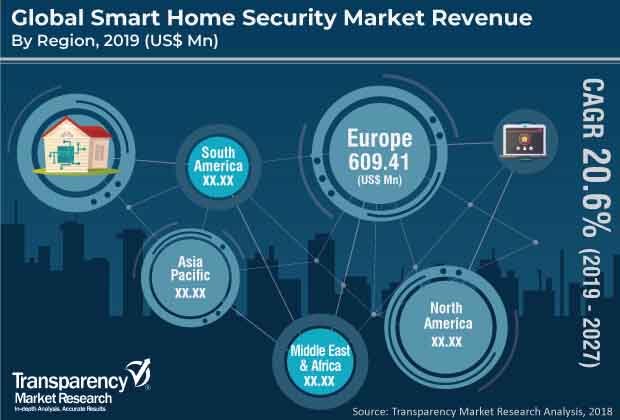

The global smart home security market, which is undergoing the development stage, is witnessing significant technological advancements currently. Technological upgrades are expanding the functionality of electronic security systems. This includes wireless integration and other smart home security features that provide greater flexibility and convenience for consumers. As the technology progresses, smart features are becoming more financially accessible. There has been a significant rise in the adoption of safety and security systems over the last few years, due to their wide range of applications in villas and apartments. The global market for smart home security is projected to reach value of US$ 7950.94 Mn by 2027 from US$ 1491.77 Mn in 2018, registering a CAGR of 20.6% during the forecast period.

Furthermore, use of smart home security devices in luxury villas, luxury apartments, mid-range apartments, and mid-range homes is acting as a driver of the market. Majority of these devices already have microphones/speakers installed in them, which might support alarm applications. Relatively low deployment cost of these alarm applications is expected to fuel the global smart home security market during the forecast period.

DIY home security solutions, wherein homeowners install and monitor systems on their own, are witnessing high demand. Consumer interest in these products is so high that several of them have been funded by Kickstarter Projects. Startups are not the only ones which are leveraging on high demand for DIY solutions. Products from large-sized corporates (such as Google's Nest and Dropcam) are also contributing to diversification of the market. Security & safety and HEMS (home energy management systems) are applications of smart home security systems with potential higher than other applications.

Currently, the penetration of smart home security systems is less than 3% worldwide. Over the last few years, the global smart home security market has been largely driven by rising demand for custom (luxury) solutions, which are costlier than mainstream or managed services. At the same time, consumers opting for a DIY model to save on cost need to face challenges in terms of technical knowhow required to install home security systems and integrate different applications in them. As a result, they need to rely on electricians or other service providers, which again increases the cost.

Smart home security systems are based on the centralized control of home gateways, wherein intelligence has shifted onto cloud networks. Cloud-based services decrease the complexity of software issues with devices and diminish the interoperability of devices in a simpler manner. Most residential users are rapidly adopting cloud-based home security solutions that are user-friendly and self-monitoring and that can be operated from a remote location.

Attracted by this rapidly expanding market and underlying latent demand, several players are planning to invest in the global smart home security market. Right from manufacturers of camera display panels to manufacturers of smart security devices, companies across industries are making efforts to strengthen their foothold in the global smart home security market. Some of the key players operating in the global smart home security market are ADT, Amazon, Honeywell, Ingersoll Rand, and Legrand. Various business strategies are being adopted by the leading players. Companies are focusing on expanding their business by developing strategic partnerships and offering innovative solutions.

Strides in Smart Home Security Market to Pivot on Expansion of IoT Frameworks in Home Automation

Smart home security is a major technological advancement in home security and surveillance. The inroads made by the internet of things (IoT)-connected devices in smart security have underpinned the evolution of smart home automation. The ecosystem of smart home security spans wide covering a wide paraphernalia of smart home entities and devices that you can monitor and control. The remote controlling and automated features are two of the compelling propositions that have driven the expansion of demand in the smart home security market. Door locks, thermostats, motion sensors, intrusion alarm system, fire alarm system, and video surveillance cameras and myriad of things can be monitored and controlled remotely using the smart framework. The ease of access through any smart device such as smartphone and app, and tablets has raised the convenience factor a notch higher with the use of IoT. Over the past few years, the need for customization is a key trend that has expanded the canvas for companies in the smart home security systems to launch new technologies. The pace of innovation is also influenced by advancements being made in network protocols used for home automation, such as the use of Wi-Fi, Z-Wave, and Zigbee. This has also helped in customization of features.

