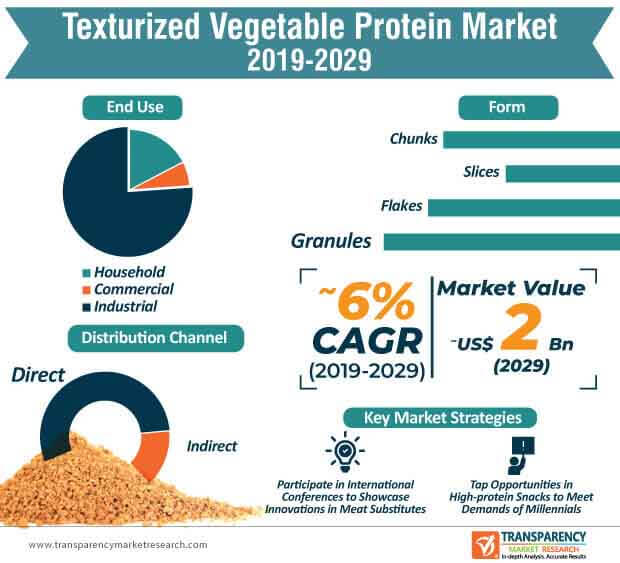

Changing consumer preferences are leaving scope for innovations in the texturized vegetable protein market. Currently, manufacturers are opting for calculated risks by introducing products that strike the right balance between indulgence and health. This new trend has been instrumental in achieving repeat purchases for plant-based products.

On the other hand, manufacturers in the texturized vegetable protein market are focusing on protein claims for packaging and other marketing strategies. In order to enhance consumer experience, companies are increasing R&D activities to find the right mix of protein with natural flavors and textures to boost product uptake. Apart from meat substitutes and snacks, manufacturers are generating incremental opportunities through the sales of nutritional supplements, bakery products, and beverages. Since the share of regional and local players is higher in the texturized vegetable protein market, tie-ups with local farmers to obtain high-quality produce will be prominent in the coming years.

The concept of clean label is intensifying competition in the market for texturized vegetable protein. Hence, manufacturers are increasing efforts to obtain clean label for their products to bolster their credibility credentials in the global market landscape. On the other hand, companies are leveraging opportunities by making available texturized vegetable protein for manufacturers of nutritional beverages, frozen meals, and dairy items. Convenience food is another key driver, which is boosting the uptake of plant-based foods, by fulfilling the demand for ‘ready-to-eat’ meals.

Analysts of Transparency Market Research opine that apart from snacks, there are high growth opportunities in frozen breakfast items, such as plant-based sausage patties and waffles. Manufacturers in the texturized vegetable protein market are introducing new dairy items to capitalize on the growing plant-based food trend. Moreover, calorie-conscious consumers are the key target audience for manufacturers, since plant-based protein helps in the production of low-calorie food products and lower sugar levels.

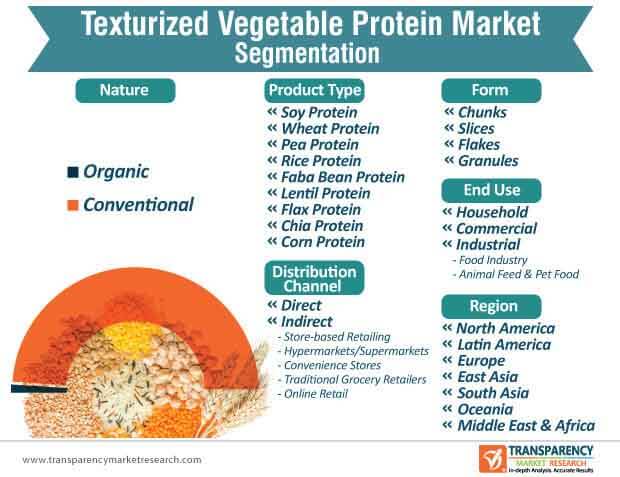

Consumers are growing increasingly conscious about the advantages of plant-based foods. Awareness about how the meat industry has led to environmental stress has accelerated the uptake of texturized vegetable protein, especially in the food & beverage industry and households, among others. Manufacturers in the texturized vegetable protein market are increasingly innovating in soy protein. As such, soy protein product type segment of the texturized vegetable protein market is estimated to reach an output of ~715,800 metric tons by the end of 2029. Hence, leading manufacturers, such as DuPont - an innovator in food ingredients and chemicals is expanding its portfolio in plant protein nuggets by including soy and pea protein made products.

Manufacturers are increasing the production of texturized vegetable protein to meet the growing demand for snacks among the millennial population. It is found that millennials have high preference for high-protein snacks, as compared to any other age group. Hence, ingredient manufacturers are launching nutritional bars to cater to ‘on-the-go’ snacking requirements of consumers.

Veganism and vegetarianism are some of the key drivers that are driving the demand for texturized vegetable protein. Moreover, prevention from various diseases, such as cardiovascular diseases is also creating a demand for meat substitutes. According to the Good Food Institute - a non-profit organization that promotes plant-based alternatives, the sales of plant-based food and beverages have witnessed a significant rise in the U.S. in recent years. As such, new trends in the U.S. are contributing toward the overall growth of the North America texturized vegetable protein market.

The texturized vegetable protein market is largely fragmented with leading players accounting to only ~14% of the total market share. However, the challenge of producing meat substitutes without compromising on the taste poses as a restraint for manufacturers. Hence, manufacturers are increasing efforts to create blends of different plant proteins. For instance, Beyond Meat - a Los Angeles-based producer of plant-based meat substitutes introduced its innovative product ‘Beyond Beef’ - a ground beef alternative, which is made from mung, pea, and rice protein.

Analysts’ Viewpoint

Regional and local players in the texturized vegetable protein market are expected to collaborate with local farmers to secure supply of high-quality grains. This trend is likely to boost sales of cereal bars and snack drinks, owing to exceptional multi-sensory properties of premium-quality grains.

However, delivering the desired taste and texture in plant-based items poses as a challenge for manufacturers, since consumers have high expectations, with a predefined perception that plant-based foods are healthy. Hence, manufacturers should aim toward striking the right blend of proteins involving pea and rice to deliver the right amount of amino acids, which eventually taste good in plant-based products.

