Analysts’ Viewpoint on Market Scenario

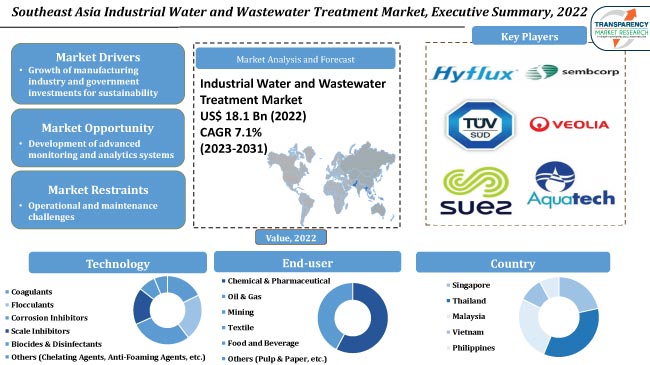

Rise in concerns related to water pollution generated through industrial activities is expected to fuel the Southeast Asia industrial water and wastewater treatment market size in the next few years. Industry players are increasingly prioritizing corporate social responsibility, especially activities related to sustainability. This is further expected to have a significant impact on the Southeast Asia industrial water and wastewater treatment market growth.

The expansion of infrastructure development projects in Southeast Asian countries owing to the fast paced economic growth is likely to surge the need for smart water treatment systems for industries. The increase in awareness of the ability to reuse and recycle water through water reuse and recycling solutions for industries is further expected to increase the Southeast Asia industrial water and wastewater treatment market share.

Industrial water and wastewater treatment comprises technologies and processes which are used for industrial wastewater management and compliance, and sustainable water treatment. Such treatments include contaminant elimination, industrial water purification, industrial water recycling, and advanced water filtration before the water is reused or discharged to water bodies such as rivers, lakes, or oceans.

Water and wastewater management systems are being utilized by a large number of sectors including oil & gas, mining, chemicals, and food & beverages. Rise in industrialization and increase in concerns related to the environment in countries of Southeast Asia underscores the importance of industrial water and wastewater treatments.

Expansion of manufacturing industries in Southeast Asian countries is anticipated to offer lucrative opportunities for Southeast Asia industrial water and wastewater treatment market development. For instance, as per the statistical information released by the World Bank, in 2021, the manufacturing value added (% of GDP) in Thailand was 27%, which was a rise from 26% of 2020.

Moreover, Southeast Asian countries are progressively investing in urban solutions and sustainability measures, including water treatment. These activities are expected to have a positive impact on market expansion. According to data released by GWF-wasser, in March 2022, the Government of Singapore invested US$ 220 Mn toward research innovation and Enterprise 2025 to propel its initiatives to improve its water technologies resource circulatory.

Governments in Southeast Asian countries are progressively aware and concerned about the environmental impact of wastewater. One of the key Southeast Asia industrial water and wastewater treatment market drivers is the implementation of strict rules and regulations related to how industrial wastewater has to be properly treated.

Manufacturers also are increasingly aware and emphasize more on industrial water and wastewater treatment. This is expected to reduce the operational cost. These initiatives are anticipated to have a positive impact on the Southeast Asia industrial water and wastewater treatment industry demand.

Based on end-user, the chemical & pharmaceutical segment is anticipated to hold major share in the industrial water and wastewater treatment market. Pharmaceutical industries produce large amounts of wastewater owing to poor biodegradability, high concentration, and the complexity of pharmaceutical operations, necessitating the effective treatment of pharmaceutical wastewater.

The toxic chemicals released by the chemical industry, if untreated, reaches natural water bodies and can create massive disturbance in the water’s organic balance. Thus, the importance of treating wastewater is expected to significantly boost market development.

According to the latest Southeast Asia industrial water and wastewater treatment market forecast, Thailand is anticipated to hold leading share from 2023 to 2031. Presence of numerous manufacturing plants which operate under strict environmental protection laws to reduce water pollution is a significant factor boosting market statistics in the country. Furthermore, the rise in number of industries is likely to favor market development in the country.

The market in Singapore, Indonesia, Vietnam, and Philippines is expected to grow at a steady pace in the forthcoming years, ascribed to the rise in number of industries in these countries progressively leaning toward the consideration of cost efficiency.

