The market for stroke therapy as growth-promoting, driven by advancements in pharmacologic therapy and a better understanding of stroke pathophysiology. The sector is focusing more on the development of thrombolytic and antiplatelet medications, pivotal in acute stroke treatment for ischemic strokes. Drug delivery systems and formulation science are aiming at maximizing the safety and efficacy profiles of such medications.

The potential role of neuroprotectants as a new focus of interest, with the potential to limit brain damage in stroke attack. New drugs are currently at late stages of clinical trials to guarantee that they possess the potential to trigger neuroprotection and optimize patient recovery from strokes.

Overall, the market for stroke medication treatment will grow enormously with continuous research, new product development, and greater focus on prevention therapy. With more number of medical professionals and consumers themselves advocating maximum pharmacological intervention, the phase of stroke treatment will undergo further change for improved results and the well-being of stroke victims.

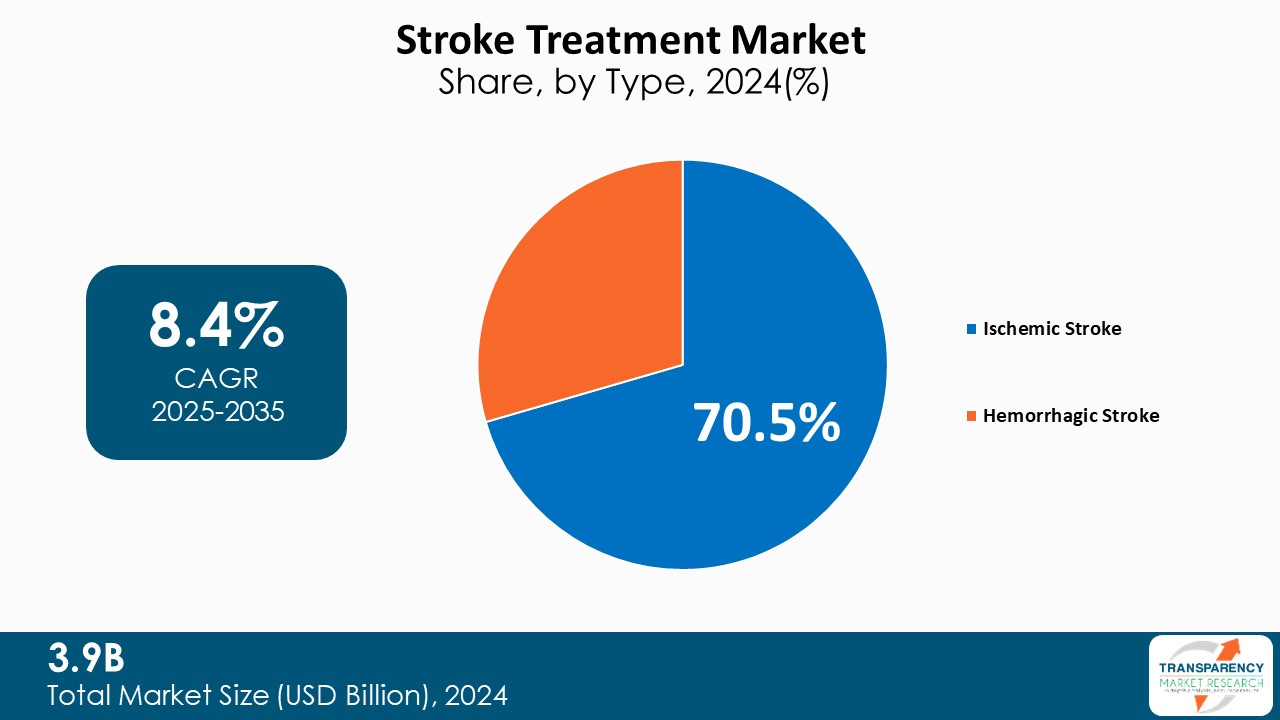

Stroke treatment comprises several medical processes to minimize brain damage and maximize the outcome for a stroke-stricken patient. Ischemic, caused by a block in blood flow to the brain, and hemorrhagic, due to bleeding within or around the brain, are two broad types of strokes. Ischemic strokes are initially treated with thrombolytic therapy, in which medications to dissolve the clot are administered to restore blood supply. It is most effective if given within a few hours of symptom onset.

For bleeding strokes treatment is all about halting bleeding and reducing intracranial pressure and can either be surgical or through medication to normalize blood pressure. Rehabilitation will also be necessary to learn anew, with some therapy to regain lost function and compensating for any residual impairments. This will depend on need and may involve physical, occupational, and speech therapy.

