Analysts’ Viewpoint

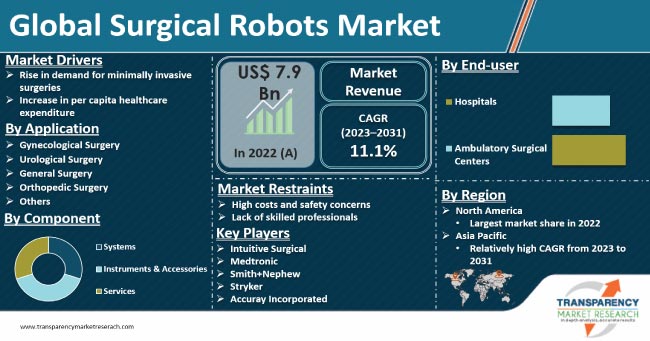

Rise in demand for minimally invasive surgeries and increase in per capita healthcare expenditure are significant factors fueling surgical robots market development. Improvement in healthcare infrastructure and increase in demand for technology-driven solutions are also contributing to market expansion. Rise in awareness about pain-free and highly efficient robot-assisted surgeries is creating lucrative opportunities for players operating in the global market.

Surgical robot companies are increasingly entering into in-licensing and collaboration agreements to launch new products in developed as well as developing economies. Manufacturers in the global market are developing innovative surgical robots based on the latest technological advancements to increase their market share.

Surgical robots are sophisticated machines that are designed to assist surgeons in surgical procedures. They are computer-controlled devices that can perform a variety of surgical tasks with high precision and accuracy.

These robots are typically made up of several components, including a control console, robotic arms, and an endoscopic camera. Surgical robots are used in a wide range of surgical procedures, including urological, gynecological, cardiothoracic, and general surgeries. They are particularly useful in prostatectomy and hysterectomy procedures.

Adoption of surgical robots has increased in the healthcare sector in the recent years due to the various benefits offered by these robots such as smaller incisions, reduced blood loss, low risk of infection, and faster recovery times. Additionally, surgical robots help improve surgical outcomes, thus leading to lower risk of complications and better patient outcomes.

Medical robotic systems have been widely used for minimally invasive surgeries in the field of gynecology and cosmetology. Demand for these computer-assisted surgical systems is high for open surgeries, laparoscopic procedures, and flexible endoscopic procedures.

Minimally invasive robotic techniques lead to fewer complications, less pain, and decrease in risk of infections. These surgeries entail faster recovery time, which leads to a shorter hospital stay vis-à-vis traditional therapies and treatments. These factors are driving the acceptance and adoption of medical robotic systems in several medical facilities and healthcare centers.

Surgeons have been adopting minimally invasive surgical (MIS) techniques in a wide range of applications including appendectomy, hysterectomy, gastric bypass, prostatectomy, colectomy, and myomectomy. The number of laparoscopic hysterectomy procedures is likely to increase during the forecast period, owing to the emergence of surgical robotic systems.

Rise in disposable income of the people, especially in emerging economies, is likely to enable them to avail better healthcare facilities. Furthermore, increase in disabled population and rise in availability of efficient medical robots are projected to fuel surgical robots market dynamics in the next few years.

According to the Office for National Statistics, healthcare expenditure in the U.K. accounted for 11.9% of the gross domestic product (GDP) in 2017. Healthcare service providers are investing significantly in advanced medical automation technologies to improve operational efficiency.

Demand for rehabilitation and assistive robots is increasing rapidly due to the rise in number of hospitals and increase in government support for improving the healthcare sector, especially in emerging economies.

As per the latest surgical robots market forecast, the urological surgery application segment held significant share in 2022. The segment is estimated to dominate the global market in the near future.

Robotic surgery allows for greater precision and accuracy in delicate procedures such as urological surgeries. Furthermore, robotic arms have a greater range of motion and can perform very fine movements as compared to human hands.

Robotic-assisted laparoscopic prostatectomy is now considered the standard of care for the surgical treatment of prostate cancer. Approximately 94.0% of prostatectomies were performed using robotic technology in the U.S. in 2019.

According to the latest surgical robots market research analysis, the hospitals end-user segment is projected to account for dominant share from 2023 to 2031.

