Analysts’ Viewpoint

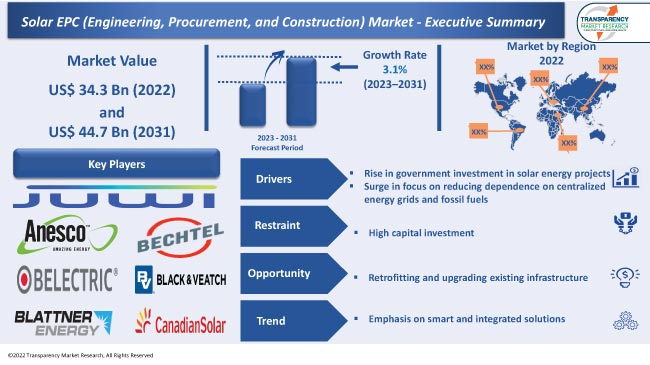

The future scope of the solar EPC (Engineering, Procurement, and Construction) market appears promising, owing to the increase in demand for renewable energy solutions and rise in government investment in solar energy projects.

The solar energy sector is continuing to witness technological advancements, including solar panels that are more efficient, advanced inverters, energy storage solutions, and smart grid integration. These innovations are improving the performance and reliability of solar energy systems, thereby contributing to the solar EPC (Engineering, Procurement, and Construction) market growth. Expansion in the solar energy sector is likely to offer lucrative opportunities to players operating in the global solar EPC (Engineering, Procurement, and Construction) industry.

Solar EPC (Engineering, Procurement, and Construction) encompasses the entire process, from the initial design and engineering phases to procurement of equipment and materials, and finally, the construction and installation of the solar power system.

Rise in focus on energy independence and resilience is fueling the demand for solar EPC services. Increasing number of people are seeking to install solar power systems on their rooftops or develop large-scale solar farms.

Solar EPC is anticipated to play a vital role in facilitating the widespread implementation of solar power systems, as the world transitions toward cleaner and more sustainable energy options. This is likely to contribute to a greener future. Demand for solar EPC is estimated to continue to increase in the near future, driven by the need for sustainable energy solutions and the ongoing transition to a low-carbon economy.

Governments and organizations worldwide are increasingly focused on transitioning to renewable energy sources in order to reduce greenhouse gas emissions and combat climate change.

Thus, growth in demand for renewable energy sources, government incentives and policies supporting solar energy adoption, and decline in cost of solar energy technologies are augmenting the solar EPC (Engineering, Procurement, and Construction) market expansion.

Governments of various countries across the globe are encouraging investments in solar energy projects, thus promoting sustainability and accelerating the transition to clean energy sources. Government support through favorable policy frameworks, such as Renewable Portfolio Standards (RPS), Feed-in Tariffs (FITs), and Power Purchase Agreements (PPAs), are incentivizing the development and installation of solar energy systems.

These policies provide long-term contracts, guaranteed pricing, and grid access, thereby creating a conducive environment for solar EPC (Engineering, Procurement, and Construction) market development.

In June 2022, the World Bank allocated US$ 165.0 Mn to assist the residential sector in India adopt rooftop solar systems and make solar energy more accessible. These solar photovoltaic (PV) projects are expected to deliver clean and renewable electricity, while reducing greenhouse gas emissions.

They are likely to cut greenhouse gas (GHG) emissions by 13.9 million tons. Thus, surge in investment in PV projects is anticipated to augment the solar EPC (Engineering, Procurement, and Construction) market value in the next few years.

Future trends in the solar EPC (Engineering, Procurement, and Construction) market, such as cost reduction, decentralized installations, energy storage integration, and smart grid technologies, are expected to shape the industry's trajectory toward a more efficient and sustainable solar energy ecosystem.

Solar energy offers a decentralized and renewable source of power, thereby reducing dependence on centralized energy grids and fossil fuels. As the demand for energy independence increases, solar EPC services are likely to play a vital role in designing and implementing solar energy systems that allow individuals, businesses, and communities to generate their own electricity.

Hence, increase in need for energy independence and resilience is boosting the solar EPC (Engineering, Procurement, and Construction) market statistics.

According to the latest solar EPC (Engineering, Procurement, and Construction) market trends, the rooftop mounting type segment held 37.9% share in 2022. It is likely to maintain the status quo and grow at a CAGR of 3.7% during the forecast period.

Rooftop solar installations offer several advantages including usage of underutilized space, proximity to an electrical load, and potential cost savings by offsetting electricity consumption. Additionally, solar companies can ensure a streamlined and efficient process, thus resulting in a high-quality and reliable solar power system on rooftops.

As per the latest global solar EPC market analysis, the residential end-user segment accounted for 38.4% share in 2022. It is projected to maintain the status quo and grow at a CAGR of 3.6% during the forecast period.

