Surgical imaging arms are devices that are highly essential to meet the rising demand for minimally invasive procedures and hence, they have become an important tool in healthcare facilities such as hospitals, clinics, and in research institutes. In terms of revenue, the global surgical imaging arms market was valued at above US$ 1,000 Mn in 2017 and is anticipated to reach approximately US$ 1,600 Mn by 2026, expanding at a CAGR of 4.6% from 2018 to 2026. Rise in the number of interventional radiology procedures, high demand for minimally invasive surgeries, and complication of orthopedic surgeries with traditional equipment are key factors that are anticipated to propel the surgical imaging arms market during the forecast period.

Rising globalization leads to the outbreak of several diseases, and some of them require surgery. According to the According to the Annual Plastic Surgery Report by the American Society of Plastic Surgeons, there were almost 15.9 million surgical and minimally-invasive cosmetic procedures performed in the U.S, in 2015, a 2% increase over 2014. This increasing number of surgeries is fueling the demand for more advanced surgical arms. A large number of global manufacturers are emphasizing on the development and manufacture of novel equipment so that the surgeons can carry out the surgical process more effectively and smoothly. Demand for mini C-arms devices is rising due to features such as small size, lower price as compared to other types of C-arms, and easy maneuverability in the operation theater. Key players are focusing on the development of new C-arm devices with better efficacy. For instance, in 2018, Hologic, Inc. launched the Fluoroscan Insight FD Mini C-arm. The system offers a variety of improved imaging features with low-dose rate modes and more flexible transport facility. These key developments are likely to augment the global surgical imaging arms market in the near future. However, high price of surgical imaging arms and technical errors of these devices are likely to restrain the global surgical imaging arms during the forecast period.

The global surgical imaging arms market has been segmented based on product, application, end-user, and region. In terms of product, the C-arm surgical imaging devices segment is projected to dominate the market. However, the segment is expected to lose market share during the forecast period, due to fewer opportunities for new entrants in the segment and the availability of more advanced devices in the market, such as the G-arm. In terms of application, the orthopedic segment is projected to expand rapidly at a notable CAGR during the forecast period. Demand for minimally invasive surgeries among orthopedic diseases patients for rapid recovery and high incidence of orthopedic disorders among the increasing geriatric population are fueling the segment. Based on end-user, the hospitals & ambulatory surgical centers segment led the market, in terms of revenue, in 2017. It is anticipated to maintain its dominance of the market during the forecast period.

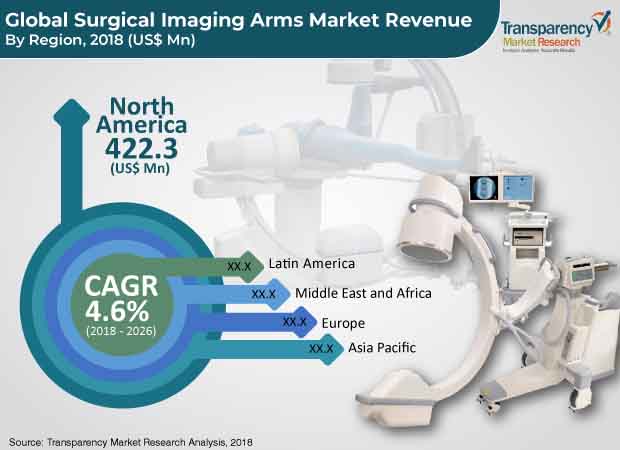

In terms of region, North America held a major share of the global surgical imaging arms market in 2017. Robust healthcare infrastructure and rise in number of surgeries are propelling the market in North America. In terms of revenue, the market in Asia Pacific is projected to expand at a rapid pace during the forecast period, due to a rise in the number of surgeries in such a huge population. Rise in hospitals in countries such as Saudi Arabia and Qatar, and increase in government investment in the healthcare system in countries such as Colombia, Mexico, and South Africa are likely to boost the market in Latin America and Middle East & Africa.