Rise in government support for the development of hospitals in countries such as China, India, and Brazil is driving the market for surgical robots. Funds received from several government bodies can be utilized to install and maintain robotic-assisted surgery systems in hospitals.

The ambulatory surgical centers end-user segment is anticipated to expand at a high CAGR during the forecast period. This can be ascribed to the presence of high-quality and cost-effective settings for performing urological as well as gynecological procedures in ambulatory surgical centers.

North America held the largest share of the global market in 2022. Lucrative presence of manufacturers and a highly structured healthcare industry are fueling surgical robots market development in the region.

The U.S. is likely to dominate the market in North America during the forecast period, owing to the increase in adoption of robotic surgery systems in hospitals in the country. Furthermore, technological advancements and rise in research & development activities in robot-assisted surgeries are contributing to market growth in North America. Rise in demand for minimally invasive procedures and increase in application of remote-controlled surgery machines are also augmenting surgical robots industry growth in the region.

Asia Pacific was the fastest-growing market in 2022. The surgical robots market size in Asia Pacific is anticipated to increase steadily in the next few years, owing to the increase in investment in the healthcare sector and rise in surgical procedures in the region.

Presence of emerging economies, increase in government funding for research activities, improvement in healthcare infrastructure, and rise in number of major players in countries such as China and India are fueling surgical robots market demand in Asia Pacific.

The global landscape is fragmented, with the presence of a large number of manufacturers that control majority of the surgical robots market share. Key players are engaged in following the latest surgical robots market trends to increase their growth opportunities.

Accuray Incorporated, Asensus Surgical, Inc., Johnson & Johnson Services, Inc., Intuitive Surgical, KUKA AG, Medtronic, Renishaw plc, Smith+Nephew, Stryker, Zimmer Biomet, Avateramedical GmbH, and Hiwin Corporation are the leading surgical robots market players operating across the globe.

Key players have been profiled in the global surgical robots report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and latest developments.

|

Attribute |

Detail |

|---|---|

|

Market Size in 2022 |

US$ 7.9 Bn |

|

Market Forecast (Value) in 2031 |

More than US$ 20.8 Bn |

|

CAGR |

11.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 7.9 Bn in 2022

It is projected to reach more than US$ 20.8 Bn by 2031

The CAGR is anticipated to be 11.1% during the forecast period

High demand for minimally invasive surgeries, increase in per capita health care expenditure, and rise in focus on development of technologically advanced robotic systems

The instrument & accessories component segment accounted for more than 50.0% share in 2022

North America is anticipated to account for the largest demand share during the forecast period

Accuray Incorporated, Asensus Surgical, Inc., Johnson & Johnson Services, Inc., Intuitive Surgical, KUKA AG, Medtronic, Renishaw plc, Smith+Nephew, Stryker, Zimmer Biomet, Avateramedical GmbH, and Hiwin Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Surgical Robots Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Surgical Robots Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Pricing Analysis

5.3. COVID-19 Impact Analysis

6. Global Surgical Robots Market Analysis and Forecast, By Component

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value & Volume Forecast By Component, 2017 - 2031

6.3.1. Systems

6.3.2. Instruments & Accessories

6.3.3. Services

6.4. Market Attractiveness By Component

7. Global Surgical Robots Market Analysis and Forecast, By Surgery Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Surgery Type, 2017 - 2031

7.3.1. Gynecological Surgery

7.3.2. Urological Surgery

7.3.3. General Surgery

7.3.4. Orthopedic Surgery

7.3.5. Others (Neurosurgery, etc.)

7.4. Market Attractiveness By Surgery Type

8. Global Surgical Robots Market Analysis and Forecast, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2017 - 2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.4. Market Attractiveness By End-user

9. Global Surgical Robots Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America Surgical Robots Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value & Volume Forecast By Component, 2017 - 2031

10.2.1. Systems

10.2.2. Instruments & Accessories

10.2.3. Services

10.3. Market Value Forecast By Surgery Type, 2017 - 2031

10.3.1. Gynecological Surgery

10.3.2. Urological Surgery

10.3.3. General Surgery

10.3.4. Orthopedic Surgery

10.3.5. Others (Neurosurgery, etc.)

10.4. Market Value Forecast By End-user, 2017 - 2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.5. Market Value Forecast By Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Component

