Digitalization coupled with rapid advancements in technology has played a key role in revolutionizing the entertainment sector. The advent of cloud services and growing adoption of the same for content creation over the past few years have come at a time when over-the-top content started becoming popular. The significant rise in the number of over-the-top content viewers and the number of viewing hours has brought about significant innovations in post-production stages due to which, the demand for special effects software has increased at an impressive rate– a factor that will augment the growth of the global special effects software market during the forecast period. From modest use of special effects in movies such as The Titanic, movies such as The Avengers feature special effects that were hard to achieve a couple of decades ago.

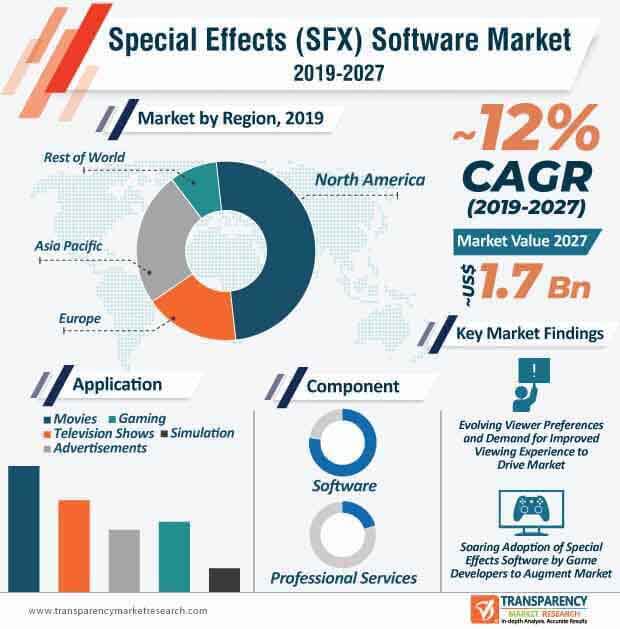

Evolving viewer demands for high-quality content coupled with soaring demand for top-notch audio-visual effects for an enhanced viewing experience has led to a rise in the adoption of special effect software in the past few years. In the current scenario, special effects software is increasingly being used in television series, advertisements, games, movies, and more– another factor that is projected to propel the growth of the special effects (SFX) software market in the coming years. These factors, along with the advent of new special effects (SFX) software with improved capabilities are expected to drive the global special effects (SFX) software market past the ~US$ 1.7 Bn mark by the end of 2027. Moreover, the dwindling cost of software tools used to develop content has increased the adoption of multiple special effects software in the past few years.

When cloud computing made an entry into the entertainment space, its adoption increased across various studios on a project-to-project basis despite being largely confined to burst to render. However, due to lack of a concrete cloud-wide audit, vendors operating in the special effects (SFX) software market were unwilling to provide services beyond burst rendering. Some of the key areas such as virtual workstations and long-term storage were completely ignored during the initial phase of deployment of cloud-based platforms in the special effects (SFX) software market.

However, the formulation of Trusted Partner Network (TPN), which constitutes of top value content producers, MPAA member studios, and other stakeholders drafted a framework for vendors involved in the special effects (SFX) software market. At present, although cloud-based platforms are predominantly available for on-premise systems, the TPN audit for cloud will pave the way for media workflows for studios who are inclined toward the use of cloud for an array of different types of content creation projects, including virtual studio, hybrid rendering, and storage of material on the cloud.

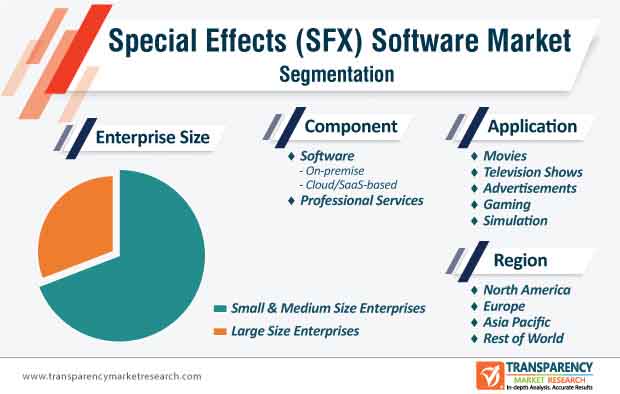

While on-premise software modules are currently in demand, cloud/SaaS-based software will gain noteworthy traction in the second half of the forecast period.

