Analysts’ Viewpoint

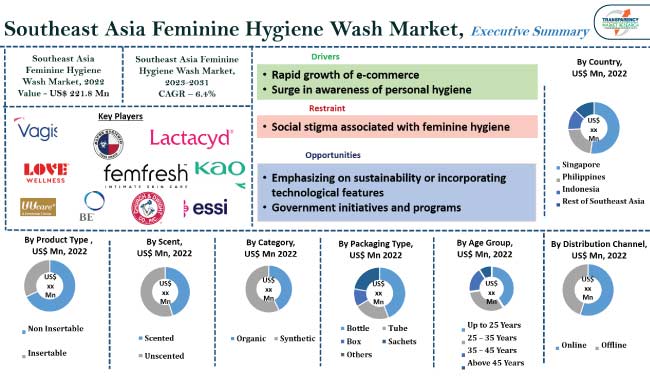

Rapid urbanization, growth in disposable incomes, and a surge in knowledge about women's health and hygiene are propelling the Southeast Asia feminine hygiene wash market growth. Urban women have access to a wider range of feminine hygiene products and are more inclined to prioritize their personal health and well-being, including menstrual hygiene.

The popularity of e-commerce is making it easier for customers to browse and buy a variety of feminine hygiene wash products. Growth in consumer demand for environment-friendly goods, along with increased understanding of the importance of menstrual health and hygiene, further fuels Southeast Asia feminine hygiene wash market progress. Expansion of e-commerce enables sellers to provide an assortment of feminine hygiene goods. Improvements in product design, and the launch of more comfortable and sustainable feminine hygiene products are also key market catalysts.

Personal care products used for menstruation, vaginal discharge, and other vulva and vaginal functions are referred to as feminine hygiene products. Period panties, pads, tampons, panty liners, menstrual cups, and menstrual sponges that are used during menstruation and referred to as menstrual hygiene products are the different types of feminine hygiene wash products available in the market.

Douches, feminine wipes, and soap that are intended to clean the vulva or vagina are also considered feminine hygiene items. Women in Southeast Asia use a range of intimate hygiene products as part of their regular hygiene practices. Many factors influence these practices, such as personal desire, societal conventions, religious beliefs, and medical professionals' advice.

Maintaining pH balance, pre- and post-intimacy care, and prevention of irritation and odor are the many associated advantages of feminine hygiene wash products.

The market for feminine hygiene products is expanding as a result of more women choosing to live in cities and middle-class consumers in developing nations such as Singapore and Indonesia having more money to spend. Increase in disposable incomes that come with urbanization frequently give women access to a broader selection of feminine hygiene products and more purchasing power. Surge in awareness and education about women's health and cleanliness are boosting the Southeast Asia feminine hygiene wash market value.

Changes in lifestyle and consumer behavior are associated with urbanization; women in urban regions are more likely to place a higher priority on their own health and well-being, which includes menstrual hygiene. Additionally, the increasing government attention to women's healthcare in both urban and rural regions, results in better efforts and policies pertaining to feminine hygiene. Southeast Asia feminine hygiene wash manufacturers are focused on enhancing their personal hygiene product offerings while abiding with the regulations and standards of the industry.

The increase in prevalence of e-commerce is simplifying the process for consumers to peruse and buy a variety of feminine hygiene goods, including online feminine hygiene wash products. There are now more opportunities for vendors to expand their businesses in Southeast Asia in terms of product availability and accessibility due to the ability to offer and sell these products online.

Furthermore, the swift adoption of the Internet in the region is enabling suppliers to offer a wide range of feminine hygiene products, including feminine hygiene wash products, and increase their customer base. Women's awareness of the significance of menstruation health and cleanliness is projected to raise demand for solutions that are sustainable and creative. Surge in consumer demand for sustainable and eco-friendly products, as more people buy feminine hygiene products online, and growth of e-commerce and online sales channels is anticipated to offer lucrative opportunities for Southeast Asia feminine hygiene wash market expansion.

