Analysts’ Viewpoint

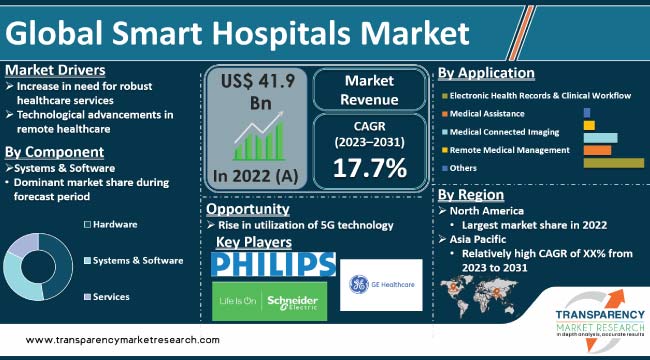

The global smart hospitals market is growing at a rapid pace by leveraging advanced technologies to enhance patient care, improve operational efficiency, and optimize resource utilization. Increase in demand for advanced healthcare services and rise in adoption of digital technologies are projected to spur smart hospitals market growth in the near future.

Surge in geriatric population and rise in prevalence of chronic diseases are also likely to boost market expansion in the next few years. Players in the smart hospitals industry are integrating various digital solutions, such as Internet of Things (IoT) devices, Artificial Intelligence (AI), big data analytics, cloud computing, and wearable devices, to broaden their customer base.

Smart hospitals are healthcare facilities that utilize advanced technologies and digital solutions to improve patient care, enhance operational efficiency, and optimize resource management.

Operational efficiency is enhanced through the use of smart systems for managing medical equipment, inventory, and workflow optimization. Digital hospitals employ digital communication tools and platforms that enable seamless collaboration and information exchange among healthcare professionals, thus leading to improved decision-making and coordinated care.

Benefits of smart hospitals include reduced medical errors, enhanced patient safety, improved treatment outcomes, increased efficiency, and cost savings. Smart hospitals contribute to the evolution of connected healthcare, enabling interoperability and data exchange between different healthcare systems and devices.

Intelligent health systems utilized in smart hospitals enable real-time monitoring of patient vital signs, remote patient monitoring, efficient management of medical equipment and supplies, streamlined communication between healthcare professionals, and personalized patient care.

Smart hospitals also use AI algorithms to analyze large volumes of patient data, thereby enabling early detection of diseases, predictive analytics for treatment outcomes, and personalized treatment plans.

Rise in geriatric population is boosting the need for robust healthcare services that can effectively address the complex medical needs of elderly individuals. Additionally, the burden of chronic diseases, such as diabetes, cardiovascular conditions, and respiratory disorders, is growing, necessitating innovative solutions to manage and treat these conditions efficiently. Thus, rise in demand for healthcare, primarily led by aging population and increase in prevalence of chronic diseases, is propelling the smart hospitals market development.

Smart hospitals offer several benefits that align with the evolving demand for healthcare. Remote patient monitoring is a crucial aspect of smart hospitals. It enables healthcare providers to monitor patients' health conditions outside of traditional clinical settings. This is particularly valuable for elderly patients or those with chronic diseases who require continuous monitoring and timely interventions. With the help of advanced technologies such as IoT devices and wearable sensors, healthcare professionals can remotely track patients' vital signs, medication adherence, and disease progression, thus ensuring early detection of complications and reducing the need for hospital visits.

Efficient resource allocation is a critical challenge faced by healthcare providers worldwide. Smart hospitals address this challenge by optimizing resource utilization through real-time data monitoring and analytics. By integrating IoT devices and AI-powered systems, healthcare facilities can effectively manage medical equipment, track inventory, and streamline workflows.

Smart hospitals enable better coordination among healthcare professionals by facilitating seamless communication and collaboration. This further enhances resource allocation and patient care, thus leading to reduced waiting times, improved operational efficiency, and cost savings.

Technological advancements and rise in demand for remote healthcare services are significantly boosting the demand for smart hospitals. Convergence of advanced technologies such as IoT, AI, big data analytics, and telemedicine has paved the way for the development of innovative healthcare solutions.

