The logistical considerations surrounding COVID-19 testing has become a part of the weekly routine for orthopedic surgeons. Although it is rare for patients to become COVID-19 positive, owing to scheduled osteochondral allograft (OCA) or the second stage of autologous chondrocyte implantation (ACI), it poses a problem when considering delivery of the expensive tissues. Mass vaccination drives are anticipated to reduce the burden of logistical and other regulatory restrictions.

Preventive measures, optimized manufacturing protocols, and post-graft release management options are growing popular in the soft tissue market. Stakeholders in the soft tissue market are increasing their communication between the surgical team and graft providers as a part of their optimized manufacturing protocols. Safe return of grafts, alternative options before wasting graft, and knowledge of liability for cost of grafts are being taken into consideration.

Companies Diverting Production Activities toward Artificial Scaffolds Due to Allograft Limitations

Allografts and xenografts are overcoming the limitations of autografts where the latter is subject to limited availability and donor-site morbidity. However, even allografts are prone to trigger immune rejection and disease transmission. Moreover, their osteoinductive potential is frequently impaired due to disruptive processing. Hence, companies in the soft tissue market are now increasing their research in alternative approaches with the help of artificial scaffolds that are specifically-designed to maintain physical integrity and promote bone ingrowth at the defect site.

Despite promising results in research for smart formulations to support improved control over growth factor release to bone regeneration sites, several of these ambitious materials are found to be limited only up to the animal study stage. As such, most of the activated devices that are being commercialized in clinics are based in allografts or collagen/tricalcium phosphate scaffolds. This is evident since collagen allografts are predicted to dominate the highest revenue share among all product types in the market during the assessment period.

The soft tissue market is expected to reach US$ 8.6 Bn by 2031. The custom 3D bone allograft block fabrication is a fast growing phenomenon in the market, as the digital technology has drastically improved all areas of modern medicine and will continue to do so in the upcoming decade. Growing demand for accurate treatment planning, decline in patient chair-side time, and greater surgical accuracy have fueled the demand for custom 3D bone allografts in the modern implant dentistry. Companies in the soft tissue market are taking advantage of such developments to gain a strong research base in platelet-rich fibrin (PRF), which is being favored in regenerative dentistry.

Tendon allografts hold promising potentials in ligament reconstruction procedures. Companies in the soft tissue market are increasing their production capacities in tendon allografts, since they simplify the surgical technique by negating the need to harvest autograft, whilst eliminating issues associated with donor site morbidity. Allograft tissue specialists, Hospital Innovations, are building their product portfolio in bone & BTB (bone–patellar tendon–bone) tendon allografts that help to accommodate multiple techniques and fixation options in primary & revision ligament reconstructions.

Manufacturers in the soft tissue market are also innovating in non-bone tendon allografts that are an excellent alternative to autograft for any ligament reconstruction procedure. High quality non-bone tendon allografts have the ability to accurately size match and allows the surgeon with flexibility to perform a variety of surgical techniques.

Apart from tendon and collagen allografts, companies in the soft tissue market are innovating in amniotic allografts. Surgenex® is gaining recognition as a producer and distributor of the highest quality of amniotic membrane tissue allograft in the healthcare industry. Manufacturers are taking cues from such innovations to increase the availability of amniotic allografts that are lightweight and flexible. This helps to provide a protective covering, offer ease of use, and reduce bulk at the site.

Unparalleled quality standards and serological testing are helping manufacturers in the soft tissue market to gain the FDA approval for products. Manufacturers are adopting processes that extract the membrane from the placental tissue, leaving only the amniotic membrane layer, which is dehydrated into a sheet-like product. Immunological properties in amniotic membranes help to offer benefits in regenerative medicine.

Osteochondral lesions are a tear or a fracture that involve damage to both the cartilage and underlying bone. Locate Bio - an orthobiologics-focused regenerative medicine company, has received the Breakthrough Device Designation from the U.S. FDA (Food and Drug Administration) for its biomimetic graft Chondro3 meant for osteochondral lesions.

