Analysts’ Viewpoint

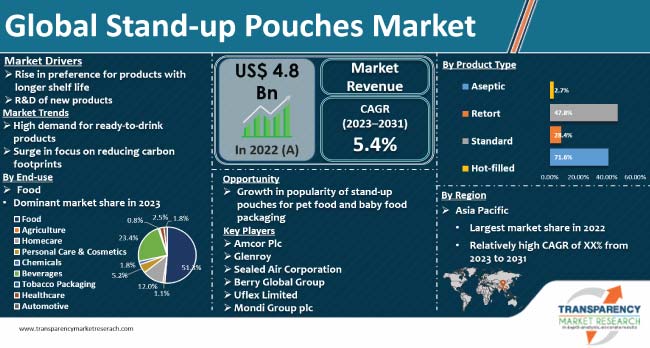

Rise in preference for products with longer shelf life and R&D of new products are projected to propel the stand-up pouches market size during the forecast period. High demand for ready-to-drink products and surge in focus on reducing carbon footprints are major trends in the global market. Brand owners are continuously working with packaging manufacturers to reduce the carbon footprint of packaging products. Growth in popularity of stand-up pouches for pet food and baby food packaging is likely to offer lucrative opportunities for vendors in the global stand-up pouches industry.

Stand-up pouches are a type of flexible packaging commonly used for the storage and packaging of various products. These pouches are suited for packaging a wide range of frozen foods and provide outstanding barrier properties, enhanced esthetics, and functional and convenience aspects.

The demand for sustainable packaging solutions has exponentially increased in the packaging sector. With awareness about depleting resources and their negative impact on the environment, manufacturers and consumers are switching to sustainable packaging solutions that are biodegradable or recyclable. Sustainable packaging is a viable alternative that leaves a positive impact on the environment. As consumers have become environment-conscious, manufacturers are now designing the packages sustainably. Moreover, in order to deliver sustainable stand-up pouches, manufacturers are collaborating with other brands and launching recyclable technology.

The global food packaging sector is witnessing a high demand for flexible and transparent packaging solutions. Growth in preference for products with extended shelf life is anticipated to augment the stand-up pouches market value in the next few years.

Consumer preferences are more inclined toward packaging solutions that are desirable, easy to handle, and have a low cost. The food habits of consumers are changing significantly. Consumers in North America are preferring food that takes less time to cook. This change in food habits is due to a hectic work culture and a fast-paced lifestyle. Increase in number of packaged and retail food outlets is driving the demand for packaging solutions that extend the shelf life of food products.

Snacks and bakery products need packaging solutions that increase their shelf life. Resalable, single-serve, and lightweight packaging solutions are also gaining traction among end-users. Thus, consumers are preferring convenient food packaging while suppliers are demanding lightweight packaging solutions. Such a scenario is boosting the stand-up pouches market progress.

The packaging sector is driven by the latest packaging trends. Innovation in packaging solutions helps products to stand out and provides cost-effective and sustainable packaging solutions. Thus, stand-up pouch manufacturers are focusing on the research and development of new products to expand their customer base.

A key focus during research and development of new technologies in packaging is on the ability to extend shelf life, improve product quality and safety, and keep the user informed about the ingredients of the product. Various benefits of stand-up pouches and the features they offer in tandem with evolving consumer preferences are prompting manufacturers to incorporate various technologies in their products. Hence, rise in investment in the R&D of new products is propelling the stand-up pouches market expansion.

High Demand for Printable and Customized Packaging Solutions

Demand for customized packaging has skyrocketed in the packaging sector. Customers are more concerned about the look and feel of packaged products. Manufacturers are offering pouches with unique designs, shapes, and styles to increase their stand-up pouches market share. They are using new digital printing technologies to enhance the quality of stand-up pouches. Printing vivid and clear designs on stand-up pouches provides brand recognition and differentiation from competitors.

According to the latest stand-up pouches market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. Increase in demand for convenient food packaging solutions is fueling the market dynamics of the region. Surge in focus on product safety, visibility, and extended shelf life is propelling adoption of stand-up pouch packaging in the U.S., Germany, and the U.K.

Brand owners are continuously working with packaging manufacturers to reduce the carbon footprint of packaging products. As a result, stand-up pouches are replacing rigid packaging products such as metal cans for beverage packaging. To pack the same amount of liquid, stand-up pouches reduce carbon footprint by more than 80% when compared with metal cans.

Reduction in the weight of packaging products is expected to result in a low carbon footprint. Stand-up pouches reduce the overall cost of transportation and logistics due to their lightweight properties and stacking ability. Stand-up pouch companies are investing in research and development activities to manufacture solutions with lower carbon footprint.

Amcor Plc, Sealed Air Corporation, Berry Global Group, Inc., Mondi Group plc, Huhtamäki Oyj, Constantia Flexibles Group GmbH, Sonoco Products, AR Packaging Group AB, Uflex Ltd., Winpak Ltd., Glenroy, Inc., Schur Flexibles Group, ProAmpac LLC, Goglio Group, Bischof and Klein GmbH and Co. KG, Korozo Ambalaj Sanayi Ve Ticaret AS, Printpack, Inc., and Coveris Holdings S.A are key players operating in the sector.

Each of these players has been profiled in the stand-up pouches market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 4.8 Bn |

| Market Forecast Value in 2031 | US$ 8.1 Bn |

| Growth Rate (CAGR) | 5.4% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 4.8 Bn in 2022

It is projected to grow at a CAGR of 5.4% from 2023 to 2031

It is estimated to be US$ 8.1 Bn by the end of 2031

Rise in preference for products with longer shelf life and R&D of new products

Asia Pacific is estimated to record the highest demand from 2023 to 2031

Amcor Plc, Sealed Air Corporation, Berry Global Group, Inc., Mondi Group plc, Huhtamäki Oyj, Constantia Flexibles Group GmbH, Sonoco Products, AR Packaging Group AB, Uflex Ltd., Winpak Ltd., Glenroy, Inc., Schur Flexibles Group, ProAmpac LLC, Goglio Group, Bischof and Klein GmbH and Co. KG, Korozo Ambalaj Sanayi Ve Ticaret AS, Printpack, Inc., and Coveris Holdings S.A.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Global Stand-up Pouches Market Overview

