Global Technology Spending on Revenue Cycle Management: Snapshot

The global technology spending on revenue cycle management is primarily being driven by the wide array of advantages that their implementation can offer, such as increase in revenue generation, better efficiency in healthcare practices, easier compliance with industry norms and regulations, and greater accuracy and easier access to healthcare IT systems. However, its market is currently being restricted by a host of issues, including the inability to handle uninsured patients, the losses and increased pressure incurred due to changes in regulations, the low mobility of a system in response to shifting market dynamics, and the overall concerns regarding the integrity and security of data.

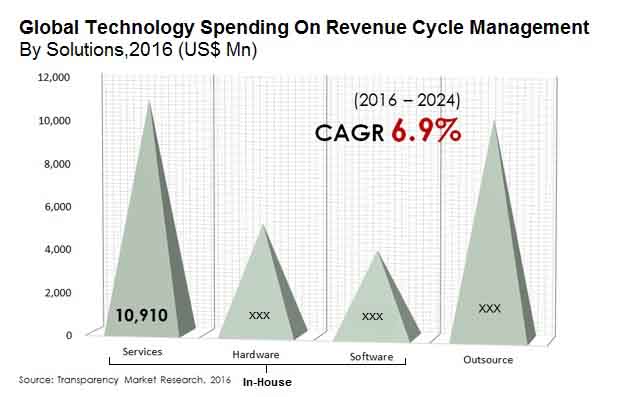

The current trends in the global market for technology spending on revenue cycle management include a growing use of credit card programs that can aid and cover a greater percentage of a national population and allow healthcare organizations to access their medical data faster. The global market for technology spending on revenue cycle management is expected to reach an evaluation of US$51.56 bn by the end of 2024. It was calculated at US$28.50 bn at the end of 2015 and is expected to expand at a healthy CAGR of 6.9% within a forecast period from 2016 to 2024.

Companies Going for Cloud-based Revenue Cycle Management

Revenue cycle management can be dissected into integrated and stand-alone, on the basis of platforms. An integrated platform for revenue cycle management is a combined system for a healthcare organization’s financial performance management, a patient’s electronic health records (EHR), and business intelligence tools, all collected under a single revenue cycle solution. A stand-alone platform in revenue cycle management, on the other hand, can work independently of other solutions or software. It works individually without requiring patient health records or medical records integration. Based on deployment, revenue cycle management is segmented into cloud-based and on-premise. Cloud-based deployment is trending and has greater growth opportunities in the forecast years due to its accessibility and lower costs.

APAC Grows Stronger in Demand for Revenue Cycle Management

North America played the leading role among all key regions in technology spending on revenue cycle management in 2015. However, over the coming years, technology spending on revenue cycle management in Asia Pacific will exhibit the leading CAGR of 8.5%, between 2016 and 2024. Asia Pacific is therefore expected to hold an important position in the sustainable growth of the global technology spending on revenue cycle management industry over the above forecast period.

The Asia Pacific region is still relatively behind in terms of adoption and development of new technologies. Although the expenditures on technology in modern revenue cycle management is currently low in the region, the market is expected to grow substantially, owing to factors such as the positive modulations in global regulatory reforms, the evolving economic scenario and its consequent increase in purchasing power of consumers and enterprises, growing awareness of the advantages of modern revenue cycle management processes and the presence of a large and growing number of patients suffering from various chronic disorders. Japan currently represents a highly lucrative market in terms of spending, compared to the rest of the APAC nations.

Cerner Corporation, McKesson Corporation, DST Systems, Inc., Allscripts, 3M, and Perot Systems have been some of the key players that have led the global market in technology spending on revenue cycle management. A large number of the more prominent entities from this market are known to be located within the U.S.

Simpler Access of Healthcare IT System to Propel Technology Spending on Revenue Cycle Management Market Forward

The global technology spending on revenue cycle management market is predicted to be influenced by the numerous benefits offered by their implementation. It is capable of providing benefits like increased revenue generation, improved effectiveness in healthcare practices, greater accuracy, simpler access to healthcare IT systems, and easier adherence to industry regulations and standards. Nevertheless, global technology spending on revenue cycle management market is currently constrained by a number of issues. Such limitations comprise the incapability to manage uninsured pool of patients, increased pressure and the losses incurred as a result of regulatory changes, the reduced mobility of a structure in answer to changing market dynamics. All these elements cause overall concerns about the security and integrity of data.

