Analysts’ Viewpoint on Market Scenario

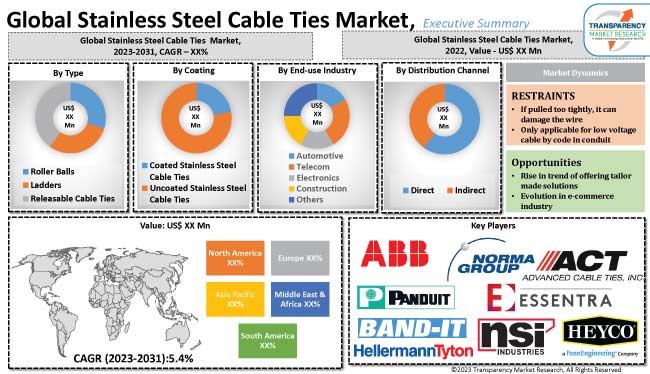

An expanding telecom sector and rise in construction activities are key factors driving the global stainless steel cable ties industry growth. Furthermore, growth in nylon and antimicrobial detectable cable ties that offer protection against a variety of microorganisms is contributing to market development.

Product diversity and significant investment in research and development activities are anticipated to bolster the market in the near future. Companies are collaborating with each other to expand their businesses and gain lucrative market opportunities. Additionally, stainless steel cable ties manufacturers are developing cable ties with high flexibility and efficiency, which are durable and require minimum maintenance. This is projected to boost market growth in the next few years.

Stainless steel cable ties or stainless zip ties are utilized to bundle wires together to keep them organized and protected from damage. Roller ball, ladder, and releasable cable ties are the various types of stainless steel cable ties. Rollerball is the most common type, and has a locking ball inside the head of the metal zip ties.

The coating of stainless steel zip ties is an important factor that helps to classify them. Polyester coatings are applied to some stainless steel cable ties to provide an extra layer for protection. Polyester coatings protect stainless steel cable ties from extreme temperature. In situations where plastic cable ties do not meet the requirements, stainless steel cable ties are typically used, due to its high tensile strength, high heat resistance, and excellent corrosion resistance. The stainless steel cable tie is better protected due to the coating, and therefore has a longer lifespan than uncoated stainless steel cable ties.

High-strength stainless steel cable ties for industrial applications find usage in mining, aerospace, automotive sector, and petrochemical industries.

The primary objective of the telecommunications industry is to maximize network efficiency; proper cable run installation is necessary to guarantee high performance. The telecom industry's global expansion during the forecast period is anticipated to boost the growth of the global stainless steel cable ties market.

The telecom sector in Asia Pacific is dominated by China, followed by India. Starting around 2022, China produced a month to month income of in excess of 130 billion Yuan from the telecom industry.

The auction of IMT/5G spectrum has been approved by the Indian Government in order to accelerate digital connectivity. Strong consumer demand is the factor contributing to the expansion of the telecom sector in India.

Usage of cable ties is increasing in the telecom industry to prevent damage to cables and to maximize network efficiency. This factor is likely to propel demand for stainless steel cable ties globally and fuel market progress.

Rise in construction activities is driving the stainless steel cable ties market demand. Stainless steel cable ties provide corrosion and high temperature resistance; they are also weather and chemical resistant.

India's construction industry is projected to reach US$ 1.4 Trillion by 2025, according to government reports. Through innovation-driven metropolitan planning, government programs such as the revolutionary Smart City Mission (targeting 100 cities) are anticipated to enhance quality of life. Developments in the construction industry are likely to offer lucrative opportunities to the market. Likewise, the European economy relies heavily on the construction industry. The sector adds to around 9% of the European Union GDP.

Significant use of steel ties within construction industries due to their ability to withstand harsh conditions, is boosting the stainless steel market size. Furthermore, substantial use of metal cable ties for installing temporary fencing and screens while construction is underway on building sites, as well as for attaching safety and advertising signs, boosts market statistics.

North America is anticipated to hold the largest stainless steel cable ties market share during the forecast period, ascribed to rise in demand from electronics & data centers to keep cable packages safe, and increased zip ties demand in aerospace industries to arrange bundles of wires in aircrafts.

