Global TETRA Market: Snapshot

The global terrestrial trunked radio (TETRA) market is set for sound growth in the forthcoming years. This is primarily to provide foolproof communication systems for homeland security of nations. Apart from this, communication needs of various public safety agencies such as police, fire department, utility companies, and other services that need to transmit critical information in a timely manner is also leading to the deployment of TETRA systems.

Due to its capability, TETRA has been deployed at some global public spectacles. For instance, in 2015, the state secretary of Rio de Janeiro engaged a company called Teltronic for secure mobile radio communication for Rio Olympics 2016.

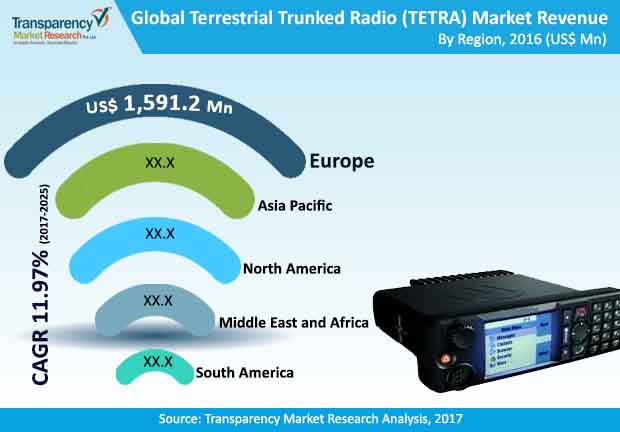

A report by Transparency Market Research (TMR) projects the global TETRA market to clock a healthy 11.97% CAGR during the forecast period from 2017 to 2025. Progressing at this rate, the market will reach a valuation of US$12,166.7 mn by the end of 2025.

Public Safety Application Segment Wins by Share due to High Consideration for Civilian Safety

The report studies the global TETRA market on the basis of application, component, device type, and region. On the basis of component, the TETRA market has been bifurcated into hardware, software, and services. Of them, the services segment is likely to clock a notable 12.11% CAGR for the global TETRA market during the forecast period. TETRA services helps to maximize uptime and efficiency of radio communication systems. The various types of TETRA services include support, training, security, network management, optimization, integration, and maintenance services. The array of services also ensure high performance of TETRA in a cost effective manner.

However, hardware segment is anticipated to account for the leading market share of 43.9% by 2025. In absolute numbers, the hardware segment is anticipated to be worth US$5,340.4 mn by the end of 2025. The hardware segment is displaying growth mainly because of increasing adoption of TETRA radios and base stations across the world.

In terms of device type, the TETRA market is categorized into portable and vehicular TETRA devices. Of the two, portable TETRA device is likely to account for the leading market share over the forecast period. Portable TETRA devices provide advantage due to their compact size. This allows safety agencies to perform functions on the go. Portable TETRA devices are also useful in the event of emergency situations or to obtain directions for remotely located destinations, as it is loaded with GPS and Bluetooth technology. In absolute value, portable TETRA devices segment is likely to be valued at US$8,022.8 mn by the end of 2025.

Depending on application, the TETRA market is segmented into transportation and logistics, aviation, oil & gas, public safety, and others. The other segment comprise military and defense, manufacturing, mining, retail, commercial, utilities, and healthcare. Amongst them, the public safety segment is estimated to account for the leading revenue contribution to the global market over the forecast period. The leading growth of this segment is mainly because of widespread adoption of TETRA systems by public safety agencies such as police patrol and law enforcement forces. Public safety is the focus of most players in the market to gain competitive advantage.

Asia Pacific to Emerge Attractive

The TETRA market has been divided into key regions of North America, Europe, Asia Pacific, the Middle East and Africa, and South America. Europe holds prominence among other key regions as TETRA was first adopted in Europe. Europe also holds significance in terms of installation of TETRA base stations and the number of TETRA users.

Asia Pacific has emerged as a lucrative market for TETRA in the recent past. This is mainly because of adoption of TETRA by transport and public safety agencies in China, India, and Japan.

Leading players in the global TETRA market include Motorola Solutions, ROHILL Engineering B.V., Damm Cellular Systems A/S, Airbus Defense and Space Oy, Rolta India Limited, Simoco Wireless Solutions, Cobham plc, JVCKENWOOD Corporation, Hytera Communications, and Leonardo among others.

Terrestrial Trunked Radio (TETRA) Market to Witness Notable Growth from Increasing Application in Clinical Administrations

The increasing adoption of advanced communication systems for homeland security worldwide is a key factor boosting the global terrestrial trunked radio market. Terrestrial trunked radios have the capacity to move information rapidly when contrasted with the portable interchanges prior is additionally boosting their interest. Terrestrial trunked radio is a private, advanced portable radio technology, discovering its application in clinical, transport, security, and fire administrations. As all correspondences by means of terrestrial trunked radio are private and secure, they are progressively being embraced. As sellers working in the terrestrial trunked radio market are investing every one of their amounts of energy towards understanding a safe, solid, and effective specialized technique in order to satisfy the necessities of purchasers, the market is seeing a development.