According to the latest Southeast Asia feminine hygiene wash market forecast, Indonesia accounts for a major share in terms of both volume and value. Indonesia’s vast population ensures a sizable consumer base, which fuels demand for feminine hygiene products and increases its market share. Rapid urbanization and economic expansion have increased disposable income and enhanced access to feminine hygiene products in Indonesia.

Singapore is anticipated to experience considerable growth and account for significant Southeast Asia feminine hygiene wash market share. Increase in population of working women and health issues related to hygiene and odor is driving the demand for feminine hygiene products in Singapore. The market for feminine hygiene has expanded as a result of women's increased spending power and easy access to a variety of feminine hygiene products, which have been made possible by Singapore's robust economy and high disposable incomes. The market in Singapore has grown due to the surge in number of women moving to urban areas, where they are exposed to a variety of feminine hygiene products.

Detailed profiles of companies are provided in the Southeast Asia feminine hygiene wash market report to evaluate their financials, key product offerings, recent developments, and strategies. Most companies are spending significantly on comprehensive R&D activities, primarily to develop innovative products. Expansion of product portfolios, and mergers & acquisitions are the key strategies adopted by manufacturers in the industry. Companies are also following the latest Southeast Asia feminine hygiene wash industry trends to avail lucrative revenue opportunities.

Vagisil Singapore, Essity Aktiebolag (publ), Kao Corporation, UUcare Group Singapore PTE.LTD, BE International Marketing Sdn. Bhd., femfresh, Lactacyd.eu, Love Wellness, Church & Dwight Co., Inc., and Alpha Hygienic are the key entities operating in this Southeast Asia feminine hygiene wash market.

Each of these players has been profiled in the Southeast Asia feminine hygiene wash market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 221.8 Mn |

| Market Forecast Value in 2031 | US$ 385.4 Mn |

| Growth Rate (CAGR) | 6.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value and Million Units for Volume |

| Market Analysis | The Southeast Asia qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profile |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 221.8 Mn in 2022

It is expected to reach US$ 385.4 Mn by 2031

Rapid growth of e-commerce, and surge in awareness of personal hygiene

The non insertable segment contributed the highest share in 2022

Indonesia contributed about 34.2% in terms of share in 2022

Vagisil Singapore, Essity Aktiebolag (publ), Kao Corporation, UUcare Group Singapore PTE.LTD, BE International Marketing Sdn. Bhd., Femfresh, Lactacyd.eu, Love Wellness, Church & Dwight Co., Inc., and Alpha Hygienic

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.2.3. Trends Related to Important Body Parts for Women and Men

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Export Import Scenario

5.7.1. Registration Process

5.7.2. Necessary Documentation

5.7.3. Time Required

5.8. Standards & Regulations

5.9. Packaging Overview

5.9.1. Primary Packaging

5.9.2. Secondary Packaging

5.9.3. Insertion in the Packaging

5.10. Southeast Asia Feminine Hygiene Wash Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Million Units)

6. Southeast Asia Feminine Hygiene Wash Market Analysis and Forecast, By Product Type

6.1. Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

6.1.1. Non Insertable

6.1.1.1. Gel

6.1.1.2. Foam

6.1.1.3. Liquid

6.1.1.4. Others (Wipes, etc.)

6.1.2. Insertable

6.1.2.1. Vaginal Cleansing Injections

6.1.2.2. Vaginal Suppository

6.1.2.3. Others (Vaginal Douche, etc.)

6.2. Incremental Opportunity Analysis, By Product Type

7. Southeast Asia Feminine Hygiene Wash Market Analysis and Forecast, By Scent

7.1. Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Scent, 2017 - 2031

7.1.1. Scented

7.1.2. Unscented

7.2. Incremental Opportunity Analysis, By Scent

8. Southeast Asia Feminine Hygiene Wash Market Analysis and Forecast, By Category

8.1. Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Category, 2017 - 2031

8.1.1. Organic

8.1.2. Synthetic

8.2. Incremental Opportunity Analysis, By Category

9. Southeast Asia Feminine Hygiene Wash Market Analysis and Forecast, By Packaging Type

9.1. Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Packaging Type, 2017 - 2031

