Analysts’ Viewpoint

Rise in number of road and infrastructure development projects in both developing and developed nations across the world is boosting the global street washer market growth. The use of street washers helps replace manual labor with machines. Street washers are in high demand for various applications including cleaning of highways, streets, seaports, airports, and train stations. As per the latest street washer market trends, manufacturers are launching electric and other green fuel-powered street washers due to increase in concerns about the environment.

Leading manufacturers are creating smart street washing machines with decreased noise emissions and configurable technology based on consumer needs. Market players are focusing on introducing new products with advanced features and multiple capabilities to clean and sanitize indoor and outdoor spaces. Numerous cleanliness campaigns by authorities are opening up new possibilities that are anticipated to boost the street washer market size.

A street washer is a mechanical road cleaner machine with a high-pressure water pump and a water tank that is used to clean roads, typically in urban and industrial areas. High-pressure water removes dust, sand, and debris from concrete, asphalt, and other comparable surfaces. Cleaning large areas in a single pass is made feasible using these machines. The street washer machine has a considerably large tank capacity and can clean the area by consuming less water.

Street washers can be utilized to clean public roads, town centers, parking lots, market squares, large industrial areas, walkways, and other places. Street washers assure that sediment and debris are removed from the road, which makes driving on the road smoother. These machines are frequently used in industrial areas and construction zones to get rid of cement and any emissions including chemical or oil residues.

Additionally, sidewalk sweepers and pavement scrubbers help reduce pavement deterioration, lessen the amount of dirt and debris entering storm sewers, and protect city infrastructure.

Demand for outdoor sanitation vehicles is growing worldwide due to increase in number of road and infrastructure development projects. For instance, the Carolina Crossroads in Columbia, South Carolina, is being reconstructed by the South Carolina Department of Transportation (SCDOT). The US$ 1.6 Bn project is aimed at providing a more secure and modern interchange design for South Carolina's Malfunction Junction. New lane miles, wider interstate miles, new bridges, and rebuilt interchanges are all included in the Carolina Crossroads Interstate upgrade project.

As part of the Nizhnekamsk and Naberezhnye Chelny bypass project, which was started in 2021 in Tatarstan, Russia, a four-lane category I highway, 10 bridges, 5 interchanges, 11 overpasses, and 5 crossroads at various levels would be built. The development of roads and bridges is expected to rise in the near future. This is expected to augment market development during the forecast period.

Several airport infrastructure construction projects were initiated in Europe during the third quarter of 2021 such as the Keflavik Airport Expansion, Cork Airport Infrastructure Development, Innsbruck Airport Redevelopment, and Jersey Airport Redevelopment. Street washer market demand is increasing at a rapid pace as a result of these construction projects, because washers and sweepers are frequently utilized to clean airport runways.

According to the street washer market analysis, the demand for electric street washers has been rising for the last few years. Diesel engines can provide more power and torque output because they run on the compression cycle. However, diesel and petrol street washer machines have substantial operating costs. They also release a significant amount of CO2 and other pollutants into the air. These issues are gradually causing customers to shift toward using clean fuel alternatives, such as electric street washers.

Electric street washer vehicles use high-density batteries that can store significant power. Electric street washers use smart technologies to increase efficiency. Lower maintenance and less fuel costs of electric vehicles are likely to fuel market demand for electric street washers during the forecast period.

Prominent manufacturers of street sweeper machines are speeding up R&D to create next-generation machinery. For instance, Dulevo International S.p.A. introduced the Dulevo D.Zero² Hydro, which is a fully electrical street washer made for high-pressure cleaning and sanitation of urban areas. These products are adaptable to industrial settings and other locations where a high standard of hygiene is required.

Manufacturers are launching autonomous street washers that utilize very little water and energy and produce very little noise. This make it convenient to clean streets at night while obstructing as little traffic as possible.

For instance, in September 2021, Boschung introduced the Urban-Sweeper S2.0, which is electric and has 360° coverage of its surroundings due to a combination of LiDARs, cameras, mm-wave radars, and GNSS antennas. The autonomous electric street sweeper can safely sweep open streets as well as closed areas and can be used all day due to reduced noise pollution.

