Analysts’ Viewpoint

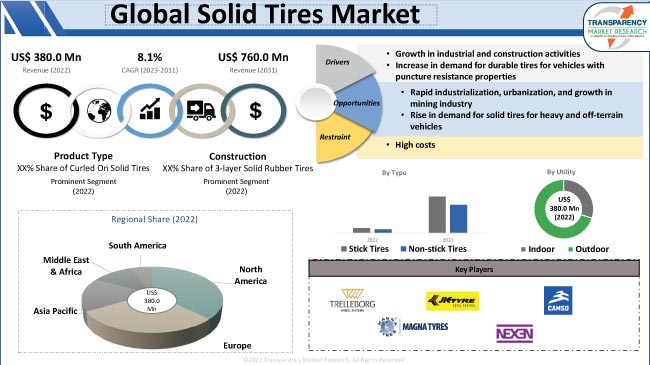

Growth in industrial and construction activities and increase in demand for durable tires with puncture resistance properties are key factors driving the global solid tires market. The market is primarily driven by infrastructure development and surge in demand for material handling equipment in various sectors.

Rise in need for tires that can withstand rugged terrain is augmenting the solid tires market value. Solid tires offer advantages such as reliability, puncture resistance, reduced downtime, and enhanced safety, making them a preferred choice for industrial and commercial applications. Leading manufacturers are concentrating on improving the efficiency of solid tires in order to provide cost-effective and diverse products that offer cutting-edge benefits to their customers. Solid tires for electric scooters and cars are gaining traction among consumers across the globe. This factor is projected to fuel market expansion during the forecast period.

Solid tires are primarily used in applications where durability, puncture resistance, and low maintenance are essential. They are commonly used in heavy-duty industrial vehicles, construction equipment, forklifts, and other material handling equipment. The global market has been witnessing steady growth for the last few years due to increase in demand from various industries. Industrialization, growth in construction and mining sectors, and rise in need for low-maintenance tires are contributing to the market dynamics. The global market is also driven by the surge in need for durable and reliable solid rubber tires for cars and bikes. Solid tires for forklifts are also gaining popularity across the globe.

Industrial and construction sectors rely heavily on heavy-duty equipment, such as forklifts, loaders, excavators, telehandlers, and other material handling machinery. These machines require durable and robust tires that can withstand the demanding environments and heavy loads associated with industrial and construction activities. Solid tires are designed to offer superior strength and durability, making them an ideal choice for such equipment.

Pneumatic tires may be susceptible to punctures, tears, or damage from debris or sharp objects commonly found at industrial and construction sites. Solid tires, with their puncture-resistant and sturdy construction, provide a reliable solution for operating in such challenging environments. They are less prone to flats or blowouts, ensuring uninterrupted operations and minimizing downtime.

Moreover, solid tires offer cost advantages to industries and construction companies. Their durability and long lifespan signify a reduced frequency of tire replacements, resulting in cost savings over time, lower maintenance requirements, and reduced downtime. These contribute to cost savings by minimizing operational disruptions and maintenance expenses. Therefore, rise in industrial as well as construction activities, worldwide, are contributing to the increase in solid tires market revenue.

Solid tires, made of solid rubber or foam-filled materials, are designed to resist punctures caused by sharp objects, debris, or rough terrain. This property enhances the reliability and durability of solid tires, making them suitable for heavy-duty operations.

The puncture resistance of solid tires translates into cost savings for businesses. Solid tires also reduce the frequency of repairs or replacements, which significantly reduces maintenance costs. Therefore, increase in demand for strong and durable tires is creating value-grab solid tires market opportunities for manufacturers.

Curled on solid tires are being widely adopted for off-road vehicles. Durability and ruggedness make these tires a preferred choice for demanding industrial applications. These tires are designed to withstand heavy loads and challenging operating conditions without compromising their performance. Their resistance to punctures, wear, and damage ensures long-lasting functionality, reducing the need for frequent replacements and resulting in cost savings for businesses.

Curled on solid tires offer enhanced stability and traction, providing operators with improved control and movability. This feature is particularly crucial for material handling equipment such as forklifts and industrial trucks. Solid forklift tires are gaining popularity as they offer stability and precise handling. The advanced construction of curled on solid tires absorbs shocks and vibrations, resulting in smoother rides and increased operator comfort. This not only improves productivity but also reduces operator fatigue and enhances overall safety in the workplace.

The widespread acceptance and availability of curled on solid tires have further contributed to the market dominance. Several leading tire manufacturers produce a wide range of curled on solid tires, offering various sizes, designs, and tread patterns to cater to diverse equipment requirements. This availability, coupled with the proven performance and reliability of these tires, has promoted trust and confidence among manufacturers.

According to the latest solid tires market forecast, the 20 inch - 25 inch rim size segment held major share of the global industry in 2022. This segment is estimated to dominate the global market during the forecast period.