3.1. Introduction

3.2. Regulations for Stand-up Pouches Materials

3.2.1. Paper

3.2.2. Plastic

3.2.3. Other Substrates

3.3. Value Chain Analysis

3.3.1. Key Participants

3.3.1.1. Raw Material Suppliers

3.3.1.2. Manufacturers

3.3.1.3. Distributors/Retailers

3.3.2. Profitability Margins

3.4. Macro-economic Factors – Correlation Analysis

3.5. Forecast Factors – Relevance & Impact

4. Global Stand-up Pouches Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections by Region

4.2. Market Size (US$ Bn) and Forecast

4.2.1. Market Size and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

5. Global Stand-up Pouches Market Dynamics

5.1. Drivers

5.2. Restraints

5.3. Opportunity Analysis

5.4. Trends

6. Global Stand-up Pouches Market Analysis and Forecast, By Material Type

6.1. Introduction

6.1.1. Market Share and Basis Points (BPS) Analysis, By Material Type

6.1.2. Y-o-Y Growth Projections, By Material Type

6.2. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Material Type

6.2.1. Plastic

6.2.1.1. Polyester (PET)

6.2.1.2. Polypropylene (PP)

6.2.1.3. Polyethylene (PE)

6.2.1.3.1. LDPE/LLDPE

6.2.1.3.2. HDPE

6.2.1.4. Polyamide (PA)

6.2.1.5. Polyvinyl Chloride (PVC)

6.2.1.6. EVOH

6.2.2. Metal (Foil)

6.2.3. Paper

6.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Material Type

6.3.1. Plastic

6.3.1.1. Polyester (PET)

6.3.1.2. Polypropylene (PP)

6.3.1.3. Polyethylene (PE)

6.3.1.3.1. LDPE/LLDPE

6.3.1.3.2. HDPE

6.3.1.4. Polyamide (PA)

6.3.1.5. Polyvinyl Chloride (PVC)

6.3.1.6. EVOH

6.3.2. Metal (Foil)

6.3.3. Paper

6.4. Market Attractiveness Analysis, By Material Type

7. Global Stand-up Pouches Market Analysis and Forecast, By Product Type

7.1. Introduction

7.1.1. Market Share and Basis Points (BPS) Analysis By Product Type

7.1.2. Y-o-Y Growth Projections By Product Type

7.2. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Product Type

7.2.1. Aseptic

7.2.2. Retort

7.2.3. Standard

7.2.4. Hot-filled

7.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Product Type

7.3.1. Aseptic

7.3.2. Retort

7.3.3. Standard

7.3.4. Hot-filled

7.4. Market Attractiveness Analysis, By Product Type

8. Global Stand-up Pouches Market Analysis and Forecast, By Capacity

8.1. Introduction

8.1.1. Market Share and Basis Points (BPS) Analysis By Capacity

8.1.2. Y-o-Y Growth Projections By Capacity

8.2. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Capacity

8.2.1. <2 Oz

8.2.2. 2 - 6 Oz

8.2.3. 6 - 10 Oz

8.2.4. 10 - 14 Oz

8.2.5. >14 Oz

8.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Capacity

8.3.1. <2 Oz

8.3.2. 2 - 6 Oz

8.3.3. 6 - 10 Oz

8.3.4. 10 - 14 Oz

8.3.5. >14 Oz

8.4. Market Attractiveness Analysis, By Capacity

9. Global Stand-up Pouches Market Analysis and Forecast, By Design

9.1. Introduction

9.1.1. Market Share and Basis Points (BPS) Analysis By Design

9.1.2. Y-o-Y Growth Projections By Design

9.2. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Design

9.2.1. Round Bottom/Doyen

9.2.2. K-seal

9.2.3. Plow Bottom/Corner Bottom

9.2.4. Flat Bottom

9.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Design

9.3.1. Round Bottom/Doyen

9.3.2. K-seal

9.3.3. Plow Bottom/Corner Bottom

9.3.4. Flat Bottom

9.4. Market Attractiveness Analysis, By Design

10. Global Stand-up Pouches Market Analysis and Forecast, By Closure Type

10.1. Introduction

10.1.1. Market Share and Basis Points (BPS) Analysis By Closure Type

10.1.2. Y-o-Y Growth Projections By Closure Type

10.2. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Closure Type

10.2.1. Top Notch

10.2.2. Spout

10.2.3. Zipper

10.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Closure Type

10.3.1. Top Notch

10.3.2. Spout

10.3.3. Zipper

10.4. Market Attractiveness Analysis, By Closure Type

11. Global Stand-up Pouches Market Analysis and Forecast, By End-use

11.1. Introduction

11.1.1. Market Share and Basis Points (BPS) Analysis By End-use

11.1.2. Y-o-Y Growth Projections By End-use

11.2. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By End-use

11.2.1. Food

11.2.1.1. Sauces, Dips, and Condiments

11.2.1.2. Baby Food

11.2.1.3. Pet Food

11.2.1.4. Ready-to-eat Food

11.2.1.5. Frozen and Chilled Food/Dried Fruit

11.2.2. Beverages

11.2.2.1. Alcoholic

11.2.2.2. Non-alcoholic

11.2.3. Agriculture

11.2.3.1. Compounds

11.2.3.2. Nutrients

11.2.3.3. Plant Supplements

11.2.3.4. Soil Additives

11.2.4. Chemicals

11.2.4.1. Additives

11.2.4.2. Flavors and Fragrances

11.2.4.3. Coatings

11.2.4.4. Other Chemicals

11.2.5. Personal Care & Cosmetics

11.2.5.1. Skin Care

11.2.5.2. Hair Care

11.2.5.3. Dental Care

11.2.5.4. Bath Salts

11.2.5.5. Color Cosmetics

11.2.6. Homecare

11.2.6.1. Toiletries

11.2.6.2. Detergents

11.2.6.3. Liquid Dishwashers

11.2.6.4. Liquid Soap & Handwash

11.2.6.5. Lawn & Garden Products

11.2.6.6. Cleaners

11.2.7. Tobacco Packaging

11.2.8. Healthcare

11.2.8.1. Pharmaceuticals

11.2.8.2. Nutraceutical

11.2.8.3. Medical Devices & Implants

11.2.9. Automotive

11.2.9.1. Motor Oils & Greases

11.2.9.2. Coolants

11.2.9.3. Automotive Components

11.2.9.4. Other Automotive Liquids and Lubes

11.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By End-use

11.3.1. Food

11.3.1.1. Sauces, Dips, and Condiments

11.3.1.2. Baby Food

11.3.1.3. Pet Food

11.3.1.4. Ready-to-eat Food

11.3.1.5. Frozen and Chilled Food/Dried Fruit

11.3.2. Beverages

11.3.2.1. Alcoholic

11.3.2.2. Non-alcoholic

11.3.3. Agriculture

11.3.3.1. Compounds

11.3.3.2. Nutrients

11.3.3.3. Plant Supplements

11.3.3.4. Soil Additives

11.3.4. Chemicals

11.3.4.1. Additives

11.3.4.2. Flavors and Fragrances

11.3.4.3. Coatings

11.3.4.4. Other Chemicals

