Analysts’ Viewpoint on Global Substance Abuse Treatment Market Scenario

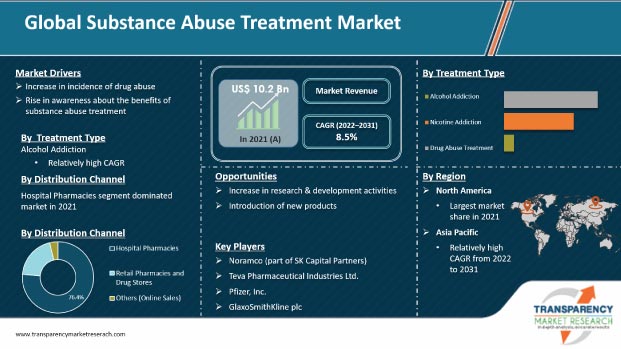

Rise in awareness about the negative effects of substance abuse, introduction of new programs, and increase in number of rehabilitation centers globally are expected to contribute to the growth of the global substance abuse treatment market during the forecast period. Moreover, a growing number of treatment centers holding partnerships with private recovery facilities are entering the market, resulting in easy access to treatment for a larger population. Awareness initiatives introduced and run by governments & manufacturers; rise in prescription drug abuse, favorable reimbursements for smoking cessation therapy; and importance of addiction treatment are the prominent factors driving the global addiction treatment market. Furthermore, rise in awareness spread through television advertisements, newspapers, information brochures, and other media is also contributing to the growth of the global market.

The term 'substance abuse' refers to a pattern of drug or substance usage that results in serious issues or distress. Addiction to illegal substances such as marijuana, heroin, cocaine, or methamphetamine is referred to as substance abuse, which is a recognized medical brain problem; or it could involve abusing substances that are legal, including alcohol, cigarettes, or prescription drugs. The most frequently abused legal substance is alcohol.

According to the 2021 World Drug Report, which was released by the United Nations Office on Drugs and Crime, over 36 million individuals in the world have drug use disorders and over 275 million people used drugs in the previous year (UNODC). The report stated that the number of drug users increased by 22% between 2010 and 2019 due in part to the growing world population. As per the forecast, the number of drug users globally will increase by 11% by 2030, with a notable rise of 40% in Africa due to its fast expanding and youthful population.

Rise in drug awareness campaigns, preventative initiatives, and increase in the population's addiction rate are propelling the global substance abuse treatment market. One of the primary factors contributing to the growth of the market is the increase in drug awareness campaigns and related preventive initiatives. This involves encouraging governments in various countries to stop the use of drugs and increasing patient awareness about their condition.

Governments in developed and developing countries are launching awareness initiatives about the negative effects of substance misuse, and trying to persuade people to choose early treatment in an effort to lower mortality and morbidity rates. For instance, the Substance Abuse and Mental Health Services Administration (SAMHSA) works primarily to spread awareness about various addictions & their treatments, and is leading several campaigns across the U.S. to reduce the impact of substance abuse on society. SAMHSA is an agency working under the U.S. Department of Health and Human Services. Some of the major campaigns run by the organization include the AWARxE Prescription Drug Safety Program, Above the Influence, and NIDA for Teens: The Science Behind Drug Abuse.

In December 2021, the Government of India launched the "Drug-Free India" campaign and issued guidelines to reduce drug abuse among Indians. Similarly, in October 2021, the Centers for Disease Control and Prevention (CDC) launched four complementary education campaigns aimed at young adults aged 18 to 34 years old, with the goal of preventing drug overdose deaths. Such campaigns and initiatives raise awareness about substance abuse treatment among the addicted population.

In 2019, the Food and Drug Administration approved Spravato (esketamine) nasal spray in combination with an oral antidepressant for the treatment of depression in adults who have tried and failed other antidepressant medications (treatment-resistant depression). Due to the risk of serious adverse outcomes from Spravato administration's sedation and dissociation, as well as the drug's potential for abuse and misuse, it is only available through a restricted distribution system as part of the Risk Evaluation and Mitigation Strategy (REMS). Hence, increase in initiatives by governments and welfare agencies to spread awareness about substance abuse and its treatments is expected to drive the global market during the forecast period.

