Global Smart Lighting and Control Systems Market: Snapshot

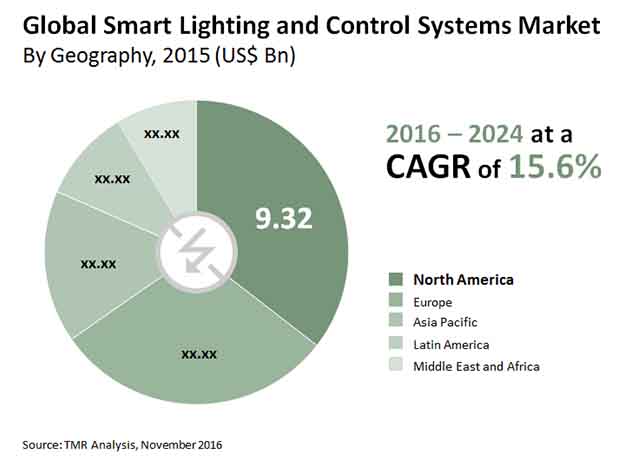

Smart lighting and control systems are being extensively used in several sectors as they offer exceptional energy-efficient along with automated control. The demand for these technologies and systems are expected to soar in times when energy consumption and its hazardous impact on the environment have become a heated debate. While the smart lighting solutions allow energy optimization, the control system permits users to control the luminance levels of lighting in accordance to the ambiance, intensity of daylight, infrastructure, and others such as occupancy, and physical presence. According to the research report, the global market is expected to be worth US$96.38 bn by the end of 2024 as compared to US$26.26 bn in 2015. The market is estimated to surge at a CAGR of 15.6% during the period from 2016 to 2024.

Adoption of Smart Technologies Improves Uptake

The global market has been witnessing a remarkable surge in the past few years due to the growing pressure of reducing the consumption of electricity. The need to create a sustainable environment by reducing the greenhouse gas emissions is also expected to spur the demand for these solutions and controls. Owing to these reasons, smart lighting and control systems are being deployed in industrial, commercial, and residential sectors. Furthermore, the increasing penetration of Internet of Things (IoT) and its integration with phones is also expected to boost the sales of smart lighting solutions and control systems. The market is also projected to receive a significant impact from the growing government initiatives to reduce conventional resource consumption is also providing impetus to the global market.

High Energy Savings with LEDs Keep Segment in Forefront

On the basis of lighting source, the market for smart lighting and control systems comprises high intensity discharge lamps, fluorescent lamps and compact fluorescent lamps, and light emitting diodes (LED). LED accounts for a significant share in the overall market owing to the fact that it is used across various lighting applications. This can be attributed to its features such as low carbon emission and high energy savings.

By way of end use, the smart lighting and control systems market includes commercial, residential, outdoor, and industrial lighting. Smart lighting and control systems are anticipated to find immense application in outdoor and residential lighting and these segments are likely to exhibit a strong growth rate over the coming years. The steadily rising demand for smart lighting in street lights and home automation is projected to aid the expansion of these segments.

North America to Continue Dominance in Global Market

On the basis of geography, the global market is segmented into North America, Europe, Latin America, Asia Pacific, and the Middle East and Africa. Of these geographies, North America is expected to show dominance in the overall market. The region’s dominance will be due to the high adoption of technology and increasing effort to curb the hazardous impact of electricity consumption on the environment. However, the research report suggests that emerging economies of Asia Pacific, South America, and the Middle East and Africa will also offer lucrative opportunities to the global market.

Some of the key players operating in the global smart lighting and control systems market are Acuity Brands Lighting, Inc., General Electric Company, Belkin International, Inc., Koninklijke Philips N.V., Eaton Corporation, Lightwave PLC, Elgato Systems, LiFI Labs, Inc., Lutron Electronics Company, Inc., and Honeywell International, Inc. The growing penetration of smart technologies across the world is projected to offer these companies lucrative opportunities in the coming few years.

