The intake of gas detection devices across a number of industries has significantly increased in countries across the South East Asia region in the past few years. The higher emphasis of companies on health and safety aspects of human resources working in areas that are highly vulnerable to hazardous reactions during manufacturing and industrial processes is fueling the rate of installation of a variety of safety measures. Of the variety of measures undertaken in this regards, installation of gas detection devices has emerged as one of the most essential safety measure in industries such as mining, petrochemical, marine, security, and government.

The demand for gas detection devices has also increased in South East Asian countries owing to the rising number and stringency of safety regulations and acts. Governments in countries such as Singapore and Malaysia have imposed stringent regulations with regards to occupational health and safety across industries. The increased need for facility downtime in South East Asian countries has also significantly boosted the demand for smoke detection devices in the past few years.

Transparency Market Research estimates that the demand will continue to be strong in the next few years as well. The market for gas detection devices in South East Asia is expected to exhibit a promising 9.2% CAGR from 2017 to 2025, rising from a valuation of US$155.6 mn in 2016 to US$337.6 mn by 2025.

In terms of the key areas of application, the report segments the South East Asia gas detection device market into mining, steel mill, petrochemical, construction, automobile, material, food and beverage making and processing, electronics, marine, utility services, government, security, medical, and environment detection. Applications across the materials segment have been examined for materials such as fiber, glass, rubber, and pulp.

Of these, the petrochemical segment contributed the dominant share in the revenue of the global market in 2017. The segment is expected to account for a significant 20.5% of the overall market in the said year. The petrochemical segment was followed by marine, utility services and mining segment. In 2017, the marine, utility, and mining segment collectively contributed nearly 39% of overall gas detection device market in South East Asia. In addition, the automobile and materials segments are expected to exhibit a healthy CAGR during the forecast period.

Singapore to Remain at Forefront of Growth

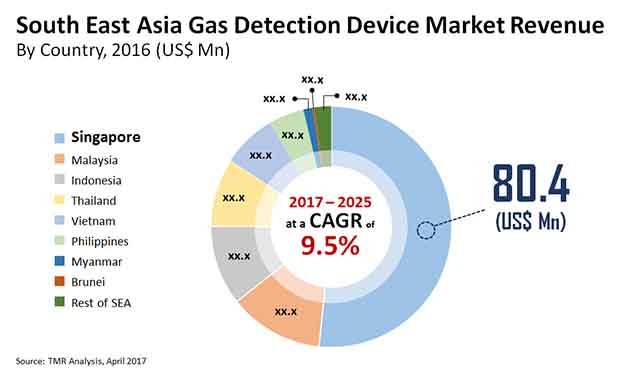

Of the key country-level markets for gas detection devices in South East Asia examined in the report, Singapore dominated, accounting for over 51% of the overall market in 2016. The strong growth of the Singapore market is primarily attributed to the thriving petrochemical and marine industries in the country. Large companies have established different manufacturing businesses in the country to exploit the vast growth opportunities offered when its economy was emerging. In the largely mature and developed economy in the present times, boasting well-established industrial and manufacturing segments, Singapore will continue to remain one of the key regional markets for gas detection devices over the forecast period.

The market in Malaysia is anticipated to exhibit a significant CAGR of 9.8% over the forecast period. In Malaysia, the detector segment is expected to contribute to the largest market share in 2017 and it is anticipated to expand at a healthy CAGR over the forecast period. Strong presence of oil refinery and crude oil industry is one of the primary reasons for the growth of gas detection devices market in Malaysia. Indonesia also shows positive growth opportunities over the forecast period. Rising investments and projects developed across oil and gas industry is expected to be one of the primary reasons for the growth of gas detection device market in Indonesia.

Some of the key players engaged in gas detection device market in South East Asia are Honeywell International, Inc., MSA Safety Incorporated, Drägerwerk AG & Co. KGaA, Industrial Scientific Corporation, Riken Keiki Co., Ltd., New Cosmos Electric Co., Ltd., and Gastron Co., Ltd.

Imposition of Stringent Security Laws Imposed by Government for Human Welfare to Propel Gas Detection Device Market

The rising worries about faculty and plant wellbeing are the key market drivers for the appropriation of gas detection frameworks. Moreover, wellbeing mindfulness is on the ascent among different end clients, because of the expanded number of lethal mishaps and gas blasts. Internationally, over the last couple of years, the reception of gas detection hardware has expanded all through, attributable to severe unofficial laws and security guidelines and natural wellbeing guidelines carried out across various applications and spillages.

Gas detection devices are the solitary way that working environments can distinguish gas breaks and likely dangers inside the working environment. Laborers are presented to conceivably dangerous gases that can make hurt their brains and bodies, or even outcome in their unfavorable passing if gas indicator devices are not utilized. Gas locator devices are basic to wellbeing as they can be utilized to identify unstable airs, oxygen lack, and poisonous gases that may have spilled into the air.

The gas detection framework incorporates items that utilization innovation to advance security and it is utilized ideally to secure laborers and to guarantee plant wellbeing. Gas detection frameworks are devoted to recognizing perilous gas fixations, setting off alerts, and initiating countermeasures, before the circumstance turn dangerous and place the representatives, resources, and climate in danger.

Consumption of oxygen is perilous to people, while even little convergences of hurtful harmful gases can prompt genuine wellbeing suggestions (even demise) for any staff entering a vacant region where such gases are available. The old advances, as handheld/individual locator screens, don't can distinguish the centralizations of flammable gases in abandoned regions that are unsafe to faculty, gear and the actual offices. Petroleum treatment facilities, pipelines, LPG/LNG plants, stockpiling ranches, and seaward stages, all use a wide scope of dangerous burnable and poisonous gases. The gas detection framework market has witnessed an increment in the quantity of consolidations and acquisitions (M&As), similar to development of products, to acquire an upper hand since the past few years. This pattern is probably going to proceed later on, subsequently solidifying market members.

