Surgical retractors are primarily used to segregate the edges of a wound or a surgical incision to ensure that underlying organs and tissues remain untouched. At present, different types of surgical retractors, including hand retractors, self-retaining retractors, and table-mounted retractors are some of the most utilized surgical retractors. Advancements in technology and science coupled with improvement in the overall living standards of individuals have played a key role in influencing the quality of medical care and the development of various surgical instruments. The demand for minimally invasive surgery continues to expand at a rapid pace around the world due to which, progress minimally invasive surgery techniques are evolving.

Several participants involved in the current surgical retractors are primarily focusing on optimizing the quality and performance of their surgical retractors to expand their market share. Advancements in robotic technology have led to the development of retractor assistant devices. In addition, surgical retractors market players are also exploring the potential of different metals to produce surgical retractors and improve the quality of diagnostic care. In addition, several medical equipment manufacturers are expanding their product portfolio to strengthen their foothold in the current market landscape. At the back of these factors, the global surgical retractors market is expected to reach ~US$ 3.1 Bn by the end of 2030.

The medical technology has evolved at a rapid pace over the past couple of decades. The progress in the medical sector can be largely attributed to the advent of sophisticated metals and alloys that are increasingly being used in external and internal medical applications. The entry of advanced and special metals has led to the development of high-quality medical instruments, including surgical retractors. Research and development activities continue to explore the potential benefits of different metals to produce medical instruments.

Stainless steel is expected to remain one of the most popular materials for the production of an array of medical and surgical instruments, due to its lightweight and exceptional properties that are compatible with the human body. However, in recent years, titanium has emerged as an important metal that increasingly being used to manufacture surgical instruments, including forceps, drills, scissors, and surgical retractors. The growing adoption of titanium to manufacture surgical retractors is expected to provide a boost to the surgical retractors market during the assessment period.

While titanium and stainless steel surgical retractors are likely to have a high market share, players operating in the current surgical retractors market are also exploring the benefits of other special metals, including niobium and tantalum.

Over the past decade, several key companies involved in the surgical retractors market are increasingly focusing on launching new variants of surgical retractors and expanding their product portfolio to strengthen their foothold in the market. While the focus on research and development pertaining to the physical design and materials utilized to manufacture surgical retractors is in full swing, market participants are deploying new manufacturing technologies to launch high-quality surgical retractors.

For instance, in May 2019, OBP, one of the leading manufacturers of self-contained and single-use medical devices announced the launch of ONETRAC LX - a newly developed single-use cordless surgical retractor that is equipped with a multi-LED light source and dual smoke evacuation channels. The newly developed surgical retractor offers optimum smoke clearance capabilities to nurses and operating surgeons.

Similarly, in January 2018, QSpine, a medical device manufacturers in the U.K. announced the launch of SURE Single Use Retractor– a single-use surgical retractor that provides optimum operating conditions at the surgical site.

The onset of the novel COVID-19 pandemic is expected to have a short-term impact on the global surgical retractor market. Several countries have imposed stringent lockdown measures and restrictions on transportation and cross-border trade due to which, surgical retractors market players are expected to address bottlenecks across the supply chain. However, as medical services and devices are listed under essential goods, the production of surgical retractors is anticipated to remain unaffected in several regions of the world.

Despite large-scale emphasis being given to the treatment of COVID-19 patients, the demand for medical devices and medication required to treat other medical conditions continues to grow due to which, the surgical retractors market is expected to witness steady growth. Product diversification is projected to remain the key during the ongoing COVID-19 pandemic and thus, market players are expected to assess and identify various pockets of opportunities to generate revenue.