High demand for solar power in residential installations is often influenced by financial factors such as the payback period, return on investment, and availability of incentives and rebates. Additionally, the solar EPC process for residential installations can be tailored to meet the homeowner's demand for clean, reliable, and cost-effective energy.

According to the latest solar EPC (Engineering, Procurement, and Construction) market forecast, Asia Pacific is projected to constitute the largest share from 2023 to 2031. The region accounted for a prominent share of 51.4% in 2022.

Increase in focus on renewable energy and sustainability is driving market dynamics of Asia Pacific. The region has a vast market potential for solar energy due to its population size, economic growth, and surge in demand for energy. Rapid urbanization and industrialization in China, India, and Japan are likely to boost the need for clean energy sources, thus making solar power a compelling solution.

North America is an emerging market for solar EPC. The region held 24.1% share in 2022. Growth in awareness and concern about climate change and its environmental impacts is augmenting market progress in the region. Increase in demand for clean and renewable energy sources is also boosting the EPC (Engineering, Procurement, and Construction) market share in North America.

The global industry is fragmented, with the presence of a large number of players. Majority of companies are investing significantly in R&D activities to expand their product portfolio. They are also adopting various growth strategies such as collaborations with key players, mergers & acquisitions, product launches, and development of a worldwide distribution network to increase their market share.

Anesco Ltd., Bechtel Corporation, Belectric Solar & Battery Holding GmbH, Black & Veatch Holding Company, Blattner Energy, Canadian Solar, Core Development Group, Juwi AG, LNB Renewable, and Sterling and Wilson Pvt. Ltd. are leading players in the solar EPC (Engineering, Procurement, and Construction) market.

Each of these players has been profiled in the solar EPC (Engineering, Procurement, and Construction) market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 34.3 Bn |

|

Market Forecast Value in 2031 |

US$ 44.7 Bn |

|

Growth Rate (CAGR) |

3.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 34.3 Bn in 2022

It is projected to be 3.1% from 2023 to 2031

Rise in government investment in solar energy projects and surge in focus on reducing dependence on centralized energy grids and fossil fuels

The rooftop mounting type segment held major share of 37.9% in 2022

Asia Pacific is likely to record the highest demand during the forecast period

It was valued at US$ 7.9 Bn in 2022

Anesco Ltd., Bechtel Corporation, Belectric Solar & Battery Holding GmbH, Black & Veatch Holding Company, Blattner Energy, Canadian Solar, Core Development Group, Juwi AG, LNB Renewable, and Sterling and Wilson Pvt. Ltd.

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Solar EPC (Engineering, Procurement, and Construction) Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Energy and Utility Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap

4.4. Industry SWOT Analysis

4.5. Porter’s Five Forces Analysis

5. Global Solar EPC (Engineering, Procurement, and Construction) Market Analysis, By Mounting Type

5.1. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Mounting Type, 2017-2031

5.1.1. Ground

5.1.2. Rooftop

5.1.3. Floating

5.2. Market Attractiveness Analysis, By Mounting Type

6. Global Solar EPC (Engineering, Procurement, and Construction) Market Analysis, By Technology

6.1. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Technology, 2017-2031

6.1.1. Concentrated Solar Power

6.1.2. Photovoltaic

6.2. Market Attractiveness Analysis, By Technology

7. Global Solar EPC (Engineering, Procurement, and Construction) Market Analysis, By End-user

7.1. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By End-user, 2017-2031

7.1.1. Residential

7.1.2. Commercial

7.1.3. Industrial

7.2. Market Attractiveness Analysis, By End-user

8. Global Solar EPC (Engineering, Procurement, and Construction) Market Analysis and Forecast, By Region

8.1. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Solar EPC (Engineering, Procurement, and Construction) Market Analysis and Forecast

9.1. Market Snapshot

9.2. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Mounting Type, 2017-2031

9.2.1. Ground

9.2.2. Rooftop

9.2.3. Floating

9.3. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Technology, 2017-2031

9.3.1. Concentrated Solar Power

9.3.2. Photovoltaic

9.4. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By End-user, 2017-2031

9.4.1. Residential

9.4.2. Commercial

9.4.3. Industrial

9.5. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017-2031

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Mounting Type

9.6.2. By Technology

9.6.3. By End-user

9.6.4. By Country/Sub-region

10. Europe Solar EPC (Engineering, Procurement, and Construction) Market Analysis and Forecast

10.1. Market Snapshot

10.2. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Mounting Type, 2017-2031

10.2.1. Ground

10.2.2. Rooftop

10.2.3. Floating

10.3. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Technology, 2017-2031

10.3.1. Concentrated Solar Power

10.3.2. Photovoltaic

10.4. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By End-user, 2017-2031

10.4.1. Residential

10.4.2. Commercial

10.4.3. Industrial

10.5. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.5.1. U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Mounting Type