11.3.5. Personal Care & Cosmetics

11.3.5.1. Skin Care

11.3.5.2. Hair Care

11.3.5.3. Dental Care

11.3.5.4. Bath Salts

11.3.5.5. Color Cosmetics

11.3.6. Homecare

11.3.6.1. Toiletries

11.3.6.2. Detergents

11.3.6.3. Liquid Dishwashers

11.3.6.4. Liquid Soap & Handwash

11.3.6.5. Lawn & Garden Products

11.3.6.6. Cleaners

11.3.7. Tobacco Packaging

11.3.8. Healthcare

11.3.8.1. Pharmaceuticals

11.3.8.2. Nutraceutical

11.3.8.3. Medical Devices & Implants

11.3.9. Automotive

11.3.9.1. Motor Oils & Greases

11.3.9.2. Coolants

11.3.9.3. Automotive Components

11.3.9.4. Other Automotive Liquids and Lubes

11.4. Market Attractiveness Analysis, By End-use

12. Global Stand-up Pouches Market Analysis and Forecast, By Region

12.1. Introduction

12.1.1. Market Share and Basis Points (BPS) Analysis by Region

12.1.2. Y-o-Y Growth Projections by Region

12.2. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Region

12.2.1. North America

12.2.2. Latin America

12.2.3. Europe

12.2.4. Asia Pacific

12.2.5. Middle East & Africa

12.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Region

12.3.1. North America

12.3.2. Latin America

12.3.3. Europe

12.3.4. Asia Pacific

12.3.5. Middle East & Africa

12.4. Market Attractiveness Analysis, By Region

13. North America Stand-up Pouches Market Analysis and Forecast

13.1. Introduction

13.1.1. Market Share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Country

13.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Country

13.3.1. U.S.

13.3.2. Canada

13.4. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Material Type

13.5. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Material Type

13.5.1. Plastic

13.5.1.1. Polyester (PET)

13.5.1.2. Polypropylene (PP)

13.5.1.3. Polyethylene (PE)

13.5.1.3.1. LDPE/LLDPE

13.5.1.3.2. HDPE

13.5.1.4. Polyamide (PA)

13.5.1.5. Polyvinyl Chloride (PVC)

13.5.1.6. EVOH

13.5.2. Metal (Foil)

13.5.3. Paper

13.6. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Product Type

13.7. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Product Type

13.7.1. Aseptic

13.7.2. Retort

13.7.3. Standard

13.7.4. Hot-filled

13.8. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Capacity

13.9. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Capacity

13.9.1. <2 Oz

13.9.2. 2 - 6 Oz

13.9.3. 6 - 10 Oz

13.9.4. 10 - 14 Oz

13.9.5. >14 Oz

13.10. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Design

13.11. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Design

13.11.1. Round Bottom/Doyen

13.11.2. K-seal

13.11.3. Plow Bottom/Corner Bottom

13.11.4. Flat Bottom

13.12. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Closure Type

13.13. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Closure Type

13.13.1. Top Notch

13.13.2. Spout

13.13.3. Zipper

13.14. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By End-use

13.15. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By End-use

13.15.1. Food

13.15.1.1. Sauces, Dips, and Condiments

13.15.1.2. Baby Food

13.15.1.3. Pet Food

13.15.1.4. Ready-to-eat Food

13.15.1.5. Frozen and Chilled Food/Dried Fruit

13.15.2. Beverages

13.15.2.1. Alcoholic

13.15.2.2. Non-alcoholic

13.15.3. Agriculture

13.15.3.1. Compounds

13.15.3.2. Nutrients

13.15.3.3. Plant Supplements

13.15.3.4. Soil Additives

13.15.4. Chemicals

13.15.4.1. Additives

13.15.4.2. Flavors and Fragrances

13.15.4.3. Coatings

13.15.4.4. Other Chemicals

13.15.5. Personal Care & Cosmetics

13.15.5.1. Skin Care

13.15.5.2. Hair Care

13.15.5.3. Dental Care

13.15.5.4. Bath Salts

13.15.5.5. Color Cosmetics

13.15.6. Homecare

13.15.6.1. Toiletries

13.15.6.2. Detergents

13.15.6.3. Liquid Dishwashers

13.15.6.4. Liquid Soap & Handwash

13.15.6.5. Lawn & Garden Products

13.15.6.6. Cleaners

13.15.7. Tobacco Packaging

13.15.8. Healthcare

13.15.8.1. Pharmaceuticals

13.15.8.2. Nutraceutical

13.15.8.3. Medical Devices & Implants

13.15.9. Automotive

13.15.9.1. Motor Oils & Greases

13.15.9.2. Coolants

13.15.9.3. Automotive Components

13.15.9.4. Other Automotive Liquids and Lubes

13.16. Market Attractiveness Analysis

13.16.1. By Country

13.16.2. Material Type

13.16.3. Product Type

13.16.4. Capacity

13.16.5. Design

13.16.6. Closure Type

13.16.7. By End-use

14. Latin America Stand-up Pouches Market Analysis and Forecast

14.1. Introduction

14.1.1. Market Share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Country

14.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031 By Country

14.3.1. Brazil

14.3.2. Mexico

14.3.3. Argentina

14.3.4. Rest of Latin America

14.4. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Material Type

14.5. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Material Type

14.5.1. Plastic

14.5.1.1. Polyester (PET)

14.5.1.2. Polypropylene (PP)

14.5.1.3. Polyethylene (PE)

14.5.1.3.1. LDPE/LLDPE

14.5.1.3.2. HDPE

14.5.1.4. Polyamide (PA)

14.5.1.5. Polyvinyl Chloride (PVC)

14.5.1.6. EVOH

14.5.2. Metal (Foil)

14.5.3. Paper

14.6. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Product Type

14.7. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Product Type

14.7.1. Aseptic

14.7.2. Retort

14.7.3. Standard

14.7.4. Hot-filled

14.8. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Capacity

14.9. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Capacity

14.9.1. <2 Oz

14.9.2. 2 - 6 Oz

14.9.3. 6 - 10 Oz

14.9.4. 10 - 14 Oz

14.9.5. >14 Oz

14.10. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Design

14.11. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Design

14.11.1. Round Bottom/Doyen

14.11.2. K-seal

14.11.3. Plow Bottom/Corner Bottom

14.11.4. Flat Bottom

14.12. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Closure Type