Analysts’ Viewpoint

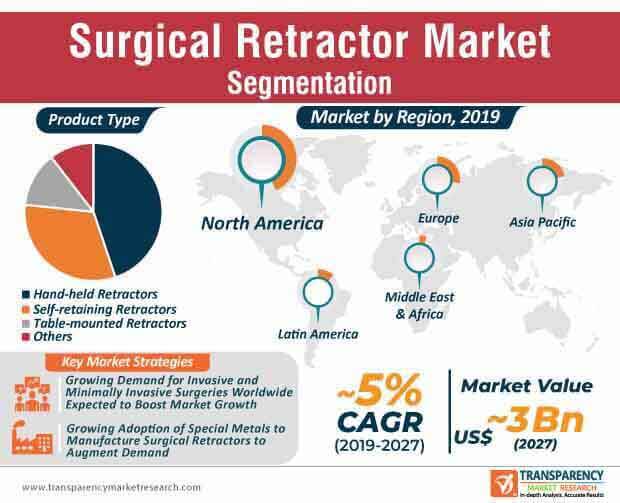

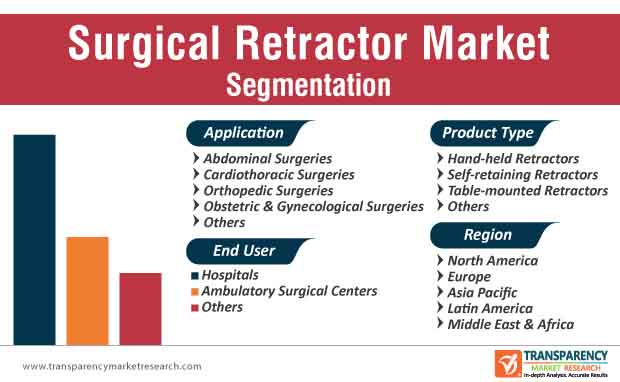

The global surgical retractors market is expected to expand at a CAGR of ~5% during the forecast period. The market growth is largely driven by research & development activities, technological advancements in the manufacturing techniques, entry of new metals and materials, expanding healthcare ecosystem worldwide, and rise in the number of invasive as well as minimally invasive surgeries worldwide. Market players should ideally focus on expanding their product portfolio and improve the quality of their products to gain an advantage in the current market landscape.

The global surgical retractors market was worth US$ 1.9 Mn and is projected to reach a value of US$ 3.1 Bn by the end of 2030

Surgical retractors market is anticipated to grow at a CAGR of 5% during the forecast period

North America accounted for a major share of the global surgical retractors market

Surgical Retractors Market is driven by rise in demand for plastic & reconstructive surgeries and increase in global geriatric population to drive market

Key players in the global surgical retractors market include Medtronic plc, Stryker, Terumo Corporation, Integra LifeSciences, Ethicon (Johnson & Johnson Services, Inc.), BD, Teleflex Incorporated, B. Braun Melsungen AG, Invuity, Inc., and Medline Industries, Inc

