategic partnerships between companies of the Thailand injection molded plastics market are the key to steer innovation in products. Apart from opportunities in packaging and consumables sectors, manufacturers are scurrying revenue opportunities in the medical business. This is because the medical industry is not primarily criticized for the use of single-use plastic components, owing to cleanliness and hygiene requirements in hospital settings.

Companies of the Thailand injection molded plastics market are raising demand for high-quality mold makers that help reduce the expenditure of producing consumables. Key aspects of circular economy, sustainability, and environment-friendly plastic use are becoming important focus points for manufacturers. In order to increase the uptake of single-use injection molded plastics in the medical business, manufacturers are investing in small tie-barless machines to enhance production.

Although the coronavirus pandemic has dulled the advancement of the Thailand injection molded plastics market, experts are casting new trends and predictions for the current year. However, increasing volume of plastic waste ending up in landfills is a challenge that manufacturers are facing. Hence, consulting experts are offering solutions to manufacturers that revolve around optimizing their operational recycling options. Since recycling has become an industry in itself, stringent regulations regarding injection molded products have compelled manufacturers to adopt 100% recyclability norms at their production facilities.

Every material in the injection molding and turnkey assembly is being pushed toward circular practices. Such constructive production practices bode well for the revenue growth of the Thailand injection molded plastics market, which is estimated to surpass the value of US$ 13.7 Bn by the end of 2030.

Better automation and software technologies are attracting investor sentiment. Companies in the Thailand injection molded plastics market are using analysis software to design and verify plastic flow through an injection mold to deliver accuracy and eliminate the need for testing & refinement for products. As such, packaging and consumables & electronics applications dictate more than 50% value share of the market. Using artificial intelligence (AI) and machine learning (ML), manufacturers will be able to replace single-use cardboard and plastic with recyclable materials in the packaging business.

Automation and software technologies are being used to develop better-engineered injection molded plastic products that have less thickness but increased strength to meet requirements of end users. Thinner packaging will ultimately reduce costs and decrease the overcall cost of products. Thus, material selection has become a turning point for companies in the Thailand injection molded plastics market.

Bio-plastics are anticipated to capture a significant share of the Thailand injection molded plastics market during the assessment period, as manufacturers aim to make changes in packaging materials. Thus, product innovation and material selection go hand-in-hand, as manufacturers are scurrying to tap business opportunities in segments such as agriculture, electrical, and biomedical products. Manufacturers are increasing their R&D capabilities to design bio-plastics from renewable biomass materials such as corn and sugarcane. Thus, renewable resources can be naturally recycled through biological decomposition and helps reduce the burden of recycling for manufacturers.

The demand for high-performance materials is surging in the Thailand injection molded plastics market. Manufacturers are increasingly utilizing engineered resins to develop lightweight and strong injection molded products that have longer product life. They are exploring opportunities in the aerospace industry where industry’s stakeholders are considering strong and lightweight materials.

With increasing number of product launches in the Thailand injection molded plastics market, the competition is intensifying by the day. However, complex processes involving minute details in material selection and other factors become cumbersome for manufacturers. In order to gain a competitive edge in the market, turnkey solution providers have stepped in to help manufacturers with production of injection molded plastic products. Nowadays, manufacturers desire consultation of experts to obtain intricate details of products.

Consulting experts are increasing their design capabilities, tooling manufacturing, and inventory management services to help companies in the Thailand injection molded plastics market gain a competitive edge over other market players. Thus, the trend of partnering with offshoring businesses is gripping the market in order to streamline business activities.

Analysts’ Viewpoint

In order to adhere to cleanliness and hygiene practices in various end-use cases, especially in hospital settings, manufacturers are eyeing incremental opportunities as the coronavirus pandemic gives the much-maligned single-use plastics a leg up. Environmental sustainability and automation innovations are the key focus points for companies in the Thailand injection molded plastics market. However, the market is expected to progress at a modest CAGR of ~4% during the forecast period, as prominent players pose a stiff competition to emerging market players in terms of rigorous R&D and automation technologies. Hence, emerging market players should collaborate with consultation experts to manufacture better-engineered products that help reduce production expenditures.

