Steam Autoclave Market: Snapshot

The global steam autoclave market is extremely consolidated and intensely competitive. The presence of a very small number of companies commanding a vast share in the global market has rendered the market difficult to penetrate for new companies. Despite this fact, the market presents promising growth opportunities for companies introducing technologically advanced products, a trend evident from the high consumption of products based on E-beam and gamma irradiation technologies in the past few years.

The vast rise in the global demand for steam autoclaves in the past few years can be attributed to the increased prevalence of a number of infectious diseases, a huge surge in surgical procedures, and an alarming rise in the numbers of hospital-acquired infections. Rising demand for improving healthcare services across developing regional markets such as Asia Pacific, owing majorly to rising healthcare expenditures and an expanding base of geriatric population.

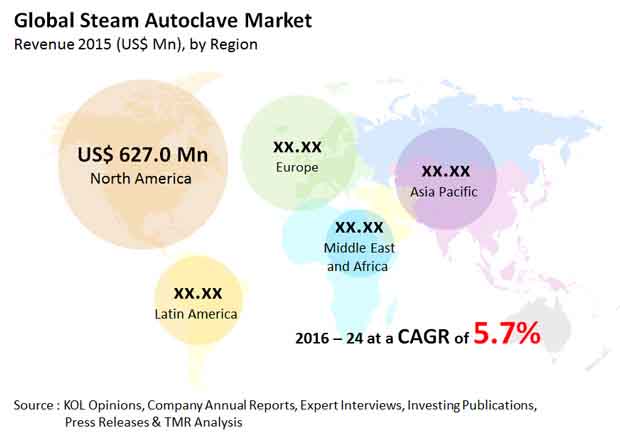

Transparency Market Research suggests that the global steam autoclave market will expand at a healthy 5.7% CAGR over the period between 2016 and 2024. The market, which had a valuation of US$1.57 bn in 2015, is expected to rise to US$2.57 bn by 2024.

Developed Economies to Remain Dominant

North America emerged as the clear leader in the global steam autoclave market in 2015, accounting for a nearly 40% share in the market’s overall revenue. Estimates suggest that in U.S. alone in the region, nearly 5 million endoscopies and about 46.5 million surgeries are undertaken every year. The severity of hospital-acquired infections in the country can be estimated from the fact that nearly 8.3 patients out of every 1,000 patients admitted in New York state hospitals in 2012 acquired hospital-onset Clostridium difficile infections (CDI). The numbers are rising at an alarming pace.

These factors have collectively influenced the increased adoption of effective sanitization practices and devices in healthcare settings in North America. Strict rules aimed at enhanced safety of patients at healthcare facilities is also a major factor influencing the increased adoption of steam autoclaves in Europe, the second-largest steam autoclave regional market in 2015.

Emerging Economies to Present Most Promising Growth Opportunities

The high prevalence of infectious diseases, a vast and alarmingly rising population base of geriatric people in Asia Pacific are expected to help the steam autoclave develop on a promising scale in the region in the next few years. The rising demand for high-quality healthcare services from the increasingly affluent consumer base will stimulate the improvement of healthcare infrastructure in countries such as India, China, and parts of Latin America, further driving the market.

The market for steam autoclave in Asia Pacific is expected to expand at the fastest CAGR of 7.9% CAGR from 2016 to 2024 among other key regional markets. The market in Latin America is expected to exhibit the second-largest CAGR of 6.9% over the same period.

Sales of Traditional Steam Autoclaves Continue to Rise

Of the two key varieties of steam autoclave systems available in the market – traditional steam autoclaves and tabletop steam autoclaves, the segment of traditional steam autoclave is presently leading the global market. The segment accounted for a share of over 91.7% in the global market in 2015 and is projected to expand at the highest CAGR over the forecasting horizon, maintaining its dominance in the near future as well.

The prominence of these product types can be attributed to their extensive usage in almost all major application areas such as pharmaceutical laboratories and medical devices. Additionally, traditional steam autoclaves are also considered highly efficient for sterilizing a large number of medical devices at the same time, making them more practical in large medical setups.

