Analyst Viewpoint

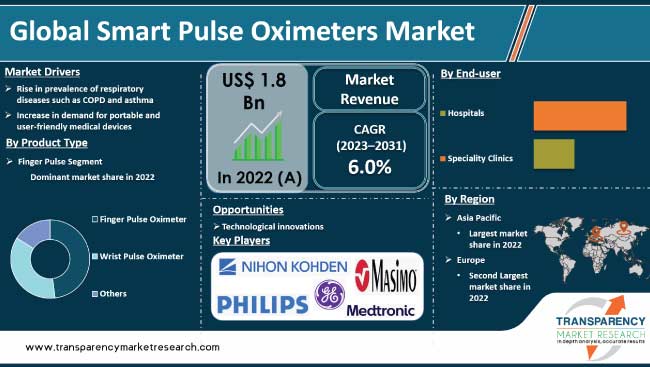

High incidence rate of cardiovascular & respiratory diseases across the world is driving the global smart pulse oximeters market. These are portable medical devices that measure pulse rate and oxygen saturation levels in blood. Rise in prevalence of respiratory diseases such as chronic obstructive pulmonary disease (COPD) and asthma is another major factor propelling market expansion. Furthermore, increase in demand for portable and user-friendly medical devices is expected to bolster the global pulse oximeters market size during the forecast period.

Advancements in technology, such as miniaturization, improved sensor accuracy, and integration with smartphones and wearable devices, offer lucrative opportunities to market players. Companies are focusing on developing convenient and accurate monitoring devices for respiratory conditions in order to increase market share.

Smart pulse oximeters are small, portable medical devices that can measure heart rate and the level of oxygen in blood. These devices are designed to be convenient and easy to use. These can also detect heart rate by measuring the changes in blood flow.

Smart pulse oximeters have become popular because they offer more than just basic readings. They often feature wireless connectivity, enabling to connect them to smartphone or other devices. Thus, patients can track oxygen levels and heart rate over time and share the data with healthcare provider or doctor.

Smart pulse oximeters are particularly useful for people with respiratory conditions such as asthma or chronic obstructive pulmonary disease (COPD). By regularly monitoring oxygen levels, patients can catch any potential issues early and take necessary actions.

During the COVID-19 pandemic, smart pulse oximeters gained even more attention. They were helpful for people who were recovering from the virus at home, as they could monitor their oxygen levels and check for significant changes that may require medical attention.

Smart pulse oximeters are handy devices that provide valuable information about oxygen levels and heart rate. These devices provide convenience and connectivity, allowing to take charge of health and seek appropriate medical care when needed.

High incidence rate of cardiovascular and respiratory diseases is expected to drive the smart pulse oximeters market demand during the forecast period. These diseases, including conditions such as heart disease, chronic obstructive pulmonary disease (COPD), and asthma, pose significant health risks and often require regular monitoring of vital signs, such as oxygen saturation levels and heart rate.

Cardiovascular diseases, such as heart attack and stroke, are the leading cause of death globally. According to the World Health Organization (WHO), an estimated 17.9 million people succumb to cardiovascular diseases each year.

Regular monitoring of oxygen levels and heart rate is crucial for individuals with cardiovascular conditions, as it helps in assessing the effectiveness of treatments, managing symptoms, and detecting any potential complications.

Smart pulse oximeters can provide individuals with respiratory diseases the ability to monitor their oxygen levels at home, allowing for early detection of any worsening symptoms or the need for medical intervention.

The COVID-19 pandemic has highlighted the importance of monitoring oxygen levels. The virus can cause severe respiratory complications, including pneumonia and acute respiratory distress syndrome (ARDS). In such cases, smart pulse oximeters have been used to monitor patients' oxygen saturation levels and identify the need for medical intervention. Thus, high incidence rate of cardiovascular and respiratory diseases is expected to bolster the smart pulse oximeters market growth.

Rise in demand for portable and user-friendly medical devices is expected to accelerate the global smart pulse oximeters industry growth. Patients and healthcare professionals alike are increasingly seeking devices that are convenient, easy to use, and can be easily integrated into their daily routines.

Portability is a crucial factor driving demand for smart pulse oximeters. These compact devices can be easily carried and used anywhere, allowing individuals to monitor their vital signs on the go.

Portability enables patients with chronic conditions to track their oxygen levels and heart rate regularly, even outside of clinical settings. It empowers individuals to take control of their health and make informed decisions about their well-being.

Demand for portable and user-friendly medical devices is further fueled by the growing trend of self-care and self-management of health. Patients are increasingly taking an active role in monitoring their vital signs and managing their conditions.

Smart pulse oximeters provide individuals with the capability to track their oxygen saturation levels and heart rate at their convenience, empowering them to make informed decisions about their health and seek timely medical intervention when needed.

