Analysts’ Viewpoint

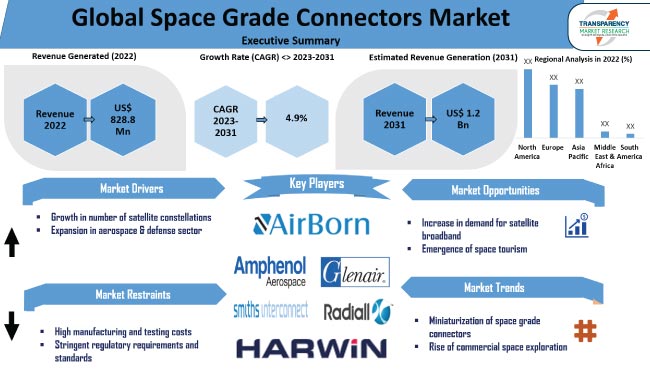

Increase in number of satellite constellations and expansion in the aerospace & defense sector are projected to propel the space grade connectors market size during the forecast period. Miniaturization of space grade connectors and rise of commercial space exploration are major trends in the market.

Surge in demand for satellite broadband and emergence of space tourism are likely to offer lucrative opportunities to vendors in the global space grade connectors industry. However, high manufacturing and testing costs as well as stringent regulatory requirements and standards are estimated to limit the space grade connectors market growth in the near future.

Space-grade connectors are specialized electrical connectors designed for use in aerospace and space applications. These connectors are vital components in spacecraft, satellites, launch vehicles, and other space systems. They facilitate the transmission of power, data, and signals under extreme conditions, including vacuum, radiation, and extreme temperatures.

Rise in investment in space exploration and satellite technologies is augmenting the space grade connectors market trajectory. Increase in demand for satellite-based services, including communication, earth observation, and navigation, has led to a surge in the development and deployment of satellites. Each satellite requires several space-grade connectors. Rise in development of smaller and more lightweight satellites is boosting demand for miniaturized space-grade connectors.

Advancements in connector technologies, including materials, designs, and manufacturing processes, are projected to fuel the space grade connectors market value in the next few years. These advancements help improve the performance and reliability of space-grade connectors. Cost-effective and high-quality space-grade connectors are gaining traction among small companies entering the space sector.

In recent years, the space sector has expanded beyond its traditional participants, encompassing government agencies and major telecommunications providers as well as emerging space companies. Several private players are providing launch services, space tourism, constellation launch services, and satellite IoT communication.

Advancements in IoT and M2M connectivity are boosting the demand for satellite communication. However, deployment of a satellite into space costs billions of dollars, which restrains the use of geostationary satellite services for communication purposes. Increase in focus on boosting internet coverage for the masses is also prompting the R&D of less expensive space tools and technologies. Low-earth Orbit (LEO) satellite constellations provide affordable and high-speed internet connectivity. Thus, major telecom companies are investing in LEO satellites, which is propelling the space grade connectors market progress.

Rapid and disruptive breakthroughs in space technology as well as developments in manufacturing capabilities have enabled the deployment of smaller satellites in Earth’s orbit at lower costs. These satellites deliver persistent Earth imagery, global communication, internet access, and IoT connectivity. Amazon, Telesat, and OneWeb are some examples of companies developing satellite constellations to boost internet access worldwide.

Satellites require a large number of high-performance components, such as connectors, to establish an infrastructure that effectively sets up a connection in space. Connectors ensure optimal performance, durability, and safety in deep space missions as well as in low, medium, and geostationary Earth orbit satellites.

According to the Aerospace Industries Association, in 2022, U.S. aerospace & defense sales increased by US$ 952 Bn, which accounted for 6.7% growth compared to 2021. Growth in the aerospace & defense sector is anticipated to fuel the space grade connectors market statistics in the near future.

