Global Sulfone Polymers Market: Snapshot

Several grades/varieties of sulfone polymers have gained vast applicability across a number of industries in the past few years. The relatively higher level of resistance wear and corrosion provided by these materials as compared to metals have increased their usage in medical devices and implants. Owing to their high transparency resistance, low weight, and high performance, the demand for sulfone polymers is also rising in the automotive industry for use in optical reflectors, headlight bezels, fog lamp housings, oil pumps, oil pistons, and impellers. Increase in environmental awareness and shifting trend of automotive manufacturers toward low-weight materials for fuel efficiency and better performance are estimated to offer growth opportunities to the sulfone polymers market from 2016 to 2024.

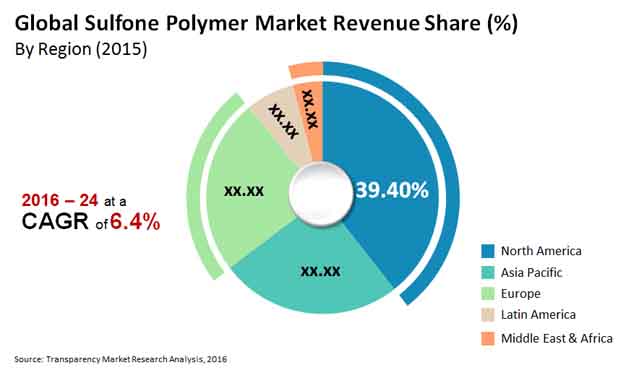

Transparency Market Research states that the global sulfone polymers market was valued at US$805.4 mn in 2015 and is will rise to US$1,394.7 mn in 2024, exhibiting a CAGR of 6.4% between 2016 and 2024.

Applications across Automobile Industry to Continue to Gain Larger Share in Overall Market

In terms of applications, the report examines the various applications of sulfone polymer across applications in the medical, automotive, aerospace, consumer goods, electrical and electronics, and industrial sectors. Of these, the applications of sulfone polymer across the medical sector led to the most promising returns, accounting for nearly 24% of the overall market in 2015. The segment is anticipated to continue its dominance during the forecast period as well, chiefly owing to the continuous growth in the global medical industry and the availability of vast variety of medical grade sulfone polymer product varieties in the global market.

Share of segments such as automotive and aerospace are expected to exhibit moderate yet steady growth in the global market in the next few years owing to the stable rise in demand for lightweight and high-performance materials in these segments. Both the segments are expected to exhibit a nearly 6.5% CAGR over the period between 2016 and 2024.

Sustainable Demand across Medical Industry to Keep North America and Europe in Dominant Positions

In terms of volume, North America held the dominant share of more than 39% in the global sulfone polymer market in 2015, in terms of revenue, and the trend is expected to remain strong in the next few years as well. However, the in North America, similar to the market in Europe, is projected to expand at a moderate pace during the forecast period, as the key end-use industries are well-established in these regions, with little scope for further expansion due to market stagnation.

Nevertheless, the rising medical industry in the regions is expected to drive the sulfone polymer market notably by the end of the forecast period. Resurgence of the automotive market in the U.S. and healthy growth of the medical devices market is also likely to provide momentum to the sulfone polymer market in North America and Europe.

However, the overall performance of the sulfone polymer market in North America and Europe regions is expected to be less promising than the Asia Pacific market over the period between 2016 and 2024. China is projected to be one of the key consumers of sulfone polymers in the region over the said period. Other countries such as Japan, South Korea, and India are also expected to be promising markets for sulfone during the forecast period. High demand for sulfone polymers in the production of automotive, electrical and electronic components, and rise in demand for sulfone polymers in membrane manufacturing are expected to be the key factors propelling the sulfone polymers market in Asia Pacific.

In the highly consolidated market for sulfone polymers, some of the key players are BASF SE, Solvay S.A., Sumitomo Chemical Co., Ltd., and Sabic.