Smart hospitals leverage technological advancements to transform traditional healthcare facilities into digitally connected and intelligent environments. Integration of IoT devices enables real-time monitoring of patients’ vital signs, remote patient monitoring, and efficient management of medical equipment and supplies. This allows healthcare providers to deliver personalized and timely care, even outside of conventional clinical settings. Hence, technological advancements in remote healthcare are augmenting the smart hospitals market value.

AI plays a key role in smart hospitals by analyzing vast amounts of patient data to derive meaningful insights. AI algorithms can identify patterns, detect anomalies, and predict disease progression, thus enabling early diagnosis and personalized treatment plans. Furthermore, AI-powered chatbots and virtual assistants enhance patient engagement and provide round-the-clock support and information to patients.

Big data analytics in smart hospitals enable the aggregation and analysis of large volumes of patient data. This data-driven approach helps healthcare providers identify trends, optimize resource allocation, and deliver evidence-based care. It also supports research and population health management initiatives by identifying public health trends and predicting disease outbreaks.

Surge in demand for remote healthcare services is driving the smart hospitals market statistics. Telemedicine and remote patient monitoring have gained significant traction, especially in light of the COVID-19 pandemic.

Smart hospitals leverage telehealth technologies to provide virtual consultations, remote diagnosis, and continuous monitoring of patients’ health conditions. This enhances accessibility to healthcare services, particularly for individuals in remote areas, and reduces the burden on physical healthcare facilities.

According to the latest smart hospitals market trends, the systems & software component segment held the largest share in 2022. Systems and software refer to technological infrastructure and software solutions that form the backbone of smart hospitals.

Smart hospitals rely on advanced software systems to enable seamless integration, data management, and communication between various healthcare devices and systems. These software solutions facilitate real-time monitoring, data analysis, and decision-making, thus enhancing patient care and operational efficiency.

The systems & software segment encompasses a wide range of solutions, including electronic health record (EHR) systems, clinical decision support systems, telemedicine platforms, and patient monitoring systems. These solutions play a vital role in optimizing healthcare workflows, improving diagnostic accuracy, and enabling remote patient monitoring and virtual consultations.

Growth in focus on data-driven healthcare and surge in need for interoperability are driving the demand for robust software systems. Smart hospitals generate massive volumes of patient data, and efficient software solutions are required to capture, store, analyze, and interpret this data for enhanced clinical insights and informed decision-making.

Advancements in AI, machine learning, and big data analytics are also contributing to the growth of the systems & software segment. These technologies are integrated into smart hospital software systems to derive meaningful insights from patient data, automate processes, and enable predictive analytics.

According to the future analysis of the smart hospitals market, the super specialty services offered segment is projected to dominate the industry during the forecast period. Super specialty services refer to specialized medical services focused on specific areas or conditions such as cardiology, neurology, oncology, and orthopedics.

Advancements in medical technology and specialized treatments have expanded the scope of super specialty services. Smart hospitals equipped with advanced diagnostic and treatment facilities attract patients seeking specialized care, thus leading to increase in demand for these services.

Rise in prevalence of chronic diseases and complex medical conditions is fueling the need for specialized care. Super specialty services cater to the unique requirements of patients with specific medical conditions, providing them with targeted treatments, advanced procedures, and specialized expertise.

Integration of advanced technologies in super specialty services is enhancing treatment outcomes and patient experience. Smart hospitals utilize cutting-edge technologies such as robotic-assisted surgery, precision medicine, and image-guided therapies to deliver precise and personalized care to patients.

The wireless connectivity segment held the largest market share in 2022. Wireless connectivity facilitates the seamless integration and connectivity of various healthcare devices and systems. It involves various wireless communication technologies and infrastructure, such as wireless networks, protocols, and devices that enable data transmission and communication without the need for physical connections.