20 inch - 25 inch rim sizes are versatile and widely used across various industries and applications. These rim sizes are commonly found in material handling equipment, construction machinery, and industrial vehicles. Their compatibility with a diverse range of equipment has contributed to their popularity and widespread adoption in the global market.

Moreover, 20 inch - 25 inch rim sizes strike a balance between stability and movability. They provide adequate stability for equipment operating on uneven terrains and offer good traction for enhanced control. At the same time, these rim sizes allow for flexibility in tight spaces, making them suitable for material handling in warehouses, construction sites, and industrial settings.

According to the solid tires market analysis, North America is anticipated to dominate the global industry during the forecast period. The region has well-established manufacturing, logistics, and material handling industries that extensively use solid tires. Growth of the construction industry in North America is also driving the market in the region.

Rise in presence of key manufacturers and increase in focus on advanced tire technologies further support solid tires market growth in the region.

Europe is another prominent market for solid tires. Solid tires market demand is increasing in Europe due to the growth in manufacturing sector. Expansion of automotive, aerospace, and logistics industries, which rely on material handling equipment for their operations, drives the demand for solid tires in the region.

Countries in Europe have implemented stringent safety regulations and emphasize on workplace safety, which drives the adoption of puncture-resistant solid tires in industrial applications. Rise in concerns about the environment and sustainability initiatives also contribute to market growth.

The solid tires market size in Asia Pacific is projected to increase in the next few years, owing to rapid industrialization, infrastructure development, and increased material handling activities in countries such as China, India, Japan, and South Korea. Moreover, rise in number of construction projects is likely to propel market development in the region.

The global landscape is consolidated, with the presence of a few manufacturers that control majority of the solid tires market share. As per the latest solid tires market research analysis, companies are adopting new technologies to expand their market presence. Expansion of product offerings, mergers, and acquisitions are major strategies adopted by key players.

Some of the major players operating in the global market are CAMSO, Continental AG, Global Rubber Industries, Initial Appearance LLC, NEXEN TIRE, Setco Solid Tire & Rim Assembly, Superior Tire & Rubber Corp, Trelleborg AB, Tube & Solid Tire, TY Cushion Tire, Magna Tyres, Affix Cold Tread Company, Load-Star Solid Tyres Pvt. Ltd., IRC Tire, and JK Tyre. These players are engaged in following the latest solid tires market trends to avail lucrative revenue opportunities.

Key players in the global solid tires market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 380.0 Mn |

|

Market Forecast Value in 2031 |

US$ 760.0 Mn |

|

Growth Rate (CAGR) |

8.1% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

Thousand Units for Volume and US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 380.0 Mn in 2022

It is anticipated to advance at a CAGR of 8.1% by 2031

It would be worth US$ 760.0 Mn in 2031

The curled on solid tires product type segment accounted for major share in 2022

The forklifts vehicle type segment accounted for major share in 2022

North America is likely to be the most lucrative region for solid tires

CAMSO, Continental AG, Global Rubber Industries, Initial Appearance LLC, NEXEN TIRE, Setco Solid Tire & Rim Assembly, Superior Tire & Rubber Corp, Trelleborg AB, Tube & Solid Tire, TY Cushion Tire, Magna Tyres, Affix Cold Tread Company, Load-Star Solid Tyres Pvt. Ltd., IRC Tire, and JK Tyre

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Volume in Thousand Units, Value in US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.2. Identification of Potential Market Spaces

2.3. Understanding the Buying Process of the Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Market Coverage / Taxonomy

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Regulatory Scenario

3.5. Key Trend Analysis

3.6. Value Chain Analysis

3.7. Cost Structure Analysis

3.8. Profit Margin Analysis

4. Global Solid Tires Market, by Product Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Solid Tires Market Size & Forecast, 2017-2031, by Product Type

4.2.1. Curled on Solid Tire

4.2.2. Super-elastic Tires

4.2.3. Press-on Bands

5. Global Solid Tires Market, by Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Solid Tires Market Size & Forecast, 2017-2031, by Type

5.2.1. Stick Tires

5.2.2. Non-stick Tires

6. Global Solid Tires Market, by Construction

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Solid Tires Market Size & Forecast, 2017-2031, by Construction

6.2.1. 2-layer Solid Rubber Tires

6.2.2. 3-layer Solid Rubber Tires

6.2.3. Special Solid Rubber Tires

7. Global Solid Tires Market, by Application

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Solid Tires Market Size & Forecast, 2017-2031, by Application

7.2.1. Industrial (Scrap Handling)

7.2.2. Mining & Earthmoving

7.2.3. Underground Mining

7.2.4. Construction

7.2.5. Port & Terminal

7.2.6. Agricultural

7.2.7. Material Handling

7.2.8. Trucking/Load Hauling

7.2.9. Logistic Centers

7.2.10. Food Industry & Pharmaceutical Industry

7.2.11. Engineering Vehicles

7.2.12. Military Vehicles

7.2.13. Others

8. Global Solid Tires Market, by Vehicle Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Solid Tires Market Size & Forecast, 2017-2031, by Vehicle Type