According to the stainless steel cable ties market analysis, the Asia Pacific market is anticipated to expand at the highest growth rate. The region is expected to be an important market for stainless steel cable ties during the forecast period due to rise in infrastructure spending in China, India, and Japan, and surge in construction activity in these countries.

As per the stainless steel cable ties market forecast, the industry in Europe is likely to expand at a steady pace due to surge in demand from end-use industries such as automotive, electrical & electronics, marine, and oil & gas.

The market in Middle East & Africa is predicted to grow at a stable rate due to ongoing construction activities across the UAE, Saudi Arabia, South Africa, and Qatar, as well as demand from the oil & gas sector.

The business model of prominent manufacturers include investments in R&D activities, product expansions, and mergers and acquisitions. Stainless steel cable ties market competitor analysis suggests that product development is a major strategy followed by top players.

The market is highly competitive with the presence of various global and regional players. ABB Installation Products Inc. (Thomas & Betts Corporation), Advanced Cable Ties, Inc., BAND-IT, Essentra plc, HellermannTyton, Heyco (Penn Engineering), Norma Group, NSI Industries, LLC, Panduit, and Tridon Australia are the prominent entities profiled in the stainless steel cable ties market.

Key players have been profiled in the stainless steel cable ties industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 648.1 Mn |

|

Market Forecast Value in 2031 |

US$ 1.1 Bn |

|

Growth Rate (CAGR) |

5.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn/Bn for Value & Million Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 648.1 Mn in 2022.

It is estimated to grow at a CAGR of 5.4% from 2023 to 2031

Expanding telecom sector and rise in construction activities

The coated stainless steel cable ties segment accounted for significant share in 2022

Asia Pacific is likely to be one of the lucrative markets in the next few years

ABB Installation Products Inc. (Thomas & Betts Corporation), Advanced Cable Ties, Inc., BAND-IT, Essentra plc, HellermannTyton, Heyco (Penn Engineering), Norma Group, NSi Industries, LLC, Panduit, and Tridon Australia

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Technological Overview Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Regulatory Framework

5.10. Global Stainless Steel Cable Ties Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Million Units)

6. Global Stainless Steel Cable Ties Market Analysis and Forecast, By Type

6.1. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Type, 2017 - 2031

6.1.1. Roller Balls

6.1.2. Ladders

6.1.3. Releasable Cable Ties

6.2. Incremental Opportunity, By Type

7. Global Stainless Steel Cable Ties Market Analysis and Forecast, By Coating

7.1. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Coating, 2017 - 2031

7.1.1. Coated Stainless Steel Cable Ties

7.1.2. Uncoated Stainless Steel Cable Ties

7.2. Incremental Opportunity, By Coating

8. Global Stainless Steel Cable Ties Market Analysis and Forecast, By End-use Industry

8.1. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By End-use Industry, 2017 - 2031

8.1.1. Automotive

8.1.2. Telecom

8.1.3. Electronics

8.1.4. Construction

8.1.5. Others

8.2. Incremental Opportunity, By End-use Industry

9. Global Stainless Steel Cable Ties Market Analysis and Forecast, By Distribution Channel

9.1. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

9.1.1. Direct

9.1.2. Indirect

9.1.2.1. Online

9.1.2.2. Offline

9.2. Incremental Opportunity, By Distribution Channel

10. Global Stainless Steel Cable Ties Market Analysis and Forecast, By Region

10.1. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Stainless Steel Cable Ties Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Brand Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supplier Side

11.5. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Type, 2017 - 2031

11.5.1. Roller Balls

11.5.2. Ladders

11.5.3. Releasable Cable Ties

11.6. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Coating, 2017 - 2031

11.6.1. Coated Stainless Steel Cable Ties

11.6.2. Uncoated Stainless Steel Cable Ties

11.7. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By End-use Industry, 2017 - 2031

11.7.1. Automotive

11.7.2. Telecom

11.7.3. Electronics

11.7.4. Construction

11.7.5. Others

11.8. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

11.8.1. Direct

11.8.2. Indirect

11.8.2.1. Online

11.8.2.2. Offline

11.9. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Country/Sub-region, 2017 - 2031

11.9.1. U.S

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Stainless Steel Cable Ties Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supplier Side