Key companies operating in the global surgical imaging arms market that are profiled in the report include GE Healthcare, Medtronic, Koninklijke Philips N.V., Canon Medical Systems Corporation, Siemens Healthineers AG, Shimadzu Corporation, Whale Imaging Inc., Hologic, Inc., and ATON GmbH. These players are adopting organic and inorganic growth strategies to expand their product offerings, strengthen their geographical reach, increase customer base, and gain market share. For instance, in May 2015, Ziehm Imaging Inc. a Germany-based company, acquired Ortho Scan Inc., a U.S.-based mini C-arm manufacturer to expand its C-arms product portfolio and geographic presence.

Surgical Imaging Arms Market to Gain Attractive Revenues from Rising Number of Medical Procedures

Careful imaging arms are gadgets that are profoundly fundamental for fulfill the rising need for negligibly intrusive methodology and thus, they have become a significant instrument in medical services offices like medical clinics, centers, and in research organizations. Ascend in the quantity of interventional radiology systems, popularity for negligibly obtrusive medical procedures, and complexity of muscular medical procedures with customary hardware are key factors that are expected to push the careful imaging arms market in the coming years.

Ascend in geriatric populace that prompts expansion in number of medical procedures, which are caused because of extreme illnesses and performed at medical clinics and facilities, and ascend in the quantity of emergency clinics are probably going to support the careful imaging arms market. Rising globalization prompts the flare-up of a few sicknesses, and some of them require a medical procedure.

This expanding number of medical procedures is energizing the interest for further developed careful arms. Countless worldwide producers are accentuating on the turn of events and production of novel gear with the goal that the specialists can do the careful interaction all the more successfully and easily. Interest for smaller than usual C-arms gadgets is ascending because of highlights like little size, lower cost when contrasted with different kinds of C-arms, and simple mobility in the activity theater. Vital participants are zeroing in on the advancement of new C-arm gadgets with better viability. The framework offers an assortment of improved imaging highlights with low-portion rate modes and more adaptable vehicle office. These key advancements are probably going to expand the worldwide careful imaging arms market sooner rather than later. Notwithstanding, excessive cost of careful imaging arms and specialized mistakes of these gadgets are probably going to limit the worldwide careful imaging arms during the estimate time frame.

Chapter 1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

Chapter 2. Assumptions and Research Methodology

Chapter 3. Executive Summary: Global Surgical Imaging Arms Market

Chapter 4. Market Overview

4.1. Introduction

4.1.1. Product Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Global Surgical Imaging Arms Market Analysis and Forecast, 2016–2026

4.3.1. Global Surgical Imaging Arms Market Revenue Projection (US$ Mn)

Chapter 5. Market Outlook

5.1. Technological Advancement

5.2. Pricing Analysis by Product

5.3. Key Merger & Acquisition

Chapter 6. Global Surgical Imaging Arms Market Analysis and Forecast, by Product

6.1. Key Findings/Developments

6.2. Introduction & Definition

6.3. Global Surgical Imaging Arms Market Value Forecast, by Product, 2017–2026

6.3.1. C-arm Surgical Imaging Devices

6.3.1.1. Full-size C-arm

6.3.1.2. Mini C-arm

6.3.1.3. Compact C-arm

6.3.2. O-arm Surgical Imaging Devices

6.3.3. G-arm Surgical Imaging Devices

6.4. Market Attractiveness, by Product

Chapter 7. Global Surgical Imaging Arms Market Analysis and Forecast, by Application

7.1. Key Findings/Developments

7.2. Introduction & Definition

7.3. Global Surgical Imaging Arms Market Value Forecast, by Application, 2017–2026

7.3.1. Orthopedic

7.3.2. Cardiovascular

7.3.3. Pain Management

7.3.4. Urology

7.3.5. Others

7.4. Global Surgical Imaging Arms Market Attractiveness, by Application

Chapter 8. Global Surgical Imaging Arms Market Analysis and Forecast, by End-user