The increasing number of knee arthroscopies performed in the U.S. each year involves a chondral lesion, which is translating into revenue opportunities for manufacturers in the global soft tissue market. Regenerative biomimetic grafts are being designed to address this growing unmet clinical need. Proprietary designs involving three-layered collagen-based biodegradable matrix that can be delivered in a single procedure are being preferred by clinicians. Manufacturers are increasing the availability of affordable biomimetic grafts that can be useful in outpatient settings.

Companies in the soft tissue market are bolstering their output capabilities in innovative cellular and tissue allografts to help surgeons heal their patients. AlloSource® - an allografts provider in the U.S. has announced that it is naming its new cellular and tissue allografts under the new brand AlloConnex™.

Tendon and ligament transplantation is being carried out through skilled hands of surgeons. Manufacturers in the soft tissue market are building their portfolio in tendon and ligament allografts to support a multitude of procedures that surgeons perform to connect patients back to their active lifestyles. They are increasing the availability of single strand, double strand double bundle, and pre-shaped configurations in tendon and ligament allografts that help to heal severe burns.

Analysts’ Viewpoint

The optimization of the logistical aspects of autologous cultured chondrocytes on porcine collagen membrane (MACI) and osteochondral allograft (OCA) surgery is becoming paramount amid the COVID-19 outbreak to avoid graft wastage. Implant surgeons are adopting custom printing 3D surgical guides in-office, following a plethora of growing courses available on the topic. The soft tissue market is slated to clock a favorable CAGR of ~7% during the forecast period. However, raw materials for tissue grafts require extensive screening to reduce the risk of disease transmission. Thus, to achieve this, stakeholders should process materials under strict cGMP (Current Good Manufacturing Practice) or ISO standards to ensure the safety, reproducibility, and scalability of the process.

The global soft tissue market was worth US$ 4.3 Mn and is projected to reach a value of US$ 8.59 Bn by the end of 2031

Soft tissue market is anticipated to grow at a CAGR of 7% during the forecast period

North America accounted for a major share of the global soft tissue market

The global soft tissue market is driven by better quality alternatives to autografts and technological advancements

Key players in the global soft tissue market include Corneat Vision, LinkoCare Life Sciences AB, Presbia plc, Bone Bank Allografts, MTF Biologics, CONMED Corporation, AlloSource, Arthrex, Inc., Zimmer Biomet Holdings, Inc., and RTI Surgical, Inc.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Global Soft Tissue Market Forecast