South East Asia Gas Detection Device Market is expected to reach US$ 337.6 Mn by 2025

South East Asia Gas Detection Device Market is estimated to rise at a CAGR of 9.2% during forecast period

Rising number and stringency of safety regulations and acts is driving the growth of the South East Asia Gas Detection Device Market

Key players of South East Asia Gas Detection Device Market are Honeywell International, Inc., MSA Safety Incorporated, Drägerwerk AG & Co. KGaA, Industrial Scientific Corporation, Riken Keiki Co., Ltd., New Cosmos Electric Co., Ltd., and Gastron Co., Ltd

In 2016, the south east asia gas detection device market was valued at US$155.6 mn

Chapter 1 Preface

1.1 Market defination and Scope

1.2 Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

Chapter 2 Assumptions and Research methodology

Chapter 3 Executive Summary : South East Asia Gas Detection Device Market

Chapter 4 Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. South East Asia Gas Detection Device Market Analysis and Forecasts, 2015 – 2025

4.3.1. Market Revenue Projections (US$ Mn)

4.3.2. Market Volume Projections (Million Units)

4.3.3. Price Trend Analysis

4.4. Ecosystem Analysis

4.5. Porter’s Five Force Analysis

4.6. Market Outlook

Chapter 5 South East Asia Gas Detection Device Market Analysis and Forecasts, By Product Type

5.1. Overview & Definitions

5.2. Key Trends

5.3. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2015 – 2025

5.3.1. Fixed

5.3.2. Portable

5.4. Product Type Comparison Matrix

5.5. Market Attractiveness By Product Type

Chapter 6 South East Asia Gas Detection Device Market Analysis and Forecasts, By Device

6.1. Overview & Definitions

6.2. Key Trends

6.3. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Device, 2015 – 2025

6.3.1. Detector

6.3.2. Transmitter

6.3.3. Controller

6.4. Device Comparison Matrix

6.5. Market Attractiveness by Device

Chapter 7 South East Asia Gas Detection Device Market Analysis and Forecasts, By Application

7.1. Overview & Definition

7.2. Key Trends

7.3. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Application, 2015 – 2025

7.3.1. Mining

7.3.1.1. Coal

7.3.1.2. Others

7.3.2. Steel Mill

7.3.3. Petro Chemical

7.3.3.1. Crude Oil

7.3.3.2. Oil Refinery

7.3.4. Construction

7.3.4.1. Tunnel

7.3.4.2. Subway

7.3.4.3. Others

7.3.5. Automobile

7.3.6. Material

7.3.7. Food & Beverage Making & Processing

7.3.8. Electronics

7.3.8.1. Semiconductor

7.3.8.2. Consumer Electronics

7.3.9. Marine

7.3.9.1. Ship Builder

7.3.9.2. Ship Owner

7.3.9.3. Ship Chandler

7.3.10. Utility Service

7.3.10.1 Electricity

7.3.10.2. Water

7.3.10.3. Gas

7.3.10.4. Tele-communication

7.3.11. Government

7.3.11.1. Fire Fighting

7.3.11.2. Police

7.3.11.3. Military

7.3.11.4. Border Control

7.3.12. Security

7.3.12.1. Building

7.3.12.2. Others

7.3.13. Medical

7.3.13.1. Hospital & Clinic

7.3.13.2. Others

7.3.14. Environment Detection

7.3.14.1. Pollution

7.3.14.2. Others

7.4. Application Comparison Matrix

7.5. Market Attractiveness By Application

Chapter 8 South East Asia Gas Detection Device Market Analysis and Forecasts, By Country

8.1. Key Findings

8.2. Policies and Regulations

8.3. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Country, 2015 – 2025

8.3.1. Singapore

8.3.2. Malaysia

8.3.3. Indonesia

8.3.4. Thailand

8.3.5. Vietnam

8.3.6. Myanmar

8.3.7. Brunei

8.3.8. Philippines

8.3.9. Rest of South East Asia

8.4. Market Attractiveness By Country

Chapter 9 Singapore Gas Detection Device Market Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2015 – 2025

9.3.1. Fixed

9.3.2. Portable

9.4. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Device, 2015 – 2025

9.4.1. Detector

9.4.2. Transmitter

9.4.3. Controller

9.5. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Application, 2015 – 2025

9.5.1. Mining

9.5.1.1. Coal

9.5.1.2. Others

9.5.2. Steel Mill

9.5.3. Petro Chemical

9.5.3.1. Crude Oil

9.5.3.2. Oil Refinery

9.5.4. Construction

9.5.4.1. Tunnel

9.5.4.2. Subway

9.5.4.3. Others

9.5.5. Automobile

9.5.6. Material

9.5.7. Food & Beverage Making & Processing

9.5.8. Electronics

9.5.8.1. Semiconductor

9.5.8.2. Consumer Electronics

9.5.9. Marine

9.5.9.1. Ship Builder

9.5.9.2. Ship Owner

9.5.9.3. Ship Chandler

9.5.10. Utility Service

9.5.10.1. Electricity

9.5.10.2. Water

9.5.10.3. Gas

9.5.10.4. Tele-communication

9.5.11. Government

9.5.11.1. Fire Fighting

9.5.11.2. Police

9.5.11.3. Military

9.5.11.4. Border Control

9.5.12. Security

9.5.12.1. Building

9.5.12.2. Others

9.5.13. Medical

9.5.13.1. Hospital & Clinic

9.5.13.2. Others

9.5.14. Environment Detection

9.5.14.1. Pollution

9.5.14.2. Others

9.6. Market Attractiveness Analysis

9.6.1. By Product Type

9.6.2. By Device

9.6.3. By Application

Chapter 10 Malaysia Gas Detection Device Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2015 – 2025

10.3.1. Fixed

10.3.2. Portable

10.4. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Device, 2015 – 2025

10.4.1. Detector

10.4.2. Transmitter

10.4.3. Controller

10.5. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Application, 2015 – 2025

10.5.1. Mining

10.5.1.1. Coal

10.5.1.2. Others

10.5.2. Steel Mill

10.5.3. Petro Chemical

10.5.3.1. Crude Oil

10.5.3.2. Oil Refinery

10.5.4. Construction

10.5.4.1. Tunnel

10.5.4.2. Subway

10.5.4.3. Others

10.5.5. Automobile

10.5.6. Material

10.5.7. Food & Beverage Making & Processing

10.5.8. Electronics

10.5.8.1. Semiconductor

10.5.8.2. Consumer Electronics

10.5.9. Marine

10.5.9.1. Ship Builder

10.5.9.2. Ship Owner

10.5.9.3. Ship Chandler

10.5.10. Utility Service

10.5.10.1. Electricity

10.5.10.2. Water

10.5.10.3. Gas

10.5.10.4.Tele-communication

10.5.11. Government

10.5.11.1. Fire Fighting

10.5.11.2. Police

10.5.11.3. Military

10.5.11.4. Border Control

10.5.12. Security

10.5.12.1. Building

10.5.12.2. Others

10.5.13. Medical

10.5.13.1. Hospital & Clinic

10.5.13.2. Others

10.5.14. Environment Detection

10.5.14.1. Pollution

10.5.14.2. Others

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Device

10.6.3. By Application

Chapter 11 Indonesia Gas Detection Device Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2015 – 2025