Rugged connectors deliver high-grade protection from various space elements, maintain mission-critical signal integrity, and protect sensitive electronics from environmental hazards. Space grade connector manufacturers are focusing on developing compact and lightweight products with high data throughput.

Connectors can be utilized in several aerospace & defense applications due to their temperature resistance, lightweight, and minimum space requirement features. Backplanes, navigation systems, radar systems, and observatory satellites employ connectors. Military activities rely on satellite communications for Position Navigation and Timing (PNT); meteorology; environmental monitoring; space situational awareness; and Intelligence, Surveillance, and Reconnaissance (ISR).

According to the latest space grade connectors market trends, the circular connector product type segment held 39.5% share in 2022. The segment is expected to maintain the status quo and grow at a CAGR of 5.1% during the forecast period. Circular space-grade connectors are crucial components used in aerospace and space applications including satellites, spacecraft, and launch vehicles. Growth in space exploration and increase in satellite deployment and commercial space activities are fueling the segment.

According to the latest space grade connectors market analysis, the panel mount application segment held 33.3% share in 2022. The segment is projected to maintain the status quo and grow at a CAGR of 5.1% during the forecast period.

Space grade connectors with panel mount configurations are used in military & defense applications for secure communication, navigation, and satellite-based defense systems. Additionally, rise in complexities in space missions is leading toward miniaturization and integration of components including panel mount connectors. These connectors are often designed to be compact and lightweight, meeting the needs of modern space systems.

According to the latest space grade connectors market forecast, North America is expected to hold largest share from 2023 to 2031. The region held a prominent share of 30.0% in 2022. Presence of a robust satellite communication sector that provides services, such as broadband internet, television broadcasting, and Global Positioning Systems (GPS), is propelling the market dynamics of North America. Development, maintenance, and upgrading of these satellite networks require space grade connectors.

Surge in investment in space exploration is driving North America space grade connectors market revenue. The U.S. is home to the National Aeronautics and Space Administration (NASA). NASA conducts a wide range of space exploration missions, scientific research, and satellite deployments, all of which require space-grade connectors for power distribution, data transmission, and instrumentation.

The sector in Europe accounted for 29.3% share in 2022. Rise in number of private space companies involved in satellite deployment, space tourism, and other space activities is augmenting market expansion in the region.

The global industry is consolidated, with prominent space grade connector companies holding significant market dominance. Vendors are adopting various growth strategies, such as collaborations with key players, mergers & acquisitions, product launches, and development of a worldwide distribution network, to increase their space grade connectors market share.

Airborn Inc., Amphenol Aerospace, Carlisle Interconnect Technologies, Glenair, Inc., Harwin, Inc., IEH Corporation, ITT Inc., Milnec Interconnect Systems, Omnetics Connector Corp., Positronic, Radiall, Smiths Interconnect, Souriau, TE Connectivity, and Teledyne Defense Electronics are key entities operating in this sector.

Each of these players has been profiled in the space grade connectors market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 828.8 Mn |

| Market Forecast Value in 2031 | US$ 1.2 Bn |

| Growth Rate (CAGR) | 4.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Mn/Bn for Value and Thousand Units for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 828.8 Mn in 2022

It is projected to be 4.9% from 2023 to 2031

Growth in number of satellite constellations and expansion in aerospace & defense sector

The circular connector segment accounted for major share of 39.5% in 2022

North America is projected to record the highest demand during the forecast period

It was valued at US$ 229.6 Mn in 2022

Airborn Inc., Amphenol Aerospace, Carlisle Interconnect Technologies, Glenair, Inc., Harwin, Inc., IEH Corporation, ITT Inc., Milnec Interconnect Systems, Omnetics Connector Corp., Positronic, Radiall, Smiths Interconnect, Souriau, TE Connectivity, and Teledyne Defense Electronics

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Space Grade Connectors Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Aerospace Component Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

