Analysts’ Viewpoint

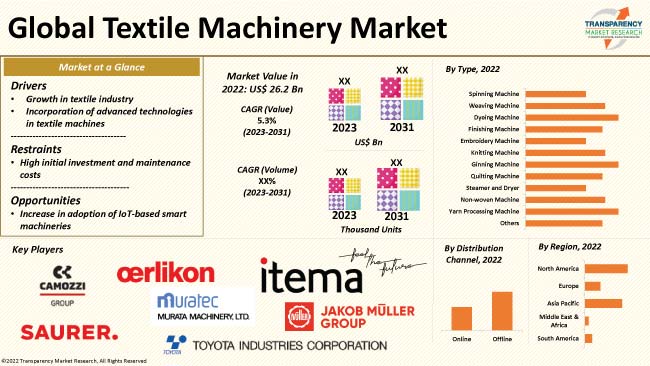

Expansion in the textile sector and rapid adoption of advanced technologies, including AI and IoT, in textile machines are expected to drive the global textile machinery market growth in the near future. Demand for automated textile machines is rising steadily due to their excellent performance in producing high-end fabric. These machines are used in fiber manufacturing, yarn processing, weaving, and various other processes.

Key market players are investing in R&D activities to develop innovative textile machinery. Organizations and customers are increasingly becoming aware of sustainability trends; therefore, textile manufacturers are shifting their focus toward non-woven and natural fabrics. Lucrative presence of prominent players across the globe is likely to boost product diversity. However, high installation cost of these machines is hampering market development.

The creation of textiles involves several techniques and textile machinery. Cotton is one of the commonly used materials or fabrics around the globe. Different types of machines are used in the fabrication process of cotton.

Various types of textile machinery are available in the market. These include spinning machines and weaving machines. Textile apparel equipment comprises cutting and finishing machines, embroidery machines, and sewing machines.

Textile machines are used to process natural fibers such as silk, wool, and cotton; and artificial fibers such as polyester, nylon, and polypropylene. The global market is projected to grow at a steady pace during the forecast period, owing to the increase in demand for garments among residential as well as industrial customers.

Textile machinery market demand is anticipated to increase in the near future owing to the the rise in demand for various types of garments such as clothing, safety wear, and seasonal wear across the globe. The textile industry deals with items made from fibers, threads, or yarn.

Demand for conventional textiles, which are made primarily for esthetics, is increasing across the globe. These include clothing and decorative items such as throw pillows and technical textiles. High demand for conventional textiles is positively impacting the textile machinery industry growth.

As per the National Council of Textile Organizations (NCTO), the U.S. textile and apparel shipments totaled US$ 65.2 Bn in 2021. The U.S. industry is the second largest exporter of textile-related products in the world. It invested US$ 20.2 Bn in new plants and equipment from 2011 to 2020. Manufacturers in the U.S. are investing significantly in the development of new recycling facilities to achieve their sustainability goals.

India is one of the top garment manufacturing countries in the world. It exports apparel, handlooms, and handicraft products to several other countries across the globe. India is also one of the largest producers and consumers of cotton. It holds around 37.0% of the global area under cotton cultivation.

According to the India Brand Equity Foundation (IBEF), the country’s textile and apparel market size is expected to increase at a CAGR of 10.0% during 2019 to 2020 and reach US$ 190 Bn during 2025 to 2026. India is the sixth largest exporter of textiles and apparel products in the world, with a large raw material and manufacturing base.

Demand for advanced high-tech textile machinery is increasing across the globe. With the help of the latest technologies, manufacturers can improve the production process and quality of deliverables. The textile industry has traditionally been labor intensive; however, emergence of machines based on IoT and AI has enabled manufacturers to save on labor and improve the overall efficiency of machines.

Digital and computerized methods can be used in the production of textiles. Quality and quantity of the manufacturing process increases with continuous innovation and advancement in textile machinery.