11.3.1. Fixed

11.3.2. Portable

11.4. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Device, 2015 – 2025

11.4.1. Detector

11.4.2. Transmitter

11.4.3. Controller

11.5. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Application, 2015 – 2025

11.5.1. Mining

11.5.1.1. Coal

11.5.1.2. Others

11.5.2. Steel Mill

11.5.3. Petro Chemical

11.5.3.1. Crude Oil

11.5.3.2. Oil Refinery

11.5.4. Construction

11.5.4.1. Tunnel

11.5.4.2. Subway

11.5.4.3. Others

11.5.5. Automobile

11.5.6. Material

11.5.7. Food & Beverage Making & Processing

11.5.8. Electronics

11.5.8.1. Semiconductor

11.5.8.2. Consumer Electronics

11.5.9. Marine

11.5.9.1. Ship Builder

11.5.9.2. Ship Owner

11.5.9.3. Ship Chandler

11.5.10. Utility Service

11.5.10.1. Electricity

11.5.10.2. Water

11.5.10.3. Gas

11.5.10.4. Tele-communication

11.5.11. Government

11.5.11.1. Fire Fighting

11.5.11.2. Police

11.5.11.3. Military

11.5.11.4. Border Control

11.5.12. Security

11.5.12.1. Building

11.5.12.2. Others

11.5.13. Medical

11.5.13.1. Hospital & Clinic

11.5.13.2. others

11.5.14. Environment Detection

11.5.14.1. Pollution

11.5.14.2. Others

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Device

11.6.3. By Application

Chapter 12 Thailand Gas Detection Device Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2015 – 2025

12.3.1. Fixed

12.3.2. Portable

12.4. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Device, 2015 – 2025

12.4.1. Detector

12.4.2. Transmitter

12.4.3. Controller

12.5. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Application, 2015 – 2025

12.5.1. Mining

12.5.1.1. Coal

12.5.1.2. Others

12.5.2. Steel Mill

12.5.3. Petro Chemical

12.5.3.1. Crude Oil

12.5.3.2. Oil Refinery

12.5.4. Construction

12.5.4.1. Tunnel

12.5.4.2. Subway

12.5.4.3. Others

12.5.5. Automobile

12.5.6. Material

12.5.7. Food & Beverage Making & Processing

12.5.8. Electronics

12.5.8.1. Semiconductor

12.5.8.2. Consumer Electronics

12.5.9. Marine

12.5.9.1. Ship Builder

12.5.9.2. Ship Owner

12.5.9.3. Ship Chandler

12.5.10. Utility Service

12.5.10.1. Electricity

12.5.10.2. Water

12.5.10.3. Gas

12.5.10.4. Tele-communication

12.5.11. Government

12.5.11.1. Fire Fighting

12.5.11.2. Police

12.5.11.3. Military

12.5.11.4. Border Control

12.5.12. Security

12.5.12.1. Building

12.5.12.2. Others

12.5.13. Medical

12.5.13.1. Hospital & Clinic

12.5.13.2. Others

12.5.14. Environment Detection

12.5.14.1. Pollution

12.5.14.2. Others

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Device

12.6.3. By Application

Chapter 13 Vietnam Gas Detection Device Market Analysis and Forecast

13.1. Key Findings

13.2. Key Trends

13.3. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2015 – 2025

13.3.1. Fixed

13.3.2. Portable

13.4. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Device, 2015 – 2025

13.4.1. Detector

13.4.2. Transmitter

13.4.3. Controller

13.5. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Application, 2015 – 2025

13.5.1. Mining

13.5.1.1. Coal

13.5.1.2. Others

13.5.2. Steel Mill

13.5.3. Petro Chemical

13.5.3.1. Crude Oil

13.5.3.2. Oil Refinery

13.5.4. Construction

13.5.4.1. Tunnel

13.5.4.2. Subway

13.5.4.3. Others

13.5.5. Automobile

13.5.6. Material

13.5.7. Food & Beverage Making & Processing

13.5.8. Electronics

13.5.8.1. Semiconductor

13.5.8.2. Consumer Electronics

13.5.9. Marine

13.5.9.1. Ship Builder

13.5.9.2. Ship Owner

13.5.9.3. Ship Chandler

13.5.10. Utility Service

13.5.10.1. Electricity

13.5.10.2. Water

13.5.10.3. Gas

13.5.10.4. Tele-communication

13.5.11. Government

13.5.11.1. Fire Fighting

13.5.11.2. Police

13.5.11.3. Military

13.5.11.4. Border Control

13.5.12. Security

13.5.12.1. Building

13.5.12.2. Others

13.5.13. Medical

13.5.13.1. Hospital & Clinic

13.5.13.2. Others

13.5.14. Environment Detection

13.5.14.1. Pollution

13.5.14.2. Others

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Device

13.6.3. By Application

Chapter 14 Myanmar Gas Detection Device Market Analysis and Forecast

14.1. Key Findings

14.2. Key Trends

14.3. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2015 – 2025

14.3.1. Fixed

14.3.2. Portable

14.4. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Device, 2015 – 2025

14.4.1. Detector

14.4.2. Transmitter

14.4.3. Controller

14.5. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Application, 2015 – 2025

14.5.1. Mining

14.5.1.1. Coal

14.5.1.2. Others

14.5.2. Steel Mill

14.5.3. Petro Chemical

14.5.3.1. Crude Oil

14.5.3.2. Oil Refinery

14.5.4. Construction

14.5.4.1. Tunnel

14.5.4.2. Subway

14.5.4.3. Others

14.5.5. Automobile

14.5.6. Material

14.5.7. Food & Beverage Making & Processing

14.5.8. Electronics

14.5.8.1. Semiconductor

14.5.8.2. Consumer Electronics

14.5.9. Marine

14.5.9.1. Ship Builder

14.5.9.2. Ship Owner

14.5.9.3. Ship Chandler

14.5.10. Utility Service

14.5.10.1. Electricity

14.5.10.2. Water

14.5.10.3. Gas

14.5.10.4. Tele-communication

14.5.11. Government

14.5.11.1. Fire Fighting

14.5.11.2. Police

14.5.11.3. Military

14.5.11.4. Border Control

14.5.12. Security

14.5.12.1. Building

14.5.12.2. Others

14.5.13. Medical

14.5.13.1. Hospital & Clinic

14.5.13.2. Others

14.5.14. Environment Detection

14.5.14.1. Pollution

14.5.14.2. Others

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Device

14.6.3. By Application

Chapter 15 Brunei Gas Detection Device Market Analysis and Forecast

15.1. Key Findings

15.2. Key Trends

15.3. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2015 – 2025

15.3.1. Fixed

15.3.2. Portable

15.4. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Device, 2015 – 2025

15.4.1. Detector

15.4.2. Transmitter

15.4.3. Controller

15.5. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Application, 2015 – 2025