The top three companies, which accounted for a share of over 70% in the global steam autoclave market in 2015, are STERIS, Getinge Group, and Johnson & Johnson. Other prominent vendors in the market include 3M Health Care, Matachana Group, Belimed Group, CISA Group, CISA Group, and SAKURA SI CO., LTD.

Steam Autoclave Market to Witness Progressive Growth Owing to Increasing Number of Infection Cases

The tremendous ascent in the worldwide interest for steam autoclaves in the previous few years can be credited to the expanded pervasiveness of various irresistible sicknesses, an immense flood in surgeries, and a disturbing ascent in the quantities of emergency clinic procured diseases. Improving medical care administrations across creating territorial business sectors like Asia Pacific, owing significantly to the rising medical services consumptions and a growing base of geriatric populace are other drivers for the growth of the global steam autoclave market.

The high pervasiveness of irresistible infections, a tremendous and alarmingly rising populace base of geriatric individuals in Asia Pacific are required to help the steam autoclave create on a promising scale in the locale in the following not many years. The rising interest for excellent medical care administrations from the undeniably well-off shopper base will invigorate the improvement of medical care foundation in nations like India, China, and parts of Latin America, further driving the market.

The surgeries are expanding because of the expansion in the constant infection cases and the need for their medicines. Additionally, the patient base is expanding particularly in the non-industrial nations in the Asia Pacific attributable to the enormous populace of the area. The previously mentioned factors are pushing appropriation of the steam autoclave and which is probably going to support the development of the steam autoclaves market.

The development of the steam autoclaves market is acquiring footing because of the presence of severe guidelines to guarantee patients wellbeing and developing presence of cutting edge medical care offices.

Regardless of these development prospects, the factor, for example, expanded take-up of dispensable items which are intended to be utilized once and required less sterilization is hampering the development of the worldwide steam autoclave market. Furthermore, higher extract obligation forced on the clinical gadgets are affecting contrarily on the development of the general steam autoclave market, particularly in the creating areas. In any case, developing mindfulness about medical care across the non-industrial nations is setting out development open doors for the vital participants working in the worldwide steam autoclave market.