With increased education regarding stroke warning signs and risk factors, prevention through lifestyle intervention and control of diseases such as diabetes and hypertension becomes increasingly important.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Higher prevalence of stroke is one of the main drivers of stroke treatment industry growth, mirroring overall trends in public health. With increasing age groups getting associated with risk factors of hypertension, diabetes, obesity, and lack of exercise, the incidence of stroke among the population has increased.

Strokes are amongst the major causes of morbidity and mortality, states the health authorities, and with it, proper treatments must be implemented. Population undergoing aging, i.e., North America, Europe, and Asia, are particularly hard hit, resulting in healthcare systems to provide increased levels of resources in the prevention and treatment of stroke.

Greater awareness of stroke symptomology and recognition of the necessity for prompt response have also been accompanied by increased presentations of patients to emergency departments. This is supplemented by progress in medical technology and clinical science that has enabled newer pharmacotherapy protocols and rehabilitation avenues to be established.

With the rise in the stroke treatment market, not only is the patient being better, but also the stakeholders such as the drug companies, physicians, and scientists are more worried about the realization of increased demand for quality treatment. Not only does the market growth become essential for the patient's improvement but also in managing the overall stroke complication healthcare cost and long-term care requirements.

Rise in the incidence of coronary heart disease and hypertension is one of the key drivers to the growth in the stroke treatment market. Both are established risk factors for stroke, and hence the incidence of ischemic and hemorrhagic strokes is high.

As lifestyle disorders set in with a sedentary lifestyle, poor diet, and high stress, the incidence of hypertension and CHD is increasing globally. This growing number of patients generates an accelerating demand for efficacious stroke therapy and prevention.

Regions such as North America and Europe, with prevalence of lifestyle disorder, are being hit hardest. The medical networks of these regions are receiving more number of patients who need to be intervened regarding drugs to manage cholesterol and blood pressure levels.

They are crucial when it comes to stroke prevention. Secondly, the role of prevention intervention care, like regular check-up and counseling of the patient, is gaining importance to manage such risk factors at a desirable level.

Pharmaceutical industry is satisfying the demand by introducing new antihypertensive and cholesterol medications to the market aimed at high-risk patients.

Oral delivery is leading the stroke treatment market due to convenience, simplicity, and patient compliance. Oral medications such as antiplatelet agents and anticoagulants are preferred as they are non-invasive medications with the benefit of not requiring special medical care to be administered as they can be given by the patient themselves. It is particularly useful in long-term management and prevention of secondary strokes.

In addition, oral medications are readily incorporated into a patient's daily routine regimens and hence foster patient compliance with the treatment regimens. The technological advancements in oral medication have also improved the safety and efficacy profiles, and they are more desirable for providers and patients than ever before.

Lastly, the growing emphasis on telemedicine and ambulatory care has hastened oral treatment needs further due to their compatibility with treatment procedures performed at home. Thus, the oral route is still in full swing in the stroke treatment market, improving the health condition of the patients.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

According to the latest analysis of the stroke treatment market, North America held the largest market share in 2024, driven by several key factors.

Firstly, the area has spent on health centers for direct treatment and diagnosis of strokes. Excessive risk factors such as inactivity, diabetes, and high blood pressure are among the determinants that boost the rate of stroke incidence that creates demand for effective treatment modalities. Secondly, large R&D spending and strong government commitment toward health programs add to the new technologies and treatment.

The most significant driver to the market in this sector is increased awareness and education of stroke prevention and treatment, which are promoting timely treatment. Furthermore, increasing use of minimally invasive treatments and novel technologies such as telemedicine will improve outcomes for patients.

As more healthcare professionals become interested in personalized treatment methods and best practice care, the North America’s stroke treatment market will see further growth, fueled by innovation and self health care delivery capability.

Bristol-Myers Squibb Company, Sanofi, F. Hoffmann-La Roche (Genentech), Daiichi Sankyo Company, Limited, AstraZeneca, Biogen Inc., Johnson & Johnson Services, Inc., Bayer AG, Eli Lilly and Company, Mylan, Teva Pharmaceuticals, Zydus Cadila, Sun Pharmaceutical and others are some of the leading key players operating in the raloxifene hydrochloride industry.