8.1. Key Findings/Developments

8.2. Introduction & Definition

8.3. Global Surgical Imaging Arms Market Value Forecast, by End-user, 2017–2026

8.3.1. Hospitals & Ambulatory Surgical Centers

8.3.2. Academic & Research Institutes

8.3.3. Others

8.4. Global Surgical Imaging Arms Market Attractiveness, by End-user

Chapter 9. Global Surgical Imaging Arms Market Analysis and Forecast, by Region

9.1. Geographical Representation

9.2. Global Surgical Imaging Arms Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Surgical Imaging Arms Market Attractiveness, by Region

Chapter 10. North America Surgical Imaging Arms Market Analysis and Forecast

10.1. North America Surgical Imaging Arms Market Value Forecast, by Country, 2017–2026

10.1.1. U.S.

10.1.2. Canada

10.2. North America Surgical Imaging Arms Market Value Share Analysis, by Product, 2017–2026

10.3. North America Surgical Imaging Arms Market Value Forecast, by Product, 2016–2026

10.3.1. C-arm Surgical Imaging Devices

10.3.1.1. Full-size C-arm

10.3.1.2. Mini C-arm

10.3.1.3. Compact C-arm

10.3.2. O-arm Surgical Imaging Devices

10.3.3. G-arm Surgical Imaging Devices

10.4. North America Surgical Imaging Arms Market Value Share Analysis, by Application, 2017–2026

10.5. North America Surgical Imaging Arms Market Value Forecast, by Application, 2016–2026

10.5.1. Orthopedic

10.5.2. Cardiovascular

10.5.3. Pain Management

10.5.4. Urology

10.5.5. Others

10.6. North America Surgical Imaging Arms Market Value Share Analysis, by End-user, 2017–2026

10.7. North America Surgical Imaging Arms Market Value Forecast, by End-user, 2016–2026

10.7.1. Hospitals & Ambulatory Surgical Centers

10.7.2. Academic & Research Institutes

10.7.3. Others

10.8. North America Surgical Imaging Arms Market Attractiveness Analysis

10.8.1. By Country

10.8.2. By Product

10.8.3. By Application

10.8.4. By End-user

Chapter 11. Europe Surgical Imaging Arms Market Analysis and Forecast

11.1. Europe Surgical Imaging Arms Market Value Forecast, by Country/Sub-region, 2017–2026

11.1.1. Germany

11.1.2. France

11.1.3. U.K.

11.1.4. Spain

11.1.5. Italy

11.1.6. Rest of Europe

11.2. Europe Surgical Imaging Arms Market Value Share Analysis, by Product, 2017–2026

11.3. Europe Surgical Imaging Arms Market Value Forecast, by Product, 2016–2026

11.3.1. C-arm Surgical Imaging Devices

11.3.1.1. Full-size C-arm

11.3.1.2. Mini C-arm

11.3.1.3. Compact C-arm

11.3.2. O-arm Surgical Imaging Devices

11.3.3. G-arm Surgical Imaging Devices

11.4. Europe Surgical Imaging Arms Market Value Share Analysis, by Application, 2017–2026

11.5. Europe Surgical Imaging Arms Market Value Forecast, by Application, 2016–2026

11.5.1. Orthopedic

11.5.2. Cardiovascular

11.5.3. Pain Management

11.5.4. Urology

11.5.5. Others

11.6. Europe Surgical Imaging Arms Market Value Share Analysis, by End-user, 2017–2026

11.7. Europe Surgical Imaging Arms Market Value Forecast, by End-user, 2016-2026

11.7.1. Hospitals & Ambulatory Surgical Centers

11.7.2. Academic & Research Institutes