9.1.1. Bottle

9.1.2. Tube

9.1.3. Box

9.1.4. Sachets

9.1.5. Others (Wipes, etc.)

9.2. Incremental Opportunity Analysis, By Packaging Type

10. Southeast Asia Feminine Hygiene Wash Market Analysis and Forecast, By Age Group

10.1. Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Age Group, 2017 - 2031

10.1.1. Up to 25 Years

10.1.2. 25 – 35 Years

10.1.3. 35 – 45 Years

10.1.4. Above 45 Years

10.2. Incremental Opportunity Analysis, By Age Group

11. Southeast Asia Feminine Hygiene Wash Market Analysis and Forecast, by Distribution Channel

11.1. Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

11.1.1. Online

11.1.1.1. E-commerce Websites

11.1.1.2. Company-owned Websites

11.1.2. Offline

11.1.2.1. Supermarkets/Hypermarkets

11.1.2.2. Drug Stores

11.1.2.3. Other Retail Stores

11.2. Incremental Opportunity Analysis, by Distribution Channel

12. Southeast Asia Feminine Hygiene Wash Market Analysis and Forecast, by Country

12.1. Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Country, 2017 - 2031

12.1.1. Singapore

12.1.2. Philippines

12.1.3. Indonesia

12.1.4. Rest of Southeast Asia

12.2. Incremental Opportunity Analysis, by Country

13. Singapore Feminine Hygiene Wash Market Analysis and Forecast

13.1. Country Snapshot

13.2. Demographic Overview

13.3. Key Trend Analysis

13.4. Market Share Analysis (%)

13.5. Consumer Buying Behavior Analysis

13.5.1. Product Preference

13.5.2. Brand Preference

13.5.3. Price Preference

13.5.4. Mode of Buying

13.6. Pricing Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Singapore Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

