Analysts’ Viewpoint on Solvent-based Inks Market Scenario

Solvent-based inks have traditionally been used in ink formulations for numerous real-life applications due to their exceptional print quality, image durability, and compatibility with a wide range of substrates. The role of solvent in a solvent-based ink is to deliver the functional material to the surface of a substrate. The solvent in the solvent-based inks is normally driven off by either passive drying or an active drying mechanism. Most solvent-based inks dry rapidly, as they are involved in the process of printing on items that have little or no absorbency, and the printing process is usually very fast. Several conventional inks on the market are petroleum-based and they also use alcohol solvents. Volatile organic compounds (VOCs) are emitted when the alcohol and petroleum in these inks evaporate during the drying process, which react with nitrogen oxides in the presence of sunlight to create ozone pollution or photochemical smog. Adopting green printing practices is a highly responsible move for any business, which brings with it a host of additional benefits that organizations can use to their advantage.

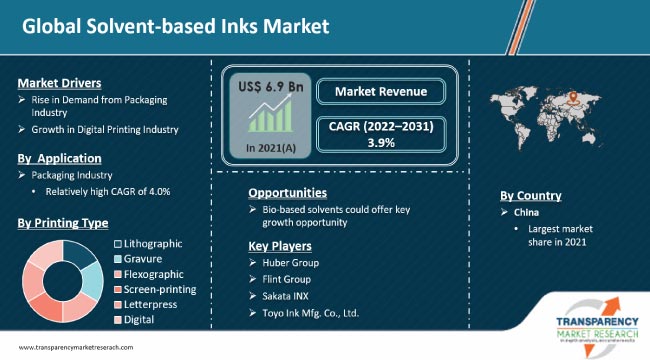

Solvent-based inks are inks that contain a solvent as the base constituent, to which pigments are added. Solvent-based inks can be used on various pigments and substrates. These inks offer long-lasting and durable prints that are resistant to scratching and rubbing, thus making them indispensable to be used on packages. Solvent-based inks are mostly preferred in gravure and flexographic printing because they dry comparatively faster. The global solvent-based inks market is projected to grow at decent growth rate due its extensive usage in printing applications.

The packaging industry has been an important sector driving technology and innovation growth globally for the last few years. It has also been adding value to various manufacturing sectors including agriculture and FMCG. Asia Pacific is expected to be the fastest growing market for the packaging industry due to the anticipated increase in demand for consumer goods in the region in the near future.

Flexographic printing and gravure printing are primarily used for printing on flexible material. Expansion of the food and beverage industry along with the increased demand for flexible packaging in the healthcare industry is expected to boost the demand for solvent-based inks during the forecast period.

Digital printing is used in textiles, advertising, fine arts, photos, architectural designs, and desktop publishing. It is preferred over traditional printing due to the flexibility and speed offered in all the applications mentioned above. Therefore, growth in the digital printing industry at a significant rate, globally, is expected to fuel the solvent-based inks market.

Several conventional inks on the market are petroleum-based and also use alcohol solvents, along with some pigments used in the inks containing heavy metallic substances, such as cadmium, lead, and mercury, which are not only harmful to the environment but also to human health. These inks are typically refined from crude oil, which is not only a valuable finite resource but whose energy requirements for extraction, refining, and treatment are incredibly high.

Increasing environmental restrictions in developed economies across Europe and North America is boosting the need for VOC (volatile organic compound)-free inks for printing. Solvent-based inks emit VOCs, which need to be controlled.

The packaged material being used in food and consumer packaging applications is directly concerned with end-customers, thus stringent environmental regulations are associated with these printing inks. Therefore, environmental regulations imposed on printing inks are a key factor restraining the solvent-based inks market.

Traditional inks mostly use petroleum-based solvents that emit volatile organic compounds while drying, and are harmful to the environment. Bio-based solvents provide an ideal solvent alternative to these inks. Bio-based solvents primarily include naturally available materials instead of petroleum-based materials as solvents.