While the deployment of special effects software in movies and television shows is expected to grow at an impressive pace during the forecast period, another major area of application wherein special effects software is likely to be deployed is gaming. The booming global gaming industry, which has entered the billion-dollar club presents a plethora of opportunities for companies operating in the current market for special effects (SFX) software. Due to the blazing pace at which gaming graphics have evolved in the past few years, the entry of special effects in the gaming space was inevitable. Moreover, the advent of novel technologies such as augmented reality and virtual reality, motion capture, and real-time rendering has enabled advanced simulations and imaging. Gaming companies are increasingly deploying advanced special effects (SFX) software to improve the overall gameplay of their games and improve the overall gaming experience of their customers. Thus, technological advancements and growing adoption of special effect software are expected to revolutionize game development models in the coming years. At present, special effect software is playing a key role in transforming the visuals of games and the trend is set to continue during the forecast period. This is expected to drive the global special effects (SFX) software market during the forecast period.

Analysts’ Viewpoint

The global special effects (SFX) software market is expected to grow at a staggering CAGR of ~12% during the forecast period. The market growth can be largely attributed to significant advancements in technology, rising demand for over-the-top content, and mounting viewer expectations for improved audio-visuals, among others. Vendors operating in the current market landscape should eye opportunities beyond movies and television films, and tap into the opportunities within the gaming industry. North America is expected to dominate the market for special effects (SFX) software due to high concentration of market players in the region and fast-paced development of new technologies.

Special Effects (SFX) Software Market: Overview

Special Effects (SFX) Software Market: Definition

North America Special Effects (SFX) Software Market: Snapshot

Key Drivers of Special Effects (SFX) Software Market

Key Restraints of Special Effects (SFX) Software Market

Special Effects (SFX) Software Market: Competition Landscape

Special Effects (SFX) Software Market: Company Profile Snapshot

Adobe Systems Inc.: Adobe Systems Inc. provides digital marketing, e-learning, and digital media solutions. The company offers product and software services in digital media, digital marketing, and print & publishing sectors. The company offers Photoshop image editing software,

Autodesk Inc.: Autodesk Inc. offers 3D design, and engineering and entertainment software and services. The company’s professional software products are sold globally, both directly to customers and through a network of resellers and distributors. The company’s product development and manufacturing software provides comprehensive digital design, engineering, manufacturing, and production solutions to automotive, transportation, industrial machinery, consumer products, and building product industries.

Telestream, LLC: Telestream, LLC is one of the prominent players providing digital media tools and workflow solutions. The company’s product range includes desktop applications, enterprise systems, video quality assurance solutions, and captioning & subtitling. Telestream, LLC provides solutions such as transcoding solutions, Facebook live solutions, OTT streaming solutions, video quality assurance solutions, and social media solutions.

The Foundry Visionmongers Limited: The Foundry Visionmongers Limited designs and develops computer graphics, visual effects, and 3D design software for the digital design, media and entertainment sector. The company has collaborated with post-production houses such as Pixar, ILM, MPC, Walt Disney Animation, Weta Digital, DNEG, and Framestore.

Special Effects Software Market is projected to reach US$ 1.7 Bn by 2027

Key vendors in the Special Effects Software Market are Adobe Systems Inc., Aptech Ltd., Autodesk Inc., BORIS FX, INC, FXhome Limited, headus (metamorphosis) Pty Ltd, Pixologic, Inc., Red Giant LLC, Side FX, Telestream, LLC, The Foundry Visionmongers Limited, and Video Copilot and Final Image Inc

The Special Effects Software Market is expected to grow at a CAGR of 12% during 2019 - 2027

Special Effects Software product type, end user, price category, distribution channel, and region.