Smart Lighting and Control Systems Market

Energy utilization examples of key businesses have improved over the previous decade. This owes to the foundation of improved practices at inherent levels. A portion of these practices remember expanded spending for smart lighting systems, data and instruction of representatives, and administrative components on the operational end. Every one of these moves has finished into sizable development openings for the worldwide smart lighting and control systems market.

The increasing adoption of Internet of things (IoT) and robotization advancements will assume a crucial part in driving business sector demand. Presence-detecting lights have been authorize as the most admirable innovation for saving energy. Emergency clinics and medical services places have rushed to enlist presence detecting lights in sitting zones and parlors. Besides, smart energy activities of governments have driven state-level specialists to utilize computerized lighting systems in government structures and public premises.

The worldwide market has been seeing a striking flood in the previous few years because of the developing pressing factor of decreasing the utilization of power. The need to establish a feasible climate by lessening the ozone harming substance outflows is additionally expected to prod the demand for these arrangements and controls. Inferable from these reasons, smart lighting and control systems are being sent in mechanical, business, and private areas. Moreover, the expanding infiltration of Internet of Things (IoT) and its incorporation with telephones is likewise expected to help the deals of smart lighting arrangements and control systems. The market is additionally projected to get a critical effect from the developing government activities to decrease customary asset utilization is likewise giving catalyst to the worldwide market.

The public area has become a vital beneficiary of smart innovations lately. The perspectives of workers in the public area have gone through sure changes. Moreover, instruction and data has assumed an imperative part in advocating smart innovations. Subsequently, the worldwide smart lighting and control systems market is projected to turn into a rewarding sanctuary in the years to come.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Smart Lighting and Control Systems Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Market Indicators

4.3.1. Smart Lighting and Control Systems Deployment in Emerging Economies

4.3.2. Smart Lighting and Control Systems Usage Targets – Global Supply Demand Scenario

4.4. Global Smart Lighting and Control Systems Market Analysis and Forecasts, 2014 – 2024

4.4.1. Market Revenue Projections (US$ Bn)

4.5. Porter’s Five Force Analysis

4.6. Value Chain Analysis

4.6.1. List of Active Market Participants (content providers/service providers/ distributors/vendors)

4.6.2. Forward – Backward Integration Scenario

4.7. Market Outlook

5. Global Smart Lighting and Control Systems Market Analysis and Forecasts, by Lighting Source

5.1. Overview & Definitions

5.2. Key Trends

5.3. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Lighting Source, 2014 - 2024

5.3.1. Fluorescent Lamps, Compact Fluorescent Lamps

5.3.2. High Intensity Discharge Lamps

5.3.3. Light Emitting Diodes

5.4. Lighting Source Comparison Matrix

5.5. Market Attractiveness by Lighting Source

6. Global Smart Lighting and Control Systems Market Analysis and Forecasts, by End-use Application

6.1. Overview & Definition

6.2. Key Trends

6.3. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by End-use Application, 2014 - 2024

6.3.1. Residential

6.3.2. Commercial

6.3.3. Industrial

6.3.4. Outdoor Lighting Applications

6.4. End-use Application Comparison Matrix

6.5. Market Attractiveness by End-use Application

7. Global Smart Lighting and Control Systems Market Analysis and Forecasts, by Control System

7.1. Overview & Definition

7.2. Key Trends

7.3. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Control System, 2014 - 2024

7.3.1. Smartphone Enabled

7.3.2. Daylight Sensing Technology

7.3.3. Proximity Sensing Technology

7.3.4. Others

7.4. Control System Comparison Matrix

7.5. Market Attractiveness by Control System

8. Global Smart Lighting and Control Systems Market Analysis and Forecasts, by Region

8.1. Key Findings

8.2. Policies and Regulations

8.3. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Region, 2014 - 2024

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Middle East and Africa

8.3.5. South America

8.4. Market Attractiveness by Region

9. North America Smart Lighting and Control Systems Market Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Lighting Source, 2014 - 2024