Manufacturers including Yantai Haide Special Vehicle Co., Ltd are providing innovations in street washing techniques with the introduction of street washers and sweepers that are integrated into one unit.

The roads/streets application segment accounted for major share of the global market in 2022. This segment is anticipated to dominate the global market in the next few years.

Street washers are employed by municipal street cleaning programs all around the world to help keep the streets and roadways clean. This market witnessed significant growth during the COVID-19 pandemic, owing to the increase in usage of street washers for road sanitization.

Authorities and contractors use dust control machines to wash the streets and highways and keep them free form dust and trash. Followed by the roads/streets segment, the highways application segment held prominent market share in 2022.

Additionally, increase in focus on cleanliness and maintenance of surroundings, such as airports, parks, hospitals, college campuses, and others, is likely to propel the demand for street washers during the forecast period.

As per the latest street washer market forecast, North America is projected to dominate the global industry during the forecast period owing to increase in investment in road and infrastructure development projects and the integration of emerging technologies in street washer machines. North America is likely to gain major street washer market share in the near future.

Rise in efforts to enhance fuel-saving technologies and the deployment of electric fleets and commercial cars are supporting the demand for electric street washers in the region.

The street washer market in Asia Pacific is anticipated to grow significantly during the forecast period due to rapid urbanization and large investment made by governments for smart city projects in the region. Increase in government regulations for environmental cleanliness is also projected to fuel the demand for street washer vehicles in urban areas in Asia Pacific in the next few years.

As per the global street washer market research analysis, the industry is consolidated with a few prominent players. Manufacturers are investing significantly in the research, development, and production of street washers.

Manufacturers use various strategies, including expansion of product portfolios, mergers & acquisitions, and showcasing their products at trade shows and exhibitions to stay competitive in the market and fulfill the needs of their customers.

Aebi Schmidt Holding AG, Dulevo International S.p.A., Dynaset Oy, Jurop S.p.A., MULAG Fahrzeugwerk, MultiOne S.r.l., Piquersa Maquinaria, S.A., Qingdao Hydun Autoparts Manufacturing Co., LTD, Tenax International S.p.A., Yantai Haide Special Vehicle Co., Ltd are a few prominent players operating in the global street washer market.

The global street washer market report includes profiles of key players who have been analyzed on diverse parameters such as business strategies, latest developments, product portfolio, financial overview, company overview, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2022 (Base Year) |

US$ 2.5 Bn |

|

Market Forecast Value in 2031 |

US$ 3.4 Bn |

|

Growth Rate (CAGR) |

3.7% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes drivers, restraints, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

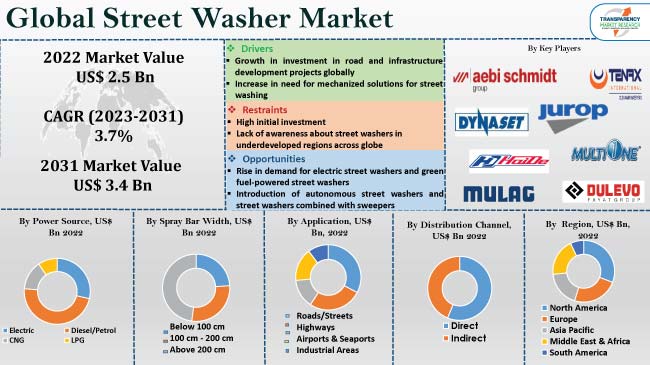

The global market was valued at US$ 2.5 Bn in 2022

The CAGR is estimated to be 3.7% during 2023 to 2031

Growth in investment in road and infrastructure development projects and increase in demand for mechanized solutions for street washing

The diesel/ petrol power source segment accounted for major share in 2022

North America was the most lucrative region in 2022

Aebi Schmidt Holding AG, Dynaset Oy, Tenax International S.p.A., DULEVO INTERNATIONAL S.P.A., MULAG Fahrzeugwerk, Piquersa Maquinaria, S.A., MultiOne S.r.l., Qingdao Hydun Autoparts Manufacturing Co., LTD, and Yantai Haide Special Vehicle Co., Ltd