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Research Methodology

3. Executive Summary

3.1. Global Surgical Retractors Market Snapshot

4. Market Overview

4.1. Product Overview

4.2. Key Industry Events

4.3. Market Dynamics

4.4. Drivers and Restraints Snapshot Analysis

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunities

4.4.4. Key Trends

4.5. Global Surgical Retractors Market Revenue Projection

4.6. Global Surgical Retractors Market Outlook

5. Market Outlook

5.1. Key Mergers & Acquisitions

5.2. Number of Surgical Procedure: Stats

5.3. COVID-19 Pandemics Impact on Industry (Value Chain and Short / Mid / Long Term Impact)

6. Global Surgical Retractors Market Analysis, by Product Type

6.1. Introduction

6.2. Global Surgical Retractors Market Value Share and Attractiveness Analysis, by Product Type

6.3. Global Surgical Retractors Market Forecast, by Product Type

6.3.1. Hand-held Retractors

6.3.2. Self-retaining Retractors

6.3.3. Table-mounted Retractors

6.3.4. Others

6.4. Global Surgical Retractors Market Analysis, by Product Type

7. Global Surgical Retractors Market Analysis, by Application

7.1. Introduction

7.2. Global Surgical Retractors Market Value Share and Attractiveness Analysis, by Application

7.3. Global Surgical Retractors Market Forecast, by Application

7.3.1. Abdominal Surgeries

7.3.2. Cardiothoracic Surgeries

7.3.3. Orthopedic Surgeries

7.3.4. Obstetric & Gynecological Surgeries

7.3.5. Others

7.4. Global Surgical Retractors Market Analysis, by Application

8. Global Surgical Retractors Market Analysis, by End-user

8.1. Introduction

8.2. Global Surgical Retractors Market Value Share and Attractiveness Analysis, by End-user

8.3. Global Surgical Retractors Market Forecast, by End-user

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Others

8.4. Global Surgical Retractors Market Analysis, by End-user

9. Global Surgical Retractors Market Analysis, by Region

9.1. Global Surgical Retractors Market Scenario, by Country

9.2. Global Surgical Retractors Market Value Share and Attractiveness Analysis, by Region

9.3. Global Surgical Retractors Market Forecast, by Region

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Latin America

9.3.5. Middle East & Africa

10. North America Surgical Retractors Market Analysis

10.1. North America Surgical Retractors Market Forecast

10.2. North America Surgical Retractors Market Analysis, by Country

10.3. North America Surgical Retractors Market Forecast, by Country

10.3.1. U.S.

10.3.2. Canada

10.4. North America Surgical Retractors Market Analysis, by Product Type

10.5. North America Surgical Retractors Market Forecast, by Product Type

10.5.1. Hand-held Retractors

10.5.2. Self-retaining Retractors

10.5.3. Table-mounted Retractors

10.5.4. Others

10.6. North America Surgical Retractors Market Analysis, by Application

10.7. North America Surgical Retractors Market Forecast, by Application

10.7.1. Abdominal Surgeries

10.7.2. Cardiothoracic Surgeries

10.7.3. Orthopedic Surgeries

10.7.4. Obstetric & Gynecological Surgeries

10.7.5. Others

10.8. North America Surgical Retractors Market Analysis, by End-user

10.9. North America Surgical Retractors Market Forecast, by End-user

10.9.1. Hospitals

10.9.2. Ambulatory Surgical Centers

10.9.3. Others

11. Europe Surgical Retractors Market Analysis

11.1. Europe Surgical Retractors Market Forecast

11.2. Europe Surgical Retractors Market Analysis, by Country/Sub-region

11.3. Europe Surgical Retractors Market Forecast, by Country/Sub-region

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

11.4. Europe Surgical Retractors Market Analysis, by Product Type

11.5. Europe Surgical Retractors Market Forecast, by Product Type

11.5.1. Hand-held Retractors

11.5.2. Self-retaining Retractors

11.5.3. Table-mounted Retractors

11.5.4. Others

11.6. Europe Surgical Retractors Market Analysis, by Application

11.7. Europe Surgical Retractors Market Forecast, by Application

11.7.1. Abdominal Surgeries

11.7.2. Cardiothoracic Surgeries

11.7.3. Orthopedic Surgeries

11.7.4. Obstetric & Gynecological Surgeries

11.7.5. Others

11.8. Europe Surgical Retractors Market Analysis, by End-user

11.9. Europe Surgical Retractors Market Forecast, by End-user

11.9.1. Hospitals

11.9.2. Ambulatory Surgical Centers

11.9.3. Others

12. Asia Pacific Surgical Retractors Market Analysis

12.1. Asia Pacific Surgical Retractors Market Forecast

12.2. Asia Pacific Surgical Retractors Market Analysis, by Country/Sub-region

12.3. Asia Pacific Surgical Retractors Market Forecast, by Country/Sub-region

12.3.1. China

12.3.2. Japan

12.3.3. India

12.3.4. Australia & New Zealand

12.3.5. Rest of Asia Pacific

12.4. Asia Pacific Surgical Retractors Market Analysis, by Product Type

12.5. Asia Pacific Surgical Retractors Market Forecast, by Product Type

12.5.1. Hand-held Retractors

12.5.2. Self-retaining Retractors

12.5.3. Table-mounted Retractors

12.5.4. Others

12.6. Asia Pacific Surgical Retractors Market Analysis, by Application

12.7. Asia Pacific Surgical Retractors Market Forecast, by Application

12.7.1. Abdominal Surgeries

12.7.2. Cardiothoracic Surgeries

12.7.3. Orthopedic Surgeries

12.7.4. Obstetric & Gynecological Surgeries

12.7.5. Others

12.8. Asia Pacific Surgical Retractors Market Analysis, by End-user

12.9. Asia Pacific Surgical Retractors Market Forecast, by End-user

12.9.1. Hospitals

12.9.2. Ambulatory Surgical Centers

12.9.3. Others

13. Latin America Surgical Retractors Market Analysis