Wireless technologies play a vital role in smart hospitals by enabling real-time data monitoring, remote patient monitoring, and efficient communication among healthcare professionals. These technologies provide the flexibility and mobility required for healthcare devices to connect and transmit data securely, thus enhancing the delivery of care.

Wireless technologies help monitor patients' vital signs and health conditions remotely. Wireless sensors and wearable devices can collect and transmit data, such as heart rate, blood pressure, and oxygen levels, to healthcare providers in real-time, thus facilitating early detection of abnormalities and timely interventions.

Wireless communication also enables seamless integration of various healthcare devices and systems. Medical equipment, electronic health record systems, telemedicine platforms, and other smart hospital components can communicate and exchange data wirelessly, streamlining workflows and enhancing operational efficiency.

Wireless connectivity supports the growth of telemedicine and remote healthcare services. By leveraging wireless connectivity, healthcare providers can offer virtual consultations, remote diagnosis, and remote patient monitoring, thus expanding access to healthcare services, particularly in remote or underserved areas.

The medical connected imaging application segment accounted for the largest share in 2022. Medical connected imaging refers to the integration of imaging devices, such as X-rays, MRI, CT scans, and ultrasound, with digital platforms and networks. This integration enables seamless transmission, storage, and analysis of medical images, thus promoting efficient diagnosis, treatment planning, and collaboration among healthcare professionals.

Digitization of medical imaging has revolutionized the way healthcare providers capture, store, and share images. Digital imaging allows for faster image acquisition, eliminates the need for physical film processing, and enables immediate access to images from any location, thus enhancing workflow efficiency and patient care.

Advancements in connectivity and cloud computing have enabled the integration of imaging devices with digital platforms. This connectivity facilitates secure and real-time transmission of images to radiologists and specialists, regardless of their physical location. It enables remote interpretation, expert consultations, and second opinions, leading to faster and more accurate diagnoses.

Integration of AI in medical connected imaging is further boosting the segment. AI algorithms can analyze medical images, detect abnormalities, and assist radiologists in interpreting complex cases. This technology enhances diagnostic accuracy, reduces interpretation time, and improves patient outcomes.

According to the latest smart hospitals market forecast, North America is expected to constitute the largest share from 2023 to 2031. Rise in adoption of advanced healthcare technologies and strategic investments in these technologies are fueling the market dynamics of the region. Presence of a robust healthcare infrastructure and an extensive research and development ecosystem is also propelling market revenue in North America.

Renowned universities, cutting-edge research institutions, and forward-thinking healthcare companies are collaborating to pioneer ground-breaking technologies. Such an environment is fostering the development of integrated systems that seamlessly connect medical devices, electronic health records, and patient management systems, thus optimizing hospital operations and patient care.

Strong emphasis on data security and privacy in North America has helped establish trust among patients and healthcare providers. Stricter regulations and guidelines, such as Health Insurance Portability and Accountability Act (HIPAA), ensure confidentiality and integrity of patient information in smart hospitals. This commitment to safeguarding sensitive data has attracted both local and international stakeholders, reinforcing the region’s reputation as a safe haven for innovative healthcare solutions.

Surge in investment in development and deployment of cutting-edge technologies is boosting market progress in North America. Venture capitalists and private equity firms are recognizing the potential for high returns in the rapidly evolving smart hospitals business. They are funding the development and deployment of cutting-edge technologies, including IoT devices, AI algorithms, and telemedicine platforms. This enhances patient care, streamlines operations, and improves outcomes.

Smart hospitals in North America are partnering with other technology giants and healthcare providers to facilitate the integration of emerging technologies into existing medical practices, thereby ensuring a smooth transition to a more connected and efficient healthcare ecosystem.

The smart hospitals market in Asia Pacific is driven by surge in digitalization in the healthcare sector. Governments, tech companies, and healthcare providers in the region are collaborating to integrate advanced technologies, such as AI, IoT, and telemedicine, into medical services. This synergy aims to enhance patient care, optimize operational efficiency, and address healthcare challenges unique to the region.