8.2.1. Dozers

8.2.2. Forklifts

8.2.3. Forklifts - Rough Terrains

8.2.4. Loaders

8.2.5. Mobile Excavators

8.2.6. Skid Steer Loaders

8.2.7. Telescopic Handlers

8.2.8. Terminal Tractors

8.2.9. Trailers

8.2.10. Trucks

8.2.11. Platform Trucks

8.2.12. Others

9. Global Solid Tires Market, by Rim Size

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Solid Tires Market Size & Forecast, 2017-2031, by Rim Size

9.2.1. Up to 8 Inch

9.2.2. 8 Inch - 12 Inch

9.2.3. 12 Inch - 16 Inch

9.2.4. 16 Inch - 20 Inch

9.2.5. 20 Inch - 25 Inch

9.2.6. Above 25 Inch

10. Global Solid Tires Market, by Utility

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Solid Tires Market Size & Forecast, 2017-2031, by Utility

10.2.1. Indoor

10.2.2. Outdoor

11. Global Solid Tires Market, by Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Solid Tires Market Size & Forecast, 2017-2031, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America Solid Tires Market

12.1. Market Snapshot

12.2. Solid Tires Market Size & Forecast, 2017-2031, by Product Type

12.2.1. Curled on Solid Tire

12.2.2. Super-elastic Tires

12.2.3. Press-on Bands

12.3. Solid Tires Market Size & Forecast, 2017-2031, by Type

12.3.1. Stick Tires

12.3.2. Non-stick Tires

12.4. Solid Tires Market Size & Forecast, 2017-2031, by Construction

12.4.1. 2-layer Solid Rubber Tires

12.4.2. 3-layer Solid Rubber Tires

12.4.3. Special Solid Rubber Tires

12.5. Solid Tires Market Size & Forecast, 2017-2031, by Application

12.5.1. Industrial (Scrap Handling)

12.5.2. Mining & Earthmoving

12.5.3. Underground Mining

12.5.4. Construction

12.5.5. Port & Terminal

12.5.6. Agricultural

12.5.7. Material Handling

12.5.8. Trucking/Load Hauling

12.5.9. Logistic Centers

12.5.10. Food Industry & Pharmaceutical Industry

12.5.11. Engineering Vehicles

12.5.12. Military Vehicles

12.5.13. Others

12.6. Solid Tires Market Size & Forecast, 2017-2031, by Vehicle Type

12.6.1. Dozers

12.6.2. Forklifts

12.6.3. Forklifts - Rough Terrains

12.6.4. Loaders

12.6.5. Mobile Excavators

12.6.6. Skid Steer Loaders

12.6.7. Telescopic Handlers

12.6.8. Terminal Tractors

12.6.9. Trailers

12.6.10. Trucks

12.6.11. Platform Trucks

12.6.12. Others

12.7. Solid Tires Market Size & Forecast, 2017-2031, by Rim Size

12.7.1. Up to 8 Inch

12.7.2. 8 Inch - 12 Inch

12.7.3. 12 Inch - 16 Inch

12.7.4. 16 Inch - 20 Inch

12.7.5. 20 Inch - 25 Inch

12.7.6. Above 25 Inch

12.8. Solid Tires Market Size & Forecast, 2017-2031, by Utility

12.8.1. Indoor

12.8.2. Outdoor

12.9. Solid Tires Market Size & Forecast, 2017-2031, by Country

12.9.1. The U. S.

12.9.2. Canada

12.9.3. Mexico

13. Europe Solid Tires Market

13.1. Market Snapshot

13.2. Solid Tires Market Size & Forecast, 2017-2031, by Product Type

13.2.1. Curled on Solid Tire

13.2.2. Super-elastic Tires

13.2.3. Press-on Bands

13.3. Solid Tires Market Size & Forecast, 2017-2031, by Type

13.3.1. Stick Tires

13.3.2. Non-stick Tires

13.4. Solid Tires Market Size & Forecast, 2017-2031, by Construction

13.4.1. 2-layer Solid Rubber Tires

13.4.2. 3-layer Solid Rubber Tires

13.4.3. Special Solid Rubber Tires

13.5. Solid Tires Market Size & Forecast, 2017-2031, by Application

13.5.1. Industrial (Scrap Handling)

13.5.2. Mining & Earthmoving

13.5.3. Underground Mining

13.5.4. Construction

13.5.5. Port & Terminal

13.5.6. Agricultural

13.5.7. Material Handling

13.5.8. Trucking/Load Hauling

13.5.9. Logistic Centers

13.5.10. Food Industry & Pharmaceutical Industry

13.5.11. Engineering Vehicles

13.5.12. Military Vehicles

13.5.13. Others

13.6. Solid Tires Market Size & Forecast, 2017-2031, by Vehicle Type

13.6.1. Dozers

13.6.2. Forklifts

13.6.3. Forklifts - Rough Terrains

13.6.4. Loaders

13.6.5. Mobile Excavators

13.6.6. Skid Steer Loaders

13.6.7. Telescopic Handlers

13.6.8. Terminal Tractors

13.6.9. Trailers