Each of these players have been have been profiled in the stroke treatment market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

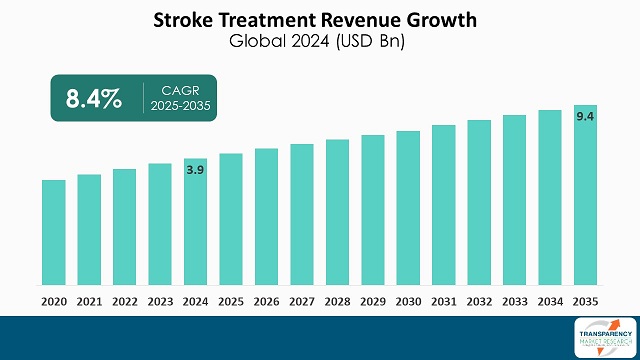

| Size in 2024 | US$ 3.9 Bn |

| Forecast Value in 2035 | US$ 9.4 Bn |

| CAGR | 8.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Mn |

| Stroke Treatment Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 3.9 Bn in 2024.

It was projected to cross US$ 9.4 Bn by the end of 2035.

Increasing incidence of stroke and rising prevalence of hypertension and coronary heart diseases.

It is projected to advance at a CAGR of 8.4% from 2025 to 2035.

North America was the dominant region in 2024.

Bristol-Myers Squibb Company, Sanofi, F. Hoffmann-La Roche (Genentech), Daiichi Sankyo Company, Limited, AstraZeneca, Biogen Inc., Johnson & Johnson Services, Inc., Bayer AG, Eli Lilly and Company, Mylan, Teva Pharmaceuticals, Zydus Cadila, Sun Pharmaceutical, and others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Stroke Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Stroke Treatment Market Analysis and Forecast, 2020-2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Key Industry Events

5.2. PESTEL Analysis

5.3. Regulatory Scenario by Key Countries/Regions

5.4. PORTER’s Five Forces Analysis

5.5. Product/Brand Analysis

5.6. Supply Chain Analysis

5.7. Pipeline Analysis

6. Global Stroke Treatment Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2020-2035

6.3.1. Ischemic Stroke

6.3.1.1. Thrombotic Stroke

6.3.1.2. Embolic Stroke

6.3.2. Hemorrhagic Stroke

6.3.2.1. Intracerebral Hemorrhage

6.3.2.2. Subarachnoid Hemorrhage

6.4. Market Attractiveness Analysis, by Type

7. Global Stroke Treatment Market Analysis and Forecast, by Drug Class

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Drug Class, 2020-2035

7.3.1. Anticoagulants

7.3.2. Antiplatelets

7.3.3. Tissue plasminogen activator (tPA)

7.3.4. Statins

7.3.5. Beta-Blockers

7.3.6. Others

7.4. Market Attractiveness Analysis, by Drug Class

8. Global Stroke Treatment Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Route of Administration, 2020-2035

8.3.1. Oral

8.3.2. Parenteral

8.4. Market Attractiveness Analysis, by Route of Administration

9. Global Stroke Treatment Market Analysis and Forecast, by Drug Availability

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Drug Availability, 2020-2035