The market is driven by factors such as the progress of radio specialized gadgets from simple to computerized and developing utilization of portable radio interchanges in the transportation business. Terrestrial trunked radio innovation offers remarkable highlights to versatile correspondence, by joining the highlights of portable mobile phones with quick information correspondence and the workgroup abilities of PMR.

Furthermore, the developing interest for crucial interchanges and increasing utilization of portable radio correspondences in the transportation business could prompt huge freedoms for this market sooner rather than later. TETRA is the biggest land versatile radio norm, has great range productivity, and remarkable basic correspondence highlights—like security, short hit set-up time, voice calls include set, and fast information administrations on direct mode and site trunking. Its selection is filling in existing and potential market portions, like public security and business applications.

The rising need to foolproof mission-control basic correspondence framework for country security of countries is basically driving the TETRA market. Further, the need to serve correspondence needs of different public wellbeing offices, for example, local group of fire-fighters, police, service organizations, and different administrations is likewise stirring up the market's development. These organizations handle basic data that are likely to create lucrative growth opportunities in the coming years.

15.3.2. ROHILL Engineering B.V.

List of Figures

Figure 01: Market Revenue (US$ Mn) Growth Analysis By Application, 2017-2025

Figure 02: Market Revenue (US$ Mn) Growth Analysis By Components, 2017-2025

Figure 03: Market Revenue (US$ Mn) Growth Analysis By Device Type, 2017-2025

Figure 04: Market Revenue (US$ Mn) Growth Analysis By Region, 2017-2025

Figure 05: Global TETRA Market Size (US$ Mn) Forecast, 2015 - 2025

Figure 06: Global TETRA Market Y-o-Y Growth (Value %) Forecast, 2016 - 2025

Figure 07: Global TETRA Market Revenue Share Analysis, By Application, 2016 and 2025

Figure 08: Global TETRA Market Revenue (US$ Mn) Growth Analysis By Application, 2017-2025

Figure 09: Global TETRA Market Attractiveness Analysis By Application

Figure 10: Global TETRA Market Value Share Analysis, By Components, 2016 and 2025

Figure 11: Global TETRA Market Revenue (US$ Mn) Growth Analysis By Components, 2017-2025

Figure 12: Global TETRA Market Attractiveness Analysis By Components

Figure 13: Global TETRA Market Value Share Analysis, By Device Type, 2016 and 2025

Figure 14: Global TETRA Market Revenue (US$ Mn) Growth Analysis By Device Type, 2017-2025

Figure 15: Global TETRA Market Attractiveness Analysis By Device Type

Figure 16: Global TETRA Market Revenue (US$ Mn) Growth Analysis By Region, 2017-2025

Figure 17: Global TETRA Market Attractiveness Analysis By Region

Figure 18: North America TETRA Market Size (US$ Mn) Forecast, 2015–2025

Figure 19: North America TETRA Market Size Y-o-Y Growth Projections, 2016–2025

Figure 20: North America TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 21: North America TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 22: North America TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 23: North America TETRA Market Revenue Share Analysis, By Country/Region, 2017 and 2025

Figure 24: North America TETRA Market Revenue (US$ Mn) Growth Analysis By Application, 2017-2025

Figure 25: North America TETRA Market Revenue share (%) Analysis By Components, 2017-2025

Figure 26: North America TETRA Market Revenue (US$ Mn) Growth Analysis By Device Type, 2017-2025

Figure 27: North America TETRA Market Revenue share (%) Analysis By Country, 2017-2025

Figure 28: The U.S. TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 29: The U.S. TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 30: The U.S. TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 31: Canada TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 32: Canada TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 33: Canada TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 34: North America TETRA Market Attractiveness Analysis By Application

Figure 35: North America TETRA Market Attractiveness Analysis By Components

Figure 36: North America TETRA Market Attractiveness Analysis By Device Type

Figure 37: North America TETRA Market Attractiveness Analysis By Country

Figure 38: Europe TETRA Market Size (US$ Mn) Forecast, 2015–2025

Figure 39: Europe TETRA Market Size Y-o-Y Growth Projections, 2016–2025

Figure 40: Europe TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 41: Europe TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 42: Europe TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 43: Europe TETRA Market Revenue Share Analysis, By Country/Region, 2017 and 2025

Figure 44: Europe TETRA Market Revenue (US$ Mn) Growth Analysis, By Application, 2017-2025

Figure 45: Europe TETRA Market Revenue (US$ Mn) Growth Analysis, By Components, 2017-2025

Figure 46: Europe TETRA Market Revenue (US$ Mn) Growth Analysis, By Device Type, 2017-2025