Recent trends in the global technology spending on revenue cycle management market comprise a rising use of credit card programmes that can help and cover a larger proportion of a country's population. It can enable health organizations to access their medical information more quickly.

Demand for Centralized System for Managing all Patient Data to Boost Market

The requirement for a centralized method of managing all administrative and clinical functions across episodes of patient care has resulted in a global push for the technology spending on revenue cycle management market. This enables healthcare organizations to make better use of revenue generated by patient services, resulting in increased technology spend on revenue cycle management. Such improvements are found in the convergence of data from systems of medical billing, electronic health records (EHRs), and other diverse health information technology systems. This convergence is likely to fuel growth of the market. Furthermore, the growing need for convenient regulatory compliance is further likely to work in favor of the market in near future.

The industry is being supported by the implementation of technologies by healthcare companies to monitor sales targets. In addition, these solutions are likely to play an important part in the results of patient recovery. One way to do this, particularly in developing countries, is to increase payments of patients or to encourage providers to review claims of insurance in order to streamline reimbursement.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Technology Spending on Revenue Cycle Management

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Key Market Indicators

4.4. Key Industry Developments

4.5. Market Opportunity Map

4.6. Market Dynamics

4.6.1. Drivers

4.6.2. Restraints

4.6.3. Opportunity

4.7. Global Technology Spending on Revenue Cycle Management Analysis and Forecasts, 2016–2024

4.7.1. Market Revenue Projections (US$ Mn)

4.8. Porter’s Five Force Analysis

4.9. Revenue Cycle Management Process Workflow

4.10. Market Outlook

5. Global Technology Spending on Revenue Cycle Management Analysis and Forecasts, By Platform

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Technology value Forecast By Platform, 2016–2024

5.3.1. Integrated

5.3.2. Stand-alone

5.4. Market Attractiveness By Platform

6. Global Technology Spending on Revenue Cycle Management Analysis and Forecasts, By End User

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Technology value Forecast By End User, 2016–2024

6.3.1. Provider

6.3.1.1. Hospitals

6.3.1.2. Ambulatory Surgical Centers and Clinics

6.3.1.3. Others

6.3.2. Payer

6.3.2.1. Insurance Companies

6.3.2.2. Government

6.3.2.3. Others

6.4. Market Attractiveness By End User

7. Global Technology Spending on Revenue Cycle Management Analysis and Forecasts, By Solution

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Technology value Forecast By Solution, 2016–2024

7.3.1. In-house

7.3.1.1. Hardware

7.3.1.2. Software

7.3.1.3. Services

7.3.2. Out-source

7.4. Market Attractiveness By Solution

8. Global Technology Spending on Revenue Cycle Management Analysis and Forecasts, By Deployment

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Technology value Forecast By Deployment, 2016–2024

8.3.1. Cloud-based

8.3.2. On-premise

8.4. Market Attractiveness By Deployment

9. Global Technology Spending on Revenue Cycle Management Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Technology value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East and Africa

9.3. Market Attractiveness By Country/Region

10. North America Technology Spending on Revenue Cycle Management Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Technology value Forecast By Platform, 2016–2024

10.2.1. Integrated

10.2.2. Stand-alone

10.3. Technology value Forecast By End User, 2016–2024

10.3.1. Provider

10.3.1.1. Hospitals

10.3.1.2. Ambulatory Surgical Centers and Clinics

10.3.1.3. Others

10.3.2. Payers

10.3.2.1. Insurance Companies

10.3.2.2. Government

10.3.2.3. Others

10.4. Technology value Forecast By Solution, 2016–2024

10.4.1. In-house

10.4.1.1. Hardware

10.4.1.2. Software

10.4.1.3. Services

10.4.2. Out-source

10.5. Technology value Forecast By Deployment, 2016–2024

10.5.1. Cloud-based

10.5.2. On-premise

10.6. Technology value Forecast By Country, 2016–2024

10.6.1. US

10.6.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. By Platform

10.7.2. By End User

10.7.3. By Solution

10.7.4. By Deployment

10.7.5. By Country

11. Europe Technology Spending on Revenue Cycle Management Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Technology value Forecast By Platform, 2016–2024

