Analysts’ Viewpoint

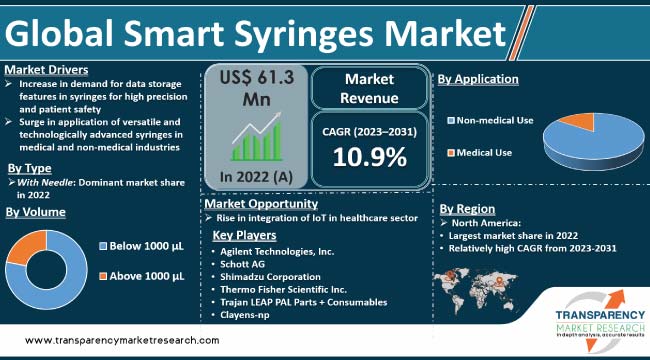

Increase in demand for data storage features in syringes and surge in application of versatile and technologically advanced syringes in medical and non-medical industries are driving the global smart syringes market. Growth in focus on patient safety and infection control has led to the adoption of smart syringes in the healthcare sector. Smart syringes help improve the precision of chemical measurements in the R&D sector. These syringes also enhance the accuracy of dosing in food production.

Surge in prevalence of chronic diseases, such as diabetes and autoimmune diseases, necessitates precise and regular usage of injections, thus fueling market growth. Furthermore, rise in integration of IoT in the healthcare sector is creating lucrative smart syringes market opportunities for manufacturers. Key players are developing innovative products that can be included in the larger digital health ecosystem.

The smart syringes industry encompasses a transformative approach to medical administration by integrating technology into syringes to store patient data and relevant information. These technologically advanced syringes are equipped with components such as RFID tags, sensors, and data storage capabilities, and are designed to enhance patient safety, precision, and healthcare efficiency.

Smart syringes offer benefits such as accurate medication dosing, real-time data monitoring, and automated recording of injection details. Automated syringes are particularly advantageous for patients requiring regular injections for chronic conditions. With needles and without needles are the two major types of smart syringes.

Increase in demand for patient-centered care, rise in need to minimize errors, and rapid progress in the sensor technology are key factors augmenting market growth. Smart syringes can be integrated into the broader digital healthcare landscape. Rise in non-medical application of smart syringes and advancements in sensor technology and data analytics are also fueling market progress.

Data collection and storage of information about the administration of medications is possible in syringes due to the integration of electronic chips or other sensing technologies into these syringes. Stored data provides useful information about patient health and treatment outcomes to healthcare professionals, thus assisting in better decision-making.

Smart syringes are capable of storing exact information such as medication type and dosage, time of delivery, and spot where the needle tip was inserted into the body. These syringes can help reduce medication errors and increase patient safety.

Smart syringes can also store patient-specific data, such as allergies and medical history, to guarantee that pharmaceuticals are administered correctly and safely. The electronic chip inside the syringe can securely store this data, and healthcare professionals can access it when needed.

Data storage capabilities of smart syringes can also enable healthcare professionals to track patient response to therapy. Healthcare professionals can modify treatment regimens and enhance patient outcomes by gathering information on drug adherence, dosage, and patient reaction.

Smart syringe is a relatively new and innovative technology that incorporates electronic chips or other data storage devices into its design. These syringes are equipped with sensors, microprocessors, and other electronic components that allow them to collect and store data about patients, medications, and other important information.

In the medical sector, smart syringes are being used to improve patient safety and reduce the risk of needlestick injuries. For instance, some smart syringes are designed to prevent the reuse of needles. This helps reduce the spread of infectious diseases.

Increase in demand for electronic medical records and other digital health solutions is boosting market dynamics. Smart syringes can be used to collect and store important patient data, such as medication dosages and injection times, which could then be uploaded into electronic medical records for easy access by healthcare providers.

Some companies are using smart syringes to improve the accuracy of dosing in food production, while others are using them to improve the precision of chemical measurements in research and development activities. These are the non-medical applications of smart syringes.

According to the latest research report on smart syringes market, the ‘with needle’ type segment is likely to lead the global industry during the forecast period. The segment can be further divided into fixed and exchangeable smart syringes.

Demand for safety syringes with needles is rising consistently across the globe. Advancement of features such as needle safety mechanisms, dosage tracking, and data logging is anticipated to propel the growth of the smart syringes industry in the next few years.