14.13. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Closure Type

14.13.1. Top Notch

14.13.2. Spout

14.13.3. Zipper

14.14. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By End-use

14.15. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By End-use

14.15.1. Food

14.15.1.1. Sauces, Dips, and Condiments

14.15.1.2. Baby Food

14.15.1.3. Pet Food

14.15.1.4. Ready-to-eat Food

14.15.1.5. Frozen and Chilled Food/Dried Fruit

14.15.2. Beverages

14.15.2.1. Alcoholic

14.15.2.2. Non-alcoholic

14.15.3. Agriculture

14.15.3.1. Compounds

14.15.3.2. Nutrients

14.15.3.3. Plant Supplements

14.15.3.4. Soil Additives

14.15.4. Chemicals

14.15.4.1. Additives

14.15.4.2. Flavors and Fragrances

14.15.4.3. Coatings

14.15.4.4. Other Chemicals

14.15.5. Personal Care & Cosmetics

14.15.5.1. Skin Care

14.15.5.2. Hair Care

14.15.5.3. Dental Care

14.15.5.4. Bath Salts

14.15.5.5. Color Cosmetics

14.15.6. Homecare

14.15.6.1. Toiletries

14.15.6.2. Detergents

14.15.6.3. Liquid Dishwashers

14.15.6.4. Liquid Soap & Handwash

14.15.6.5. Lawn & Garden Products

14.15.6.6. Cleaners

14.15.7. Tobacco Packaging

14.15.8. Healthcare

14.15.8.1. Pharmaceuticals

14.15.8.2. Nutraceutical

14.15.8.3. Medical Devices & Implants

14.15.9. Automotive

14.15.9.1. Motor Oils & Greases

14.15.9.2. Coolants

14.15.9.3. Automotive Components

14.15.9.4. Other Automotive Liquids and Lubes

14.16. Market Attractiveness Analysis

14.16.1. By Country

14.16.2. Material Type

14.16.3. Product Type

14.16.4. Capacity

14.16.5. Design

14.16.6. Closure Type

14.16.7. By End-use

15. Europe Stand-up Pouches Market Analysis and Forecast

15.1. Introduction

15.1.1. Market Share and Basis Points (BPS) Analysis, By Country

15.1.2. Y-o-Y Growth Projections, By Country

15.2. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Country

15.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031 By Country

15.3.1. Germany

15.3.2. Spain

15.3.3. Italy

15.3.4. France

15.3.5. U.K.

15.3.6. BENELUX

15.3.7. Nordic

15.3.8. Russia

15.3.9. Poland

15.3.10. Rest of Europe

15.4. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Material Type

15.5. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Material Type

15.5.1. Plastic

15.5.1.1. Polyester (PET)

15.5.1.2. Polypropylene (PP)

15.5.1.3. Polyethylene (PE)

15.5.1.3.1. LDPE/LLDPE

15.5.1.3.2. HDPE

15.5.1.4. Polyamide (PA)

15.5.1.5. Polyvinyl Chloride (PVC)

15.5.1.6. EVOH

15.5.2. Metal (Foil)

15.5.3. Paper

15.6. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Product Type

15.7. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Product Type

15.7.1. Aseptic

15.7.2. Retort

15.7.3. Standard

15.7.4. Hot-filled

15.8. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Capacity

15.9. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Capacity

15.9.1. <2 Oz

15.9.2. 2 - 6 Oz

15.9.3. 6 - 10 Oz

15.9.4. 10 - 14 Oz

15.9.5. >14 Oz

15.10. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Design

15.11. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Design

15.11.1. Round Bottom/Doyen

15.11.2. K-seal

15.11.3. Plow Bottom/Corner Bottom

15.11.4. Flat Bottom

15.12. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Closure Type

15.13. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Closure Type

15.13.1. Top Notch

15.13.2. Spout

15.13.3. Zipper

15.14. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By End-use

15.15. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By End-use

15.15.1. Food

15.15.1.1. Sauces, Dips, and Condiments

15.15.1.2. Baby Food

15.15.1.3. Pet Food

15.15.1.4. Ready-to-eat Food

15.15.1.5. Frozen and Chilled Food/Dried Fruit

15.15.2. Beverages

15.15.2.1. Alcoholic

15.15.2.2. Non-alcoholic

15.15.3. Agriculture

15.15.3.1. Compounds

15.15.3.2. Nutrients

15.15.3.3. Plant Supplements

15.15.3.4. Soil Additives

15.15.4. Chemicals

15.15.4.1. Additives

15.15.4.2. Flavors and Fragrances

15.15.4.3. Coatings

15.15.4.4. Other Chemicals

15.15.5. Personal Care & Cosmetics

15.15.5.1. Skin Care

15.15.5.2. Hair Care

15.15.5.3. Dental Care

15.15.5.4. Bath Salts

15.15.5.5. Color Cosmetics

15.15.6. Homecare

15.15.6.1. Toiletries

15.15.6.2. Detergents

15.15.6.3. Liquid Dishwashers

15.15.6.4. Liquid Soap & Handwash

15.15.6.5. Lawn & Garden Products

15.15.6.6. Cleaners

15.15.7. Tobacco Packaging

15.15.8. Healthcare

15.15.8.1. Pharmaceuticals

15.15.8.2. Nutraceutical

15.15.8.3. Medical Devices & Implants

15.15.9. Automotive

15.15.9.1. Motor Oils & Greases

15.15.9.2. Coolants

15.15.9.3. Automotive Components

15.15.9.4. Other Automotive Liquids and Lubes

15.16. Market Attractiveness Analysis

15.16.1. By Country

15.16.2. Material Type

15.16.3. Product Type

15.16.4. Capacity

15.16.5. Design

15.16.6. Closure Type

15.16.7. By End-use

16. Asia Pacific Stand-up Pouches Market Analysis and Forecast

16.1. Introduction

16.1.1. Market Share and Basis Points (BPS) Analysis, By Country

16.1.2. Y-o-Y Growth Projections, By Country

16.2. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Country

16.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031 By Country

16.3.1. China

16.3.2. India

16.3.3. Japan

16.3.4. ASEAN

16.3.5. Australia and New Zealand

16.3.6. Rest of Asia Pacific

16.4. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Material Type

16.5. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Material Type

16.5.1. Plastic

16.5.1.1. Polyester (PET)

16.5.1.2. Polypropylene (PP)

16.5.1.3. Polyethylene (PE)

16.5.1.3.1. LDPE/LLDPE

16.5.1.3.2. HDPE

16.5.1.4. Polyamide (PA)

16.5.1.5. Polyvinyl Chloride (PVC)

16.5.1.6. EVOH

16.5.2. Metal (Foil)