13.7.1. Non Insertable

13.7.1.1. Gel

13.7.1.2. Foam

13.7.1.3. Liquid

13.7.1.4. Others (Wipes, etc.)

13.7.2. Insertable

13.7.2.1. Vaginal Cleansing Injections

13.7.2.2. Vaginal Suppository

13.7.2.3. Others (Vaginal Douche, etc.)

13.8. Singapore Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Scent, 2017 - 2031

13.8.1. Scented

13.8.2. Unscented

13.9. Singapore Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Category, 2017 - 2031

13.9.1. Organic

13.9.2. Synthetic

13.10. Singapore Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Packaging Type, 2017 - 2031

13.10.1. Bottle

13.10.2. Tube

13.10.3. Box

13.10.4. Sachets

13.10.5. Others (Wipes, etc.)

13.11. Singapore Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Age Group, 2017 - 2031

13.11.1. Up to 25 Years

13.11.2. 25 – 35 Years

13.11.3. 35 – 45 Years

13.11.4. Above 45 Years

13.12. Singapore Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

13.12.1. Online

13.12.1.1. E-commerce Websites

13.12.1.2. Company-owned Websites

13.12.2. Offline

13.12.2.1. Supermarkets/Hypermarkets

13.12.2.2. Drug Stores

13.12.2.3. Other Retail Stores

13.13. Incremental Opportunity Analysis

14. Philippines Feminine Hygiene Wash Market Analysis and Forecast

14.1. Country Snapshot

14.2. Demographic Overview

14.3. Key Trend Analysis

14.4. Market Share Analysis (%)

14.5. Consumer Buying Behavior Analysis

14.5.1. Product Preference

14.5.2. Brand Preference

14.5.3. Price Preference

14.5.4. Mode of Buying

14.6. Pricing Analysis

14.6.1. Weighted Average Selling Price (US$)

14.7. Philippines Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

14.7.1. Non Insertable

14.7.1.1. Gel

14.7.1.2. Foam

14.7.1.3. Liquid

14.7.1.4. Others (Wipes, etc.)

14.7.2. Insertable

14.7.2.1. Vaginal Cleansing Injections

14.7.2.2. Vaginal Suppository

14.7.2.3. Others (Vaginal Douche, etc.)

14.8. Philippines Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Scent, 2017 - 2031

14.8.1. Scented

14.8.2. Unscented

14.9. Philippines Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Category, 2017 - 2031

14.9.1. Organic

14.9.2. Synthetic

14.10. Philippines Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Packaging Type, 2017 - 2031

14.10.1. Bottle

14.10.2. Tube

14.10.3. Box

14.10.4. Sachets

14.10.5. Others (Wipes, etc.)

14.11. Philippines Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Age Group, 2017 - 2031

14.11.1. Up to 25 Years

14.11.2. 25 – 35 Years

14.11.3. 35 – 45 Years

14.11.4. Above 45 Years

14.12. Philippines Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

14.12.1. Online

14.12.1.1. E-commerce Websites

14.12.1.2. Company-owned Websites

14.12.2. Offline

14.12.2.1. Supermarkets/Hypermarkets

14.12.2.2. Drug Stores

14.12.2.3. Other Retail Stores

14.13. Incremental Opportunity Analysis

15. Indonesia Feminine Hygiene Wash Market Analysis and Forecast

15.1. Country Snapshot

15.2. Demographic Overview

15.3. Key Trend Analysis

15.4. Market Share Analysis (%)

15.5. Consumer Buying Behavior Analysis

15.5.1. Product Preference

15.5.2. Brand Preference

15.5.3. Price Preference

15.5.4. Mode of Buying

15.6. Pricing Analysis

15.6.1. Weighted Average Selling Price (US$)

15.7. Indonesia Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

15.7.1. Non Insertable

15.7.1.1. Gel

15.7.1.2. Foam

15.7.1.3. Liquid

15.7.1.4. Others (Wipes, etc.)

15.7.2. Insertable

15.7.2.1. Vaginal Cleansing Injections

15.7.2.2. Vaginal Suppository

15.7.2.3. Others (Vaginal Douche, etc.)

15.8. Indonesia Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Scent, 2017 - 2031

15.8.1. Scented

15.8.2. Unscented

15.9. Indonesia Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Category, 2017 - 2031

15.9.1. Organic

15.9.2. Synthetic

15.10. Indonesia Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Packaging Type, 2017 - 2031

15.10.1. Bottle

15.10.2. Tube

15.10.3. Box

15.10.4. Sachets

15.10.5. Others (Wipes, etc.)

15.11. Indonesia Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Age Group, 2017 - 2031

15.11.1. Up to 25 Years

15.11.2. 25 – 35 Years

15.11.3. 35 – 45 Years

15.11.4. Above 45 Years

15.12. Indonesia Feminine Hygiene Wash Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

15.12.1. Online

15.12.1.1. E-commerce Websites

15.12.1.2. Company-owned Websites

15.12.2. Offline

15.12.2.1. Supermarkets/Hypermarkets

15.12.2.2. Drug Stores

15.12.2.3. Other Retail Stores

15.13. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), 2022

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence,Revenue, Strategy & Business Overview)