Texturized Vegetable Protein Market: Overview

Texturized Vegetable Protein: Market Frontrunners

Texturized Vegetable Protein Market: Trends

Texturized Vegetable Protein Market: Players

1. Executive Summary

1.1. Global Texturized Vegetable Protein Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Opportunity Assessment- Winning & Loosing Components

1.5. Proprietary Wheel of Fortune

1.6. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.1.1. Consumer preference for organic and natural feed products

3.1.2. Rising demand in the functional drinks

3.1.3. Increasing demand for Ready-to-Eat (RTE) food products

3.1.4. Growing popularity of textured soya protein as a meat substitute

3.1.5. Rise of vegan culture and flexitarianism

3.1.6. Increased social media influence upon the consumers

3.2. Product Innovation / Development Trends

4. Risk and Opportunities

4.1. Associated Risk

4.1.1. Regulatory Landscape Associated Risk

4.1.2. Standard and Certification Risk

4.2. Opportunities

4.2.1. Niche within the existing product line

4.2.2. Opportunities in new product categories

4.2.3. Latent opportunities in established market

5. Market Dynamics

5.1. Macro-economic Factors

5.1.1. Rise in Consumption of Food Items across Globe

5.1.2. Global and Regional Per Capita Food Consumption (kcal per capita per day)

5.1.3. Change in Consumer Price Indexes (Percentage Change) 2019 (Forecast)

5.1.4. Population of Key Countries

5.1.5. Global Retail Dynamics/ Retail Sector GVA and Growth

5.1.6. Per Capita Disposable Income

5.1.7. Organized Retail Penetration

5.1.8. Middle Income Population Group

5.1.9. Global GDP Growth Outlook

5.2. Drivers

5.2.1. Economic Drivers

5.2.2. Supply Side Drivers

5.2.3. Demand Side Drivers

5.3. Market Restraints

5.4. Market Trends

5.5. Forecast Factors - Relevance & Impact

5.5.1. Top Companies Historical Growth

5.5.2. Foodservice Industry Growth

5.5.3. Packaged Food Industry Growth

5.5.4. Per Capita Consumption of Spices

5.5.5. Plant Based Protein Market Growth

5.5.6. Soy Protein Market Growth

5.5.7. Wheat Protein Market Growth

6. Value Chain Analysis and Operating Margins

6.1. Supply Side Participants and their Roles

6.1.1. Producers

6.1.2. Mid-Level Participants (Traders/ Agents/ Brokers)

6.1.3. Wholesalers and Distributors

6.2. Profit Margin Analysis

6.2.1. Traders/ Agents/ Brokers

6.2.2. Wholesalers and Distributors

6.2.3. Retailers

6.3. Key Factors Impacting Profit Margin

7. Policy and Regulatory Landscape

7.1. Dietary Supplement Health and Education Act (DSHEA)

7.2. Federal Food & Cosmetics Act

7.3. Europe Food & Safety Authority

7.4. State Food and Drug Administration (SFDA)

7.5. Foods for Specified Health Uses

7.6. FSSAI

7.7. Food Packaging Claims

7.8. Labeling and Claims

7.9. Import/Export Regulations

8. Global Texturized Vegetable Protein Market Demand Analysis 2014-2018

9. and Forecast, 2019-2029

9.1. Historical Market Volume (MT) Analysis, 2014-2018

9.2. Current and Future Market Volume (MT) Projections, 2019-2029

9.3. Y-o-Y Growth Trend Analysis

10. Global Texturized Vegetable Protein Market - Pricing Analysis

10.1. Regional Pricing Analysis (US$/’000 Tons) By Form/Nature, 2019

10.2. Country-level Pricing Analysis (US$/’000 Tons) By Form/Nature, 2019

10.3. Pricing Break-up, 2019

10.3.1. Producer Level Pricing

10.3.2. Distributor Level Pricing

10.3.3. Retail Level Pricing

10.4. Global Average Pricing Analysis Benchmark, 2019-2029

10.5. Factors Influencing Pricing and Forecast Impact Analysis, 2014-2029

11. Global Texturized Vegetable Protein Market Demand (Size in US$ Mn) Analysis

12. 2014-2018 and Forecast, 2019-2029

12.1. Historical Market Value (US$ Mn) Analysis, 2013-2017

12.2. Current and Future Market Value (US$ Mn) Projections, 2018-2028

12.2.1. Y-o-Y Growth Trend Analysis

12.2.2. Absolute $ Opportunity Analysis

13. Global Texturized Vegetable Protein Market Analysis 2014-2018 and

14. Forecast, 2019-2029, By Product Type

14.1. Introduction / Key Findings

14.2. Historical Market Size (US$ Mn) and Volume Analysis By Product Type, 2014-2018

14.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Product Type, 2019-2029

14.3.1. Soy Protein

14.3.2. Wheat Protein

14.3.3. Pea Protein

14.3.4. Rice Protein

14.3.5. Faba Bean Protein

14.3.6. Lentil Protein

14.3.7. Flax Protein

14.3.8. Chia Protein

14.3.9. Corn Protein

14.4. Market Attractiveness Analysis By Product Type

15. Global Texturized Vegetable Protein Market Analysis 2014-2018 and

16. Forecast, 2019-2029, By Nature

16.1. Introduction / Key Findings

16.2. Historical Market Size (US$ Mn) and Volume Analysis By Nature, 2014-2018

16.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Nature, 2019-2029

16.3.1. Organic

16.3.2. Conventional

16.4. Market Attractiveness Analysis By Nature

17. Global Texturized Vegetable Protein Market Analysis 2014-2018 and

18. Forecast, 2019-2029, By Form

18.1. Introduction / Key Findings

18.2. Historical Market Size (US$ Mn) and Volume Analysis By Form, 2014-2018

18.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Form, 2019-2029

18.3.1. Chunks

18.3.2. Slices

18.3.3. Flakes

18.3.4. Granules

18.4. Market Attractiveness Analysis By Form

19. Global Texturized Vegetable Protein Market Analysis 2014-2018 and

20. Forecast, 2019-2029, By End Use

20.1. Introduction / Key Findings

20.2. Historical Market Size (US$ Mn) and Volume Analysis By End Use, 2014-2018

20.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By End Use, 2019-2029

20.3.1. Households

20.3.2. Commercial

20.3.3. Industrial

20.3.3.1. Food Industry

20.3.3.1.1. Food Industry

20.3.3.1.2. Snacks and Functional Bars

20.3.3.1.3. Ready Meals

20.3.3.1.4. Sport Nutrition

20.3.3.1.5. Clinical Nutrition

20.3.3.1.6. Baby Food

20.3.3.1.7. Meat Analogues/ Meat Extenders

20.3.3.1.8. Others

20.3.3.2. Animal Feed and Pet Food

20.4. Market Attractiveness Analysis By End Use

21. Global Texturized Vegetable Protein Market Analysis 2014-2018 and Forecast,

22. 2019-2029, By Distribution Channel

22.1. Introduction / Key Findings

22.2. Historical Market Size (US$ Mn) and Volume Analysis By Distribution Channel, 2014-2018

22.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Distribution Channel, 2019-2029