Alcohol consumption has long been a common practice in several countries. Nonetheless, easy access, fewer government restrictions, and large-scale licensed production have resulted in an increase in alcohol dependency. According to the World Bank, the global average alcohol consumption per capita was estimated at 6.18 liters of pure alcohol in 2018. Moreover, rise in awareness about alcohol use disorder and increase in the number of rehabilitation facilities are propelling the global market.

According to the WHO, nearly one-third population of the U.S. consumes enough alcohol to be considered at risk of alcohol addiction, and alcohol abuse is responsible for around three million deaths each year accounting for 5.3% of all deaths. However, there are numerous options for alcohol addiction treatment. Alcohol abuse treatment includes counselling and group therapy. However, depending on the circumstances, medications are frequently prescribed in conjunction with general alcohol addiction treatment options.

As companies are growing their customer pool, drug abuse treatment providers and manufacturers of drug abuse treatment products are focusing on generating awareness among people and drug store owners about the adverse effects of drug abuse and the importance of abuse treatment. For instance, in July 2021, Adial Pharmaceuticals, a clinical-stage biopharmaceutical company focused on the development of addiction treatments, reported significant progress in its pivotal ONWARD phase 3 clinical trial evaluating AD04 as a therapeutic agent for the treatment of Alcohol Use Disorder (AUD). It achieved 100% of its patient screening target and 90% of its patient enrollment target.

In terms of treatment type, the drug abuse treatment segment is projected to dominate the global market, accounting for around 52% share by 2031. Drug abuse treatment is a medical treatment for compulsive behavior/habit that involves excessive and self-damaging use/consumption of drugs or substances, which normally leads to addiction or dependence. It could lead to serious physiological injury such as damage to heart, kidney, and liver, and also psychological harm including hallucinations, dysfunctional behavior patterns, and memory loss. Rise in usage of prescription drugs/illicit drugs, increase in the number of deaths from excessive use of prescription drugs, and surge in research & development by leading pharmaceutical companies during the forecast period drive the demand for drug abuse treatment.

The prevalence of prescription drug abuse is rising rapidly. This, in turn, is increasing the rate of overdose deaths and the frequency of emergency room visits. The nonmedical consumption of prescription drugs is rising rapidly. The high incidence of comorbid illnesses is responsible for wrong prescriptions and addiction to prescription drugs among the elderly. A continuous rise in the abuse of prescription drugs is expected to propel the demand for drug abuse treatments.

Based on distribution channel, the hospital pharmacies segment accounted for a key share of around 50% of the global market in 2021. The segment is likely to be driven by increase in demand for prescription filling at hospital pharmacies, availability of certified physicians, advice for use of the drugs from certified physicians, and authenticity of quality and price of the medicines.

Hospital pharmacies have emerged as the preferred channel of distribution for substance abuse treatment. Drug compounding is the process of combining, mixing, or modifying pharmaceutical ingredients to create medications that are tailored to an individual's needs. The presence of skilled professionals capable of performing such tasks in hospitals has resulted in the increase in demand for the procedure of drug compounding in hospital pharmacies. These factors are expected to propel the segment over the next few years.

North America dominated the global substance abuse treatment market in 2021. The market in the region is anticipated to grow at a CAGR of 9.2% from 2022 to 2031. The U.S. is expected to dominate the market in North America over the next few years due to rise in tobacco use and surge in the number of government initiatives aimed at reducing substance abuse.

According to a December 2020 update from the Centers for Disease Control and Prevention (CDC), nearly 14 out of every 100 adults in the U.S. aged 18 years and above (14%) smoked cigarettes in 2019. As per the same source, an estimated 34.1 million adults in the country currently smoke cigarettes, and more than 16 million suffer from a smoking-related disease. With such a large addiction population in the country, there will be a greater demand for addiction treatment, which is likely to drive the market in the U.S.

The U.S. Government is implementing a number of initiatives to monitor symptoms and determine drug abuse among the population. For instance, according to a February 2022 update, the U.S. and the U.K. are providing free Narcan, a brand name for the medication naloxone, in 16 counties to help reduce overdose deaths. Such initiatives will help to supplement countries growing treatment for substance abuse. These factors are anticipated to fuel the expansion of the global substance abuse treatment market.

The market in Asia Pacific is likely to grow at a high CAGR during the forecast period due to improvements in healthcare infrastructure and rise in demand for substance abuse treatment programs in emerging economies such as China and India. Moreover, increase in prevalence of substance abuse disorders in key countries and ongoing regulatory initiatives to combat it are projected to propel the market in the region during the forecast period.