16.5.3. Paper

16.6. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Product Type

16.7. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Product Type

16.7.1. Aseptic

16.7.2. Retort

16.7.3. Standard

16.7.4. Hot-filled

16.8. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Capacity

16.9. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Capacity

16.9.1. <2 Oz

16.9.2. 2 - 6 Oz

16.9.3. 6 - 10 Oz

16.9.4. 10 - 14 Oz

16.9.5. >14 Oz

16.10. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Design

16.11. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Design

16.11.1. Round Bottom/Doyen

16.11.2. K-seal

16.11.3. Plow Bottom/Corner Bottom

16.11.4. Flat Bottom

16.12. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Closure Type

16.13. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Closure Type

16.13.1. Top Notch

16.13.2. Spout

16.13.3. Zipper

16.14. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By End-use

16.15. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By End-use

16.15.1. Food

16.15.1.1. Sauces, Dips, and Condiments

16.15.1.2. Baby Food

16.15.1.3. Pet Food

16.15.1.4. Ready-to-eat Food

16.15.1.5. Frozen and Chilled Food/Dried Fruit

16.15.2. Beverages

16.15.2.1. Alcoholic

16.15.2.2. Non-alcoholic

16.15.3. Agriculture

16.15.3.1. Compounds

16.15.3.2. Nutrients

16.15.3.3. Plant Supplements

16.15.3.4. Soil Additives

16.15.4. Chemicals

16.15.4.1. Additives

16.15.4.2. Flavors and Fragrances

16.15.4.3. Coatings

16.15.4.4. Other Chemicals

16.15.5. Personal Care & Cosmetics

16.15.5.1. Skin Care

16.15.5.2. Hair Care

16.15.5.3. Dental Care

16.15.5.4. Bath Salts

16.15.5.5. Color Cosmetics

16.15.6. Homecare

16.15.6.1. Toiletries

16.15.6.2. Detergents

16.15.6.3. Liquid Dishwashers

16.15.6.4. Liquid Soap & Handwash

16.15.6.5. Lawn & Garden Products

16.15.6.6. Cleaners

16.15.7. Tobacco Packaging

16.15.8. Healthcare

16.15.8.1. Pharmaceuticals

16.15.8.2. Nutraceutical

16.15.8.3. Medical Devices & Implants

16.15.9. Automotive

16.15.9.1. Motor Oils & Greases

16.15.9.2. Coolants

16.15.9.3. Automotive Components

16.15.9.4. Other Automotive Liquids and Lubes

16.16. Market Attractiveness Analysis

16.16.1. By Country

16.16.2. Material Type

16.16.3. Product Type

16.16.4. Capacity

16.16.5. Design

16.16.6. Closure Type

16.16.7. By End-use

17. Middle East & Africa Stand-up Pouches Market Analysis and Forecast

17.1. Introduction

17.1.1. Market Share and Basis Points (BPS) Analysis, By Country

17.1.2. Y-o-Y Growth Projections, By Country

17.2. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Country

17.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Country

17.3.1. North Africa

17.3.2. GCC countries

17.3.3. South Africa

17.3.4. Turkey

17.3.5. Rest of Middle East & Africa

17.4. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Material Type

17.5. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Material Type

17.5.1. Plastic

17.5.1.1. Polyester (PET)

17.5.1.2. Polypropylene (PP)

17.5.1.3. Polyethylene (PE)

17.5.1.3.1. LDPE/LLDPE

17.5.1.3.2. HDPE

17.5.1.4. Polyamide (PA)

17.5.1.5. Polyvinyl Chloride (PVC)

17.5.1.6. EVOH

17.5.2. Metal (Foil)

17.5.3. Paper

17.6. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Product Type

17.7. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Product Type

17.7.1. Aseptic

17.7.2. Retort

17.7.3. Standard

17.7.4. Hot-filled

17.8. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Capacity

17.9. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Capacity

17.9.1. <2 Oz

17.9.2. 2 - 6 Oz

17.9.3. 6 - 10 Oz

17.9.4. 10 - 14 Oz

17.9.5. >14 Oz

17.10. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Design

17.11. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Design

17.11.1. Round Bottom/Doyen

17.11.2. K-seal

17.11.3. Plow Bottom/Corner Bottom

17.11.4. Flat Bottom

17.12. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By Closure Type

17.13. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Closure Type

17.13.1. Top Notch

17.13.2. Spout

17.13.3. Zipper

17.14. Historical Market Value (US$ Bn) and Volume (Tons), 2018-2022, By End-use

17.15. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By End-use

17.15.1. Food

17.15.1.1. Sauces, Dips, and Condiments

17.15.1.2. Baby Food

17.15.1.3. Pet Food

17.15.1.4. Ready-to-eat Food

17.15.1.5. Frozen and Chilled Food/Dried Fruit

17.15.2. Beverages

17.15.2.1. Alcoholic

17.15.2.2. Non-alcoholic

17.15.3. Agriculture

17.15.3.1. Compounds

17.15.3.2. Nutrients

17.15.3.3. Plant Supplements

17.15.3.4. Soil Additives

17.15.4. Chemicals

17.15.4.1. Additives

17.15.4.2. Flavors and Fragrances

17.15.4.3. Coatings

17.15.4.4. Other Chemicals

17.15.5. Personal Care & Cosmetics

17.15.5.1. Skin Care

17.15.5.2. Hair Care

17.15.5.3. Dental Care

17.15.5.4. Bath Salts

17.15.5.5. Color Cosmetics

17.15.6. Homecare

17.15.6.1. Toiletries

17.15.6.2. Detergents

17.15.6.3. Liquid Dishwashers

17.15.6.4. Liquid Soap & Handwash

17.15.6.5. Lawn & Garden Products

17.15.6.6. Cleaners

17.15.7. Tobacco Packaging

17.15.8. Healthcare

17.15.8.1. Pharmaceuticals

17.15.8.2. Nutraceutical

17.15.8.3. Medical Devices & Implants

17.15.9. Automotive

17.15.9.1. Motor Oils & Greases

17.15.9.2. Coolants

17.15.9.3. Automotive Components

17.15.9.4. Other Automotive Liquids and Lubes

17.16. Market Attractiveness Analysis

17.16.1. By Country

17.16.2. Material Type

17.16.3. Product Type

17.16.4. Capacity

17.16.5. Design

17.16.6. Closure Type

17.16.7. By End-use

18. Stand-up Pouches Market Country-wise Analysis 2023 & 2031

18.1. U.S. Stand-up Pouches Market Analysis