4.4. Global Soft Tissue Market Outlook

5. Market Outlook

5.1. Key Industry Events

5.2. Product Pricing Analysis, by Region

5.3. Impact of COVID-19 Pandemic

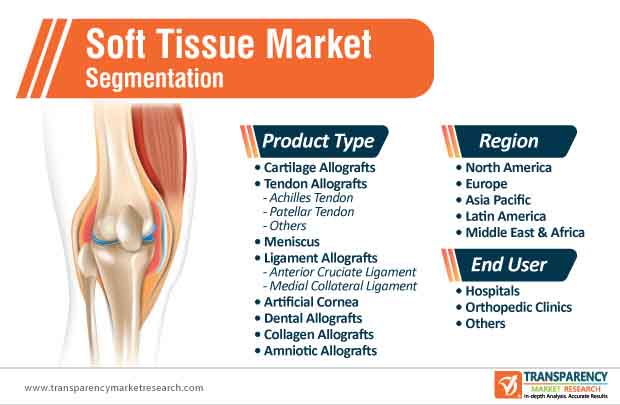

6. Global Soft Tissue Market Analysis, by Product Type

6.1. Introduction

6.2. Global Soft Tissue Market Value Share Analysis, by Product Type

6.3. Global Soft Tissue Market Forecast, by Product Type

6.3.1. Cartilage Allografts

6.3.2. Tendon Allografts

6.3.2.1. Achilles Tendon

6.3.2.2. Patellar Tendon

6.3.2.3. Others

6.3.3. Meniscus

6.3.4. Ligament Allografts

6.3.4.1. Anterior Cruciate Ligament

6.3.4.2. Medial Collateral ligament

6.3.5. Artificial Cornea

6.3.6. Dental Allografts

6.3.7. Collagen Allografts

6.3.8. Amniotic Allografts

6.4. Global Soft Tissue Market Analysis, by Product Type

6.5. Global Soft Tissue Market Attractiveness Analysis, by Product Type

7. Global Soft Tissue Market Analysis, by End-user

7.1. Introduction

7.2. Global Soft Tissue Market Value Share Analysis, by End-user

7.3. Global Soft Tissue Market Forecast, by End-user

7.3.1. Hospitals

7.3.2. Orthopedic Clinics

7.3.3. Others

7.4. Global Soft Tissue Market Analysis, by End-user

7.5. Global Soft Tissue Market Attractiveness Analysis, by End-user

8. Global Soft Tissue Market Analysis, by Region

9. Global Soft Tissue Market Analysis, by Region

9.1. Global Soft Tissue Market Value Share Analysis, by Region

9.2. Global Soft Tissue Market Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

10. North America Soft Tissue Market Analysis

10.1. North America Soft Tissue Market Overview

10.2. North America Soft Tissue Market Value Share and Attractiveness Analysis, by Country

10.3. North America Soft Tissue Market Forecast, by Country

10.3.1. U.S.

10.3.2. Canada

10.4. North America Soft Tissue Market Value Share and Attractiveness Analysis, by Product Type

10.5. North America Soft Tissue Market Forecast, by Product Type

10.5.1. Cartilage Allografts

10.5.2. Tendon Allografts

10.5.2.1. Achilles Tendon

10.5.2.2. Patellar Tendon

10.5.2.3. Others

10.5.3. Meniscus

10.5.4. Ligament Allografts

10.5.4.1. Anterior Cruciate Ligament

10.5.4.2. Medial Collateral ligament

10.5.5. Artificial Cornea

10.5.6. Dental Allografts

10.5.7. Collagen Allografts

10.5.8. Amniotic Allografts

10.6. North America Soft Tissue Market Value Share and Attractiveness Analysis, by End-user

10.7. North America Soft Tissue Market Forecast, by End-user

10.7.1. Hospitals

10.7.2. Orthopedic Clinics

10.7.3. Others

11. Europe Soft Tissue Market Analysis

11.1. Europe Soft Tissue Market Overview

11.2. Europe Soft Tissue Market Value Share and Attractiveness Analysis, by Country/Sub-region

11.3. Europe Soft Tissue Market Forecast, by Country/Sub-region

11.3.1. Germany

11.3.2. France

11.3.3. U.K.

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

11.4. Europe Soft Tissue Market Value Share and Attractiveness Analysis, by Product Type

11.5. Europe Soft Tissue Market Forecast, by Product Type

11.5.1. Cartilage Allografts

11.5.2. Tendon Allografts

11.5.3. Achilles Tendon

11.5.3.1. Patellar Tendon

11.5.3.2. Others

11.5.3.3. Meniscus

11.5.4. Ligament Allografts

11.5.4.1. Anterior Cruciate Ligament

11.5.4.2. Medial Collateral ligament

11.5.5. Artificial Cornea

11.5.6. Dental Allografts

11.5.7. Collagen Allografts

11.5.8. Amniotic Allografts

11.6. Europe Soft Tissue Market Value Share and Attractiveness Analysis, by End-user

11.7. Europe Soft Tissue Market Forecast, by End-user

11.7.1. Hospitals

11.7.2. Orthopedic Clinics

11.7.3. Others

12. Asia Pacific Soft Tissue Market Analysis

12.1. Asia Pacific Soft Tissue Market Overview

12.2. Asia Pacific Soft Tissue Market Value Share and Attractiveness Analysis, by Country/Sub-region

12.3. Asia Pacific Soft Tissue Market Forecast, by Country/Sub-region

12.3.1. China

12.3.2. Japan

12.3.3. India

12.3.4. Australia & New Zealand

12.3.5. Rest of Asia Pacific

12.4. Asia Pacific Soft Tissue Market Value Share and Attractiveness Analysis, by Product Type

12.5. Asia Pacific Soft Tissue Market Forecast, by Product Type

12.5.1. Cartilage Allografts