Key players are investing significantly in innovative technologies, such as nanotechnology, in textile machines. Nanotechnology offers various benefits. Products can be made more fire-repellent and water-repellent with the help of this technology. Furthermore, apparel can be produced with less energy, thus making it sustainable.

Designs can be printed on fibers more quickly and precisely through laser printing. 3D printers are employed to print on thinner and more resilient fibers. Digital printing has become a crucial technology in the textile industry. These printers can easily produce creative designs on textiles. Increase in efficiency of digital printers makes manufacturing and designing more creative, innovative, time-saving, and cost-effective.

According to the latest textile machinery market report, Asia Pacific is projected to dominate the global landscape during the forecast period. The region held significant share in 2022.

Asia Pacific is the hub of the textile industry. China has been dominating the textile and garment industry since the last 30 years. The country remains the single largest producer and exporter of textiles and clothing, led by low production costs. China is a major exporter of textiles, with 37.0% share of the global trade, followed by India.

India is one of the fastest growing economies, with abundant raw material availability and stable government. Growth in the textile industry in the country is augmenting market progress in Asia Pacific. Bangladesh, Indonesia, Vietnam, and Cambodia are also lucrative markets for the textile business.

The textile machinery market size in North America and Europe is anticipated to grow at a considerable pace in the near future. Rise in demand for textiles, presence of numerous manufacturers, and technological advancement & innovation in textile machinery are some of the prominent factors contributing to textile machinery market development in these regions. Furthermore, increase in disposable income of the people is fueling market expansion in these regions.

According to the latest textile machinery market forecast report analysis, prominent companies are investing significantly in comprehensive R&D activities, primarily to develop smart and innovative textile machineries. These companies are following the latest textile machinery market trends and implementing various strategies to stay ahead of the competition. Leading players are engaged in expanding their product portfolio as well as acquisitions and collaborations to gain lucrative textile machinery market share.

Benninger AG (Jakob Muller AG), Saurer Intelligent Technology AG, Murata Machinery Ltd., Camozzi Group S.p.A., Rieter, Mayer & Cie, Morgan Tecnica, OC Oerlikon Management AG, Santex Rimar Group, and Toyota Industries Corporation are some of the leading companies in the textile machinery market.

Each of these players has been profiled in the textile machinery market research report based on parameters such as business strategies, business segments, company overview, product portfolio, recent developments, and financial overview.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 26.2 Bn |

|

Market Forecast Value in 2031 |

US$ 41.2 Bn |

|

Growth Rate (CAGR) |

5.3% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 26.2 Bn in 2022.

The CAGR is projected be 5.3% from 2023 to 2031.

Growth in textile industry across the globe and rise in adoption of advanced textile machines.

The weaving machine type segment accounted for significant share in 2022.

Asia Pacific is likely to be one of the most lucrative regions in the next few years.

Benninger AG (Jakob Muller AG), Camozzi Group S.p.A., Mayer & Cie, Morgan Tecnica, Murata Machinery Ltd., OC Oerlikon Management AG, Rieter, Santex Rimar Group, Saurer Intelligent Technology AG, and Toyota Industries Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Regional Snapshot

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Technological Overview Analysis

5.9. Regulatory Framework

5.10. Global Textile Machinery Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Revenue Projections (US$ Bn)

5.10.2. Market Revenue Projections (Thousand Units)

6. Global Textile Machinery Market Analysis and Forecast, By Type

6.1. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

6.1.1. Spinning Machine

6.1.2. Weaving Machine

6.1.3. Dyeing Machine

6.1.4. Finishing Machine

6.1.5. Embroidery Machine

6.1.6. Knitting Machine

6.1.7. Ginning Machine

6.1.8. Quilting Machine

6.1.9. Steamer and Dryer

6.1.10. Non-woven Machine

6.1.11. Yarn Processing Machine

6.1.12. Others

6.2. Incremental Opportunity, By Type

7. Global Textile Machinery Market Analysis and Forecast, By Distribution Channel

7.1. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

7.1.1. Direct

7.1.2. Indirect

7.2. Incremental Opportunity, By Distribution Channel

8. Global Textile Machinery Market Analysis and Forecast, by Region

8.1. Textile Machinery Market (US$ Bn and Thousand Units), Region, 2017 - 2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Incremental Opportunity, by Region