16.3.1. Alpha Hygienic

16.3.1.1. Company Overview

16.3.1.2. Sales Area

16.3.1.3. Geographical Presence

16.3.1.4. Revenue

16.3.1.5. Strategy & Business Overview

16.3.2. BE International Marketing Sdn. Bhd.

16.3.2.1. Company Overview

16.3.2.2. Sales Area

16.3.2.3. Geographical Presence

16.3.2.4. Revenue

16.3.2.5. Strategy & Business Overview

16.3.3. Church & Dwight Co., Inc.

16.3.3.1. Company Overview

16.3.3.2. Sales Area

16.3.3.3. Geographical Presence

16.3.3.4. Revenue

16.3.3.5. Strategy & Business Overview

16.3.4. Essity Aktiebolag (publ)

16.3.4.1. Company Overview

16.3.4.2. Sales Area

16.3.4.3. Geographical Presence

16.3.4.4. Revenue

16.3.4.5. Strategy & Business Overview

16.3.5. Femfresh

16.3.5.1. Company Overview

16.3.5.2. Sales Area

16.3.5.3. Geographical Presence

16.3.5.4. Revenue

16.3.5.5. Strategy & Business Overview

16.3.6. Kao Corporation

16.3.6.1. Company Overview

16.3.6.2. Sales Area

16.3.6.3. Geographical Presence

16.3.6.4. Revenue

16.3.6.5. Strategy & Business Overview

16.3.7. Lactacyd.eu

16.3.7.1. Company Overview

16.3.7.2. Sales Area

16.3.7.3. Geographical Presence

16.3.7.4. Revenue

16.3.7.5. Strategy & Business Overview

16.3.8. Love Wellness

16.3.8.1. Company Overview

16.3.8.2. Sales Area

16.3.8.3. Geographical Presence

16.3.8.4. Revenue

16.3.8.5. Strategy & Business Overview

16.3.9. UUcare Group Singapore PTE.LTD

16.3.9.1. Company Overview

16.3.9.2. Sales Area

16.3.9.3. Geographical Presence

16.3.9.4. Revenue

16.3.9.5. Strategy & Business Overview

16.3.10. Vagisil Singapore

16.3.10.1. Company Overview

16.3.10.2. Sales Area

16.3.10.3. Geographical Presence

16.3.10.4. Revenue

16.3.10.5. Strategy & Business Overview

16.3.11. Other Key Players

16.3.11.1. Company Overview

16.3.11.2. Sales Area

16.3.11.3. Geographical Presence

16.3.11.4. Revenue

16.3.11.5. Strategy & Business Overview

17. Go To Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Understanding the Buying Process of Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Southeast Feminine Hygiene Wash Market Value, by Product Type US$ Mn, 2017-2031

Table 2 : Southeast Feminine Hygiene Wash Market Volume, by Product Type Million Units,2017-2031

Table 3: Southeast Feminine Hygiene Wash Market Value, by Scent Type US$ Mn, 2017-2031

Table 4: Southeast Feminine Hygiene Wash Market Volume, by Scent Type Million Units,2017-2031

Table 5: Southeast Feminine Hygiene Wash Market Value, by Category US$ Mn, 2017-2031

Table 6: Southeast Feminine Hygiene Wash Market Volume, by Category Million Units,2017-2031

Table 7: Southeast Feminine Hygiene Wash Market Value, by Packaging Type US$ Mn, 2017-2031

Table 8: Southeast Feminine Hygiene Wash Market Volume, by Packaging Type Million Units, 2017-2031

Table 9: Southeast Feminine Hygiene Wash Market Value, by Age Group US$ Mn, 2017-2031

Table 10: Southeast Feminine Hygiene Wash Market Volume, by Age Group Million Units, 2017-2031

Table 11: Southeast Feminine Hygiene Wash Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 12: Southeast Feminine Hygiene Wash Market Volume, by Distribution Channel, Million Units,2017-2031

Table 13: Southeast Feminine Hygiene Wash Market Value, by Country, US$ Mn, 2017-2031

Table 14: Southeast Feminine Hygiene Wash Market Volume, by Country, Million Units,2017-2031

Table 15: Singapore Feminine Hygiene Wash Market Value, by Product Type US$ Mn, 2017-2031

Table 16: Singapore Feminine Hygiene Wash Market Volume, by Product Type Million Units,2017-2031

Table 17: Singapore Feminine Hygiene Wash Market Value, by Scent Type US$ Mn, 2017-2031

Table 18: Singapore Feminine Hygiene Wash Market Volume, by Scent Type Million Units,2017-2031

Table 19: Singapore Feminine Hygiene Wash Market Value, by Category US$ Mn, 2017-2031

Table 20: Singapore Feminine Hygiene Wash Market Volume, by Category Million Units,2017-2031

Table 21: Singapore Feminine Hygiene Wash Market Value, by Packaging Type US$ Mn, 2017-2031