5. Global Space Grade Connectors Market Analysis, By Product Type

5.1. Space Grade Connectors Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Product Type, 2017-2031

5.1.1. Circular Connector

5.1.2. D-sub Connector

5.1.3. Micro-D Connector

5.1.4. Others (Nano-D Connector, Hermetic Connector, etc.)

5.2. Market Attractiveness Analysis, By Product Type

6. Global Space Grade Connectors Market Analysis, By Application

6.1. Space Grade Connectors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

6.1.1. PCB Connection

6.1.2. Panel Mount

6.1.3. Basic Cable Assembly

6.1.4. Heavy-duty Cable Assembly

6.1.5. Test Equipment

6.1.6. Others (Satellite Harness & Payload, etc.)

6.2. Market Attractiveness Analysis, By Application

7. Global Space Grade Connectors Market Analysis, By End-use

7.1. Space Grade Connectors Market Size (US$ Mn) Analysis & Forecast, By End-use, 2017-2031

7.1.1. Satellite

7.1.2. Space Station and Deep Space Robots

7.1.3. Spacecraft

7.1.4. Carrier Rocket

7.1.5. Ground Support Equipment

7.1.6. Others (Space R&D Center, etc.)

7.2. Market Attractiveness Analysis, By End-use

8. Global Space Grade Connectors Market Analysis and Forecast, By Region

8.1. Space Grade Connectors Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Space Grade Connectors Market Analysis and Forecast

9.1. Market Snapshot

9.2. Space Grade Connectors Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Product Type, 2017-2031

9.2.1. Circular Connector

9.2.2. D-sub Connector

9.2.3. Micro-D Connector

9.2.4. Others (Nano-D Connector, Hermetic Connector, etc.)

9.3. Space Grade Connectors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

9.3.1. PCB Connection

9.3.2. Panel Mount

9.3.3. Basic Cable Assembly

9.3.4. Heavy-duty Cable Assembly

9.3.5. Test Equipment

9.3.6. Others (Satellite Harness & Payload, etc.)

9.4. Space Grade Connectors Market Size (US$ Mn) Analysis & Forecast, By End-use, 2017-2031

9.4.1. Satellite

9.4.2. Space Station and Deep Space Robots

9.4.3. Spacecraft

9.4.4. Carrier Rocket

9.4.5. Ground Support Equipment

9.4.6. Others (Space R&D Center, etc.)

9.5. Space Grade Connectors Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country, 2017-2031

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Product Type

9.6.2. By Application

9.6.3. By End-use

9.6.4. By Country/Sub-region

10. Europe Space Grade Connectors Market Analysis and Forecast

10.1. Market Snapshot

10.2. Space Grade Connectors Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Product Type, 2017-2031

10.2.1. Circular Connector

10.2.2. D-sub Connector

10.2.3. Micro-D Connector

10.2.4. Others (Nano-D Connector, Hermetic Connector, etc.)

10.3. Space Grade Connectors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

10.3.1. PCB Connection

10.3.2. Panel Mount

10.3.3. Basic Cable Assembly

10.3.4. Heavy-duty Cable Assembly

10.3.5. Test Equipment

10.3.6. Others (Satellite Harness & Payload, etc.)

10.4. Space Grade Connectors Market Size (US$ Mn) Analysis & Forecast, By End-use, 2017-2031

10.4.1. Satellite

10.4.2. Space Station and Deep Space Robots

10.4.3. Spacecraft

10.4.4. Carrier Rocket

10.4.5. Ground Support Equipment

10.4.6. Others (Space R&D Center, etc.)

10.5. Space Grade Connectors Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.5.1. U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-use