11.2.1. Integrated

11.2.2. Stand-alone

11.3. Technology value Forecast By End User, 2016–2024

11.3.1. Provider

11.3.1.1. Hospitals

11.3.1.2. Ambulatory Surgical Centers and Clinics

11.3.1.3. Others

11.3.2. Payers

11.3.2.1. Insurance Companies

11.3.2.2. Government

11.3.2.3. Others

11.4. Technology value Forecast By Solution, 2016–2024

11.4.1. In-house

11.4.1.1. Hardware

11.4.1.2. Software

11.4.1.3. Services

11.4.2. Out-source

11.5. Technology value Forecast By Deployment, 2016–2024

11.5.1. Cloud-based

11.5.2. On-premise

11.6. Technology value Forecast By Country, 2016–2024

11.6.1. Germany

11.6.2. UK

11.6.3. France

11.6.4. Spain

11.6.5. Italy

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Platform

11.7.2. By End User

11.7.3. By Solution

11.7.4. By Deployment

11.7.5. By Country

12. Asia Pacific Technology Spending on Revenue Cycle Management Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.1.2. Policies and Regulations

12.1.3. Price Trend Analysis

12.1.4. Key Trends

12.2. Technology value Forecast By Platform, 2016–2024

12.2.1. Integrated

12.2.2. Stand-alone

12.3. Technology value Forecast By End User, 2016–2024

12.3.1. Provider

12.3.1.1. Hospitals

12.3.1.2. Ambulatory Surgical Centers and Clinics

12.3.1.3. Others

12.3.2. Payers

12.3.2.1. Insurance Companies

12.3.2.2. Government

12.3.2.3. Others

12.4. Technology value Forecast By Solution, 2016–2024

12.4.1. In-house

12.4.1.1. Hardware

12.4.1.2. Software

12.4.1.3. Services

12.4.2. Out-source

12.5. Technology value Forecast By Deployment, 2016–2024

12.5.1. Cloud-based

12.5.2. On-premise

12.6. Technology value Forecast By Country, 2016–2024

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Australia

12.6.5. New Zealand

12.6.6. Rest of APAC

12.7. Market Attractiveness Analysis

12.7.1. By Platform

12.7.2. By End User

12.7.3. By Solution

12.7.4. By Deployment

12.7.5. By Country

13. Latin America Technology Spending on Revenue Cycle Management Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Technology value Forecast By Platform, 2016–2024

13.2.1. Integrated

13.2.2. Stand-alone

13.3. Technology value Forecast By End User, 2016–2024

13.3.1. Provider

13.3.1.1. Hospitals

13.3.1.2. Ambulatory Surgical Centers and Clinics

13.3.1.3. Others

13.3.2. Payers

13.3.2.1. Insurance Companies

13.3.2.2. Government

13.3.2.3. Others

13.4.Technology value Forecast By Solution, 2016–2024

13.4.1. In-house

13.4.1.1. Hardware

13.4.1.2. Software

13.4.1.3. Services

13.4.2. Out-source

13.5. Technology value Forecast By Deployment, 2016–2024

13.5.1. Cloud-based

13.5.2. On-premise

13.6. Technology value Forecast By Country, 2016–2024

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Platform

13.7.2. By End User

13.7.3. By Solution

13.7.4. By Deployment

13.7.5. By Country

14. Middle East & Africa Technology Spending on Revenue Cycle Management Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Technology value Forecast By Platform, 2016–2024