11.7.3. Others

11.8. Europe Surgical Imaging Arms Market Attractiveness Analysis

11.8.1. By Country/Sub-region

11.8.2. By Product

11.8.3. By Application

11.8.4. By End-user

Chapter 12. Asia Pacific Surgical Imaging Arms Market Analysis and Forecast

12.1. Asia Pacific Surgical Imaging Arms Market Value Forecast, by Country/Sub-regions, 2017–2026

12.1.1. China

12.1.2. Japan

12.1.3. India

12.1.4. Australia & New Zealand

12.1.5. Rest of Asia Pacific

12.2. Asia Pacific Surgical Imaging Arms Market Value Share Analysis, by Product, 2017–2026

12.3. Asia Pacific Surgical Imaging Arms Market Value Forecast, by Product, 2016–2026

12.3.1. C-arm Surgical Imaging Devices

12.3.1.1. Full-size C-arm

12.3.1.2. Mini C-arm

12.3.1.3. Compact C-arm

12.3.2. O-arm Surgical Imaging Devices

12.3.3. G-arm Surgical Imaging Devices

12.4. Asia Pacific Surgical Imaging Arms Market Value Share Analysis, by Application, 2017–2026

12.5. Asia Pacific Surgical Imaging Arms Market Value Forecast, by Application, 2016–2026

12.5.1. Orthopedic

12.5.2. Cardiovascular

12.5.3. Pain Management

12.5.4. Urology

12.5.5. Others

12.6. Asia Pacific Surgical Imaging Arms Market Value Share Analysis, by End-user, 2017–2026

12.7. Asia Pacific Surgical Imaging Arms Market Value Forecast, by End-user, 2016–2026

12.7.1. Hospitals & Ambulatory Surgical Centers

12.7.2. Academic & Research Institutes

12.7.3. Others

12.8. Asia Pacific Surgical Imaging Arms Market Attractiveness Analysis

12.8.1. By Country/Sub-region

12.8.2. By Product

12.8.3. By Application

12.8.4. By End-user

Chapter 13. Latin America Surgical Imaging Arms Market Analysis and Forecast

13.1. Latin America Surgical Imaging Arms Market Value Forecast, by Country/Sub-region, 2017–2026

13.1.1. Brazil

13.1.2. Mexico

13.1.3. Rest of Latin America

13.2. Latin America Surgical Imaging Arms Market Value Share Analysis, by Product, 2017–2026

13.3. Latin America Surgical Imaging Arms Market Value Forecast, by Product, 2016–2026

13.3.1. C-arm Surgical Imaging Devices

13.3.1.1. Full-size C-arm

13.3.1.2. Mini C-arm

13.3.1.3. Compact C-arm

13.3.2. O-arm Surgical Imaging Devices

13.3.3. G-arm Surgical Imaging Devices

13.4. Latin America Surgical Imaging Arms Market Value Share Analysis, by Application, 2017–2026

13.5. Latin America Surgical Imaging Arms Market Value Forecast, by Application, 2016–2026

13.5.1. Orthopedic

13.5.2. Cardiovascular

13.5.3. Pain Management

13.5.4. Urology

13.5.5. Others

13.6. Latin America Surgical Imaging Arms Market Value Share Analysis, by End-user, 2017–2026

13.7. Latin America Surgical Imaging Arms Market Value Forecast, by End-user, 2016–2026

13.7.1. Hospitals & Ambulatory Surgical Centers

13.7.2. Academic & Research Institutes

13.7.3. Others

13.8. Latin America Surgical Imaging Arms Market Attractiveness Analysis

13.8.1. By Country/Sub-region

13.8.2. By Product

13.8.3. By Application

13.8.4. By End-user

Chapter 14. Middle East & Africa Surgical Imaging Arms Market Analysis and Forecast

