Analysts’ Viewpoint on Smart Insulin Pens Market Scenario

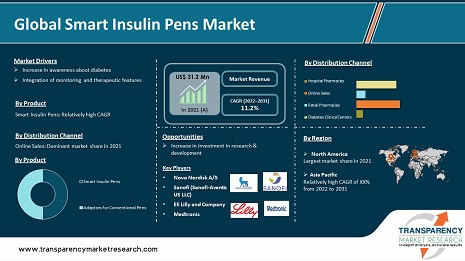

Smart insulin pens are used to deliver insulin for the treatment of type 1 and type 2 diabetes. These insulin pens have additional features such as memory function, time and dose recorder, and data transfer. Rise in prevalence of the two types of diabetes in children and adults, owing to obesity and changing lifestyle & dietary habits, is a key factor expected to drive the global smart insulin pens market in the next few years. Technological advancements and integration of glucose monitoring and therapeutics for better diabetes management are likely to propel the global smart insulin pen market during the forecast period. Manufacturers of smart insulin pens are regularly launching new products to broaden their revenue streams.

Smart insulin pen is a reusable injector pen that can be connected to a smartphone app, which helps diabetic patients to better manage insulin administration. Most diabetic patients have difficulty calculating their insulin dosage correctly. This can lead to insulin stacking. Adding more insulin while the rest of the insulin is still active in the body from previous doses can lead to hypoglycemia. Smart insulin pen can calculate each dose based on the current blood sugar level, carbohydrate amounts, meal size, active insulin, and settings prescribed by the doctor. It can also deliver accurate half-unit doses; help prevent skipped or missed doses; keep track of the time and amount of each dose; and remind a patient when it is time for the next one. The two types of insulin pen are disposable and reusable. Disposable pens are prefilled with insulin. These can be disposed when the insulin runs out. Reusable pen allows replacement of cartridge when empty. Overall, large number of people prefer insulin pens over syringes. It is easier to carry insulin pens and prepare doses for injection.

In 2022, the American Diabetes Association (ADA) updated its diabetes guidelines. For the first time, the ADA recommended insulin pens instead of vials and syringes. Newer devices, such as smart insulin pens, are likely to play a role in better management of diabetes, which is a chronic disease. A number of technologies have become available to help diabetic patients control their insulin usage over the last decade. Smart insulin pen can help patients adjust insulin doses, monitor blood sugar, and make dosage reminders. The global smart insulin pens market analysis indicates that different smart insulin pens are available based on patient convenience.

Diabetes is a leading cause of death globally. The prevalence of diabetes is increasing in the adult and pediatric population. In November 2018, the American Diabetes Association entered into a partnership with the American Heart Association to increase awareness about cardiovascular diseases caused due to type 2 diabetes.

Diabetes is a leading cause of death in India. The Ministry of Health and Family Welfare (MoHFW) launched mDiabetes, a mobile health initiative for the prevention and care of diabetes, in collaboration with the WHO Country Office for India and other partners. The Division of Diabetes and Translation, a department of the CDC, supports activities and programs that help prevent type 2 diabetes and improve patient health outcomes. In March 2015, NHS and Public Health England launched a National NHS Diabetes Prevention Program. Prevalence of type 2 diabetes has decreased in the U.K. through this program. The National Programme for Prevention and Control of Cancers, Diabetes, Cardiovascular Diseases, and Stroke is arranged by the National Health Mission. The program aims to strengthen the infrastructure, primary healthcare system, and health prevention. Thus, increase in awareness about diabetes is likely to drive the global smart insulin pens market share during the forecast period.

Smart insulin pens offer significant advantages in diabetes management. These pens carry additional features that help record the last dose of insulin. Taking insulin every day through a syringe and needle is quite difficult and stressful. Hence, patients prefer integrated technology. Usage of smartphone and the Internet for record tracking has increased due to advances in the device connectivity technology. Integrated technology helps detect the blood glucose level and calculate the insulin dose. Additionally, it provides a predetermined time interval for insulin administration. Self-collected information by a patient is transferred via smart technological tools and apps to physicians or medical professionals. For instance, InPen insulin pens are connected with smartwatches & armbands and smart apps, which help record physical activity and transfer the data to physicians.

Diabetes is a disease, in which a patient’s blood glucose level increases. Type 1 is insulin-dependent diabetes, while type 2 is non-insulin-dependent. A patient suffering from diabetes finds it quite painful and stressful to self-administer doses of insulin every day. Hence, patients are looking for pain-free, safe, cost-effective, and easy-to-handle novel insulin delivery technologies.