9.3.1. Fluorescent Lamps, Compact Fluorescent Lamps

9.3.2. High Intensity Discharge Lamps

9.3.3. Light Emitting Diodes

9.4. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by End-use Application, 2014 - 2024

9.4.1. Residential

9.4.2. Commercial

9.4.3. Industrial

9.4.4. Outdoor Lighting Applications

9.5. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Control System, 2014 - 2024

9.5.1. Smartphone Enabled

9.5.2. Daylight Sensing Technology

9.5.3. Proximity Sensing Technology

9.5.4. Others

9.6. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast By Country, 2014 - 2024

9.6.1. The U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Country

9.7.2. By Lighting Source

9.7.3. By End-use Application

9.7.4. By Control System

10. Europe Smart Lighting and Control Systems Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Lighting Source, 2014 - 2024

10.3.1. Fluorescent Lamps, Compact Fluorescent Lamps

10.3.2. High Intensity Discharge Lamps

10.3.3. Light Emitting Diodes

10.4. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by End-use Application, 2014 - 2024

10.4.1. Residential

10.4.2. Commercial

10.4.3. Industrial

10.4.4. Outdoor Lighting Applications

10.5. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Control System, 2014 - 2024

10.5.1. Smartphone Enabled

10.5.2. Daylight Sensing Technology

10.5.3. Proximity Sensing Technology

10.5.4. Others

10.6. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast By Country, 2014 - 2024

10.6.1. Germany

10.6.2. France

10.6.3. UK

10.6.4. Italy

10.6.5. Spain

10.6.6. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Country

10.7.2. By Lighting Source

10.7.3. By End-use Application

10.7.4. By Control System

11. Asia Pacific (APAC) Smart Lighting and Control Systems Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Lighting Source, 2014 - 2024

11.3.1. Fluorescent Lamps, Compact Fluorescent Lamps

11.3.2. High Intensity Discharge Lamps

11.3.3. Light Emitting Diodes

11.4. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by End-use Application, 2014 - 2024

11.4.1. Residential

11.4.2. Commercial

11.4.3. Industrial

11.4.4. Outdoor Lighting Applications

11.5. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Control System, 2014 - 2024

11.5.1. Smartphone Enabled

11.5.2. Daylight Sensing Technology

11.5.3. Proximity Sensing Technology

11.5.4. Others

11.6. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast By Country, 2014 - 2024

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. Australia

11.6.5. Rest of APAC

11.7. Market Attractiveness Analysis

11.7.1. By Country

11.7.2. By Lighting Source

11.7.3. By End-use Application

11.7.4. By Control System

12. Middle East and Africa (MEA) Smart Lighting and Control Systems Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Lighting Source, 2014 - 2024

12.3.1. Fluorescent Lamps, Compact Fluorescent Lamps

12.3.2. High Intensity Discharge Lamps

12.3.3. Light Emitting Diodes

12.4. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by End-use Application, 2014 - 2024

12.4.1. Residential

12.4.2. Commercial

12.4.3. Industrial

12.4.4. Outdoor Lighting Applications

12.5. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Control System, 2014 - 2024

12.5.1. Smartphone Enabled

12.5.2. Daylight Sensing Technology

12.5.3. Proximity Sensing Technology

12.5.4. Others

12.6. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast By Country, 2014 - 2024

12.6.1. UAE

12.6.2. Saudi Arabia

12.6.3. South Africa

12.6.4. Rest of MEA

12.7. Market Attractiveness Analysis

12.7.1. By Country

12.7.2. By Lighting Source

12.7.3. By End-use Application

12.7.4. By Control System

13. South America Smart Lighting and Control Systems Market Analysis and Forecast

13.1. Key Findings

13.2. Key Trends

13.3. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Lighting Source, 2014 - 2024

13.3.1. Fluorescent Lamps, Compact Fluorescent Lamps

13.3.2. High Intensity Discharge Lamps

13.3.3. Light Emitting Diodes

13.4. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by End-use Application, 2014 - 2024