Exchangeable needles are widely used due to their potential to lower the risk of needle-related injuries. Additionally, syringes with exchangeable needles offer a range of safety and convenience benefits compared to traditional syringes with fixed needles. Furthermore, governments of countries around the world are increasingly promoting the usage of smart syringes with exchangeable needles.

Based on volume, the below 1000 μl volume segment is projected to dominate the global market in the near future.

Syringes with volume capacity below 1000 μl are extensively used for research and development activities in clinical and academic laboratories. Significant increase in need to administer accurate medication doses to patients suffering from chronic illnesses is fueling the segment.

Smart syringes with volume below 1000 μl are also used in clinical trials to administer experimental drugs.

According to smart syringes market analysis, the medical use application segment is anticipated to account for significant share of the global landscape during the forecast period.

Rise in cases of diabetes and asthma across the globe is likely to boost the demand for smart syringes in medical applications. Diabetes and asthma are chronic conditions necessitating regular medication of injections. Smart syringes can enhance injection safety, precision, and convenience.

Smart or intelligent syringes facilitate accurate medication dosing for diabetic patients. Smart syringes also help mitigate the risks associated with needlestick injuries and potential cross-contamination. Rise in prevalence of diabetes and asthma is fueling the adoption of smart syringes in the medical sector, thereby boosting the overall market dynamics.

North America dominated the global landscape in 2022. The region is anticipated to account for large market share during the forecast period, owing to the presence of significant number of suppliers and manufacturers in the region.

Partnerships between vendors and CMOs, pharmaceutical companies, and biotech firms have fostered an environment that is conducive to technological advancements. This has resulted in an increase in adoption of smart syringes in the region, thereby contributing to market development.

The smart syringes market size in Europe is projected to increase at a steady pace during the forecast period, owing to the rise in awareness about the advantages of advanced syringes in improving safety and effectiveness among healthcare providers and patients in the region.

Several universities and companies in Europe are actively engaged in pioneering the development of innovative techniques for cancer detection, diagnosis, and patient data storage. Rise in R&D activities is expected to fuel smart syringes market growth in the region during the forecast period.

Growth in elderly population in Asia Pacific is resulting in higher occurrence of conditions necessitating injections, such as diabetes and hepatitis, thereby increasing smart syringes market demand in the region.

The global landscape is fragmented, with the presence of a few leading players that control majority of the smart syringes market share. As per the latest smart syringes market forecast, these players are engaged in mergers & acquisitions, strategic collaborations, and new product launches to gain revenue benefits.

Some of the leading players in the global market are Agilent Technologies, Inc., Schott AG, Shimadzu Corporation, Thermo Fisher Scientific Inc., Trajan LEAP PAL Parts + Consumables, and Clayens-np. These companies are following the smart syringes market trends to avail lucrative revenue opportunities.

Key players have been profiled in the global smart syringes market report based on parameters such as company overview, financial summary, business strategies, product portfolio, business segments, and latest developments.

| Attribute | Details |

|---|---|

|

Market Value in 2022 |

US$ 61.3 Mn |

|

Forecast Value in 2031 |

More than US$ 152.3 Mn |

|

CAGR |

10.9% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

It was valued at US$ 61.3 Mn in 2022

It is projected to reach more than US$ 152.3 Mn by 2031

The CAGR is anticipated to be 10.9% from 2023 to 2031

North America is likely to hold major share during the forecast period

Agilent Technologies, Inc., Schott AG, Shimadzu Corporation, Thermo Fisher Scientific Inc., Trajan LEAP PAL Parts + Consumables, and Clayens-np

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Smart Syringes Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Smart Syringes Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Regulatory Scenario by Region/Globally

5.3. Key Industry Events

5.4. Overview & Analysis of Smart Needles

5.5. Covid-19 Impact Analysis

6. Global Smart Syringes Market Analysis and Forecast, By Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Type, 2017 - 2031

6.3.1. With Needle

6.3.1.1. Fixed

6.3.1.2. Exchangeable

6.3.2. Without Needle

6.4. Market Attractiveness By Type

7. Global Smart Syringes Market Analysis and Forecast, By Volume

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Volume, 2017 - 2031

7.3.1. Below 1000 µL

7.3.2. Above 1000 µL

7.4. Market Attractiveness By Volume

8. Global Smart Syringes Market Analysis and Forecast, By Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Application, 2017 - 2031