Inks produced from bio-based solvents, or cellulose inks, are currently gaining importance owing to several environmental issues associated with petroleum-based solvent inks. Additionally, several environmental-based regulations are expected to negatively impact the demand for petroleum-based solvent inks. The market for bio-based printing inks is expected to expand in the near future, as they do not contain any hazardous chemicals.

Key players operating in the printing ink market such as Sun Chemical, Toyo Ink Group, and Huber Group are developing inks based on natural raw materials such as soy-oil as solvent. Presently, bio-based printing inks based on rice bran oil, sugars, dextrin, and polysaccharides are being tested for printing abilities.

Continued experimentation on the usage of soy in printing ink as a solvent has led to substantial progress in bio-based printing inks. Moreover, inks manufactured using soy oil enable ink pigments to penetrate the substrates completely, thereby showing better vibrancy in colors on printing. This is one of the emerging trends of the solvent-based inks market, as they are extremely environment friendly. Analysis of the solvent-based inks market outlook reveals that the solvent-based ink market is expected to witness a radical change in the next decade.

In terms of printing type, the solvent based inks market has been divided into lithographic, gravure, flexographic, screen printing, letterpress, and digital printing.

In terms of value, the lithographic printing segment held 36% share of the solvent-based inks market. Lithography is extensively utilized for printing books, catalogs and posters, because of its high-quality results and fast turnaround time. Lithographic printing is also used for printing on packaging and tags & labels. The flexographic printing segment of the solvent-based inks market is also expanding, primarily due to growth in the flexible packaging industry across the globe.

In terms of product type, the solvent-based inks market has been classified into vinyl inks, vinyl acrylic inks, epoxy inks, polyurethanic inks, and cellulosic inks.

The vinyl inks segment held a major share of 29.0% of the solvent-based inks market in 2021. Vinyl inks are typically used to print on paper, cardboard, and PVC among others types of substrates. These inks are ideal for applications on graphic printing of advertising, POP and display, stickers, labels, trucks tarpaulins, and decorations on woodware. Epoxy inks are widely used for printing on substrates such as glass, metal, difficult printing synthetic resins (pre-treated polyethylene and polypropylene), bakelite, and melamine among others.

Based on application, the global solvent-based inks market has been split into packaging, books & catalogue, advertising, tags & labels, office stationery, magazines, newspaper and others. Packaging was the largest application segment of the solvent-based inks market and held 37.9% share in 2021. Solvent-based inks used on packaged goods provide long-lasting print. Types of packaging, such as flexible packaging and narrow web and label segments, majorly contribute to the growth of the market. An in-depth demand analysis of solvent-based inks market reveals significantly high demand for solvent-based inks in the advertising sector due to rise in promotional and commercial advertising activities globally.

Asia Pacific is expected to remain the most attractive region for the solvent-based inks market. In terms of value, Asia Pacific held 41.9% share of the solvent-based inks market in 2021. The region is home to more than half the global population and emerging markets, which has prompted global players to increase their focus on Asia Pacific. In 2019, Sakata Inx planned to invest US$ 10 Mn in a new factory in Bangladesh.

Europe and North America are mature markets for solvent-based inks owing to environmental regulations enacted in these regions, as solvent-based inks contain high content of volatile organic compounds (VOC) that pose a systematic and development risk. In terms of value, Europe and North America are also prominent markets for solvent-based inks, and the regions held 25.2% and 24.9% share, respectively, of the global solvent-based inks market in 2021. The market in Europe and North America is expected to grow at CAGR of 4.1 % and 3.3%, respectively, during the forecast period. In case of Latin America, increase in ad spending, personalization, outdoor advertising, and packaging offers considerable growth opportunities for the solvent-based inks market.