Smart insulin pens carry several advantages over conventional delivery. They provide better flexibility regarding the daily schedule and also improve the quality of life. These insulin pens can deliver accurate dosage of insulin. The memory feature of smart insulin pen can recall the timing and amount of the previous dose. Furthermore, the portable and convenient nature of pens is a key advantage over conventional delivery. Smart insulin pens save time, as they contain a pre-set insulin level and are prefilled. Administration of insulin with pens is time-saving and is highly preferred among children and older adults. These features of smart insulin pens lead to higher patient compliance.

Emerging technologies in smart insulin pens are projected to drive the global smart insulin pens market size during the forecast period. iSenz, an adaptor for smart insulin pens, has a feature to detect the insulin level by scanning. It provides the correct angles for injections in order to optimize the injection sites for diabetes. Easylog is an adaptor for insulin pens connected via the Internet. It provides the right dosage and offers better comfort to the patient for the treatment of chronic diseases such as diabetes. InsulCheck is a cap for insulin pens that contains a sensor to track pen usage and temperature.

In terms of product, the smart insulin pens market has been bifurcated into adaptors for conventional pens and smart insulin pens segments. The adaptors for conventional pens segment accounted for the leading share of the global market in 2021. The trend is anticipated to continue during the forecast period. Rise in prevalence of diabetes in people of all ages across the globe is projected to drive the segment during the forecast period.

Technological advancements such as memory function and accurate dosage administration are anticipated to augment the smart insulin pens segment during the forecast period.

North America accounted for major share of the global market in 2021. The market in the region is driven by the presence of key players and high rate of adoption of technologies. Rise in prevalence of diabetes and new product launches and approval are likely to propel the market in North America. The market in Europe is driven by the increase in prevalence of diabetes. According to the International Diabetes Federation, around 352 million people were at risk of developing type 2 diabetes in Europe in 2017. The smart insulin pens market in Asia Pacific is projected to grow at a rapid pace during the forecast period owing to the increase in geriatric population with diabetes in the region.

The global smart insulin pens market is highly fragmented, with the presence of a large number of players. Key players are expanding their footprint to strengthen their position in the global market. Prominent players operating in the global smart insulin pens market are Novo Nordisk A/S, Sanofi (Sanofi-Aventis US LLC), Eli Lilly and Company, Medtronic plc, Emperra GmbH, Bigfoot Biomedical, Jiangsu Deflu Medical Device Co. Ltd., Diamesco Co. Ltd., and Ypsomed Holding AG.

Each of these players has been profiled in the smart insulin pens market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 31.2 Mn |

|

Market Forecast Value in 2031 |

More than US$ 90.1 Mn |

|

Growth Rate (2022–2031) |

11.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, and a parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global smart insulin pens market was valued at US$ 31.2 Mn in 2021

The global smart insulin pens market is projected to reach more than US$ 90.1 Mn by 2031

The global smart insulin pens market grew at a CAGR of 4.0% from 2017 to 2021

The global smart insulin pens market is anticipated to grow at a CAGR of 11.2% from 2022 to 2031

The smart insulin pens segment held around 55% share of the global smart insulin pens market in 2021

Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Medtronic plc, Emperra GmbH, Bigfoot Biomedical, Jiangsu Deflu Medical Device Co. Ltd., Diamesco Co. Ltd., and Ypsomed Holding AG

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Smart Insulin Pens Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Smart Insulin Pens Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Type-I Diabetes Prevalence by region/globally

5.3. Regulatory Scenario by Region/globally

5.4. Key Industry Events (mergers, acquisitions, partnerships, etc.)

5.5. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Smart Insulin Pens Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Smart Insulin Pens

6.3.2. Adaptors for Conventional Pens

6.4. Market Attractiveness Analysis, by Product

7. Global Smart Insulin Pens Market Analysis and Forecast, by Connectivity Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Connectivity Type, 2017–2031

7.3.1. Bluetooth

7.3.2. USB

7.4. Market Attractiveness Analysis, by Connectivity Type

8. Global Smart Insulin Pens Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Type 1 Diabetes

8.3.2. Type 2 Diabetes

8.4. Market Attractiveness Analysis, by Application

9. Global Smart Insulin Pens Market Analysis and Forecast, by Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Diabetes Clinics/Centers