10.6.2. By Surgery Type

10.6.3. By End-user

10.6.4. By Country

11. Europe Surgical Robots Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value & Volume Forecast By Component, 2017 - 2031

11.2.1. Systems

11.2.2. Instruments & Accessories

11.2.3. Services

11.3. Market Value Forecast By Surgery Type, 2017 - 2031

11.3.1. Gynecological Surgery

11.3.2. Urological Surgery

11.3.3. General Surgery

11.3.4. Orthopedic Surgery

11.3.5. Others (Neurosurgery, etc.)

11.4. Market Value Forecast By End-user, 2017 - 2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.5. Market Value Forecast By Country/Sub-region, 2017 - 2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Component

11.6.2. By Surgery Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Surgical Robots Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value & Volume Forecast By Component, 2017 - 2031

12.2.1. Systems

12.2.2. Instruments & Accessories

12.2.3. Services

12.3. Market Value Forecast By Surgery Type, 2017 - 2031

12.3.1. Gynecological Surgery

12.3.2. Urological Surgery

12.3.3. General Surgery

12.3.4. Orthopedic Surgery

12.3.5. Others (Neurosurgery, etc.)

12.4. Market Value Forecast By End-user, 2017 - 2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.5. Market Value Forecast By Country/Sub-region, 2017 - 2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Component

12.6.2. By Surgery Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Surgical Robots Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value & Volume Forecast By Component, 2017 - 2031

13.2.1. Systems

13.2.2. Instruments & Accessories

13.2.3. Services

13.3. Market Value Forecast By Surgery Type, 2017 - 2031

13.3.1. Gynecological Surgery

13.3.2. Urological Surgery

13.3.3. General Surgery

13.3.4. Orthopedic Surgery

13.3.5. Others (Neurosurgery, etc.)

13.4. Market Value Forecast By End-user, 2017 - 2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.5. Market Value Forecast By Country/Sub-region, 2017 - 2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Component

13.6.2. By Surgery Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Surgical Robots Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value & Volume Forecast By Component, 2017 - 2031

14.2.1. Systems

14.2.2. Instruments & Accessories

14.2.3. Services

14.3. Market Value Forecast By Surgery Type, 2017 - 2031

14.3.1. Gynecological Surgery

14.3.2. Urological Surgery

14.3.3. General Surgery

14.3.4. Orthopedic Surgery

14.3.5. Others (Neurosurgery, etc.)

14.4. Market Value Forecast By End-user, 2017 - 2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.5. Market Value Forecast By Country/Sub-region, 2017 - 2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Component

14.6.2. By Surgery Type

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2021)

15.3. Company Profiles

15.3.1. Accuray Incorporated

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Asensus Surgical, Inc.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Johnson & Johnson Services, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Intuitive Surgical

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. KUKA AG

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Medtronic

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Renishaw plc

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Smith+Nephew

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Stryker

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Zimmer Biomet

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Avateramedical GmbH

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. Hiwin Corporation

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

List of Tables

Table 01: Global Surgical Robots Market Size (US$ Mn) Forecast, by Component, 2017-2031

Table 02: Global Surgical Robots Market Volume (Units) Forecast, by Component, 2017-2031

Table 03: Global Surgical Robots Market Size (US$ Mn) Forecast, By Surgery Type, 2017-2031

Table 04: Global Surgical Robots Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 05: Global Surgical Robots Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 06: Global Surgical Robots Market Volume (Units) Forecast, by Region, 2017-2031

Table 07: North America Surgical Robots Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 08: North America Surgical Robots Market Size (US$ Mn) Forecast, by Component, 2017-2031

Table 09: North America Surgical Robots Market Volume (Units) Forecast, by Component, 2017-2031

Table 10: North America Surgical Robots Market Size (US$ Mn) Forecast, By Surgery Type, 2017-2031

Table 11: North America Surgical Robots Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 12: Europe Surgical Robots Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 13: Europe Surgical Robots Market Size (US$ Mn) Forecast, by Component, 2017-2031

Table 14: Europe Surgical Robots Market Volume (Units) Forecast, by Component, 2017-2031