Table 22: Singapore Feminine Hygiene Wash Market Volume, by Packaging Type Million Units, 2017-2031

Table 23: Singapore Feminine Hygiene Wash Market Value, by Age Group US$ Mn, 2017-2031

Table 24: Singapore Feminine Hygiene Wash Market Volume, by Age Group Million Units, 2017-2031

Table 25: Singapore Feminine Hygiene Wash Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 26: Singapore Feminine Hygiene Wash Market Volume, by Distribution Channel, Million Units,2017-2031

Table 27: Philippines Feminine Hygiene Wash Market Value, by Product Type US$ Mn, 2017-2031

Table 28: Philippines Feminine Hygiene Wash Market Volume, by Product Type Million Units,2017-2031

Table 29: Philippines Feminine Hygiene Wash Market Value, by Scent Type US$ Mn, 2017-2031

Table 30: Philippines Feminine Hygiene Wash Market Volume, by Scent Type Million Units,2017-2031

Table 31: Philippines Feminine Hygiene Wash Market Value, by Category US$ Mn, 2017-2031

Table 32: Philippines Feminine Hygiene Wash Market Volume, by Category Million Units,2017-2031

Table 33: Philippines Feminine Hygiene Wash Market Value, by Packaging Type US$ Mn, 2017-2031

Table 34: Philippines Feminine Hygiene Wash Market Volume, by Packaging Type Million Units, 2017-2031

Table 35: Philippines Feminine Hygiene Wash Market Value, by Age Group US$ Mn, 2017-2031

Table 36: Philippines Feminine Hygiene Wash Market Volume, by Age Group Million Units, 2017-2031

Table 37: Philippines Feminine Hygiene Wash Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 38: Philippines Feminine Hygiene Wash Market Volume, by Distribution Channel, Million Units,2017-2031

Table 39: Indonesia Feminine Hygiene Wash Market Value, by Product Type US$ Mn, 2017-2031

Table 40: Indonesia Feminine Hygiene Wash Market Volume, by Product Type Million Units,2017-2031

Table 41: Indonesia Feminine Hygiene Wash Market Value, by Scent Type US$ Mn, 2017-2031

Table 42: Indonesia Feminine Hygiene Wash Market Volume, by Scent Type Million Units,2017-2031

Table 43: Indonesia Feminine Hygiene Wash Market Value, by Category US$ Mn, 2017-2031

Table 44: Indonesia Feminine Hygiene Wash Market Volume, by Category Million Units,2017-2031

Table 45: Indonesia Feminine Hygiene Wash Market Value, by Packaging Type US$ Mn, 2017-2031

Table 46: Indonesia Feminine Hygiene Wash Market Volume, by Packaging Type Million Units, 2017-2031

Table 47: Indonesia Feminine Hygiene Wash Market Value, by Age Group US$ Mn, 2017-2031

Table 48: Indonesia Feminine Hygiene Wash Market Volume, by Age Group Million Units, 2017-2031

Table 49: Indonesia Feminine Hygiene Wash Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 50: Indonesia Feminine Hygiene Wash Market Volume, by Distribution Channel, Million Units,2017-2031

List of Figures

Figure 1: Southeast Asia Feminine Hygiene Wash Market Value, by Product Type, US$ Mn, 2017-2031

Figure 2: Southeast Asia Feminine Hygiene Wash Market Volume, by Product Type, Million Units, 2017-2031

Figure 3: Southeast Asia Feminine Hygiene Wash Market Incremental Opportunity, by Product Type2023-2031

Figure 4: Southeast Asia Feminine Hygiene Wash Market Value, by Scent Type US$ Mn, 2017-2031

Figure 5: Southeast Asia Feminine Hygiene Wash Market Volume, by Scent Type, Million Units, 2017-2031

Figure 6: Southeast Asia Feminine Hygiene Wash Market Incremental Opportunity, by Scent Type 2023-2031