Thailand Injection Molded Plastics Market: Overview

Key Indicators of Thailand Injection Molded Plastics Market

Major Growth Drivers of Thailand Injection Molded Plastics Market

Impact of COVID-19 on Thailand Injection Molded Plastics Market

Leading Players in Thailand Injection Molded Plastics Market

1. Executive Summary

1.1. Market Snapshot: Thailand Injection Molded Plastics Market

1.2. Key Trends

2. Market Overview

2.1. Product Overview

2.2. Market Indicators

2.3. Drivers and Restraints Snapshot Analysis

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.4.1. Threat of Substitutes

2.4.2. Bargaining Power of Buyers

2.4.3. Bargaining Power of Suppliers

2.4.4. Threat of New Entrants

2.4.5. Degree of Competition

2.5. Value Chain Analysis

2.5.1. List of Potential Customers

3. COVID-19 Impact Analysis

4. Production Output Analysis

5. Price Trend Analysis

5.1. Thailand Injection Molded Plastics Market Pricing Analysis (US$/Ton), by Application, 2019-2030

6. Thailand Injection Molded Plastics Market Analysis and Forecast, by Application

6.1. Introduction

6.2. Thailand Injection Molded Plastics Market Volume Share Analysis, by Application, 2019 and 2030

6.3. Thailand Injection Molded Plastics Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

6.3.1. Packaging

6.3.2. Consumables & Electronics

6.3.3. Automotive & Transportation

6.3.4. Building & Construction

6.3.5. Others (including Enclosures)

6.4. Thailand Injection Molded Plastics Market Attractiveness Analysis, by Application

7. Competition Landscape

7.1. Thailand Injection Molded Plastics Market Share Analysis, by Company (2019)

7.2. Company Profiles

7.2.1. THAI NISSIN MOLD CO.,LTD

7.2.1.1. Company Description

7.2.1.2. Business Overview

7.2.2. Kasem International Co. Ltd

7.2.2.1. Company Description

7.2.2.2. Business Overview

7.2.3. HI-Q PLAS COMPANY LIMITED

7.2.3.1. Company Description

7.2.3.2. Business Overview

7.2.4. Thai Newton Co., Ltd.

7.2.4.1. Company Description

7.2.4.2. Business Overview

7.2.5. Sanko Mold and Plastics (Thailand) Co.,Ltd

7.2.5.1. Company Description

7.2.5.2. Business Overview

7.2.6. Mawin Plastics Co., Ltd.

7.2.6.1. Company Description

7.2.6.2. Business Overview

7.2.7. Jet Industries (Thailand) Company Limited

7.2.7.1. Company Description

7.2.7.2. Business Overview

7.2.8. Av plastic co.ltd

7.2.8.1. Company Description

7.2.8.2. Business Overview

7.2.9. Chulapat Plastic Co., Ltd.

7.2.9.1. Company Description

7.2.9.2. Business Overview

8. Primary Research – Key Insights

9. Assumptions and Research Methodology

9.1. Report Assumptions

9.2. Secondary Sources and Acronyms Used

9.3. Research Methodology

List of Tables

Table 01: Thailand Injection Molded Plastics Market Volume (Kilo Tons) Forecast, by Application, 2019–2030

Table 02: Thailand Injection Molded Plastics Market Value (US$ Mn) Forecast, by Application, 2019–2030

List of Figures

Figure 01: Thailand Sales of Automotive, 2006-2019 (US$ Thousand)

Figure 02: Thailand Plastics Economic Contribution, 2018

Figure 03: Value of Thailand Plastics Resin Conversion Industry

Figure 04: Price Trend Analysis (US$/Ton), 2019-2030, by Application

Figure 05: Thailand Injection Molded Plastics Market Volume Share Analysis, by Application, 2019, and 2030

Figure 06: Thailand Injection Molded Plastics Market Attractiveness Analysis, by Application

Figure 07: Company Market Share Analysis, 2019