Detailed profiles of companies are provided in the Southeast Asia industrial water and wastewater treatment market report to evaluate their financials, key product offerings, recent developments, and strategies.

The business model of prominent manufacturers includes investments in R&D, product expansions, and mergers and acquisitions. Recent market trends underscore that product development is a major marketing strategy of key players.

The market is highly competitive with the presence of various global and regional players. HYFLUX LTD., Sembcorp Industries, TÜV SÜD, Veolia Water Technologies Pte Ltd, SUEZ, Aquatech International LLC., PUB, Taliworks Corporation Berhad, Manila Water Company Ltd, and Evoqua Water Technologies LLC are the major Southeast Asia industrial water and wastewater treatment companies.

Each of these players has been profiled in the Southeast Asia industrial water and wastewater treatment market report based on parameters such as business segments, company overview, latest developments, financial overview, product portfolio, and business strategies.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 18.1 Bn |

|

Market Forecast Value in 2031 |

US$ 33.2 Bn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross-segment analysis at the Southeast Asia as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 18.1 Bn in 2022

The CAGR is estimated to be CAGR 7.1% from 2023 to 2031

Growth of manufacturing industry, and government investments in sustainability measures

The chemical & pharmaceutical segment is expected to account for leading share in terms of end-user during the forecast period

Thailand is anticipated to hold a prominent share during the forecast period

HYFLUX LTD., Sembcorp Industries, TÜV SÜD, Veolia Water Technologies Pte Ltd, SUEZ, Aquatech International LLC., PUB, Taliworks Corporation Berhad, Manila Water Company Ltd, and Evoqua Water Technologies LLC.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Southeast Asia Industrial Water and Wastewater Treatment Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projections (US$ Mn)