9.3.1. Branded

9.3.2. Generic

9.4. Market Attractiveness Analysis, by Drug Availability

10. Global Stroke Treatment Market Analysis and Forecast, by Distribution Channel

10.1. Introduction & Definition

10.2. Key Findings/Developments

10.3. Market Value Forecast, by Distribution Channel, 2020-2035

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Pharmacies

10.4. Market Attractiveness Analysis, by Distribution Channel

11. Global Stroke Treatment Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast, by Region, 2020-2035

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness Analysis, by Region

12. North America Stroke Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2020-2035

12.2.1. Ischemic Stroke

12.2.1.1. Thrombotic Stroke

12.2.1.2. Embolic Stroke

12.2.2. Hemorrhagic Stroke

12.2.2.1. Intracerebral Hemorrhage

12.2.2.2. Subarachnoid Hemorrhage

12.3. Market Value Forecast, by Drug Class, 2020-2035

12.3.1. Anticoagulants

12.3.2. Antiplatelets

12.3.3. Tissue plasminogen activator (tPA)

12.3.4. Statins

12.3.5. Beta-Blockers

12.3.6. Others

12.4. Market Value Forecast, by Route of Administration, 2020-2035

12.4.1. Oral

12.4.2. Parenteral

12.5. Market Value Forecast, by Drug Availability, 2020-2035

12.5.1. Branded

12.5.2. Generic

12.6. Market Value Forecast, by Distribution Channel, 2020-2035

12.6.1. Hospital Pharmacies

12.6.2. Retail Pharmacies

12.6.3. Online Pharmacies

12.7. Market Value Forecast, by Country, 2020-2035

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Type

12.8.2. By Drug Class

12.8.3. By Route of Administration

12.8.4. By Drug Availability

12.8.5. By Distribution Channel

12.8.6. By Country

13. Europe Stroke Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2020-2035

13.2.1. Ischemic Stroke

13.2.1.1. Thrombotic Stroke

13.2.1.2. Embolic Stroke

13.2.2. Hemorrhagic Stroke

13.2.2.1. Intracerebral Hemorrhage

13.2.2.2. Subarachnoid Hemorrhage

13.3. Market Value Forecast, by Drug Class, 2020-2035

13.3.1. Anticoagulants

13.3.2. Antiplatelets

13.3.3. Tissue plasminogen activator (tPA)

13.3.4. Statins

13.3.5. Beta-Blockers

13.3.6. Others

13.4. Market Value Forecast, by Route of Administration, 2020-2035

13.4.1. Oral

13.4.2. Parenteral

13.5. Market Value Forecast, by Drug Availability, 2020-2035

13.5.1. Branded

13.5.2. Generic

13.6. Market Value Forecast, by Distribution Channel, 2020-2035

13.6.1. Hospital Pharmacies

13.6.2. Retail Pharmacies

13.6.3. Online Pharmacies

13.7. Market Value Forecast, by Country/Sub-region, 2020-2035

13.7.1. Germany

13.7.2. UK

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Type

13.8.2. By Drug Class

13.8.3. By Route of Administration

13.8.4. By Drug Availability

13.8.5. By Distribution Channel

13.8.6. By Country/Sub-region

14. Asia Pacific Stroke Treatment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2020-2035

14.2.1. Ischemic Stroke

14.2.1.1. Thrombotic Stroke

14.2.1.2. Embolic Stroke

14.2.2. Hemorrhagic Stroke

14.2.2.1. Intracerebral Hemorrhage

14.2.2.2. Subarachnoid Hemorrhage

14.3. Market Value Forecast, by Drug Class, 2020-2035

14.3.1. Anticoagulants

14.3.2. Antiplatelets

14.3.3. Tissue plasminogen activator (tPA)

14.3.4. Statins

14.3.5. Beta-Blockers

14.3.6. Others

14.4. Market Value Forecast, by Route of Administration, 2020-2035

14.4.1. Oral

14.4.2. Parenteral

14.5. Market Value Forecast, by Drug Availability, 2020-2035

14.5.1. Branded

14.5.2. Generic

14.6. Market Value Forecast, by Distribution Channel, 2020-2035

14.6.1. Hospital Pharmacies

14.6.2. Retail Pharmacies

14.6.3. Online Pharmacies

14.7. Market Value Forecast, by Country/Sub-region, 2020-2035

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Type

14.8.2. By Drug Class

14.8.3. By Route of Administration

14.8.4. By Drug Availability

14.8.5. By Distribution Channel

14.8.6. By Country/Sub-region

15. Latin America Stroke Treatment Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Type, 2020-2035

15.2.1. Ischemic Stroke

15.2.1.1. Thrombotic Stroke

15.2.1.2. Embolic Stroke

15.2.2. Hemorrhagic Stroke

15.2.2.1. Intracerebral Hemorrhage

15.2.2.2. Subarachnoid Hemorrhage

15.3. Market Value Forecast, by Drug Class, 2020-2035

15.3.1. Anticoagulants

15.3.2. Antiplatelets

15.3.3. Tissue plasminogen activator (tPA)

15.3.4. Statins