13.6.10. Trucks

13.6.11. Platform Trucks

13.6.12. Others

13.7. Solid Tires Market Size & Forecast, 2017-2031, by Rim Size

13.7.1. Up to 8 Inch

13.7.2. 8 Inch - 12 Inch

13.7.3. 12 Inch - 16 Inch

13.7.4. 16 Inch - 20 Inch

13.7.5. 20 Inch - 25 Inch

13.7.6. Above 25 Inch

13.8. Solid Tires Market Size & Forecast, 2017-2031, by Utility

13.8.1. Indoor

13.8.2. Outdoor

13.9. Solid Tires Market Size & Forecast, 2017-2031, by Country

13.9.1. Germany

13.9.2. U. K.

13.9.3. France

13.9.4. Italy

13.9.5. Spain

13.9.6. Nordic Countries

13.9.7. Russia & CIS

13.9.8. Rest of Europe

14. Asia Pacific Solid Tires Market

14.1. Market Snapshot

14.2. Solid Tires Market Size & Forecast, 2017-2031, by Product Type

14.2.1. Curled on Solid Tire

14.2.2. Super-elastic Tires

14.2.3. Press-on Bands

14.3. Solid Tires Market Size & Forecast, 2017-2031, by Type

14.3.1. Stick Tires

14.3.2. Non-stick Tires

14.4. Solid Tires Market Size & Forecast, 2017-2031, by Construction

14.4.1. 2-layer Solid Rubber Tires

14.4.2. 3-layer Solid Rubber Tires

14.4.3. Special Solid Rubber Tires

14.5. Solid Tires Market Size & Forecast, 2017-2031, by Application

14.5.1. Industrial (Scrap Handling)

14.5.2. Mining & Earthmoving

14.5.3. Underground Mining

14.5.4. Construction

14.5.5. Port & Terminal

14.5.6. Agricultural

14.5.7. Material Handling

14.5.8. Trucking/Load Hauling

14.5.9. Logistic Centers

14.5.10. Food Industry & Pharmaceutical Industry

14.5.11. Engineering Vehicles

14.5.12. Military Vehicles

14.5.13. Others

14.6. Solid Tires Market Size & Forecast, 2017-2031, by Vehicle Type

14.6.1. Dozers

14.6.2. Forklifts

14.6.3. Forklifts - Rough Terrains

14.6.4. Loaders

14.6.5. Mobile Excavators

14.6.6. Skid Steer Loaders

14.6.7. Telescopic Handlers

14.6.8. Terminal Tractors

14.6.9. Trailers

14.6.10. Trucks

14.6.11. Platform Trucks

14.6.12. Others

14.7. Solid Tires Market Size & Forecast, 2017-2031, by Rim Size

14.7.1. Up to 8 Inch

14.7.2. 8 Inch - 12 Inch

14.7.3. 12 Inch - 16 Inch

14.7.4. 16 Inch - 20 Inch

14.7.5. 20 Inch - 25 Inch

14.7.6. Above 25 Inch

14.8. Solid Tires Market Size & Forecast, 2017-2031, by Utility

14.8.1. Indoor

14.8.2. Outdoor

14.9. Solid Tires Market Size & Forecast, 2017-2031, by Country

14.9.1. China

14.9.2. India

14.9.3. Japan

14.9.4. ASEAN Countries

14.9.5. South Korea

14.9.6. ANZ

14.9.7. Rest of Asia Pacific

15. Middle East & Africa Solid Tires Market

15.1. Market Snapshot

15.2. Solid Tires Market Size & Forecast, 2017-2031, by Product Type

15.2.1. Curled on Solid Tire

15.2.2. Super-elastic Tires

15.2.3. Press-on Bands

15.3. Solid Tires Market Size & Forecast, 2017-2031, by Type

15.3.1. Stick Tires

15.3.2. Non-stick Tires

15.4. Solid Tires Market Size & Forecast, 2017-2031, by Construction

15.4.1. 2-layer Solid Rubber Tires

15.4.2. 3-layer Solid Rubber Tires

15.4.3. Special Solid Rubber Tires

15.5. Solid Tires Market Size & Forecast, 2017-2031, by Application

15.5.1. Industrial (Scrap Handling)

15.5.2. Mining & Earthmoving

15.5.3. Underground Mining

15.5.4. Construction

15.5.5. Port & Terminal

15.5.6. Agricultural

15.5.7. Material Handling

15.5.8. Trucking/Load Hauling

15.5.9. Logistic Centers

15.5.10. Food Industry & Pharmaceutical Industry

15.5.11. Engineering Vehicles

15.5.12. Military Vehicles

15.5.13. Others

15.6. Solid Tires Market Size & Forecast, 2017-2031, by Vehicle Type

15.6.1. Dozers

15.6.2. Forklifts

15.6.3. Forklifts - Rough Terrains

15.6.4. Loaders

15.6.5. Mobile Excavators

15.6.6. Skid Steer Loaders

15.6.7. Telescopic Handlers

15.6.8. Terminal Tractors

15.6.9. Trailers

15.6.10. Trucks

15.6.11. Platform Trucks

15.6.12. Others

15.7. Solid Tires Market Size & Forecast, 2017-2031, by Rim Size

15.7.1. Up to 8 Inch

15.7.2. 8 Inch - 12 Inch

15.7.3. 12 Inch - 16 Inch

15.7.4. 16 Inch - 20 Inch

15.7.5. 20 Inch - 25 Inch