1. Preface

1.1. Report Description

1.2. Market Segmentation

1.3. Research Methodology

2. Executive Summary

2.1. Global steam autoclave Market Share, by Product, (US$ Mn), 2014–2024

2.2. Global Market, by Geography, (US$ Mn), 2015

2.3. Steam Autoclave Market Snapshot

3. Steam Autoclave Market - Industry Analysis

3.1. Introduction

3.2. Market Drivers

3.2.1. Rising Number of Surgeries

3.2.2. Increasing Number of Nosocomial Infections

3.3. Restraints

3.3.1. Shifting Trend Toward Disposable Medical Devices

3.4. Opportunities

3.4.1. E-Beam Sterilization Represents Vast Opportunities

3.5. Porter’s Five Forces Analysis

3.6. Market Attractiveness Analysis - Steam Autoclave Market, by Geography (2015) (%)

3.7. Competitive Landscape, 2015

4. Market Segmentation - By Product

4.1. Introduction

4.2. Global Steam Autoclave Market Revenue, by Product, (US$ Mn), 2014–2024

4.3. Global Traditional Autoclave Market Revenue, (US$ Mn), 2014–2024

4.4. Global Tabletop Autoclave Market Revenue, (US$ Mn), 2014–2024

5. Market Segmentation - By Indicator

5.1. Introduction

5.2. Global Steam Autoclave Market Revenue, by Product, (US$ Mn), 2014–2024

5.3. Global Chemical Indicator Market Revenue, (US$ Mn), 2014–2024

5.4. Global Biological Indicator Market Revenue, (US$ Mn), 2014–2024

5.5. Global Mechanical Indicator Market Revenue, (US$ Mn), 2014–2024

6. Market Segmentation - By Technology

6.1. Introduction

6.2. Global Steam Autoclave Market Revenue, by Technology, (US$ Mn), 2014–2024

6.3. Global Gravity Displacement Autoclave Market Revenue, (US$ Mn), 2014–2024

6.4. Global Pre-vacuum Autoclave Market Revenue, (US$ Mn), 2014–2024

6.5. Global Steam Flush Autoclave Market Revenue, (US$ Mn), 2014–2024

7. Market Segmentation - By End-User

7.1. Introduction

7.2. Global Steam Autoclave Market Revenue, by End-user, (US$ Mn), 2014–2024

7.3. Global Hospitals Autoclave Market Revenue, (US$ Mn), 2014–2024

7.4. Global Health Care Organizations Autoclave Market Revenue, 2(US$ Mn), 2014–2024

7.5. Global Academics Autoclave Market Revenue, (US$ Mn), 2014–2024

8. Market Segmentation - By Geography

8.1. Introduction

8.2. Global Steam Autoclave Market Revenue, by Geography, (US$ Mn), 2014–2024

8.3. North America Steam Autoclave Market Revenue, by Country, (US$ Mn), 2014–2024

8.3.1. U.S.

8.3.2. Canada

8.4. North America Market Revenue, by Product, (US$ Mn), 2014–2024

8.4.1. Traditional

8.4.2. Tabletop

8.5. North America Steam Autoclave Market Revenue, by Indicator, (US$ Mn), 2014–2024

8.5.1. Chemical

8.5.2. Biological

8.5.3. Mechanical

8.6. North America Market Revenue, by Technology, (US$ Mn), 2014–2024

8.6.1. Gravity Displacement

8.6.2. Pre-vacuum

8.6.3. Steam Flush

8.7. North America Market Revenue, by End-user, (US$ Mn), 2014–2024

8.7.1. Hospitals

8.7.2. Health Care Organizations

8.7.3. Academics

8.8. Europe Steam Autoclave Market Revenue, by Country, (US$ Mn), 2014–2024

8.8.1. Germany

8.8.2. France

8.8.3. Rest of Europe

8.9. Europe Market Revenue, by Product, (US$ Mn), 2014–2024

8.9.1. Traditional

8.9.2. Tabletop

8.10. Europe Market Revenue, by Indicator, (US$ Mn), 2014–2024

8.10.1. Chemical

8.10.2. Biological

8.10.3. Mechanical

8.11. Europe Steam Autoclave Market Revenue, by Technology, (US$ Mn), 2014–2024

8.11.1. Gravity Displacement

8.11.2. Pre-vacuum

8.11.3. Steam Flush

8.12. Europe Market Revenue, by End-user, (US$ Mn), 2014–2024

8.12.1. Hospitals

8.12.2. Health Care Organizations

8.12.3. Academics

8.13. Asia Pacific Steam Autoclave Market Revenue, by Country, (US$ Mn), 2014–2024

8.13.1. China

8.13.2. Japan

8.13.3. Rest of APAC

8.14. Asia Pacific Steam Autoclave Market Revenue, by Product, (US$ Mn), 2014–2024

8.14.1. Traditional

8.14.2. Tabletop

8.15. Asia Pacific Market Revenue, by Indicator, (US$ Mn), 2014–2024

8.15.1. Chemical

8.15.2. Biological

8.15.3. Mechanical

8.16. Asia Pacific Autoclave Market Revenue, by Technology, (US$ Mn), 2014–2024