15.3.5. Beta-Blockers

15.3.6. Others

15.4. Market Value Forecast, by Route of Administration, 2020-2035

15.4.1. Oral

15.4.2. Parenteral

15.5. Market Value Forecast, by Drug Availability, 2020-2035

15.5.1. Branded

15.5.2. Generic

15.6. Market Value Forecast, by Distribution Channel, 2020-2035

15.6.1. Hospital Pharmacies

15.6.2. Retail Pharmacies

15.6.3. Online Pharmacies

15.7. Market Value Forecast, by Country/Sub-region, 2020-2035

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Type

15.8.2. By Drug Class

15.8.3. By Route of Administration

15.8.4. By Drug Availability

15.8.5. By Distribution Channel

15.8.6. By Country/Sub-region

16. Middle East & Africa Stroke Treatment Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Type, 2020-2035

16.2.1. Ischemic Stroke

16.2.1.1. Thrombotic Stroke

16.2.1.2. Embolic Stroke

16.2.2. Hemorrhagic Stroke

16.2.2.1. Intracerebral Hemorrhage

16.2.2.2. Subarachnoid Hemorrhage

16.3. Market Value Forecast, by Drug Class, 2020-2035

16.3.1. Anticoagulants

16.3.2. Antiplatelets

16.3.3. Tissue plasminogen activator (tPA)

16.3.4. Statins

16.3.5. Beta-Blockers

16.3.6. Others

16.4. Market Value Forecast, by Route of Administration, 2020-2035

16.4.1. Oral

16.4.2. Parenteral

16.5. Market Value Forecast, by Drug Availability, 2020-2035

16.5.1. Branded

16.5.2. Generic

16.6. Market Value Forecast, by Distribution Channel, 2020-2035

16.6.1. Hospital Pharmacies

16.6.2. Retail Pharmacies

16.6.3. Online Pharmacies

16.7. Market Value Forecast, by Country/Sub-region, 2020-2035

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Type

16.8.2. By Drug Class

16.8.3. By Route of Administration

16.8.4. By Drug Availability

16.8.5. By Distribution Channel

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player - Competition Matrix (By Tier and Size of Companies)

17.2. Market Share Analysis, by Company (2024)

17.3. Company Profiles

17.3.1. Bristol-Myers Squibb Company

17.3.1.1. Company Overview

17.3.1.2. Financial Overview

17.3.1.3. Product Portfolio

17.3.1.4. Business Strategies

17.3.1.5. Recent Developments

17.3.2. Sanofi

17.3.2.1. Company Overview

17.3.2.2. Financial Overview

17.3.2.3. Product Portfolio

17.3.2.4. Business Strategies

17.3.2.5. Recent Developments

17.3.3. F. Hoffmann-La Roche (Genentech)

17.3.3.1. Company Overview

17.3.3.2. Financial Overview

17.3.3.3. Product Portfolio

17.3.3.4. Business Strategies

17.3.3.5. Recent Developments

17.3.4. Daiichi Sankyo Company, Limited

17.3.4.1. Company Overview

17.3.4.2. Financial Overview

17.3.4.3. Product Portfolio

17.3.4.4. Business Strategies

17.3.4.5. Recent Developments

17.3.5. AstraZeneca

17.3.5.1. Company Overview

17.3.5.2. Financial Overview

17.3.5.3. Product Portfolio

17.3.5.4. Business Strategies

17.3.5.5. Recent Developments

17.3.6. Biogen Inc.

17.3.6.1. Company Overview

17.3.6.2. Financial Overview

17.3.6.3. Product Portfolio

17.3.6.4. Business Strategies

17.3.6.5. Recent Developments

17.3.7. Johnson & Johnson Services, Inc.

17.3.7.1. Company Overview

17.3.7.2. Financial Overview

17.3.7.3. Product Portfolio

17.3.7.4. Business Strategies

17.3.7.5. Recent Developments

17.3.8. Bayer AG

17.3.8.1. Company Overview

17.3.8.2. Financial Overview

17.3.8.3. Product Portfolio

17.3.8.4. Business Strategies

17.3.8.5. Recent Developments

17.3.9. Eli Lilly and Company

17.3.9.1. Company Overview

17.3.9.2. Financial Overview

17.3.9.3. Product Portfolio

17.3.9.4. Business Strategies

17.3.9.5. Recent Developments

17.3.10. Mylan

17.3.10.1. Company Overview

17.3.10.2. Financial Overview

17.3.10.3. Product Portfolio

17.3.10.4. Business Strategies

17.3.10.5. Recent Developments

17.3.11. Teva Pharmaceuticals

17.3.11.1. Company Overview

17.3.11.2. Financial Overview

17.3.11.3. Product Portfolio

17.3.11.4. Business Strategies

17.3.11.5. Recent Developments

17.3.12. Zydus Cadila

17.3.12.1. Company Overview

17.3.12.2. Financial Overview

17.3.12.3. Product Portfolio

17.3.12.4. Business Strategies

17.3.12.5. Recent Developments

17.3.13. Sun Pharmaceutical

17.3.13.1. Company Overview

17.3.13.2. Financial Overview

17.3.13.3. Product Portfolio

17.3.13.4. Business Strategies

17.3.13.5. Recent Developments

List of Tables

Table 01: Global Stroke Treatment Market Value (US$ Bn) Forecast, By Type, 2020-2035