9.3.4. E-commerce

9.4. Market Attractiveness Analysis, by Distribution Channel

10. Global Smart Insulin Pens Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Smart Insulin Pens Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Smart Insulin Pens

11.2.2. Adaptors for Conventional Pens

11.3. Market Value Forecast, by Connectivity Type, 2017–2031

11.3.1. Bluetooth

11.3.2. USB

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Type 1 Diabetes

11.4.2. Type 2 Diabetes

11.5. Market Value Forecast, by Distribution Channel, 2017–2031

11.5.1. Hospital Pharmacies

11.5.2. Retail Pharmacies

11.5.3. Diabetes Clinics/Centers

11.5.4. E-commerce

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Connectivity Type

11.7.3. By Application

11.7.4. By Distribution Channel

11.7.5. By Country

12. Europe Smart Insulin Pens Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Smart Insulin Pens

12.2.2. Adaptors for Conventional Pens

12.3. Market Value Forecast, by Connectivity Type, 2017–2031

12.3.1. Bluetooth

12.3.2. USB

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Type 1 Diabetes

12.4.2. Type 2 Diabetes

12.5. Market Value Forecast, by Distribution Channel, 2017–2031

12.5.1. Hospital Pharmacies

12.5.2. Retail Pharmacies

12.5.3. Diabetes Clinics/Centers

12.5.4. E-commerce

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Connectivity Type

12.7.3. By Application

12.7.4. By Distribution Channel

12.7.5. By Country/Sub-region

13. Asia Pacific Smart Insulin Pens Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Smart Insulin Pens

13.2.2. Adaptors for Conventional Pens

13.3. Market Value Forecast, by Connectivity Type, 2017–2031

13.3.1. Bluetooth

13.3.2. USB

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Type 1 Diabetes

13.4.2. Type 2 Diabetes

13.5. Market Value Forecast, by Distribution Channel, 2017–2031

13.5.1. Hospital Pharmacies

13.5.2. Retail Pharmacies

13.5.3. Diabetes Clinics/Centers

13.5.4. E-commerce

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Connectivity Type

13.7.3. By Application

13.7.4. By Distribution Channel

13.7.5. By Country/Sub-region

14. Latin America Smart Insulin Pens Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Smart Insulin Pens

14.2.2. Adaptors for Conventional Pens

14.3. Market Value Forecast, by Connectivity Type, 2017–2031

14.3.1. Bluetooth

14.3.2. USB

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Type 1 Diabetes

14.4.2. Type 2 Diabetes

14.5. Market Value Forecast, by Distribution Channel, 2017–2031

14.5.1. Hospital Pharmacies

14.5.2. Retail Pharmacies

14.5.3. Diabetes Clinics/Centers

14.5.4. E-commerce

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Connectivity Type

14.7.3. By Application

14.7.4. By Distribution Channel

14.7.5. By Country/Sub-region

15. Middle East & Africa Smart Insulin Pens Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product, 2017–2031

15.2.1. Smart Insulin Pens

15.2.2. Adaptors for Conventional Pens

15.3. Market Value Forecast, by Connectivity Type, 2017–2031

15.3.1. Bluetooth

15.3.2. USB

15.4. Market Value Forecast, by Application, 2017–2031

15.4.1. Type 1 Diabetes

15.4.2. Type 2 Diabetes

15.5. Market Value Forecast, by Distribution Channel, 2017–2031

15.5.1. Hospital Pharmacies

15.5.2. Retail Pharmacies

15.5.3. Diabetes Clinics/Centers

15.5.4. E-commerce

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product

15.7.2. By Connectivity Type

15.7.3. By Application

15.7.4. By Distribution Channel

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis, by Company, 2021

16.3. Company Profiles

16.3.1. Novo Nordisk A/S

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Sanofi (Sanofi-Aventis US LLC)

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Eli Lilly and Company

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Medtronic plc

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Emperra GmbH

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Bigfoot Biomedical

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Jiangsu Deflu Medical Device Co. Ltd.