13.1. Latin America Surgical Retractors Market Forecast

13.2. Latin America Surgical Retractors Market Analysis, by Country/Sub-region

13.3. Latin America Surgical Retractors Market Forecast, by Country/Sub-region

13.3.1. Brazil

13.3.2. Mexico

13.3.3. Rest of Latin America

13.4. Latin America Surgical Retractors Market Analysis, by Product Type

13.5. Latin America Surgical Retractors Market Forecast, by Product Type

13.5.1. Hand-held Retractors

13.5.2. Self-retaining Retractors

13.5.3. Table-mounted Retractors

13.5.4. Others

13.6. Latin America Surgical Retractors Market Analysis, by Application

13.7. Latin America Surgical Retractors Market Forecast, by Application

13.7.1. Abdominal Surgeries

13.7.2. Cardiothoracic Surgeries

13.7.3. Orthopedic Surgeries

13.7.4. Obstetric & Gynecological Surgeries

13.7.5. Others

13.8. Latin America Surgical Retractors Market Analysis, by End-user

13.9. Latin America Surgical Retractors Market Forecast, by End-user

13.9.1. Hospitals

13.9.2. Ambulatory Surgical Centers

13.9.3. Others

14. Middle East & Africa Surgical Retractors Market Analysis

14.1. Middle East & Africa Surgical Retractors Market Forecast

14.2. Middle East & Africa Surgical Retractors Market Analysis, by Country/Sub-region

14.3. Middle East & Africa Surgical Retractors Market Forecast, by Country/Sub-region

14.3.1. GCC Countries

14.3.2. South Africa

14.3.3. Rest of Middle East & Africa

14.4. Middle East & Africa Surgical Retractors Market Analysis, by Product Type

14.5. Middle East & Africa Surgical Retractors Market Forecast, by Product Type

14.5.1. Hand-held Retractors

14.5.2. Self-retaining Retractors

14.5.3. Table-mounted Retractors

14.5.4. Others

14.6. Middle East & Africa Surgical Retractors Market Analysis, by Application

14.7. Middle East & Africa Surgical Retractors Market Forecast, by Application

14.7.1. Abdominal Surgeries

14.7.2. Cardiothoracic Surgeries

14.7.3. Orthopedic Surgeries

14.7.4. Obstetric & Gynecological Surgeries

14.7.5. Others

14.8. Middle East & Africa Surgical Retractors Market Analysis, by End-user

14.9. Middle East & Africa Surgical Retractors Market Forecast, by End-user

14.9.1. Hospitals

14.9.2. Ambulatory Surgical Centers

14.9.3. Others

15. Competition Analysis

15.1. Market Player - Competition Matrix (By Tier and Size of companies)

15.2. Global Surgical Retractors Market Share Analysis, by Company, 2019

15.3. Company Profile

15.3.1. Medtronic plc

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Stryker

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Terumo Corporation

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Integra LifeSciences

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Ethicon (Johnson & Johnson Services, Inc.)

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. BD

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Teleflex Incorporated

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. B. Braun Melsungen AG

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Invuity, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Medline Industries, Inc.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

List of Tables

Table 01: Global Surgical Retractors Market Value (US$ Mn) Forecast, by Product Type, 2018–2030

Table 02: Global Surgical Retractors Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 03: Global Surgical Retractors Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 04: Global Surgical Retractors Market Value (US$ Mn) Forecast, by Region, 2018–2030

Table 05: North America Surgical Retractors Market Value (US$ Mn) Forecast, by Country, 2018–2030

Table 06: North America Surgical Retractors Market Value (US$ Mn) Forecast, by Product Type, 2018–2030

Table 07: North America Surgical Retractors Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 08: North America Surgical Retractors Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 09: Europe Surgical Retractors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 10: Europe Surgical Retractors Market Value (US$ Mn) Forecast, by Product Type, 2018–2030

Table 11: Europe Surgical Retractors Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 12: Europe Surgical Retractors Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 13: Asia Pacific Surgical Retractors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 14: Asia Pacific Surgical Retractors Market Value (US$ Mn) Forecast, by Product Type, 2018–2030

Table 15: Asia Pacific Surgical Retractors Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 16: Asia Pacific Surgical Retractors Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 17: Latin America Surgical Retractors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 18: Latin America Surgical Retractors Market Value (US$ Mn) Forecast, by Product Type, 2018–2030

Table 19: Latin America Surgical Retractors Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 20: Latin America Surgical Retractors Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 21: Middle East & Africa East & Africa Surgical Retractors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 22: Middle East & Africa East & Africa Surgical Retractors Market Value (US$ Mn) Forecast, by Product Type, 2018–2030

Table 23: Middle East & Africa East & Africa Surgical Retractors Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 24: Middle East & Africa East & Africa Surgical Retractors Market Value (US$ Mn) Forecast, by End-user, 2018–2030