Koninklijke Philips NV, GE Healthcare (General Electric), Medtronic PLC, Honeywell Life Care Solutions (Honeywell International Inc.), Stanley Healthcare, SAP SE, Microsoft Corporation, Allscripts Healthcare Solutions Inc., Cerner Corporation, McKesson Corporation, Schneider Electric Healthcare, and ThoughtWire Corp. are key entities operating in this industry.

Each of these players has been profiled in the global smart hospitals market report based on parameters such as company overview, product portfolio, business strategies, financial overview, and recent developments.

Players are investing in hybrid cloud and AI strategies to increase their smart hospitals market share. In January 2022, Francisco Partners announced the acquisition of IBM's healthcare data and analytics assets. This strategic acquisition provided Francisco Partners with an advanced platform to bolster its hybrid cloud and AI strategy in the healthcare sector.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 41.9 Bn |

|

Forecast Value in 2031 |

US$ 184.9 Bn |

|

Growth Rate (CAGR) |

17.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 41.9 Bn in 2022

It is projected to reach US$ 184.9 Bn by the end of 2031

It is anticipated to advance at a CAGR of 17.7% from 2023 to 2031

Increase in need for robust healthcare services and technological advancements in remote healthcare

The systems & software component segment accounted for more than 50.0% share in 2022

North America is expected to record the highest demand from 2023 to 2031

Koninklijke Philips NV, GE Healthcare (General Electric), Medtronic PLC, Honeywell Life Care Solutions (Honeywell International Inc.), Stanley Healthcare, SAP SE, Microsoft Corporation, Allscripts Healthcare Solutions Inc., Cerner Corporation, McKesson Corporation, Schneider Electric Healthcare, and ThoughtWire Corp.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Smart Hospitals Market

4. Market Overview

4.1. Introduction

4.1.1. Component Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Smart Hospitals Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Technological Advancements

5.2. Key Industry Events

5.3. Regulatory Scenario by Region/Globally

5.4. Top 3 Players Operating in Market Space

5.5. COVID-19 Pandemic Impact on Industry (Value Chain and Short/Mid/Long Term Impact)

6. Global Smart Hospitals Market Analysis and Forecast, by Component

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Component, 2017-2031

6.3.1. Hardware

6.3.2. Systems & Software

6.3.3. Services

6.4. Market Attractiveness Analysis, by Component

7. Global Smart Hospitals Market Analysis and Forecast, by Service Offered

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Service Offered, 2017-2031

7.3.1. General

7.3.2. Super Specialty

7.3.3. Others

7.4. Market Attractiveness Analysis, by Service Offered

8. Global Smart Hospitals Market Analysis and Forecast, by Connectivity

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Connectivity, 2017-2031

8.3.1. Wired

8.3.2. Wireless

8.4. Market Attractiveness Analysis, by Connectivity

9. Global Smart Hospitals Market Analysis and Forecast, by Application

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Application, 2017-2031

9.3.1. Electronic Health Records & Clinical Workflow

9.3.2. Medical Assistance

9.3.3. Medical Connected Imaging

9.3.4. Remote Medical Management

9.3.5. Others

9.4. Market Attractiveness Analysis, by Application

10. Global Smart Hospitals Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017-2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Country/Region