10.6.2. By Technology

10.6.3. By End-user

10.6.4. By Country/Sub-region

11. Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Analysis and Forecast

11.1. Market Snapshot

11.2. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Mounting Type, 2017-2031

11.2.1. Ground

11.2.2. Rooftop

11.2.3. Floating

11.3. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Technology, 2017-2031

11.3.1. Concentrated Solar Power

11.3.2. Photovoltaic

11.4. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By End-user, 2017-2031

11.4.1. Residential

11.4.2. Commercial

11.4.3. Industrial

11.5. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Mounting Type

11.6.2. By Technology

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Analysis and Forecast

12.1. Market Snapshot

12.2. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Mounting Type, 2017-2031

12.2.1. Ground

12.2.2. Rooftop

12.2.3. Floating

12.3. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Technology, 2017-2031

12.3.1. Concentrated Solar Power

12.3.2. Photovoltaic

12.4. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By End-user, 2017-2031

12.4.1. Residential

12.4.2. Commercial

12.4.3. Industrial

12.5. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Mounting Type

12.6.2. By Technology

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. South America Solar EPC (Engineering, Procurement, and Construction) Market Analysis and Forecast

13.1. Market Snapshot

13.2. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Mounting Type, 2017-2031

13.2.1. Ground

13.2.2. Rooftop

13.2.3. Floating

13.3. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Technology, 2017-2031

13.3.1. Concentrated Solar Power

13.3.2. Photovoltaic

13.4. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By End-user, 2017-2031

13.4.1. Residential

13.4.2. Commercial

13.4.3. Industrial

13.5. Solar EPC (Engineering, Procurement, and Construction) Market Size (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Rest of South America

13.6. Market Attractiveness Analysis

13.6.1. By Mounting Type

13.6.2. By Technology

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Solar EPC (Engineering, Procurement, and Construction) Market Competition Matrix - a Dashboard View

14.1.1. Global Solar EPC (Engineering, Procurement, and Construction) Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Anesco Ltd.

15.1.1. Overview

15.1.2. Mounting Type Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Bechtel Corporation

15.2.1. Overview

15.2.2. Mounting Type Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Belectric Solar & Battery Holding GmbH

15.3.1. Overview

15.3.2. Mounting Type Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Black & Veatch Holding Company

15.4.1. Overview

15.4.2. Mounting Type Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Blattner Energy

15.5.1. Overview

15.5.2. Mounting Type Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Canadian Solar

15.6.1. Overview

15.6.2. Mounting Type Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Core Development Group

15.7.1. Overview

15.7.2. Mounting Type Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Juwi AG

15.8.1. Overview

15.8.2. Mounting Type Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. LNB Renewable

15.9.1. Overview

15.9.2. Mounting Type Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Sterling and Wilson Pvt. Ltd.

15.10.1. Overview

15.10.2. Mounting Type Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Other Key Players

15.11.1. Overview

15.11.2. Mounting Type Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Mounting Type, 2017-2031

Table 2: Global Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 3: Global Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by End-user, 2017-2031

Table 4: Global Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Region, 2017-2031

Table 5: North America Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Mounting Type, 2017-2031

Table 6: North America Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 7: North America Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by End-user, 2017-2031

Table 8: North America Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 9: Europe Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Mounting Type, 2017-2031

Table 10: Europe Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 11: Europe Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by End-user, 2017-2031

Table 12: Europe Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 13: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Mounting Type, 2017-2031

Table 14: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 15: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by End-user, 2017-2031

Table 16: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 17: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Mounting Type, 2017-2031

Table 18: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 19: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by End-user, 2017-2031

Table 20: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 21: South America Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Mounting Type, 2017-2031

Table 22: South America Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 23: South America Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by End-user, 2017-2031

Table 24: South America Solar EPC (Engineering, Procurement, and Construction) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global Solar EPC (Engineering, Procurement, and Construction) Market

Figure 02: Porter Five Forces Analysis - Global Solar EPC (Engineering, Procurement, and Construction) Market

Figure 03: Technology Road Map - Global Solar EPC (Engineering, Procurement, and Construction) Market

Figure 04: Global Solar EPC (Engineering, Procurement, and Construction) Market, Value (US$ Bn), 2017-2031

Figure 05: Global Solar EPC (Engineering, Procurement, and Construction) Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 06: Global Solar EPC (Engineering, Procurement, and Construction) Market Projections by Mounting Type, Value (US$ Bn), 2017‒2031

Figure 07: Global Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Mounting Type, 2023‒2031

Figure 08: Global Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Mounting Type, 2023 and 2031

Figure 09: Global Solar EPC (Engineering, Procurement, and Construction) Market Projections by Technology, Value (US$ Bn), 2017‒2031