8.3.1. Medical Use

8.3.1.1. Drug Delivery

8.3.1.2. Blood Sample Collection

8.3.1.3. Vaccination

8.3.2. Non-medical Use

8.4. Market Attractiveness By Application

9. Global Smart Syringes Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America Smart Syringes Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Type, 2017 - 2031

10.2.1. With Needle

10.2.1.1. Fixed

10.2.1.2. Exchangeable

10.2.2. Without Needle

10.3. Market Value Forecast By Volume, 2017 - 2031

10.3.1. Below 1000 µL

10.3.2. Above 1000 µL

10.4. Market Value Forecast By Application, 2017 - 2031

10.4.1. Medical Use

10.4.1.1. Drug Delivery

10.4.1.2. Blood Sample Collection

10.4.1.3. Vaccination

10.4.2. Non-medical Use

10.5. Market Value Forecast By Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Volume

10.6.3. By Application

10.6.4. By Country

11. Europe Smart Syringes Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Type, 2017 - 2031

11.2.1. With Needle

11.2.1.1. Fixed

11.2.1.2. Exchangeable

11.2.2. Without Needle

11.3. Market Value Forecast By Volume, 2017 - 2031

11.3.1. Below 1000 µL

11.3.2. Above 1000 µL

11.4. Market Value Forecast By Application, 2017 - 2031

11.4.1. Medical Use

11.4.1.1. Drug Delivery

11.4.1.2. Blood Sample Collection

11.4.1.3. Vaccination

11.4.2. Non-medical Use

11.5. Market Value Forecast By Country/Sub-region, 2017 - 2031

11.5.1. U.K.

11.5.2. Germany

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Volume

11.6.3. By Application

11.6.4. By Country/Sub-region

12. Asia Pacific Smart Syringes Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Type, 2017 - 2031

12.2.1. With Needle

12.2.1.1. Fixed

12.2.1.2. Exchangeable

12.2.2. Without Needle

12.3. Market Value Forecast By Volume, 2017 - 2031

12.3.1. Below 1000 µL

12.3.2. Above 1000 µL

12.4. Market Value Forecast By Application, 2017 - 2031

12.4.1. Medical Use

12.4.1.1. Drug Delivery

12.4.1.2. Blood Sample Collection

12.4.1.3. Vaccination

12.4.2. Non-medical Use

12.5. Market Value Forecast By Country/Sub-region, 2017 - 2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of APAC

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Volume

12.6.3. By Application

12.6.4. By Country/Sub-region

13. Latin America Smart Syringes Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Type, 2017 - 2031

13.2.1. With Needle

13.2.1.1. Fixed

13.2.1.2. Exchangeable

13.2.2. Without Needle

13.3. Market Value Forecast By Volume, 2017 - 2031

13.3.1. Below 1000 µL

13.3.2. Above 1000 µL

13.4. Market Value Forecast By Application, 2017 - 2031

13.4.1. Medical Use

13.4.1.1. Drug Delivery

13.4.1.2. Blood Sample Collection

13.4.1.3. Vaccination

13.4.2. Non-medical Use

13.5. Market Value Forecast By Country/Sub-region, 2017 - 2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of LATAM

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Volume

13.6.3. By Application

13.6.4. By Country/Sub-region

14. Middle East & Africa Smart Syringes Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Type, 2017 - 2031

14.2.1. With Needle

14.2.1.1. Fixed

14.2.1.2. Exchangeable

14.2.2. Without Needle

14.3. Market Value Forecast By Volume, 2017 - 2031

14.3.1. Below 1000 µL

14.3.2. Above 1000 µL

14.4. Market Value Forecast By Application, 2017 - 2031

14.4.1. Medical Use

14.4.1.1. Drug Delivery

14.4.1.2. Blood Sample Collection

14.4.1.3. Vaccination

14.4.2. Non-medical Use

14.5. Market Value Forecast By Country/Sub-region, 2017 - 2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle Eat & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Volume

14.6.3. By Application

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of companies)