11. North America Smart Hospitals Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Component, 2017-2031

11.2.1. Hardware

11.2.2. Systems & Software

11.2.3. Services

11.3. Market Value Forecast, by Service Offered, 2017-2031

11.3.1. General

11.3.2. Super Specialty

11.3.3. Others

11.4. Market Value Forecast, by Connectivity, 2017-2031

11.4.1. Wired

11.4.2. Wireless

11.5. Market Value Forecast, by Application, 2017-2031

11.5.1. Electronic Health Records & Clinical Workflow

11.5.2. Medical Assistance

11.5.3. Medical Connected Imaging

11.5.4. Remote Medical Management

11.5.5. Others

11.6. Market Value Forecast, by Country/Sub-region, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Component

11.7.2. By Service Offered

11.7.3. By Connectivity

11.7.4. By Application

11.7.5. By Country/Sub-region

12. Europe Smart Hospitals Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Component, 2017-2031

12.2.1. Hardware

12.2.2. Systems & Software

12.2.3. Services

12.3. Market Value Forecast, by Service Offered, 2017-2031

12.3.1. General

12.3.2. Super Specialty

12.3.3. Others

12.4. Market Value Forecast, by Connectivity, 2017-2031

12.4.1. Wired

12.4.2. Wireless

12.5. Market Value Forecast, by Application, 2017-2031

12.5.1. Electronic Health Records & Clinical Workflow

12.5.2. Medical Assistance

12.5.3. Medical Connected Imaging

12.5.4. Remote Medical Management

12.5.5. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017-2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Component

12.7.2. By Service Offered

12.7.3. By Connectivity

12.7.4. By Application

12.7.5. By Country/Sub-region

13. Asia Pacific Smart Hospitals Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Component, 2017-2031

13.2.1. Hardware

13.2.2. Systems & Software

13.2.3. Services

13.3. Market Value Forecast, by Service Offered, 2017-2031

13.3.1. General

13.3.2. Super Specialty

13.3.3. Others

13.4. Market Value Forecast, by Connectivity, 2017-2031

13.4.1. Wired

13.4.2. Wireless

13.5. Market Value Forecast, by Application, 2017-2031

13.5.1. Electronic Health Records & Clinical Workflow

13.5.2. Medical Assistance

13.5.3. Medical Connected Imaging

13.5.4. Remote Medical Management

13.5.5. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017-2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Component

13.7.2. By Service Offered

13.7.3. By Connectivity

13.7.4. By Application

13.7.5. By Country/Sub-region

14. Latin America Smart Hospitals Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Component, 2017-2031

14.2.1. Hardware

14.2.2. Systems & Software

14.2.3. Services

14.3. Market Value Forecast, by Service Offered, 2017-2031

14.3.1. General

14.3.2. Super Specialty

14.3.3. Others

14.4. Market Value Forecast, by Connectivity, 2017-2031

14.4.1. Wired

14.4.2. Wireless

14.5. Market Value Forecast, by Application, 2017-2031

14.5.1. Electronic Health Records & Clinical Workflow

14.5.2. Medical Assistance

14.5.3. Medical Connected Imaging

14.5.4. Remote Medical Management

14.5.5. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Component

14.7.2. By Service Offered

14.7.3. By Connectivity

14.7.4. By Application

14.7.5. By Country/Sub-region

15. Middle East & Africa Smart Hospitals Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Component, 2017-2031

15.2.1. Hardware

15.2.2. Systems & Software

15.2.3. Services

15.3. Market Value Forecast, by Service Offered, 2017-2031

15.3.1. General

15.3.2. Super Specialty

15.3.3. Others

15.4. Market Value Forecast, by Connectivity, 2017-2031

15.4.1. Wired

15.4.2. Wireless

15.5. Market Value Forecast, by Application, 2017-2031

15.5.1. Electronic Health Records & Clinical Workflow

15.5.2. Medical Assistance

15.5.3. Medical Connected Imaging

15.5.4. Remote Medical Management

15.5.5. Others

15.6. Market Value Forecast, by Country/Sub-region, 2017-2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Component

15.7.2. By Service Offered

15.7.3. By Connectivity

15.7.4. By Application

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (By Tier and Size of Companies)

16.2. Market Share Analysis, by Company (2021)

16.3. Company Profiles

16.3.1. Koninklijke Philips NV

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. GE Healthcare (General Electric)

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Medtronic PLC

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Honeywell Life Care Solutions (Honeywell International Inc.)

