Global Smart Home as a Service Market: Snapshot

Besides convenience, a chief factor fuelling the uptake of smart home products is their assistance in energy management. Smart home as a service solutions not only enable users manage entertainment and other electronic appliances remotely, they also help customers keep a tab on the energy consumption. In addition, the rising demand for advanced security and surveillance has created an environment supporting strong growth of the global smart home as a service market. Because of opportunities it exhibits, the smart home as a service market has been attracting new players. While this pose threat to the existing companies, it also paves way for innovations and upgrade of existing technologies.

On the flip side, the high cost of smart home products is inhibiting the market’s trajectory to an extent. Furthermore, privacy concerns and possibility of misusing the technology have made customers skeptical of deploying smart home solutions. Nevertheless, the advent of novel connectivity standards is expected to help the market players mitigate the aforementioned concerns in the coming years.

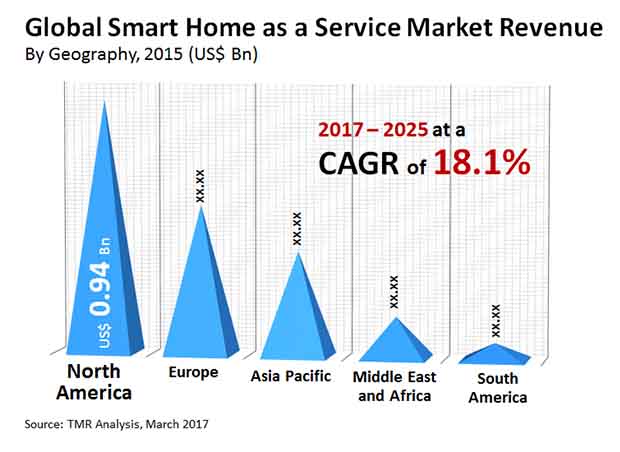

The global smart home as a service market is forecast to reach US$10.9 bn by the end of 2025. In 2016, the market’s valuation stood at US$2.46 bn. If these figures hold true, the global smart home as a service market will exhibit an impressive CAGR of 18.1% between 2017 and 2025.

The demand within the global smart home as a service market is set to increase in the years to follow. Advancements in the energy sector have boded well for the growth of this market. The development of urban centers across all major regions of the world have played a crucial part in popularizing smart homes. The utility and ease offered by the components of smart homes have further caused an uptick in demand across the global market. Several people have become sensitive towards their energy consumption patterns, prompting them to install smart and energy-efficient technologies in their household. In light of these factors, it is safe to predict that the global smart home as a service market would grow at a stupendous pace.

There is little contention about the inflow of fresh revenues into the global smart home as a service market as new and intelligent technologies make their way across the marketplace.

Advancements in the domain of cyber security have created new inlets for growth across the global supervisory control and data acquisition (SCADA) market. The unprecedented demand for improved hardware and software architecture across organizations and industrial units has generated increased demand within the global market. The domain of cyber security has expanded its roots to all other industries, reflecting the seriousness of the masses to develop novel cyber practices. Several companies have strengthened their holds over their cyber security architecture in order to stay relevant in times of entropy and change. As the hardware architecture of companies becomes more sophisticated, the global SCADA market would tread along a lucrative pathway.

The security industry is at the forefront of growth within the global SCADA market, and is expected to dig out new technologies and systems that use supervisory control.

Integrated Services to Continue Witnessing High Demand

On the basis of service, the global smart home as a service market is bifurcated into managed and integrated. The integrated service segment is anticipated to contribute major share in the global smart home as a service market. It is expected to hold nearly 63.6% of the market by the end of 2017. With the increasing demand and adoption of integrated services, the integrated services segment is likely to witness steady growth and thus remain dominant throughout the forecast period. The managed service segment is expected to hold a comparatively smaller share of the global smart home as a service market.

