Specialty chemicals are mainly produced by a complex as well as interlinked industry. These chemicals are a type of chemical product which are mainly sold based on their function and performance, instead of their composition. Such chemicals either can be found as a single-chemical entity or as complete formulations. Their composition helps in enhancing the performance as well as processing of customers’ desired product. With rapidly mushrooming urbanization, industrialization, and increasing standard of living, the requirement of high-performance chemicals like specialty chemicals is rising at a breathneck speed. This is majorly responsible for driving the global specialty chemicals market.

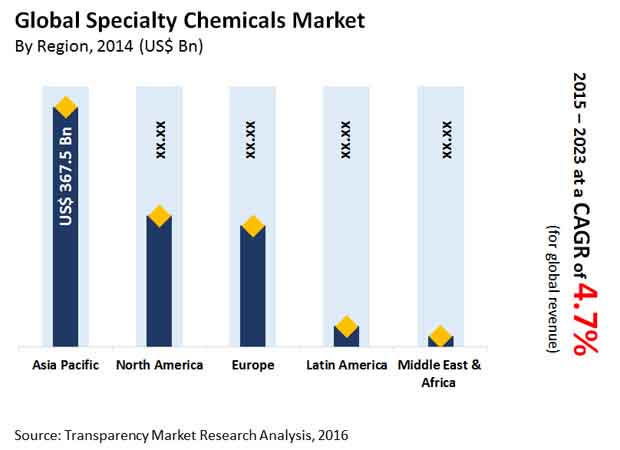

As per expert analysts, the global specialty chemicals market is expected to register a valuation of US$1,210.1bn by 2023-end. This growth is predicted to occur at a promising CAGR of 4.7% during the forecast period from 2017 to 2023. Flourishing agriculture industry worldwide, and growing demand for agrochemicals are fueling the global specialty chemicals market. The market is mainly segmented on the basis of product and region.

On the basis of product, the global specialty chemicals market has been divided into following segments – cosmetic chemicals, food additives, textile chemicals, agrochemicals, water treatment chemicals, construction chemicals, ink additives, oil field chemicals, and paper & pulp chemicals. The construction chemicals segment registered the highest share of 22.3%. This is due to the rising urbanization such as growing housing projects and public infrastructure in developing countries, which further augments the demand for specialty construction chemicals, specially adhesives and sealants, protective coatings, asphalt additives, and concrete admixtures. However, in high-end markets such as Central and South America, Asia Pacific, and the Middle East and Africa, the popularity of construction chemicals is expected to continue.

Apart from construction chemicals, agrochemicals is expected to witness highest share of 13.5% in the next few years, especially during the mentioned forecast period – 2015 to 2023. This is mainly due to the rising demand for improving quality and quantity of yield from agricultural industry.

Geographically, Asia pacific is expected to grab 54.4% of the global specialty chemicals market value by 2023 end, as the region has seen rapid industrialization. Rising demand for specialty chemicals from agricultural industry, growing paper and textiles industry, and increasing disposable income could be responsible for fueling specialty chemicals market in this region. Countries like China and India contributes more in this regional market as these countries have witnessed high extent of agriculture trade and exports along with rapid growth in paper and textiles industry. Apart from these, rising consumption of paper and apparel, and rapid establishment of several manufacturers are also expected to boost the global specialty chemicals market.

A competitive vendor landscape exists in this market thanks to the presence of innumerable players. Some of the prominent players operating in the global specialty chemicals market are The Dow Chemical Company, BASF SE, INEOS Group AG, Clariant AG, Eastman Chemical Company, and Evonik Industries AG, and Akzo Nobel N.V.

Chapter 1 Preface

1.1 Research Description

1.2 Research Scope

1.3 Assumptions

1.4 Market Segmentation

1.5 Research Methodology

Chapter 2 Executive Summary

2.1 Global Specialty Chemicals Market, 2014 – 2023 (US$ Bn)

2.2 Global Specialty Chemicals Market: Market Snapshot

Chapter 3 Specialty Chemicals Market - Industry Analysis

3.1 Introduction

3.2 Value Chain Analysis

3.3 Market Drivers

3.3.1 Increasing Need for Yield-enhancing Agrochemicals Boosted by Food Security Concerns Among Booming Global Population