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Stanley Healthcare

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. SAP SE

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Microsoft Corporation

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Allscripts Healthcare Solutions Inc.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Cerner Corporation

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. McKesson Corporation

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. Schneider Electric Healthcare

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Portfolio

16.3.11.3. Financial Overview

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

16.3.12. ThoughtWire Corp.

16.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.12.2. Product Portfolio

16.3.12.3. Financial Overview

16.3.12.4. SWOT Analysis

16.3.12.5. Strategic Overview

List of Tables

Table 01: Global Smart Hospitals Market Value (US$ Bn) Forecast, by Component, 2018-2030

Table 02: Global Smart Hospitals Market Value (US$ Bn) Forecast, by Service Offered, 2018-2030

Table 03: Global Smart Hospitals Market Value (US$ Bn) Forecast, by Connectivity, 2018-2030

Table 04: Global Smart Hospitals Market Value (US$ Bn) Forecast, by Application, 2018-2030

Table 05: Global Smart Hospitals Market Value (US$ Bn) Forecast, by Region, 2018-2030

Table 06: North America Smart Hospitals Market Value (US$ Bn) Forecast, by Country, 2018-2030

Table 07: North America Smart Hospitals Market Value (US$ Bn) Forecast, by Component, 2018-2030

Table 08: North America Smart Hospitals Market Value (US$ Bn) Forecast, by Service Offered, 2018-2030

Table 09: North America Smart Hospitals Market Value (US$ Bn) Forecast, by Connectivity, 2018-2030

Table 10: North America Smart Hospitals Market Value (US$ Bn) Forecast, by Application, 2018-2030

Table 11: Europe Smart Hospitals Market Value (US$ Bn) Forecast, by Country, 2018-2030

Table 12: Europe Smart Hospitals Market Value (US$ Bn) Forecast, by Component, 2018-2030

Table 13: Europe Smart Hospitals Market Value (US$ Bn) Forecast, by Service Offered, 2018-2030

Table 14: Europe Smart Hospitals Market Value (US$ Bn) Forecast, by Connectivity, 2018-2030

Table 15: Europe Smart Hospitals Market Value (US$ Bn) Forecast, by Application, 2018-2030

Table 16: Asia Pacific Smart Hospitals Market Value (US$ Bn) Forecast, by Country/Sub-region, 2018-2030

Table 17: Asia Pacific Smart Hospitals Market Value (US$ Bn) Forecast, by Component, 2018-2030

Table 18: Asia Pacific Smart Hospitals Market Value (US$ Bn) Forecast, by Services Offered, 2018-2030

Table 19: Asia Pacific Smart Hospitals Market Value (US$ Bn) Forecast, by Connectivity, 2018-2030

Table 20: Asia Pacific Smart Hospitals Market Value (US$ Bn) Forecast, by Application, 2018-2030

Table 21: Latin America Smart Hospitals Market Value (US$ Bn) Forecast, by Country/Sub-region, 2018-2030

Table 22: Latin America Smart Hospitals Market Value (US$ Bn) Forecast, by Component, 2018-2030

Table 23: Latin America Smart Hospitals Market Value (US$ Bn) Forecast, by Services Offered, 2018-2030

Table 24: Latin America Smart Hospitals Market Value (US$ Bn) Forecast, by Connectivity, 2018-2030

Table 25: Latin America Smart Hospitals Market Value (US$ Bn) Forecast, by Application, 2018-2030

Table 26: Middle East & Africa Smart Hospitals Market Value (US$ Bn) Forecast, by Country/Sub-region, 2018-2030

Table 27: Middle East & Africa Smart Hospitals Market Value (US$ Bn) Forecast, by Component, 2018-2030

Table 28: Middle East & Africa Smart Hospitals Market Value (US$ Bn) Forecast, by Services Offered, 2018-2030

Table 29: Middle East & Africa Smart Hospitals Market Value (US$ Bn) Forecast, by Connectivity, 2018-2030

Table 30: Middle East & Africa Smart Hospitals Market Value (US$ Bn) Forecast, by Application, 2018-2030

List of Figures

Figure 01: Global Smart Hospitals Market Value (US$ Bn) Forecast, 2017-2031

Figure 02: Global Smart Hospitals Market Value Share, by Component, 2022

Figure 03: Global Smart Hospitals Market Value Share, by Service Offered, 2022

Figure 04: Global Smart Hospitals Market Value Share, by Connectivity, 2022

Figure 05: Global Smart Hospitals Market Value Share, by Application, 2022

Figure 06: Global Smart Hospitals Market Value Share, by Region, 2022

Figure 07: Global Smart Hospitals Market Value Share Analysis, by Component, 2022 and 2030