15.5.1. Mining

15.5.1.1. Coal

15.5.1.2. Others

15.5.2. Steel Mill

15.5.3. Petro Chemical

15.5.3.1. Crude Oil

15.5.3.2. Oil Refinery

15.5.4. Construction

15.5.4.1. Tunnel

15.5.4.2. Subway

15.5.4.3. Others

15.5.5. Automobile

15.5.6. Material

15.5.7. Food & Beverage Making & Processing

15.5.8. Electronics

15.5.8.1. Semiconductor

15.5.8.2. Consumer Electronics

15.5.9. Marine

15.5.9.1. Ship Builder

15.5.9.2. Ship Owner

15.5.9.3. Ship Chandler

15.5.10. Utility Service

15.5.10.1. Electricity

15.5.10.2. Water

15.5.10.3. Gas

15.5.10.4. Tele-communication

15.5.11. Government

15.5.11.1. Fire Fighting

15.5.11.2. Police

15.5.11.3. Military

15.5.11.4. Border Control

15.5.12. Security

15.5.12.1. Building

15.5.12.2. Others

15.5.13. Medical

15.5.13.1. Hospital & Clinic

15.5.13.2. Others

15.5.14. Environment Detection

15.5.14.1. Pollution

15.5.14.2. Others

15.6. Market Attractiveness Analysis

15.6.1. By Product Type

15.6.2. By Device

15.6.3. By Application

Chapter 16 Philippines Gas Detection Device Market Analysis and Forecast

16.1. Key Findings

16.2. Key Trends

16.3. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2015 – 2025

16.3.1. Fixed

16.3.2. Portable

16.4. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Device, 2015 – 2025

16.4.1. Detector

16.4.2. Transmitter

16.4.3. Controller

16.5. Gas Detection Device Market Size and Volume (US$ Mn and Million Units) Forecast By Application, 2015 – 2025

16.5.1. Mining

16.5.1.1. Coal

16.5.1.2. Others

16.5.2. Steel Mill

16.5.3. Petro Chemical

16.5.3.1. Crude Oil

16.5.3.2. Oil Refinery

16.5.4. Construction

16.5.4.1. Tunnel

16.5.4.2. Subway

16.5.4.3. Others

16.5.5. Automobile

16.5.6. Material

16.5.7. Food & Beverage Making & Processing

16.5.8. Electronics

16.5.8.1. Semiconductor

16.5.8.2. Consumer Electronics

16.5.9. Marine

16.5.9.1. Ship Builder

16.5.9.2. Ship Owner

16.5.9.3. Ship Chandler

16.5.10. Utility Service

16.5.10.1. Electricity

16.5.10.2. Water

16.5.10.3. Gas

16.5.10.4. Tele-communication

16.5.11. Government

16.5.11.1. Fire Fighting

16.5.11.2. Police

16.5.11.3. Military

16.5.11.4. Border Control

16.5.12. Security

16.5.12.1. Building

16.5.12.2. Others

16.5.13. Medical

16.5.13.1. Hospital & Clinic

16.5.13.2. Others

16.5.14. Environment Detection

16.5.14.1. Pollution

16.5.14.2. Others

16.6. Market Attractiveness Analysis

16.6.1. By Product Type

16.6.2. By Device

16.6.3. By Application

Chapter 17 Competition Landscape

(For the below mentioned companies)

17.1. Market Player – Competition Matrix

17.2. Country-wise Market Share Analysis of Companies (2016)

17.3. Company Profiles

17.3.1. Honeywell Analytics

17.3.1.1. Company Detail

17.3.1.2. Company Description

17.3.1.3. Financial Overview

17.3.1.4. SWOT Analysis

17.3.1.5. Strategic Overview

17.3.2. Mine Safety Appliances

17.3.2.1. Company Detail

17.3.2.2. Company Description

17.3.2.3. Financial Overview

17.3.2.4. SWOT Analysis

17.3.2.5. Strategic Overview

17.3.3. Drägerwerk AG & Co. KGaA

17.3.3.1. Company Detail

17.3.3.2. Company Description

17.3.3.3. Financial Overview

17.3.3.4. SWOT Analysis

17.3.3.5. Strategic Overview

17.3.4. Industrial Scientific Corporation

17.3.4.1. Company Detail

17.3.4.2. Company Description

17.3.4.3. Financial Overview

17.3.4.4. SWOT Analysis

17.3.4.5. Strategic Overview

17.3.5. Riken Keiki Co., Ltd.

17.3.5.1. Company Detail

17.3.5.2. Company Description

17.3.5.3. Financial Overview

17.3.5.4. SWOT Analysis

17.3.5.5. Strategic Overview

17.3.6. New Cosmos Electric Co., Ltd.

17.3.6.1. Company Detail

17.3.6.2. Company Description

17.3.6.3. Financial Overview

17.3.6.4. SWOT Analysis

17.3.6.5. Strategic Overview

17.3.7. Gastron Co., Ltd.

17.3.7.1. Company Detail

17.3.7.2. Company Description

17.3.7.3. Financial Overview

17.3.7.4. SWOT Analysis

17.3.7.5. Strategic Overview

Chapter 18 Key Takeaways

List of Tables

Table 01: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast, by Product Type, 2015 – 2025

Table 02: South East Asia Gas Detection Device Market Size (Thousand units) Forecast, by Product Type, 2015 – 2025

Table 03: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast, by Device, 2015 – 2025

Table 04: South East Asia Gas Detection Device Market Size (Thousand units) Forecast, by Device, 2015 – 2025

Table 05: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 06: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 07: South East Asia Gas Detection Device Market Size (Thousand units) Forecast, by Application, 2015 – 2025

Table 08: South East Asia Gas Detection Device Market Size (Thousand units) Forecast, by Application, 2015 – 2025