22.3.1. Direct

22.3.2. Indirect

22.3.2.1. Store Based Retailing

22.3.2.2. Hypermarket/Supermarket

22.3.2.3. Convenience Stores

22.3.2.4. Traditional Grocery Retailers

22.3.2.5. Online Retail

22.4. Market Attractiveness Analysis By Distribution Channel

23. Global Texturized Vegetable Protein Market Analysis 2014-2018 and Forecast,

24. 2019-2029, By Region

24.1. Introduction

24.2. Historical Market Size (US$ Mn) and Volume Analysis By Region, 2014-2018

24.3. Current Market Size (US$ Mn) and Volume Analysis and Forecast By Region, 2019-2029

24.3.1. North America

24.3.2. Latin America

24.3.3. Europe

24.3.4. East Asia

24.3.5. South Asia

24.3.6. Oceania

24.3.7. Middle East and Africa

24.4. Market Attractiveness Analysis By Region

25. North America Texturized Vegetable Protein Market Analysis 2014-2018 and

26. Forecast, 2019-2029

26.1. Introduction

26.2. Pricing Analysis

26.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2014-2018

26.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2019 - 2029

26.4.1. By Country

26.4.1.1. U.S.

26.4.1.2. Canada

26.4.2. By Product Type

26.4.3. By Nature

26.4.4. By Form

26.4.5. By End Use

26.4.6. By Distribution Channel

26.5. Market Attractiveness Analysis

26.5.1. By Country

26.5.2. By Product Type

26.5.3. By Nature

26.5.4. By Form

26.5.5. By End Use

26.5.6. By Distribution Channel

26.6. Market Trends

26.7. Key Market Participants - Intensity Mapping

26.8. Drivers and Restraints - Impact Analysis

27. Latin America Texturized Vegetable Protein Market Analysis 2014-2018 and Forecast, 2019-2029

27.1. Introduction

27.2. Pricing Analysis

27.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2014-2018

27.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2019 - 2029

27.4.1. By Country

27.4.1.1. Brazil

27.4.1.2. Mexico

27.4.1.3. Argentina

27.4.1.4. Rest of Latin America

27.4.2. By Product Type

27.4.3. By Nature

27.4.4. By Form

27.4.5. By End Use

27.4.6. By Distribution Channel

27.5. Market Attractiveness Analysis

27.5.1. By Country

27.5.2. By Product Type

27.5.3. By Nature

27.5.4. By Form

27.5.5. By End Use

27.5.6. By Distribution Channel

27.6. Market Trends

27.7. Key Market Participants - Intensity Mapping

27.8. Drivers and Restraints - Impact Analysis

28. Europe Texturized Vegetable Protein Market Analysis 2014-2018 and Forecast, 2019-2029

28.1. Introduction

28.2. Pricing Analysis

28.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2014-2018

28.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2019 - 2029

28.4.1. By Country

28.4.1.1. Germany

28.4.1.2. Italy

28.4.1.3. France

28.4.1.4. U.K.

28.4.1.5. Spain

28.4.1.6. BENELUX

28.4.1.7. Russia

28.4.1.8. Poland

28.4.1.9. Rest of Europe

28.4.2. By Product Type

28.4.3. By Nature

28.4.4. By Form

28.4.5. By End Use

28.4.6. By Distribution Channel

28.5. Market Attractiveness Analysis

28.5.1. By Country

28.5.2. By Product Type

28.5.3. By Nature

28.5.4. By Form

28.5.5. By End Use

28.5.6. By Distribution Channel

28.6. Market Trends

28.7. Key Market Participants - Intensity Mapping

28.8. Drivers and Restraints - Impact Analysis

29. East Asia Texturized Vegetable Protein Market Analysis 2014-2018 and Forecast, 2019-2029

29.1. Introduction

29.2. Pricing Analysis

29.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2014-2018

29.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2019 - 2029

29.4.1. By Country

29.4.1.1. China

29.4.1.2. Japan

29.4.1.3. South Korea

29.4.2. By Product Type

29.4.3. By Nature

29.4.4. By Form

29.4.5. By End Use

29.4.6. By Distribution Channel

29.5. Market Attractiveness Analysis

29.5.1. By Country

29.5.2. By Product Type

29.5.3. By Nature

29.5.4. By Form

29.5.5. By End Use

29.5.6. By Distribution Channel

29.6. Market Trends

29.7. Key Market Participants - Intensity Mapping

29.8. Drivers and Restraints - Impact Analysis

30. South Asia Texturized Vegetable Protein Market Analysis 2014-2018 and Forecast, 2019-2029

30.1. Introduction

30.2. Pricing Analysis

30.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2014-2018

30.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2019 - 2029

30.4.1. By Country

30.4.1.1. India

30.4.1.2. Thailand

30.4.1.3. Indonesia

30.4.1.4. Malaysia

30.4.1.5. Singapore

30.4.1.6. Rest of South Asia

30.4.2. By Product Type

30.4.3. By Nature

30.4.4. By Form

30.4.5. By End Use

30.4.6. By Distribution Channel

30.5. Market Attractiveness Analysis

30.5.1. By Country

30.5.2. By Product Type

30.5.3. By Nature

30.5.4. By Form

30.5.5. By End Use

30.5.6. By Distribution Channel

30.6. Market Trends

30.7. Key Market Participants - Intensity Mapping

30.8. Drivers and Restraints - Impact Analysis

31. Oceania Texturized Vegetable Protein Market Analysis 2014-2018 and Forecast, 2019-2029

31.1. Introduction

31.2. Pricing Analysis

31.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2014-2018

31.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2019 - 2029

31.4.1. By Country

31.4.1.1. Australia

31.4.1.2. New Zealand

31.4.2. By Product Type

31.4.3. By Nature

31.4.4. By Form

31.4.5. By End Use

31.4.6. By Distribution Channel

31.5. Market Attractiveness Analysis

31.5.1. By Country

31.5.2. By Product Type

31.5.3. By Nature

31.5.4. By Form

31.5.5. By End Use

31.5.6. By Distribution Channel

31.6. Market Trends

31.7. Key Market Participants - Intensity Mapping

31.8. Drivers and Restraints - Impact Analysis