On the basis of solution, the global smart home as a service market is segmented into security and access, lighting and window, audio-visual and entertainment, energy management and climate and integrated solutions. Of these, the integrated solutions segment is expected to hold the major share of the smart home as a service market. Security and access solution segment will emerge as the second-lead in terms of market share. Audio-visual and entertainment is projected to beat other segments in terms of growth pace. The segment is forecast to exhibit a CAGR of 19.67% during the period from 2017 to 2025. This growth is primarily ascribable to increased demand for streaming services and online content.

Presence of Leading Players in North America helps it attain Dominance

The global smart home as a service market is expected to be led by North America. The region’s share in the market is expected to reach over 45% by the end of 2017, with the U.S. at the fore. Besides being an early adopted of advanced technologies, the North America market is gaining from the presence of several leading players in the region. Europe in 2016, has emerged as the second-leading market for smart home as a service in the world. In the region, France, Germany, and the U.K., have emerged as the most lucrative pockets. Moreover, Europe’s local industry exhibits a strong growth and overall consumers are aware of the latest technologies. These factors are expected to act in favor of the market in Europe.

Through the course of the forecast period, Asia Pacific is forecast to exhibit highly lucrative opportunities. The market players are likely to capitalize on the rising demand from China, Japan, Australia, and South East Asian countries.

The key players profiled in the global smart home as a service market include AT&T Inc., CenturyLink, Inc., Charter Communications (TWC), Comcast Corporation, Frontpoint Security Solutions, Ingersoll-Rand plc (Nexia), Johnson Controls, Inc., Protection One Alarm Monitoring, Inc., The ADT Corporation and Vivint, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Smart Home as a Service Market