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Street Washer Industry Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Regulatory Framework and Standards

5.8. Technology Analysis

5.9. COVID-19 Impact Analysis

5.10. Global Street Washer Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Street Washer Market Analysis and Forecast, by Power Source

6.1. Street Washer Market Size (US$ Bn and Thousand Units), by Power Source, 2017 - 2031

6.1.1. Electric

6.1.2. Diesel/Petrol

6.1.3. CNG

6.1.4. LPG

6.2. Incremental Opportunity, by Power Source

7. Global Street Washer Market Analysis and Forecast, by Spray Bar Width

7.1. Street Washer Market Size (US$ Bn and Thousand Units), by Spray Bar Width, 2017 - 2031

7.1.1. Below 100 cm

7.1.2. 100 cm – 200 cm

7.1.3. Above 200 cm

7.2. Incremental Opportunity, by Spray Bar Width

8. Global Street Washer Market Analysis and Forecast, by Application

8.1. Street Washer Market Size (US$ Bn and Thousand Units), by Application, 2017 - 2031

8.1.1. Roads/Streets

8.1.2. Highways

8.1.3. Airports & Seaports

8.1.4. Industrial Areas

8.1.5. Others

8.2. Incremental Opportunity, by Application

9. Global Street Washer Market Analysis and Forecast, by Distribution Channel

9.1. Street Washer Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

9.1.1. Direct

9.1.2. Indirect

9.2. Incremental Opportunity, by Distribution Channel

10. Global Street Washer Market Analysis and Forecast, by Region

10.1. Street Washer Market Size (US$ Bn and Thousand Units), by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Street Washer Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Key Trends Analysis

11.3.1. Demand Side Analysis

11.3.2. Supply Side Analysis

11.4. Street Washer Market Size (US$ Bn and Thousand Units), by Power Source, 2017 - 2031

11.4.1. Electric

11.4.2. Diesel/Petrol

11.4.3. CNG

11.4.4. LPG

11.5. Street Washer Market Size (US$ Bn and Thousand Units), by Spray Bar Width, 2017 - 2031

11.5.1. Below 100 cm

11.5.2. 100 cm - 200 cm

11.5.3. Above 200 cm

11.6. Street Washer Market Size (US$ Bn and Thousand Units), by Application, 2017 - 2031

11.6.1. Roads/Streets

11.6.2. Highways

11.6.3. Airports & Seaports

11.6.4. Industrial Areas

11.6.5. Others

11.7. Street Washer Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

11.7.1. Direct

11.7.2. Indirect

11.8. Street Washer Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

11.8.1. U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Incremental Opportunity Analysis

12. Europe Street Washer Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Street Washer Market Size (US$ Bn and Thousand Units), by Power Source, 2017 - 2031

12.4.1. Electric

12.4.2. Diesel/Petrol

12.4.3. CNG

12.4.4. LPG

12.5. Street Washer Market Size (US$ Bn and Thousand Units), by Spray Bar Width, 2017 - 2031

12.5.1. Below 100 cm

12.5.2. 100 cm - 200 cm

12.5.3. Above 200 cm

12.6. Street Washer Market Size (US$ Bn and Thousand Units), by Application, 2017 - 2031

12.6.1. Roads/Streets

12.6.2. Highways

12.6.3. Airports & Seaports

12.6.4. Industrial Areas

12.6.5. Others

12.7. Street Washer Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

12.7.1. Direct

12.7.2. Indirect

12.8. Street Washer Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

12.8.1. U.K.

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Incremental Opportunity Analysis

13. Asia Pacific Street Washer Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Street Washer Market Size (US$ Bn and Thousand Units), by Power Source, 2017 - 2031