North America Takes Lead in the Special Effects Software Market

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Special Effects (SFX) Software Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macroeconomic Factors Overview

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Global ICT Spending (US$ Mn), 2013, 2019, 2023 and 2027

4.3. Technology/ Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. Ecosystem Analysis

4.4.3. PEST Analysis

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers and Restraints

4.5. Global Special Effects (SFX) Software Market Analysis and Forecast, 2013 - 2027

4.5.1. Market Revenue Analysis (US$ Mn)

4.5.1.1. Historic Growth Trends, 2016-2018

4.5.1.2. Forecast Trends, 2019-2027

4.6. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Rest of the World)

4.6.1. By Country

4.6.2. By Component

4.6.3. By Enterprise Size

4.6.4. By Application

4.7. Competitive Scenario and Trends

4.7.1. Special Effects (SFX) Software Market Concentration Rate

4.7.1.1. List of Emerging, Prominent and Leading Players

4.7.2. Mergers & Acquisitions, Expansions

4.8. Market Outlook

5. Global Special Effects (SFX) Software Market Analysis and Forecast, by Component

5.1. Overview and Definitions

5.2. Key Segment Analysis

5.3. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

5.3.1. Software

5.3.1.1. On-Premises

5.3.1.2. Cloud/SaaS Based

5.3.2. Professional Services

6. Global Special Effects (SFX) Software Market Analysis and Forecast, by Enterprise Size

6.1. Overview

6.2. Key Segment Analysis

6.3. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

6.3.1. Small & Medium Enterprises

6.3.2. Large Enterprises

7. Global Special Effects (SFX) Software Market Analysis and Forecast, by Application

7.1. Overview

7.2. Key Segment Analysis

7.3. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

7.3.1. Movies

7.3.2. Television Shows

7.3.3. Advertisement

7.3.4. Gaming

7.3.5. Simulation

8. Global Special Effects (SFX) Software Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Emerging Markets/Countries

8.3. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Rest of the World

9. North America Special Effects (SFX) Software Market Analysis and Forecast

9.1. Regional Outlook

9.2. Key Findings

9.3. Impact Analysis of Drivers and Restraints

9.4. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

9.4.1. Software

9.4.1.1. On-Premises

9.4.1.2. Cloud/SaaS Based

9.4.2. Professional Services

9.5. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

9.5.1. Small & Medium Enterprises

9.5.2. Large Enterprises

9.6. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

9.6.1. Movies

9.6.2. Television Shows

9.6.3. Advertisement

9.6.4. Gaming

9.6.5. Simulation

9.7. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Country, 2017 - 2027

9.7.1. U.S.

9.7.2. Canada

9.7.3. Mexico

10. Europe Special Effects (SFX) Software Market Analysis and Forecast

10.1. Regional Outlook

10.2. Key Findings

10.3. Impact Analysis of Drivers and Restraints

10.4. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

10.4.1. Software

10.4.1.1. On-Premises

10.4.1.2. Cloud/SaaS Based

10.4.2. Professional Services

10.5. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

10.5.1. Small & Medium Enterprises

10.5.2. Large Enterprises

10.6. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

10.6.1. Movies

10.6.2. Television Shows

10.6.3. Advertisement

10.6.4. Gaming

10.6.5. Simulation

10.7. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

10.7.1. Western Europe

10.7.1.1. Germany

10.7.1.2. U.K.

10.7.1.3. France

10.7.1.4. Spain

10.7.1.5. Rest of Western Europe

10.7.2. Eastern Europe

10.7.2.1. Russia

10.7.2.2. Rest of Eastern Europe

