Global Textile Coatings Market: Snapshot

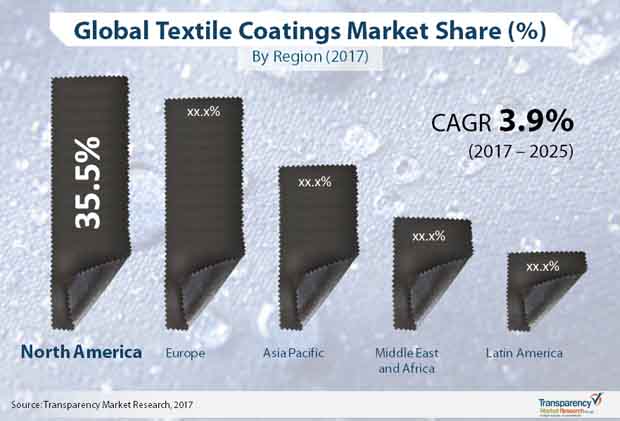

The demand in the global textile coatings market is projected for a CAGR of 3.9% during the forecast period of 2017 to 2025, gaining traction from the prosperity of a number of end-use industries such as building and construction, automotive, footwear and apparels, medical devices, and protective clothing. On the other hand, environmental concerns regarding these coatings and growing popularity of bio-based alternatives are hindering the desired prosperity of the textile coatings market. In the near future, vendors operating in this market are expected to gain new opportunities from the advent of nanotechnology and microencapsulation in textiles. The global textile coatings market is estimated to be worth US$4,918.5 mn by 2025, considerably up from its evaluated worth of US$3,406.0 mn in 2016.

Thermoplastic Based Raw Materials Widely Used

On the basis of raw materials, the global textile coatings market has been segmented into thermoplastic type based, which includes sub-segments of polyurethane, polyvinylchloride, and acrylics, and thermoset type based, with is further bifurcated into natural rubber, styrene butadiene rubber, and silicones. Thermosets segment held a lower share in the market in comparison to thermoplastics segment across the globe. Thermoplastic products are cheaper and efficient, therefore they have high demand in the market. Technology-wise, the global textile coatings market has been segmented into dot coating and full surface coating. As full surface coating completely laminates the textile product the segment has higher demand in the market and is expected to rise at a higher CAGR in the forecast period. The technology is employed to coat products partially (in form of dots). Dot coating technology is employed in various industries such as medical hygiene, upholstery fabric, footwear, and sports products.

As far as end-users are concerned, the report categorizes the global textile coatings market into industrial clothing, upholstery fabric, geotextiles, footwear, and medical hygiene. The first two end-use categories served the most prominent share of the demand in the global market for textile coatings in 2016. Growing demand for protective fabric in various industries is likely to boost the market for textile coatings. Increase in performance requirements, rise in fire safety regulations, and growth in quality are driving the industrial clothing segment. Rise in demand for premium upholstery fabric in automotive interiors, furniture, curtains, etc. is augmenting the demand for textile coatings.

Asia Pacific Most Lucrative Region with Above-average Growth Rate

Geographically, the market for textile coatings has been classified into North America including the U.S., Asia Pacific including China and India, Europe, the Middle East and Africa, and Latin America. While North America and Europe are most lucrative regions in terms of revenue, Asia Pacific continues serve maximum demand for textile coatings in terms of volume, and is projected for an above-average growth rate of 4.3% during the forecast period of 2017 to 2025. The expansion of the textile coatings market in Asia Pacific is due to the rise in standard of living and growth in population in the region. North America and Europe follow Asia Pacific. The textile coatings market in Middle East & Africa and Latin America held lower share in 2016. The textile coatings market in these regions is estimated to anticipate expand at a sluggish pace during the forecast period.

Some of the key companies currently operating in the global textile coatings market are Clariant AG, The Dow Chemical Company, Covestro AG, BASF SE, and Huntsman International LLC., Lubrizol Corporation, Omnova Solutions Inc., Solvay SA, Sumitomo Chemical Company, and Tanatex B.V.

Increasing Application Outreach to Lay a Red Carpet of Growth across the Textile Coatings Market

The textile coatings market will flourish extensively during the assessment period of 2017-2025 based on the phenomenal advancements across the textile industry. The utilization of textile coatings in applications across end-users such as upholstery fabrics, footwear, geotextiles, medical hygiene, industrial clothing, transportation, fabric filters, hoardings, building and construction, extracorporeal devices, chemical protective clothing, and others will bring tremendous growth opportunities across the forecast period.