Figure 10: Global Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 11: Global Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Technology, 2023 and 2031

Figure 12: Global Solar EPC (Engineering, Procurement, and Construction) Market Projections by End-user, Value (US$ Bn), 2017‒2031

Figure 13: Global Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 14: Global Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by End-user, 2023 and 2031

Figure 15: Global Solar EPC (Engineering, Procurement, and Construction) Market Projections by Region, Value (US$ Bn), 2017‒2031

Figure 16: Global Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Region, 2023 and 2031

Figure 18: North America Solar EPC (Engineering, Procurement, and Construction) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 19: North America Solar EPC (Engineering, Procurement, and Construction) Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 20: North America Solar EPC (Engineering, Procurement, and Construction) Market Projections by Mounting Type Value (US$ Bn), 2017‒2031

Figure 21: North America Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Mounting Type, 2023‒2031

Figure 22: North America Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Mounting Type, 2023 and 2031

Figure 23: North America Solar EPC (Engineering, Procurement, and Construction) Market Projections by Technology (US$ Bn), 2017‒2031

Figure 24: North America Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 25: North America Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Technology, 2023 and 2031

Figure 26: North America Solar EPC (Engineering, Procurement, and Construction) Market Projections by End-user Value (US$ Bn), 2017‒2031

Figure 27: North America Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 28: North America Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by End-user, 2023 and 2031

Figure 29: North America Solar EPC (Engineering, Procurement, and Construction) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 30: North America Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 31: North America Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 32: Europe Solar EPC (Engineering, Procurement, and Construction) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 33: Europe Solar EPC (Engineering, Procurement, and Construction) Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 34: Europe Solar EPC (Engineering, Procurement, and Construction) Market Projections by Mounting Type Value (US$ Bn), 2017‒2031

Figure 35: Europe Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Mounting Type, 2023‒2031

Figure 36: Europe Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Mounting Type, 2023 and 2031

Figure 37: Europe Solar EPC (Engineering, Procurement, and Construction) Market Projections by Technology, Value (US$ Bn), 2017‒2031

Figure 38: Europe Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 39: Europe Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Technology, 2023 and 2031

Figure 40: Europe Solar EPC (Engineering, Procurement, and Construction) Market Projections by End-user, Value (US$ Bn), 2017‒2031

Figure 41: Europe Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 42: Europe Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by End-user, 2023 and 2031

Figure 43: Europe Solar EPC (Engineering, Procurement, and Construction) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 44: Europe Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 45: Europe Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 46: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 47: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 48: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Projections by Mounting Type Value (US$ Bn), 2017‒2031

Figure 49: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Mounting Type, 2023‒2031

Figure 50: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Mounting Type, 2023 and 2031

Figure 51: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Projections by Technology, Value (US$ Bn), 2017‒2031

Figure 52: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 53: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Technology, 2023 and 2031

Figure 54: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Projections by End-user, Value (US$ Bn), 2017‒2031

Figure 55: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 56: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by End-user, 2023 and 2031

Figure 57: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 58: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 59: Asia Pacific Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 60: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 61: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 62: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Projections by Mounting Type Value (US$ Bn), 2017‒2031

Figure 63: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Mounting Type, 2023‒2031

Figure 64: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Mounting Type, 2023 and 2031

Figure 65: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Projections by Technology, Value (US$ Bn), 2017‒2031

Figure 66: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 67: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Technology, 2023 and 2031

Figure 68: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Projections by End-user Value (US$ Bn), 2017‒2031

Figure 69: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 70: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by End-user, 2023 and 2031

Figure 71: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 72: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 73: Middle East & Africa Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 74: South America Solar EPC (Engineering, Procurement, and Construction) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 75: South America Solar EPC (Engineering, Procurement, and Construction) Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 76: South America Solar EPC (Engineering, Procurement, and Construction) Market Projections by Mounting Type Value (US$ Bn), 2017‒2031

Figure 77: South America Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Mounting Type, 2023‒2031

Figure 78: South America Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Mounting Type, 2023 and 2031

Figure 79: South America Solar EPC (Engineering, Procurement, and Construction) Market Projections by Technology, Value (US$ Bn), 2017‒2031

Figure 80: South America Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 81: South America Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Technology, 2023 and 2031

Figure 82: South America Solar EPC (Engineering, Procurement, and Construction) Market Projections by End-user Value (US$ Bn), 2017‒2031

Figure 83: South America Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 84: South America Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by End-user, 2023 and 2031

Figure 85: South America Solar EPC (Engineering, Procurement, and Construction) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 86: South America Solar EPC (Engineering, Procurement, and Construction) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 87: South America Solar EPC (Engineering, Procurement, and Construction) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 88: Global Solar EPC (Engineering, Procurement, and Construction) Market Competition

Figure 89: Global Solar EPC (Engineering, Procurement, and Construction) Market Company Share Analysis