15.7.6. Above 25 Inch

15.8. Solid Tires Market Size & Forecast, 2017-2031, by Utility

15.8.1. Indoor

15.8.2. Outdoor

15.9. Solid Tires Market Size & Forecast, 2017-2031, by Country

15.9.1. GCC

15.9.2. South Africa

15.9.3. Turkey

15.9.4. Rest of Middle East & Africa

16. South America Solid Tires Market

16.1. Market Snapshot

16.2. Solid Tires Market Size & Forecast, 2017-2031, by Product Type

16.2.1. Curled on Solid Tire

16.2.2. Super-elastic Tires

16.2.3. Press-on Bands

16.3. Solid Tires Market Size & Forecast, 2017-2031, by Type

16.3.1. Stick Tires

16.3.2. Non-stick Tires

16.4. Solid Tires Market Size & Forecast, 2017-2031, by Construction

16.4.1. 2-layer Solid Rubber Tires

16.4.2. 3-layer Solid Rubber Tires

16.4.3. Special Solid Rubber Tires

16.5. Solid Tires Market Size & Forecast, 2017-2031, by Application

16.5.1. Industrial (Scrap Handling)

16.5.2. Mining & Earthmoving

16.5.3. Underground Mining

16.5.4. Construction

16.5.5. Port & Terminal

16.5.6. Agricultural

16.5.7. Material Handling

16.5.8. Trucking/Load Hauling

16.5.9. Logistic Centers

16.5.10. Food Industry & Pharmaceutical Industry

16.5.11. Engineering Vehicles

16.5.12. Military Vehicles

16.5.13. Others

16.6. Solid Tires Market Size & Forecast, 2017-2031, by Vehicle Type

16.6.1. Dozers

16.6.2. Forklifts

16.6.3. Forklifts - Rough Terrains

16.6.4. Loaders

16.6.5. Mobile Excavators

16.6.6. Skid Steer Loaders

16.6.7. Telescopic Handlers

16.6.8. Terminal Tractors

16.6.9. Trailers

16.6.10. Trucks

16.6.11. Platform Trucks

16.6.12. Others

16.7. Solid Tires Market Size & Forecast, 2017-2031, by Rim Size

16.7.1. Up to 8 Inch

16.7.2. 8 Inch - 12 Inch

16.7.3. 12 Inch - 16 Inch

16.7.4. 16 Inch - 20 Inch

16.7.5. 20 Inch - 25 Inch

16.7.6. Above 25 Inch

16.8. Solid Tires Market Size & Forecast, 2017-2031, by Utility

16.8.1. Indoor

16.8.2. Outdoor

16.9. Solid Tires Market Size & Forecast, 2017-2031, by Country

16.9.1. Brazil

16.9.2. Argentina

16.9.3. Rest of South America

17. Competitive Landscape

17.1. Company Share Analysis/ Brand Share Analysis, 2022

17.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

18. Company Profile/ Key Players

18.1. CAMSO

18.1.1. Company Overview

18.1.2. Company Footprints

18.1.3. Production Locations

18.1.4. Product Portfolio

18.1.5. Competitors & Customers

18.1.6. Subsidiaries & Parent Organization

18.1.7. Recent Developments

18.1.8. Financial Analysis

18.1.9. Profitability

18.1.10. Revenue Share

18.2. Continental AG

18.2.1. Company Overview

18.2.2. Company Footprints

18.2.3. Production Locations

18.2.4. Product Portfolio

18.2.5. Competitors & Customers

18.2.6. Subsidiaries & Parent Organization

18.2.7. Recent Developments

18.2.8. Financial Analysis

18.2.9. Profitability

18.2.10. Revenue Share

18.3. Global Rubber Industries

18.3.1. Company Overview

18.3.2. Company Footprints

18.3.3. Production Locations

18.3.4. Product Portfolio

18.3.5. Competitors & Customers

18.3.6. Subsidiaries & Parent Organization

18.3.7. Recent Developments

18.3.8. Financial Analysis

18.3.9. Profitability

18.3.10. Revenue Share

18.4. Initial Appearance LLC

18.4.1. Company Overview

18.4.2. Company Footprints

18.4.3. Production Locations

18.4.4. Product Portfolio

18.4.5. Competitors & Customers

18.4.6. Subsidiaries & Parent Organization

18.4.7. Recent Developments

18.4.8. Financial Analysis

18.4.9. Profitability

18.4.10. Revenue Share

18.5. NEXEN TIRE

18.5.1. Company Overview

18.5.2. Company Footprints

18.5.3. Production Locations

18.5.4. Product Portfolio

18.5.5. Competitors & Customers

18.5.6. Subsidiaries & Parent Organization

18.5.7. Recent Developments

18.5.8. Financial Analysis

18.5.9. Profitability

18.5.10. Revenue Share

18.6. Setco Solid Tire & Rim Assembly

18.6.1. Company Overview

18.6.2. Company Footprints

18.6.3. Production Locations