List of Figures

Figure 01: Global Surgical Retractors Market Value (US$ Mn) and Distribution, by Region, 2019 and 2030

Figure 02: Global Surgical Retractors Market Value (US$ Mn) Forecast, 2018–2030

Figure 03: Global Surgical Retractors Market Value Share, by Product Type, 2019

Figure 04: Global Surgical Retractors Market Value Share, by Application, 2019

Figure 05: Global Surgical Retractors Market Value Share, by End-user, 2019

Figure 06: Global Surgical Retractors Market Value Share, by Region, 2019

Figure 07: Global Surgical Retractors Market Value Share Analysis, by Product Type, 2019 and 2030

Figure 08: Global Surgical Retractors Market Attractiveness Analysis, by Product Type, 2020–2030

Figure 09: Global Surgical Retractors Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hand-held Retractors, 2018–2030

Figure 10: Global Surgical Retractors Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Self-retaining Retractors, 2018–2030

Figure 11: Global Surgical Retractors Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Table-mounted Retractors, 2018–2030

Figure 12: Global Surgical Retractors Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2018–2030

Figure 13: Global Surgical Retractors Market Value Share Analysis, by Application, 2019 and 2030

Figure 14: Global Surgical Retractors Market Attractiveness Analysis, by Application, 2020–2030

Figure 15: Global Surgical Retractors Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Abdominal Surgeries, 2018–2030

Figure 16: Global Surgical Retractors Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cardiothoracic Surgeries, 2018–2030

Figure 17: Global Surgical Retractors Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Orthopedic Surgeries, 2018–2030

Figure 18: Global Surgical Retractors Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Obstetric & Gynecological Surgeries, 2018–2030

Figure 19: Global Surgical Retractors Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2018–2030

Figure 20: Global Surgical Retractors Market Value Share Analysis, by End-user, 2019 and 2030

Figure 21: Global Surgical Retractors Market Attractiveness Analysis, by End-user, 2020–2030

Figure 22: Global Surgical Retractors Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2018–2030

Figure 23: Global Surgical Retractors Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ambulatory Surgical Centers, 2018–2030

Figure 24: Global Surgical Retractors Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2018–2030

Figure 25: Global Surgical Retractors Market Value Share Analysis, by Region, 2019 and 2030

Figure 26: Global Surgical Retractors Market Attractiveness Analysis, by Region, 2019–2027

Figure 27: North America Surgical Retractors Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2018–2030

Figure 28: North America Surgical Retractors Market Value Share Analysis, by Country, 2019 and 2030

Figure 29: North America Surgical Retractors Market Attractiveness Analysis, by Country, 2020–2030

Figure 30: North America Surgical Retractors Market Value Share Analysis, by Product Type, 2019 and 2030

Figure 31: North America Surgical Retractors Market Attractiveness Analysis, by Product Type, 2020–2030

Figure 32: North America Surgical Retractors Market Value Share Analysis, by Application, 2019 and 2030

Figure 33: North America Surgical Retractors Market Attractiveness Analysis, by Application, 2020–2030

Figure 34: North America Surgical Retractors Market Value Share, by End-user, 2019 and 2030

Figure 35: North America Surgical Retractors Market Attractiveness Analysis, by End-user, 2020–2030

Figure 36: Europe Surgical Retractors Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2018–2030

Figure 37: Europe Surgical Retractors Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 38: Europe Surgical Retractors Market Attractiveness Analysis, by Country/sub-region, 2019–2027

Figure 39: Europe Surgical Retractors Market Value Share Analysis, by Product Type, 2019 and 2030

Figure 40: Europe Surgical Retractors Market Attractiveness Analysis, by Product Type, 2020–2030

Figure 41: Europe Surgical Retractors Market Value Share Analysis, by Application, 2019 and 2030

Figure 42: Europe Surgical Retractors Market Attractiveness Analysis, by Application, 2020–2030

Figure 43: Europe Surgical Retractors Market Value Share Analysis, by End-user, 2019 and 2030

Figure 44: Europe Surgical Retractors Market Attractiveness Analysis, by End-user, 2020–2030

Figure 45: Asia Pacific Surgical Retractors Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2018–2030

Figure 46: Asia Pacific Surgical Retractors Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 47: Asia Pacific Surgical Retractors Market Attractiveness Analysis, by Country/sub-region, 2020–2030