11. Asia Pacific Special Effects (SFX) Software Market Analysis and Forecast

11.1. Regional Outlook

11.2. Key Findings

11.3. Impact Analysis of Drivers and Restraints

11.4. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

11.4.1. Software

11.4.1.1. On-Premises

11.4.1.2. Cloud/SaaS Based

11.4.2. Professional Services

11.5. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

11.5.1. Small & Medium Enterprises

11.5.2. Large Enterprises

11.6. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

11.6.1. Movies

11.6.2. Television Shows

11.6.3. Advertisement

11.6.4. Gaming

11.6.5. Simulation

11.7. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

11.7.1. China

11.7.2. Japan

11.7.3. India

11.7.4. Australia

11.7.5. ASEAN

11.7.6. Rest of Asia Pacific

12. Rest of the World Special Effects (SFX) Software Market Analysis and Forecast

12.1. Regional Outlook

12.2. Key Findings

12.3. Impact Analysis of Drivers and Restraints

12.4. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

12.4.1. Software

12.4.1.1. On-Premises

12.4.1.2. Cloud/SaaS Based

12.4.2. Professional Services

12.5. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

12.5.1. Small & Medium Enterprises

12.5.2. Large Enterprises

12.6. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

12.6.1. Movies

12.6.2. Television Shows

12.6.3. Advertisement

12.6.4. Gaming

12.6.5. Simulation

12.7. Special Effects (SFX) Software Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

12.7.1. Middle East & Africa (MEA)

12.7.2. South America

13. Competition Landscape

13.1. Market Competition Matrix, by Leading Players

13.2. Market Revenue Share Analysis (%), by Leading Players (2018)

14. Company Profiles (Details – Business Overview, Geographical Presence, Key Competitors, Revenue and Strategy)

14.1. Adobe Systems Inc.

14.1.1. Business Overview

14.1.2. Geographical Presence

14.1.3. Key Competitors

14.1.4. Revenue and Strategy

14.2. Aptech Ltd.

14.2.1. Business Overview

14.2.2. Geographical Presence

14.2.3. Key Competitors

14.2.4. Revenue and Strategy

14.3. BORIS FX, INC

14.3.1. Business Overview

14.3.2. Geographical Presence

14.3.3. Key Competitors

14.3.4. Revenue and Strategy

14.4. FXhome Limited

14.4.1. Business Overview

14.4.2. Geographical Presence

14.4.3. Key Competitors

14.4.4. Revenue and Strategy

14.5. Headus (metamorphosis) Pty Ltd

14.5.1. Business Overview

14.5.2. Geographical Presence

14.5.3. Key Competitors

14.5.4. Revenue and Strategy

14.6. Maxon Computer GmbH

14.6.1. Business Overview

14.6.2. Geographical Presence

14.6.3. Key Competitors

14.6.4. Revenue and Strategy

14.7. Pixologic, Inc.

14.7.1. Business Overview

14.7.2. Geographical Presence

14.7.3. Key Competitors

14.7.4. Revenue and Strategy

14.8. Red Giant LLC

14.8.1. Business Overview

14.8.2. Geographical Presence

14.8.3. Key Competitors

14.8.4. Revenue and Strategy

14.9. Side FX

14.9.1. Business Overview

14.9.2. Geographical Presence

14.9.3. Key Competitors

14.9.4. Revenue and Strategy

14.10. Telestream, LLC

14.10.1. Business Overview

14.10.2. Geographical Presence

14.10.3. Key Competitors

14.10.4. Revenue and Strategy

14.11. The Foundry Visionmongers Limited

14.11.1. Business Overview

14.11.2. Geographical Presence

14.11.3. Key Competitors

14.11.4. Revenue and Strategy

14.12. Video Copilot and Final Image Inc.

14.12.1. Business Overview

14.12.2. Geographical Presence

14.12.3. Key Competitors

14.12.4. Revenue and Strategy

15. Key Takeaways

List of Tables

Table 1: List of Primary and Secondary Resources

Table 2: List of Vendors

Table 3: Acquisition/Partnership/Product Launch

Table 4: Global Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Component, 2017 - 2027