4. Market Overview

4.1. Key Industry Developments

4.2. Key Market Indicators

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.4. Key Trends

4.5. Global Smart Home as a Service Market Analysis and Forecasts, 2015 – 2025

4.5.1. Market Revenue Projections (US$ Mn)

4.6. Porter’s Five Force Analysis

4.7. Market Outlook

5. Global Smart Home as a Service Market Analysis and Forecasts, By Solution

5.1. Overview & Definition

5.2. Key Findings / Developments

5.3. Market Size (US$ Mn) Forecast By Solution, 2015 – 2025

5.3.1. Security and Access

5.3.2. Lighting and Window

5.3.3. Audio-Visual and Entertainment

5.3.4. Energy Management and Climate

5.3.5. Integrated

5.4. Comparison Matrix By Solution

5.5. Market Attractiveness By Solution

6. Global Smart Home as a Service Market Analysis and Forecasts, By Service

6.1. Overview & Definition

6.2. Key Findings / Developments

6.3. Market Size (US$ Mn) Forecast By Service, 2015 – 2025

6.3.1. Managed

6.3.2. Integrated

6.4. Comparison Matrix By Service

6.5. Market Attractiveness By Service

7. Global Smart Home as a Service Market Analysis and Forecasts, By Region

7.1. Key Trends

7.2. Market Size (US$ Mn) Forecast By Region, 2015 – 2025

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East and Africa

7.2.5. South America

7.3. Market Attractiveness By Region

8. North America Smart Home as a Service Market Analysis and Forecast

8.1. Key Findings

8.2. Market Size (US$ Mn) Forecast By Service, 2015 – 2025

8.2.1. Managed

8.2.2. Integrated

8.3. Market Size (US$ Mn) Forecast By Solution, 2015 – 2025

8.3.1. Security and Access

8.3.2. Lighting and Window

8.3.3. Audio-Visual and Entertainment

8.3.4. Energy Management and Climate

8.3.5. Integrated

8.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

8.4.1. United States

8.4.2. Canada

8.4.3. Rest of North America

8.5. Market Attractiveness Analysis

8.5.1. By Solution

8.5.2. By Service

8.5.3. By Country

9. Europe Smart Home as a Service Market Analysis and Forecast

9.1. Key Findings

9.2. Market Size (US$ Mn) Forecast By Service, 2015 – 2025

9.2.1. Managed

9.2.2. Integrated

9.3. Market Size (US$ Mn) Forecast By Solution, 2015 – 2025

9.3.1. Security and Access

9.3.2. Lighting and Window

9.3.3. Audio-Visual and Entertainment

9.3.4. Energy Management and Climate

9.3.5. Integrated

9.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

9.4.1. The U.K.

9.4.2. Germany

9.4.3. France

9.4.4. Rest of Europe

9.5. Market Attractiveness Analysis

9.5.1. By Solution

9.5.2. By Service

9.5.3. By Country

10. Asia Pacific Smart Home as a Service Market Analysis and Forecast

10.1. Key Findings

10.2. Market Size (US$ Mn) Forecast By Service, 2015 – 2025

10.2.1. Managed

10.2.2. Integrated

10.3. Market Size (US$ Mn) Forecast By Solution, 2015 – 2025

10.3.1. Security and Access

10.3.2. Lighting and Window

10.3.3. Audio-Visual and Entertainment

10.3.4. Energy Management and Climate

10.3.5. Integrated

10.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. Rest of Asia Pacific

10.5. Market Attractiveness Analysis

10.5.1. By Solution

10.5.2. By Service

10.5.3. By Country

11. Middle East and Africa Smart Home as a Service Market Analysis and Forecast

11.1. Key Findings

11.2. Market Size (US$ Mn) Forecast By Service, 2015 – 2025

11.2.1. Managed

11.2.2. Integrated

11.3. Market Size (US$ Mn) Forecast By Solution, 2015 – 2025

11.3.1. Security and Access

11.3.2. Lighting and Window

11.3.3. Audio-Visual and Entertainment

11.3.4. Energy Management and Climate

11.3.5. Integrated

11.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

11.4.1. UAE

11.4.2. Saudi Arabia

11.4.3. Rest of Middle East and Africa

11.5. Market Attractiveness Analysis

11.5.1. By Solution

11.5.2. By Service

11.5.3. By Country

12. South America Smart Home as a Service Market Analysis and Forecast

12.1. Key Findings

12.2. Market Size (US$ Mn) Forecast By Service, 2015 – 2025

12.2.1. Managed

12.2.2. Integrated

12.3. Market Size (US$ Mn) Forecast By Solution, 2015 – 2025

12.3.1. Security and Access

12.3.2. Lighting and Window

12.3.3. Audio-Visual and Entertainment

12.3.4. Energy Management and Climate

12.3.5. Integrated

12.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

12.4.1. Brazil

12.4.2. Argentina

12.4.3. Rest of South America

12.5. Market Attractiveness Analysis

12.5.1. By Solution

12.5.2. By Service

12.5.3. By Country

13. Competition Landscape

13.1. Market Player – Competition Matrix (By Tier and Size of companies)

13.2. Market Share Analysis By Company (2015)

13.3. Company Profiles

13.3.1. Vivint, Inc.

13.3.1.1. Company Description

13.3.1.2. Financials

13.3.1.3. Strategic Overview

13.3.1.4. SWOT Analysis

13.3.2. The ADT Corporation

13.3.2.1. Company Description

13.3.2.2. Financials

13.3.2.3. Strategic Overview