6. Southeast Asia Industrial Water and Wastewater Treatment Market Analysis and Forecast, by Technology

6.1. Southeast Asia Industrial Water and Wastewater Treatment Market Size (US$ Mn), by Technology, 2017 - 2031

6.1.1. Coagulants

6.1.2. Flocculants

6.1.3. Corrosion Inhibitors

6.1.4. Scale Inhibitors

6.1.5. Biocides & Disinfectants

6.1.6. Others (Chelating Agents, Anti-Foaming Agents, etc.)

6.2. Incremental Opportunity, by Technology

7. Southeast Asia Industrial Water and Wastewater Treatment Market Analysis and Forecast, by End-user

7.1. Southeast Asia Industrial Water and Wastewater Treatment Market Size (US$ Mn), by End-user, 2017 - 2031

7.1.1. Chemical & Pharmaceutical

7.1.2. Oil & Gas

7.1.3. Mining

7.1.4. Textile

7.1.5. Food and Beverage

7.1.6. Others (Pulp & Paper, etc.)

7.2. Incremental Opportunity, by End-user

8. Singapore Industrial Water and Wastewater Treatment Market Analysis and Forecast

8.1. Country Snapshot

8.2. Key Supplier Analysis

8.3. Key Trends Analysis

8.3.1. Supply Side

8.3.2. Demand Side

8.4. Price Trend Analysis

8.4.1. Weighted Average Selling Price (US$)

8.5. Industrial Water and Wastewater Treatment Market Size (US$ Mn), by Technology, 2017 - 2031

8.5.1. Coagulants

8.5.2. Flocculants

8.5.3. Corrosion Inhibitors

8.5.4. Scale inhibitors

8.5.5. Biocides & Disinfectants

8.5.6. Others (Chelating Agents, Anti-Foaming Agents, etc.)

8.6. Industrial Water and Wastewater Treatment Market Size (US$ Mn), by End-user, 2017 - 2031

8.6.1. Chemical & Pharmaceutical

8.6.2. Oil & Gas

8.6.3. Mining

8.6.4. Textile

8.6.5. Food and Beverage

8.6.6. Others (Pulp & Paper, etc.)

9. Thailand Industrial Water and Wastewater Treatment Market Analysis and Forecast

9.1. Country Snapshot

9.2. Key Supplier Analysis

9.3. Key Trends Analysis

9.3.1. Supply Side

9.3.2. Demand Side

9.4. Price Trend Analysis

9.4.1. Weighted Average Selling Price (US$)

9.5. Industrial Water and Wastewater Treatment Market Size (US$ Mn), by Technology, 2017 - 2031

9.5.1. Coagulants

9.5.2. Flocculants

9.5.3. Corrosion Inhibitors

9.5.4. Scale inhibitors

9.5.5. Biocides & Disinfectants

9.5.6. Others (Chelating Agents, Anti-Foaming Agents, etc.)

9.6. Industrial Water and Wastewater Treatment Market Size (US$ Mn), by End-user, 2017 - 2031

9.6.1. Chemical & Pharmaceutical

9.6.2. Oil & Gas

9.6.3. Mining

9.6.4. Textile

9.6.5. Food and Beverage

9.6.6. Others (Pulp & Paper, etc.)

10. Malaysia Industrial Water and Wastewater Treatment Market Analysis and Forecast

10.1. Country Snapshot

10.2. Key Supplier Analysis

10.3. Key Trends Analysis

10.3.1. Supply Side

10.3.2. Demand Side

10.4. Price Trend Analysis

10.4.1. Weighted Average Selling Price (US$)

10.5. Industrial Water and Wastewater Treatment Market Size (US$ Mn), by Technology, 2017 - 2031

10.5.1. Coagulants

10.5.2. Flocculants

10.5.3. Corrosion Inhibitors

10.5.4. Scale Inhibitors

10.5.5. Biocides & Disinfectants

10.5.6. Others (Chelating Agents, Anti-Foaming Agents, etc.)

10.6. Industrial Water and Wastewater Treatment Market Size (US$ Mn), by End-user, 2017 - 2031

10.6.1. Chemical & Pharmaceutical

10.6.2. Oil & Gas

10.6.3. Mining

10.6.4. Textile

10.6.5. Food and Beverage

10.6.6. Others (Pulp & Paper, etc.)

11. Vietnam Industrial Water and Wastewater Treatment Market Analysis and Forecast

11.1. Country Snapshot

11.2. Key Supplier Analysis

11.3. Key Trends Analysis

11.3.1. Supply Side

11.3.2. Demand Side

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. Industrial Water and Wastewater Treatment Market Size (US$ Mn), by Technology, 2017 - 2031

11.5.1. Coagulants

11.5.2. Flocculants

11.5.3. Corrosion Inhibitors

11.5.4. Scale inhibitors

11.5.5. Biocides & Disinfectants

11.5.6. Others (Chelating Agents, Anti-Foaming Agents, etc.)

11.6. Industrial Water and Wastewater Treatment Market Size (US$ Mn), by End-user, 2017 - 2031

11.6.1. Chemical & Pharmaceutical

11.6.2. Oil & Gas

11.6.3. Mining

11.6.4. Textile

11.6.5. Food and Beverage

11.6.6. Others (Pulp & Paper, etc.)

12. Philippines Industrial Water and Wastewater Treatment Market Analysis and Forecast

12.1. Country Snapshot

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply Side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Industrial Water and Wastewater Treatment Market Size (US$ Mn), by Technology, 2017 - 2031