Table 5: Global Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Enterprise Size 2017 - 2027

Table 6: Global Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Application 2017 - 2027

Table 7: Global Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Region, 2017 - 2027

Table 8: North America Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Component, 2017 - 2027

Table 9: North America Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Enterprise Size 2017 - 2027

Table 10: Global Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Application 2017 - 2027

Table 11: North America Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Country, 2017 - 2027

Table 12: Europe Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Component, 2017 - 2027

Table 13: Europe Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Enterprise Size 2017 - 2027

Table 14: Europe Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Application 2017 - 2027

Table 15: Europe special effects (SFX) software Market Revenue (US$ Mn) Forecast, By Country, 2017 - 2027

Table 16: Asia Pacific Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Component, 2017 - 2027

Table 17: Asia Pacific Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Enterprise Size 2017 - 2027

Table 18: Europe Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Application 2017 - 2027

Table 19: Asia Pacific Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Country, 2017 - 2027

Table 20: Rest of the World Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Component, 2017 - 2027

Table 21: Rest of the World Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Enterprise Size 2017 - 2027

Table 22: Rest of the World Special Effects (SFX) Software Market Revenue (US$ Mn) Forecast, By Application 2017 - 2027

Table 23: Rest of the World Special Effects (SFX) software Market Revenue (US$ Mn) Forecast, By Region, 2017 - 2027

Table 24: Business Overview / Portfolio

Table 25: Business Overview / Portfolio

List of Figures

Figure 1: Global Special Effects (SFX) Software Market Size (US$ Mn) Forecast, 2017 – 2027

Figure 2: Global Special Effects (SFX) Software Market Value (US$ Mn), by Region, 2019E

Figure 3: Global Special Effects (SFX) Software Market Value (US$ Mn), by Region, 2027F

Figure 4: Top Segment Analysis

Figure 5: REGIONAL OUTLINE, 2018

Figure 6: GLOBAL CAGR BREAKDOWN

Figure 7: COUNTRY ABSTRACT, 2018

Figure 8: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 9: Top Economies GDP Landscape, 2018

Figure 10: % Represents Regional Spending Share

Figure 11: Global ICT Spending (%), by Region, 2019E

Figure 12: Global ICT Spending (US$ Bn), Regional Contribution, 2019E

Figure 13: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019E

Figure 14: Global ICT Spending (%), by Type, 2019E

Figure 15: Ecosystem Analysis (1/2)

Figure 16: Global Special Effects (SFX) Software Market Historic Growth Trends (US$ Mn), 2016 – 2018

Figure 17: Global Special Effects (SFX) Software Market Forecast Growth Trends (US$ Mn), 2019 – 2027

Figure 18: Attractiveness Assessment, By Component

Figure 19: Opportunity Assessment, By Component

Figure 20: Attractiveness Assessment, By Application

Figure 21: Opportunity Assessment, By Application

Figure 22: Attractiveness Assessment, By Enterprise Size

Figure 23: Opportunity Assessment, By Enterprise size

Figure 24: Attractiveness Assessment, By Region

Figure 25: Opportunity Assessment, By Region

Figure 26: Five Firm Concentration Ratio Analysis (2018)

Figure 27: Global Special Effects (SFX) Software Market, By Component, CAGR (%) (2019 – 2027)

Figure 28: Global Special Effects (SFX) Software Market, By Enterprise Size, CAGR (%) (2019 – 2027)

Figure 29: Global Special Effects (SFX) Software Market, By Application, CAGR (%) (2019 – 2027)

Figure 30: Global Special Effects (SFX) Software Market, By Region, CAGR (%) (2019 – 2027)

Figure 31: Global Special Effects (SFX) Software Market Share Analysis, By Component (2019)

Figure 32: Global Special Effects (SFX) Software Market Share Analysis, By Component (2027)

Figure 33: Global Special Effects (SFX) Software Market Share Analysis, By Enterprise Size (2019)

Figure 34: Global Special Effects (SFX) Software Market Share Analysis, By Enterprise Size (2027)