Figure 47: Europe TETRA Market Revenue (US$ Mn) Growth Analysis, By Country, 2017-2025

Figure 48: The U.K. TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 49: The U.K. TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 50: The U.K. TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 51: Germany TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 52: Germany TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 53: Germany TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 54: France TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 55: France TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 56: France TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 57: Europe TETRA Market Attractiveness Analysis, By Application

Figure 58: Europe TETRA Market Attractiveness Analysis, By Components

Figure 59: Europe TETRA Market Attractiveness Analysis By Device Type

Figure 60: Europe TETRA Market Attractiveness Analysis By Country

Figure 61: Asia Pacific TETRA Market Size (US$ Mn) Forecast, 2015–2025

Figure 62: Asia Pacific TETRA Market Size Y-o-Y Growth Projections, 2016–2025

Figure 63: Asia Pacific TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 64: Asia Pacific TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 65: Asia Pacific TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 66: Asia Pacific TETRA Market Revenue Share Analysis, By Country/Region, 2017 and 2025

Figure 67: Asia Pacific TETRA Market Revenue (US$ Mn) Growth Analysis, By Application, 2017-2025

Figure 68: Asia Pacific TETRA Market Revenue share (%) Analysis, By Components, 2017-2025

Figure 69: Asia Pacific TETRA Market Revenue (US$ Mn) Growth Analysis, By Device Type, 2017-2025

Figure 70: Asia Pacific TETRA Market Revenue share (%) Analysis, By Region, 2017-2025

Figure 71: India TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 72: India TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 73: India TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 74: Japan TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 75: Japan TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 76: Japan TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 77: China TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 78: China TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 79: China TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 80: Asia Pacific TETRA Market Attractiveness Analysis, By Application

Figure 81: Asia Pacific TETRA Market Attractiveness Analysis, By Components

Figure 82: Asia Pacific TETRA Market Attractiveness Analysis, By Device Type

Figure 83: Asia Pacific TETRA Market Attractiveness Analysis, By Country

Figure 84: Middle East & Africa TETRA Market Size (US$ Mn) Forecast, 2015–2025

Figure 85: Middle East & Africa TETRA Market Size Y-o-Y Growth Projections, 2016–2025

Figure 86: Middle East & Africa TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 87: Middle East & Africa TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 88: Middle East & Africa TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 89: Middle East & Africa TETRA Market Revenue Share Analysis, By Country/Region, 2017 and 2025

Figure 90: Middle East & Africa TETRA Market Revenue (US$ Mn) Growth Analysis, By Application, 2017-2025

Figure 91: Middle East & Africa TETRA Market Revenue (US$ Mn) Growth Analysis, By Components, 2017-2025

Figure 92: Middle East & Africa TETRA Market Revenue (US$ Mn) Growth Analysis, By Device Type, 2017-2025

Figure 93: Middle East & Africa TETRA Market Revenue (US$ Mn) Growth Analysis, By Region, 2017-2025

Figure 94: GCC Countries TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 95: GCC Countries TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 96: GCC Countries TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 97: South Africa TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 98: South Africa TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 99: South Africa TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 100: Middle East & Africa TETRA Market Attractiveness Analysis, By Application

Figure 101: Middle East & Africa TETRA Market Attractiveness Analysis, By Components

Figure 102: Middle East & Africa TETRA Market Attractiveness Analysis, By Device Type

Figure 103: Middle East & Africa TETRA Market Attractiveness Analysis, By Region

Figure 104: South America TETRA Market Size (US$ Mn) Forecast, 2015–2025

Figure 105: South America TETRA Market Size Y-o-Y Growth Projections, 2016–2025

Figure 106: South America TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 107: South America TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 108: South America TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 109: South America TETRA Market Revenue Share Analysis, By Country/Region, 2017 and 2025

Figure 110: South America TETRA Market Revenue (US$ Mn) Growth Analysis, By Application, 2017-2025

Figure 111: South America TETRA Market Revenue (US$ Mn) Growth Analysis, By Components, 2017-2025

Figure 112: South America TETRA Market Revenue (US$ Mn) Growth Analysis, By Device Type, 2017-2025

Figure 113: South America TETRA Market Revenue (US$ Mn) Growth Analysis, By Region, 2017-2025

Figure 114: Brazil TETRA Market Revenue Share Analysis, By Application, 2017 and 2025

Figure 115: Brazil TETRA Market Revenue Share Analysis, By Components, 2017 and 2025

Figure 116: Brazil TETRA Market Revenue Share Analysis, By Device Type, 2017 and 2025

Figure 117: South America TETRA Market Attractiveness Analysis, By Application

Figure 118: South America TETRA Market Attractiveness Analysis, By Components

Figure 119: South America TETRA Market Attractiveness Analysis, By Device Type

Figure 120: South America TETRA Market Attractiveness Analysis, By Region

Figure 121: Global TETRA Market Revenue Share Analysis, By Company (2016)