18.6.4. Product Portfolio

18.6.5. Competitors & Customers

18.6.6. Subsidiaries & Parent Organization

18.6.7. Recent Developments

18.6.8. Financial Analysis

18.6.9. Profitability

18.6.10. Revenue Share

18.7. Superior Tire & Rubber Corp

18.7.1. Company Overview

18.7.2. Company Footprints

18.7.3. Production Locations

18.7.4. Product Portfolio

18.7.5. Competitors & Customers

18.7.6. Subsidiaries & Parent Organization

18.7.7. Recent Developments

18.7.8. Financial Analysis

18.7.9. Profitability

18.7.10. Revenue Share

18.8. Trelleborg AB

18.8.1. Company Overview

18.8.2. Company Footprints

18.8.3. Production Locations

18.8.4. Product Portfolio

18.8.5. Competitors & Customers

18.8.6. Subsidiaries & Parent Organization

18.8.7. Recent Developments

18.8.8. Financial Analysis

18.8.9. Profitability

18.8.10. Revenue Share

18.9. Tube & Solid Tire

18.9.1. Company Overview

18.9.2. Company Footprints

18.9.3. Production Locations

18.9.4. Product Portfolio

18.9.5. Competitors & Customers

18.9.6. Subsidiaries & Parent Organization

18.9.7. Recent Developments

18.9.8. Financial Analysis

18.9.9. Profitability

18.9.10. Revenue Share

18.10. TY Cushion Tire

18.10.1. Company Overview

18.10.2. Company Footprints

18.10.3. Production Locations

18.10.4. Product Portfolio

18.10.5. Competitors & Customers

18.10.6. Subsidiaries & Parent Organization

18.10.7. Recent Developments

18.10.8. Financial Analysis

18.10.9. Profitability

18.10.10. Revenue Share

18.11. Magna Tyres

18.11.1. Company Overview

18.11.2. Company Footprints

18.11.3. Production Locations

18.11.4. Product Portfolio

18.11.5. Competitors & Customers

18.11.6. Subsidiaries & Parent Organization

18.11.7. Recent Developments

18.11.8. Financial Analysis

18.11.9. Profitability

18.11.10. Revenue Share

18.12. Affix Cold Tread Company

18.12.1. Company Overview

18.12.2. Company Footprints

18.12.3. Production Locations

18.12.4. Product Portfolio

18.12.5. Competitors & Customers

18.12.6. Subsidiaries & Parent Organization

18.12.7. Recent Developments

18.12.8. Financial Analysis

18.12.9. Profitability

18.12.10. Revenue Share

18.13. Load-Star Solid Tyres Pvt. Ltd.

18.13.1. Company Overview

18.13.2. Company Footprints

18.13.3. Production Locations

18.13.4. Product Portfolio

18.13.5. Competitors & Customers

18.13.6. Subsidiaries & Parent Organization

18.13.7. Recent Developments

18.13.8. Financial Analysis

18.13.9. Profitability

18.13.10. Revenue Share

18.14. IRC Tire

18.14.1. Company Overview

18.14.2. Company Footprints

18.14.3. Production Locations

18.14.4. Product Portfolio

18.14.5. Competitors & Customers

18.14.6. Subsidiaries & Parent Organization

18.14.7. Recent Developments

18.14.8. Financial Analysis

18.14.9. Profitability

18.14.10. Revenue Share

18.15. JK Tyre

18.15.1. Company Overview

18.15.2. Company Footprints

18.15.3. Production Locations

18.15.4. Product Portfolio

18.15.5. Competitors & Customers

18.15.6. Subsidiaries & Parent Organization

18.15.7. Recent Developments

18.15.8. Financial Analysis

18.15.9. Profitability

18.15.10. Revenue Share

18.16. Other Key Players

18.16.1. Company Overview

18.16.2. Company Footprints

18.16.3. Production Locations

18.16.4. Product Portfolio

18.16.5. Competitors & Customers

18.16.6. Subsidiaries & Parent Organization

18.16.7. Recent Developments

18.16.8. Financial Analysis

18.16.9. Profitability

18.16.10. Revenue Share

List of Tables

Table 1: Global Solid Tires Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 2: Global Solid Tires Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 3: Global Solid Tires Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 4: Global Solid Tires Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 5: Global Solid Tires Market Volume (Thousand Units) Forecast, by Construction, 2017-2031