9. North America Textile Machinery Market Analysis and Forecast

9.1. Regional Snapshot

9.2. Price Trend Analysis

9.2.1. Weighted Average Selling Price (US$)

9.3. Key Trends Analysis

9.3.1. Demand Side

9.3.2. Supply Side

9.4. Key Supplier Analysis

9.5. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

9.5.1. Spinning Machine

9.5.2. Weaving Machine

9.5.3. Dyeing Machine

9.5.4. Finishing Machine

9.5.5. Embroidery Machine

9.5.6. Knitting Machine

9.5.7. Ginning Machine

9.5.8. Quilting Machine

9.5.9. Steamer and Dryer

9.5.10. Non-woven Machine

9.5.11. Yarn Processing Machine

9.5.12. Others

9.6. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

9.6.1. Direct

9.6.2. Indirect

9.7. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

9.7.1. U.S.

9.7.2. Canada

9.7.3. Rest of North America

9.8. Incremental Opportunity Analysis

10. Europe Textile Machinery Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Price Trend Analysis

10.2.1. Weighted Average Selling Price (US$)

10.3. Key Trends Analysis

10.3.1. Demand Side

10.3.2. Supply Side

10.4. Key Supplier Analysis

10.5. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

10.5.1. Spinning Machine

10.5.2. Weaving Machine

10.5.3. Dyeing Machine

10.5.4. Finishing Machine

10.5.5. Embroidery Machine

10.5.6. Knitting Machine

10.5.7. Ginning Machine

10.5.8. Quilting Machine

10.5.9. Steamer and Dryer

10.5.10. Non-woven Machine

10.5.11. Yarn Processing Machine

10.5.12. Others

10.6. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

10.6.1. Direct

10.6.2. Indirect

10.7. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

10.7.1. U.K

10.7.2. Germany

10.7.3. France

10.7.4. Rest of Europe

10.8. Incremental Opportunity Analysis

11. Asia Pacific Textile Machinery Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Key Trends Analysis

11.3.1. Demand Side

11.3.2. Supply Side

11.4. Key Supplier Analysis

11.5. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

11.5.1. Spinning Machine

11.5.2. Weaving Machine

11.5.3. Dyeing Machine

11.5.4. Finishing Machine

11.5.5. Embroidery Machine

11.5.6. Knitting Machine

11.5.7. Ginning Machine

11.5.8. Quilting Machine

11.5.9. Steamer and Dryer

11.5.10. Non-woven Machine

11.5.11. Yarn Processing Machine

11.5.12. Others

11.6. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

11.6.1. Direct

11.6.2. Indirect

11.7. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

11.7.1. China

11.7.2. India

11.7.3. Japan

11.7.4. Rest of Asia Pacific

11.8. Incremental Opportunity Analysis

12. Middle East & Africa Textile Machinery Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Trends Analysis

12.3.1. Demand Side

12.3.2. Supply Side

12.4. Key Supplier Analysis

12.5. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

12.5.1. Spinning Machine

12.5.2. Weaving Machine

12.5.3. Dyeing Machine

12.5.4. Finishing Machine

12.5.5. Embroidery Machine

12.5.6. Knitting Machine

12.5.7. Ginning Machine

12.5.8. Quilting Machine

12.5.9. Steamer and Dryer

12.5.10. Non-woven Machine

12.5.11. Yarn Processing Machine

12.5.12. Others

12.6. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.6.1. Direct

12.6.2. Indirect

12.7. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

12.7.1. GCC

12.7.2. South Africa

12.7.3. Rest of Middle East & Africa

12.8. Incremental Opportunity Analysis

13. South America Textile Machinery Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Trends Analysis

13.3.1. Demand Side

13.3.2. Supply Side

13.4. Key Supplier Analysis

13.5. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

13.5.1. Spinning Machine

13.5.2. Weaving Machine

13.5.3. Dyeing Machine

13.5.4. Finishing Machine

13.5.5. Embroidery Machine

13.5.6. Knitting Machine

13.5.7. Ginning Machine

13.5.8. Quilting Machine

13.5.9. Steamer and Dryer

13.5.10. Non-woven Machine

13.5.11. Yarn Processing Machine

13.5.12. Others