13.4.1. Electric

13.4.2. Diesel/Petrol

13.4.3. CNG

13.4.4. LPG

13.5. Street Washer Market Size (US$ Bn and Thousand Units), by Spray Bar Width, 2017 - 2031

13.5.1. Below 100 cm

13.5.2. 100 cm - 200 cm

13.5.3. Above 200 cm

13.6. Street Washer Market Size (US$ Bn and Thousand Units), by Application, 2017 - 2031

13.6.1. Roads/Streets

13.6.2. Highways

13.6.3. Airports & Seaports

13.6.4. Industrial Areas

13.6.5. Others

13.7. Street Washer Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

13.7.1. Direct

13.7.2. Indirect

13.8. Street Washer Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

13.8.1. China

13.8.2. India

13.8.3. Japan

13.8.4. Rest of Asia Pacific

13.9. Incremental Opportunity Analysis

14. Middle East & Africa Street Washer Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Street Washer Market Size (US$ Bn and Thousand Units), by Power Source, 2017 - 2031

14.4.1. Electric

14.4.2. Diesel/Petrol

14.4.3. CNG

14.4.4. LPG

14.5. Street Washer Market Size (US$ Bn and Thousand Units), by Spray Bar Width, 2017 - 2031

14.5.1. Below 100 cm

14.5.2. 100 cm - 200 cm

14.5.3. Above 200 cm

14.6. Street Washer Market Size (US$ Bn and Thousand Units), by Application, 2017 - 2031

14.6.1. Roads/Streets

14.6.2. Highways

14.6.3. Airports & Seaports

14.6.4. Industrial Areas

14.6.5. Others

14.7. Street Washer Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

14.7.1. Direct

14.7.2. Indirect

14.8. Street Washer Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Incremental Opportunity Analysis

15. South America Street Washer Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Street Washer Market Size (US$ Bn and Thousand Units), by Power Source, 2017 - 2031

15.4.1. Electric

15.4.2. Diesel/Petrol

15.4.3. CNG

15.4.4. LPG

15.5. Street Washer Market Size (US$ Bn and Thousand Units), by Spray Bar Width, 2017 - 2031

15.5.1. Below 100 cm

15.5.2. 100 cm - 200 cm

15.5.3. Above 200 cm

15.6. Street Washer Market Size (US$ Bn and Thousand Units), by Application, 2017 - 2031

15.6.1. Roads/Streets

15.6.2. Highways

15.6.3. Airports & Seaports

15.6.4. Industrial Areas

15.6.5. Others

15.7. Street Washer Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

15.7.1. Direct

15.7.2. Indirect

15.8. Street Washer Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), 2022

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

16.3.1. Aebi Schmidt Holding AG

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Financial/Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Sales Channel Analysis

16.3.1.6. Size Portfolio

16.3.2. DULEVO INTERNATIONAL S.P.A.

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Financial/Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Sales Channel Analysis

16.3.2.6. Size Portfolio

16.3.3. Dynaset Oy

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Financial/Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Sales Channel Analysis

16.3.3.6. Size Portfolio

16.3.4. Jurop S.p.A.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Financial/Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Sales Channel Analysis

16.3.4.6. Size Portfolio

16.3.5. MULAG Fahrzeugwerk

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Financial/Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Sales Channel Analysis

16.3.5.6. Size Portfolio

16.3.6. MultiOne S.r.l.

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Financial/Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Sales Channel Analysis

16.3.6.6. Size Portfolio

16.3.7. Piquersa Maquinaria, S.A.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Financial/Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Sales Channel Analysis

16.3.7.6. Size Portfolio

16.3.8. Qingdao Hydun Autoparts Manufacturing Co., LTD

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Financial/Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Sales Channel Analysis

16.3.8.6. Size Portfolio

16.3.9. Tenax International S.p.A.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Financial/Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Sales Channel Analysis

16.3.9.6. Size Portfolio

16.3.10. Yantai Haide Special Vehicle Co., Ltd

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Financial/Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Sales Channel Analysis

16.3.10.6. Size Portfolio

17. Go To Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Street Washer Market, by Power Source, Thousand Units, 2017-2031

Table 2: Global Street Washer Market, by Power Source, US$ Bn, 2017-2031

Table 3: Global Street Washer Market, by Spray Bar Width, Thousand Units, 2017-2031

Table 4: Global Street Washer Market, by Spray Bar Width, US$ Bn, 2017-2031

Table 5: Global Street Washer Market, by Application, Thousand Units, 2017-2031

Table 6: Global Street Washer Market, by Application, US$ Bn, 2017-2031

Table 7: Global Street Washer Market, by Distribution Channel, Thousand Units, 2017-2031