Figure 7: Southeast Asia Feminine Hygiene Wash Market Value, by Category, US$ Mn, 2017-2031

Figure 8: Southeast Asia Feminine Hygiene Wash Market Volume, by Category, Million Units, 2017-2031

Figure 9: Southeast Asia Feminine Hygiene Wash Market Incremental Opportunity, by Category, 2023-2031

Figure 10: Southeast Asia Feminine Hygiene Wash Market Value, by Packaging Type, US$ Mn, 2017-2031

Figure 11: Southeast Asia Feminine Hygiene Wash Market Volume, by Packaging Type, Million Units, 2017-2031

Figure 12: Southeast Asia Feminine Hygiene Wash Market Incremental Opportunity, by Packaging Type, 2023-2031

Figure 13: Southeast Asia Feminine Hygiene Wash Market Value, by Age Group, US$ Mn, 2017-2031

Figure 14: Southeast Asia Feminine Hygiene Wash Market Volume, by Age Group, Million Units, 2017-2031

Figure 15: Southeast Asia Feminine Hygiene Wash Market Incremental Opportunity, by Age Group, 2023-2031

Figure 16: Southeast Asia Feminine Hygiene Wash Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 17: Southeast Asia Feminine Hygiene Wash Market Volume, by Distribution Channel, Million Units, 2017-2031

Figure 18: Southeast Asia Feminine Hygiene Wash Market Incremental Opportunity, by Distribution Channel, 2023-2031

Figure 19: Southeast Asia Feminine Hygiene Wash Market Value, by Country, US$ Mn, 2017-2031

Figure 20: Southeast Asia Feminine Hygiene Wash Market Volume, by Country, Million Units, 2017-2031

Figure 21: Southeast Asia Feminine Hygiene Wash Market Incremental Opportunity, by Country,2023-2031

Figure 22: Singapore Feminine Hygiene Wash Market Value, by Product Type, US$ Mn, 2017-2031

Figure 23: Singapore Feminine Hygiene Wash Market Volume, by Product Type, Million Units, 2017-2031

Figure 24: Singapore Feminine Hygiene Wash Market Incremental Opportunity, by Product Type2023-2031

Figure 25: Singapore Feminine Hygiene Wash Market Value, by Scent Type US$ Mn, 2017-2031

Figure 26: Singapore Feminine Hygiene Wash Market Volume, by Scent Type Million Units, 2017-2031

Figure 27: Singapore Feminine Hygiene Wash Market Incremental Opportunity, by Scent Type 2023-2031

Figure 28: Singapore Feminine Hygiene Wash Market Value, by Category, US$ Mn, 2017-2031

Figure 29: Singapore Feminine Hygiene Wash Market Volume, by Category, Million Units, 2017-2031

Figure 30: Singapore Feminine Hygiene Wash Market Incremental Opportunity, by Category, 2023-2031

Figure 31: Singapore Feminine Hygiene Wash Market Value, by Packaging Type, US$ Mn, 2017-2031

Figure 32: Singapore Feminine Hygiene Wash Market Volume, by Packaging Type, Million Units, 2017-2031

Figure 33: Singapore Feminine Hygiene Wash Market Incremental Opportunity, by Packaging Type, 2023-2031

Figure 34: Singapore Feminine Hygiene Wash Market Value, by Age Group, US$ Mn, 2017-2031

Figure 35: Singapore Feminine Hygiene Wash Market Volume, by Age Group, Million Units, 2017-2031

Figure 36: Singapore Feminine Hygiene Wash Market Incremental Opportunity, by Age Group, 2023-2031

Figure 37: Singapore Feminine Hygiene Wash Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 38: Singapore Feminine Hygiene Wash Market Volume, by Distribution Channel, Million Units, 2017-2031

Figure 39: Singapore Feminine Hygiene Wash Market Incremental Opportunity, by Distribution Channel, 2023-2031

Figure 40: Philippines Feminine Hygiene Wash Market Value, by Product Type, US$ Mn, 2017-2031

Figure 41: Philippines Feminine Hygiene Wash Market Volume, by Product Type, Million Units, 2017-2031