3.3.2 Rising Demand from Automotive Industry is Anticipated to Drive the Specialty Chemicals Market

3.4 Restraints

3.4.1 Stringent Regulations Against Agrochemicals Expected to Hamper Market for Specialty Chemicals

3.4.2 Declining Demand for Coated Paper in North America and Europe Reduces Market Profitability

3.5 Opportunity

3.5.1 Growing Construction Activities in BRIC Countries Projected to Act as Opportunity for the Market

3.6 Porter’s Five Forces Analysis

3.6.1 Bargaining Power of Suppliers

3.6.2 Bargaining Power of Buyers

3.6.3 Threat of New Entrants

3.6.4 Threat of Substitutes

3.6.5 Degree of Competition

3.7 Market Attractiveness Analysis – By Product

3.7 Market Attractiveness Analysis – By Country

3.8 Company Market Share Analysis, 2014

Chapter 4 Price Trend Analysis

4.2 Raw Materials Price Trend, 2014–2023

Chapter 5 Specialty Chemicals Market – Product Segment Analysis

5.1 Specialty Chemicals Market: Product Segment Overview

5.2 Specialty Chemicals Market, by Product Segment, 2014–2023

5.2.1 Global Specialty Chemicals Market for Agrochemicals, 2014 – 2023 (US$ Bn)

5.2.2 Global Specialty Chemicals Market for Polymers & Plastic Additives, 2014 – 2023 (US$ Bn)

5.2.3 Global Specialty Chemicals Market for Construction Chemicals, 2014 – 2023 (US$ Bn)

5.2.4 Global Specialty Chemicals Market for Electronic Chemicals, 2014 – 2023 (US$ Bn)

5.2.5 Global Specialty Chemicals Market for Cleaning Chemicals, 2014 – 2023 (US$ Bn)

5.2.6 Global Specialty Chemicals Market for Surfactants, 2014 – 2023 (US$ Bn)

5.2.7 Global Specialty Chemicals Market for Lubricants & Oilfield Chemicals, 2014 – 2023 (US$ Bn)

5.2.8 Global Specialty Chemicals Market for Specialty Coatings, 2014 – 2023 (US$ Bn)

5.2.9 Global Specialty Chemicals Market for Paper & Textile Chemicals, 2014 – 2023 (US$ Bn)

5.2.10 Global Specialty Chemicals Market for Food Additives, 2014 – 2023 (US$ Bn)

5.2.11 Global Specialty Chemicals Market for Adhesives & Sealants, 2014 – 2023 (US$ Bn)

5.2.12 Global Specialty Chemicals Market for Others, 2014 – 2023 (US$ Bn)

Chapter 6 Global Specialty Chemicals Market - Regional Analysis

6.1 Global Specialty Chemicals Market: Regional Overview

6.1.1 North America Specialty Chemicals Market – By Regional Sub-segment, 2014 – 2023

6.2 North America Specialty Chemicals Market

6.2.1 North America Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.2.2 US Specialty Chemicals Market

6.2.2.1 U.S. Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.2.3 Rest of North America Specialty Chemicals Market

6.2.3.1 Rest of North America Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.3 Europe Specialty Chemicals Market- By Regional Sub-segment, 2014-2023

6.4 Europe Specialty Chemicals Market

6.4.1 Europe Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.4.2 Germany Specialty Chemicals Market

6.4.2.1 Germany Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.4.3 Italy Specialty Chemicals Market

6.4.3.1 Italy Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.4.4 Spain Specialty Chemicals Market

6.4.4.1 Spain Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.4.5 U.K. Specialty Chemicals Market

6.4.5.1 U.K. Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.4.6 France Specialty Chemicals Market

6.4.6.1 France Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.4.7 Rest of Europe Specialty Chemicals Market

6.4.7.1 Rest of Europe Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.5 Asia Pacific Specialty Chemicals Market- By Regional Sub-segment, 2014-2023

6.6 Asia Pacific Specialty Chemicals Market

6.6.1 Asia Pacific Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.6.2 China Specialty Chemicals Market

6.6.2.1 China Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.6.3 Japan Specialty Chemicals Market

6.6.3.1 Japan Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.6.4 ASEAN Specialty Chemicals Market

6.6.4.1 ASEAN Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.6.5 India Specialty Chemicals Market

6.6.5.1 India Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.6.6 Rest of Asia Pacific Specialty Chemicals Market

6.6.6.1 Rest of Asia Pacific Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.7 Latin America Specialty Chemicals Market- By Regional Sub-segment, 2014-2023

6.8 Latin America Specialty Chemicals Market

6.8.1 Latin America Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.8.2 Brazil Specialty Chemicals Market

6.8.2.1 Brazil Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.8.3 Rest of Latin America Specialty Chemicals Market

6.8.3.1 Rest of Latin America Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.9 Middle East & Africa Specialty Chemicals Market- By Regional Sub-segment, 2014-2023

6.10 Middle East & Africa Specialty Chemicals Market

6.10.1 Middle East & Africa Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.10.2 GCC Countries Specialty Chemicals Market

6.10.2.1 GCC Countries Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.10.3 South Africa Specialty Chemicals Market

6.10.3.1 South Africa Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

6.10.4 Rest of Middle East & Africa Specialty Chemicals Market

6.10.4.1 Rest of Middle East & Africa Specialty Chemicals Market, Revenue by Product Segment, 2014 - 2023 (US$ Bn)

Chapter 7 Company Profiles

7.1 Akzo Nobel N.V.

7.2 BASF SE

7.3 Ashland Inc.

7.4 Clariant AG

7.5 Evonik Industries

7.6 The Dow Chemical Company

7.7 Huntsman Corporation

7.8 E. I. du Pont de Nemours and Company (DuPont)

7.9 Arkema S.A.

7.10 Bayer AG

7.11 Chevron Philips Chemical Company

7.12 Syngenta AG

7.13 Albemarle Corporation

7.14 Chemtura Corporation

7.15 Eastman Chemical Company

7.16 Solvay

7.17 INEOS Group AG

Chapter 8 Primary Findings

Chapter 9 List of Customers