32. Middle East and Africa Texturized Vegetable Protein Market Analysis 2014-2018 and

33. Forecast, 2019-2029

33.1. Introduction

33.2. Pricing Analysis

33.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2014-2018

33.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2019 - 2029

33.4.1. By Country

33.4.1.1. GCC Countries

33.4.1.2. North Africa

33.4.1.3. South Africa

33.4.1.4. Central Africa

33.4.2. By Product Type

33.4.3. By Nature

33.4.4. By Form

33.4.5. By End Use

33.4.6. By Distribution Channel

33.5. Market Attractiveness Analysis

33.5.1. By Country

33.5.2. By Product Type

33.5.3. By Nature

33.5.4. By Form

33.5.5. By End Use

33.5.6. By Distribution Channel

33.6. Market Trends

33.7. Key Market Participants - Intensity Mapping

33.8. Drivers and Restraints - Impact Analysis

34. Emerging Countries Texturized Vegetable Protein Market Analysis 2014-2018 and

35. Forecast, 2019-2029

35.1. Introduction

35.1.1. Market Value Proportion Analysis, By Key Countries

35.1.2. Growth Comparison of Global Market v/s Emerging Countries

35.2. China Texturized Vegetable Protein Market Analysis

35.2.1. Introduction

35.2.2. Pricing Analysis

35.2.3. Market Value Proportion Analysis by Market Taxonomy

35.2.4. Market Volume (MT) and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

35.2.4.1. By Product Type

35.2.4.2. By Nature

35.2.4.3. By Form

35.2.4.4. By End Use

35.2.4.5. By Distribution Channel

35.2.5. China Texturized Vegetable Protein Market - Competition Landscape

35.2.6. China - Trade Analysis

35.3. France Texturized Vegetable Protein Market Analysis

35.3.1. Introduction

35.3.2. Pricing Analysis

35.3.3. Market Value Proportion Analysis by Market Taxonomy

35.3.4. Market Volume (MT) and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

35.3.4.1. By Product Type

35.3.4.2. By Nature

35.3.4.3. By Form

35.3.4.4. By End Use

35.3.4.5. By Distribution Channel

35.3.5. France Texturized Vegetable Protein Market - Competition Landscape

35.4. U.K. Texturized Vegetable Protein Market Analysis

35.4.1. Introduction

35.4.2. Pricing Analysis

35.4.3. Market Value Proportion Analysis by Market Taxonomy

35.4.4. Market Volume (MT) and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

35.4.4.1. By Product Type

35.4.4.2. By Nature

35.4.4.3. By Form

35.4.4.4. By End Use

35.4.4.5. By Distribution Channel

35.4.5. U.K. Texturized Vegetable Protein Market - Competition Landscape

36. Market Structure Analysis

36.1. Global Plant Based Beverages Market Competition - a Dashboard View

36.2. Global Plant Based Beverages Market Structure Analysis

36.3. Global Plant Based Beverages Market Company Share Analysis

36.3.1. Company Market Share Analysis of Top 10 Players, By Region

36.3.2. Company Market Share Analysis of Top 10 Players, By Product Type

36.4. Key Participants Market Presence (Intensity Mapping) by Region

37. Brand Assessment

37.1. Brand Identity (Brand as Product, Brand as Organization, Brand as Person, Brand as Symbol)

37.2. Dehydrated Vegetables Audience and Positioning (Demographic Segmentation, Geographic Segmentation,

38. Psychographic Segmentation, Situational Segmentation)

38.1. Brand Strategy

39. Competition Analysis

39.1. Competition Dashboard

39.2. Competition Benchmarking

39.3. Competition Deep Dive

39.3.1. Archer Daniels Midland Company

39.3.1.1. Company Overview

39.3.1.2. Product Offerings

39.3.1.3. Regional Footprint

39.3.1.3.1. Production Sites

39.3.1.3.2. Production Capacity , Production Volume (MT)

39.3.1.3.3. Sales Offices

39.3.1.3.4. Revenue Share per region

39.3.1.4. Key Financials

39.3.1.5. Gross Margin and Revenue

39.3.1.6. M&As, Joint Ventures, Investments

39.3.1.7. Company Strategy

39.3.1.7.1. Portfolio Strategy

39.3.1.7.2. Innovation strategy

39.3.1.7.3. New product Launches

39.3.1.7.4. Analyst Comments

39.3.2. BENEO GmbH

39.3.2.1. Company Overview

39.3.2.2. Product Offerings

39.3.2.3. Regional Footprint

39.3.2.3.1. Production Sites

39.3.2.3.2. Production Capacity , Production Volume (MT)

39.3.2.3.3. Sales Offices

39.3.2.3.4. Revenue Share per region

39.3.2.4. Key Financials

39.3.2.5. Gross Margin and Revenue

39.3.2.6. M&As, Joint Ventures, Investments

39.3.2.7. Company Strategy

39.3.2.7.1. Portfolio Strategy

39.3.2.7.2. Innovation strategy

39.3.2.7.3. New product Launches

39.3.2.7.4. Analyst Comments

39.3.3. Cargill, Incorporated

39.3.3.1. Company Overview

39.3.3.2. Product Offerings

39.3.3.3. Regional Footprint

39.3.3.3.1. Production Sites

39.3.3.3.2. Production Capacity , Production Volume (MT)

39.3.3.3.3. Sales Offices

39.3.3.3.4. Revenue Share per region

39.3.3.4. Key Financials

39.3.3.5. Gross Margin and Revenue

39.3.3.6. M&As, Joint Ventures, Investments

39.3.3.7. Company Strategy

39.3.3.7.1. Portfolio Strategy

39.3.3.7.2. Innovation strategy

39.3.3.7.3. New product Launches

39.3.3.7.4. Analyst Comments

39.3.4. CHS, Inc.

39.3.4.1. Company Overview

39.3.4.2. Product Offerings

39.3.4.3. Regional Footprint

39.3.4.3.1. Production Sites

39.3.4.3.2. Production Capacity , Production Volume (MT)

39.3.4.3.3. Sales Offices

39.3.4.3.4. Revenue Share per region

39.3.4.4. Key Financials

39.3.4.5. Gross Margin and Revenue

39.3.4.6. M&As, Joint Ventures, Investments

39.3.4.7. Company Strategy

39.3.4.7.1. Portfolio Strategy

39.3.4.7.2. Innovation strategy

39.3.4.7.3. New product Launches

39.3.4.7.4. Analyst Comments

39.3.5. Crown Soya Protein Group

39.3.5.1. Company Overview

39.3.5.2. Product Offerings

39.3.5.3. Regional Footprint