Figure 42: Philippines Feminine Hygiene Wash Market Incremental Opportunity, by Product Type2023-2031

Figure 43: Philippines Feminine Hygiene Wash Market Value, by Scent Type US$ Mn, 2017-2031

Figure 44: Philippines Feminine Hygiene Wash Market Volume, by Scent Type Million Units, 2017-2031

Figure 45: Philippines Feminine Hygiene Wash Market Incremental Opportunity, by Scent Type 2023-2031

Figure 46: Philippines Feminine Hygiene Wash Market Value, by Category, US$ Mn, 2017-2031

Figure 47: Philippines Feminine Hygiene Wash Market Volume, by Category, Million Units, 2017-2031

Figure 48: Philippines Feminine Hygiene Wash Market Incremental Opportunity, by Category, 2023-2031

Figure 49: Philippines Feminine Hygiene Wash Market Value, by Packaging Type, US$ Mn, 2017-2031

Figure 50: Philippines Feminine Hygiene Wash Market Volume, by Packaging Type, Million Units, 2017-2031

Figure 51: Philippines Feminine Hygiene Wash Market Incremental Opportunity, by Packaging Type, 2023-2031

Figure 52: Philippines Feminine Hygiene Wash Market Value, by Age Group, US$ Mn, 2017-2031

Figure 53: Philippines Feminine Hygiene Wash Market Volume, by Age Group, Million Units, 2017-2031

Figure 54: Philippines Feminine Hygiene Wash Market Incremental Opportunity, by Age Group, 2023-2031

Figure 55: Philippines Feminine Hygiene Wash Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 56: Philippines Feminine Hygiene Wash Market Volume, by Distribution Channel, Million Units, 2017-2031

Figure 57: Philippines Feminine Hygiene Wash Market Incremental Opportunity, by Distribution Channel, 2023-2031

Figure 58: Indonesia Feminine Hygiene Wash Market Value, by Product Type, US$ Mn, 2017-2031

Figure 59: Indonesia Feminine Hygiene Wash Market Volume, by Product Type, Million Units, 2017-2031

Figure 60: Indonesia Feminine Hygiene Wash Market Incremental Opportunity, by Product Type2023-2031

Figure 61: Indonesia Feminine Hygiene Wash Market Value, by Scent Type US$ Mn, 2017-2031

Figure 62: Indonesia Feminine Hygiene Wash Market Volume, by Scent Type Million Units, 2017-2031

Figure 63: Indonesia Feminine Hygiene Wash Market Incremental Opportunity, by Scent Type 2023-2031

Figure 64: Indonesia Feminine Hygiene Wash Market Value, by Category, US$ Mn, 2017-2031

Figure 65: Indonesia Feminine Hygiene Wash Market Volume, by Category, Million Units, 2017-2031

Figure 66: Indonesia Feminine Hygiene Wash Market Incremental Opportunity, by Category, 2023-2031

Figure 67: Indonesia Feminine Hygiene Wash Market Value, by Packaging Type, US$ Mn, 2017-2031

Figure 68: Indonesia Feminine Hygiene Wash Market Volume, by Packaging Type, Million Units, 2017-2031

Figure 69: Indonesia Feminine Hygiene Wash Market Incremental Opportunity, by Packaging Type, 2023-2031

Figure 70: Indonesia Feminine Hygiene Wash Market Value, by Age Group, US$ Mn, 2017-2031

Figure 71: Indonesia Feminine Hygiene Wash Market Volume, by Age Group, Million Units, 2017-2031

Figure 72: Indonesia Feminine Hygiene Wash Market Incremental Opportunity, by Age Group, 2023-2031

Figure 73: Indonesia Feminine Hygiene Wash Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 74: Indonesia Feminine Hygiene Wash Market Volume, by Distribution Channel, Million Units, 2017-2031

Figure 75: Indonesia Feminine Hygiene Wash Market Incremental Opportunity, by Distribution Channel, 2023-2031