12.5.2. Tendon Allografts

12.5.2.1. Achilles Tendon

12.5.2.2. Patellar Tendon

12.5.2.3. Others

12.5.3. Meniscus

12.5.4. Ligament Allografts

12.5.4.1. Anterior Cruciate Ligament

12.5.4.2. Medial Collateral Ligament

12.5.5. Artificial Cornea

12.5.6. Dental Allografts

12.5.7. Collagen Allografts

12.5.8. Amniotic Allografts

12.6. Asia Pacific Soft Tissue Market Value Share and Attractiveness Analysis, by End-user

12.7. Asia Pacific Soft Tissue Market Forecast, by End-user

12.7.1. Hospitals

12.7.2. Orthopedic Clinics

12.7.3. Others

13. Latin America Soft Tissue Market Analysis

13.1. Latin America Soft Tissue Market Overview

13.2. Latin America Soft Tissue Market Value Share and Attractiveness Analysis, by Country/Sub-region

13.3. Latin America Soft Tissue Market Forecast, by Country/Sub-region

13.3.1. Brazil

13.3.2. Mexico

13.3.3. Rest of Latin America

13.4. Latin America Soft Tissue Market Value Share and Attractiveness Analysis, by Product Type

13.5. Latin America Soft Tissue Market Forecast, by Product Type

13.5.1. Cartilage Allografts

13.5.2. Tendon Allografts

13.5.2.1. Achilles Tendon

13.5.2.2. Patellar Tendon

13.5.2.3. Others

13.5.3. Meniscus

13.5.4. Ligament Allografts

13.5.4.1. Anterior Cruciate Ligament

13.5.4.2. Medial Collateral Ligament

13.5.5. Artificial Cornea

13.5.6. Dental Allografts

13.5.7. Collagen Allografts

13.5.8. Amniotic Allografts

13.6. Latin America Soft Tissue Market Value Share and Attractiveness Analysis, by End-user

13.7. Latin America Soft Tissue Market Forecast, by End-user

13.7.1. Hospitals

13.7.2. Orthopedic Clinics

13.7.3. Others

14. Middle East & Africa Soft Tissue Market Analysis

14.1. Middle East & Africa Soft Tissue Market Overview

14.2. Middle East & Africa Soft Tissue Market Value Share and Attractiveness Analysis, by Country/Sub-region

14.3. Middle East & Africa Soft Tissue Market Forecast, by Country/Sub-region

14.3.1. South Africa

14.3.2. GCC countries

14.3.3. Rest of Middle East & Africa

14.4. Middle East & Africa Soft Tissue Market Value Share and Attractiveness Analysis, by Product Type

14.5. Middle East & Africa Soft Tissue Market Forecast, by Product Type

14.5.1. Cartilage Allografts

14.5.2. Tendon Allografts

14.5.2.1. Achilles Tendon

14.5.2.2. Patellar Tendon

14.5.2.3. Others

14.5.3. Meniscus

14.5.4. Ligament Allografts

14.5.4.1. Anterior Cruciate Ligament

14.5.4.2. Medial Collateral Ligament

14.5.5. Artificial Cornea

14.5.6. Dental Allografts

14.5.7. Collagen Allografts

14.5.8. Amniotic Allografts

14.6. Middle East & Africa Soft Tissue Market Value Share and Attractiveness Analysis, by End-user

14.7. Middle East & Africa Soft Tissue Market Forecast, by End-user

14.7.1. Hospitals

14.7.2. Orthopedic Clinics

14.7.3. Others

15. Competition Landscape

15.1. Competition Matrix

15.2. Company Profiles

15.2.1. Corneat Vision

15.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2. Product Portfolio

15.2.1.3. SWOT Analysis

15.2.1.4. Strategic Overview

15.2.2. LinkoCare Life Sciences AB.

15.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2. Product Portfolio

15.2.2.3. SWOT Analysis

15.2.2.4. Strategic Overview

15.2.3. Presbia plc

15.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.3.2. Product Portfolio

15.2.3.3. SWOT Analysis

15.2.3.4. Strategic Overview

15.2.4. Bone Bank Allografts

15.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.4.2. Product Portfolio

15.2.4.3. SWOT Analysis

15.2.4.4. Strategic Overview

15.2.5. MTF Biologics

15.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.5.2. Product Portfolio

15.2.5.3. SWOT Analysis

15.2.5.4. Strategic Overview

15.2.6. CONMED Corporation

15.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.6.2. Product Portfolio

15.2.6.3. Financial Overview

15.2.6.4. SWOT Analysis

15.2.6.5. Strategic Overview

15.2.7. AlloSource

15.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.7.2. Product Portfolio

15.2.7.3. SWOT Analysis

15.2.7.4. Strategic Overview

15.2.8. Arthrex, Inc.

15.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.8.2. Product Portfolio

15.2.8.3. SWOT Analysis

15.2.8.4. Strategic Overview