39.3.5.3.1. Production Sites

39.3.5.3.2. Production Capacity , Production Volume (MT)

39.3.5.3.3. Sales Offices

39.3.5.3.4. Revenue Share per region

39.3.5.4. Key Financials

39.3.5.5. Gross Margin and Revenue

39.3.5.6. M&As, Joint Ventures, Investments

39.3.5.7. Company Strategy

39.3.5.7.1. Portfolio Strategy

39.3.5.7.2. Innovation strategy

39.3.5.7.3. New product Launches

39.3.5.7.4. Analyst Comments

39.3.6. Danisco A/S

39.3.6.1. Company Overview

39.3.6.2. Product Offerings

39.3.6.3. Regional Footprint

39.3.6.3.1. Production Sites

39.3.6.3.2. Production Capacity , Production Volume (MT)

39.3.6.3.3. Sales Offices

39.3.6.3.4. Revenue Share per region

39.3.6.4. Key Financials

39.3.6.5. Gross Margin and Revenue

39.3.6.6. M&As, Joint Ventures, Investments

39.3.6.7. Company Strategy

39.3.6.7.1. Portfolio Strategy

39.3.6.7.2. Innovation strategy

39.3.6.7.3. New product Launches

39.3.6.7.4. Analyst Comments

39.3.7. FUJI OIL CO., LTD.

39.3.7.1. Company Overview

39.3.7.2. Product Offerings

39.3.7.3. Regional Footprint

39.3.7.3.1. Production Sites

39.3.7.3.2. Production Capacity , Production Volume (MT)

39.3.7.3.3. Sales Offices

39.3.7.3.4. Revenue Share per region

39.3.7.4. Key Financials

39.3.7.5. Gross Margin and Revenue

39.3.7.6. M&As, Joint Ventures, Investments

39.3.7.7. Company Strategy

39.3.7.7.1. Portfolio Strategy

39.3.7.7.2. Innovation strategy

39.3.7.7.3. New product Launches

39.3.7.7.4. Analyst Comments

39.3.8. MGP Ingredients, Inc.

39.3.8.1. Company Overview

39.3.8.2. Product Offerings

39.3.8.3. Regional Footprint

39.3.8.3.1. Production Sites

39.3.8.3.2. Production Capacity , Production Volume (MT)

39.3.8.3.3. Sales Offices

39.3.8.3.4. Revenue Share per region

39.3.8.4. Key Financials

39.3.8.5. Gross Margin and Revenue

39.3.8.6. M&As, Joint Ventures, Investments

39.3.8.7. Company Strategy

39.3.8.7.1. Portfolio Strategy

39.3.8.7.2. Innovation strategy

39.3.8.7.3. New product Launches

39.3.8.7.4. Analyst Comments

39.3.9. Roquette Frères

39.3.9.1. Company Overview

39.3.9.2. Product Offerings

39.3.9.3. Regional Footprint

39.3.9.3.1. Production Sites

39.3.9.3.2. Production Capacity , Production Volume (MT)

39.3.9.3.3. Sales Offices

39.3.9.3.4. Revenue Share per region

39.3.9.4. Key Financials

39.3.9.5. Gross Margin and Revenue

39.3.9.6. M&As, Joint Ventures, Investments

39.3.9.7. Company Strategy

39.3.9.7.1. Portfolio Strategy

39.3.9.7.2. Innovation strategy

39.3.9.7.3. New product Launches

39.3.9.7.4. Analyst Comments

39.3.10. Shandong Yuxin Soybean Protein Co. Ltd.

39.3.10.1. Company Overview

39.3.10.2. Product Offerings

39.3.10.3. Regional Footprint

39.3.10.3.1. Production Sites

39.3.10.3.2. Production Capacity , Production Volume (MT)

39.3.10.3.3. Sales Offices

39.3.10.3.4. Revenue Share per region

39.3.10.4. Key Financials

39.3.10.5. Gross Margin and Revenue

39.3.10.6. M&As, Joint Ventures, Investments

39.3.10.7. Company Strategy

39.3.10.7.1. Portfolio Strategy

39.3.10.7.2. Innovation strategy

39.3.10.7.3. New product Launches

39.3.10.7.4. Analyst Comments

39.3.11. Sonic Biochem Extractions Limited

39.3.11.1. Company Overview

39.3.11.2. Product Offerings

39.3.11.3. Regional Footprint

39.3.11.3.1. Production Sites

39.3.11.3.2. Production Capacity , Production Volume (MT)

39.3.11.3.3. Sales Offices

39.3.11.3.4. Revenue Share per region

39.3.11.4. Key Financials

39.3.11.5. Gross Margin and Revenue

39.3.11.6. M&As, Joint Ventures, Investments

39.3.11.7. Company Strategy

39.3.11.7.1. Portfolio Strategy

39.3.11.7.2. Innovation strategy

39.3.11.7.3. New product Launches

39.3.11.7.4. Analyst Comments

39.3.12. Sotexpro

39.3.12.1. Company Overview

39.3.12.2. Product Offerings

39.3.12.3. Regional Footprint

39.3.12.3.1. Production Sites

39.3.12.3.2. Production Capacity , Production Volume (MT)

39.3.12.3.3. Sales Offices

39.3.12.3.4. Revenue Share per region

39.3.12.4. Key Financials

39.3.12.5. Gross Margin and Revenue

39.3.12.6. M&As, Joint Ventures, Investments

39.3.12.7. Company Strategy

39.3.12.7.1. Portfolio Strategy

39.3.12.7.2. Innovation strategy

39.3.12.7.3. New product Launches

39.3.12.7.4. Analyst Comments

39.3.13. Victoria Group

39.3.13.1. Company Overview

39.3.13.2. Product Offerings

39.3.13.3. Regional Footprint

39.3.13.3.1. Production Sites

39.3.13.3.2. Production Capacity , Production Volume (MT)

39.3.13.3.3. Sales Offices

39.3.13.3.4. Revenue Share per region

39.3.13.4. Key Financials

39.3.13.5. Gross Margin and Revenue

39.3.13.6. M&As, Joint Ventures, Investments

39.3.13.7. Company Strategy

39.3.13.7.1. Portfolio Strategy

39.3.13.7.2. Innovation strategy

39.3.13.7.3. New product Launches

39.3.13.7.4. Analyst Comments

39.3.14. Wilmar BioEthanol

39.3.14.1. Company Overview

39.3.14.2. Product Offerings

39.3.14.3. Regional Footprint

39.3.14.3.1. Production Sites

39.3.14.3.2. Production Capacity , Production Volume (MT)

39.3.14.3.3. Sales Offices

39.3.14.3.4. Revenue Share per region

39.3.14.4. Key Financials

39.3.14.5. Gross Margin and Revenue

39.3.14.6. M&As, Joint Ventures, Investments

39.3.14.7. Company Strategy

39.3.14.7.1. Portfolio Strategy

39.3.14.7.2. Innovation strategy

39.3.14.7.3. New product Launches

39.3.14.7.4. Analyst Comments

39.3.15. Other Players (On Additional Request)

40. Assumptions and Acronyms Used

41. Research Methodology

List of Tables

Table 1: Global Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Region, 2019-2029