The global substance abuse treatment market report concludes with the company profiles section, which includes information about key players in the global substance abuse treatment market.

Leading players analyzed in the report include Alkermes, Allergan plc, Indivior plc, Noramco (part of SK Capital Partners), Teva Pharmaceutical Industries Ltd., Pfizer, Inc., GlaxoSmithKline plc, Mallinckrodt plc, BioCorRx, Inc., and Glenmark Pharmaceuticals Ltd.

Each of these players has been profiled in the substance abuse treatment market report based on parameters such as company overview, financial overview, business strategies, application portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 10.2 Bn |

|

Market Forecast Value in 2031 |

US$ 23.1 Bn |

|

Growth Rate (CAGR) |

8.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global substance abuse treatment market was valued at US$ 10.2 Bn in 2021.

The global substance abuse treatment market is projected to surpass US$ 23.1 Bn by 2031.

The global substance abuse treatment market is anticipated to grow at a CAGR of 8.5% from 2022 to 2031.

New product launches, increase in incidence of drug abuse, and rise in awareness about the benefits of substance abuse treatment are driving the global market.

The hospital pharmacies segment held over 75% share of the global substance abuse treatment market in 2021.

North America is expected to account for a key share of the global substance abuse treatment market during the forecast period.

Prominent players in the global substance abuse treatment market are Alkermes, Allergan plc, Indivior plc, Noramco (part of SK Capital Partners), Teva Pharmaceutical Industries Ltd., Pfizer, Inc., GlaxoSmithKline plc, Mallinckrodt plc, BioCorRx, Inc., and Glenmark Pharmaceuticals Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Substance Abuse Treatment Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Substance Abuse Treatment Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Pipeline Analysis

5.2. Porter’s Five Force Analysis

5.3. Value Chain Analysis

5.4. Key Industry Development

5.5. Top Company’s Product Specification Details

6. Global Substance Abuse Treatment Market Analysis and Forecast, by Treatment Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Treatment Type, 2017–2031

6.3.1. Alcohol Addiction

6.3.1.1. Disulfiram

6.3.1.2. Acamprosate

6.3.1.3. Naltrexone

6.3.1.4. Others

6.3.2. Nicotine Addiction

6.3.2.1. Total NRT Therapy

6.3.2.2. Varenicline

6.3.2.3. Bupropion

6.3.3. Drug Abuse Treatment

6.3.3.1. Methadone

6.3.3.2. Buprenorphine

6.3.3.3. Naltexone

6.4. Market Attractiveness Analysis, by Treatment Type

7. Global Substance Abuse Treatment Market Analysis and Forecast, by Distribution Channel Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Distribution Channel, 2017–2031

7.3.1. Hospital Pharmacies

7.3.2. Retail Pharmacies & Drug Stores

7.3.3. Others (online sales)

7.4. Market Attractiveness Analysis, by Distribution Channel

8. Global Substance Abuse Treatment Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Substance Abuse Treatment Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Treatment Type, 2017–2031

9.2.1. Alcohol Addiction

9.2.1.1. Disulfiram

9.2.1.2. Acamprosate

9.2.1.3. Naltrexone

9.2.1.4. Others

9.2.2. Nicotine Addiction

9.2.2.1. Total NRT Therapy

9.2.2.2. Varenicline

9.2.2.3. Bupropion

9.2.3. Drug Abuse Treatment

9.2.3.1. Methadone

9.2.3.2. Buprenorphine

9.2.3.3. Naltexone

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies & Drug Stores

9.3.3. Others (online sales)

9.3.4. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.5. Hospital Pharmacies