Table 8: Global Street Washer Market, by Distribution Channel, US$ Bn, 2017-2031

Table 9: Global Street Washer Market, by Region, Thousand Units, 2017-2031

Table 10: Global Street Washer Market, by Region, US$ Bn, 2017-2031

Table 11: North America Street Washer Market, by Power Source, Thousand Units, 2017-2031

Table 12: North America Street Washer Market, by Power Source, US$ Bn, 2017-2031

Table 13: North America Street Washer Market, by Spray Bar Width, Thousand Units, 2017-2031

Table 14: North America Street Washer Market, by Spray Bar Width, US$ Bn, 2017-2031

Table 15: North America Street Washer Market, by Application, Thousand Units, 2017-2031

Table 16: North America Street Washer Market, by Application, US$ Bn, 2017-2031

Table 17: North America Street Washer Market, by Distribution Channel, Thousand Units, 2017-2031

Table 18: North America Street Washer Market, by Distribution Channel, US$ Bn, 2017-2031

Table 19: North America Street Washer Market, by Country, Thousand Units, 2017-2031

Table 20: North America Street Washer Market, by Country, US$ Bn, 2017-2031

Table 21: Europe Street Washer Market, by Power Source, Thousand Units, 2017-2031

Table 22: Europe Street Washer Market, by Power Source, US$ Bn, 2017-2031

Table 23: Europe Street Washer Market, by Spray Bar Width, Thousand Units, 2017-2031

Table 24: Europe Street Washer Market, by Spray Bar Width, US$ Bn, 2017-2031

Table 25: Europe Street Washer Market, by Application, Thousand Units, 2017-2031

Table 26: Europe Street Washer Market, by Application, US$ Bn, 2017-2031

Table 27: Europe Street Washer Market, by Distribution Channel, Thousand Units, 2017-2031

Table 28: Europe Street Washer Market, by Distribution Channel, US$ Bn, 2017-2031

Table 29: Europe Street Washer Market, by Country, Thousand Units, 2017-2031

Table 30: Europe Street Washer Market, by Country, US$ Bn, 2017-2031

Table 31: Asia Pacific Street Washer Market, by Power Source, Thousand Units, 2017-2031

Table 32: Asia Pacific Street Washer Market, by Power Source, US$ Bn, 2017-2031

Table 33: Asia Pacific Street Washer Market, by Spray Bar Width, Thousand Units, 2017-2031

Table 34: Asia Pacific Street Washer Market, by Spray Bar Width, US$ Bn, 2017-2031

Table 35: Asia Pacific Street Washer Market, by Application, Thousand Units, 2017-2031

Table 36: Asia Pacific Street Washer Market, by Application, US$ Bn, 2017-2031

Table 37: Asia Pacific Street Washer Market, by Distribution Channel, Thousand Units, 2017-2031

Table 38: Asia Pacific Street Washer Market, by Distribution Channel, US$ Bn, 2017-2031

Table 39: Asia Pacific Street Washer Market, by Country, Thousand Units, 2017-2031

Table 40: Asia Pacific Street Washer Market, by Country, US$ Bn, 2017-2031

Table 41: Middle East & Africa Street Washer Market, by Power Source, Thousand Units, 2017-2031

Table 42: Middle East & Africa Street Washer Market, by Power Source, US$ Bn, 2017-2031

Table 43: Middle East & Africa Street Washer Market, by Spray Bar Width, Thousand Units, 2017-2031

Table 44: Middle East & Africa Street Washer Market, by Spray Bar Width, US$ Bn, 2017-2031

Table 45: Middle East & Africa Street Washer Market, by Application, Thousand Units, 2017-2031

Table 46: Middle East & Africa Street Washer Market, by Application, US$ Bn, 2017-2031

Table 47: Middle East & Africa Street Washer Market, by Distribution Channel, Thousand Units, 2017-2031

Table 48: Middle East & Africa Street Washer Market, by Distribution Channel, US$ Bn, 2017-2031

Table 49: Middle East & Africa Street Washer Market, by Country, Thousand Units, 2017-2031