8.16.1. Gravity Displacement

8.16.2. Pre-vacuum

8.16.3. Steam Flush

8.17. Asia Pacific Steam Autoclave Market Revenue, by End-user, (US$ Mn), 2014–2024

8.17.1. Hospitals

8.17.2. Health Care Organizations

8.17.3. Academics

8.18. LATAM Steam Autoclave Market Revenue, by Country, (US$ Mn), 2014–2024

8.18.1. Brazil

8.18.2. Mexico

8.18.3. Rest of LATAM

8.19. LATAM Market Revenue, by Product, (US$ Mn), 2014–2024

8.19.1. Traditional

8.19.2. Tabletop

8.20. LATAM Market Revenue, by Indicator, (US$ Mn), 2014–2024

8.20.1. Chemical

8.20.2. Biological

8.20.3. Mechanical

8.21. LATAM Autoclave Market Revenue, by Technology, (US$ Mn), 2014–2024

8.21.1. Gravity Displacement

8.21.2. Pre-vacuum

8.21.3. Steam Flush

8.22. LATAM Steam Autoclave Market Revenue, by End-user, (US$ Mn), 2014–2024

8.22.1. Hospitals

8.22.2. Health Care Organizations

8.22.3. Academics

8.23. MEA Market Revenue, by Country, (US$ Mn), 2014–2024

8.23.1. Saudi Arabia

8.23.2. South Africa

8.23.3. Rest of MEA

8.24. MEA Steam Autoclave Market Revenue, by Product, (US$ Mn), 2014–2024

8.24.1. Traditional

8.24.2. Tabletop

8.25. MEA Market Revenue, by Indicator, (US$ Mn), 2014–2024

8.25.1. Chemical

8.25.2. Biological

8.25.3. Mechanical

8.26. MEA Autoclave Market Revenue, by Technology, (US$ Mn), 2014–2024

8.26.1. Gravity Displacement

8.26.2. Pre-vacuum

8.26.3. Steam Flush

8.27. MEA Market Revenue, by End-user, (US$ Mn), 2014–2024

8.27.1. Hospitals

8.27.2. Health Care Organizations

8.27.3. Academics

9. Company Profiles

9.1. 3M Health Care

9.1.1. Company Overview (HQ, Business Segments, Employee Strength)

9.1.2. Financial Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.1.5. Recent Developments

9.2. Belimed Group

9.2.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.2. Financial Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.2.5. Recent Developments

9.3. CISA Group

9.3.1. Company Overview (HQ, Business Segments, Employee Strength)

9.3.2. Product Portfolio

9.3.3. Business Strategies

9.3.4. Recent Developments

9.4. Getinge AB

9.4.1. Company Overview (HQ, Business Segments, Employee Strength)

9.4.2. Financial Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.4.5. Recent Developments

9.5. Johnson & Johnson

9.5.1. Company Overview (HQ, Business Segments, Employee Strength)

9.5.2. Financial Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.5.5. Recent Developments

9.6. SAKURA SI CO., LTD.

9.6.1. Company Overview (HQ, Business Segments, Employee Strength)

9.6.2. Product Portfolio

9.6.3. Business Strategies

9.6.4. Recent Developments

9.7. STERIS plc.

9.7.1. Company Overview (HQ, Business Segments, Employee Strength)

9.7.2. Financial Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.7.5. Recent Developments

List of Tables

TABLE 1 Market Snapshot: Global Steam Autoclave Market

TABLE 2 Global Steam Autoclave Market Revenue, by Product Type, (US$ Mn), 2014–2024

TABLE 3 Global Market Revenue, by Indicators, (US$ Mn), 2014–2024

TABLE 4 Global Market Revenue, by Technology, (US$ Mn), 2014–2024

TABLE 5 Global Market Revenue, by End-user, (US$ Mn), 2014–2024

TABLE 6 Global Steam Autoclave Market Revenue, by Geography, (US$ Mn), 2014–2024

TABLE 7 North America Steam Autoclave Market Revenue, by Country, (US$ Mn), 2014–2024

TABLE 8 North America Market Revenue, by Indicator, (US$ Mn), 2014–2024

TABLE 9 North America Steam Autoclave Market Revenue, by Technology, (US$ Mn), 2014–2024

TABLE 10 North America Market Revenue, by End-user, (US$ Mn), 2014–2024

TABLE 11 Europe Steam Autoclave Market Revenue, by Country, (US$ Mn), 2014–2024

TABLE 12 Europe Market Revenue, by Indicator, (US$ Mn), 2014–2024

TABLE 13 Europe Market Revenue, by Technology, (US$ Mn), 2014–2024

TABLE 14 Europe Market Revenue, by End-user, (US$ Mn), 2014–2024

TABLE 15 Asia Pacific Steam Autoclave Market Revenue, by Country, (US$ Mn), 2014–2024