14.2.1. Integrated

14.2.2. Stand-alone

14.3. Technology value Forecast By End User, 2016–2024

14.3.1. Provider

14.3.1.1. Hospitals

14.3.1.2. Ambulatory Surgical Centers and Clinics

14.3.1.3. Others

14.3.2. Payers

14.3.2.1. Insurance Companies

14.3.2.2. Government

14.3.2.3. Others

14.4. Technology value Forecast By Solution, 2016–2024

14.4.1. In-house

14.4.1.1. Hardware

14.4.1.2. Software

14.4.1.3. Services

14.4.2. Out-source

14.5. Technology value Forecast By Deployment, 2016–2024

14.5.1. Cloud-based

14.5.2. On-premise

14.6. Technology value Forecast By Country, 2016–2024

14.6.1. Saudi Arabia

14.6.2. UAE

14.6.3. South Africa (RSA)

14.6.4. Rest of MEA

14.7. Market Attractiveness Analysis

14.7.1. By Platform

14.7.2. By End User

14.7.3. By Solution

14.7.4. By Deployment

14.7.5. By Country

15. Competition Landscape

15.1. Major Licenses and Contracts

15.2. Market Player – Competition Matrix (By Tier and Size of companies)

15.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

15.3.1. McKesson Corporation

15.3.1.1. Company Overview

15.3.1.2. Financials

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Cerner Corporation

15.3.2.1. Company Overview

15.3.2.2. Financials

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. 3M Solution

15.3.3.1. Company Overview

15.3.3.2. Financials

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Allscripts

15.3.4.1. Company Overview

15.3.4.2. Financials

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Next Gen

15.3.5.1. Company Overview

15.3.5.2. Financials

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. MedAssets

15.3.6.1. Company Overview

15.3.6.2. Financials

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Optum Corporation

15.3.7.1. Company Overview

15.3.7.2. Financials

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. GE Healthcare

15.3.8.1. Company Overview

15.3.8.2. Financials

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Perot Systems (a NTT DATA company)

15.3.9.1. Company Overview

15.3.9.2. Financials

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. CPSI

15.3.10.1. Company Overview

15.3.10.2. Financials

15.3.10.3. SWOT Analysis

List of Tables

Table 01 Global Revenue Cycle Management Market Size (US$ Mn) Forecast, By Platform, 2016–2024

Table 02 Global Technology Spending on Revenue Cycle Management (US$ Mn) Forecast, By Solution, 2016–2024

Table 03 Global Technology Spending on Revenue Cycle Management (US$ Mn) Forecast, By Solution (In-House), 2016–2024

Table 04 Global Technology Spending on Revenue Cycle Management (US$ Mn) Forecast, By Deployment, 2016–2024

Table 05 Global Technology Spending on Revenue Cycle Management (US$ Mn) Forecast, By End User, 2016–2024

Table 06 Global Technology Spending on Revenue Cycle Management (US$ Mn) Forecast, By End User (Provider), 2016–2024

Table 07 Global Technology Spending on Revenue Cycle Management (US$ Mn) Forecast, By End User (Payer), 2016–2024

Table 08 Global Technology Spending on Revenue Cycle Management (US$ Mn) Forecast, By Region, 2016-2024

Table 09 North America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by Platform, 2016-2024

Table 10 North America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by Solution, 2016-2024

Table 11 North America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by Solution (In-House), 2016-2024

Table 12 North America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Deployment, 2016-2024

Table 13 North America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User, 2016–2024

Table 14 North America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User (Provider), 2016–2024

Table 15 North America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User (Payer), 2016–2024

Table 16 North America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by Country, 2016-2024

Table 17 Europe Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Platform, 2016-2024

Table 18 Europe Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Solution, 2016-2024

Table 19 Europe Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by Solution (In-House), 2016-2024

Table 20 Europe Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Deployment, 2016-2024

Table 21 Europe Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User, 2016–2024

Table 22 Europe Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User (Provider), 2016–2024

Table 23 Europe Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User (Payer), 2016–2024

Table 24 Europe Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by Country, 2016-2024

Table 25 Asia Pacific Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Platform, 2016-2024

Table 26 Asia Pacific Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Solution, 2016-2024

Table 27 Asia Pacific Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by Solution (In-House), 2016-2024

Table 28 Asia Pacific Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Deployment, 2016-2024

Table 29 Asia Pacific Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User, 2016–2024

Table 30 Asia Pacific Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User (Provider), 2016–2024

Table 31 Asia Pacific Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User (Payer), 2016–2024

Table 32 Asia Pacific Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by Country, 2016-2024

Table 33 Latin America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Platform, 2016-2024

Table 34 Latin America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Solution, 2016-2024

Table 35 Latin America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by Solution (In-House), 2016-2024

Table 36 Latin America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Deployment, 2016-2024

Table 37 Latin America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User, 2016–2024

Table 38 Latin America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User (Provider), 2016–2024

Table 39 Latin America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User (Payer), 2016–2024

Table 40 Latin America Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by Country, 2016-2024

Table 41 Middle East & Africa Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Platform, 2016-2024

Table 42 Middle East & Africa Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Solution, 2016-2024

Table 43 Middle East & Africa Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by Solution (In-House), 2016-2024

Table 44 Middle East & Africa Technology Spending on Revenue Cycle Management (US$ Mn) Forecast By Deployment, 2016-2024

Table 45 Middle East & Africa Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User, 2016–2024

Table 46 Middle East & Africa Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User (Provider), 2016–2024

Table 47 Middle East & Africa Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by End User (Payer), 2016–2024

Table 48 Middle East & Africa Technology Spending on Revenue Cycle Management (US$ Mn) Forecast by Country, 2016-2024

List of Figures

Figure 01 Global Technology Spending on Revenue Cycle Management (US$ Mn) Forecast, 2016–2024