Figure 35: Global Special Effects (SFX) Software Market Share Analysis, By Application (2019)

Figure 36: Global Special Effects (SFX) Software Market Share Analysis, By Application (2027)

Figure 37: Global special effects (SFX) software Market Share Analysis, By Region (2019)

Figure 38: Global special effects (SFX) software Market Share Analysis, By Region (2027)

Figure 39: North America Special Effects (SFX) Software Market Share Analysis, By Component (2019)

Figure 40: North America Special Effects (SFX) Software Market Share Analysis, By Component (2027)

Figure 41: North America Special Effects (SFX) Software Market Share Analysis, By Enterprise Size (2019)

Figure 42: North America Special Effects (SFX) Software Market Share Analysis, By Enterprise Size (2027)

Figure 43: North America Special Effects (SFX) Software Market Share Analysis, By Application (2019)

Figure 44: North America Special Effects (SFX) Software Market Share Analysis, By Application (2027)

Figure 45: North America Special Effects (SFX) Software Market Share Analysis, By Country (2019)

Figure 46: North America Special Effects (SFX) Software Market Share Analysis, By Country (2027)

Figure 47: Europe Special Effects (SFX) Software Market Share Analysis, By Component (2019)

Figure 48: Europe Special Effects (SFX) Software Market Share Analysis, By Component (2027)

Figure 49: Europe Special Effects (SFX) Software Market Share Analysis, By Enterprise Size (2019)

Figure 50: Europe Special Effects (SFX) Software Market Share Analysis, By Enterprise Size (2027)

Figure 51: Europe Special Effects (SFX) Software Market Share Analysis, By Application (2019)

Figure 52: Europe Special Effects (SFX) Software Market Share Analysis, By Application (2027)

Figure 53: Europe special effects (SFX) software Market Share Analysis, By Country (2019)

Figure 54: Europe special effects (SFX) software Market Share Analysis, By Country (2027)

Figure 55: Asia Pacific Special Effects (SFX) Software Market Share Analysis, By Component (2019)

Figure 56: Asia Pacific Special Effects (SFX) Software Market Share Analysis, By Component (2027)

Figure 57: Asia Pacific Special Effects (SFX) Software Market Share Analysis, By Enterprise Size (2019)

Figure 58: Asia Pacific Special Effects (SFX) Software Market Share Analysis, By Enterprise Size (2027)

Figure 59: Asia Pacific Special Effects (SFX) Software Market Share Analysis, By Application (2019)

Figure 60: Asia Pacific Special Effects (SFX) Software Market Share Analysis, By Application (2027)

Figure 61: Asia Pacific Special Effects (SFX) Software Market Share Analysis, By Country (2019)

Figure 62: Asia Pacific Special Effects (SFX) Software Market Share Analysis, By Country (2027)

Figure 63: Rest of the World Special Effects (SFX) Software Market Share Analysis, By Component (2019)

Figure 64: Rest of the World Special Effects (SFX) Software Market Share Analysis, By Component (2027)

Figure 65: Rest of the World Special Effects (SFX) Software Market Share Analysis, By Enterprise Size (2019)

Figure 66: Rest of the World Special Effects (SFX) Software Market Share Analysis, By Enterprise Size (2027)

Figure 67: Rest of the World Special Effects (SFX) Software Market Share Analysis, By Application (2019)

Figure 68: Rest of the World Special Effects (SFX) Software Market Share Analysis, By Application (2027)

Figure 69: Rest of the World Special Effects (SFX) Software Market Share Analysis, By Region (2019)

Figure 70: Rest of the World Special Effects (SFX) Software Market Share Analysis, By Region (2027)

Figure 71: Global Special Effects (SFX) Software Market Share Analysis by Company (2018)

Figure 72: Net Sales (US$ Mn), by Region, 2018

Figure 73: Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 74: Net Sales (US$ Mn), by Region, 2018

Figure 75: Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018