18.1.1. Market Volume (Tons) and Value (US$ Bn) Analysis and Forecast, by Market Taxonomy

18.1.1.1. Material Type

18.1.1.2. Product Type

18.1.1.3. Capacity

18.1.1.4. Design

18.1.1.5. Closure Type

18.1.1.6. By End-use

18.2. Brazil Stand-up Pouches Market Analysis

18.2.1. Market Volume (Tons) and Value (US$ Bn) Analysis and Forecast, by Market Taxonomy

18.2.1.1. Material Type

18.2.1.2. Product Type

18.2.1.3. Capacity

18.2.1.4. Design

18.2.1.5. Closure Type

18.2.1.6. By End-use

18.3. Mexico Stand-up Pouches Market Analysis

18.3.1. Market Volume (Tons) and Value (US$ Bn) Analysis and Forecast, by Market Taxonomy

18.3.1.1. Material Type

18.3.1.2. Product Type

18.3.1.3. Capacity

18.3.1.4. Design

18.3.1.5. Closure Type

18.3.1.6. By End-use

18.4. Germany Stand-up Pouches Market Analysis

18.4.1. Market Volume (Tons) and Value (US$ Bn) Analysis and Forecast, by Market Taxonomy

18.4.1.1. Material Type

18.4.1.2. Product Type

18.4.1.3. Capacity

18.4.1.4. Design

18.4.1.5. Closure Type

18.4.1.6. By End-use

18.5. France Stand-up Pouches Market Analysis

18.5.1. Market Volume (Tons) and Value (US$ Bn) Analysis and Forecast, by Market Taxonomy

18.5.1.1. Material Type

18.5.1.2. Product Type

18.5.1.3. Capacity

18.5.1.4. Design

18.5.1.5. Closure Type

18.5.1.6. By End-use

18.6. U.K. Stand-up Pouches Market Analysis

18.6.1. Market Volume (Tons) and Value (US$ Bn) Analysis and Forecast, by Market Taxonomy

18.6.1.1. Material Type

18.6.1.2. Product Type

18.6.1.3. Capacity

18.6.1.4. Design

18.6.1.5. Closure Type

18.6.1.6. By End-use

18.7. GCC Countries Stand-up Pouches Market Analysis

18.7.1. Market Volume (Tons) and Value (US$ Bn) Analysis and Forecast, by Market Taxonomy

18.7.1.1. Material Type

18.7.1.2. Product Type

18.7.1.3. Capacity

18.7.1.4. Design

18.7.1.5. Closure Type

18.7.1.6. By End-use

18.8. China Stand-up Pouches Market Analysis

18.8.1. Market Volume (Tons) and Value (US$ Bn) Analysis and Forecast, by Market Taxonomy

18.8.1.1. Material Type

18.8.1.2. Product Type

18.8.1.3. Capacity

18.8.1.4. Design

18.8.1.5. Closure Type

18.8.1.6. By End-use

18.9. Japan Stand-up Pouches Market Analysis

18.9.1. Market Volume (Tons) and Value (US$ Bn) Analysis and Forecast, by Market Taxonomy

18.9.1.1. Material Type

18.9.1.2. Product Type

18.9.1.3. Capacity

18.9.1.4. Design

18.9.1.5. Closure Type

18.9.1.6. By End-use

18.10. India Stand-up Pouches Market Analysis

18.10.1. Market Volume (Tons) and Value (US$ Bn) Analysis and Forecast, by Market Taxonomy

18.10.1.1. Material Type

18.10.1.2. Product Type

18.10.1.3. Capacity

18.10.1.4. Design

18.10.1.5. Closure Type

18.10.1.6. By End-use

19. Competitive Landscape

19.1. Market Structure

19.2. Competition Dashboard

19.3. Company Market Share Analysis

19.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT Analysis)

19.5. Competition Deep Dive

19.5.1. Amcor Plc

19.5.1.1. Overview

19.5.1.2. Financials

19.5.1.3. Strategy

19.5.1.4. Recent Developments

19.5.1.5. SWOT Analysis

19.5.2. Sealed Air Corporation

19.5.2.1. Overview

19.5.2.2. Financials

19.5.2.3. Strategy

19.5.2.4. Recent Developments

19.5.2.5. SWOT Analysis

19.5.3. Berry Global Group, Inc.

19.5.3.1. Overview

19.5.3.2. Financials

19.5.3.3. Strategy

19.5.3.4. Recent Developments

19.5.3.5. SWOT Analysis

19.5.4. Mondi Group plc

19.5.4.1. Overview

19.5.4.2. Financials

19.5.4.3. Strategy

19.5.4.4. Recent Developments

19.5.4.5. SWOT Analysis

19.5.5. Huhtamäki Oyj

19.5.5.1. Overview

19.5.5.2. Financials

19.5.5.3. Strategy

19.5.5.4. Recent Developments

19.5.5.5. SWOT Analysis

19.5.6. Constantia Flexibles Group GmbH

19.5.6.1. Overview

19.5.6.2. Financials

19.5.6.3. Strategy

19.5.6.4. Recent Developments

19.5.6.5. SWOT Analysis

19.5.7. Sonaco Products

19.5.7.1. Overview

19.5.7.2. Financials

19.5.7.3. Strategy

19.5.7.4. Recent Developments

19.5.7.5. SWOT Analysis

19.5.8. AR Packaging Group AB

19.5.8.1. Overview

19.5.8.2. Financials

19.5.8.3. Strategy

19.5.8.4. Recent Developments

19.5.8.5. SWOT Analysis

19.5.9. Uflex Ltd.

19.5.9.1. Overview

19.5.9.2. Financials

19.5.9.3. Strategy

19.5.9.4. Recent Developments

19.5.9.5. SWOT Analysis

19.5.10. Winpak Ltd.

19.5.10.1. Overview

19.5.10.2. Financials

19.5.10.3. Strategy

19.5.10.4. Recent Developments

19.5.10.5. SWOT Analysis

19.5.11. Glenroy Inc.

19.5.11.1. Overview

19.5.11.2. Financials

19.5.11.3. Strategy

19.5.11.4. Recent Developments

19.5.11.5. SWOT Analysis

19.5.12. Schur Flexibles Group

19.5.12.1. Overview

19.5.12.2. Financials

19.5.12.3. Strategy

19.5.12.4. Recent Developments

19.5.12.5. SWOT Analysis

19.5.13. ProAmpac LLC

19.5.13.1. Overview

19.5.13.2. Financials

19.5.13.3. Strategy

19.5.13.4. Recent Developments

19.5.13.5. SWOT Analysis

19.5.14. Goglio Group

19.5.14.1. Overview

19.5.14.2. Financials

19.5.14.3. Strategy

19.5.14.4. Recent Developments

19.5.14.5. SWOT Analysis

19.5.15. Bischof & Klein GmbH & Co. KG

19.5.15.1. Overview

19.5.15.2. Financials

19.5.15.3. Strategy

19.5.15.4. Recent Developments

19.5.15.5. SWOT Analysis

19.5.16. Korozo Ambalaj Sanayi Ve Ticaret AS

19.5.16.1. Overview

19.5.16.2. Financials

19.5.16.3. Strategy

19.5.16.4. Recent Developments

19.5.16.5. SWOT Analysis

19.5.17. Printpack, Inc.

19.5.17.1. Overview

19.5.17.2. Financials

19.5.17.3. Strategy

19.5.17.4. Recent Developments

19.5.17.5. SWOT Analysis

19.5.18. Coveris Holdings S.A.

19.5.18.1. Overview

19.5.18.2. Financials

19.5.18.3. Strategy

19.5.18.4. Recent Developments

19.5.18.5. SWOT Analysis

20. Assumptions and Acronyms Used

21. Research Methodology

List of Tables

Table 1: Global Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, 2018-2031, By Material Type