Table 15: Europe Surgical Robots Market Size (US$ Mn) Forecast, By Surgery Type, 2017-2031

Table 16: Europe Surgical Robots Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 17: Asia Pacific Surgical Robots Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 18: Asia Pacific Surgical Robots Market Size (US$ Mn) Forecast, by Component, 2017-2031

Table 19: Asia Pacific Surgical Robots Market Volume (Units) Forecast, by Component, 2017-2031

Table 20: Asia Pacific Surgical Robots Market Size (US$ Mn) Forecast, By Surgery Type, 2017-2031

Table 21: Asia Pacific Surgical Robots Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 22: Latin America Surgical Robots Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 23: Latin America Surgical Robots Market Size (US$ Mn) Forecast, by Component, 2017-2031

Table 24: Latin America Surgical Robots Market Volume (units) Forecast, by Component, 2017-2031

Table 25: Latin America Surgical Robots Market Size (US$ Mn) Forecast, By Surgery Type, 2017-2031

Table 26: Latin America Surgical Robots Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 27: Middle East & Africa Surgical Robots Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 28: Middle East & Africa Surgical Robots Market Size (US$ Mn) Forecast, by Component, 2017-2031

Table 29: Middle East & Africa Surgical Robots Market Volume (Units) Forecast, by Component, 2017-2031

Table 30: Middle East & Africa Surgical Robots Market Size (US$ Mn) Forecast, By Surgery Type, 2017-2031

Table 32: Middle East & Africa Surgical Robots Market Size (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Surgical Robots Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Surgical Robots Market Value Share, by Component, 2022

Figure 03: Global Surgical Robots Market Value Share, By Surgery Type, 2022

Figure 04: Global Surgical Robots Market Value Share, by End-user, 2022

Figure 05: Global Surgical Robots Market Value Share Analysis, by Component, 2022 and 2031

Figure 06: Global Surgical Robots Market Revenue (US$ Mn), by Systems, 2017-2031

Figure 07: Global Surgical Robots Market Revenue (US$ Mn), by Instruments & Accessories, 2017-2031

Figure 08: Global Surgical Robots Market Revenue (US$ Mn), by Services 2017-2031

Figure 09: Global Surgical Robots Market Attractiveness Analysis, by Component, 2023-2031

Figure 10: Global Surgical Robots Market Value Share Analysis, By Surgery Type, 2022 and 2031

Figure 11: Global Surgical Robots Market Revenue (US$ Mn), by Gynecological Surgery, 2017-2031

Figure 12: Global Surgical Robots Market Revenue (US$ Mn), by Urological Surgery, 2017-2031

Figure 13: Global Surgical Robots Market Revenue (US$ Mn), by General Surgery, 2017-2031

Figure 14: Global Surgical Robots Market Revenue (US$ Mn), by Orthopedic Surgery, 2017-2031

Figure 15: Global Surgical Robots Market Revenue (US$ Mn), by Others (Neurosurgery, etc.), 2017-2031

Figure 16: Global Surgical Robots Market Attractiveness Analysis, By Surgery Type, 2023-2031

Figure 17: Global Surgical Robots Market Value Share Analysis, by End-user, 2022 and 2031

Figure 18: Global Surgical Robots Market Revenue (US$ Mn), by Hospitals, 2017-2031

Figure 19: Global Surgical Robots Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017-2031

Figure 20: Global Surgical Robots Market Attractiveness Analysis, by End-user, 2023-2031

Figure 21: Global Surgical Robots Market Value Share Analysis, by Region, 2022 and 2031

Figure 22: Global Surgical Robots Market Attractiveness Analysis, by Region, 2023-2031

Figure 23: North America Surgical Robots Market Value (US$ Mn) Forecast, 2017-2031

Figure 24: North America Surgical Robots Market Value Share Analysis, by Country, 2022 and 2031

Figure 25: North America Surgical Robots Market Attractiveness Analysis, by Country, 2023-2031

Figure 26: North America Surgical Robots Market Value Share Analysis, by Component, 2022 and 2031

Figure 27: North America Surgical Robots Market Attractiveness Analysis, by Component, 2023-2031

Figure 28: North America Surgical Robots Market Value Share Analysis, By Surgery Type, 2022 and 2031