9.3.6. Retail Pharmacies & Drug Stores

9.3.7. Others (online sales)

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Treatment Type

9.5.2. By Distribution Channel Type

9.5.3. By Country

10. Europe Substance Abuse Treatment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Treatment Type, 2017–2031

10.2.1. Alcohol Addiction

10.2.1.1. Disulfiram

10.2.1.2. Acamprosate

10.2.1.3. Naltrexone

10.2.1.4. Others

10.2.2. Nicotine Addiction

10.2.2.1. Total NRT Therapy

10.2.2.2. Varenicline

10.2.2.3. Bupropion

10.2.3. Drug Abuse Treatment

10.2.3.1. Methadone

10.2.3.2. Buprenorphine

10.2.3.3. Naltexone

10.3. Market Value Forecast, by Distribution Channel, 2017–2031

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies & Drug Stores

10.3.3. Others (online sales)

10.3.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Treatment Type

10.5.2. By Distribution Channel Type

10.5.3. By Country/Sub-region

11. Asia Pacific Substance Abuse Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Treatment Type, 2017–2031

11.2.1. Alcohol Addiction

11.2.1.1. Disulfiram

11.2.1.2. Acamprosate

11.2.1.3. Naltrexone

11.2.1.4. Others

11.2.2. Nicotine Addiction

11.2.2.1. Total NRT Therapy

11.2.2.2. Varenicline

11.2.2.3. Bupropion

11.2.3. Drug Abuse Treatment

11.2.3.1. Methadone

11.2.3.2. Buprenorphine

11.2.3.3. Naltexone

11.3. Market Value Forecast, by Distribution Channel, 2017–2031

11.3.1. Hospital Pharmacies

11.3.2. Retail Pharmacies & Drug Stores

11.3.3. Others (online sales)

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. Japan

11.4.2. China

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of APAC

11.5. Market Attractiveness Analysis

11.5.1. By Treatment Type

11.5.2. By Distribution Channel Type

11.5.3. By Country/Sub-region

12. Latin America Substance Abuse Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Treatment Type, 2017–2031

12.2.1. Alcohol Addiction

12.2.1.1. Disulfiram

12.2.1.2. Acamprosate

12.2.1.3. Naltrexone

12.2.1.4. Others

12.2.2. Nicotine Addiction

12.2.2.1. Total NRT Therapy

12.2.2.2. Varenicline

12.2.2.3. Bupropion

12.2.3. Drug Abuse Treatment

12.2.3.1. Methadone

12.2.3.2. Buprenorphine

12.2.3.3. Naltexone

12.3. Market Value Forecast, by Distribution Channel, 2017–2031

12.3.1. Hospital Pharmacies

12.3.2. Retail Pharmacies & Drug Stores

12.3.3. Others (online sales)

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of LATAM

12.5. Market Attractiveness Analysis

12.5.1. By Treatment Type

12.5.2. By Distribution Channel Type

12.5.3. By Country/Sub-region

13. Middle East & Africa Substance Abuse Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Treatment Type, 2017–2031

13.2.1. Alcohol Addiction

13.2.1.1. Disulfiram

13.2.1.2. Acamprosate

13.2.1.3. Naltrexone

13.2.1.4. Others

13.2.2. Nicotine Addiction

13.2.2.1. Total NRT Therapy

13.2.2.2. Varenicline

13.2.2.3. Bupropion

13.2.3. Drug Abuse Treatment

13.2.3.1. Methadone

13.2.3.2. Buprenorphine

13.2.3.3. Naltexone

13.3. Market Value Forecast, by Distribution Channel, 2017–2031

13.3.1. Hospital Pharmacies

13.3.2. Retail Pharmacies & Drug Stores

13.3.3. Others (online sales)

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of MEA

13.5. Market Attractiveness Analysis

13.5.1. By Treatment Type

13.5.2. By Distribution Channel Type

13.5.3. By Country/Sub-region

14. Competitive Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. Alkermes

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Company Financials

14.3.1.3. Growth Strategies

14.3.1.4. SWOT Analysis

14.3.2. Allergan plc

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Company Financials

14.3.2.3. Growth Strategies

14.3.2.4. SWOT Analysis

14.3.3. Indivior plc

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Company Financials

14.3.3.3. Growth Strategies

14.3.3.4. SWOT Analysis

14.3.4. Noramco (part of SK Capital Partners)

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Company Financials

14.3.4.3. Growth Strategies

14.3.4.4. SWOT Analysis

14.3.5. Teva Pharmaceutical Industries Ltd.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Company Financials

14.3.5.3. Growth Strategies

14.3.5.4. SWOT Analysis

14.3.6. Pfizer, Inc.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Company Financials

14.3.6.3. Growth Strategies

14.3.6.4. SWOT Analysis

14.3.7. GlaxoSmithKline plc

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Company Financials

14.3.7.3. Growth Strategies

14.3.7.4. SWOT Analysis

14.3.8. Mallinckrodt plc

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Company Financials

14.3.8.3. Growth Strategies

14.3.8.4. SWOT Analysis

14.3.9. BioCorRx, Inc.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Company Financials

14.3.9.3. Growth Strategies

14.3.9.4. SWOT Analysis

14.3.10. Glenmark Pharmaceuticals Ltd.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Company Financials

14.3.10.3. Growth Strategies

14.3.10.4. SWOT Analysis

List of Tables

Table 1: Global Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 2: Global Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Alcohol Addiction Treatment