12.5.1. Coagulants

12.5.2. Flocculants

12.5.3. Corrosion Inhibitors

12.5.4. Scale inhibitors

12.5.5. Biocides & Disinfectants

12.5.6. Others (Chelating Agents, Anti-Foaming Agents, etc.)

12.6. Industrial Water and Wastewater Treatment Market Size (US$ Mn), by End-user, 2017 - 2031

12.6.1. Chemical & Pharmaceutical

12.6.2. Oil & Gas

12.6.3. Mining

12.6.4. Textile

12.6.5. Food and Beverage

12.6.6. Others (Pulp & Paper, etc.)

13. Competition Landscape

13.1. Competition Dashboard

13.2. Market Share Analysis % (2022)

13.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

13.3.1. HYFLUX LTD.

13.3.1.1. Company Overview

13.3.1.2. Product Portfolio

13.3.1.3. Financial Information, (Subject to Data Availability)

13.3.1.4. Business Strategies / Recent Developments

13.3.2. Sembcorp Industries

13.3.2.1. Company Overview

13.3.2.2. Product Portfolio

13.3.2.3. Financial Information, (Subject to Data Availability)

13.3.2.4. Business Strategies / Recent Developments

13.3.3. TÜV SÜD

13.3.3.1. Company Overview

13.3.3.2. Product Portfolio

13.3.3.3. Financial Information, (Subject to Data Availability)

13.3.3.4. Business Strategies / Recent Developments

13.3.4. Veolia Water Technologies Pte Ltd

13.3.4.1. Company Overview

13.3.4.2. Product Portfolio

13.3.4.3. Financial Information, (Subject to Data Availability)

13.3.4.4. Business Strategies / Recent Developments

13.3.5. SUEZ

13.3.5.1. Company Overview

13.3.5.2. Product Portfolio

13.3.5.3. Financial Information, (Subject to Data Availability)

13.3.5.4. Business Strategies / Recent Developments

13.3.6. Aquatech International LLC.

13.3.6.1. Company Overview

13.3.6.2. Product Portfolio

13.3.6.3. Financial Information, (Subject to Data Availability)

13.3.6.4. Business Strategies / Recent Developments

13.3.7. PUB

13.3.7.1. Company Overview

13.3.7.2. Product Portfolio

13.3.7.3. Financial Information, (Subject to Data Availability)

13.3.7.4. Business Strategies / Recent Developments

13.3.8. Taliworks Corporation Berhad

13.3.8.1. Company Overview

13.3.8.2. Product Portfolio

13.3.8.3. Financial Information, (Subject to Data Availability)

13.3.8.4. Business Strategies / Recent Developments

13.3.9. Manila Water Company Ltd

13.3.9.1. Company Overview

13.3.9.2. Product Portfolio

13.3.9.3. Financial Information, (Subject to Data Availability)

13.3.9.4. Business Strategies / Recent Developments

13.3.10. Evoqua Water Technologies LLC

13.3.10.1. Company Overview

13.3.10.2. Product Portfolio

13.3.10.3. Financial Information, (Subject to Data Availability)

13.3.10.4. Business Strategies / Recent Developments

14. Go To Market Strategy

14.1. Identification of Potential Market Spaces

14.2. Understanding the Buying Process of Customers

14.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Southeast Asia Industrial Water and Wastewater Treatment Market, By Technology, US$ Mn, 2017-2031

Table 2: Southeast Asia Industrial Water and Wastewater Treatment Market, By End-user, US$ Mn, 2017-2031

Table 3: Singapore Industrial Water and Wastewater Treatment Market, By Technology, US$ Mn, 2017-2031

Table 4: Singapore Industrial Water and Wastewater Treatment Market, By End-user, US$ Mn, 2017-2031

Table 5: Thailand Industrial Water and Wastewater Treatment Market, By Technology, US$ Mn, 2017-2031

Table 6: Thailand Industrial Water and Wastewater Treatment Market, By End-user, US$ Mn, 2017-2031

Table 7: Malaysia Industrial Water and Wastewater Treatment Market, By Technology, US$ Mn, 2017-2031

Table 8: Malaysia Industrial Water and Wastewater Treatment Market, By End-user, US$ Mn, 2017-2031

Table 9: Vietnam Industrial Water and Wastewater Treatment Market, By Technology, US$ Mn, 2017-2031

Table 10: Vietnam Industrial Water and Wastewater Treatment Market, By End-user, US$ Mn, 2017-2031

Table 11: Philippines Industrial Water and Wastewater Treatment Market, By Technology, US$ Mn, 2017-2031

Table 12: Philippines Industrial Water and Wastewater Treatment Market, By End-user, US$ Mn, 2017-2031

List of Figures

Figure 1: Southeast Asia Industrial Water and Wastewater Treatment Market, By Technology, Thousand Units, 2017-2031

Figure 2: Southeast Asia Industrial Water and Wastewater Treatment Market, By Technology, US$ Mn, 2017-2031

Figure 3: Southeast Asia Industrial Water and Wastewater Treatment Market Incremental Opportunity, By Technology, US$ Mn, 2017-2031

Figure 4: Southeast Asia Industrial Water and Wastewater Treatment Market, By End-user, Thousand Units, 2017-2031