List of Tables

Table 01: Global Textile Coatings Market Volume (Kilo Tons) Forecast, By Raw Materials, 2016–2025

Table 02: Global Textile Coatings Market Size (US$ Mn) Forecast, By Raw Materials, 2016–2025

Table 03: Global Textile Coatings Market Size (US$ Mn) and Volume (Tons) Forecast, By Technology, 2016–2025

Table 04: Global Textile Coatings Market Size (US$ Mn) and Volume (Tons) Forecast, By End-user, 2016–2025

Table 05: Global Textile Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, By Region, 2016–2025

Table 06: North America Textile Coatings Market Volume (Kilo Tons) Forecast, By Raw Materials, 2016–2025

Table 07: North America Textile Coatings Market Size (US$ Mn) Forecast, By Raw Materials, 2016–2025

Table 08: North America Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By Technology, 2016–2025

Table 09: North America Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By End-user, 2016–2025

Table 10: North America Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By Country, 2016–2025

Table 11: Europe Textile Coatings Market Volume (Kilo Tons) Forecast, By Raw Materials, 2016–2025

Table 12: Europe Textile Coatings Market Size (US$ Mn) Forecast, By Raw Materials, 2016–2025

Table 13: Europe Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By Technology, 2016–2025

Table 14: Europe Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By End-user, 2016–2025

Table 15: Europe Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By Country, 2016–2025

Table 16: Asia Pacific Textile Coatings Market Volume (Kilo Tons) Forecast, By Raw Materials, 2016–2025

Table 17: Asia Pacific Textile Coatings Market Size (US$ Mn) Forecast, By Raw Materials, 2016–2025

Table 18: Asia Pacific Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By Technology, 2016–2025

Table 19: Asia Pacific Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By End-user, 2016–2025

Table 20: Asia Pacific Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By Country, 2016–2025

Table 21: Latin America Textile Coatings Market Volume (Kilo Tons) Forecast, By Raw Materials, 2016–2025

Table 22: Latin America Textile Coatings Market Size (US$ Mn) Forecast, By Raw Materials, 2016–2025

Table 23: Latin America Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By Technology, 2016–2025

Table 24: Latin America Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By End-user, 2016–2025

Table 25: Latin America Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By Country, 2016–2025

Table 26: Middle East & Africa Textile Coatings Market Volume (Kilo Tons) Forecast, By Raw Materials, 2016–2025

Table 27: Middle East & Africa Textile Coatings Market Size (US$ Mn) Forecast, By Raw Materials, 2016–2025

Table 28: Middle East & Africa Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By Technology, 2016–2025

Table 29: Middle East & Africa Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By End-user, 2016–2025

Table 30: Middle East & Africa Textile Coatings Market Size (US$ Mn) and Market Volume (Kilo Tons) Forecast, By Country, 2016–2025

List of Figures

Figure 01: Textile Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 02: Textile Coatings Price Trend Analysis (US$/Tons) 2016–2025

Figure 03: Global Textile Coatings Market, Value Share Analysis, By Raw Materials, 2016 and 2025

Figure 04: Thermoplastics Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 05: Thermosets Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 06: Global Textile Coatings Market Attractiveness Analysis, By Raw Materials

Figure 07: Global Textile Coatings Market, Value Share Analysis, By Technology, 2016 and 2025

Figure 08: Dot Coating Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 09: Full Surface Coating Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 10: Global Textile Coatings Market Attractiveness Analysis, By Technology

Figure 11: Global Textile Coatings Market, Value Share Analysis, By End-user, 2016 and 2025

Figure 12: Geotextiles Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 13: Upholstery Fabric Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 14: Industrial Clothing Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 15: Medical Hygiene Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 16: Footwear Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 17: Others Value (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 18: Global Textile Coatings Market Attractiveness Analysis, By End-user

Figure 19: Global Textile Coatings Market Value Share Analysis, By Region, 2016 and 2025

Figure 20: Global Textile Coatings Market Attractiveness Analysis, By Region

Figure 21: North America Textile Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 22: North America Textile Coatings Market Size and Volume Y-o-Y Growth Projections, 2016–2025

Figure 23: North America Textile Coatings Market Price (US$/Tons) Forecast, 2016–2025