13.6. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.6.1. Direct

13.6.2. Indirect

13.7. Textile Machinery Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

13.7.1. Brazil

13.7.2. Rest of South America

13.8. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Revenue Share Analysis (%), By Company, (2022)

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

14.3.1. Benninger AG (Jakob Muller AG)

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.2. Camozzi Group S.p.A.

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.3. Mayer & Cie

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.4. Morgan Tecnica

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.5. Murata Machinery Ltd.

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.6. OC Oerlikon Management AG

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.7. Rieter

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.8. Santex Rimar Group

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

14.3.9. Saurer Intelligent Technology AG

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Revenue

14.3.9.4. Strategy & Business Overview

14.3.10. Toyota Industries Corporation

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Revenue

14.3.10.4. Strategy & Business Overview

15. Key Takeaway

15.1. Identification of Potential Market Spaces

15.1.1. Type

15.1.2. Distribution Channel

15.1.3. Region

15.2. Prevailing Market Risks

List of Tables

Table 1: Global Textile Machinery Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Textile Machinery Market Volume (Thousand Units), by Type 2017-2031

Table 3: Global Textile Machinery Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 4: Global Textile Machinery Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 5: Global Textile Machinery Market Value (US$ Bn), by Region, 2017-2031

Table 6: Global Textile Machinery Market Volume (Thousand Units), by Region 2017-2031

Table 7: North America Textile Machinery Market Value (US$ Bn), by Type, 2017-2031

Table 8: North America Textile Machinery Market Volume (Thousand Units), by Type 2017-2031

Table 9: North America Textile Machinery Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 10: North America Textile Machinery Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 11: North America Textile Machinery Market Value (US$ Bn), by Country, 2017-2031

Table 12: North America Textile Machinery Market Volume (Thousand Units), by Country 2017-2031

Table 13: Europe Textile Machinery Market Value (US$ Bn), by Type, 2017-2031

Table 14: Europe Textile Machinery Market Volume (Thousand Units), by Type 2017-2031

Table 15: Europe Textile Machinery Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 16: Europe Textile Machinery Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 17: Europe Textile Machinery Market Value (US$ Bn), by Country, 2017-2031

Table 18: Europe Textile Machinery Market Volume (Thousand Units), by Country 2017-2031

Table 19: Asia Pacific Textile Machinery Market Value (US$ Bn), by Type, 2017-2031

Table 20: Asia Pacific Textile Machinery Market Volume (Thousand Units), by Type 2017-2031

Table 21: Asia Pacific Textile Machinery Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 22: Asia Pacific Textile Machinery Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 23: Asia Pacific Textile Machinery Market Value (US$ Bn), by Country, 2017-2031

Table 24: Asia Pacific Textile Machinery Market Volume (Thousand Units), by Country 2017-2031

Table 25: Middle East & Africa Textile Machinery Market Value (US$ Bn), by Type, 2017-2031

Table 26: Middle East & Africa Textile Machinery Market Volume (Thousand Units), by Type 2017-2031

Table 27: Middle East & Africa Textile Machinery Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 28: Middle East & Africa Textile Machinery Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 29: Middle East & Africa Textile Machinery Market Value (US$ Bn), by Country, 2017-2031