Table 2: Global Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Region, 2019-2029

Table 3: Global Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Product Type, 2019-2029

Table 4: Global Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Product Type, 2019-2029

Table 5: Global Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Nature, 2019-2029

Table 6: Global Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Nature, 2019-2029

Table 7: Global Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2019-2029

Table 8: Global Texturized Vegetable Protein Market Volume (‘000) Analysis and Forecast by Form, 2019-2029

Table 9: Global Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Distribution Channel, 2019-2029

Table 10: Global Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Distribution Channel, 2019-2029

Table 11: North America Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2019-2029

Table 12: North America Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Country, 2019-2029

Table 13: North America Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Product Type, 2019-2029

Table 14: North America Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Product Type, 2019-2029

Table 15: North America Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Nature, 2019-2029

Table 16: North America Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Nature, 2019-2029

Table 17: North America Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2019-2029

Table 18: North America Texturized Vegetable Protein Market Volume (‘000) Analysis and Forecast by Form, 2019-2029

Table 19: North America Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Distribution Channel, 2019-2029

Table 20: North America Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Distribution Channel, 2019-2029

Table 21: Latin America Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2019-2029

Table 22: Latin America Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Country, 2019-2029

Table 23: Latin America Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Product Type, 2019-2029

Table 24: Latin America Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Product Type, 2019-2029

Table 25: Latin America Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Nature, 2019-2029

Table 26: Latin America Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Nature, 2019-2029

Table 27: Latin America Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2019-2029

Table 28: Latin America Texturized Vegetable Protein Market Volume (‘000) Analysis and Forecast by Form, 2019-2029

Table 29: Latin America Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Distribution Channel, 2019-2029

Table 30: Latin America Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Distribution Channel, 2019-2029

Table 31: Europe Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2019-2029

Table 32: Europe Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Country, 2019-2029

Table 33: Europe Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Product Type, 2019-2029

Table 34: Europe Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Product Type, 2019-2029

Table 35: Europe Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Nature, 2019-2029

Table 36: Europe Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Nature, 2019-2029

Table 37: Europe Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2019-2029

Table 38: Europe Texturized Vegetable Protein Market Volume (‘000) Analysis and Forecast by Form, 2019-2029

Table 39: Europe Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Distribution Channel, 2019-2029

Table 40: Europe Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Distribution Channel, 2019-2029

Table 41: East Asia Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2019-2029

Table 42: East Asia Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Country, 2019-2029

Table 43: East Asia Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Product Type, 2019-2029

Table 44: East Asia Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Product Type, 2019-2029

Table 45: East Asia Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Nature, 2019-2029

Table 46: East Asia Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Nature, 2019-2029

Table 47: East Asia Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2019-2029

Table 48: East Asia Texturized Vegetable Protein Market Volume (‘000) Analysis and Forecast by Form, 2019-2029

Table 49: East Asia Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Distribution Channel, 2019-2029

Table 50: East Asia Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Distribution Channel, 2019-2029

Table 51: South Asia Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2019-2029

Table 52: South Asia Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Country, 2019-2029

Table 53: South Asia Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Product Type, 2019-2029

Table 54: South Asia Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Product Type, 2019-2029

Table 55: South Asia Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Nature, 2019-2029

Table 56: South Asia Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Nature, 2019-2029

Table 57: South Asia Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2019-2029

Table 58: South Asia Texturized Vegetable Protein Market Volume (‘000) Analysis and Forecast by Form, 2019-2029

Table 59: South Asia Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Distribution Channel, 2019-2029

Table 60: South Asia Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Distribution Channel, 2019-2029

Table 61: MEA Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2019-2029

Table 62: MEA Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Country, 2019-2029

Table 63: MEA Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Product Type, 2019-2029

Table 64: MEA Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Product Type, 2019-2029

Table 65: MEA Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Nature, 2019-2029

Table 66: MEA Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Nature, 2019-2029

Table 67: MEA Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2019-2029

Table 68: MEA Texturized Vegetable Protein Market Volume (‘000) Analysis and Forecast by Form, 2019-2029

Table 69: MEA Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Distribution Channel, 2019-2029

Table 70: MEA Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Distribution Channel, 2019-2029

Table 71: Oceania Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Country, 2019-2029

Table 72: Oceania Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Country, 2019-2029

Table 73: Oceania Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Product Type, 2019-2029

Table 74: Oceania Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Product Type, 2019-2029

Table 75: Oceania Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Nature, 2019-2029

Table 76: Oceania Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Nature, 2019-2029

Table 77: Oceania Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Form, 2019-2029

Table 78: Oceania Texturized Vegetable Protein Market Volume (‘000) Analysis and Forecast by Form, 2019-2029

Table 79: Oceania Texturized Vegetable Protein Market Volume (MT) Analysis and Forecast by Distribution Channel, 2019-2029

Table 80: Oceania Texturized Vegetable Protein Market Value (US$ Mn) Analysis and Forecast by Distribution Channel, 2019-2029

List of Figures

Figure 1: Global Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Region, 2014, 2019 & 2029

Figure 2: Global Texturized Vegetable Protein Market Y-o-Y Analysis by Region, 2019 & 2029

Figure 3: Global Texturized Vegetable Protein Market Attractiveness, by Region, 2019 to 2029

Figure 4: Global Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Product Type, 2014, 2019 & 2029

Figure 5: Global Texturized Vegetable Protein Market Y-o-Y Analysis by Product Type, 2019 & 2029

Figure 6: Global Texturized Vegetable Protein Market Attractiveness, by Product Type, 2019 to 2029

Figure 7: Global Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 8: Global Texturized Vegetable Protein Market Y-o-Y Analysis by Nature, 2019 & 2029

Figure 9: Global Texturized Vegetable Protein Market Attractiveness, by Nature, 2019 to 2029