Advancements in technology have led to the development of smart pulse oximeters with wireless connectivity and data tracking capabilities. These features enable seamless integration with smartphones, tablets, and wearable devices, allowing users to monitor their health metrics and share data with healthcare providers for better diagnosis and treatment decisions.

Hence, rise in demand for portable and user-friendly medical devices is expected to drive the smart pulse oximeters market value in the next few years.

In terms of product type, the finger pulse oximeter segment accounted for the largest global smart pulse oximeters market in 2022. Finger pulse oximeters are compact, handheld devices that are designed to be worn on the fingertip. These are widely used due to their ease of use, convenience, and accurate measurement capabilities.

Finger pulse oximeters are highly portable and user-friendly, making them suitable for both clinical and home settings. These oximeters are small and easy to carry. These can be quickly and comfortably placed on the fingertip for oxygen saturation and heart rate measurements.

Finger pulse oximeters also provide real-time readings, allowing for immediate monitoring and assessment of the patient's vital signs. This real-time feedback is particularly valuable in critical care settings, emergency situations, and during physical activities such as sports and fitness training.

Finger pulse oximeters are cost-effective compared to other types of pulse oximeters, making them more accessible to healthcare facilities, professionals, and individuals. Their affordability, combined with their accuracy and ease of use, has contributed to their widespread adoption and market dominance.

According to smart pulse oximeters market forecast, Asia Pacific dominated the global industry in 2022. This is ascribed to increase in focus on healthcare accessibility and rise in awareness about personal health monitoring. Asia Pacific also benefited from a rapidly expanding healthcare infrastructure, particularly in countries such as China and India.

Expansion of leading healthcare technology companies & research institutions and proactive regulatory environment have fueled the development and adoption of smart pulse oximeters in the region.

Increase in awareness about health & wellness and rise in prevalence of chronic diseases are accelerating demand for smart pulse oximeters market in Asia Pacific. Consumers in the region exhibit strong interest in leveraging technology to track and manage their health, which is contributing to the widespread adoption of wearable health devices. Moreover, significant consumer purchasing power and tech-savvy population are driving market expansion.

Leading players in the industry are adopting strategies such as mergers & acquisitions, strategic collaborations, and new product launches to expand presence and gain market share.

Contec Medical Systems Co., Ltd., Medtronic plc, GE Healthcare, Nihon Kohden Corporation, Koninklijke Philips N.V., Masimo, OMRON Corporation, ICU Medical, Inc. (Smiths Medical), Renesas Electronics Corporation., and Halma plc are the prominent players in the global market.

The smart pulse oximeters market report profiles the top players based on parameters such as company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 1.8 Bn |

| Forecast (Value) in 2031 | More than US$ 3.0 Bn |

| Growth Rate (CAGR) | 6.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.8 Bn in 2022

It is projected to reach more than US$ 3.0 Bn by 2031

It is expected to grow at a CAGR of 6.0% from 2023 to 2031

Rise in prevalence of respiratory diseases such as COPD & asthma and increase in demand for portable and user-friendly medical devices

Asia Pacific is projected to account for major share from 2023 to 2031.

Contec Medical Systems Co., Ltd., Medtronic plc, GE Healthcare, Nihon Kohden Corporation, Koninklijke Philips N.V., Masimo, OMRON Corporation, ICU Medical, Inc. (Smiths Medical), Renesas Electronics Corporation., and Halma plc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Smart Pulse Oximeters Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Smart Pulse Oximeters Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Disease Epidemiology

5.2. Major Technological Advancements

5.3. Key Industry Events (product launches/mergers, acquisitions & partnerships)

5.4. COVID-19 Pandemic Impact on Industry

6. Global Smart Pulse Oximeters Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value & Volume Forecast, by Product Type, 2017–2031

6.3.1. Finger Pulse Oximeter

6.3.1.1. Finger Pulse Oximeter

6.3.1.2. Finger Pulse Oximeter

6.3.2. Wrist Pulse Oximeter

6.3.3. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global Smart Pulse Oximeters Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Distribution Channel, 2017–2031

7.3.1. Online Stores

7.3.2. Retail Stores

7.4. Market Attractiveness Analysis, by Distribution Channel

8. Global Smart Pulse Oximeters Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Smart Pulse Oximeters Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value & Volume Forecast, by Product Type, 2017–2031

9.2.1. Finger Pulse Oximeter

9.2.1.1. Finger Pulse Oximeter

9.2.1.2. Finger Pulse Oximeter

9.2.2. Wrist Pulse Oximeter

9.2.3. Others

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Online Stores

9.3.2. Retail Stores

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By Distribution Channel

9.5.3. By Country

10. Europe Smart Pulse Oximeters Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value & Volume Forecast, by Product Type, 2017–2031