13.4.1. Residential

13.4.2. Commercial

13.4.3. Industrial

13.4.4. Outdoor Lighting Applications

13.5. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast by Control System, 2014 - 2024

13.5.1. Smartphone Enabled

13.5.2. Daylight Sensing Technology

13.5.3. Proximity Sensing Technology

13.5.4. Others

13.6. Smart Lighting and Control Systems Market Size (US$ Bn) Forecast By Country, 2014 - 2024

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Country

13.7.2. By Lighting Source

13.7.3. By End-use Application

13.7.4. By Control System

14. Competition Landscape

14.1. Market Player – Competition Matrix

14.2. Market Share Analysis By Company (2015)

14.3. Company Profiles

14.3.1. General Electric Company

14.3.1.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.1.2. Market Presence, By Segment and Geography

14.3.1.3. Key Developments

14.3.1.4. Strategy

14.3.1.5. Revenue

14.3.2. Koninklijke Philips N.V

14.3.2.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.2.2. Market Presence, By Segment and Geography

14.3.2.3. Key Developments

14.3.2.4. Strategy

14.3.2.5. Revenue

14.3.3. Belkin International, Inc.

14.3.3.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.3.2. Market Presence, By Segment and Geography

14.3.3.3. Key Developments

14.3.3.4. Strategy

14.3.3.5. Revenue

14.3.4. Eaton Corporation

14.3.4.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.4.2. Market Presence, By Segment and Geography

14.3.4.3. Key Developments

14.3.4.4. Strategy

14.3.4.5. Revenue

14.3.5. Lightwave PLC

14.3.5.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.5.2. Market Presence, By Segment and Geography

14.3.5.3. Key Developments

14.3.5.4. Strategy

14.3.5.5. Revenue

14.3.6. Elgato Systems

14.3.6.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.6.2. Market Presence, By Segment and Geography

14.3.6.3. Key Developments

14.3.6.4. Strategy

14.3.6.5. Revenue

14.3.7. LiFI Labs, Inc.

14.3.7.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.7.2. Market Presence, By Segment and Geography

14.3.7.3. Key Developments

14.3.7.4. Strategy

14.3.7.5. Revenue

14.3.8. Honeywell International, Inc.

14.3.8.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.8.2. Market Presence, By Segment and Geography

14.3.8.3. Key Developments

14.3.8.4. Strategy

14.3.8.5. Revenue

14.3.9. Lutron Electronics Company, Inc.

14.3.9.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.9.2. Market Presence, By Segment and Geography

14.3.9.3. Key Developments

14.3.9.4. Strategy

14.3.9.5. Revenue

14.3.10. Acuity Brands Lighting, Inc.

14.3.10.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.10.2. Market Presence, By Segment and Geography

14.3.10.3. Key Developments

14.3.10.4. Strategy

14.3.10.5. Revenue

15. Key Takeaways

List of Tables

Table 01: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Lighting Source, 2014–2024

Table 02: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by End-use Application,

Table 03: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Control System, 2014 – 2024

Table 04: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Region, 2014 – 2024

Table 05: North America Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Lighting Source, 2014 – 2024

Table 06: North America Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by End-use Application, 2014 – 2024

Table 07: North America Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Control System, 2014 – 2024

Table 08: North America Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Country, 2014 – 2024

Table 09: Europe Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Lighting Source, 2014 – 2024

Table 10: Europe Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by End-use Application, 2014 – 2024

Table 11: Europe Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Control System, 2014 – 2024

Table 12: Europe Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Country, 2014 – 2024

Table 13: Asia Pacific Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Lighting Source, 2014 – 2024

Table 14: Asia Pacific Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by End-use Application, 2014 – 2024

Table 15: Asia Pacific Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Control System, 2014 – 2024

Table 16: Asia Pacific Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Country, 2014 – 2024

Table 17: MEA Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Lighting Source, 2014 – 2024

Table 18: MEA Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by End-use Application, 2014 – 2024

Table 19: MEA Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Control System, 2014 – 2024

Table 20: MEA Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Country, 2014 – 2024