Table 02: Global Stroke Treatment Market Value (US$ Bn) Forecast, By Ischemic Stroke, 2020-2035

Table 03: Global Stroke Treatment Market Value (US$ Bn) Forecast, By Hemorrhagic Stroke, 2020-2035

Table 04: Global Stroke Treatment Market Value (US$ Bn) Forecast, By Drug Class, 2020-2035

Table 05: Global Stroke Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020-2035

Table 06: Global Stroke Treatment Market Value (US$ Bn) Forecast, By Drug Availability, 2020-2035

Table 07: Global Stroke Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020-2035

Table 08: Global Stroke Treatment Market Value (US$ Bn) Forecast, By Region, 2020-2035

Table 09: North America - Stroke Treatment Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 10: North America - Stroke Treatment Market Value (US$ Bn) Forecast, By Type, 2020-2035

Table 11: North America - Stroke Treatment Market Value (US$ Bn) Forecast, By Ischemic Stroke, 2020-2035

Table 12: North America - Stroke Treatment Market Value (US$ Bn) Forecast, By Hemorrhagic Stroke, 2020-2035

Table 13: North America - Stroke Treatment Market Value (US$ Bn) Forecast, By Drug Class, 2020-2035

Table 14: North America - Stroke Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020-2035

Table 15: North America - Stroke Treatment Market Value (US$ Bn) Forecast, By Drug Availability, 2020-2035

Table 16: North America - Stroke Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020-2035

Table 17: Europe - Stroke Treatment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 18: Europe - Stroke Treatment Market Value (US$ Bn) Forecast, By Type, 2020-2035

Table 19: Europe - Stroke Treatment Market Value (US$ Bn) Forecast, By Ischemic Stroke, 2020-2035

Table 20: Europe - Stroke Treatment Market Value (US$ Bn) Forecast, By Hemorrhagic Stroke, 2020-2035

Table 21: Europe - Stroke Treatment Market Value (US$ Bn) Forecast, By Drug Class, 2020-2035

Table 22: Europe - Stroke Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020-2035

Table 23: Europe - Stroke Treatment Market Value (US$ Bn) Forecast, By Drug Availability, 2020-2035

Table 24: Europe - Stroke Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020-2035

Table 25: Asia Pacific - Stroke Treatment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 26: Asia Pacific - Stroke Treatment Market Value (US$ Bn) Forecast, By Type, 2020-2035

Table 27: Asia Pacific - Stroke Treatment Market Value (US$ Bn) Forecast, By Ischemic Stroke, 2020-2035

Table 28: Asia Pacific - Stroke Treatment Market Value (US$ Bn) Forecast, By Hemorrhagic Stroke, 2020-2035

Table 29: Asia Pacific - Stroke Treatment Market Value (US$ Bn) Forecast, By Drug Class, 2020-2035

Table 30: Asia Pacific - Stroke Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020-2035

Table 31: Asia Pacific - Stroke Treatment Market Value (US$ Bn) Forecast, By Drug Availability, 2020-2035

Table 32: Asia Pacific - Stroke Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020-2035

Table 33: Latin America - Stroke Treatment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 34: Latin America - Stroke Treatment Market Value (US$ Bn) Forecast, By Type, 2020-2035

Table 35: Latin America - Stroke Treatment Market Value (US$ Bn) Forecast, By Ischemic Stroke, 2020-2035

Table 36: Latin America - Stroke Treatment Market Value (US$ Bn) Forecast, By Hemorrhagic Stroke, 2020-2035

Table 37: Latin America - Stroke Treatment Market Value (US$ Bn) Forecast, By Drug Class, 2020-2035

Table 38: Latin America - Stroke Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020-2035

Table 39: Latin America - Stroke Treatment Market Value (US$ Bn) Forecast, By Drug Availability, 2020-2035

Table 40: Latin America - Stroke Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020-2035

Table 41: Middle East & Africa - Stroke Treatment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 42: Middle East & Africa - Stroke Treatment Market Value (US$ Bn) Forecast, By Type, 2020-2035

Table 43: Middle East & Africa - Stroke Treatment Market Value (US$ Bn) Forecast, By Ischemic Stroke, 2020-2035

Table 44: Middle East & Africa - Stroke Treatment Market Value (US$ Bn) Forecast, By Hemorrhagic Stroke, 2020-2035