The COVID-19 pandemic has impacted the demands in home automation markets, including the smart home security market. Overall, there has been a substantial decline in demand for some components of smart home security systems. The reluctance to part with the discretionary spending in general population, even in developed nations, has led to decline in growth rate in the market in various regions. The restrictions of stay-at-home contributed to the decline in demand. Nevertheless, smart homes and automation systems have started gaining steam in recent months. The expansion of IoT systems and focus on launching new technologies are expected to spur the growth momentum of the smart home security market in next few years.

Table 01: Global Smart Home Security Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 02: Global Smart Home Security Market Value (US$ Mn) Forecast, by Safety & Security System, 2017–2027

Table 03: Global Smart Home Security Market Value (US$ Mn) Forecast, by Access Control, 2017–2027

Table 04: Global Smart Home Security Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 05: Global Smart Home Security Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 06: North America Smart Home Security Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 07: North America Smart Home Security Market Value (US$ Mn) Forecast, by Safety & Security System, 2017–2027

Table 08: North America Smart Home Security Market Value (US$ Mn) Forecast, by Access Control, 2017–2027

Table 09: North America Smart Home Security Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 10: North America Smart Home Security Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 11: Europe Smart Home Security Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 12: Europe Smart Home Security Market Value (US$ Mn) Forecast, by Safety & Security System, 2017–2027

Table 13: Europe Smart Home Security Market Value (US$ Mn) Forecast, by Access Control, 2017–2027

Table 14: Europe Smart Home Security Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 15: Europe Smart Home Security Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16: Asia Pacific Smart Home Security Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 17: Asia Pacific Smart Home Security Market Value (US$ Mn) Forecast, by Safety & Security System, 2017–2027

Table 18: Asia Pacific Smart Home Security Market Value (US$ Mn) Forecast, by Access Control, 2017–2027

Table 19: Asia Pacific Smart Home Security Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 20: Asia Pacific Smart Home Security Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 21: MEA Smart Home Security Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 22: MEA Smart Home Security Market Value (US$ Mn) Forecast, by Safety & Security System, 2017–2027

Table 23: MEA Smart Home Security Market Value (US$ Mn) Forecast, by Access Control, 2017–2027

Table 24: MEA Smart Home Security Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 25: MEA Smart Home Security Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 26: South America Smart Home Security Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 27: South America Smart Home Security Market Value (US$ Mn) Forecast, by Safety & Security System, 2017–2027

Table 28: South America Smart Home Security Market Value (US$ Mn) Forecast, by Access Control, 2017–2027

Table 29: South America Smart Home Security Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 30: South America Smart Home Security Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Figure 01: Global Smart Home Security Market Value (US$ Mn)

Figure 02: Global Smart Home Security Market Analysis, by Type

Figure 03: Global Smart Home Security Market Share, by Application (2018)

Figure 04: Global Smart Home Security Market Value (US$ Mn) Analysis and Forecast, 2019–2027

Figure 05: Global Smart Home Security Market Y-o-Y Growth Analysis and Forecast, 2019–2027

Figure 06: Global Smart Home Security Market CAGR (%), by Type (2019–2027)

Figure 07: Global Smart Home Security Market CAGR (%), by Application (2019–2027)

Figure 08: Global Smart Home Security Market Value Share Analysis, by Type, 2019 and 2027

Figure 09: Global Smart Home Security Market Value (US$ Mn), by Alarm System

Figure 10: Global Smart Home Security Market Value (US$ Mn), by Safety & Security System

Figure 11: Global Smart Home Security Market Value (US$ Mn), by Video Surveillance

Figure 12: Global Smart Home Security Market Value (US$ Mn), by Access Control

Figure 13: Global Smart Home Security Market Value (US$ Mn), by Biometric Access Control

Figure 14: Global Smart Home Security Market Value (US$ Mn), by Non-biometric Access Control

Figure 15: Global Smart Home Security Market Comparison Matrix, by Type, Revenue Contribution (%)

Figure 16: Global Smart Home Security Market Comparison Matrix, by Type, CAGR (%)

Figure 17: Global Smart Home Security Market Attractiveness, by Type

Figure 18: Global Smart Home Security Market Value Share Analysis, by Application, 2019 and 2027

Figure 19: Global Smart Home Security Market Value (US$ Mn), by Big Villa

Figure 20: Global Smart Home Security Market Value (US$ Mn), by Apartment

Figure 21: Global Smart Home Security Market Comparison Matrix, by Application, Revenue Contribution (%)