The global solvent-based inks market comprises several small and large-scale manufacturers and suppliers who are controlling a majority of the market share. A majority of firms are adopting strategies that include comprehensive research and development activities and process optimization. Expansion of product portfolios and mergers and acquisitions are notable strategies adopted by key players. Huber Group, Siegwerk Druckfarben AG & Co. KGaA, Sakata INX, Toyo Ink Mfg. Co., Ltd., Flint Group and Sun Chemical Group are the prominent entities operating in the market.

Key players have been profiled in the solvent-based inks market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 6.9 Bn |

|

Market Forecast Value in 2031 |

US$ 10.2 Bn |

|

Growth Rate (CAGR) |

3.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value and Kilo Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at Europe as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood at US$ 6.9 Bn in 2021.

The market is expected to grow at a CAGR of 3.9% from 2022 to 2031.

Rise in demand from the packaging industry and growth in the digital printing industry.

Packaging was the largest application segment that held 37.9% share in 2021.

Asia Pacific was the most lucrative region of the solvent-based ink market in 2021.

Huber Group, Siegwerk Druckfarben AG & Co. KGaA, Sakata INX, Toyo Ink Mfg. Co., Ltd., Flint Group, and Sun Chemical Group.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.4.1. Market Dynamics

2.4.2. Drivers

2.4.3. Restraints

2.4.4. Opportunities

2.5. Global Solvent-based Inks Market Analysis and Forecasts, 2020-2031

2.5.1. Global Solvent-based Inks Market Volume (Kilo Tons)

2.5.2. Global Solvent-based Inks Market Revenue (US$ Mn)

2.6. Porter’s Five Forces Analysis

2.7. Regulatory Landscape

2.8. Value Chain Analysis

2.8.1. List of Raw Material Providers

2.8.2. List of Manufacturers

2.8.3. List of Dealers/Distributors

2.8.4. List of Potential Customers

2.9. Production Overview

2.10. Product Specification Analysis

2.11. Cost Structure Analysis

3. COVID-19 Impact Analysis

4. Global Solvent-based Inks Market Analysis and Forecast, by Printing Type, 2020–2031

4.1. Key Findings

4.2. Global Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

4.2.1. Lithographic

4.2.2. Gravure

4.2.3. Flexographic

4.2.4. Screen-printing

4.2.5. Letterpress

4.2.6. Digital

4.3. Global Solvent-based Inks Market Attractiveness, by Printing Type

5. Global Solvent-based Inks Market Analysis and Forecast, by Product Type, 2020–2031

5.1. Key Findings

5.2. Global Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

5.2.1. Vinyl Inks

5.2.2. Vinyl-Acrylic Inks

5.2.3. Epoxy Inks

5.2.4. Polyurethanic Inks

5.2.5. Cellulose Inks

5.3. Global Solvent-based Inks Market Attractiveness, by Product Type

6. Global Solvent-based Inks Market Analysis and Forecast, by Application, 2020–2031

6.1. Key Findings

6.2. Global Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

6.2.1. Packaging

6.2.2. Books & Catalogue

6.2.3. Advertising

6.2.4. Tags & Labels

6.2.5. Office Stationery

6.2.6. Magazines

6.2.7. News Paper

6.2.8. Others

6.3. Global Solvent-based Inks Market Attractiveness, by Application

7. Global Solvent-based Inks Market Analysis and Forecast, by Region, 2020–2031

7.1. Key Findings

7.2. Global Solvent-based Inks Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Global Solvent-based Inks Market Attractiveness, by Region

8. North America Solvent-based Inks Market Analysis and Forecast, 2020–2031

8.1. Key Findings

8.2. North America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

8.3. North America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

8.4. North America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.5. North America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

8.5.1. U.S. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

8.5.2. U.S. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

8.5.3. U.S. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.5.4. Canada Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

8.5.5. Canada Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

8.5.6. Canada Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.6. North America Solvent-based Inks Market Attractiveness Analysis

9. Europe Solvent-based Inks Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

9.3. Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

9.4. Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5. Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

9.5.1. Germany Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

9.5.2. Germany Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

9.5.3. Germany Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5.4. France Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