10.6.4. By Country/Sub-region

11. Asia Pacific Space Grade Connectors Market Analysis and Forecast

11.1. Market Snapshot

11.2. Space Grade Connectors Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Product Type, 2017-2031

11.2.1. Circular Connector

11.2.2. D-sub Connector

11.2.3. Micro-D Connector

11.2.4. Others (Nano-D Connector, Hermetic Connector, etc.)

11.3. Space Grade Connectors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

11.3.1. PCB Connection

11.3.2. Panel Mount

11.3.3. Basic Cable Assembly

11.3.4. Heavy-duty Cable Assembly

11.3.5. Test Equipment

11.3.6. Others (Satellite Harness & Payload, etc.)

11.4. Space Grade Connectors Market Size (US$ Mn) Analysis & Forecast, By End-use, 2017-2031

11.4.1. Satellite

11.4.2. Space Station and Deep Space Robots

11.4.3. Spacecraft

11.4.4. Carrier Rocket

11.4.5. Ground Support Equipment

11.4.6. Others (Space R&D Center, etc.)

11.5. Space Grade Connectors Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-use

11.6.4. By Country/Sub-region

12. Middle East & Africa Space Grade Connectors Market Analysis and Forecast

12.1. Market Snapshot

12.2. Space Grade Connectors Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Product Type, 2017-2031

12.2.1. Circular Connector

12.2.2. D-sub Connector

12.2.3. Micro-D Connector

12.2.4. Others (Nano-D Connector, Hermetic Connector, etc.)

12.3. Space Grade Connectors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

12.3.1. PCB Connection

12.3.2. Panel Mount

12.3.3. Basic Cable Assembly

12.3.4. Heavy-duty Cable Assembly

12.3.5. Test Equipment

12.3.6. Others (Satellite Harness & Payload, etc.)

12.4. Space Grade Connectors Market Size (US$ Mn) Analysis & Forecast, By End-use, 2017-2031

12.4.1. Satellite

12.4.2. Space Station and Deep Space Robots

12.4.3. Spacecraft

12.4.4. Carrier Rocket

12.4.5. Ground Support Equipment

12.4.6. Others (Space R&D Center, etc.)

12.5. Space Grade Connectors Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-use

12.6.4. By Country/Sub-region

13. South America Space Grade Connectors Market Analysis and Forecast

13.1. Market Snapshot

13.2. Space Grade Connectors Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Product Type, 2017-2031

13.2.1. Circular Connector

13.2.2. D-sub Connector

13.2.3. Micro-D Connector

13.2.4. Others (Nano-D Connector, Hermetic Connector, etc.)

13.3. Space Grade Connectors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

13.3.1. PCB Connection

13.3.2. Panel Mount

13.3.3. Basic Cable Assembly

13.3.4. Heavy-duty Cable Assembly

13.3.5. Test Equipment

13.3.6. Others (Satellite Harness & Payload, etc.)

13.4. Space Grade Connectors Market Size (US$ Mn) Analysis & Forecast, By End-use, 2017-2031

13.4.1. Satellite

13.4.2. Space Station and Deep Space Robots

13.4.3. Spacecraft

13.4.4. Carrier Rocket

13.4.5. Ground Support Equipment

13.4.6. Others (Space R&D Center, etc.)

13.5. Space Grade Connectors Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Rest of South America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-use

13.6.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Space Grade Connectors Market Competition Matrix - a Dashboard View

14.1.1. Global Space Grade Connectors Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Airborn Inc.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Amphenol Aerospace

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Carlisle Interconnect Technologies

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Glenair, Inc.

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Harwin, Inc.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. IEH Corporation

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. ITT Inc.

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Milnec Interconnect Systems

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Omnetics Connector Corp.

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Positronic

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Radiall

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Smiths Interconnect

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. Souriau

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

15.14. TE Connectivity

15.14.1. Overview

15.14.2. Product Portfolio

15.14.3. Sales Footprint

15.14.4. Key Subsidiaries or Distributors

15.14.5. Strategy and Recent Developments

15.14.6. Key Financials

15.15. Teledyne Defense Electronics

15.15.1. Overview

15.15.2. Product Portfolio

15.15.3. Sales Footprint

15.15.4. Key Subsidiaries or Distributors

15.15.5. Strategy and Recent Developments

15.15.6. Key Financials

15.16. Other Key Players

15.16.1. Overview

15.16.2. Product Portfolio

15.16.3. Sales Footprint

15.16.4. Key Subsidiaries or Distributors

15.16.5. Strategy and Recent Developments

15.16.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Space Grade Connectors Market Value (US$ Mn) & Forecast, by Product Type, 2017-2031