15.2. Company Profiles

15.2.1. Agilent Technologies, Inc.

15.2.1.1. Company Overview

15.2.1.2. Financial Overview

15.2.1.3. Product Portfolio

15.2.1.4. Business Strategies

15.2.1.5. Recent Developments

15.2.2. Schott AG

15.2.2.1. Company Overview

15.2.2.2. Financial Overview

15.2.2.3. Product Portfolio

15.2.2.4. Business Strategies

15.2.2.5. Recent Developments

15.2.3. Shimadzu Corporation

15.2.3.1. Company Overview

15.2.3.2. Financial Overview

15.2.3.3. Product Portfolio

15.2.3.4. Business Strategies

15.2.3.5. Recent Developments

15.2.4. Thermo Fisher Scientific Inc.

15.2.4.1. Company Overview

15.2.4.2. Financial Overview

15.2.4.3. Product Portfolio

15.2.4.4. Business Strategies

15.2.4.5. Recent Developments

15.2.5. Trajan LEAP PAL Parts + Consumables

15.2.5.1. Company Overview

15.2.5.2. Financial Overview

15.2.5.3. Product Portfolio

15.2.5.4. Business Strategies

15.2.5.5. Recent Developments

15.2.6. Clayens-np

15.2.6.1. Company Overview

15.2.6.2. Financial Overview

15.2.6.3. Product Portfolio

15.2.6.4. Business Strategies

15.2.6.5. Recent Developments

List of Tables

Table 01: Global Smart Syringes Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 02: Global Smart Syringes Market Value (US$ Mn) Forecast, by With Needle, 2017-2031

Table 03: Global Smart Syringes Market Value (US$ Mn) Forecast, by Volume, 2017-2031

Table 04: Global Smart Syringes Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 05: Global Smart Syringes Market Value (US$ Mn) Forecast, by Medical Use, 2017-2031

Table 06: Global Smart Syringes Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 07: North America Smart Syringes Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 08: North America Smart Syringes Market Value (US$ Mn) Forecast, by With Needle, 2017-2031

Table 09: North America Smart Syringes Market Value (US$ Mn) Forecast, by Volume, 2017-2031

Table 10: North America Smart Syringes Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 11: North America Smart Syringes Market Value (US$ Mn) Forecast, by Medical Use, 2017-2031

Table 12: North America Smart Syringes Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 13: Europe Smart Syringes Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 14: Europe Smart Syringes Market Value (US$ Mn) Forecast, by With Needle, 2017-2031

Table 15: Europe Smart Syringes Market Value (US$ Mn) Forecast, by Volume, 2017-2031

Table 16: Europe Smart Syringes Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 17: Europe Smart Syringes Market Value (US$ Mn) Forecast, by Medical Use, 2017-2031

Table 18: Europe Smart Syringes Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017-2031

Table 19: Asia Pacific Smart Syringes Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 20: Asia Pacific Smart Syringes Market Value (US$ Mn) Forecast, by With Needle, 2017-2031

Table 21: Asia Pacific Smart Syringes Market Value (US$ Mn) Forecast, by Volume, 2017-2031

Table 22: Asia Pacific Smart Syringes Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 23: Asia Pacific Smart Syringes Market Value (US$ Mn) Forecast, by Medical Use, 2017-2031

Table 24: Asia Pacific Smart Syringes Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017-2031

Table 25: Rest of World Smart Syringes Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 26: Rest of World Smart Syringes Market Value (US$ Mn) Forecast, by With Needle, 2017-2031

Table 27: Rest of World Smart Syringes Market Value (US$ Mn) Forecast, by Volume, 2017-2031

Table 28: Rest of World Smart Syringes Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 29: Rest of World Smart Syringes Market Value (US$ Mn) Forecast, by Medical Use, 2017-2031

List of Figures

Figure 01: Global Smart Syringes Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Smart Syringes Market Value Share, by Type, 2022

Figure 03: Smart Syringes Market Value Share, by Volume, 2022

Figure 04: Smart Syringes Market Value Share, by Application, 2022

Figure 05: Smart Syringes Market Value Share, by Region, 2022

Figure 06: Global Smart Syringes Market Value Share Analysis, by Type, 2022 and 2031

Figure 07: Global Smart Syringes Market Attractiveness Analysis, by Type, 2023-2031

Figure 08: Global Smart Syringes Market Value (US$ Mn), by With Needle, 2017-2031

Figure 09: Global Smart Syringes Market Value (US$ Mn), by Without Needle, 2017-2031

Figure 10: Global Smart Syringes Market Value Share Analysis, by Volume, 2022 and 2031

Figure 11: Global Smart Syringes Market Attractiveness Analysis, by Volume, 2023-2031

Figure 12: Global Smart Syringes Market Value (US$ Mn), by Below 1000 μl, 2017-2031