Sulfone Polymers Market to Observe Growth from Rising Popularity of Electric Vehicles

Increasing construction activity in rapidly developing countries such as South Africa, Brazil, the Philippines, India, and China is expected to increase demand for electronic goods, which is likely to work in favor of the global sulfone polymer market. Furthermore, increasing demand for electric Vehicles, along with increased understanding of GHG emissions across the globe, the demand for sulfone polymer in the automotive industry is likely to rise in the forthcoming years.

Engineering thermoplastics with excellent heat-deflection temperatures and dimensional stiffness are known as sulfone polymers. They are the only thermoplastics that can maintain transparency at temperatures of up to 400°F. With growing demand from consumer goods sector, the global sulfone polymers market is likely to expand significantly. Sulfone polymers are a kind of high-heat plastic that has a distinct advantage. This thermoplastic polymer comes with a lot of resilience and flexibility at high temperatures. It is commonly utilized in a variety of end-user sectors, including electronics, healthcare, aerospace, food processing, and automobiles amongst many others, due to its flexible qualities. For a variety of high-temperature applications, sulfone polymer is extremely rigid, durable, and stable. It's suitable for automobiles and aircraft interiors because of its chemical resistance, low smoke production, and low point flammability.

Wide Scope of Use in the Aerospace Industry to Accentuate Demand in the Market

Sulfone polymers have improved properties that enable them to be used in automotive applications, such as excellent flame retardancy, oxidation resistance, increased hardness, high strength, high thermal stability, and dimensional stability at higher temperature. In addition, a growing trend in the aerospace sector to replace metals with low-weight engineering materials is likely to give a major boost to the global sulfone polymers market.

Product makers are being forced to develop lightweight and robust components for revolutionary applications as the need for optimal fuel consumption in aircraft grows. For example, BASF provides a PESU-grade strengthened with 30% carbon fibres that are primarily utilized in the aviation sector due to its high strength and light weight.

Strict regulations governing the use of sulfone polymers in some of the domestic industries are expected to stifle the development of the sulfone polymers industry in the coming years. Many regulatory authorities need to approve the use of sulfone polymers in several industries, particularly in the medical industries and aerospace. These factors are estimated to support growth of the global sulfone polymers market in the years to come.