Table 09: South East Asia Gas Detection Device Market Analysis (Thousand Units), by Mining

Table 10: South East Asia Gas Detection Device Market Analysis (Thousand Units), by Petrochemical

Table 11: South East Asia Gas Detection Device Market Analysis (Thousand Units), by Construction

Table 12: South East Asia Gas Detection Device Market Analysis (Thousand Units), by Electronics

Table 13: South East Asia Gas Detection Device Market Analysis (Thousand Units), by Marine

Table 14: South East Asia Gas Detection Device Market Analysis (Thousand Units), by Utility Service

Table 15: South East Asia Gas Detection Device Market Analysis (Thousand Units), by Government

Table 16: South East Asia Gas Detection Device Market Analysis (Thousand Units), by Medical

Table 17: South East Asia Gas Detection Device Market Analysis (Thousand Units), by Environment Detection

Table 18: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast, by Country, 2015 – 2025

Table 19: South East Asia Gas Detection Device Market Size (Thousand Units) Forecast, by Country, 2015 – 2025

Table 20: Singapore Gas Detection Device Market Size (US$ Mn) Forecast, by Product Type, 2015 – 2025

Table 21: Singapore Gas Detection Device Market Size (Thousand Units) Forecast, by Product Type, 2015 – 2025

Table 22: Singapore Gas Detection Device Market Size (US$ Mn) Forecast, by Device, 2015 – 2025

Table 23: Singapore Gas Detection Device Market Size (Thousand units) Forecast, by Device, 2015 – 2025

Table 24: Singapore Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 25: Singapore Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 26: Singapore Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 27: Singapore Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 28: Singapore Gas Detection Device Market Analysis (Thousand Units), by Mining

Table 29: Singapore Gas Detection Device Market Analysis (Thousand Units), by Petrochemical

Table 30: Singapore Gas Detection Device Market Analysis (Thousand Units), by Construction

Table 31: Singapore Gas Detection Device Market Analysis (Thousand Units), by Electronics

Table 32: Singapore Gas Detection Device Market Analysis (Thousand Units), by Marine

Table 33: Singapore Gas Detection Device Market Analysis (Thousand Units), by Utility Service

Table 34: Singapore Gas Detection Device Market Analysis (Thousand Units), by Government

Table 35: Singapore Gas Detection Device Market Analysis (Thousand Units), by Medical

Table 36: Singapore Gas Detection Device Market Analysis (Thousand Units), by Environment Detection

Table 37: Malaysia Gas Detection Device Market Size (US$ Mn) Forecast, by Product Type, 2015 – 2025

Table 38: Malaysia Gas Detection Device Market Size (Thousand Units) Forecast, by Product Type, 2015 – 2025

Table 39: Malaysia Gas Detection Device Market Size (US$ Mn) Forecast, by Device, 2017 – 2025

Table 40: Malaysia Gas Detection Device Market Size (Thousand units) Forecast, by Device, 2015 – 2025

Table 41: Malaysia Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 42: Malaysia Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 43: Malaysia Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 44: Malaysia Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 45: Malaysia Gas Detection Device Market Analysis (Thousand Units), by Mining

Table 46: Malaysia Gas Detection Device Market Analysis (Thousand Units), by Petrochemical

Table 47: Malaysia Gas Detection Device Market Analysis (Thousand Units), by Construction

Table 48: Malaysia Gas Detection Device Market Analysis (Thousand Units), by Electronics

Table 49: Malaysia Gas Detection Device Market Analysis (Thousand Units), by Marine

Table 50: Malaysia Gas Detection Device Market Analysis (Thousand Units), by Utility Service

Table 51: Malaysia Gas Detection Device Market Analysis (Thousand Units), by Government

Table 52: Malaysia Gas Detection Device Market Analysis (Thousand Units), by Medical

Table 53: Malaysia Gas Detection Device Market Analysis (Thousand Units), by Environment Detection

Table 54: Indonesia Gas Detection Device Market Size (US$ Mn) Forecast, by Product Type, 2015 – 2025

Table 55: Indonesia Gas Detection Device Market Size (Thousand Units) Forecast, by Product Type, 2015 – 2025

Table 56: Indonesia Gas Detection Device Market Size (US$ Mn) Forecast, by Device, 2015 – 2025

Table 57: Indonesia Gas Detection Device Market Size (Thousand units) Forecast, by Device, 2015 – 2025

Table 58: Indonesia Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 59: Indonesia Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 60: Indonesia Gas Detection Device Market Size (Thousand units) Forecast, by Application, 2015 – 2025

Table 61: Indonesia Gas Detection Device Market Size (Thousand units) Forecast, by Application, 2015 – 2025

Table 62: Indonesia Gas Detection Device Market Analysis (Thousand Units), by Mining

Table 63: Indonesia Gas Detection Device Market Analysis (Thousand Units), by Petrochemical

Table 64: Indonesia Gas Detection Device Market Analysis (Thousand Units), by Construction

Table 65: Indonesia Gas Detection Device Market Analysis (Thousand Units), by Electronics

Table 66: Indonesia Gas Detection Device Market Analysis (Thousand Units), by Marine

Table 67: Indonesia Gas Detection Device Market Analysis (Thousand Units), by Utility Service

Table 68: Indonesia Gas Detection Device Market Analysis (Thousand Units), by Government

Table 69: Indonesia Gas Detection Device Market Analysis (Thousand Units), by Medical

Table 70: Indonesia Gas Detection Device Market Analysis (Thousand Units), by Environment Detection

Table 71: Thailand Gas Detection Device Market Size (US$ Mn) Forecast, by Product Type, 2015 – 2025

Table 72: Thailand Gas Detection Device Market Size (Thousand units) Forecast, by Product Type, 2015 – 2025

Table 73: Thailand Gas Detection Device Market Size (US$ Mn) Forecast, by Device, 2015 – 2025

Table 74: Thailand Gas Detection Device Market Size (Thousand units) Forecast, by Device, 2015 – 2025

Table 75: Thailand Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 76: Thailand Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 77: Thailand Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 78: Thailand Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 79: Thailand Gas Detection Device Market Analysis (Thousand Units), by Mining

Table 80: Thailand Gas Detection Device Market Analysis (Thousand Units), by Petrochemical

Table 81: Thailand Gas Detection Device Market Analysis (Thousand Units), by Construction

Table 82: Thailand Gas Detection Device Market Analysis (Thousand Units), by Electronics

Table 83: Thailand Gas Detection Device Market Analysis (Thousand Units), by Marine