Table 6: Global Solid Tires Market Value (US$ Bn) Forecast, by Construction, 2017‒2031

Table 7: Global Solid Tires Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 8: Global Solid Tires Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 9: Global Solid Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 10: Global Solid Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 11: Global Solid Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 12: Global Solid Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017‒2031

Table 13: Global Solid Tires Market Volume (Thousand Units) Forecast, by Utility, 2017-2031

Table 14: Global Solid Tires Market Value (US$ Bn) Forecast, by Utility, 2017‒2031

Table 15: Global Solid Tires Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 16: Global Solid Tires Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 17: North America Solid Tires Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 18: North America Solid Tires Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 19: North America Solid Tires Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 20: North America Solid Tires Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 21: North America Solid Tires Market Volume (Thousand Units) Forecast, by Construction, 2017-2031

Table 22: North America Solid Tires Market Value (US$ Bn) Forecast, by Construction, 2017‒2031

Table 23: North America Solid Tires Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 24: North America Solid Tires Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 25: North America Solid Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 26: North America Solid Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 27: North America Solid Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 28: North America Solid Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017‒2031

Table 29: North America Solid Tires Market Volume (Thousand Units) Forecast, by Utility, 2017-2031

Table 30: North America Solid Tires Market Value (US$ Bn) Forecast, by Utility, 2017‒2031

Table 31: North America Solid Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 32: North America Solid Tires Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 33: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 34: Europe Solid Tires Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 35: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 36: Europe Solid Tires Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 37: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Construction, 2017-2031

Table 38: Europe Solid Tires Market Value (US$ Bn) Forecast, by Construction, 2017‒2031

Table 39: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 40: Europe Solid Tires Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 41: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 42: Europe Solid Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 43: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 44: Europe Solid Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017‒2031

Table 45: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Utility, 2017-2031

Table 46: Europe Solid Tires Market Value (US$ Bn) Forecast, by Utility, 2017‒2031

Table 47: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Europe Solid Tires Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 49: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 50: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 51: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 52: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 53: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Construction, 2017-2031

Table 54: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Construction, 2017‒2031

Table 55: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 56: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 57: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 58: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 59: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 60: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017‒2031

Table 61: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Utility, 2017-2031

Table 62: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Utility, 2017‒2031

Table 63: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 64: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 65: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 66: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 67: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 68: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 69: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Construction, 2017-2031

Table 70: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Construction, 2017‒2031

Table 71: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 72: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 73: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 74: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 75: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 76: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017‒2031

Table 77: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Utility, 2017-2031

Table 78: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Utility, 2017‒2031

Table 79: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 80: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 81: South America Solid Tires Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 82: South America Solid Tires Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 83: South America Solid Tires Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 84: South America Solid Tires Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 85: South America Solid Tires Market Volume (Thousand Units) Forecast, by Construction, 2017-2031

Table 86: South America Solid Tires Market Value (US$ Bn) Forecast, by Construction, 2017‒2031

Table 87: South America Solid Tires Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 88: South America Solid Tires Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 89: South America Solid Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 90: South America Solid Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 91: South America Solid Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 92: South America Solid Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017‒2031

Table 93: South America Solid Tires Market Volume (Thousand Units) Forecast, by Utility, 2017-2031

Table 94: South America Solid Tires Market Value (US$ Bn) Forecast, by Utility, 2017‒2031

Table 95: South America Solid Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 96: South America Solid Tires Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Solid Tires Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 2: Global Solid Tires Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 3: Global Solid Tires Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 4: Global Solid Tires Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 5: Global Solid Tires Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 6: Global Solid Tires Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 7: Global Solid Tires Market Volume (Thousand Units) Forecast, by Construction, 2017-2031

Figure 8: Global Solid Tires Market Value (US$ Bn) Forecast, by Construction, 2017-2031

Figure 9: Global Solid Tires Market, Incremental Opportunity, by Construction, Value (US$ Bn), 2023-2031

Figure 10: Global Solid Tires Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 11: Global Solid Tires Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 12: Global Solid Tires Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 13: Global Solid Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 14: Global Solid Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 15: Global Solid Tires Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 16: Global Solid Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 17: Global Solid Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 18: Global Solid Tires Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 19: Global Solid Tires Market Volume (Thousand Units) Forecast, by Utility, 2017-2031

Figure 20: Global Solid Tires Market Value (US$ Bn) Forecast, by Utility, 2017-2031

Figure 21: Global Solid Tires Market, Incremental Opportunity, by Utility, Value (US$ Bn), 2023-2031

Figure 22: Global Solid Tires Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 23: Global Solid Tires Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 24: Global Solid Tires Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 25: North America Solid Tires Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 26: North America Solid Tires Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 27: North America Solid Tires Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 28: North America Solid Tires Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 29: North America Solid Tires Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 30: North America Solid Tires Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 31: North America Solid Tires Market Volume (Thousand Units) Forecast, by Construction, 2017-2031