Table 2: Global Space Grade Connectors Market Volume (Thousand Units) & Forecast, by Product Type, 2017-2031

Table 3: Global Space Grade Connectors Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 4: Global Space Grade Connectors Market Value (US$ Mn) & Forecast, by End-use, 2017-2031

Table 5: Global Space Grade Connectors Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 6: Global Space Grade Connectors Market Volume (Thousand Units) & Forecast, by Region, 2017-2031

Table 7: North America Space Grade Connectors Market Value (US$ Mn) & Forecast, by Product Type, 2017-2031

Table 8: North America Space Grade Connectors Market Volume (Thousand Units) & Forecast, by Product Type, 2017-2031

Table 9: North America Space Grade Connectors Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 10: North America Space Grade Connectors Market Value (US$ Mn) & Forecast, by End-use, 2017-2031

Table 11: North America Space Grade Connectors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 12: North America Space Grade Connectors Market Volume (Thousand Units) & Forecast, by Country and Sub-region, 2017-2031

Table 13: Europe Space Grade Connectors Market Value (US$ Mn) & Forecast, by Product Type, 2017-2031

Table 14: Europe Space Grade Connectors Market Volume (Thousand Units) & Forecast, by Product Type, 2017-2031

Table 15: Europe Space Grade Connectors Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 16: Europe Space Grade Connectors Market Value (US$ Mn) & Forecast, by End-use, 2017-2031

Table 17: Europe Space Grade Connectors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 18: Europe Space Grade Connectors Market Volume (Thousand Units) & Forecast, by Country and Sub-region, 2017-2031

Table 19: Asia Pacific Space Grade Connectors Market Value (US$ Mn) & Forecast, by Product Type, 2017-2031

Table 20: Asia Pacific Space Grade Connectors Market Volume (Thousand Units) & Forecast, by Product Type, 2017-2031

Table 21: Asia Pacific Space Grade Connectors Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 22: Asia Pacific Space Grade Connectors Market Value (US$ Mn) & Forecast, by End-use, 2017-2031

Table 23: Asia Pacific Space Grade Connectors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 24: Asia Pacific Space Grade Connectors Market Volume (Thousand Units) & Forecast, by Country and Sub-region, 2017-2031

Table 25: Middle East & Africa Space Grade Connectors Market Value (US$ Mn) & Forecast, by Product Type, 2017-2031

Table 26: Middle East & Africa Space Grade Connectors Market Volume (Thousand Units) & Forecast, by Product Type, 2017-2031

Table 27: Middle East & Africa Space Grade Connectors Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 28: Middle East & Africa Space Grade Connectors Market Value (US$ Mn) & Forecast, by End-use, 2017-2031

Table 29: Middle East & Africa Space Grade Connectors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 30: Middle East & Africa Space Grade Connectors Market Volume (Thousand Units) & Forecast, by Country and Sub-region, 2017-2031

Table 31: South America Space Grade Connectors Market Value (US$ Mn) & Forecast, by Product Type, 2017-2031

Table 32: South America Space Grade Connectors Market Volume (Thousand Units) & Forecast, by Product Type, 2017-2031

Table 33: South America Space Grade Connectors Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 34: South America Space Grade Connectors Market Value (US$ Mn) & Forecast, by End-use, 2017-2031

Table 35: South America Space Grade Connectors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 36: South America Space Grade Connectors Market Volume (Thousand Units) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global Space Grade Connectors Market