Table 84: Thailand Gas Detection Device Market Analysis (Thousand Units), by Utility Service

Table 85: Thailand Gas Detection Device Market Analysis (Thousand Units), by Government

Table 86: Thailand Gas Detection Device Market Analysis (Thousand Units), by Medical

Table 87: Thailand Gas Detection Device Market Analysis (Thousand Units), by Environment Detection

Table 88: Vietnam Gas Detection Device Market Size (US$ Mn) Forecast, by Product Type, 2015 – 2025

Table 89: Vietnam Gas Detection Device Market Size (Thousand Units) Forecast, by Product Type, 2015 – 2025

Table 90: Vietnam Gas Detection Device Market Size (US$ Mn) Forecast, by Device, 2015 – 2025

Table 91: Vietnam Gas Detection Device Market Size (Thousand units) Forecast, by Device, 2015 – 2025

Table 92: Vietnam Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 93: Vietnam Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 94: Vietnam Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 95: Vietnam Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 96: Vietnam Gas Detection Device Market Analysis (Thousand Units), by Mining

Table 97: Vietnam Gas Detection Device Market Analysis (Thousand Units), by Petrochemical

Table 98: Vietnam Gas Detection Device Market Analysis (Thousand Units), by Construction

Table 99: Vietnam Gas Detection Device Market Analysis (Thousand Units), by Electronics

Table 100: Vietnam Gas Detection Device Market Analysis (Thousand Units), by Marine

Table 101: Vietnam Gas Detection Device Market Analysis (Thousand Units), by Utility Service

Table 102: Vietnam Gas Detection Device Market Analysis (Thousand Units), by Government

Table 103: Vietnam Gas Detection Device Market Analysis (Thousand Units), by Medical

Table 104: Vietnam Gas Detection Device Market Analysis (Thousand Units), by Environment Detection

Table 105: Myanmar Gas Detection Device Market Size (US$ Mn) Forecast, by Product Type, 2015– 2025

Table 106: Myanmar Gas Detection Device Market Size (Thousand Units) Forecast, by Product Type, 2015– 2025

Table 107: Myanmar Gas Detection Device Market Size (US$ Mn) Forecast, by Device, 2017 – 2025

Table 108: Myanmar Gas Detection Device Market Size (Thousand units) Forecast, by Device, 2015 – 2025

Table 109: Myanmar Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 110: Myanmar Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 111: Myanmar Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 112: Myanmar Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 113: Myanmar Gas Detection Device Market Analysis (Thousand Units), by Mining

Table 114: Myanmar Gas Detection Device Market Analysis (Thousand Units), by Petrochemical

Table 115: Myanmar Gas Detection Device Market Analysis (Thousand Units), by Construction

Table 116: Myanmar Gas Detection Device Market Analysis (Thousand Units), by Electronics

Table 117: Myanmar Gas Detection Device Market Analysis (Thousand Units), by Marine

Table 118: Myanmar Gas Detection Device Market Analysis (Thousand Units), by Utility Service

Table 119: Myanmar Gas Detection Device Market Analysis (Thousand Units), by Government

Table 120: Myanmar Gas Detection Device Market Analysis (Thousand Units), by Medical

Table 121: Myanmar Gas Detection Device Market Analysis (Thousand Units), by Environment Detection

Table 122: Brunei Gas Detection Device Market Size (US$ Mn) Forecast, by Product Type, 2015 – 2025

Table 123: Brunei Gas Detection Device Market Size (Thousand Units) Forecast, by Product Type, 2015 – 2025

Table 124: Brunei Gas Detection Device Market Size (US$ Mn) Forecast, by Device, 2017 – 2025

Table 125: Brunei Gas Detection Device Market Size (Thousand units) Forecast, by Device, 2015 – 2025

Table 126: Brunei Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 127: Brunei Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 128: Brunei Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 129: Brunei Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 130: Brunei Gas Detection Device Market Analysis (Thousand Units), by Mining

Table 131: Brunei Gas Detection Device Market Analysis (Thousand Units), by Petrochemical

Table 132: Brunei Gas Detection Device Market Analysis (Thousand Units), by Construction

Table 133: Brunei Gas Detection Device Market Analysis (Thousand Units), by Electronics

Table 134: Brunei Gas Detection Device Market Analysis (Thousand Units), by Marine

Table 135: Brunei Gas Detection Device Market Analysis (Thousand Units), by Utility Service

Table 136: Brunei Gas Detection Device Market Analysis (Thousand Units), by Government

Table 137: Brunei Gas Detection Device Market Analysis (Thousand Units), by Medical

Table 138: Brunei Gas Detection Device Market Analysis (Thousand Units), by Environment Detection

Table 139: Philippines Gas Detection Device Market Size (US$ Mn) Forecast, by Product Type, 2015 – 2025

Table 140: Philippines Gas Detection Device Market Size (Thousand Units) Forecast, by Product Type, 2015 – 2025

Table 141: Philippines Gas Detection Device Market Size (US$ Mn) Forecast, by Device, 2017 – 2025

Table 142: Philippines Gas Detection Device Market Size (Thousand units) Forecast, by Device, 2015 – 2025

Table 143: Philippines Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 144: Philippines Gas Detection Device Market Size (US$ Mn) Forecast, by Application, 2015 – 2025

Table 145: Philippines Gas Detection Device Market Size (Thousand Units) Forecast, by Application, 2015 – 2025

Table 146: Philippines Gas Detection Device Market Size (Thousand units) Forecast, by Application, 2015 – 2025

Table 147: South East Asia Gas Detection Device Market Analysis (Thousand Units), by Mining

Table 148: Philippines Gas Detection Device Market Analysis (Thousand Units), by Petrochemical

Table 149: Philippines Gas Detection Device Market Analysis (Thousand Units), by Construction

Table 150: Philippines Gas Detection Device Market Analysis (Thousand Units), by Electronics

Table 151: Philippines Gas Detection Device Market Analysis (Thousand Units), by Marine

Table 152: Philippines Gas Detection Device Market Analysis (Thousand Units), by Utility Service

Table 153: Philippines Gas Detection Device Market Analysis (Thousand Units), by Government

Table 154: Philippines Gas Detection Device Market Analysis (Thousand Units), by Medical

Table 155: Philippines Gas Detection Device Market Analysis (Thousand Units), by Environment Detection

List of Figures

Figure 01: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast, 2015 – 2025

Figure 02: South East Asia Gas Detection Device Market Y-o-Y Growth (Value %) Forecast, 2015 – 2025