Figure 5: Southeast Asia Industrial Water and Wastewater Treatment Market, By End-user, US$ Mn, 2017-2031

Figure 6: Southeast Asia Industrial Water and Wastewater Treatment Market Incremental Opportunity, By End-user, US$ Mn, 2017-2031

Figure 7: Singapore Industrial Water and Wastewater Treatment Market, By Technology, Thousand Units, 2017-2031

Figure 8: Singapore Industrial Water and Wastewater Treatment Market, By Technology, US$ Mn, 2017-2031

Figure 9: Singapore Industrial Water and Wastewater Treatment Market Incremental Opportunity, By Technology, US$ Mn, 2017-2031

Figure 10: Singapore Industrial Water and Wastewater Treatment Market, By End-user, Thousand Units, 2017-2031

Figure 11: Singapore Industrial Water and Wastewater Treatment Market, By End-user, US$ Mn, 2017-2031

Figure 12: Singapore Industrial Water and Wastewater Treatment Market Incremental Opportunity, By End-user, US$ Mn, 2017-2031

Figure 13: Thailand Industrial Water and Wastewater Treatment Market, By Technology, Thousand Units, 2017-2031

Figure 14: Thailand Industrial Water and Wastewater Treatment Market, By Technology, US$ Mn, 2017-2031

Figure 15: Thailand Industrial Water and Wastewater Treatment Market Incremental Opportunity, By Technology, US$ Mn, 2017-2031

Figure 16: Thailand Industrial Water and Wastewater Treatment Market, By End-user, Thousand Units, 2017-2031

Figure 17: Thailand Industrial Water and Wastewater Treatment Market, By End-user, US$ Mn, 2017-2031

Figure 18: Thailand Industrial Water and Wastewater Treatment Market Incremental Opportunity, By End-user, US$ Mn, 2017-2031

Figure 19: Malaysia Industrial Water and Wastewater Treatment Market, By Technology, Thousand Units, 2017-2031

Figure 20: Malaysia Industrial Water and Wastewater Treatment Market, By Technology, US$ Mn, 2017-2031

Figure 21: Malaysia Industrial Water and Wastewater Treatment Market Incremental Opportunity, By Technology, US$ Mn, 2017-2031

Figure 22: Malaysia Industrial Water and Wastewater Treatment Market, By End-user, Thousand Units, 2017-2031

Figure 23: Malaysia Industrial Water and Wastewater Treatment Market, By End-user, US$ Mn, 2017-2031

Figure 24: Malaysia Industrial Water and Wastewater Treatment Market Incremental Opportunity, By End-user, US$ Mn, 2017-2031

Figure 25: Vietnam Industrial Water and Wastewater Treatment Market, By Technology, Thousand Units, 2017-2031

Figure 26: Vietnam Industrial Water and Wastewater Treatment Market, By Technology, US$ Mn, 2017-2031

Figure 27: Vietnam Industrial Water and Wastewater Treatment Market Incremental Opportunity, By Technology, US$ Mn, 2017-2031

Figure 28: Vietnam Industrial Water and Wastewater Treatment Market, By End-user, Thousand Units, 2017-2031

Figure 29: Vietnam Industrial Water and Wastewater Treatment Market, By End-user, US$ Mn, 2017-2031

Figure 30: Vietnam Industrial Water and Wastewater Treatment Market Incremental Opportunity, By End-user, US$ Mn, 2017-2031

Figure 31: Philippines Industrial Water and Wastewater Treatment Market, By Technology, Thousand Units, 2017-2031

Figure 32: Philippines Industrial Water and Wastewater Treatment Market, By Technology, US$ Mn, 2017-2031

Figure 33: Philippines Industrial Water and Wastewater Treatment Market Incremental Opportunity, By Technology, US$ Mn, 2017-2031

Figure 34: Philippines Industrial Water and Wastewater Treatment Market, By End-user, Thousand Units, 2017-2031

Figure 35: Philippines Industrial Water and Wastewater Treatment Market, By End-user, US$ Mn, 2017-2031

Figure 36: Philippines Industrial Water and Wastewater Treatment Market Incremental Opportunity, By End-user, US$ Mn, 2017-2031