12.5. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Coating, 2017 - 2031

12.5.1. Coated Stainless Steel Cable Ties

12.5.2. Uncoated Stainless Steel Cable Ties

12.6. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By End-use Industry, 2017 - 2031

12.6.1. Automotive

12.6.2. Telecom

12.6.3. Electronics

12.6.4. Construction

12.6.5. Others

12.7. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

12.7.1. Direct

12.7.2. Indirect

12.7.2.1. Online

12.7.2.2. Offline

12.8. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Country/Sub-region, 2017 - 2031

12.8.1. U.K

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Incremental Opportunity Analysis

13. Asia Pacific Stainless Steel Cable Ties Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Key Trends Analysis

13.3.1. Demand Side

13.3.2. Supplier Side

13.4. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Coating, 2017 - 2031

13.4.1. Coated Stainless Steel Cable Ties

13.4.2. Uncoated Stainless Steel Cable Ties

13.5. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By End-use Industry, 2017 - 2031

13.5.1. Automotive

13.5.2. Telecom

13.5.3. Electronics

13.5.4. Construction

13.5.5. Others

13.6. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

13.6.1. Direct

13.6.2. Indirect

13.6.2.1. Online

13.6.2.2. Offline

13.7. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Country/Sub-region, 2017 - 2031

13.7.1. India

13.7.2. China

13.7.3. Japan

13.7.4. Rest of Asia Pacific

13.8. Incremental Opportunity Analysis

14. Middle East & South Africa Stainless Steel Cable Ties Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supplier Side

14.5. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Coating, 2017 - 2031

14.5.1. Coated Stainless Steel Cable Ties

14.5.2. Uncoated Stainless Steel Cable Ties

14.6. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By End-use Industry, 2017 - 2031

14.6.1. Automotive

14.6.2. Telecom

14.6.3. Electronics

14.6.4. Construction

14.6.5. Others

14.7. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

14.7.1. Direct

14.7.2. Indirect

14.7.2.1. Online

14.7.2.2. Offline

14.8. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Country/Sub-region, 2017 - 2031

14.8.1. GCC

14.8.2. Rest of MEA

14.9. Incremental Opportunity Analysis

15. South America Stainless Steel Cable Ties Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supplier Side

15.5. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Coating, 2017 - 2031

15.5.1. Coated Stainless Steel Cable Ties

15.5.2. Uncoated Stainless Steel Cable Ties

15.6. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By End-use Industry, 2017 - 2031

15.6.1. Automotive

15.6.2. Telecom

15.6.3. Electronics

15.6.4. Construction

15.6.5. Others

15.7. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

15.7.1. Direct

15.7.2. Indirect

15.7.2.1. Online

15.7.2.2. Offline

15.8. Stainless Steel Cable Ties Market Size (US$ Mn and Million Units) Forecast, By Country/Sub-region, 2017 - 2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis (%), by Company, (2022)

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. ABB Installation Products Inc. (Thomas & Betts Corporation)

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Advanced Cable Ties, Inc.

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. BAND-IT

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Essentra plc

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. HellermannTyton

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Heyco (Penn Engineering)

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Norma Group

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. NSi Industries, LLC

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Panduit

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Tridon Australia

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. By Type

17.1.2. By Coating

17.1.3. By End-use Industry

17.1.4. By Distribution Channel

17.1.5. By Region

17.2. Prevailing Market Risks

17.3. Understanding the Buying Process of Customers

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Stainless Steel Cable Ties Market Value (US$ Mn), by Type, 2017-2031

Table 2: Global Stainless Steel Cable Ties Market Volume (Million Units), by Type 2017-2031

Table 3: Global Stainless Steel Cable Ties Market Value (US$ Mn), by Coating, 2017-2031

Table 4: Global Stainless Steel Cable Ties Market Volume (Million Units), by Coating 2017-2031

Table 5: Global Stainless Steel Cable Ties Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 6: Global Stainless Steel Cable Ties Market Volume (Million Units), by End-use Industry 2017-2031

Table 7: Global Stainless Steel Cable Ties Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 8: Global Stainless Steel Cable Ties Market Volume (Million Units), by Distribution Channel 2017-2031