Figure 10: Global Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Form, 2014, 2019 & 2029

Figure 11: Global Texturized Vegetable Protein Market Y-o-Y Analysis by Form, 2019 & 2029

Figure 12: Global Texturized Vegetable Protein Market Attractiveness, by Form, 2019 to 2029

Figure 13: Global Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 14: Global Texturized Vegetable Protein Market Y-o-Y Analysis by End Use, 2019 & 2029

Figure 15: Global Texturized Vegetable Protein Market Attractiveness, by End Use, 2019 to 2029

Figure 16: Global Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Distribution Channel, 2014, 2019 & 2029

Figure 17: Global Texturized Vegetable Protein Market Y-o-Y Analysis by Distribution Channel, 2019 & 2029

Figure 18: Global Texturized Vegetable Protein Market Attractiveness, by Distribution Channel, 2019 to 2029

Figure 19: North America Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Country, 2014, 2019 & 2029

Figure 20: North America Texturized Vegetable Protein Market Y-o-Y Analysis by Country, 2019 & 2029

Figure 21: North America Texturized Vegetable Protein Market Attractiveness, by Country, 2019 to 2029

Figure 22: North America Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Product Type, 2014, 2019 & 2029

Figure 23: North America Texturized Vegetable Protein Market Y-o-Y Analysis by Product Type, 2019 & 2029

Figure 24: North America Texturized Vegetable Protein Market Attractiveness, by Product Type, 2019 to 2029

Figure 25: North America Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 26: North America Texturized Vegetable Protein Market Y-o-Y Analysis by Nature, 2019 & 2029

Figure 27: North America Texturized Vegetable Protein Market Attractiveness, by Nature, 2019 to 2029

Figure 28: North America Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Form, 2014, 2019 & 2029

Figure 29: North America Texturized Vegetable Protein Market Y-o-Y Analysis by Form, 2019 & 2029

Figure 30: North America Texturized Vegetable Protein Market Attractiveness, by Form, 2019 to 2029

Figure 31: North America Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 32: North America Texturized Vegetable Protein Market Y-o-Y Analysis by End Use, 2019 & 2029

Figure 33: North America Texturized Vegetable Protein Market Attractiveness, by End Use, 2019 to 2029

Figure 34: North America Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Distribution Channel, 2014, 2019 & 2029

Figure 35: North America Texturized Vegetable Protein Market Y-o-Y Analysis by Distribution Channel, 2019 & 2029

Figure 36: North America Texturized Vegetable Protein Market Attractiveness, by Distribution Channel, 2019 to 2029

Figure 37: Latin America Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Country, 2014, 2019 & 2029

Figure 38: Latin America Texturized Vegetable Protein Market Y-o-Y Analysis by Country, 2019 & 2029

Figure 39: Latin America Texturized Vegetable Protein Market Attractiveness, by Country, 2019 to 2029

Figure 40: Latin America Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Product Type, 2014, 2019 & 2029

Figure 41: Latin America Texturized Vegetable Protein Market Y-o-Y Analysis by Product Type, 2019 & 2029

Figure 42: Latin America Texturized Vegetable Protein Market Attractiveness, by Product Type, 2019 to 2029

Figure 43: Latin America Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 44: Latin America Texturized Vegetable Protein Market Y-o-Y Analysis by Nature, 2019 & 2029

Figure 45: Latin America Texturized Vegetable Protein Market Attractiveness, by Nature, 2019 to 2029

Figure 46: Latin America Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Form, 2014, 2019 & 2029

Figure 47: Latin America Texturized Vegetable Protein Market Y-o-Y Analysis by Form, 2019 & 2029

Figure 48: Latin America Texturized Vegetable Protein Market Attractiveness, by Form, 2019 to 2029

Figure 49: Latin America Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 50: Latin America Texturized Vegetable Protein Market Y-o-Y Analysis by End Use, 2019 & 2029

Figure 51: Latin America Texturized Vegetable Protein Market Attractiveness, by End Use, 2019 to 2029

Figure 52: Latin America Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Distribution Channel, 2014, 2019 & 2029

Figure 53: Latin America Texturized Vegetable Protein Market Y-o-Y Analysis by Distribution Channel, 2019 & 2029

Figure 54: Latin America Texturized Vegetable Protein Market Attractiveness, by Distribution Channel, 2019 to 2029

Figure 55: Europe Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Country, 2014, 2019 & 2029

Figure 56: Europe Texturized Vegetable Protein Market Y-o-Y Analysis by Country, 2019 & 2029

Figure 57: Europe Texturized Vegetable Protein Market Attractiveness, by Country, 2019 to 2029

Figure 58: Europe Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Product Type, 2014, 2019 & 2029

Figure 59: Europe Texturized Vegetable Protein Market Y-o-Y Analysis by Product Type, 2019 & 2029

Figure 60: Europe Texturized Vegetable Protein Market Attractiveness, by Product Type, 2019 to 2029

Figure 61: Europe Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 62: Europe Texturized Vegetable Protein Market Y-o-Y Analysis by Nature, 2019 & 2029

Figure 63: Europe Texturized Vegetable Protein Market Attractiveness, by Nature, 2019 to 2029

Figure 64: Europe Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Form, 2014, 2019 & 2029

Figure 65: Europe Texturized Vegetable Protein Market Y-o-Y Analysis by Form, 2019 & 2029

Figure 66: Europe Texturized Vegetable Protein Market Attractiveness, by Form, 2019 to 2029

Figure 67: Europe Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 68: Europe Texturized Vegetable Protein Market Y-o-Y Analysis by End Use, 2019 & 2029

Figure 69: Europe Texturized Vegetable Protein Market Attractiveness, by End Use, 2019 to 2029

Figure 70: Europe Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Distribution Channel, 2014, 2019 & 2029

Figure 71: Europe Texturized Vegetable Protein Market Y-o-Y Analysis by Distribution Channel, 2019 & 2029

Figure 72: Europe Texturized Vegetable Protein Market Attractiveness, by Distribution Channel, 2019 to 2029

Figure 73: East Asia Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Country, 2014, 2019 & 2029

Figure 74: East Asia Texturized Vegetable Protein Market Y-o-Y Analysis by Country, 2019 & 2029

Figure 75: East Asia Texturized Vegetable Protein Market Attractiveness, by Country, 2019 to 2029

Figure 76: East Asia Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Product Type, 2014, 2019 & 2029

Figure 77: East Asia Texturized Vegetable Protein Market Y-o-Y Analysis by Product Type, 2019 & 2029