9.5.5. France Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

9.5.6. France Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5.7. U.K. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

9.5.8. U.K. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

9.5.9. U.K. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5.10. Italy Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

9.5.11. Italy. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

9.5.12. Italy Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5.13. Russia & CIS Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

9.5.14. Russia & CIS Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

9.5.15. Russia & CIS Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5.16. Rest of Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

9.5.17. Rest of Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

9.5.18. Rest of Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.6. Europe Solvent-based Inks Market Attractiveness Analysis

10. Asia Pacific Solvent-based Inks Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020-2031

10.3. Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.4. Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5. Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

10.5.1. China Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

10.5.2. China Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.5.3. China Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.4. Japan Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

10.5.5. Japan Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.5.6. Japan Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.7. India Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

10.5.8. India Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.5.9. India Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.10. ASEAN Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

10.5.11. ASEAN Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.5.12. ASEAN Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.13. Rest of Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

10.5.14. Rest of Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.5.15. Rest of Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.6. Asia Pacific Solvent-based Inks Market Attractiveness Analysis

11. Latin America Solvent-based Inks Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

11.3. Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4. Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5. Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

11.5.1. Brazil Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

11.5.2. Brazil Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.5.3. Brazil Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.4. Mexico Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

11.5.5. Mexico Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.5.6. Mexico Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.7. Rest of Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

11.5.8. Rest of Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.5.9. Rest of Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.6. Latin America Solvent-based Inks Market Attractiveness Analysis

12. Middle East & Africa Solvent-based Inks Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

12.3. Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.4. Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5. Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

12.5.1. GCC Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

12.5.2. GCC Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.5.3. GCC Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.4. South Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

12.5.5. South Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.5.6. South Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.7. Rest of Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

12.5.8. Rest of Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.5.9. Rest of Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.6. Middle East & Africa Solvent-based Inks Market Attractiveness Analysis

13. Global Solvent-based Inks Company Market Share Analysis, 2021

13.1. Competition Matrix

13.2. Market Footprint Analysis

13.2.1. By Printing Type

13.2.2. By Product Type

13.2.3. By Application

13.3. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

13.3.1. Tokyo Printing Ink Mfg. Co., Ltd.

13.3.1.1. Company Description

13.3.1.2. Business Overview

13.3.1.3. Financial Details

13.3.1.4. Strategic Overview

13.3.2. Dainichiseika Color & Chemicals Mfg. Co., Ltd.

13.3.2.1. Company Description

13.3.2.2. Business Overview

13.3.2.3. Financial Details

13.3.2.4. Strategic Overview

13.3.3. Sun Chemical Corporation

13.3.3.1. Company Description

13.3.3.2. Business Overview

13.3.3.3. Financial Details

13.3.3.4. Strategic Overview

13.3.4. Flint Group

13.3.4.1. Company Description

13.3.4.2. Business Overview

13.3.4.3. Financial Details

13.3.4.4. Strategic Overview

13.3.5. Toyo Ink SC Holdings Co., Ltd.

13.3.5.1. Company Description

13.3.5.2. Business Overview

13.3.5.3. Financial Details

13.3.5.4. Strategic Overview

13.3.6. Lawter Inc.

13.3.6.1. Company Description

13.3.6.2. Business Overview

13.3.6.3. Financial Details

13.3.6.4. Strategic Overview

13.3.7. Yansefu Inks and Coatings Pvt. Ltd.

13.3.7.1. Company Description

13.3.7.2. Business Overview

13.3.7.3. Financial Details

13.3.7.4. Strategic Overview

13.3.8. Sakata INX Corporation

13.3.8.1. Company Description

13.3.8.2. Business Overview

13.3.8.3. Financial Details

13.3.8.4. Strategic Overview

13.3.9. Huber Group

13.3.9.1. Company Description

13.3.9.2. Business Overview

13.3.9.3. Financial Details

13.3.9.4. Strategic Overview

13.3.10. Zeller+Gmelin GmbH & Co. KG

13.3.10.1. Company Description

13.3.10.2. Business Overview

13.3.10.3. Financial Details

13.3.10.4. Strategic Overview

13.3.11. ALTANA AG

13.3.11.1. Company Description

13.3.11.2. Business Overview

13.3.11.3. Financial Details

13.3.11.4. Strategic Overview

13.3.12. Wikoff Color Corporation

13.3.12.1. Company Description

13.3.12.2. Business Overview

13.3.12.3. Financial Details

13.3.12.4. Strategic Overview

14. Primary Research: Key Insights

15. Appendix

List of Tables

Table 1: Global Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 2: Global Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 3: Global Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 4: Global Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