Figure 03: South East Asia Gas Detection Device Market Size (Thousand Units) Forecast, 2015 – 2025

Figure 04: South East Asia Gas Detection Device Market Y-o-Y Growth (Value %) Forecast, 2015 – 2025

Figure 05: South East Asia Gas Detection Device Market Value Share, by Application (%), 2016

Figure 06: South East Asia Gas Detection Device Market Value Share, by Product Type (%), 2016

Figure 07: South East Asia Gas Detection Device Market Opportunity Growth Analysis (US$ Mn), 2015 – 2025

Figure 08: South East Asia Gas Detection Device Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 09: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Product Type, Fixed

Figure 10: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Product Type, Portable

Figure 11: South East Asia Gas Detection Device Market Attractiveness, by Product Type (2016)

Figure 12: South East Asia Gas Detection Device Market Value Share Analysis, by Device, 2017 and 2025

Figure 13: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Device, Detector

Figure 14: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Device, Transmitter

Figure 15: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Device, Controller

Figure 16: South East Asia Gas Detection Device Market Attractiveness, by Device (2017)

Figure 17: South East Asia Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 18: South East Asia Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 19: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Mining

Figure 20: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Petro Chemical

Figure 21: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Construction

Figure 22: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Electronics

Figure 23: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application, Marine

Figure 24: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Utility Services

Figure 25: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Government

Figure 26: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Medical

Figure 27: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Environment Detection

Figure 28: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Steel Mill

Figure 29: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Automobile

Figure 30: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Food & Beverage

Figure 31: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Material

Figure 32: South East Asia Gas Detection Device Market Size (US$ Mn) Forecast by Application – Security

Figure 33: South East Asia Gas Detection Device Market Attractiveness, by Application (2016)

Figure 34: South East Asia Gas Detection Device Market Value Share Analysis, by Country, 2017 and 2025

Figure 35: South East Asia Gas Detection Device Market Attractiveness Analysis, by Region (2016)

Figure 36: Singapore Gas Detection Device Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 37: Singapore Gas Detection Device Market Value Share Analysis, by Device, 2017 and 2025

Figure 38: Singapore Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 39: Singapore Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 40: Singapore Gas Detection Device Market Share (Value %) by Application, Mining

Figure 41: Singapore Gas Detection Device Market Share (Value %) by Application, Petro Chemical

Figure 42: Singapore Gas Detection Device Market Share (Value %) by Application, Construction

Figure 43: Singapore Gas Detection Device Market Share (Value %) by Application, Electronics

Figure 44: Singapore Gas Detection Device Market Share (Value %) by Application, Marine

Figure 45: Singapore Gas Detection Device Market Share (Value %) by Application, Utility Services

Figure 46: Singapore Gas Detection Device Market Share (Value %) by Application, Government

Figure 47: Singapore Gas Detection Device Market Share (Value %) by Application, Medical

Figure 48: Singapore Gas Detection Device Market Share (Value %) by Application, Environment Detection

Figure 49: Singapore Gas Detection Device Market Attractiveness, by Application (2016)

Figure 50: Singapore Gas Detection Device Market Attractiveness, by Device (2016)

Figure 51: Singapore Gas Detection Device Market Attractiveness, by Product Type (2016)

Figure 52: Malaysia Gas Detection Device Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 53: Malaysia Gas Detection Device Market Value Share Analysis, by Device, 2017 and 2025

Figure 54: Malaysia Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 55: Malaysia Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 56: Malaysia Gas Detection Device Market Share (Value %) by Application, Mining

Figure 57: Malaysia Gas Detection Device Market Share (Value %) by Application, Petro Chemical

Figure 58: Malaysia Gas Detection Device Market Share (Value %) by Application, Construction

Figure 59: Malaysia Gas Detection Device Market Share (Value %) by Application, Electronics

Figure 60: Malaysia Gas Detection Device Market Share (Value %) by Application, Marine

Figure 61: Malaysia Gas Detection Device Market Share (Value %) by Application, Utility Services

Figure 62: Malaysia Gas Detection Device Market Share (Value %) by Application, Government

Figure 63: Malaysia Gas Detection Device Market Share (Value %) by Application, Medical

Figure 64: Malaysia Gas Detection Device Market Share (Value %) by Application, Environment Detection

Figure 65: Malaysia Gas Detection Device Market Attractiveness, by Application (2016)

Figure 66: Malaysia Gas Detection Device Market Attractiveness, by Device (2016)

Figure 67: Malaysia Gas Detection Device Market Attractiveness, by Product Type (2016)

Figure 68: Indonesia Gas Detection Device Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 69: Indonesia Gas Detection Device Market Value Share Analysis, by Device, 2017 and 2025

Figure 70: Indonesia Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 71: Indonesia Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 72: Indonesia Gas Detection Device Market Share (Value %), by Application – Mining

Figure 73: Indonesia Gas Detection Device Market Share (Value %), by Application – Petro Chemical

Figure 74: Indonesia Gas Detection Device Market Share (Value %) by Application – Construction

Figure 75: Indonesia Gas Detection Device Market Share (Value %) by Application – Electronics

Figure 76: Indonesia Gas Detection Device Market Share (Value %) by Application – Marine

Figure 77: Indonesia Gas Detection Device Market Share (Value %) by Application - Utility Services

Figure 78: Indonesia Gas Detection Device Market Share (Value %) by Application – Government

Figure 79: Indonesia Gas Detection Device Market Share (Value %) by Application – Medical

Figure 80: Indonesia Gas Detection Device Market Share (Value %) by Application – Environment Detection

Figure 81: Indonesia Gas Detection Device Market Attractiveness, by Application (2016)

Figure 82: Indonesia Gas Detection Device Market Attractiveness, by Device (2016)

Figure 83: Indonesia Gas Detection Device Market Attractiveness, by Product Type (2016)

Figure 84: Thailand Gas Detection Device Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 85: Thailand Gas Detection Device Market Value Share Analysis, by Device, 2017 and 2025

Figure 86: Thailand Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 87: Thailand Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 88: Thailand Gas Detection Device Market Share (Value %) by Application, Mining

Figure 89: Thailand Gas Detection Device Market Share (Value %) by Application, Petro Chemical

Figure 90: Thailand Gas Detection Device Market Share (Value %) by Application, Construction

Figure 91: Thailand Gas Detection Device Market Share (Value %) by Application, Electronics

Figure 92: Thailand Gas Detection Device Market Share (Value %) by Application, Marine