Figure 29: North America Surgical Robots Market Attractiveness Analysis, By Surgery Type, 2023-2031

Figure 30: North America Surgical Robots Market Value Share Analysis, by End-user, 2022 and 2031

Figure 31: North America Surgical Robots Market Attractiveness Analysis, by End-user, 2023-2031

Figure 32: Europe Surgical Robots Market Value (US$ Mn) Forecast, 2017-2031

Figure 33: Europe Surgical Robots Market Value Share Analysis, by Country, 2022 and 2031

Figure 34: Europe Surgical Robots Market Attractiveness Analysis, by Country, 2023-2031

Figure 35: Europe Surgical Robots Market Value Share Analysis, by Component, 2022 and 2031

Figure 36: Europe Surgical Robots Market Attractiveness Analysis, by Component, 2023-2031

Figure 37: Europe Surgical Robots Market Value Share Analysis, By Surgery Type, 2022 and 2031

Figure 38: Europe Surgical Robots Market Attractiveness Analysis, By Surgery Type, 2023-2031

Figure 39: Europe Surgical Robots Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Europe Surgical Robots Market Attractiveness Analysis, by End-user, 2023-2031

Figure 41: Asia Pacific Surgical Robots Market Value (US$ Mn) Forecast, 2017-2031

Figure 42: Asia Pacific Surgical Robots Market Value Share Analysis, by Country, 2022 and 2031

Figure 43: Asia Pacific Surgical Robots Market Attractiveness Analysis, by Country, 2023-2031

Figure 44: Asia Pacific Surgical Robots Market Value Share Analysis, by Component, 2022 and 2031

Figure 45: Asia Pacific Surgical Robots Market Attractiveness Analysis, by Component, 2023-2031

Figure 46: Asia Pacific Surgical Robots Market Value Share Analysis, By Surgery Type, 2022 and 2031

Figure 47: Asia Pacific Surgical Robots Market Attractiveness Analysis, By Surgery Type, 2023-2031

Figure 48: Asia Pacific Surgical Robots Market Value Share Analysis, by End-user, 2022 and 2031

Figure 49: Asia Pacific Surgical Robots Market Attractiveness Analysis, by End-user, 2023-2031

Figure 50: Latin America Surgical Robots Market Value (US$ Mn) Forecast, 2017-2031

Figure 51: Latin America Surgical Robots Market Value Share Analysis, by Country, 2022 and 2031

Figure 52: Latin America Surgical Robots Market Attractiveness Analysis, by Country, 2023-2031

Figure 53: Latin America Surgical Robots Market Value Share Analysis, by Component, 2022 and 2031

Figure 54: Latin America Surgical Robots Market Attractiveness Analysis, by Component, 2023-2031

Figure 55: Latin America Surgical Robots Market Value Share Analysis, By Surgery Type, 2022 and 2031

Figure 56: Latin America Surgical Robots Market Attractiveness Analysis, By Surgery Type, 2023-2031

Figure 57: Latin America Surgical Robots Market Value Share Analysis, by End-user, 2022 and 2031

Figure 58: Latin America Surgical Robots Market Attractiveness Analysis, by End-user, 2023-2031

Figure 59: Middle East & Africa Surgical Robots Market Value (US$ Mn) Forecast, 2017-2031

Figure 60: Middle East & Africa Surgical Robots Market Value Share Analysis, by Country, 2022 and 2031

Figure 61: Middle East & Africa Surgical Robots Market Attractiveness Analysis, by Country, 2023-2031

Figure 62: Middle East & Africa Surgical Robots Market Value Share Analysis, by Component, 2022 and 2031

Figure 63: Middle East & Africa Surgical Robots Market Attractiveness Analysis, by Component, 2023-2031

Figure 64: Middle East & Africa Surgical Robots Market Value Share Analysis, By Surgery Type, 2022 and 2031

Figure 65: Middle East & Africa Surgical Robots Market Attractiveness Analysis, By Surgery Type, 2023-2031

Figure 66: Middle East & Africa Surgical Robots Market Value Share Analysis, by End-user, 2022 and 2031

Figure 67: Middle East & Africa Surgical Robots Market Attractiveness Analysis, by End-user, 2023-2031

Figure 68: Company Share Analysis, 2022