Figure 32: North America Solid Tires Market Value (US$ Bn) Forecast, by Construction, 2017-2031

Figure 33: North America Solid Tires Market, Incremental Opportunity, by Construction, Value (US$ Bn), 2023-2031

Figure 34: North America Solid Tires Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 35: North America Solid Tires Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 36: North America Solid Tires Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 37: North America Solid Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 38: North America Solid Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 39: North America Solid Tires Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 40: North America Solid Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 41: North America Solid Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 42: North America Solid Tires Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 43: North America Solid Tires Market Volume (Thousand Units) Forecast, by Utility, 2017-2031

Figure 44: North America Solid Tires Market Value (US$ Bn) Forecast, by Utility, 2017-2031

Figure 45: North America Solid Tires Market, Incremental Opportunity, by Utility, Value (US$ Bn), 2023-2031

Figure 46: North America Solid Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 47: North America Solid Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: North America Solid Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 50: Europe Solid Tires Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 51: Europe Solid Tires Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 52: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 53: Europe Solid Tires Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 54: Europe Solid Tires Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 55: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Construction, 2017-2031

Figure 56: Europe Solid Tires Market Value (US$ Bn) Forecast, by Construction, 2017-2031

Figure 57: Europe Solid Tires Market, Incremental Opportunity, by Construction, Value (US$ Bn), 2023-2031

Figure 58: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 59: Europe Solid Tires Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 60: Europe Solid Tires Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 61: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 62: Europe Solid Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 63: Europe Solid Tires Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 64: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 65: Europe Solid Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 66: Europe Solid Tires Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 67: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Utility, 2017-2031

Figure 68: Europe Solid Tires Market Value (US$ Bn) Forecast, by Utility, 2017-2031

Figure 69: Europe Solid Tires Market, Incremental Opportunity, by Utility, Value (US$ Bn), 2023-2031

Figure 70: Europe Solid Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Europe Solid Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Europe Solid Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 73: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 74: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 75: Asia Pacific Solid Tires Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 76: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 77: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 78: Asia Pacific Solid Tires Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 79: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Construction, 2017-2031

Figure 80: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Construction, 2017-2031

Figure 81: Asia Pacific Solid Tires Market, Incremental Opportunity, by Construction, Value (US$ Bn), 2023-2031

Figure 82: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 83: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 84: Asia Pacific Solid Tires Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 85: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 86: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 87: Asia Pacific Solid Tires Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 88: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 89: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 90: Asia Pacific Solid Tires Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 91: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Utility, 2017-2031

Figure 92: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Utility, 2017-2031

Figure 93: Asia Pacific Solid Tires Market, Incremental Opportunity, by Utility, Value (US$ Bn), 2023-2031

Figure 94: Asia Pacific Solid Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 95: Asia Pacific Solid Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 96: Asia Pacific Solid Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 97: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 98: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 99: Middle East & Africa Solid Tires Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 100: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 101: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 102: Middle East & Africa Solid Tires Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 103: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Construction, 2017-2031

Figure 104: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Construction, 2017-2031

Figure 105: Middle East & Africa Solid Tires Market, Incremental Opportunity, by Construction, Value (US$ Bn), 2023-2031

Figure 106: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 107: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 108: Middle East & Africa Solid Tires Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 109: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 110: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 111: Middle East & Africa Solid Tires Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 112: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 113: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 114: Middle East & Africa Solid Tires Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 115: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Utility, 2017-2031

Figure 116: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Utility, 2017-2031

Figure 117: Middle East & Africa Solid Tires Market, Incremental Opportunity, by Utility, Value (US$ Bn), 2023-2031

Figure 118: Middle East & Africa Solid Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 119: Middle East & Africa Solid Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 120: Middle East & Africa Solid Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 121: South America Solid Tires Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 122: South America Solid Tires Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 123: South America Solid Tires Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 124: South America Solid Tires Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 125: South America Solid Tires Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 126: South America Solid Tires Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 127: South America Solid Tires Market Volume (Thousand Units) Forecast, by Construction, 2017-2031

Figure 128: South America Solid Tires Market Value (US$ Bn) Forecast, by Construction, 2017-2031

Figure 129: South America Solid Tires Market, Incremental Opportunity, by Construction, Value (US$ Bn), 2023-2031

Figure 130: South America Solid Tires Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 131: South America Solid Tires Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 132: South America Solid Tires Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 133: South America Solid Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 134: South America Solid Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 135: South America Solid Tires Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 136: South America Solid Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 137: South America Solid Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 138: South America Solid Tires Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 139: South America Solid Tires Market Volume (Thousand Units) Forecast, by Utility, 2017-2031

Figure 140: South America Solid Tires Market Value (US$ Bn) Forecast, by Utility, 2017-2031

Figure 141: South America Solid Tires Market, Incremental Opportunity, by Utility, Value (US$ Bn), 2023-2031

Figure 142: South America Solid Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 143: South America Solid Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 144: South America Solid Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031