14.1. Middle East & Africa Surgical Imaging Arms Market Value Forecast, by Country/Sub-regions, 2017–2026

14.1.1. GCC Countries

14.1.2. South Africa

14.1.3. Israel

14.1.4. Rest of Middle East & Africa

14.2. Middle East & Africa Surgical Imaging Arms Market Value Share Analysis, by Product, 2017–2026

14.3. Middle East & Africa Surgical Imaging Arms Market Value Forecast, by Product, 2016–2026

14.3.1. C-arm Surgical Imaging Devices

14.3.1.1. Full-size C-arm

14.3.1.2. Mini C-arm

14.3.1.3. Compact C-arm

14.3.2. O-arm Surgical Imaging Devices

14.3.3. G-arm Surgical Imaging Devices

14.4. Middle East & Africa Surgical Imaging Arms Market Value Share Analysis, by Application, 2017–2026

14.5. Middle East & Africa Surgical Imaging Arms Market Value Forecast, by Application, 2016–2026

14.5.1. Orthopedic

14.5.2. Cardiovascular

14.5.3. Pain Management

14.5.4. Urology

14.5.5. Others

14.6. Middle East & Africa Surgical Imaging Arms Market Value Share Analysis, by End-user, 2017–2026

14.7. Middle East & Africa Surgical Imaging Arms Market Value Forecast, by End-user, 2016–2026

14.7.1. Hospitals & Ambulatory Surgical Centers

14.7.2. Academic & Research Institutes

14.7.3. Others

14.8. Middle East & Africa Surgical Imaging Arms Market Attractiveness Analysis

14.8.1. By Country/Sub-region

14.8.2. By Product

14.8.3. By Application

14.8.4. By End-user

Chapter 15. Competition Landscape

15.1. Competition Matrix

15.1.1. GE Healthcare

15.1.2. Whale Imaging Inc.

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

15.2.1. Medtronic (HQ, Business Segments, Employee Strength)

15.2.1.1. Company Details

15.2.1.2. Company Description

15.2.1.3. Business Overview

15.2.1.4. SWOT Analysis

15.2.1.5. Financial Analysis

15.2.1.6. Strategic Overview

15.2.2. GE Healthcare (HQ, Business Segments, Employee Strength)

15.2.2.1. Company Details

15.2.2.2. Company Description

15.2.2.3. Business Overview

15.2.2.4. SWOT Analysis

15.2.2.5. Strategic Overview

15.2.3. Hologic Inc. (HQ, Business Segments, Employee Strength)

15.2.3.1. Company Details

15.2.3.2. Company Description

15.2.3.3. Business Overview

15.2.3.4. SWOT Analysis

15.2.3.5. Strategic Overview

15.2.4. Koninklijke Philips N.V. (HQ, Business Segments, Employee Strength)

15.2.4.1. Company Details

15.2.4.2. Company Description

15.2.4.3. Business Overview

15.2.4.4. SWOT Analysis

15.2.4.5. Strategic Overview

15.2.5. Siemens Healthineers AG (HQ, Business Segments, Employee Strength)

15.2.5.1. Company Details

15.2.5.2. Company Description

15.2.5.3. Business Overview

15.2.5.4. SWOT Analysis

15.2.5.5. Financial Analysis

15.2.5.6. Strategic Overview

15.2.6. Canon Medical System Corporation (HQ, Business Segments, Employee Strength)

15.2.6.1. Company Details

15.2.6.2. Company Description

15.2.6.3. Business Overview

15.2.6.4. SWOT Analysis

15.2.6.5. Financial Analysis

15.2.6.6. Strategic Overview

15.2.7. Shimadzu Corporation (HQ, Business Segments, Employee Strength)

15.2.7.1. Company Details

15.2.7.2. Company Description

15.2.7.3. Business Overview

15.2.7.4. SWOT Analysis

15.2.7.5. Financial Analysis

15.2.7.6. Strategic Overview

15.2.8. Whale Imaging Inc. (HQ, Business Segments, Employee Strength)

15.2.8.1. Company Details

15.2.8.2. Company Description

15.2.8.3. Business Overview

15.2.8.4. SWOT Analysis

15.2.8.5. Financial Analysis

15.2.8.6. Strategic Overview

15.2.9. ATON GmbH (HQ, Business Segments, Employee Strength)

15.2.9.1. Company Details

15.2.9.2. Company Description

15.2.9.3. Business Overview

15.2.9.4. SWOT Analysis

15.2.9.5. Strategic Overview

List of Tables

Table 01: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Product, 2016–2026

Table 02: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast, by C-arms, 2016–2026

Table 03: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 04: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast, by End-user, 2016–2026

Table 05: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Region, 2016–2026

Table 06: North America Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Country, 2016–2026

Table 07: North America Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Product, 2016–2026

Table 08: North America Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Product (C-arms) 2016–2026