Figure 22: Global Smart Home Security Market Comparison Matrix, by Application, CAGR (%)

Figure 23: Global Smart Home Security Market Attractiveness, by Application

Figure 24: Global Smart Home Security Market Value Share Analysis, by Region, 2019 and 2027

Figure 25: Global Smart Home Security Market Attractiveness, by Region

Figure 26: North America Smart Home Security Market Value Share Analysis, by Type, 2019 and 2027

Figure 27: North America Smart Home Security Market Value Share Analysis, by Application, 2019 and 2027

Figure 28: North America Smart Home Security Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 29: North America Smart Home Security Market Attractiveness, by Type

Figure 30: North America Smart Home Security Market Attractiveness, by Application

Figure 31: North America Smart Home Security Market Attractiveness, by Country/Sub-region

Figure 32: Europe Smart Home Security Market Value Share Analysis, by Type, 2019 and 2027

Figure 33: Europe Smart Home Security Market Value Share Analysis, by Application, 2019 and 2027

Figure 34: Europe Smart Home Security Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 35: Europe Smart Home Security Market Attractiveness, by Type

Figure 36: Europe Smart Home Security Market Attractiveness, by Application

Figure 37: Europe Smart Home Security Market Attractiveness, by Country/Sub-region

Figure 38: Asia Pacific Smart Home Security Market Value Share Analysis, by Type, 2019 and 2027

Figure 39: Asia Pacific Smart Home Security Market Value Share Analysis, by Application, 2019 and 2027

Figure 40: Asia Pacific Smart Home Security Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 41: Asia Pacific Smart Home Security Market Attractiveness, by Type

Figure 42: Asia Pacific Smart Home Security Market Attractiveness, by Application

Figure 43: Asia Pacific Smart Home Security Market Attractiveness, by Country/Sub-region

Figure 44: MEA Smart Home Security Market Value Share Analysis, by Type, 2019 and 2027

Figure 45: MEA Smart Home Security Market Value Share Analysis, by Application, 2019 and 2027

Figure 46: MEA Smart Home Security Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 47: MEA Smart Home Security Market Attractiveness, by Type

Figure 48: MEA Smart Home Security Market Attractiveness, by Application

Figure 49: MEA Smart Home Security Market Attractiveness, by Country/Sub-region

Figure 50: South America Smart Home Security Market Value Share Analysis, by Type, 2019 and 2027

Figure 51: South America Smart Home Security Market Value Share Analysis, by Application, 2019 and 2027

Figure 52: South America Smart Home Security Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 53: South America Smart Home Security Market Attractiveness, by Type

Figure 54: South America Smart Home Security Market Attractiveness, by Application

Figure 55: South America Smart Home Security Market Attractiveness, by Country/Sub-region

Figure 56: Global Smart Home Security Market Share Analysis, by Company (2018)

Figure 57: Revenue ADT LLC (2015–2017)

Figure 58: Geographical Sales Breakup ADT LLC (2017)

Figure 59: Revenue Google Inc. (2015–2017)

Figure 60: Geographical Sales Breakup Google Inc. (2017)

Figure 61: Revenue Amazon Inc. (2015–2017)

Figure 62: Geographical Sales Breakup Amazon Inc. (2017)

Figure 63: Revenue (US$ Mn) & Y-o-Y Growth (%), 2014–2016 (Apple Inc.)

Figure 64: Breakdown of Net Sales, by Geography, 2016 (Apple Inc.)

Figure 65: Revenue Johnson Controls, Inc. (2015–2017)

Figure 66: Geographical Sales Breakup of Revenue Johnson Controls, Inc. (2017)

Figure 67: Revenue Honeywell International, Inc. (2015–2017)

Figure 68: Geographical Sales Breakup of Revenue Honeywell International, Inc. (2017)

Figure 69: Revenue Ingersoll-Rand plc (2015–2017)

Figure 70: Geographical Sales Breakup of Revenue Ingersoll-Rand plc (2017)

Figure 71: Revenue (US$ Mn) & Y-o-Y Growth (%), 2014–2016 (Robert Bosch GmbH)

Figure 72: Breakdown of Revenue, by Geography, 2016 (Robert Bosch GmbH)

Figure 73: Revenue Legrand SA (2015–2017)

Figure 74: Geographical Sales Breakup of Revenue Legrand SA (2017)