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Diamesco Co. Ltd.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Ypsomed Holding AG

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

List of Tables

Table 01: Global Smart Insulin Pens Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Smart Insulin Pens Market Value (US$ Mn) Forecast, by Connectivity Type, 2017–2031

Table 03: Global Smart Insulin Pens Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global Smart Insulin Pens Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 05: Global Smart Insulin Pens Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Smart Insulin Pens Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Smart Insulin Pens Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 08: North America Smart Insulin Pens Market Value (US$ Mn) Forecast, by Connectivity Type, 2017–2031

Table 09: North America Smart Insulin Pens Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 10: North America Smart Insulin Pens Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 12: Europe Smart Insulin Pens Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 13: Europe Smart Insulin Pens Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 14: Europe Smart Insulin Pens Market Value (US$ Mn) Forecast, by Connectivity Type, 2017–2031

Table 15: Europe Smart Insulin Pens Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Europe Smart Insulin Pens Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 17: Asia Pacific Smart Insulin Pens Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 18: Asia Pacific Smart Insulin Pens Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Asia Pacific Smart Insulin Pens Market Value (US$ Mn) Forecast, by Connectivity Type, 2017–2031

Table 20: Asia Pacific Smart Insulin Pens Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 21: Asia Pacific Smart Insulin Pens Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 22: Latin America Smart Insulin Pens Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 23: Latin America Smart Insulin Pens Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 24: Latin America Smart Insulin Pens Market Value (US$ Mn) Forecast, by Connectivity Type, 2017–2031

Table 25: Latin America Smart Insulin Pens Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 26: Latin America Smart Insulin Pens Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 27: Middle East & Africa Smart Insulin Pens Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 28: Middle East & Africa Smart Insulin Pens Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 29: Middle East & Africa Smart Insulin Pens Market Value (US$ Mn) Forecast, by Connectivity, Type 2017–2031

Table 30: Middle East & Africa Smart Insulin Pens Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 31: Middle East & Africa Smart Insulin Pens Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

List of Figures

Figure 01: Global Smart Insulin Pens Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Smart Insulin Pens Market Value Share, by Product, 2021

Figure 03: Global Smart Insulin Pens Market Value Share, by Connectivity Type, 2021

Figure 04: Global Smart Insulin Pens Market Value Share, by Application, 2021

Figure 05: Global Smart Insulin Pens Market Value Share, by Distribution Channel, 2021

Figure 06: Global Smart Insulin Pens Market, by Product, 2021 and 2031

Figure 07: Global Smart Insulin Pens Market Attractiveness Analysis, by Smart Insulin Pen, 2021–2031

Figure 08: Global Smart Insulin Pens Market Attractiveness Analysis, by Adaptors for Conventional Pens, 2021–2031

Figure 09: Global Smart Insulin Pens Market, by Connectivity Type, 2021 and 2031

Figure 10: Global Smart Insulin Pens Market Attractiveness Analysis, by Connectivity Type, 2021–2031

Figure 11: Global Smart Insulin Pens Market Attractiveness Analysis, by Bluetooth, 2021–2031

Figure 12: Global Smart Insulin Pens Market Attractiveness Analysis, by USB, 2021–2031

Figure 13: Global Smart Insulin Pens Market, by Application, 2021 and 2031

Figure 14: Global Smart Insulin Pens Market Attractiveness Analysis, by Application, 2021–2031

Figure 15: Global Smart Insulin Pens Market (US$ Mn), by Type 1 Diabetes, 2017–2031

Figure 16: Global Smart Insulin Pens Market (US$ Mn), by Type 2 Diabetes, 2017–2031

Figure 17: Global Smart Insulin Pens Market, by Distribution Channel, 2021 and 2031

Figure 18: Global Smart Insulin Pens Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 19: Global Smart Insulin Pens Market (US$ Mn), by Hospital Pharmacies, 2017–2031

Figure 20: Global Smart Insulin Pens Market (US$ Mn), by Online Sales, 2017–2031

Figure 21: Global Smart Insulin Pens Market (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 22: Global Smart Insulin Pens Market (US$ Mn), by Diabetes Clinics/Centers, 2017–2031

Figure 23: Global Smart Insulin Pens Market Value Share Analysis, by Region, 2021 and 2031

Figure 24: Global Smart Insulin Pens Market Attractiveness Analysis, by Region, 2017–2031

Figure 25: North America Smart Insulin Pens Market Value (US$ Mn) Forecast, 2017–2031

Figure 26: North America Smart Insulin Pens Market Value Share Analysis, by Country, 2021 and 2031

Figure 27: North America Smart Insulin Pens Market Attractiveness Analysis, by Country, 2021–2031

Figure 28: North America Smart Insulin Pens Market Value Share Analysis, by Product, 2021 and 2031

Figure 29: North America Smart Insulin Pens Market Attractiveness Analysis, by Product, 2021–2031

Figure 30: North America Smart Insulin Pens Market Value Share Analysis, by Connectivity Type, 2021 and 2031

Figure 31: North America Smart Insulin Pens Market Attractiveness Analysis, by Connectivity Type, 2021–2031