Table 30: Middle East & Africa Textile Machinery Market Volume (Thousand Units), by Country 2017-2031

Table 31: South America Textile Machinery Market Value (US$ Bn), by Type, 2017-2031

Table 32: South America Textile Machinery Market Volume (Thousand Units), by Type 2017-2031

Table 33: South America Textile Machinery Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 34: South America Textile Machinery Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 35: South America Textile Machinery Market Value (US$ Bn), by Country, 2017-2031

Table 36: South America Textile Machinery Market Volume (Thousand Units), by Country 2017-2031

List of Figures

Figure 1: Global Textile Machinery Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Textile Machinery Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Textile Machinery Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 5: Global Textile Machinery Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 6: Global Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2022-231

Figure 7: Global Textile Machinery Market Value (US$ Bn), by Region, 2017-2031

Figure 8: Global Textile Machinery Market Volume (Thousand Units), by Region 2017-2031

Figure 9: Global Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 10: North America Textile Machinery Market Value (US$ Bn), by Type, 2017-2031

Figure 11: North America Textile Machinery Market Volume (Thousand Units), by Type 2017-2031

Figure 12: North America Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 13: North America Textile Machinery Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 14: North America Textile Machinery Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 15: North America Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel,2023-2031

Figure 16: North America Textile Machinery Market Value (US$ Bn), by Country, 2017-2031

Figure 17: North America Textile Machinery Market Volume (Thousand Units), by Country 2017-2031

Figure 18: North America Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 19: Europe Textile Machinery Market Value (US$ Bn), by Type, 2017-2031

Figure 20: Europe Textile Machinery Market Volume (Thousand Units), by Type 2017-2031

Figure 21: Europe Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 22: Europe Textile Machinery Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 23: Europe Textile Machinery Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 24: Europe Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2022-231

Figure 25: Europe Textile Machinery Market Value (US$ Bn), by Country, 2017-2031

Figure 26: Europe Textile Machinery Market Volume (Thousand Units), by Country 2017-2031

Figure 27: Europe Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 28: Asia Pacific Textile Machinery Market Value (US$ Bn), by Type, 2017-2031

Figure 29: Asia Pacific Textile Machinery Market Volume (Thousand Units), by Type 2017-2031

Figure 30: Asia Pacific Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 31: Asia Pacific Textile Machinery Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 32: Asia Pacific Textile Machinery Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 33: Asia Pacific Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel,2023-2031

Figure 34: Asia Pacific Textile Machinery Market Value (US$ Bn), by Country, 2017-2031

Figure 35: Asia Pacific Textile Machinery Market Volume (Thousand Units), by Country 2017-2031

Figure 36: Asia Pacific Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 37: Middle East & Africa Textile Machinery Market Value (US$ Bn), by Type, 2017-2031

Figure 38: Middle East & Africa Textile Machinery Market Volume (Thousand Units), by Type 2017-2031

Figure 39: Middle East & Africa Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 40: Middle East & Africa Textile Machinery Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 41: Middle East & Africa Textile Machinery Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 42: Middle East & Africa Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 43: Middle East & Africa Textile Machinery Market Value (US$ Bn), by Country, 2017-2031

Figure 44: Middle East & Africa Textile Machinery Market Volume (Thousand Units), by Country 2017-2031

Figure 45: Middle East & Africa Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 46: South America Textile Machinery Market Value (US$ Bn), by Type, 2017-2031

Figure 47: South America Textile Machinery Market Volume (Thousand Units), by Type 2017-2031

Figure 48: South America Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 49: South America Textile Machinery Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 50: South America Textile Machinery Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 51: South America Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel,2023-2031

Figure 52: South America Textile Machinery Market Value (US$ Bn), by Country, 2017-2031

Figure 53: South America Textile Machinery Market Volume (Thousand Units), by Country 2017-2031

Figure 54: South America Textile Machinery Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031