Figure 02 Global Technology Spending on Revenue Cycle Management Value Share Analysis: By Platform, 2016 and 2024

Figure 03 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By Integrated Platform, 2016–2024

Figure 04 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By Stand-alone Platform, 2016–2024

Figure 05 Global Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Platform

Figure 06 Global Technology Spending on Revenue Cycle Management Share Analysis: By Solution, 2016 and 2024

Figure 07 Global Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth (%): By In-House Solution, 2016–2024

Figure 08 Global Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth (%): By Out-Source Solution, 2016–2024

Figure 09 Global Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Solution

Figure 10 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By Hardware, 2016–2024

Figure 11 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By Software, 2016–2024

Figure 12 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By Services, 2016–2024

Figure 13 Global Technology Spending on Revenue Cycle Management Attractiveness Analysis: By In-House Solution

Figure 14 Global Technology Spending on Revenue Cycle Management Value Share Analysis: By Deployment, 2016 and 2024

Figure 15 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By Cloud-based Deployment, 2016–2024

Figure 16 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By On-Premise Deployment, 2016–2024

Figure 17 Global Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Deployment

Figure 18 Global Technology Spending on Revenue Cycle Management Value Share Analysis: By End User, 2016 and 2024

Figure 19 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By Provider, 2016–2024

Figure 20 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By Payer, 2016–2024

Figure 21 Global Technology Spending on Revenue Cycle Management Attractiveness Analysis: By End User

Figure 22 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By Hospitals, 2016–2024

Figure 23 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By ASC’s and Clinics, 2016–2024

Figure 24 Global Technology Spending on Revenue Cycle Management Market Value (US$ Mn) and Y-o-Y Growth (%): By Other Providers, 2016–2024

Figure 25 Global Technology Spending on Revenue Cycle Management Attractiveness Analysis: By End User (Provider)

Figure 26 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By Insurance Companies, 2016–2024

Figure 27 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By Government, 2016–2024

Figure 28 Global Technology Spending on Revenue Cycle Management Value (US$ Mn) and Y-o-Y Growth (%): By Other Payers, 2016–2024

Figure 29 Global Technology Spending on Revenue Cycle Management Attractiveness Analysis: By End User (Payer)

Figure 30 Global Technology Spending on Revenue Cycle Management Value Share Analysis: By Region, 2016 and 2024

Figure 31 Global Technology Spending on Revenue Cycle Management Technology Attractiveness Analysis: By Region

Figure 32 North America Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 33 North America Technology Spending on Revenue Cycle Management Attractiveness: By Country

Figure 34 North America Technology Spending on Revenue Cycle Management Value Share Analysis: By Platform, 2016 and 2024

Figure 35 North America Technology Spending on Revenue Cycle Management Value Share Analysis: By Solution, 2016 and 2024

Figure 36 North America Technology Spending on Revenue Cycle Management Value Share Analysis: By Deployment, 2016 & 2024

Figure 37 North America Technology Spending on Revenue Cycle Management Value Share Analysis: By End User, 2016 and 2024

Figure 38 North America Technology Spending on Revenue Cycle Management Value Share Analysis: By Country, 2016 and 2024

Figure 39 U.S. Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 40 U.S. Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 41 Canada Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 42 Canada Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 43 North America Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Platform, 2016-2024

Figure 44 North America Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Solution, 2016–2024

Figure 45 North America Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Deployment, 2016–2024

Figure 46 North America Technology Spending on Revenue Cycle Management Attractiveness Analysis: By End-User, 2016–2024

Figure 47 Europe Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 48 Europe Technology Spending on Revenue Cycle Management Attractiveness: By Country

Figure 49 Europe Technology Spending on Revenue Cycle Management Value Share Analysis: By Platform, 2016 and 2024

Figure 50 Europe Technology Spending on Revenue Cycle Management Value Share Analysis: By Solution, 2016 and 2024

Figure 51 Europe Technology Spending on Revenue Cycle Management Value Share Analysis: By Deployment, 2016 & 2024

Figure 52 Europe Technology Spending on Revenue Cycle Management Value Share Analysis: By End User, 2016 and 2024

Figure 53 Europe Technology Spending on Revenue Cycle Management Value Share Analysis: By Country, 2016 and 2024

Figure 54 Germany Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 55 Germany Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 56 U.K. Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 57 U.K. Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 58 France Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 59 France Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 60 Italy Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 61 Italy Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 62 Spain Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 63 Spain Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 64 Rest of Europe Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 65 Rest of Europe Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 66 Europe Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Platform, 2016-2024