Table 21: South America Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Lighting Source, 2014 – 2024

Table 22: South America Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by End-use Application, 2014 – 2024

Table 23: South America Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Control System, 2014 – 2024

Table 24: South America Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, by Country, 2014 – 2024

List of Figures

Figure 01: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, 2014 – 2024

Figure 02: Global Smart Lighting and Control Systems Market Y-o-Y Growth (Value %) Forecast, 2014 – 2024

Figure 03: Global Smart Lighting and Control Systems Market Value Share, by End-use Application (%), 2016

Figure 04: Global Smart Lighting and Control Systems Market Value Share, by Control System (%), 2016

Figure 05: Global Smart Lighting and Control Systems Market Value Share, by Lighting Source (%), 2016

Figure 06: Global Smart Lighting and Control Systems Market Opportunity Growth Analysis (US$ Bn), 2014 – 2024

Figure 07: Global Smart Lighting and Control Systems Market Value Share Analysis, by Lighting Source, 2016 and 2024

Figure 08: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast and Y-o-Y Growth Projection (%), by Fluorescent Lamps and Compact Fluorescent Lamps

Figure 09: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast and Y-o-Y Growth Projection (%), by High-intensity Discharge Lamps

Figure 10: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast and Y-o-Y Growth Projection (%), by Light-emitting Diodes

Figure 11: Global Smart Lighting and Control Systems Market Attractiveness, by Lighting Source (2015)

Figure 12: Global Smart Lighting and Control Systems Market Value Share Analysis, by End-use Application, 2016 and 2024

Figure 13: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast and Y-o-Y Growth Projection (%), by Residential

Figure 14: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast and Y-o-Y Growth Projection (%), by Commercial

Figure 15: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast and Y-o-Y Growth Projection (%), by Industrial

Figure 16: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast and Y-o-Y Growth Projection (%), by Outdoor Lighting Applications

Figure 17: Global Smart Lighting and Control Systems Market Attractiveness, by End-user Application (2015)

Figure 18: Global Smart Lighting and Control Systems Market Value Share Analysis, by Control System, 2016 and 2024

Figure 19: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast and Y-o-Y Growth Projection (%), by Smartphone Enabled Technology

Figure 20: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast and Y-o-Y Growth Projection (%), by Daylight Sensing Technology

Figure 21: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast and Y-o-Y Growth Projection (%), by Proximity Sensing Technology

Figure 22: Global Smart Lighting and Control Systems Market Size (US$ Bn) Forecast and Y-o-Y Growth Projection (%), by Others

Figure 23: Smart Lighting and Control Systems Market Attractiveness, by Control System (2015)

Figure 24: Global Smart Lighting and Control Systems Market Value Share Analysis, by Region, 2016 and 2024

Figure 25: Smart Lighting and Control Systems Market Attractiveness Analysis, by Region (2015)

Figure 26: North America Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, 2014 – 2024

Figure 27: North America Smart Lighting and Control Systems Market Y-o-Y Growth (Value %) Forecast, 2014 – 2024

Figure 28: North America Smart Lighting and Control Systems Market Value Share Analysis, by Lighting Source, 2016 and 2024

Figure 29: North America Smart Lighting and Control Systems Market Value Share Analysis, by End-use Application, 2016 and 2024

Figure 30: North America Smart Lighting and Control Systems Market Value Share Analysis, by Control System, 2016 and 2024

Figure 31: North America Smart Lighting and Control Systems Market Value Share Analysis, by Country, 2016 and 2024

Figure 32: North America Market Attractiveness Analysis, by End-user (2015)

Figure 33: North America Market Attractiveness Analysis, by Lighting Source (2015)

Figure 34: North America Market Attractiveness Analysis, by Control System (2015)

Figure 35: North America Market Attractiveness Analysis, by Country (2015)

Figure 36: Europe Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, 2014 – 2024

Figure 37: Europe Smart Lighting and Control Systems Market Y-o-Y Growth (Value %) Forecast, 2014 – 2024