Figure 02: Porter Five Forces Analysis - Global Space Grade Connectors Market

Figure 03: Technology Road Map - Global Space Grade Connectors Market

Figure 04: Global Space Grade Connectors Market, Value (US$ Mn), 2017-2031

Figure 05: Global Space Grade Connectors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 06: Global Space Grade Connectors Market Projections, by Product Type, Value (US$ Mn), 2017-2031

Figure 07: Global Space Grade Connectors Market, Incremental Opportunity, by Product Type, 2023-2031

Figure 08: Global Space Grade Connectors Market Share Analysis, by Product Type, 2023 and 2031

Figure 09: Global Space Grade Connectors Market Projections, by Application, Value (US$ Mn), 2017-2031

Figure 10: Global Space Grade Connectors Market, Incremental Opportunity, by Application, 2023-2031

Figure 11: Global Space Grade Connectors Market Share Analysis, by Application, 2023 and 2031

Figure 12: Global Space Grade Connectors Market Projections, by End-use, Value (US$ Mn), 2017-2031

Figure 13: Global Space Grade Connectors Market, Incremental Opportunity, by End-use, 2023-2031

Figure 14: Global Space Grade Connectors Market Share Analysis, by End-use, 2023 and 2031

Figure 15: Global Space Grade Connectors Market Projections, by Region, Value (US$ Mn), 2017-2031

Figure 16: Global Space Grade Connectors Market, Incremental Opportunity, by Region, 2023-2031

Figure 17: Global Space Grade Connectors Market Share Analysis, by Region, 2023 and 2031

Figure 18: North America Space Grade Connectors Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 19: North America Space Grade Connectors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 20: North America Space Grade Connectors Market Projections, by Product Type Value (US$ Mn), 2017-2031

Figure 21: North America Space Grade Connectors Market, Incremental Opportunity, by Product Type, 2023-2031

Figure 22: North America Space Grade Connectors Market Share Analysis, by Product Type, 2023 and 2031

Figure 23: North America Space Grade Connectors Market Projections, by Application (US$ Mn), 2017-2031

Figure 24: North America Space Grade Connectors Market, Incremental Opportunity, by Application, 2023-2031

Figure 25: North America Space Grade Connectors Market Share Analysis, by Application, 2023 and 2031

Figure 26: North America Space Grade Connectors Market Projections, by End-use Value (US$ Mn), 2017-2031

Figure 27: North America Space Grade Connectors Market, Incremental Opportunity, by End-use, 2023-2031

Figure 28: North America Space Grade Connectors Market Share Analysis, by End-use, 2023 and 2031

Figure 29: North America Space Grade Connectors Market Projections, by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 30: North America Space Grade Connectors Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 31: North America Space Grade Connectors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 32: Europe Space Grade Connectors Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 33: Europe Space Grade Connectors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 34: Europe Space Grade Connectors Market Projections, by Product Type Value (US$ Mn), 2017-2031

Figure 35: Europe Space Grade Connectors Market, Incremental Opportunity, by Product Type, 2023-2031

Figure 36: Europe Space Grade Connectors Market Share Analysis, by Product Type, 2023 and 2031

Figure 37: Europe Space Grade Connectors Market Projections, by Application, Value (US$ Mn), 2017-2031

Figure 38: Europe Space Grade Connectors Market, Incremental Opportunity, by Application, 2023-2031

Figure 39: Europe Space Grade Connectors Market Share Analysis, by Application, 2023 and 2031

Figure 40: Europe Space Grade Connectors Market Projections, by End-use, Value (US$ Mn), 2017-2031

Figure 41: Europe Space Grade Connectors Market, Incremental Opportunity, by End-use, 2023-2031

Figure 42: Europe Space Grade Connectors Market Share Analysis, by End-use, 2023 and 2031

Figure 43: Europe Space Grade Connectors Market Projections, by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 44: Europe Space Grade Connectors Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 45: Europe Space Grade Connectors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 46: Asia Pacific Space Grade Connectors Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 47: Asia Pacific Space Grade Connectors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 48: Asia Pacific Space Grade Connectors Market Projections, by Product Type Value (US$ Mn), 2017-2031