Figure 67 Europe Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Solution, 2016–2024

Figure 68 Europe Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Deployment, 2016–2024

Figure 69 Europe Technology Spending on Revenue Cycle Management Attractiveness Analysis: By End User, 2016–2024

Figure 70 Asia Pacific Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 71 Asia Pacific Technology Spending on Revenue Cycle Management Attractiveness: By Country

Figure 72 Asia Pacific Technology Spending on Revenue Cycle Management Value Share Analysis: By Platform, 2016 and 2024

Figure 73 Asia Pacific Technology Spending on Revenue Cycle Management Value Share Analysis: By Solution, 2016 and 2024

Figure 74 Asia Pacific Technology Spending on Revenue Cycle Management Value Share Analysis: By Deployment, 2016 & 2024

Figure 75 Asia Pacific Technology Spending on Revenue Cycle Management Value Share Analysis: By End User, 2016 and 2024

Figure 76 Asia Pacific Technology Spending on Revenue Cycle Management Value Share Analysis: By Country, 2016 and 2024

Figure 77 China Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 78 China Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 79 Japan Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 80 Japan Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 81 India Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 82 India Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 83 Australia Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 84 Australia Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 85 New Zealand Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 86 New Zealand Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 87 Rest of Asia Pacific Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 88 Rest of Asia Pacific Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 89 Asia Pacific Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Platform, 2016-2024

Figure 90 Asia Pacific Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Solution, 2016–2024

Figure 91 Asia Pacific Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Deployment, 2016–2024

Figure 92 Asia Pacific Technology Spending on Revenue Cycle Management Attractiveness Analysis: By End-User, 2016–2024

Figure 93 Latin America Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 94 Latin America Technology Spending on Revenue Cycle Management Attractiveness: By Country

Figure 95 Latin America Technology Spending on Revenue Cycle Management Value Share Analysis: By Platform, 2016 and 2024

Figure 96 Latin America Technology Spending on Revenue Cycle Management Value Share Analysis: By Solution, 2016 and 2024

Figure 97 Latin America Technology Spending on Revenue Cycle Management Value Share Analysis: By Deployment, 2016 & 2024

Figure 98 Latin America Technology Spending on Revenue Cycle Management Value Share Analysis: By End User, 2016 and 2024

Figure 99 Latin America Technology Spending on Revenue Cycle Management Value Share Analysis: By Country, 2016 and 2024

Figure 100 Brazil Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 101 Brazil Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 102 Mexico Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 103 Mexico Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 104 Rest of Latin America Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 105 Rest of Latin America Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 106 Latin America Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Platform, 2016-2024

Figure 107 Latin America Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Solution, 2016–2024

Figure 108 Latin America Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Deployment, 2016-2024

Figure 109 Latin America Technology Spending on Revenue Cycle Management Attractiveness Analysis: By End User, 2016–2024

Figure 110 Middle East & Africa Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 111 Middle East and Africa Technology Spending on Revenue Cycle Management Attractiveness: By Country

Figure 112 Middle East & Africa Technology Spending on Revenue Cycle Management Value Share Analysis: By Platform, 2016 and 2024

Figure 113 Middle East & Africa Technology Spending on Revenue Cycle Management Value Share Analysis: By Solution, 2016 and 2024

Figure 114 Middle East & Africa Technology Spending on Revenue Cycle Management Value Share Analysis: By Deployment, 2016 & 2024

Figure 115 Middle East & Africa Technology Spending on Revenue Cycle Management Value Share Analysis: By End User, 2016 and 2024

Figure 116 Middle East & Africa Technology Spending on Revenue Cycle Management Value Share Analysis: By Country, 2016 and 2024

Figure 117 Saudi Arabia Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 118 Saudi Arabia Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 119 UAE Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 120 UAE Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 121 South Africa Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 122 South Africa Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 123 Rest of Middle East & Africa Technology Spending on Revenue Cycle Management (US$ Mn) and Y-o-Y Growth Forecast, 2016-2024

Figure 124 Rest of Middle East & Africa Technology Spending on Revenue Cycle Management Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 125 Middle East & Africa Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Platform, 2016-2024

Figure 126 Middle East & Africa Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Solution, 2016–2024

Figure 127 Middle East & Africa Technology Spending on Revenue Cycle Management Attractiveness Analysis: By Deployment, 2016-2024

Figure 128 Middle East & Africa Technology Spending on Revenue Cycle Management Attractiveness Analysis: By End User, 2016–2024