Table 45: Middle East & Africa - Stroke Treatment Market Value (US$ Bn) Forecast, By Drug Class, 2020-2035

Table 46: Middle East & Africa - Stroke Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020-2035

Table 47: Middle East & Africa - Stroke Treatment Market Value (US$ Bn) Forecast, By Drug Availability, 2020-2035

Table 48: Middle East & Africa - Stroke Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020-2035

List of Figures

Figure 01: Global Stroke Treatment Market Value (US$ Bn) Forecast, 2020-2035

Figure 02: Global Stroke Treatment Market Value Share Analysis, By Type, 2024 and 2035

Figure 03: Global Stroke Treatment Market Attractiveness Analysis, By Type, 2025-2035

Figure 04: Global Stroke Treatment Market Revenue (US$ Bn), by Ischemic Stroke, 2020-2035

Figure 05: Global Stroke Treatment Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 06: Global Stroke Treatment Market Attractiveness Analysis, By Drug Class, 2025-2035

Figure 07: Global Stroke Treatment Market Revenue (US$ Bn), by Anticoagulants, 2020-2035

Figure 08: Global Stroke Treatment Market Revenue (US$ Bn), by Antiplatelets, 2020-2035

Figure 09: Global Stroke Treatment Market Revenue (US$ Bn), by Tissue plasminogen activator (tPA), 2020-2035

Figure 10: Global Stroke Treatment Market Revenue (US$ Bn), by Statins, 2020-2035

Figure 11: Global Stroke Treatment Market Revenue (US$ Bn), by Beta-Blockers, 2020-2035

Figure 12: Global Stroke Treatment Market Revenue (US$ Bn), by Others, 2020-2035

Figure 13: Global Stroke Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 14: Global Stroke Treatment Market Attractiveness Analysis, By Route of Administration, 2025-2035

Figure 15: Global Stroke Treatment Market Revenue (US$ Bn), by Oral, 2020-2035

Figure 16: Global Stroke Treatment Market Revenue (US$ Bn), by Parenteral, 2020-2035

Figure 17: Global Stroke Treatment Market Value Share Analysis, By Drug Availability, 2024 and 2035

Figure 18: Global Stroke Treatment Market Attractiveness Analysis, By Drug Availability, 2025-2035

Figure 19: Global Stroke Treatment Market Revenue (US$ Bn), by Branded, 2020-2035

Figure 20: Global Stroke Treatment Market Revenue (US$ Bn), by Generic, 2020-2035

Figure 21: Global Stroke Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 22: Global Stroke Treatment Market Attractiveness Analysis, By Distribution Channel, 2025-2035

Figure 23: Global Stroke Treatment Market Revenue (US$ Bn), by Hospital Pharmacies, 2020-2035

Figure 24: Global Stroke Treatment Market Revenue (US$ Bn), by Retail Pharmacies, 2020-2035

Figure 25: Global Stroke Treatment Market Revenue (US$ Bn), by Online Pharmacies, 2020-2035

Figure 26: Global Stroke Treatment Market Value Share Analysis, By Region, 2024 and 2035

Figure 27: Global Stroke Treatment Market Attractiveness Analysis, By Region, 2025-2035

Figure 28: North America - Stroke Treatment Market Value (US$ Bn) Forecast, 2020-2035

Figure 29: North America - Stroke Treatment Market Value Share Analysis, by Country, 2024 and 2035

Figure 30: North America - Stroke Treatment Market Attractiveness Analysis, by Country, 2025-2035

Figure 31: North America - Stroke Treatment Market Value Share Analysis, By Type, 2024 and 2035

Figure 32: North America - Stroke Treatment Market Attractiveness Analysis, By Type, 2025-2035

Figure 33: North America - Stroke Treatment Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 34: North America - Stroke Treatment Market Attractiveness Analysis, By Drug Class, 2025-2035

Figure 35: North America - Stroke Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 36: North America - Stroke Treatment Market Attractiveness Analysis, By Route of Administration, 2025-2035

Figure 37: North America - Stroke Treatment Market Value Share Analysis, By Drug Availability, 2024 and 2035

Figure 38: North America - Stroke Treatment Market Attractiveness Analysis, By Drug Availability, 2025-2035

Figure 39: North America - Stroke Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 40: North America - Stroke Treatment Market Attractiveness Analysis, By Distribution Channel, 2025-2035

Figure 41: Europe - Stroke Treatment Market Value (US$ Bn) Forecast, 2020-2035

Figure 42: Europe - Stroke Treatment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 43: Europe - Stroke Treatment Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 44: Europe - Stroke Treatment Market Value Share Analysis, By Type, 2024 and 2035