Figure 08: Global Smart Hospitals Market Value (US$ Bn), by Hardware, 2017-2031

Figure 09: Global Smart Hospitals Market Value (US$ Bn), by Systems & Software, 2017-2031

Figure 10: Global Smart Hospitals Market Value (US$ Bn), by Services, 2017-2031

Figure 11: Global Smart Hospitals Market Attractiveness Analysis, by Component, 2020-2030

Figure 12: Global Smart Hospitals Market Value Share Analysis, by Service Offered, 2022 and 2030

Figure 13: Global Smart Hospitals Market Value (US$ Bn), by General, 2017-2031

Figure 14: Global Smart Hospitals Market Value (US$ Bn), by Super Specialty, 2017-2031

Figure 15: Global Smart Hospitals Market Value (US$ Bn), by Others, 2017-2031

Figure 16: Global Smart Hospitals Market Attractiveness Analysis, by Service Offered, 2020-2030

Figure 17: Global Smart Hospitals Market Value Share Analysis, by Connectivity, 2022 and 2030

Figure 18: Global Smart Hospitals Market Revenue (US$ Bn), by Wired, 2017-2031

Figure 19: Global Smart Hospitals Market Revenue (US$ Bn), by Wireless, 2017-2031

Figure 20: Global Smart Hospitals Market Attractiveness Analysis, by Connectivity, 2020-2030

Figure 21: Global Smart Hospitals Market Value Share Analysis, by Application, 2022 and 2030

Figure 22: Global Smart Hospitals Market Revenue (US$ Bn), by Electronic Health Records & Clinical Workflow, 2017-2031

Figure 23: Global Smart Hospitals Market Revenue (US$ Bn), by Medical Assistance, 2017-2031

Figure 24: Global Smart Hospitals Market Revenue (US$ Bn), by Medical Connected Imaging, 2017-2031

Figure 25: Global Smart Hospitals Market Revenue (US$ Bn), by Remote Medical Management, 2017-2031

Figure 26: Global Smart Hospitals Market Revenue (US$ Bn), by Others, 2017-2031

Figure 27: Global Smart Hospitals Market Attractiveness Analysis, by Application, 2020-2030

Figure 28: Global Smart Hospitals Market Value Share Analysis, by Region, 2022 and 2030

Figure 29: Global Smart Hospitals Market Attractiveness Analysis, by Region

Figure 30: North America Smart Hospitals Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 31: North America Smart Hospitals Market Value Share (%), by Country, 2022 and 2030

Figure 32: North America Smart Hospitals Market Attractiveness, by Country, 2020-2030

Figure 33: North America Smart Hospitals Market Value Share (%), by Component, 2022 and 2030

Figure 34: North America Smart Hospitals Market Attractiveness, by Component, 2020-2030

Figure 35: North America Smart Hospitals Market Value Share (%), by Service Offered, 2022 and 2030

Figure 36: North America Smart Hospitals Market Attractiveness, by Service Offered, 2020-2030

Figure 37: North America Smart Hospitals Market Value Share (%), by Connectivity, 2022 and 2030

Figure 38: North America Smart Hospitals Market Attractiveness, by Connectivity, 2020-2030

Figure 39: North America Smart Hospitals Market Value Share (%), by Application, 2022 and 2030

Figure 40: North America Smart Hospitals Market Attractiveness, by Application, 2020-2030

Figure 41: Europe Smart Hospitals Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 42: Europe Smart Hospitals Market Value Share (%), by Country, 2022 and 2030

Figure 43: Europe Smart Hospitals Market Attractiveness, by Country, 2020-2030

Figure 44: Europe Smart Hospitals Market Value Share (%), by Component, 2022 and 2030

Figure 45: Europe Smart Hospitals Market Attractiveness, by Component, 2020-2030

Figure 46: Europe Smart Hospitals Market Value Share (%), by Service Offered, 2022 and 2030