Table 09: North America Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 10: North America Surgical Imaging Arms Market Value (US$ Mn) Forecast, by End-user, 2016–2026

Table 11: Europe Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 12: Europe Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Product, 2016–2026

Table 13: Europe Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Product, (C-arms) 2016–2026

Table 14: Europe Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 15: Europe Surgical Imaging Arms Market Value (US$ Mn) Forecast, by End-user, 2016–2026

Table 16: Asia Pacific Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 17: Asia Pacific Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Product, 2016–2026

Table 18: Asia Pacific Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Product, (C-arms) 2016–2026

Table 19: Asia Pacific Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 20: Asia Pacific Surgical Imaging Arms Market Value (US$ Mn) Forecast, by End-user, 2016–2026

Table 21: Latin America Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 22: Latin America Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Product, 2016–2026

Table 23: Latin America Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Product, (C-arms Surgical Imaging Devices) 2016–2026

Table 24: Latin America Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 25: Latin America Surgical Imaging Arms Market Value (US$ Mn) Forecast, by End-user, 2016–2026

Table 26: Middle East & Africa Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 27: Middle East & Africa Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Product, 2016–2026

Table 28: Middle East & Africa Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Product, (C-arms) 2016–2026

Table 29: Middle East & Africa Surgical Imaging Arms Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 30: Middle East & Africa Surgical Imaging Arms Market Value (US$ Mn) Forecast, by End-user, 2016–2026

List of Figures

Figure 01: Global Surgical Imaging Arms Market Size (US$ Mn) and Distribution, by Region, 2018 and 2026

Figure 02: Global Surgical Imaging Arms Market Snapshot of Global Surgical Imaging Arms Market

Figure 03: Global Surgical Imaging Arms Market Opportunity Map, Revenue Share, by Product

Figure 04: Global Surgical Imaging Arms Market Opportunity Map, Revenue Share, by Application

Figure 05: Global Surgical Imaging Arms Market Opportunity Map, Revenue Share, by End user

Figure 06: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 07: Global Surgical Imaging Arms Market Value Share, by Product (2017)

Figure 08: Global Surgical Imaging Arms Market Value Share, by Application (2017)

Figure 09: Global Surgical Imaging Arms Market Value Share, by End-user (2017)

Figure 10: Global Surgical Imaging Arms Market Value Share Analysis, by Product, 2018 and 2026

Figure 11: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by C-arms, 2016–2026

Figure 12: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by O-arms, 2016–2026

Figure 13: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by G-arms, 2016–2026

Figure 14: Global Surgical Imaging Arms Market Attractiveness, by Product, 2018–2026

Figure 15: Global Surgical Imaging Arms Market Value Share Analysis, by Application, 2017 and 2026

Figure 16: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Orthopedic, 2016–2026

Figure 17: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Cardiovascular, 2016–2026

Figure 18: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Pain Management, 2016–2026

Figure 19: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Urology, 2016–2026

Figure 20: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2016–2026

Figure 21: Global Surgical Imaging Arms Market Attractiveness, by Application, 2018–2026

Figure 22: Global Surgical Imaging Arms Market Value Share Analysis, by End-user, 2017 and 2026

Figure 23: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hospitals & Ambulatory Surgical Centers 2016–2026

Figure 24: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Academic & Research Institutes, 2016–2026

Figure 25: Global Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2016–2026

Figure 26: Global Surgical Imaging Arms Market Attractiveness, by End-user, 2018–2026

Figure 27: Global Surgical Imaging Arms Market Value Share (%), by Region, 2018 and 2026

Figure 28: Global Surgical Imaging Arms Market Attractiveness, by Region, 2018–2026

Figure 29: North America Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 30: North America Surgical Imaging Arms Market Value Share, by Country, 2017 and 2026

Figure 31: North America Surgical Imaging Arms Market Attractiveness, by Country, 2017–2026

Figure 32: North America Surgical Imaging Arms Market Value Share, by Product, 2017 and 2026

Figure 33: North America Surgical Imaging Arms Market Attractiveness, by Product, 2017–2026

Figure 34: North America Surgical Imaging Arms Market Value Share, by Application, 2017 and 2026