Figure 32: North America Smart Insulin Pens Market Value Share Analysis, by Application, 2021 and 2031

Figure 33: North America Smart Insulin Pens Market Attractiveness Analysis, by Application, 2021–2031

Figure 34: North America Smart Insulin Pens Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 35: North America Smart Insulin Pens Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 36: Europe Smart Insulin Pens Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Europe Smart Insulin Pens Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 38: Europe Smart Insulin Pens Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 39: Europe Smart Insulin Pens Market Value Share Analysis, by Product, 2021 and 2031

Figure 40: Europe Smart Insulin Pens Market Attractiveness Analysis, by Product, 2021–2031

Figure 41: Europe Smart Insulin Pens Market Value Share Analysis, by Connectivity Type, 2021 and 2031

Figure 42: Europe Smart Insulin Pens Market Attractiveness Analysis, by Connectivity Type, 2021–2031

Figure 43: Europe Smart Insulin Pens Market Value Share Analysis, by Application, 2021 and 2031

Figure 44: Europe Smart Insulin Pens Market Attractiveness Analysis, by Application, 2021–2031

Figure 45: Europe Smart Insulin Pens Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 46: Europe Smart Insulin Pens Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 47: Asia Pacific Smart Insulin Pens Market Value (US$ Mn) Forecast, 2017–2031

Figure 48: Asia Pacific Smart Insulin Pens Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 49: Asia Pacific Smart Insulin Pens Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 50: Asia Pacific Smart Insulin Pens Market Value Share Analysis, by Product, 2021 and 2031

Figure 51: Asia Pacific Smart Insulin Pens Market Attractiveness Analysis, by Product, 2021–2031

Figure 52: Asia Pacific Smart Insulin Pens Market Value Share Analysis, by Connectivity Type, 2021 and 2031

Figure 53: Asia Pacific Smart Insulin Pens Market Attractiveness Analysis, by Connectivity Type, 2021–2031

Figure 54: Asia Pacific Smart Insulin Pens Market Value Share Analysis, by Application, 2021 and 2031

Figure 55: Asia Pacific Smart Insulin Pens Market Attractiveness Analysis, by Application, 2021–2031

Figure 56: Asia Pacific Smart Insulin Pens Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 57: Asia Pacific Smart Insulin Pens Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 58: Latin America Smart Insulin Pens Market Value (US$ Mn) Forecast, 2017–2031

Figure 59: Latin America Smart Insulin Pens Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 60: Latin America Smart Insulin Pens Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 61: Latin America Smart Insulin Pens Market Value Share Analysis, by Product, 2021 and 2031

Figure 62: Latin America Smart Insulin Pens Market Attractiveness Analysis, by Product, 2021–2031

Figure 63: Latin America Smart Insulin Pens Market Value Share Analysis, by Connectivity Type, 2021 and 2031

Figure 64: Latin America Smart Insulin Pens Market Attractiveness Analysis, by Connectivity Type, 2021–2031

Figure 65: Latin America Smart Insulin Pens Market Value Share Analysis, by Application, 2021 and 2031

Figure 66: Latin America Smart Insulin Pens Market Attractiveness Analysis, by Application, 2021–2031

Figure 67: Latin America Smart Insulin Pens Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 68: Latin America Smart Insulin Pens Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 69: Middle East & Africa Smart Insulin Pens Market Value (US$ Mn) Forecast, 2017–2031

Figure 70: Middle East & Africa Smart Insulin Pens Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 71: Middle East & Africa Smart Insulin Pens Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 72: Middle East & Africa Smart Insulin Pens Market Value Share Analysis, by Product, 2021 and 2031

Figure 73: Middle East & Africa Smart Insulin Pens Market Attractiveness Analysis, by Product, 2021–2031

Figure 74: Middle East & Africa Smart Insulin Pens Market Value Share Analysis, by Connectivity Type, 2021 and 2031

Figure 75: Middle East & Africa Smart Insulin Pens Market Attractiveness Analysis, by Connectivity Type, 2021–2031

Figure 76: Middle East & Africa Smart Insulin Pens Market Value Share Analysis, by Application, 2021 and 2031

Figure 77: Middle East & Africa Smart Insulin Pens Market Attractiveness Analysis, by Application, 2021–2031

Figure 78: Middle East & Africa Smart Insulin Pens Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 79: Middle East & Africa Smart Insulin Pens Market Attractiveness Analysis, by Distribution Channel, 2021–2031