Table 9: Global Stainless Steel Cable Ties Market Value (US$ Mn), by Region, 2017-2031

Table 10: Global Stainless Steel Cable Ties Market Volume (Million Units), by Region 2017-2031

Table 11: North America Stainless Steel Cable Ties Market Value (US$ Mn), by Type, 2017-2031

Table 12: North America Stainless Steel Cable Ties Market Volume (Million Units), by Type 2017-2031

Table 13: North America Stainless Steel Cable Ties Market Value (US$ Mn), by Coating, 2017-2031

Table 14: North America Stainless Steel Cable Ties Market Volume (Million Units), by Coating 2017-2031

Table 15: North America Stainless Steel Cable Ties Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 16: North America Stainless Steel Cable Ties Market Volume (Million Units), by End-use Industry 2017-2031

Table 17: North America Stainless Steel Cable Ties Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 18: North America Stainless Steel Cable Ties Market Volume (Million Units), by Distribution Channel 2017-2031

Table 19: North America Stainless Steel Cable Ties Market Value (US$ Mn), by Region, 2017-2031

Table 20: North America Stainless Steel Cable Ties Market Volume (Million Units), by Region 2017-2031

Table 21: Europe Stainless Steel Cable Ties Market Value (US$ Mn), by Type, 2017-2031

Table 22: Europe Stainless Steel Cable Ties Market Volume (Million Units), by Type 2017-2031

Table 23: Europe Stainless Steel Cable Ties Market Value (US$ Mn), by Coating, 2017-2031

Table 24: Europe Stainless Steel Cable Ties Market Volume (Million Units), by Coating 2017-2031

Table 25: Europe Stainless Steel Cable Ties Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 26: Europe Stainless Steel Cable Ties Market Volume (Million Units), by End-use Industry 2017-2031

Table 27: Europe Stainless Steel Cable Ties Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 28: Europe Stainless Steel Cable Ties Market Volume (Million Units), by Distribution Channel 2017-2031

Table 29: Europe Stainless Steel Cable Ties Market Value (US$ Mn), by Region, 2017-2031

Table 30: Europe Stainless Steel Cable Ties Market Volume (Million Units), by Region 2017-2031

Table 31: Asia Pacific Stainless Steel Cable Ties Market Value (US$ Mn), by Type, 2017-2031

Table 32: Asia Pacific Stainless Steel Cable Ties Market Volume (Million Units), by Type 2017-2031

Table 33: Asia Pacific Stainless Steel Cable Ties Market Value (US$ Mn), by Coating, 2017-2031

Table 34: Asia Pacific Stainless Steel Cable Ties Market Volume (Million Units), by Coating 2017-2031

Table 35: Asia Pacific Stainless Steel Cable Ties Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 36: Asia Pacific Stainless Steel Cable Ties Market Volume (Million Units), by End-use Industry 2017-2031

Table 37: Asia Pacific Stainless Steel Cable Ties Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 38: Asia Pacific Stainless Steel Cable Ties Market Volume (Million Units), by Distribution Channel 2017-2031

Table 39: Asia Pacific Stainless Steel Cable Ties Market Value (US$ Mn), by Region, 2017-2031

Table 40: Asia Pacific Stainless Steel Cable Ties Market Volume (Million Units), by Region 2017-2031

Table 41: Middle East & Africa Stainless Steel Cable Ties Market Value (US$ Mn), by Type, 2017-2031

Table 42: Middle East & Africa Stainless Steel Cable Ties Market Volume (Million Units), by Type 2017-2031

Table 43: Middle East & Africa Stainless Steel Cable Ties Market Value (US$ Mn), by Coating, 2017-2031

Table 44: Middle East & Africa Stainless Steel Cable Ties Market Volume (Million Units), by Coating 2017-2031

Table 45: Middle East & Africa Stainless Steel Cable Ties Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 46: Middle East & Africa Stainless Steel Cable Ties Market Volume (Million Units), by End-use Industry 2017-2031

Table 47: Middle East & Africa Stainless Steel Cable Ties Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 48: Middle East & Africa Stainless Steel Cable Ties Market Volume (Million Units), by Distribution Channel 2017-2031