Figure 45: Europe - Stroke Treatment Market Attractiveness Analysis, By Type, 2025-2035

Figure 46: Europe - Stroke Treatment Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 47: Europe - Stroke Treatment Market Attractiveness Analysis, By Drug Class, 2025-2035

Figure 48: Europe - Stroke Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 49: Europe - Stroke Treatment Market Attractiveness Analysis, By Route of Administration, 2025-2035

Figure 50: Europe - Stroke Treatment Market Value Share Analysis, By Drug Availability, 2024 and 2035

Figure 51: Europe - Stroke Treatment Market Attractiveness Analysis, By Drug Availability, 2025-2035

Figure 52: Europe - Stroke Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 53: Europe - Stroke Treatment Market Attractiveness Analysis, By Distribution Channel, 2025-2035

Figure 54: Asia Pacific - Stroke Treatment Market Value (US$ Bn) Forecast, 2020-2035

Figure 55: Asia Pacific - Stroke Treatment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 56: Asia Pacific - Stroke Treatment Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 57: Asia Pacific - Stroke Treatment Market Value Share Analysis, By Type, 2024 and 2035

Figure 58: Asia Pacific - Stroke Treatment Market Attractiveness Analysis, By Type, 2025-2035

Figure 59: Asia Pacific - Stroke Treatment Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 60: Asia Pacific - Stroke Treatment Market Attractiveness Analysis, By Drug Class, 2025-2035

Figure 61: Asia Pacific - Stroke Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 62: Asia Pacific - Stroke Treatment Market Attractiveness Analysis, By Route of Administration, 2025-2035

Figure 63: Asia Pacific - Stroke Treatment Market Value Share Analysis, By Drug Availability, 2024 and 2035

Figure 64: Asia Pacific - Stroke Treatment Market Attractiveness Analysis, By Drug Availability, 2025-2035

Figure 65: Asia Pacific - Stroke Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 66: Asia Pacific - Stroke Treatment Market Attractiveness Analysis, By Distribution Channel, 2025-2035

Figure 67: Latin America - Stroke Treatment Market Value (US$ Bn) Forecast, 2020-2035

Figure 68: Latin America - Stroke Treatment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 69: Latin America - Stroke Treatment Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 70: Latin America - Stroke Treatment Market Value Share Analysis, By Type, 2024 and 2035

Figure 71: Latin America - Stroke Treatment Market Attractiveness Analysis, By Type, 2025-2035

Figure 72: Latin America - Stroke Treatment Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 73: Latin America - Stroke Treatment Market Attractiveness Analysis, By Drug Class, 2025-2035

Figure 74: Latin America - Stroke Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 75: Latin America - Stroke Treatment Market Attractiveness Analysis, By Route of Administration, 2025-2035

Figure 76: Latin America - Stroke Treatment Market Value Share Analysis, By Drug Availability, 2024 and 2035

Figure 77: Latin America - Stroke Treatment Market Attractiveness Analysis, By Drug Availability, 2025-2035

Figure 78: Latin America - Stroke Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 79: Latin America - Stroke Treatment Market Attractiveness Analysis, By Distribution Channel, 2025-2035

Figure 80: Middle East & Africa - Stroke Treatment Market Value (US$ Bn) Forecast, 2020-2035

Figure 81: Middle East & Africa - Stroke Treatment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 82: Middle East & Africa - Stroke Treatment Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 83: Middle East & Africa - Stroke Treatment Market Value Share Analysis, By Type, 2024 and 2035

Figure 84: Middle East & Africa - Stroke Treatment Market Attractiveness Analysis, By Type, 2025-2035

Figure 85: Middle East & Africa - Stroke Treatment Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 86: Middle East & Africa - Stroke Treatment Market Attractiveness Analysis, By Drug Class, 2025-2035

Figure 87: Middle East & Africa - Stroke Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 88: Middle East & Africa - Stroke Treatment Market Attractiveness Analysis, By Route of Administration, 2025-2035

Figure 89: Middle East & Africa - Stroke Treatment Market Value Share Analysis, By Drug Availability, 2024 and 2035

Figure 90: Middle East & Africa - Stroke Treatment Market Attractiveness Analysis, By Drug Availability, 2025-2035

Figure 91: Middle East & Africa - Stroke Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 92: Middle East & Africa - Stroke Treatment Market Attractiveness Analysis, By Distribution Channel, 2025-2035