1. Preface

1.1. Report Scope And Market Segmentation

1.2. Research Highlights

1.3. Research Objectives

1.4. Key Questions Answered

2. Assumptions And Research Methodology

2.1. Report Assumptions

2.2. Abbreviations Used

2.3. Research Methodology

3. Executive Summary

3.1. Global Sulfone Polymers Market Size, By Market Value (U$ Bn) And Market Value Share, By Region

3.2. Key Trends

4. Market Overview

4.1. Product Overview

4.2. Key Industry Developments

4.3. Market Indicators

4.4. Drivers And Restraints Snapshot Analysis

4.4.1. Drivers

4.4.1.1. Rising demand from the medical industry

4.4.1.2. Growing use of sulfone polymer membranes

4.4.1.3. Increasing number of applications in automobiles

4.4.2. Restraints

4.4.2.1. Regulatory barriers in end-use applications

4.4.2.2. High development costs and high product costs

4.4.2.3. High lead time

4.4.3. Opportunities

4.5. Value Chain Analysis

4.6. Porter’s Analysis

5. Global Sulfone Polymers Market Analysis And Forecasts, By Product

5.1. Key Findings

5.2. Introduction

5.3. .Market Size (Tons) (Us$ Mn) Forecast By Product

5.4. Sulfone Polymers Market Forecast By Product

5.5. Sulfone Polymers Market Attractiveness Analysis By Product

6. Global Sulfone Polymers Market Analysis And Forecasts, By Application

6.1. Key Findings

6.2. Introduction

6.3. Market Size (Us$ Mn) Forecast By Application

6.4. Market Size (Tons) Forecast By Application

6.5. Market Size (Us$ Mn) Forecast By Application

6.6. Sulfone Polymers Market Attractiveness Analysis By Application

6.7. Application Comparison Matrix

7. Sulfone Polymers Market Analysis By Region

7.1. Global Regulatory Scenario

7.2. Market Size (Tons) (Us$ Mn) Forecast By Region

7.3. Sulfone Polymers Market Attractiveness Analysis, By Region Type

8. North America Sulfone Polymers Market Analysis

8.1. Key Findings

8.2. North America Sulfone Polymers Market Overview

8.3. North America Market Value Share Analysis, By Product

8.4. North America Market Forecast By Product

8.5. North America Market Value Share Analysis, By Application

8.6. North America Market Forecast By Application Type

8.7. North America Market Value Share Analysis, By Country

8.8. North America Market Forecast By Country

8.9. North America Market Attractiveness Analysis

8.10. Market Trends

9. Europe Sulfone Polymers Market Analysis

9.1. Key Findings

9.2. Europe Sulfone Polymers Market Overview

9.3. Europe Market Value Share Analysis, By Product

9.4. Europe Market Forecast By Product

9.5. Europe Market Value Share Analysis, By Application

9.6. Europe Market Forecast By Application Type

9.7. Europe Market Value Share Analysis, By Country

9.8. Europe Market Forecast By Country

9.9. Europe Market Attractiveness Analysis

9.10. Market Trends

10. Asia Pacific Sulfone Polymers Market Analysis

10.1. Key Findings

10.2. Asia Pacific Sulfone Polymers Market Overview

10.3. Asia Pacific Market Value Share Analysis, By Product

10.4. Asia Pacific Market Forecast By Product

10.5. Asia Pacific Market Value Share Analysis, By Application

10.6. Asia Pacific Market Forecast By Application Type

10.7. Asia Pacific Market Value Share Analysis, By Country

10.8. Asia Pacific Market Forecast By Country

10.9. Asia Pacific Market Attractiveness Analysis

10.10. Market Trends

11. Middle East And Africa (Mea) Sulfone Polymers Market Analysis

11.1. Key Findings

11.2. Middle East And Africa Sulfone Polymers Market Overview

11.3. Middle East And Africa Market Value Share Analysis, By Product

11.4. Middle East And Africa Market Forecast By Product

11.5. Middle East And Africa Market Value Share Analysis, By Application

11.6. Middle East And Africa Market Forecast By Application Type

11.7. Middle East And Africa Market Value Share Analysis, By Country

11.8. Middle East And Africa Market Forecast By Country

11.9. Middle East And Africa Market Attractiveness Analysis

11.10. Market Trends

12. Latin America Sulfone Polymers Market Analysis

12.1. Key Findings

12.2. Latin America Sulfone Polymers Market Overview

12.3. Latin America Market Value Share Analysis, By Product

12.4. Latin America Market Forecast By Product

12.5. Latin America Market Value Share Analysis, By Application

12.6. Latin America Market Forecast By Application Type

12.7. Latin America Market Value Share Analysis, By Country

12.8. Latin America Market Forecast By Country

12.9. Latin America Market Attractiveness Analysis

12.10. Market Trends

13. Competition Landscape

13.1. Sulfone Polymers Market Share Analysis, By Company (2015)

13.2. Competition Matrix

13.3. Key Players

13.3.1.1. Solvay S.A.

13.3.1.2. Company Overview

13.3.1.3. Financial Overview

13.3.1.4. Business Strategy

13.3.1.5. Swot Analysis

13.3.1.6. Recent Developments

13.3.2. Basf Se

13.3.2.1. Company Overview

13.3.2.2. Financial Overview

13.3.2.3. Business Strategy

13.3.2.4. Swot Analysis

13.3.2.5. Recent Developments

13.3.3. Sumitomo Chemical Co., Ltd.

13.3.3.1. Company Overview

13.3.3.2. Financial Overview

13.3.3.3. Business Strategy

13.3.3.4. Swot Analysis

13.3.3.5. Recent Developments

13.3.4. Sabic

13.3.4.1. Company Overview

13.3.4.2. Financial Overview

13.3.4.3. Business Strategy

13.3.4.4. Swot Analysis

13.3.4.5. Recent Developments

13.3.5. Uju New Materials Co. Ltd.

13.3.5.1. Company Overview

13.3.5.2. Financial Overview

13.3.5.3. Business Strategy

13.3.5.4. Swot Analysis

13.3.5.5. Recent Developments

List of Tables

Table 01: Global Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type, 2015–2024