TABLE 16 Asia Pacific Steam Autoclave Market Revenue, by Indicator, (US$ Mn), 2014–2024

TABLE 17 Asia Pacific Market Revenue, by Technology, (US$ Mn), 2014–2024

TABLE 18 Asia Pacific Market Revenue, by End-user, (US$ Mn), 2014–2024

TABLE 19 Latin America Steam Autoclave Market Revenue, by Country, (US$ Mn), 2014–2024

TABLE 20 Latin America Steam Autoclave Market Revenue, by Indicator, (US$ Mn), 2014–2024

TABLE 21 Latin America Market Revenue, by Technology, (US$ Mn), 2014–2024

TABLE 22 Latin America Steam Autoclave Market Revenue, by End-user, (US$ Mn), 2014–2024

TABLE 23 Middle East & Africa Steam Autoclave Market Revenue, by Country, (US$ Mn), 2014–2024

TABLE 24 Middle East & Africa Market Revenue, by Indicator, (US$ Mn), 2014–2024

TABLE 25 Middle East & Africa Market Revenue, by Technology, (US$ Mn), 2014–2024

TABLE 26 Middle East & Africa Steam Autoclave Market Revenue, by End-user, (US$ Mn), 2014–2024

List of Figures

FIG. 1 Market Segmentation

FIG. 2 Global Steam Autoclave Market Revenue, by Product Type, 2015 and 2024 (Value %)

FIG. 3 Global Steam Autoclave Market Revenue, by Geography, 2015 (Value %)

FIG. 4 Global Market Revenue, by Geography, 2024 (Value %)

FIG. 5 Global Market Revenue, by Geography, 2014 - 2024 (US$ Mn)

FIG. 6 Global Steam Autoclave Market Revenue, by Technology, 2014 - 2024 (US$ Mn)

FIG. 7 Global Steam Autoclave Market Revenue, by Product, 2014 - 2024 (US$ Mn)

FIG. 8 Global Steam Autoclave Market Revenue, by Indicator, 2014 - 2024 (US$ Mn)

FIG. 9 Market Attractiveness Analysis: Steam Autoclave Market, by Geography, 2015

FIG. 10 Porter’s Five Forces Analysis

FIG. 11 Competitive Landscape

FIG. 12 Global Traditional Autoclave Market Revenue, (US$ Mn), 2014–2024

FIG. 13 Global Tabletop Autoclave Market Revenue, (US$ Mn), 2014–2024

FIG. 14 Global Chemical Autoclaves Market Revenue, (US$ Mn), 2014–2024

FIG. 15 Global Biological Autoclaves Market Revenue, (US$ Mn), 2014–2024

FIG. 16 Global Mechanical Autoclaves Market Revenue, (US$ Mn), 2014–2024

FIG. 17 Global Gravity Displacement Technology Market Revenue, (US$ Mn), 2014–2024

FIG. 18 Global Pre-vacuum Technology Market Revenue, (US$ Mn), 2014–2024

FIG. 19 Global Steam Flush Technology Market Revenue, (US$ Mn), 2014–2024

FIG. 20 Global Hospital Autoclaves Market Revenue, (US$ Mn), 2014–2024

FIG. 21 Global Health Care Organization Autoclaves Market Revenue, (US$ Mn), 2014–2024

FIG. 22 Global Academic Autoclaves Market Revenue, (US$ Mn), 2014–2024

FIG. 23 Financial Overview (3M Company): 2013–2015 (US$ Mn)

FIG. 24 Financial Overview: Belimed (US$ Mn), 2013–2015

FIG. 25 Financial Overview: Getinge, (US$ Mn), 2013–2015

FIG. 26 Financial Overview: J&J, Medical Device (US$ Mn), 2013–2015

FIG. 27 Financial Overview: Steris, (US$ Mn), 2013–2015