Figure 49: Asia Pacific Space Grade Connectors Market, Incremental Opportunity, by Product Type, 2023-2031

Figure 50: Asia Pacific Space Grade Connectors Market Share Analysis, by Product Type, 2023 and 2031

Figure 51: Asia Pacific Space Grade Connectors Market Projections, by Application, Value (US$ Mn), 2017-2031

Figure 52: Asia Pacific Space Grade Connectors Market, Incremental Opportunity, by Application, 2023-2031

Figure 53: Asia Pacific Space Grade Connectors Market Share Analysis, by Application, 2023 and 2031

Figure 54: Asia Pacific Space Grade Connectors Market Projections, by End-use, Value (US$ Mn), 2017-2031

Figure 55: Asia Pacific Space Grade Connectors Market, Incremental Opportunity, by End-use, 2023-2031

Figure 56: Asia Pacific Space Grade Connectors Market Share Analysis, by End-use, 2023 and 2031

Figure 57: Asia Pacific Space Grade Connectors Market Projections, by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 58: Asia Pacific Space Grade Connectors Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 59: Asia Pacific Space Grade Connectors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 60: Middle East & Africa Space Grade Connectors Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 61: Middle East & Africa Space Grade Connectors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 62: Middle East & Africa Space Grade Connectors Market Projections, by Product Type Value (US$ Mn), 2017-2031

Figure 63: Middle East & Africa Space Grade Connectors Market, Incremental Opportunity, by Product Type, 2023-2031

Figure 64: Middle East & Africa Space Grade Connectors Market Share Analysis, by Product Type, 2023 and 2031

Figure 65: Middle East & Africa Space Grade Connectors Market Projections, by Application, Value (US$ Mn), 2017-2031

Figure 66: Middle East & Africa Space Grade Connectors Market, Incremental Opportunity, by Application, 2023-2031

Figure 67: Middle East & Africa Space Grade Connectors Market Share Analysis, by Application, 2023 and 2031

Figure 68: Middle East & Africa Space Grade Connectors Market Projections, by End-use Value (US$ Mn), 2017-2031

Figure 69: Middle East & Africa Space Grade Connectors Market, Incremental Opportunity, by End-use, 2023-2031

Figure 70: Middle East & Africa Space Grade Connectors Market Share Analysis, by End-use, 2023 and 2031

Figure 71: Middle East & Africa Space Grade Connectors Market Projections, by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 72: Middle East & Africa Space Grade Connectors Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 73: Middle East & Africa Space Grade Connectors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 74: South America Space Grade Connectors Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 75: South America Space Grade Connectors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 76: South America Space Grade Connectors Market Projections, by Product Type Value (US$ Mn), 2017-2031

Figure 77: South America Space Grade Connectors Market, Incremental Opportunity, by Product Type, 2023-2031

Figure 78: South America Space Grade Connectors Market Share Analysis, by Product Type, 2023 and 2031

Figure 79: South America Space Grade Connectors Market Projections, by Application, Value (US$ Mn), 2017-2031

Figure 80: South America Space Grade Connectors Market, Incremental Opportunity, by Application, 2023-2031

Figure 81: South America Space Grade Connectors Market Share Analysis, by Application, 2023 and 2031

Figure 82: South America Space Grade Connectors Market Projections, by End-use Value (US$ Mn), 2017-2031

Figure 83: South America Space Grade Connectors Market, Incremental Opportunity, by End-use, 2023-2031

Figure 84: South America Space Grade Connectors Market Share Analysis, by End-use, 2023 and 2031

Figure 85: South America Space Grade Connectors Market Projections, by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 86: South America Space Grade Connectors Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 87: South America Space Grade Connectors Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 88: Global Space Grade Connectors Market Competition

Figure 89: Global Space Grade Connectors Market Company Share Analysis