Figure 93: Thailand Gas Detection Device Market Share (Value %) by Application, Utility Services

Figure 94: Thailand Gas Detection Device Market Share (Value %) by Application, Government

Figure 95: Thailand Gas Detection Device Market Share (Value %) by Application, Medical

Figure 96: Thailand Gas Detection Device Market Share (Value %) by Application, Environment Detection

Figure 97: Thailand Gas Detection Device Market Attractiveness, by Application (2016)

Figure 98: Thailand Gas Detection Device Market Attractiveness, by Device (2016)

Figure 99: Thailand Gas Detection Device Market Attractiveness, by Product Type (2016)

Figure 100: Vietnam Gas Detection Device Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 101: Vietnam Gas Detection Device Market Value Share Analysis, by Device, 2017 and 2025

Figure 102: Vietnam Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 103: Vietnam Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 104: Vietnam Gas Detection Device Market Share (Value %) by Application – Mining

Figure 105: Vietnam Gas Detection Device Market Share (Value %) by Application – Petro Chemical

Figure 106: Vietnam Gas Detection Device Market Share (Value %) by Application – Construction

Figure 107: Vietnam Gas Detection Device Market Share (Value %) by Application – Electronics

Figure 108: Vietnam Gas Detection Device Market Share (Value %) by Application – Marine

Figure 109: Vietnam Gas Detection Device Market Share (Value %) by Application – Utility Services

Figure 110: Vietnam Gas Detection Device Market Share (Value %) by Application – Government

Figure 111: Vietnam Gas Detection Device Market Share (Value %) by Application – Medical

Figure 112: Vietnam Gas Detection Device Market Share (Value %) by Application – Environment Detection

Figure 113: Vietnam Gas Detection Device Market Attractiveness, by Application (2016)

Figure 114: Vietnam Gas Detection Device Market Attractiveness, by Device (2016)

Figure 115: Vietnam Gas Detection Device Market Attractiveness, by Product Type (2016)

Figure 116: Myanmar Gas Detection Device Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 117: Myanmar Gas Detection Device Market Value Share Analysis, by Device, 2017 and 2025

Figure 118: Myanmar Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 119: Myanmar Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 120: Myanmar Gas Detection Device Market Share (Value %) by Application, Mining

Figure 121: Myanmar Gas Detection Device Market Share (Value %) by Application, Petro Chemical

Figure 122: Myanmar Gas Detection Device Market Share (Value %) by Application, Construction

Figure 123: Myanmar Gas Detection Device Market Share (Value %) by Application, Electronics

Figure 124: Myanmar Gas Detection Device Market Share (Value %) by Application, Marine

Figure 125: Myanmar Gas Detection Device Market Share (Value %) by Application, Utility Services

Figure 126: Myanmar Gas Detection Device Market Share (Value %) by Application, Government

Figure 127: Myanmar Gas Detection Device Market Share (Value %) by Application, Medical

Figure 128: Myanmar Gas Detection Device Market Share (Value %) by Application, Environment Detection

Figure 129: Myanmar Gas Detection Device Market Attractiveness, by Application (2016)

Figure 130: Myanmar Gas Detection Device Market Attractiveness, by Device (2016)

Figure 131: Myanmar Gas Detection Device Market Attractiveness, by Product Type (2016)

Figure 132: Brunei Gas Detection Device Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 133: Brunei Gas Detection Device Market Value Share Analysis, by Device, 2017 and 2025

Figure 134: Brunei Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 135: Brunei Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 136: Brunei Gas Detection Device Market Share, by Application – Mining

Figure 137: Brunei Gas Detection Device Market Share, by Application – Petro Chemical

Figure 138: Brunei Gas Detection Device Market Share, by Application – Construction

Figure 139: Brunei Gas Detection Device Market Share, by Application – Electronics

Figure 140: Brunei Gas Detection Device Market Share, by Application – Marine

Figure 141: Brunei Gas Detection Device Market Share, by Application – Utility Services

Figure 142: Brunei Gas Detection Device Market Share, by Application – Government

Figure 143: Brunei Gas Detection Device Market Share, by Application – Medical

Figure 144: Brunei Gas Detection Device Market Share, by Application – Environment Detection

Figure 145: Brunei Gas Detection Device Market Attractiveness, by Application (2016)

Figure 146: Brunei Gas Detection Device Market Attractiveness, by Device (2016)

Figure 147: Brunei Gas Detection Device Market Attractiveness, by Product Type (2016)

Figure 148: Philippines Gas Detection Device Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 149: Philippines Gas Detection Device Market Value Share Analysis, by Device, 2017 and 2025

Figure 150: Philippines Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 151: Philippines Gas Detection Device Market Value Share Analysis, by Application, 2017 and 2025

Figure 152: Philippines Gas Detection Device Market Share, by Application, Mining

Figure 153: Philippines Gas Detection Device Market Share, by Application, Petro Chemical

Figure 154: Philippines Gas Detection Device Market Share, by Application, Construction

Figure 155: Philippines Gas Detection Device Market Share, by Application, Electronics

Figure 156: Philippines Gas Detection Device Market Share, by Application, Marine

Figure 157: Philippines Gas Detection Device Market Share, by Application, Utility Services

Figure 158: Philippines Gas Detection Device Market Share, by Application, Government

Figure 159: Philippines Gas Detection Device Market Share, by Application, Medical

Figure 160: Philippines Gas Detection Device Market Share, by Application, Environment Detection

Figure 161: Philippines Gas Detection Device Market Attractiveness, by Application (2016)

Figure 162: Attractiveness Philippines Gas Detection Device Market, by Device (2016)

Figure 163: Philippines Gas Detection Device Market Attractiveness, by Product Type (2016)

Figure 164: South East Asia Gas Detection Device Market Share Analysis by Company (2016)

Figure 165: Singapore Gas Detection Device Market Share Analysis by Company (2016)

Figure 166: Malaysia Gas Detection Device Market Share Analysis by Company (2016)

Figure 167: Indonesia Gas Detection Device Market Share Analysis by Company (2016)

Figure 168: Thailand Gas Detection Device Market Share Analysis by Company (2016)

Figure 169: Vietnam Gas Detection Device Market Share Analysis by Company (2016)

Figure 170: Myanmar Gas Detection Device Market Share Analysis by Company (2016)

Figure 171: Brunei Gas Detection Device Market Share Analysis by Company (2016)

Figure 172: Philippines Gas Detection Device Market Share Analysis by Company (2016)