Table 3: Global Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Nicotine Addiction Treatment

Table 4: Global Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Drug Abuse Treatment, 2017–2031

Table 5: Global Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 6: Global Substance Abuse Treatment Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 7: North America Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2031

Table 8: North America Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Alcohol Addiction Treatment, 2017–2031

Table 9: North America Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Nicotine Addiction Treatment, 2017–2031

Table 10: North America Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Drug Abuse Treatment, 2017–2031

Table 11: North America Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Distribution Channel

Table 12: North America Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 13: Europe Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2031

Table 14: Europe Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Alcohol Addiction Treatment,

Table 15: Europe Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Nicotine Addiction Treatment, 2017–2031

Table 16: Europe Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Drug Abuse Treatment, 2017–2031

Table 17: Europe Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 18: Europe Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 19: Asia Pacific Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2031

Table 20: Asia Pacific Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Alcohol Addiction Treatment, 2017–2031

Table 21: Asia Pacific Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Nicotine Addiction Treatment, 2017–2031

Table 22: Asia Pacific Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Drug Abuse Treatment

Table 23: Asia Pacific Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Distribution Channel

Table 24: Asia Pacific Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 25: Latin America Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2031

Table 26: Latin America Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Alcohol Addiction Treatment, 2017–2031

Table 27: Latin America Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Nicotine Addiction Treatment, 2017–2031

Table 28: Latin America Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Drug Abuse Treatment, 2017–2031

Table 29: Latin America Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 30: Latin America Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region

Table 31: Middle East & Africa Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2031

Table 32: Middle East & Africa Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Alcohol Addiction Treatment, 2017–2031

Table 33: Middle East & Africa Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Nicotine Addiction Treatment, 2017–2031

Table 34: Middle East & Africa Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Drug Abuse Treatment, 2017–2031

Table 35: Middle East & Africa Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 36: Middle East & Africa Substance Abuse Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 1: Global Substance Abuse Treatment Market Value (US$ Mn) and Distribution, by Region, 2021 and 2031

Figure 2: Global Substance Abuse Treatment Market Value (US$ Mn), by Treatment Type, 2017

Figure 3: Global Substance Abuse Treatment Market Value (US$ Mn), by Distribution Channel, 2017

Figure 4: Global Substance Abuse Treatment Market Opportunity Map, by Treatment Type, 2022–2031

Figure 5: Global Substance Abuse Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 6: Global Substance Abuse Treatment Market Value Share, by Treatment Type, 2021 and 2031

Figure 7: Global Substance Abuse Treatment Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 8: Global Substance Abuse Treatment Market Value (US$ Mn), by Alcohol Addiction Treatment, 2017–2031

Figure 9: Global Substance Abuse Treatment Market Value (US$ Mn), by Nicotine Addiction Treatment, 2017–2031

Figure 10: Global Substance Abuse Treatment Market Value (US$ Mn), by Drug Abuse Treatment, 2017–2031

Figure 11: Global Substance Abuse Treatment Market Value Share, by Alcohol Addiction Treatment, 2021 and 2031

Figure 12: Global Substance Abuse Treatment Market Attractiveness Analysis, by Alcohol Addiction Treatment, 2018-2026

Figure 13: Global Substance Abuse Treatment Market Value (US$ Mn), by Acamprosate, 2017–2031

Figure 14: Global Substance Abuse Treatment Market Value (US$ Mn), by Disulphirum, 2017–2031

Figure 15: Global Substance Abuse Treatment Market Value (US$ Mn), by Naltrexone, 2017–2031

Figure 16: Global Substance Abuse Treatment Market Value (US$ Mn), by Benzodiazepine (BZD), 2017–2031

Figure 17: Global Substance Abuse Treatment Market Value Share, by Nicotine Addiction Treatment, 2021 and 2031

Figure 18: Global Substance Abuse Treatment Market Attractiveness Analysis, by Nicotine Addiction Treatment, 2022–2031

Figure 19: Global Substance Abuse Treatment Market Value (US$ Mn), by Total NRT Therapy, 2017–2031

Figure 20: Global Substance Abuse Treatment Market Value (US$ Mn), by Varenicline, 2017–2031

Figure 21: Global Substance Abuse Treatment Market Value (US$ Mn), by Bupropion, 2017–2031