10.2.1. Finger Pulse Oximeter

10.2.1.1. Finger Pulse Oximeter

10.2.1.2. Finger Pulse Oximeter

10.2.2. Wrist Pulse Oximeter

10.2.3. Others

10.3. Market Value Forecast, by Distribution Channel, 2017–2031

10.3.1. Online Stores

10.3.2. Retail Stores

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By Distribution Channel

10.5.3. By Country/Sub-region

11. Asia Pacific Smart Pulse Oximeters Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value & Volume Forecast, by Product Type, 2017–2031

11.2.1. Finger Pulse Oximeter

11.2.1.1. Finger Pulse Oximeter

11.2.1.2. Finger Pulse Oximeter

11.2.2. Wrist Pulse Oximeter

11.2.3. Others

11.3. Market Value Forecast, by Distribution Channel, 2017–2031

11.3.1. Online Stores

11.3.2. Retail Stores

11.3.3. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By Distribution Channel

11.5.3. By Country/Sub-region

12. Latin America Smart Pulse Oximeters Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value & Volume Forecast, by Product Type, 2017–2031

12.2.1. Finger Pulse Oximeter

12.2.1.1. Finger Pulse Oximeter

12.2.1.2. Finger Pulse Oximeter

12.2.2. Wrist Pulse Oximeter

12.2.3. Others

12.3. Market Value Forecast, by Distribution Channel, 2017–2031

12.3.1. Online Stores

12.3.2. Retail Stores

12.3.3. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By Distribution Channel

12.5.3. By Country/Sub-region

13. Middle East & Africa Smart Pulse Oximeters Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value & Volume Forecast, by Product Type, 2017–2031

13.2.1. Finger Pulse Oximeter

13.2.1.1. Finger Pulse Oximeter

13.2.1.2. Finger Pulse Oximeter

13.2.2. Wrist Pulse Oximeter

13.2.3. Others

13.3. Market Value Forecast, by Distribution Channel, 2017–2031

13.3.1. Online Stores

13.3.2. Retail Stores

13.3.3. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product Type

13.5.2. By Distribution Channel

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Contec Medical Systems Co., Ltd.

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Medtronic plc

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. GE Healthcare

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Nihon Kohden Corporation

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Koninklijke Philips N.V.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Masimo

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. OMRON Corporation

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. ICU Medical, Inc. (Smiths Medical)

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Renesas Electronics Corporation

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Halma plc.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

List of Tables

Table 01: Global Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 03: Global Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 05: North America Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 06: North America Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: Europe Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 08: Europe Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Asia Pacific Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 11: Asia Pacific Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 12: Asia Pacific Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Latin America Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 14: Latin America Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 15: Latin America Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Middle East & Africa Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 17: Middle East & Africa Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 18: Middle East & Africa Smart Pulse Oximeters Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Smart Pulse Oximeters Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Smart Pulse Oximeters Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 03: Global Smart Pulse Oximeters Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 04: Global Smart Pulse Oximeters Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 05: Global Smart Pulse Oximeters Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 06: Global Smart Pulse Oximeters Market Value Share Analysis, by Region, 2022 and 2031

Figure 07: Global Smart Pulse Oximeters Market Attractiveness Analysis, by Region, 2023–2031

Figure 08: North America Smart Pulse Oximeters Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: North America Smart Pulse Oximeters Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 10: North America Smart Pulse Oximeters Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 11: North America Smart Pulse Oximeters Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 12: North America Smart Pulse Oximeters Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 13: North America Smart Pulse Oximeters Market Value Share Analysis, by Country, 2022 and 2031

Figure 14: North America Smart Pulse Oximeters Market Attractiveness Analysis, by Country, 2023–2031

Figure 15: Europe Smart Pulse Oximeters Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: Europe Smart Pulse Oximeters Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 17: Europe Smart Pulse Oximeters Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 18: Europe Smart Pulse Oximeters Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 19: Europe Smart Pulse Oximeters Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 20: Europe Smart Pulse Oximeters Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 21: Europe Smart Pulse Oximeters Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 22: Asia Pacific Smart Pulse Oximeters Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: Asia Pacific Smart Pulse Oximeters Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 24: Asia Pacific Smart Pulse Oximeters Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 25: Asia Pacific Smart Pulse Oximeters Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 26: Asia Pacific Smart Pulse Oximeters Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 27: Asia Pacific Smart Pulse Oximeters Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Asia Pacific Smart Pulse Oximeters Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Latin America Smart Pulse Oximeters Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Latin America Smart Pulse Oximeters Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 31: Latin America Smart Pulse Oximeters Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 32: Latin America Smart Pulse Oximeters Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 33: Latin America Smart Pulse Oximeters Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 34: Latin America Smart Pulse Oximeters Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Latin America Smart Pulse Oximeters Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 36: Middle East & Africa Smart Pulse Oximeters Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Middle East & Africa Smart Pulse Oximeters Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 38: Middle East & Africa Smart Pulse Oximeters Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 39: Middle East & Africa Smart Pulse Oximeters Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 40: Middle East & Africa Smart Pulse Oximeters Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 41: Middle East & Africa Smart Pulse Oximeters Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Middle East & Africa Smart Pulse Oximeters Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Global Smart Pulse Oximeters Market Share Analysis, by Company, 2021