Table 49: Middle East & Africa Stainless Steel Cable Ties Market Value (US$ Mn), by Region, 2017-2031

Table 50: Middle East & Africa Stainless Steel Cable Ties Market Volume (Million Units), by Region 2017-2031

Table 51: South America Stainless Steel Cable Ties Market Value (US$ Mn), by Type, 2017-2031

Table 52: South America Stainless Steel Cable Ties Market Volume (Million Units), by Type 2017-2031

Table 53: South America Stainless Steel Cable Ties Market Value (US$ Mn), by Coating, 2017-2031

Table 54: South America Stainless Steel Cable Ties Market Volume (Million Units), by Coating 2017-2031

Table 55: South America Stainless Steel Cable Ties Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 56: South America Stainless Steel Cable Ties Market Volume (Million Units), by End-use Industry 2017-2031

Table 57: South America Stainless Steel Cable Ties Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 58: South America Stainless Steel Cable Ties Market Volume (Million Units), by Distribution Channel 2017-2031

Table 59: South America Stainless Steel Cable Ties Market Value (US$ Mn), by Region, 2017-2031

Table 60: South America Stainless Steel Cable Ties Market Volume (Million Units), by Region 2017-2031

List of Figures

Figure 1: Global Stainless Steel Cable Ties Market Value (US$ Mn), by Type, 2017-2031

Figure 2: Global Stainless Steel Cable Ties Market Volume (Million Units), by Type 2017-2031

Figure 3: Global Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 4: Global Stainless Steel Cable Ties Market Value (US$ Mn), by Coating, 2017-2031

Figure 5: Global Stainless Steel Cable Ties Market Volume (Million Units), by Coating 2017-2031

Figure 6: Global Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Coating, 2023-2031

Figure 7: Global Stainless Steel Cable Ties Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 8: Global Stainless Steel Cable Ties Market Volume (Million Units), by End-use Industry 2017-2031

Figure 9: Global Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 10: Global Stainless Steel Cable Ties Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 11: Global Stainless Steel Cable Ties Market Volume (Million Units), by Distribution Channel 2017-2031

Figure 12: Global Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 13: Global Stainless Steel Cable Ties Market Value (US$ Mn), by Region, 2017-2031

Figure 14: Global Stainless Steel Cable Ties Market Volume (Million Units), by Region 2017-2031

Figure 15: Global Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 16: North America Stainless Steel Cable Ties Market Value (US$ Mn), by Type, 2017-2031

Figure 17: North America Stainless Steel Cable Ties Market Volume (Million Units), by Type 2017-2031

Figure 18: North America Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 19: North America Stainless Steel Cable Ties Market Value (US$ Mn), by Coating, 2017-2031

Figure 20: North America Stainless Steel Cable Ties Market Volume (Million Units), by Coating 2017-2031

Figure 21: North America Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Coating, 2023-2031

Figure 22: North America Stainless Steel Cable Ties Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 23: North America Stainless Steel Cable Ties Market Volume (Million Units), by End-use Industry 2017-2031

Figure 24: North America Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 25: North America Stainless Steel Cable Ties Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 26: North America Stainless Steel Cable Ties Market Volume (Million Units), by Distribution Channel 2017-2031

Figure 27: North America Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 28: North America Stainless Steel Cable Ties Market Value (US$ Mn), by Region, 2017-2031

Figure 29: North America Stainless Steel Cable Ties Market Volume (Million Units), by Region 2017-2031

Figure 30: North America Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 31: Europe Stainless Steel Cable Ties Market Value (US$ Mn), by Type, 2017-2031

Figure 32: Europe Stainless Steel Cable Ties Market Volume (Million Units), by Type 2017-2031

Figure 33: Europe Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 34: Europe Stainless Steel Cable Ties Market Value (US$ Mn), by Coating, 2017-2031

Figure 35: Europe Stainless Steel Cable Ties Market Volume (Million Units), by Coating 2017-2031

Figure 36: Europe Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Coating, 2023-2031

Figure 37: Europe Stainless Steel Cable Ties Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 38: Europe Stainless Steel Cable Ties Market Volume (Million Units), by End-use Industry 2017-2031