Figure 22: Global Substance Abuse Treatment Market Value Share, by Drug Abuse Treatment, 2021 and 2031

Figure 23: Global Substance Abuse Treatment Market Attractiveness Analysis, by Drug Abuse Treatment, 2022–2031

Figure 24: Global Substance Abuse Treatment Market Value (US$ Mn), by Methadone, 2017–2031

Figure 25: Global Substance Abuse Treatment Market Value (US$ Mn), by Buprenorphine, 2017–2031

Figure 26: Global Substance Abuse Treatment Market Value (US$ Mn), by Naltexone, 2017–2031

Figure 27: Global Substance Abuse Treatment Market Value Share, by Distribution Channel, 2021 and 2031

Figure 28: Global Substance Abuse Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 29: Global Substance Abuse Treatment Market Value (US$ Mn), by Hospital Pharmacies, 2017–2031

Figure 30: Global Substance Abuse Treatment Market Value (US$ Mn), by Retail Pharmacies & Drug Stores, 2017–2031

Figure 31: Global Substance Abuse Treatment Market Value (US$ Mn) by Others (online sales), 2017–2031

Figure 32: Global Substance Abuse Treatment Market Attractiveness Analysis, by Region, 2018 and 2026

Figure 33: North America Substance Abuse Treatment Market, Y-o-Y Growth (%), by Substance Abuse Treatment, 2021 and 2031

Figure 34: North America Substance Abuse Treatment Market Value Share, by Treatment, 2017 and 2025

Figure 35: North America Substance Abuse Treatment Market Attractiveness Analysis, by Treatment, 2018-2026

Figure 36: North America Substance Abuse Treatment Market Value Share, by Alcohol Addiction Treatment, 2021 and 2031

Figure 37: North America Substance Abuse Treatment Market Attractiveness Analysis, Alcohol Addiction Treatment, 2018-2026

Figure 38: North America Substance Abuse Treatment Market Value Share, by Nicotine Addiction Treatment, 2021 and 2031

Figure 39: North America Substance Abuse Treatment Market Attractiveness Analysis, by Nicotine Addiction Treatment, 2022–2031

Figure 40: North America Substance Abuse Treatment Market Value Share, by Drug Abuse Treatment, 2021 and 2031

Figure 41: North America Substance Abuse Treatment Market Attractiveness Analysis, by Drug Abuse Treatment, 2022–2031

Figure 42: North America Substance Abuse Treatment Market Value Share, by Distribution Channel, 2021 and 2031

Figure 43: North America Substance Abuse Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 44: North America Substance Abuse Treatment Market Value Share, by Country, 2021 and 2031

Figure 45: North America Substance Abuse Treatment Market Attractiveness Analysis, by Country, 2022–2031

Figure 46: Europe Substance Abuse Treatment Market, Y-o-Y Growth (%), by Substance Abuse Treatment, 2021 and 2031

Figure 47: Europe Substance Abuse Treatment Market Value Share, by Treatment, 2017 and 2025

Figure 48: Europe Substance Abuse Treatment Market Attractiveness Analysis, by Treatment, 2018-2026

Figure 49: Europe Substance Abuse Treatment Market Value Share, by Alcohol Addiction Treatment, 2021 and 2031

Figure 50: Europe Substance Abuse Treatment Market Attractiveness Analysis, Alcohol Addiction Treatment, 2018-2026

Figure 51: Europe Substance Abuse Treatment Market Value Share, by Nicotine Addiction Treatment, 2021 and 2031

Figure 52: Europe Substance Abuse Treatment Market Attractiveness Analysis, by Nicotine Addiction Treatment, 2022–2031

Figure 53: Europe Substance Abuse Treatment Market Value Share, by Drug Abuse Treatment, 2021 and 2031

Figure 54: Europe Substance Abuse Treatment Market Attractiveness Analysis, by Drug Abuse Treatment, 2022–2031

Figure 55: Europe Substance Abuse Treatment Market Value Share, by Distribution Channel, 2021 and 2031

Figure 56: Europe Substance Abuse Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 57: Europe Substance Abuse Treatment Market Value Share, by Country/Sub-region, 2021 and 2031

Figure 58: Europe Substance Abuse Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 59: Asia Pacific Substance Abuse Treatment Market, Y-o-Y Growth (%), by Substance Abuse Treatment, 2021 and 2031