Figure 78: East Asia Texturized Vegetable Protein Market Attractiveness, by Product Type, 2019 to 2029

Figure 79: East Asia Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 80: East Asia Texturized Vegetable Protein Market Y-o-Y Analysis by Nature, 2019 & 2029

Figure 81: East Asia Texturized Vegetable Protein Market Attractiveness, by Nature, 2019 to 2029

Figure 82: East Asia Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Form, 2014, 2019 & 2029

Figure 83: East Asia Texturized Vegetable Protein Market Y-o-Y Analysis by Form, 2019 & 2029

Figure 84: East Asia Texturized Vegetable Protein Market Attractiveness, by Form, 2019 to 2029

Figure 85: East Asia Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 86: East Asia Texturized Vegetable Protein Market Y-o-Y Analysis by End Use, 2019 & 2029

Figure 87: East Asia Texturized Vegetable Protein Market Attractiveness, by End Use, 2019 to 2029

Figure 88: East Asia Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Distribution Channel, 2014, 2019 & 2029

Figure 89: East Asia Texturized Vegetable Protein Market Y-o-Y Analysis by Distribution Channel, 2019 & 2029

Figure 90: East Asia Texturized Vegetable Protein Market Attractiveness, by Distribution Channel, 2019 to 2029

Figure 91: South Asia Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Country, 2014, 2019 & 2029

Figure 92: South Asia Texturized Vegetable Protein Market Y-o-Y Analysis by Country, 2019 & 2029

Figure 93: South Asia Texturized Vegetable Protein Market Attractiveness, by Country, 2019 to 2029

Figure 94: South Asia Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Product Type, 2014, 2019 & 2029

Figure 95: South Asia Texturized Vegetable Protein Market Y-o-Y Analysis by Product Type, 2019 & 2029

Figure 96: South Asia Texturized Vegetable Protein Market Attractiveness, by Product Type, 2019 to 2029

Figure 97: South Asia Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 98: South Asia Texturized Vegetable Protein Market Y-o-Y Analysis by Nature, 2019 & 2029

Figure 99: South Asia Texturized Vegetable Protein Market Attractiveness, by Nature, 2019 to 2029

Figure 100: South Asia Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Form, 2014, 2019 & 2029

Figure 101: South Asia Texturized Vegetable Protein Market Y-o-Y Analysis by Form, 2019 & 2029

Figure 102: South Asia Texturized Vegetable Protein Market Attractiveness, by Form, 2019 to 2029

Figure 103: South Asia Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 104: South Asia Texturized Vegetable Protein Market Y-o-Y Analysis by End Use, 2019 & 2029

Figure 105: South Asia Texturized Vegetable Protein Market Attractiveness, by End Use, 2019 to 2029

Figure 106: South Asia Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Distribution Channel, 2014, 2019 & 2029

Figure 107: South Asia Texturized Vegetable Protein Market Y-o-Y Analysis by Distribution Channel, 2019 & 2029

Figure 108: South Asia Texturized Vegetable Protein Market Attractiveness, by Distribution Channel, 2019 to 2029

Figure 109: MEA Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Country, 2014, 2019 & 2029

Figure 110: MEA Texturized Vegetable Protein Market Y-o-Y Analysis by Country, 2019 & 2029

Figure 111: MEA Texturized Vegetable Protein Market Attractiveness, by Country, 2019 to 2029

Figure 112: MEA Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Product Type, 2014, 2019 & 2029

Figure 113: MEA Texturized Vegetable Protein Market Y-o-Y Analysis by Product Type, 2019 & 2029

Figure 114: MEA Texturized Vegetable Protein Market Attractiveness, by Product Type, 2019 to 2029

Figure 115: MEA Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 116: MEA Texturized Vegetable Protein Market Y-o-Y Analysis by Nature, 2019 & 2029

Figure 117: MEA Texturized Vegetable Protein Market Attractiveness, by Nature, 2019 to 2029

Figure 118: MEA Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Form, 2014, 2019 & 2029

Figure 119: MEA Texturized Vegetable Protein Market Y-o-Y Analysis by Form, 2019 & 2029

Figure 120: MEA Texturized Vegetable Protein Market Attractiveness, by Form, 2019 to 2029

Figure 121: MEA Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 122: MEA Texturized Vegetable Protein Market Y-o-Y Analysis by End Use, 2019 & 2029

Figure 123: MEA Texturized Vegetable Protein Market Attractiveness, by End Use, 2019 to 2029

Figure 124: MEA Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Distribution Channel, 2014, 2019 & 2029

Figure 125: MEA Texturized Vegetable Protein Market Y-o-Y Analysis by Distribution Channel, 2019 & 2029

Figure 126: MEA Texturized Vegetable Protein Market Attractiveness, by Distribution Channel, 2019 to 2029

Figure 127: Oceania Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Country, 2014, 2019 & 2029

Figure 128: Oceania Texturized Vegetable Protein Market Y-o-Y Analysis by Country, 2019 & 2029

Figure 129: Oceania Texturized Vegetable Protein Market Attractiveness, by Country, 2019 to 2029

Figure 130: Oceania Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Product Type, 2014, 2019 & 2029

Figure 131: Oceania Texturized Vegetable Protein Market Y-o-Y Analysis by Product Type, 2019 & 2029

Figure 132: Oceania Texturized Vegetable Protein Market Attractiveness, by Product Type, 2019 to 2029

Figure 133: Oceania Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 134: Oceania Texturized Vegetable Protein Market Y-o-Y Analysis by Nature, 2019 & 2029

Figure 135: Oceania Texturized Vegetable Protein Market Attractiveness, by Nature, 2019 to 2029

Figure 136: Oceania Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Form, 2014, 2019 & 2029

Figure 137: Oceania Texturized Vegetable Protein Market Y-o-Y Analysis by Form, 2019 & 2029

Figure 138: Oceania Texturized Vegetable Protein Market Attractiveness, by Form, 2019 to 2029

Figure 139: Oceania Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 140: Oceania Texturized Vegetable Protein Market Y-o-Y Analysis by End Use, 2019 & 2029

Figure 141: Oceania Texturized Vegetable Protein Market Attractiveness, by End Use, 2019 to 2029

Figure 142: Oceania Texturized Vegetable Protein Market Value Share (%) and BPS Analysis by Distribution Channel, 2014, 2019 & 2029

Figure 143: Oceania Texturized Vegetable Protein Market Y-o-Y Analysis by Distribution Channel, 2019 & 2029

Figure 144: Oceania Texturized Vegetable Protein Market Attractiveness, by Distribution Channel, 2019 to 2029