15.2.9. Zimmer Biomet Holdings, Inc.

15.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.9.2. Product Portfolio

15.2.9.3. Financial Overview

15.2.9.4. SWOT Analysis

15.2.9.5. Strategic Overview

15.2.10. RTI Surgical, Inc.

15.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.10.2. Product Portfolio

15.2.10.3. Financial Overview

15.2.10.4. SWOT Analysis

15.2.10.5. Strategic Overview

List of Tables

Table 01: Pricing Analysis, by Cartilage Allografts

Table 02: Pricing Analysis, by Ligament Allografts

Table 03: Pricing Analysis, by Meniscus

Table 04: Pricing Analysis, by Tendon Allografts

Table 05: Pricing Analysis, by Artificial Cornea

Table 06: Global Soft Tissue Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 07: Global Soft tissue Market Value (US$ Mn) Forecast, by Ligament Allografts, 2017–2031

Table 08: Global Soft tissue Market Value (US$ Mn) Forecast, by Tendon Allografts, 2017–2031

Table 09: Global Soft Tissue Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 10: Global Soft Tissue Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 11: North America Soft tissue Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 12: North America Soft tissue Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 13: North America Soft tissue Market Size (US$ Mn) Forecast, by Ligament Allografts, 2017–2031

Table 14: North America Soft tissue Market Size (US$ Mn) Forecast, by Tendon Allografts, 2017–2031

Table 15: North America Soft tissue Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Europe Soft tissue Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Europe Soft tissue Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 18: Europe Soft tissue Market Size (US$ Mn) Forecast, by Ligament Allografts, 2017–2031

Table 19: Europe Soft tissue Market Size (US$ Mn) Forecast, by Tendon Allografts, 2017–2031

Table 20: Europe Soft tissue Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Asia Pacific Soft tissue Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Asia Pacific Soft tissue Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 23: Asia Pacific Soft tissue Market Size (US$ Mn) Forecast, by Ligament Allografts, 2017–2031

Table 24: Asia Pacific Soft tissue Market Size (US$ Mn) Forecast, by Tendon Allografts, 2017–2031

Table 25: Asia Pacific Soft tissue Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Latin America Soft tissue Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Latin America Soft tissue Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 28: Latin America Soft tissue Market Size (US$ Mn) Forecast, by Ligament Allografts, 2017–2031

Table 29: Latin America Soft tissue Market Size (US$ Mn) Forecast, by Tendon Allografts, 2017–2031

Table 30: Latin America Soft tissue Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 31: Middle East & Africa Soft Tissue Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 32: Middle East & Africa Soft Tissue Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 33: Middle East & Africa Soft Tissue Market Size (US$ Mn) Forecast, by Ligament Allografts, 2017–2031

Table 34: Middle East & Africa Soft Tissue Market Size (US$ Mn) Forecast, by Tendon Allografts, 2017–2031

Table 35: Middle East & Africa Soft Tissue Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Soft Tissue Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Soft Tissue Market Value Share, by Product Type, 2020

Figure 03: Global Soft Tissue Market Value Share, by End-user, 2020

Figure 04: Global Soft Tissue Market Value Share, by Region, 2020

Figure 05: Global Soft Tissue Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 06: Global Soft Tissue Market Value (US$ Mn), by Cartilage Allografts, 2017–2031

Figure 07: Global Soft Tissue Market Value (US$ Mn), by Tendon Allografts, 2017–2031

Figure 08: Global Soft Tissue Market Value (US$ Mn), by Meniscus, 2017–2031

Figure 09: Global Soft Tissue Market Value (US$ Mn), by Ligament Allografts, 2017–2031

Figure 10: Global Soft Tissue Market Value (US$ Mn), by Artificial Cornea, 2017–2031

Figure 11: Global Soft Tissue Market Value (US$ Mn), by Dental Allografts, 2017–2031