Figure 39: Europe Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 40: Europe Stainless Steel Cable Ties Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 41: Europe Stainless Steel Cable Ties Market Volume (Million Units), by Distribution Channel 2017-2031

Figure 42: Europe Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 43: Europe Stainless Steel Cable Ties Market Value (US$ Mn), by Region, 2017-2031

Figure 44: Europe Stainless Steel Cable Ties Market Volume (Million Units), by Region 2017-2031

Figure 45: Europe Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 46: Asia Pacific Stainless Steel Cable Ties Market Value (US$ Mn), by Type, 2017-2031

Figure 47: Asia Pacific Stainless Steel Cable Ties Market Volume (Million Units), by Type 2017-2031

Figure 48: Asia Pacific Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 49: Asia Pacific Stainless Steel Cable Ties Market Value (US$ Mn), by Coating, 2017-2031

Figure 50: Asia Pacific Stainless Steel Cable Ties Market Volume (Million Units), by Coating 2017-2031

Figure 51: Asia Pacific Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Coating, 2023-2031

Figure 52: Asia Pacific Stainless Steel Cable Ties Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 53: Asia Pacific Stainless Steel Cable Ties Market Volume (Million Units), by End-use Industry 2017-2031

Figure 54: Asia Pacific Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by End Use Industry, 2023-2031

Figure 55: Asia Pacific Stainless Steel Cable Ties Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 56: Asia Pacific Stainless Steel Cable Ties Market Volume (Million Units), by Distribution Channel 2017-2031

Figure 57: Asia Pacific Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Asia Pacific Stainless Steel Cable Ties Market Value (US$ Mn), by Region, 2017-2031

Figure 59: Asia Pacific Stainless Steel Cable Ties Market Volume (Million Units), by Region 2017-2031

Figure 60: Asia Pacific Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 61: Middle East & Africa Stainless Steel Cable Ties Market Value (US$ Mn), by Type, 2017-2031

Figure 62: Middle East & Africa Stainless Steel Cable Ties Market Volume (Million Units), by Type 2017-2031

Figure 63: Middle East & Africa Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 64: Middle East & Africa Stainless Steel Cable Ties Market Value (US$ Mn), by Coating, 2017-2031

Figure 65: Middle East & Africa Stainless Steel Cable Ties Market Volume (Million Units), by Coating 2017-2031

Figure 66: Middle East & Africa Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Coating,2023-2031

Figure 67: Middle East & Africa Stainless Steel Cable Ties Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 68: Middle East & Africa Stainless Steel Cable Ties Market Volume (Million Units), by End-use Industry 2017-2031

Figure 69: Middle East & Africa Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2017-2031

Figure 70: Middle East & Africa Stainless Steel Cable Ties Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 71: Middle East & Africa Stainless Steel Cable Ties Market Volume (Million Units), by Distribution Channel 2017-2031

Figure 72: Middle East & Africa Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 73: Middle East & Africa Stainless Steel Cable Ties Market Value (US$ Mn), by Region, 2017-2031

Figure 74: Middle East & Africa Stainless Steel Cable Ties Market Volume (Million Units), by Region 2017-2031

Figure 75: Middle East & Africa Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 76: South America Stainless Steel Cable Ties Market Value (US$ Mn), by Type, 2017-2031

Figure 77: South America Stainless Steel Cable Ties Market Volume (Million Units), by Type 2017-2031

Figure 78: South America Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 79: South America Stainless Steel Cable Ties Market Value (US$ Mn), by Coating, 2017-2031

Figure 80: South America Stainless Steel Cable Ties Market Volume (Million Units), by Coating 2017-2031

Figure 81: South America Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Coating, 2023-2031

Figure 82: South America Stainless Steel Cable Ties Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 83: South America Stainless Steel Cable Ties Market Volume (Million Units), by End-use Industry 2017-2031

Figure 84: South America Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 85: South America Stainless Steel Cable Ties Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 86: South America Stainless Steel Cable Ties Market Volume (Million Units), by Distribution Channel 2017-2031

Figure 87: South America Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 88: South America Stainless Steel Cable Ties Market Value (US$ Mn), by Region, 2017-2031

Figure 89: South America Stainless Steel Cable Ties Market Volume (Million Units), by Region 2017-2031

Figure 90: South America Stainless Steel Cable Ties Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031