Table 02: Global Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2015–2024

Table 03: Global Sulfone Polymers Market Size (US$ Mn) and Volume (Units) Forecast, By Region Type, 2015–2024

Table 04: North America Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, By Product Type, 2015–2024

Table 05: North America Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, By Application Type, 2015–2024

Table 06: North America Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, By Country, 2015–2024

Table 07: Europe Sulfone Polymers Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2015–2024

Table 08: Europe Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 09: Europe Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015–2024

Table 10: Asia Pacific Sulfone Polymers Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2015–2024

Table 11: Asia Pacific Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 12: Asia Pacific Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015–2024

Table 13: Middle East & Africa Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, By Product Type, 2015–2024

Table 14: Middle East & Africa Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, By Application Type, 2015–2024

Table 15: Middle East & Africa Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, By Country, 2015–2024

Table 16: Latin America Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, By Product Type, 2015–2024

Table 17: Latin America Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, By Application Type, 2015–2024

Table 18: Latin America Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, By Country, 2015–2024

List of Figures

Figure 1: Global Sulfone Polymers Market

Figure 02: Global Sulfone Polymers Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 03: Sulfone Polymers Market Attractiveness Analysis, by Product Type

Figure 04: Global Sulfone Polymers Market Value Share Analysis, by Application Type, 2015 and 2024

Figure 05: Sulfone Polymers Market Attractiveness Analysis, by Application Type

Figure 06: Global Sulfone Polymers Market Value Share Analysis By Region Type, 2016 and 2024

Figure 07: Sulfone Polymers Market Attractiveness Analysis, By Region Type

Figure 08: North America Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 09: North America Sulfone Polymers Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 10: North America Market Attractiveness Analysis By Country

Figure 11: North America Market Value Share Analysis By Product Type, 2015 and 2024

Figure 12: North America Market Value Share Analysis By Application Type, 2015 and 2024

Figure 13: North America Market Value Share Analysis By Country, 2016 and 2024

Figure 14: Europe Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 15: Europe Sulfone Polymers Market Size and Volume, Y-o-Y Growth Projections, 2015–2024

Figure 16: Europe Sulfone Polymers Market Attractiveness Analysis, by Country

Figure 17: Europe Sulfone Polymers Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 18: Europe Sulfone Polymers Market Value Share Analysis, by Application, 2015 and 2024

Figure 19: Europe Sulfone Polymers Market Value Share Analysis, by Country, 2015 and 2024

Figure 20: Asia Pacific Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 21: Asia Pacific Sulfone Polymers Market Size and Volume, Y-o-Y Growth Projections, 2015–2024

Figure 22: Asia Pacific Sulfone Polymers Market Attractiveness Analysis, by Country

Figure 23: Asia Pacific Sulfone Polymers Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 24: Asia Pacific Sulfone Polymers Market Value Share Analysis, by Application, 2015 and 2024

Figure 25: Asia Pacific Sulfone Polymers Market Value Share Analysis, by Country, 2015 and 2024

Figure 26: MEA Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 27: MEA Sulfone Polymers Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 28: Middle East and Africa Market Attractiveness Analysis By Country

Figure 29: MEA Market Value Share Analysis By Product Type, 2015 and 2024

Figure 30: MEA Market Value Share Analysis By Application Type, 2015 and 2024

Figure 31: MEA Market Value Share Analysis By Country, 2015 and 2024

Figure 32: Latin America Sulfone Polymers Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 33: MEA Sulfone Polymers Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 34: MEA Market Attractiveness Analysis By Country

Figure 35: MEA Market Value Share Analysis By Product Type, 2016 and 2024

Figure 36: Latin America Market Value Share Analysis By Application Type, 2016 and 2024

Figure 37: MEA Market Value Share Analysis By Country, 2016 and 2024

Figure 38: Global Sulfone Polymers Market Share Analysis By Company (2015) Figure 1. Market Segmentation