Figure 12: Global Soft Tissue Market Value (US$ Mn), by Artificial Cornea, 2017–2031

Figure 13: Global Soft Tissue Market Value (US$ Mn), by Amniotic Allografts, 2017–2031

Figure 14: Global Soft Tissue Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 15: Global Soft Tissue Market Value Share Analysis, by End-user, 2020 and 2031

Figure 16: Global Soft Tissue Market Value (US$ Mn), by Hospitals, 2017–2031

Figure 17: Global Soft Tissue Market Value (US$ Mn), by Orthopedic Clinics, 2017–2031

Figure 18: Global Soft Tissue Market Value (US$ Mn), by Others, 2017–2031

Figure 19: Global Soft Tissue Market Attractiveness Analysis, by End-user, 2021–2031

Figure 20: Global Soft Tissue Market Value Share Analysis, by Region, 2020 and 2031

Figure 21: Global Soft Tissue Market Attractiveness Analysis, by Region, 2021-2031

Figure 22: North America Soft tissue Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 23: North America Soft tissue Market Value Share (%), by Country, 2020 and 2031

Figure 24: North America Soft tissue Market Attractiveness Analysis, by Country, 2021–2031

Figure 25: North America Soft tissue Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 26: North America Soft tissue Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 27: North America Soft tissue Market Value Share Analysis, by End-user, 2020 and 2031

Figure 28: North America Soft tissue Market Attractiveness Analysis, by End-user, 2021–2031

Figure 29: Europe Soft tissue Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 30: Europe Soft tissue Market Value Share (%), by Country/Sub-region, 2020 and 2031

Figure 31: Europe Soft tissue Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 32: Europe Soft tissue Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 33: Europe Soft tissue Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 34: Europe Soft tissue Market Value Share Analysis, by End-user, 2020 and 2031

Figure 35: Europe Soft tissue Market Attractiveness Analysis, by End-user, 2021–2031

Figure 36: Asia Pacific Soft tissue Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 37: Asia Pacific Soft tissue Market Value Share (%), by Country/Sub-region, 2020 and 2031

Figure 38: Asia Pacific Soft tissue Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 39: Asia Pacific Soft tissue Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 40: Asia Pacific Soft tissue Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 41: Asia Pacific Soft tissue Market Value Share Analysis, by End-user, 2020 and 2031

Figure 42: Asia Pacific Soft tissue Market Attractiveness Analysis, by End-user, 2021–2031

Figure 43: Latin America Soft tissue Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 44: Latin America Soft tissue Market Value Share (%), by Country/Sub-region, 2020 and 2031

Figure 45: Latin America Soft tissue Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 46: Latin America Soft tissue Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 47: Latin America Soft tissue Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 48: Latin America Soft tissue Market Value Share Analysis, by End-user, 2020 and 2031

Figure 49: Latin America Soft tissue Market Attractiveness Analysis, by End-user, 2021–2031

Figure 50: Middle East & Africa Soft Tissue Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 51: Middle East & Africa Soft Tissue Market Value Share (%), by Country/Sub-region, 2020 and 2031

Figure 52: Middle East & Africa Soft Tissue Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 53: Middle East & Africa Soft Tissue Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 54: Middle East & Africa Soft Tissue Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 55: Middle East & Africa Soft Tissue Market Value Share Analysis, by End-user, 2020 and 2031

Figure 56: Middle East & Africa Soft Tissue Market Attractiveness Analysis, by End-user, 2021–2031

Figure 57: CONMED Corporation, Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2020

Figure 58: CONMED Corporation, R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2020

Figure 59: CONMED Corporation, Breakdown of Net Sales (%), by Region, 2020

Figure 60: CONMED Corporation, Breakdown of Net Sales (%), by Business Segment, 2020

Figure 61: Zimmer Biomet Holdings, Inc., Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2020

Figure 62: Zimmer Biomet Holdings, Inc., R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2020

Figure 63: Zimmer Biomet Holdings, Inc., Breakdown of Net Sales (%), by Region, 2020

Figure 64: Zimmer Biomet Holdings, Inc., Breakdown of Net Sales (%), by Product Category, 2020

Figure 65: RTI Surgical, Inc., Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 66: RTI Surgical, Inc., R& D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2017