Figure 24: North America Market Value Share Analysis By Raw Materials, 2016 and 2025

Figure 25: North America Market Value Share Analysis By Technology, 2016 and 2025

Figure 26: North America Market Value Share Analysis By End-user, 2016 and 2025

Figure 27: North America Market Value Share Analysis By Country, 2016 and 2025

Figure 29: North America Textile Coatings Market Attractiveness, By Technology

Figure 31: North America Textile Coatings Market Attractiveness, By Country

Figure 28: North America Textile Coatings Market Attractiveness, By Raw Materials

Figure 30: North America Textile Coatings Market Attractiveness, By End-user

Figure 32: Europe Textile Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 33: Europe Textile Coatings Market Size and Volume Y-o-Y Growth Projections, 2016–2025

Figure 34: Europe Textile Coatings Market Price (US$/Tons) Forecast, 2016–2025

Figure 35: Europe Market Value Share Analysis By Raw Materials, 2016 and 2025

Figure 36: Europe Market Value Share Analysis By Technology, 2016 and 2025

Figure 37: Europe Market Value Share Analysis By End-user, 2016 and 2025

Figure 38: Europe Market Value Share Analysis By Country, 2016 and 2025

Figure 40: Europe Textile Coatings Market Attractiveness, By Technology

Figure 42: Europe Textile Coatings Market Attractiveness, By Country

Figure 39: Europe Textile Coatings Market Attractiveness, By Raw Materials

Figure 41: Europe Textile Coatings Market Attractiveness, By End-user

Figure 43: Asia Pacific Textile Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 44: Asia Pacific Textile Coatings Market Size and Volume Y-o-Y Growth Projections, 2016–2025

Figure 45: Asia Pacific Textile Coatings Market Price (US$/Tons) Forecast, 2016–2025

Figure 46: Asia Pacific Market Value Share Analysis By Raw Materials, 2016 and 2025

Figure 47: Asia Pacific Market Value Share Analysis By Technology, 2016 and 2025

Figure 48: Asia Pacific Market Value Share Analysis By End-user, 2016 and 2025

Figure 49: Asia Pacific Market Value Share Analysis By Country, 2016 and 2025

Figure 51: Asia Pacific Textile Coatings Market Attractiveness, By Technology

Figure 53: Asia Pacific Textile Coatings Market Attractiveness, By Country

Figure 50: Asia Pacific Textile Coatings Market Attractiveness, By Raw Materials

Figure 52: Asia Pacific Textile Coatings Market Attractiveness, By End-user

Figure 54: Latin America Textile Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 55: Latin America Textile Coatings Market Size and Volume Y-o-Y Growth Projections, 2016–2025

Figure 56: Latin America Textile Coatings Market Price (US$/Tons) Forecast, 2016–2025

Figure 57: Latin America Market Value Share Analysis By Raw Materials, 2016 and 2025

Figure 58: Latin America Market Value Share Analysis By Technology, 2016 and 2025

Figure 59: Latin America Market Value Share Analysis By End-user, 2016 and 2025

Figure 62: Latin America Textile Coatings Market Attractiveness, By Technology

Figure 64: Latin America Textile Coatings Market Attractiveness, By Country

Figure 61: Latin America Textile Coatings Market Attractiveness, By Raw Materials

Figure 63: Latin America Textile Coatings Market Attractiveness, By End-user

Figure 65: Middle East & Africa Textile Coatings Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 66: Middle East & Africa Textile Coatings Market Size and Volume Y-o-Y Growth Projections, 2016–2025

Figure 67: Middle East & Africa Region Textile Coatings Market Price (US$/Tons) Forecast, 2016–2025

Figure 68: Middle East & Africa Market Value Share Analysis By Raw Materials, 2016 and 2025

Figure 69: Middle East & Africa Market Value Share Analysis By Technology, 2016 and 2025

Figure 70: Middle East & Africa Market Value Share Analysis By End-user, 2016 and 2025

Figure 71: Middle East & Africa Market Value Share Analysis By Country, 2016 and 2025

Figure 73: Middle East & Africa Textile Coatings Market Attractiveness, By Technology

Figure 75: Middle East & Africa Textile Coatings Market Attractiveness, By Country

Figure 72: Middle East & Africa Textile Coatings Market Attractiveness, By Raw Materials

Figure 76: Global Textile Coatings Market Share Analysis By Company (2016)