Figure 47: Europe Smart Hospitals Market Attractiveness, by Service Offered, 2020-2030

Figure 48: Europe Smart Hospitals Market Value Share (%), by Connectivity, 2022 and 2030

Figure 49: Europe Smart Hospitals Market Attractiveness, by Connectivity, 2020-2030

Figure 50: Europe Smart Hospitals Market Value Share (%), by Application, 2022 and 2030

Figure 51: Europe Smart Hospitals Market Attractiveness, by Application, 2020-2030

Figure 52: Asia Pacific Smart Hospitals Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 53: Asia Pacific Smart Hospitals Market Value Share (%), by Country/Sub-region, 2022 and 2030

Figure 54: Asia Pacific Smart Hospitals Market Attractiveness, by Country/Sub-region, 2020-2030

Figure 55: Asia Pacific Smart Hospitals Market Value Share (%), by Component, 2022 and 2030

Figure 56: Asia Pacific Smart Hospitals Market Attractiveness, by Component, 2020-2030

Figure 57: Asia Pacific Smart Hospitals Market Value Share (%), by Service Offered, 2022 and 2030

Figure 58: Asia Pacific Smart Hospitals Market Attractiveness, by Service Offered, 2020-2030

Figure 59: Asia Pacific Smart Hospitals Market Value Share (%), by Application, 2022 and 2030

Figure 60: Asia Pacific Smart Hospitals Market Attractiveness, by Connectivity, 2020-2030

Figure 61: Asia Pacific Smart Hospitals Market Value Share (%), by Application, 2022 and 2030

Figure 62: Asia Pacific Smart Hospitals Market Attractiveness, by Application, 2020-2030

Figure 63: Latin America Smart Hospitals Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 64: Latin America Smart Hospitals Market Value Share (%), by Country/Sub-region, 2022 and 2030

Figure 65: Latin America Smart Hospitals Market Attractiveness, by Country/Sub-region, 2020-2030

Figure 66: Latin America Smart Hospitals Market Value Share (%), by Component, 2022 and 2030

Figure 67: Latin America Smart Hospitals Market Attractiveness, by Component, 2020-2030

Figure 68: Latin America Smart Hospitals Market Value Share (%), by Service Offered, 2022 and 2030

Figure 69: Latin America Smart Hospitals Market Attractiveness, by Service Offered, 2020-2030

Figure 70: Latin America Smart Hospitals Market Value Share (%), by Connectivity, 2022 and 2030

Figure 71: Latin America Smart Hospitals Market Attractiveness, by Connectivity, 2020-2030

Figure 72: Latin America Smart Hospitals Market Value Share (%), by Application, 2022 and 2030

Figure 73: Latin America Smart Hospitals Market Attractiveness, by Application, 2020-2030

Figure 74: Middle East & Africa Smart Hospitals Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 75: Middle East & Africa Smart Hospitals Market Value Share (%), by Country/Sub-region, 2022 and 2030

Figure 76: Middle East & Africa Smart Hospitals Market Attractiveness, by Country/Sub-region, 2020-2030

Figure 77: Middle East & Africa Smart Hospitals Market Value Share (%), by Component, 2022 and 2030

Figure 78: Middle East & Africa Smart Hospitals Market Attractiveness, by Component, 2020-2030

Figure 79: Middle East & Africa Smart Hospitals Market Value Share (%), by Service Offered, 2022 and 2030

Figure 80: Middle East & Africa Smart Hospitals Market Attractiveness, by Service Offered, 2020-2030

Figure 81: Middle East & Africa Smart Hospitals Market Value Share (%), by Connectivity, 2022 and 2030

Figure 82: Middle East & Africa Smart Hospitals Market Attractiveness, by Connectivity, 2020-2030

Figure 83: Middle East & Africa Smart Hospitals Market Value Share (%), by Application, 2022 and 2030

Figure 84: Middle East & Africa Smart Hospitals Market Attractiveness, by Application, 2020-2030