Figure 35: North America Surgical Imaging Arms Market Attractiveness, by Application, 2017–2026

Figure 36: North America Surgical Imaging Arms Market Value Share, by End-user, 2017 and 2026

Figure 37: North America Surgical Imaging Arms Market Attractiveness, by End-user, 2017–2026

Figure 38: Europe Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 39: Europe Surgical Imaging Arms Market Value Share, by Country/Sub-region, 2017 and 2026

Figure 40: Europe Surgical Imaging Arms Market Attractiveness, by Country/Sub-region, 2017–2026

Figure 41: Europe Surgical Imaging Arms Market Value Share, by Product, 2017 and 2026

Figure 42: Europe Surgical Imaging Arms Market Attractiveness, by Product, 2017–2026

Figure 43: Europe Surgical Imaging Arms Market Value Share, by Application, 2017 and 2026

Figure 44: Europe Surgical Imaging Arms Market Attractiveness, by Application, 2017–2026

Figure 45: Europe Surgical Imaging Arms Market Value Share, by End-user, 2017 and 2026

Figure 46: Europe Surgical Imaging Arms Market Attractiveness, by End-user, 2017–2026

Figure 47: Asia Pacific Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 48: Asia Pacific Surgical Imaging Arms Market Value Share, by Country/Sub-region, 2017 and 2026

Figure 49: Asia Pacific Surgical Imaging Arms Market Attractiveness, by Country/Sub-region, 2017–2026

Figure 50: Asia Pacific Surgical Imaging Arms Market Value Share, by Product, 2017 and 2026

Figure 51: Asia Pacific Surgical Imaging Arms Market Attractiveness, by Product, 2017–2026

Figure 52: Asia Pacific Surgical Imaging Arms Market Value Share, by Application, 2017 and 2026

Figure 53: Asia Pacific Surgical Imaging Arms Market Attractiveness, by Application, 2017–2026

Figure 54: Asia Pacific Surgical Imaging Arms Market Value Share, by End-user, 2017 and 2026

Figure 55: Asia Pacific Surgical Imaging Arms Market Attractiveness, by End-user, 2017–2026

Figure 56: Latin America Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 57: Latin America Surgical Imaging Arms Market Value Share, by Country/Sub-region, 2017 and 2026

Figure 58: Latin America Surgical Imaging Arms Market Attractiveness, by Country/Sub-region, 2017–2026

Figure 59: Latin America Surgical Imaging Arms Market Value Share, by Product, 2017 and 2026

Figure 60: Latin America Surgical Imaging Arms Market Attractiveness, by Product, 2017–2026

Figure 61: Latin America Surgical Imaging Arms Market Value Share, by Application, 2017 and 2026

Figure 62: Latin America Surgical Imaging Arms Market Attractiveness, by Application, 2017–2026

Figure 63: Latin America Surgical Imaging Arms Market Value Share, by End-user, 2017 and 2026

Figure 64: Latin America Surgical Imaging Arms Market Attractiveness, by End-user, 2017–2026

Figure 65: Middle East & Africa Surgical Imaging Arms Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 66: Middle East & Africa Surgical Imaging Arms Market Value Share, by Country/Sub-region, 2017 and 2026

Figure 67: Middle East & Africa Surgical Imaging Arms Market Attractiveness, by Country/Sub-region, 2017–2026

Figure 68: Middle East & Africa Surgical Imaging Arms Market Value Share, by Product, 2017 and 2026

Figure 69: Middle East & Africa Surgical Imaging Arms Market Attractiveness, by Product, 2017–2026

Figure 70: Middle East & Africa Surgical Imaging Arms Market Value Share, by Application, 2017 and 2026

Figure 71: Middle East & Africa Surgical Imaging Arms Market Attractiveness, by Application, 2017–2026

Figure 72: Middle East & Africa Surgical Imaging Arms Market Value Share, by End-user, 2017 and 2026

Figure 73: Middle East & Africa Surgical Imaging Arms Market Attractiveness, by End-user, 2018–2026