Table 50: Middle East & Africa Street Washer Market, by Country, US$ Bn, 2017-2031

Table 51: South America Street Washer Market, by Power Source, Thousand Units, 2017-2031

Table 52: South America Street Washer Market, by Power Source, US$ Bn, 2017-2031

Table 53: South America Street Washer Market, by Spray Bar Width, Thousand Units, 2017-2031

Table 54: South America Street Washer Market, by Spray Bar Width, US$ Bn, 2017-2031

Table 55: South America Street Washer Market, by Application, Thousand Units, 2017-2031

Table 56: South America Street Washer Market, by Application, US$ Bn, 2017-2031

Table 57: South America Street Washer Market, by Distribution Channel, Thousand Units, 2017-2031

Table 58: South America Street Washer Market, by Distribution Channel, US$ Bn, 2017-2031

Table 59: South America Street Washer Market, by Country, Thousand Units, 2017-2031

Table 60: South America Street Washer Market, by Country, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Street Washer Market Projections by Power Source, Thousand Units, 2017-2031

Figure 2: Global Street Washer Market Projections by Power Source, US$ Bn, 2017-2031

Figure 3: Global Street Washer Market, Incremental Opportunity, by Power Source, US$ Bn, 2017-2031

Figure 4: Global Street Washer Market Projections by Spray Bar Width, Thousand Units, 2017-2031

Figure 5: Global Street Washer Market Projections by Spray Bar Width, US$ Bn, 2017-2031

Figure 6: Global Street Washer Market, Incremental Opportunity, by Spray Bar Width, US$ Bn, 2017-2031

Figure 7: Global Street Washer Market Projections by Application, Thousand Units, 2017-2031

Figure 8: Global Street Washer Market Projections by Application, US$ Bn, 2017-2031

Figure 9: Global Street Washer Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 10: Global Street Washer Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 11: Global Street Washer Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 12: Global Street Washer Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 13: Global Street Washer Market Projections by Region, Thousand Units, 2017-2031

Figure 14: Global Street Washer Market Projections by Region, US$ Bn, 2017-2031

Figure 15: Global Street Washer Market, Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 16: North America Street Washer Market Projections by Power Source, Thousand Units, 2017-2031

Figure 17: North America Street Washer Market Projections by Power Source, US$ Bn, 2017-2031

Figure 18: North America Street Washer Market, Incremental Opportunity, by Power Source, US$ Bn, 2017-2031

Figure 19: North America Street Washer Market Projections by Spray Bar Width, Thousand Units, 2017-2031

Figure 20: North America Street Washer Market Projections by Spray Bar Width, US$ Bn, 2017-2031

Figure 21: North America Street Washer Market, Incremental Opportunity, by Spray Bar Width, US$ Bn, 2017-2031

Figure 22: North America Street Washer Market Projections by Application, Thousand Units, 2017-2031

Figure 23: North America Street Washer Market Projections by Application, US$ Bn, 2017-2031

Figure 24: North America Street Washer Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 25: North America Street Washer Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 26: North America Street Washer Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 27: North America Street Washer Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 28: North America Street Washer Market Projections by Country, Thousand Units, 2017-2031

Figure 29: North America Street Washer Market Projections by Country, US$ Bn, 2017-2031

Figure 30: North America Street Washer Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 31: Europe Street Washer Market Projections by Power Source, Thousand Units, 2017-2031

Figure 32: Europe Street Washer Market Projections by Power Source, US$ Bn, 2017-2031

Figure 33: Europe Street Washer Market, Incremental Opportunity, by Power Source, US$ Bn, 2017-2031

Figure 34: Europe Street Washer Market Projections by Spray Bar Width, Thousand Units, 2017-2031

Figure 35: Europe Street Washer Market Projections by Spray Bar Width, US$ Bn, 2017-2031

Figure 36: Europe Street Washer Market, Incremental Opportunity, by Spray Bar Width, US$ Bn, 2017-2031

Figure 37: Europe Street Washer Market Projections by Application, Thousand Units, 2017-2031

Figure 38: Europe Street Washer Market Projections by Application, US$ Bn, 2017-2031