Figure 13: Global Smart Syringes Market Value (US$ Mn), by Above 1000 μl, 2017-2031

Figure 14: Global Smart Syringes Market Value Share Analysis, by Application, 2022 and 2031

Figure 15: Global Smart Syringes Market Attractiveness Analysis, by Application, 2023-2031

Figure 16: Global Smart Syringes Market Revenue (US$ Mn), by Medical Use, 2017-2031

Figure 17: Global Smart Syringes Market Revenue (US$ Mn), by Non-medical Use, 2017-2031

Figure 18: Global Smart Syringes Market Value Share Analysis, by Region, 2022 and 2031

Figure 19: Global Smart Syringes Market Attractiveness Analysis, by Region, 2023-2031

Figure 20: North America Smart Syringes Market Value (US$ Mn) Forecast, 2017-2031

Figure 21: North America Smart Syringes Market Value Share Analysis, by Type, 2022 and 2031

Figure 22: North America Smart Syringes Market Attractiveness Analysis, by Type, 2023-2031

Figure 23: North America Smart Syringes Market Value Share Analysis, by Volume, 2022 and 2031

Figure 24: North America Smart Syringes Market Attractiveness Analysis, by Volume, 2023-2031

Figure 25: North America Smart Syringes Market Value Share Analysis, by Application, 2022 and 2031

Figure 26: North America Smart Syringes Market Attractiveness Analysis, by Application, 2023-2031

Figure 27: North America Smart Syringes Market Value Share Analysis, by Country, 2022 and 2031

Figure 28: North America Smart Syringes Market Attractiveness Analysis, by Country, 2023-2031

Figure 29: Europe Smart Syringes Market Value (US$ Mn) Forecast, 2017-2031

Figure 30: Europe Smart Syringes Market Value Share Analysis, by Type, 2022 and 2031

Figure 31: Europe Smart Syringes Market Attractiveness Analysis, by Type, 2023-2031

Figure 32: Europe Smart Syringes Market Value Share Analysis, by Volume, 2022 and 2031

Figure 33: Europe Smart Syringes Market Attractiveness Analysis, by Volume, 2023-2031

Figure 34: Europe Smart Syringes Market Value Share Analysis, by Application, 2022 and 2031

Figure 35: Europe Smart Syringes Market Attractiveness Analysis, by Application, 2023-2031

Figure 36: Europe Smart Syringes Market Value Share Analysis, by Country/Sub-Region, 2022 and 2031

Figure 37: Europe Smart Syringes Market Attractiveness Analysis, by Country/Sub-Region, 2023-2031

Figure 38: Asia Pacific Smart Syringes Market Value (US$ Mn) Forecast, 2017-2031

Figure 39: Asia Pacific Smart Syringes Market Value Share Analysis, by Type, 2022 and 2031

Figure 40: Asia Pacific Smart Syringes Market Attractiveness Analysis, by Type, 2023-2031

Figure 41: Asia Pacific Smart Syringes Market Value Share Analysis, by Volume, 2022 and 2031

Figure 42: Asia Pacific Smart Syringes Market Attractiveness Analysis, by Volume, 2023-2031

Figure 43: Asia Pacific Smart Syringes Market Value Share Analysis, by Application, 2022 and 2031

Figure 44: Asia Pacific Smart Syringes Market Attractiveness Analysis, by Application, 2023-2031

Figure 45: Asia Pacific Smart Syringes Market Value Share Analysis, by Country/Sub-Region, 2022 and 2031

Figure 46: Asia Pacific Smart Syringes Market Attractiveness Analysis, by Country/Sub-Region, 2023-2031

Figure 47: Rest of World Smart Syringes Market Value (US$ Mn) Forecast, 2017-2031

Figure 48: Rest of World Smart Syringes Market Value Share Analysis, by Type, 2022 and 2031

Figure 49: Rest of World Smart Syringes Market Attractiveness Analysis, by Type, 2023-2031

Figure 50: Rest of World Smart Syringes Market Value Share Analysis, by Volume, 2022 and 2031

Figure 51: Rest of World Smart Syringes Market Attractiveness Analysis, by Volume, 2023-2031

Figure 52: Rest of World Smart Syringes Market Value Share Analysis, by Application, 2022 and 2031

Figure 53: Rest of World Smart Syringes Market Attractiveness Analysis, by Application, 2023-2031