Table 5: North America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 6: North America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 7: North America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 8: North America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

Table 9: U.S. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 10: U.S. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 11: U.S. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 12: Canada Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 13: Canada Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 14: Canada Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 15: Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 16: Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 17: Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 18: Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 19: Germany Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 20: Germany Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 21: Germany Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 22: France Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 23: France Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 24: France Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 25: U.K. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 26: U.K. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 27: U.K. Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 28: Italy Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 29: Italy Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 30: Italy Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: Spain Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 32: Spain Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 33: Spain Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 34: Russia & CIS Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 35: Russia & CIS Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 36: Russia & CIS Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 37: Rest of Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 38: Rest of Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 39: Rest of Europe Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 40: Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 41: Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 42: Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 44: China Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type 2020–2031

Table 45: China Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 46: China Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 47: Japan Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 48: Japan Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 49: Japan Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 50: India Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 51: India Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 52: India Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 54: ASEAN Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 55: ASEAN Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 56: ASEAN Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 57: Rest of Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 58: Rest of Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 59: Rest of Asia Pacific Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 60: Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 61: Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 62: Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 63: Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 64: Brazil Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 65: Brazil Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 66: Brazil Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 67: Mexico Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 68: Mexico Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 69: Mexico Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 70: Rest of Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 71: Rest of Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 72: Rest of Latin America Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 73: Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 74: Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 75: Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 76: Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 77: GCC Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 78: GCC Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 79: GCC Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 80: South Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 81: South Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 82: South Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 83: Rest of Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Type, 2020–2031

Table 84: Rest of Middle East & Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 85: Rest of Middle East and Africa Solvent-based Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

List of figures

Figure 1: Global Solvent-based Inks Market Attractiveness, by Printing Type

Figure 2: Global Solvent-based Inks Market Attractiveness, by Product Type

Figure 3: Global Solvent-based Inks Market Attractiveness, by Application

Figure 4: Global Solvent-based Inks Market Attractiveness, by Region

Figure 5: North America Solvent-based Inks Market Attractiveness, by Printing Type

Figure 6: North America Solvent-based Inks Market Attractiveness, by Product Type

Figure 7: North America Solvent-based Inks Market Attractiveness, by Application

Figure 8: North America Solvent-based Inks Market Attractiveness, by Country

Figure 9: Europe Solvent-based Inks Market Attractiveness, by Printing Type

Figure 10: Europe Solvent-based Inks Market Attractiveness, by Product Type

Figure 11: Europe Solvent-based Inks Market Attractiveness, by Application

Figure 12: Europe Solvent-based Inks Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Solvent-based Inks Market Attractiveness, by Printing Type

Figure 14: Asia Pacific Solvent-based Inks Market Attractiveness, by Product Type

Figure 15: Asia Pacific Solvent-based Inks Market Attractiveness, by Application

Figure 16: Asia Pacific Solvent-based Inks Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Solvent-based Inks Market Attractiveness, by Printing Type

Figure 18: Latin America Solvent-based Inks Market Attractiveness, by Product Type

Figure 19: Latin America Solvent-based Inks Market Attractiveness, by Application

Figure 20: Latin America Solvent-based Inks Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Solvent-based Inks Market Attractiveness, by Printing Type

Figure 22: Middle East & Africa Solvent-based Inks Market Attractiveness, by Product Type

Figure 23: Middle East & Africa Solvent-based Inks Market Attractiveness, by Application

Figure 24: Middle East & Africa Solvent-based Inks Market Attractiveness, by Country and Sub-region