Figure 39: Europe Street Washer Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 40: Europe Street Washer Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 41: Europe Street Washer Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 42: Europe Street Washer Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 43: Europe Street Washer Market Projections by Country, Thousand Units, 2017-2031

Figure 44: Europe Street Washer Market Projections by Country, US$ Bn, 2017-2031

Figure 45: Europe Street Washer Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 46: Asia Pacific Street Washer Market Projections by Power Source, Thousand Units, 2017-2031

Figure 47: Asia Pacific Street Washer Market Projections by Power Source, US$ Bn, 2017-2031

Figure 48: Asia Pacific Street Washer Market, Incremental Opportunity, by Power Source, US$ Bn, 2017-2031

Figure 49: Asia Pacific Street Washer Market Projections by Spray Bar Width, Thousand Units, 2017-2031

Figure 50: Asia Pacific Street Washer Market Projections by Spray Bar Width, US$ Bn, 2017-2031

Figure 51: Asia Pacific Street Washer Market, Incremental Opportunity, by Spray Bar Width, US$ Bn, 2017-2031

Figure 52: Asia Pacific Street Washer Market Projections by Application, Thousand Units, 2017-2031

Figure 53: Asia Pacific Street Washer Market Projections by Application, US$ Bn, 2017-2031

Figure 54: Asia Pacific Street Washer Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 55: Asia Pacific Street Washer Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 56: Asia Pacific Street Washer Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 57: Asia Pacific Street Washer Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 58: Asia Pacific Street Washer Market Projections by Country, Thousand Units, 2017-2031

Figure 59: Asia Pacific Street Washer Market Projections by Country, US$ Bn, 2017-2031

Figure 60: Asia Pacific Street Washer Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 61: Middle East & Africa Street Washer Market Projections by Power Source, Thousand Units, 2017-2031

Figure 62: Middle East & Africa Street Washer Market Projections by Power Source, US$ Bn, 2017-2031

Figure 63: Middle East & Africa Street Washer Market, Incremental Opportunity, by Power Source, US$ Bn, 2017-2031

Figure 64: Middle East & Africa Street Washer Market Projections by Spray Bar Width, Thousand Units, 2017-2031

Figure 65: Middle East & Africa Street Washer Market Projections by Spray Bar Width, US$ Bn, 2017-2031

Figure 66: Middle East & Africa Street Washer Market, Incremental Opportunity, by Spray Bar Width, US$ Bn, 2017-2031

Figure 67: Middle East & Africa Street Washer Market Projections by Application, Thousand Units, 2017-2031

Figure 68: Middle East & Africa Street Washer Market Projections by Application, US$ Bn, 2017-2031

Figure 69: Middle East & Africa Street Washer Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 70: Middle East & Africa Street Washer Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 71: Middle East & Africa Street Washer Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 72: Middle East & Africa Street Washer Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 73: Middle East & Africa Street Washer Market Projections by Country, Thousand Units, 2017-2031

Figure 74: Middle East & Africa Street Washer Market Projections by Country, US$ Bn, 2017-2031

Figure 75: Middle East & Africa Street Washer Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 76: South America Street Washer Market Projections by Power Source, Thousand Units, 2017-2031

Figure 77: South America Street Washer Market Projections by Power Source, US$ Bn, 2017-2031

Figure 78: South America Street Washer Market, Incremental Opportunity, by Power Source, US$ Bn, 2017-2031

Figure 79: South America Street Washer Market Projections by Spray Bar Width, Thousand Units, 2017-2031

Figure 80: South America Street Washer Market Projections by Spray Bar Width, US$ Bn, 2017-2031

Figure 81: South America Street Washer Market, Incremental Opportunity, by Spray Bar Width, US$ Bn, 2017-2031

Figure 82: South America Street Washer Market Projections by Application, Thousand Units, 2017-2031

Figure 83: South America Street Washer Market Projections by Application, US$ Bn, 2017-2031

Figure 84: South America Street Washer Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 85: South America Street Washer Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 86: South America Street Washer Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 87: South America Street Washer Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 88: South America Street Washer Market Projections by Country, Thousand Units, 2017-2031

Figure 89: South America Street Washer Market Projections by Country, US$ Bn, 2017-2031

Figure 90: South America Street Washer Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031