Table 2: Global Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, 2018-2031, By Product Type

Table 3: Global Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, 2018-2031, By Design

Table 4: Global Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, 2018-2031, By Capacity

Table 5: Global Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, 2018-2031, By Closure Type

Table 6: Global Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, 2018-2031, By End-use

Table 7: Global Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, 2018-2031, By Region

Table 8: North America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Country, 2018(H) – 2031(F)

Table 9: North America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Material Type, 2018(H) – 2031(F)

Table 10: North America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Product Type, 2018(H) – 2031(F)

Table 11: North America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Design, 2018(H) – 2031(F)

Table 12: North America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Capacity, 2018(H) – 2031(F)

Table 13: North America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Closure Type 2018(H) – 2031(F)

Table 14: North America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by End-use, 2018(H) – 2031(F)

Table 15: Latin America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Country, 2018(H) – 2031(F)

Table 16: Latin America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Material Type, 2018(H) – 2031(F)

Table 17: Latin America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Product Type, 2018(H) – 2031(F)

Table 18: Latin America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Design, 2018(H) – 2031(F)

Table 19: Latin America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Capacity, 2018(H) – 2031(F)

Table 20: Latin America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Closure Type 2018(H) – 2031(F)

Table 21: Latin America Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by End-use, 2018(H) – 2031(F)

Table 22: Europe Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Country, 2018(H) – 2031(F)

Table 23: Europe Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Material Type, 2018(H) – 2031(F)

Table 24: Europe Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Product Type, 2018(H) – 2031(F)

Table 25: Europe Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Design, 2018(H) – 2031(F)

Table 26: Europe Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Capacity, 2018(H) – 2031(F)

Table 27: Europe Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Closure Type 2018(H) – 2031(F)

Table 28: Europe Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by End-use, 2018(H) – 2031(F)

Table 29: Asia Pacific Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Country, 2018(H) – 2031(F)

Table 30: Asia Pacific Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Material Type, 2018(H) – 2031(F)

Table 31: Asia Pacific Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Product Type, 2018(H) – 2031(F)

Table 32: Asia Pacific Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Design, 2018(H) – 2031(F)

Table 33: Asia Pacific Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Capacity, 2018(H) – 2031(F)

Table 34: Asia Pacific Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Closure Type 2018(H) – 2031(F)

Table 35: Asia Pacific Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by End-use, 2018(H) – 2031(F)

Table 36: Middle East & Africa Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Country, 2018(H) – 2031(F)

Table 37: Middle East & Africa Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Material Type, 2018(H) – 2031(F)

Table 38: Middle East & Africa Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Product Type, 2018(H) – 2031(F)

Table 39: Middle East & Africa Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Design, 2018(H) – 2031(F)

Table 40: Middle East & Africa Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Capacity, 2018(H) – 2031(F)

Table 41: Middle East & Africa Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by Closure Type 2018(H) – 2031(F)

Table 42: Middle East & Africa Stand-up Pouches Market Value (US$ Bn) and Volume (Tons) Historic and Forecast, by End-use, 2018(H) – 2031(F)

List of Figures

Figure 01: Global Stand-up Pouches Market, BPS Analysis, by Material Type, 2018 & 2031

Figure 02: Global Stand-up Pouches Market Attractiveness Index, by Material Type, 2018–2031

Figure 03: Global Stand-up Pouches Market, BPS Analysis, by Product Type, 2018 & 2031

Figure 04: Global Stand-up Pouches Market Attractiveness Index, by Product Type, 2018–2031

Figure 05: Global Stand-up Pouches Market, BPS Analysis, by Capacity, 2018 & 2031

Figure 06: Global Stand-up Pouches Market Attractiveness Index, by Capacity, 2018–2031

Figure 07: Global Stand-up Pouches Market, BPS Analysis, by Design, 2018 & 2031

Figure 08: Global Stand-up Pouches Market Attractiveness Index, by Design, 2018–2031

Figure 09: Global Stand-up Pouches Market, BPS Analysis, by Closure Type, 2018 & 2031

Figure 10: Global Stand-up Pouches Market Attractiveness Index, by Closure Type, 2018–2031

Figure 11: Global Stand-up Pouches Market, BPS Analysis, by End-use, 2018 & 2031

Figure 12: Global Stand-up Pouches Market Attractiveness Index, by End-use, 2018–2031

Figure 13: Global Stand-up Pouches Market Value Share and BPS Analysis, By Region, 2018 & 2031

Figure 14: Global Stand-up Pouches Market Y-o-Y growth, By Region 2018 & 2031

Figure 15: Global Stand-up Pouches Market Attractiveness Analysis, by Region, 2018

Figure 16: North America Stand-up Pouches Market Value (US$ Bn), and Volume (Tons) Analysis, 2018-2031

Figure 17: North America Stand-up Pouches Market Absolute $ Opportunity, 2018-2031

Figure 18: North America Stand-up Pouches Market Value Share 2018, by Material Type

Figure 19: North America Stand-up Pouches Market Value Share 2018, by Country

Figure 20: North America Stand-up Pouches Market Value Share 2018, by Product Type

Figure 21: North America Stand-up Pouches Market Value Share 2018, by Design

Figure 22: North America Stand-up Pouches Market Value Share 2018, by Capacity

Figure 23: North America Stand-up Pouches Market Value Share 2018, by Region

Figure 24: North America Stand-up Pouches Market Value Share 2018, by Closure Type

Figure 25: North America Stand-up Pouches Market Attractiveness Index, by Country, 2018–2031

Figure 26: North America Stand-up Pouches Market Attractiveness Index, by Material Type, 2018–2031

Figure 27: North America Stand-up Pouches Market Attractiveness Index, by Product Type, 2018–2031

Figure 28: North America Stand-up Pouches Market Attractiveness Index, by Design, 2018–2031

Figure 29: North America Stand-up Pouches Market Attractiveness Index, by Closure Type, 2018–2031

Figure 30: North America Stand-up Pouches Market Attractiveness Index, by Capacity, 2018–2031