Figure 60: Asia Pacific Substance Abuse Treatment Market Value Share, by Treatment, 2017 and 2025

Figure 61: Asia Pacific Substance Abuse Treatment Market Attractiveness Analysis, by Treatment, 2018-2026

Figure 62: Asia Pacific Substance Abuse Treatment Market Value Share, by Alcohol Addiction Treatment, 2021 and 2031

Figure 63: Asia Pacific Substance Abuse Treatment Market Attractiveness Analysis, Alcohol Addiction Treatment, 2018-2026

Figure 64: Asia Pacific Substance Abuse Treatment Market Value Share, by Nicotine Addiction Treatment, 2021 and 2031

Figure 65: Asia Pacific Substance Abuse Treatment Market Attractiveness Analysis, by Nicotine Addiction Treatment, 2022–2031

Figure 66: Asia Pacific Substance Abuse Treatment Market Value Share, by Drug Abuse Treatment, 2021 and 2031

Figure 67: Asia Pacific Substance Abuse Treatment Market Attractiveness Analysis, by Drug Abuse Treatment, 2022–2031

Figure 68: Asia Pacific Substance Abuse Treatment Market Value Share, by Distribution Channel, 2021 and 2031

Figure 69: Asia Pacific Substance Abuse Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 70: Asia Pacific Substance Abuse Treatment Market Value Share, by Country/Sub-region, 2021 and 2031

Figure 71: Asia Pacific Substance Abuse Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 72: Latin America Substance Abuse Treatment Market, Y-o-Y Growth (%), by Treatment, 2021 and 2031

Figure 73: Latin America Substance Abuse Treatment Market Value Share, by Treatment, 2017 and 2025

Figure 74: Latin America Substance Abuse Treatment Market Attractiveness Analysis, by Treatment, 2018-2026

Figure 75: Latin America Substance Abuse Treatment Market Value Share, by Alcohol Addiction Treatment, 2021 and 2031

Figure 76: Latin America Substance Abuse Treatment Market Attractiveness Analysis, Alcohol Addiction Treatment, 2018-2026

Figure 77: Latin America Substance Abuse Treatment Market Value Share, by Nicotine Addiction Treatment, 2021 and 2031

Figure 78: Latin America Substance Abuse Treatment Market Attractiveness Analysis, by Nicotine Addiction Treatment, 2022–2031

Figure 79: Latin America Substance Abuse Treatment Market Value Share, by Drug Abuse Treatment, 2021 and 2031

Figure 80: Latin America Substance Abuse Treatment Market Attractiveness Analysis, by Drug Abuse Treatment, 2022–2031

Figure 81: Latin America Substance Abuse Treatment Market Value Share, by Distribution Channel, 2021 and 2031

Figure 82: Latin America Substance Abuse Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 83: Latin America Substance Abuse Treatment Market Value Share, by Country/Sub-region, 2021 and 2031

Figure 84: Latin America Substance Abuse Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 85: Middle East & Africa Substance Abuse Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 86: Middle East & Africa Substance Abuse Treatment Market Value Share, by Treatment, 2017 and 2025

Figure 87: Middle East & Africa Substance Abuse Treatment Market Attractiveness Analysis, by Treatment, 2022–2031

Figure 88: Middle East & Africa Substance Abuse Treatment Market Value Share, by Alcohol Addiction Treatment, 2021 and 2031

Figure 89: Middle East & Africa Substance Abuse Treatment Market Attractiveness Analysis, by Alcohol Addiction Treatment, 2022–2031

Figure 90: Middle East & Africa Substance Abuse Treatment Market Value Share, by Nicotine Addiction Treatment, 2021 and 2031

Figure 91: Middle East & Africa Substance Abuse Treatment Market Attractiveness Analysis, by Nicotine Addiction Treatment,

Figure 92: Middle East & Africa Substance Abuse Treatment Market Value Share, by Drug Abuse Treatment, 2021 and 2031

Figure 93: Middle East & Africa Substance Abuse Treatment Market Attractiveness Analysis, by Drug Abuse Treatment, 2022–2031

Figure 94: Middle East & Africa Substance Abuse Treatment Market Value Share, by Distribution Channel, 2021 and 2031

Figure 95: Middle East & Africa Substance Abuse Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 96: Middle East & Africa Substance Abuse Treatment Market Value Share, by Country/Sub-region, 2021 and 2031

Figure 97: Middle East & Africa Substance Abuse Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031