Figure 38: Europe Smart Lighting and Control Systems Market Value Share Analysis, by Lighting Source, 2016 and 2024

Figure 39: Europe Smart Lighting and Control Systems Market Value Share Analysis, by End-use Application, 2016 and 2024

Figure 40: Europe Smart Lighting and Control Systems Market Value Share Analysis, by Control System, 2016 and 2024

Figure 41: Europe Smart Lighting and Control Systems Market Value Share Analysis, by Country, 2016 and 2024

Figure 42: Europe Market Attractiveness Analysis, by End-user (2015)

Figure 43: Europe Market Attractiveness Analysis, by Lighting Source (2015)

Figure 44: Europe Market Attractiveness Analysis, by Control System (2015)

Figure 45: Europe Market Attractiveness Analysis, by Country (2015)

Figure 46: Asia Pacific Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, 2014 – 2024

Figure 47: Asia Pacific Smart Lighting and Control Systems Market Y-o-Y Growth (Value %) Forecast, 2014 – 2024

Figure 48: Asia Pacific Smart Lighting and Control Systems Market Value Share Analysis, by Lighting Source, 2016 and 2024

Figure 49: Asia Pacific Smart Lighting and Control Systems Market Value Share Analysis, by End-use Application, 2016 and 2024

Figure 50: Asia Pacific Smart Lighting and Control Systems Market Value Share Analysis, by Control System, 2016 and 2024

Figure 51: Asia Pacific Smart Lighting and Control Systems Market Value Share Analysis, by Country, 2016 and 2024

Figure 52: Europe Market Attractiveness Analysis, by End-user (2015)

Figure 53: Europe Market Attractiveness Analysis, by Lighting Source (2015)

Figure 54: Europe Market Attractiveness Analysis, by Control System (2015)

Figure 55: Europe Market Attractiveness Analysis, by Country (2015)

Figure 56: MEA Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, 2014 – 2024

Figure 57: MEA Smart Lighting and Control Systems Market Y-o-Y Growth (Value %) Forecast, 2014 – 2024

Figure 58: MEA Smart Lighting and Control Systems Market Value Share Analysis, by Lighting Source, 2016 and 2024

Figure 59: MEA Smart Lighting and Control Systems Market Value Share Analysis, by End-use Application, 2016 and 2024

Figure 60: MEA Smart Lighting and Control Systems Market Value Share Analysis, by Control System, 2016 and 2024

Figure 61: MEA Smart Lighting and Control Systems Market Value Share Analysis, by Country, 2016 and 2024

Figure 62: MEA Market Attractiveness Analysis, by End-use Application (2015)

Figure 63: MEA Market Attractiveness Analysis, by Lighting Source (2015)

Figure 64: MEA Market Attractiveness Analysis, by Control System (2015)

Figure 65: MEA Market Attractiveness Analysis, by Country (2015)

Figure 66: South America Smart Lighting and Control Systems Market Size (US$ Bn) Forecast, 2014 – 2024

Figure 67: South America Smart Lighting and Control Systems Market Y-o-Y Growth (Value %) Forecast, 2014 – 2024

Figure 68: South America Smart Lighting and Control Systems Market Value Share Analysis, by Lighting Source, 2016 and 2024

Figure 69: South America Smart Lighting and Control Systems Market Value Share Analysis, by End-use Application, 2016 and 2024

Figure 70: South America Smart Lighting and Control Systems Market Value Share Analysis, by Control System, 2016 and 2024

Figure 71: South America Smart Lighting and Control Systems Market Value Share Analysis, by Country, 2016 and 2024

Figure 72: South America Market Attractiveness Analysis, by End-use Application (2015)

Figure 73: South America Market Attractiveness Analysis, by Lighting Source (2015)

Figure 74: South America Market Attractiveness Analysis, by Control System (2015)

Figure 75: South America Market Attractiveness Analysis, by Country (2015)

Figure 76: Global Smart Lighting and Control Systems Market Share Analysis by Company (2015)