Figure 31: North America Stand-up Pouches Market Attractiveness Index, by End-use, 2018–2031

Figure 32: Latin America Stand-up Pouches Market Value (US$ Bn), and Volume (Tons) Analysis, 2018-2031

Figure 33: Latin America Stand-up Pouches Market Absolute $ Opportunity, 2018-2031

Figure 34: Latin America Stand-up Pouches Market Value Share 2018, by Material Type

Figure 35: Latin America Stand-up Pouches Market Value Share 2018, by Country

Figure 36: Latin America Stand-up Pouches Market Value Share 2018, by Product Type

Figure 37: Latin America Stand-up Pouches Market Value Share 2018, by Design

Figure 38: Latin America Stand-up Pouches Market Value Share 2018, by Capacity

Figure 39: Latin America Stand-up Pouches Market Value Share 2018, by Region

Figure 40: Latin America Stand-up Pouches Market Value Share 2018, by Closure Type

Figure 41: Latin America Stand-up Pouches Market Attractiveness Index, by Country, 2018–2031

Figure 42: Latin America Stand-up Pouches Market Attractiveness Index, by Material Type, 2018–2031

Figure 43: Latin America Stand-up Pouches Market Attractiveness Index, by Product Type, 2018–2031

Figure 44: Latin America Stand-up Pouches Market Attractiveness Index, by Design, 2018–2031

Figure 45: Latin America Stand-up Pouches Market Attractiveness Index, by Closure Type, 2018–2031

Figure 46: Latin America Stand-up Pouches Market Attractiveness Index, by Capacity, 2018–2031

Figure 47: Latin America Stand-up Pouches Market Attractiveness Index, by End-use, 2018–2031

Figure 48: Europe Stand-up Pouches Market Value (US$ Bn), and Volume (Tons) Analysis, 2018-2031

Figure 49: Europe Stand-up Pouches Market Absolute $ Opportunity, 2018-2031

Figure 50: Europe Stand-up Pouches Market Value Share 2018, by Material Type

Figure 51: Europe Stand-up Pouches Market Value Share 2018, by Country

Figure 52: Europe Stand-up Pouches Market Value Share 2018, by Product Type

Figure 53: Europe Stand-up Pouches Market Value Share 2018, by Design

Figure 54: Europe Stand-up Pouches Market Value Share 2018, by Capacity

Figure 55: Europe Stand-up Pouches Market Value Share 2018, by Region

Figure 56: Europe Stand-up Pouches Market Value Share 2018, by Closure Type

Figure 57: Europe Stand-up Pouches Market Attractiveness Index, by Country, 2018–2031

Figure 58: Europe Stand-up Pouches Market Attractiveness Index, by Material Type, 2018–2031

Figure 59: Europe Stand-up Pouches Market Attractiveness Index, by Product Type, 2018–2031

Figure 60: Europe Stand-up Pouches Market Attractiveness Index, by Design, 2018–2031

Figure 61: Europe Stand-up Pouches Market Attractiveness Index, by Closure Type, 2018–2031

Figure 62: Europe Stand-up Pouches Market Attractiveness Index, by Capacity, 2018–2031

Figure 63: Europe Stand-up Pouches Market Attractiveness Index, by End-use, 2018–2031

Figure 64: Asia Pacific Stand-up Pouches Market Value (US$ Bn), and Volume (Tons) Analysis, 2018-2031

Figure 65: Asia Pacific Stand-up Pouches Market Absolute $ Opportunity, 2018-2031

Figure 66: Asia Pacific Stand-up Pouches Market Value Share 2018, by Material Type

Figure 67: Asia Pacific Stand-up Pouches Market Value Share 2018, by Country

Figure 68: Asia Pacific Stand-up Pouches Market Value Share 2018, by Product Type

Figure 69: Asia Pacific Stand-up Pouches Market Value Share 2018, by Design

Figure 70: Asia Pacific Stand-up Pouches Market Value Share 2018, by Capacity

Figure 71: Asia Pacific Stand-up Pouches Market Value Share 2018, by Region

Figure 72: Asia Pacific Stand-up Pouches Market Value Share 2018, by Closure Type

Figure 73: Asia Pacific Stand-up Pouches Market Attractiveness Index, by Country, 2018–2031

Figure 74: Asia Pacific Stand-up Pouches Market Attractiveness Index, by Material Type, 2018–2031

Figure 75: Asia Pacific Stand-up Pouches Market Attractiveness Index, by Product Type, 2018–2031

Figure 76: Asia Pacific Stand-up Pouches Market Attractiveness Index, by Design, 2018–2031

Figure 77: Asia Pacific Stand-up Pouches Market Attractiveness Index, by Closure Type, 2018–2031

Figure 78: Asia Pacific Stand-up Pouches Market Attractiveness Index, by Capacity, 2018–2031

Figure 79: Asia Pacific Stand-up Pouches Market Attractiveness Index, by End-use, 2018–2031

Figure 80: Middle East & Africa Stand-up Pouches Market Value (US$ Bn), and Volume (Tons) Analysis, 2018-2031

Figure 81: Middle East & Africa Stand-up Pouches Market Absolute $ Opportunity, 2018-2031

Figure 82: Middle East & Africa Stand-up Pouches Market Value Share 2018, by Material Type

Figure 83: Middle East & Africa Stand-up Pouches Market Value Share 2018, by Country

Figure 84: Middle East & Africa Stand-up Pouches Market Value Share 2018, by Product Type

Figure 85: Middle East & Africa Stand-up Pouches Market Value Share 2018, by Design

Figure 86: Middle East & Africa Stand-up Pouches Market Value Share 2018, by Capacity

Figure 87: Middle East & Africa Stand-up Pouches Market Value Share 2018, by Region

Figure 88: Middle East & Africa Stand-up Pouches Market Value Share 2018, by Closure Type

Figure 89: Middle East & Africa Stand-up Pouches Market Attractiveness Index, by Country, 2018–2031

Figure 90: Middle East & Africa Stand-up Pouches Market Attractiveness Index, by Material Type, 2018–2031

Figure 91: Middle East & Africa Stand-up Pouches Market Attractiveness Index, by Product Type, 2018–2031

Figure 92: Middle East & Africa Stand-up Pouches Market Attractiveness Index, by Design, 2018–2031

Figure 93: Middle East & Africa Stand-up Pouches Market Attractiveness Index, by Closure Type, 2018–2031

Figure 94: Middle East & Africa Stand-up Pouches Market Attractiveness Index, by Capacity, 2018–2031

Figure 95: Middle East & Africa Stand-up Pouches Market Attractiveness Index, by End-use, 2018–2031