Figure 48: Asia Pacific Surgical Retractors Market Value Share Analysis, by Product Type, 2019 and 2030

Figure 49: Asia Pacific Surgical Retractors Market Attractiveness Analysis, by Product Type, 2020–2030

Figure 50: Asia Pacific Surgical Retractors Market Value Share Analysis, by Application, 2019 and 2030

Figure 51: Asia Pacific Surgical Retractors Market Attractiveness Analysis, by Application, 2020–2030

Figure 52: Asia Pacific Surgical Retractors Market Value Share Analysis, by End-user, 2019 and 2030

Figure 53: Asia Pacific Surgical Retractors Market Attractiveness Analysis, by End-user, 2020–2030

Figure 54: Latin America Surgical Retractors Market Value (US$ Mn) Forecast and Y-o-Y Growth

Figure 55: Latin America Surgical Retractors Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 56: Latin America Surgical Retractors Market Attractiveness Analysis, by Country/sub-region, 2020–2030

Figure 57: Latin America Surgical Retractors Market Value Share Analysis, by Product Type, 2019 and 2030

Figure 58: Latin America Surgical Retractors Market Attractiveness Analysis, by Product Type, 2020–2030

Figure 59: Latin America Surgical Retractors Market Value Share Analysis, by Application, 2019 and 2030

Figure 60: Latin America Surgical Retractors Market Attractiveness Analysis, by Application, 2020–2030

Figure 61: Latin America Surgical Retractors Market Value Share Analysis, by End-user, 2019 and 2030

Figure 62: Latin America Surgical Retractors Market Attractiveness Analysis, by End-user, 2020–2030

Figure 63: Middle East & Africa East & Africa Surgical Retractors Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2018–2030

Figure 64: Middle East & Africa East & Africa Surgical Retractors Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 65: Middle East & Africa East & Africa Surgical Retractors Market Attractiveness Analysis, by Country/sub-region, 2020–2030

Figure 66: Middle East & Africa East & Africa Surgical Retractors Market Value Share Analysis, by Product Type, 2019 and 2030

Figure 67: Middle East & Africa East & Africa Surgical Retractors Market Attractiveness Analysis, by Product Type, 2020–2030

Figure 68: Middle East & Africa East & Africa Surgical Retractors Market Value Share Analysis, by Application, 2019 and 2030

Figure 69: Middle East & Africa East & Africa Surgical Retractors Market Attractiveness Analysis, by Application, 2020–2030

Figure 70: Middle East & Africa East & Africa Surgical Retractors Market Value Share Analysis, by End-user, 2019 and 2030

Figure 71: Middle East & Africa East & Africa Surgical Retractors Market Attractiveness Analysis, by End-user, 2020–2030

Figure 72: Global Surgical Retractors Market Share Analysis, by Company, 2019

Figure 73: Medtronic plc, Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 74: Medtronic plc, Breakdown of Net Sales, by Region, 2019

Figure 75: Medtronic plc, Breakdown of Net Sales, by Business Segment, 2019

Figure 76: Medtronic plc, R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 77: Stryker, Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 78: Stryker, Breakdown of Net Sales, by Region, 2019

Figure 79: Stryker, Breakdown of Net Sales, by Business Segment, 2019

Figure 80: Stryker, R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 81: Terumo Corporation, Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 82: Terumo Corporation, Breakdown of Net Sales, by Region, 2019

Figure 83: Terumo Corporation, Breakdown of Net Sales, by Business Segment, 2019

Figure 84: Terumo Corporation, R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 85: Integra LifeSciences, Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 86: Integra LifeSciences, Breakdown of Net Sales, by Region, 2019

Figure 87: Integra LifeSciences, Breakdown of Net Sales, by Business Segment, 2019

Figure 88: Integra LifeSciences, R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2019

Figure 89: Ethicon (Johnson & Johnson Services, Inc.), Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2019

Figure 90: Ethicon (Johnson & Johnson Services, Inc.), Breakdown of Net Sales, by Region, 2019

Figure 91: Ethicon (Johnson & Johnson Services, Inc.), Breakdown of Net Sales, by Business Segment, 2019

Figure 92: Ethicon (Johnson & Johnson Services, Inc.), R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2019

Figure 93: BD, Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2019

Figure 94: BD, Breakdown of Net Sales, by Region, 2019

Figure 95: BD, Breakdown of Net Sales, by Business Segment, 2019

Figure 96: BD, R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2019