13.3.2.4. SWOT Analysis

13.3.3. AT&T Inc

13.3.3.1. Company Description

13.3.3.2. Financials

13.3.3.3. Strategic Overview

13.3.3.4. SWOT Analysis

13.3.4. Comcast Corporation

13.3.4.1. Company Description

13.3.4.2. Financials

13.3.4.3. Strategic Overview

13.3.4.4. SWOT Analysis

13.3.5. CenturyLink, Inc

13.3.5.1. Company Description

13.3.5.2. Financials

13.3.5.3. Strategic Overview

13.3.5.4. SWOT Analysis

13.3.6. Ingersoll-Rand plc (Nexia)

13.3.6.1. Company Description

13.3.6.2. Financials

13.3.6.3. Strategic Overview

13.3.6.4. SWOT Analysis

13.3.7. Charter Communications (TWC)

13.3.7.1. Company Description

13.3.7.2. Financials

13.3.7.3. Strategic Overview

13.3.7.4. SWOT Analysis

13.3.8. Johnson Controls, Inc.

13.3.8.1. Company Description

13.3.8.2. Financials

13.3.8.3. Strategic Overview

13.3.8.4. SWOT Analysis

13.3.9. Frontpoint Security Solutions

13.3.9.1. Company Description

13.3.9.2. Financials

13.3.9.3. Strategic Overview

13.3.9.4. SWOT Analysis

13.3.10. Protection One Alarm Monitoring, Inc.

13.3.10.1. Company Description

13.3.10.2. Financials

13.3.10.3. Strategic Overview

13.3.10.4. SWOT Analysis

14. Key Takeaways

List of Tables

Table 1: Global Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Solution, 2015–2025

Table 2: Global Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Service, 2015–2025

Table 3: Global Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Region, 2015–2025

Table 4: North America Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Service, 2015–2025

Table 5: North America Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Solution, 2015–2025

Table 6: North America Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Country, 2015 – 2025

Table 7: Europe Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Service, 2015–2025

Table 8: Europe Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Solution, 2015–2025

Table 9: Europe Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Country, 2015 – 2025

Table 10: Asia Pacific Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Service, 2015–2025

Table 11: Asia Pacific Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Solution, 2015–2025

Table 12: Asia Pacific Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Country, 2015 – 2025

Table 13: Middle East and Africa Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Service, 2015–2025

Table 14: Middle East and Africa Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Solution, 2015–2025

Table 15: Middle East and Africa Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Country, 2015 – 2025

Table 16: South America Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Service, 2015–2025

Table 17: South America Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Solution, 2015–2025

Table 18: South America Smart Home as a Service Market Revenue (US$ Bn) Forecast, by Country, 2015 – 2025

List of Figures

Figure 1: Executive Summary: Market Size, Indicative (US$ Bn) and Top Solution Segments

Figure 2: Global Smart Home as a Service Market Revenue (US$ Bn) Forecast, 2015–2025

Figure 3: Global Smart Home as a Service Market Y-o-Y Growth (Value %), 2016 – 2025

Figure 4: Global Smart Home as a Service Market Value Share by Service (2025)

Figure 5: Global Smart Home as a Service Market CAGR by Service (2017 – 2025)

Figure 6: Global Smart Home as a Service Market Value Share by Solution (2025)

Figure 7: Global Smart Home as a Service Market CAGR by Solution (2017 – 2025)

Figure 8: Global Smart Home as a Service market Value Share Analysis by Solution, 2017 and 2025

Figure 9: Global Smart Home as a Service market Revenue and Y-o-Y Growth, by Solution – Security and Access, 2015 - 2025, (US$ Bn and Value %)

Figure 10: Global Smart Home as a Service market Revenue and Y-o-Y Growth, by Solution – Lighting and Window, 2015 – 2025, (US$ Bn and Value %)

Figure 11: Global Smart Home as a Service market Revenue and Y-o-Y Growth, by Solution – Audio-Visual and Entertainment, 2015 - 2025, (US$ Bn and Value %)

Figure 12: Global Smart Home as a Service market Revenue and Y-o-Y Growth, by Solution – Energy Management and Climate, 2015 - 2025, (US$ Bn and Value %)

Figure 13: Global Smart Home as a Service market Revenue and Y-o-Y Growth, by Solution– Integrated, 2015 - 2025, (US$ Bn and Value %)

Figure 14: Smart Home as a Service market Attractiveness Analysis by Solution

Figure 15: Global Smart Home as a Service Market Share Analysis, by Service, 2017 and 2025

Figure 16: Global Smart Home as a Service market Revenue and Y-o-Y Growth, by Service– Managed, 2015 - 2025, (US$ Bn and Value %)

Figure 17: Global Smart Home as a Service market Revenue and Y-o-Y Growth, by Service– Integrated, 2015 - 2025, (US$ Bn and Value %)

Figure 18: Smart Home as a Service market Attractiveness Analysis by Service

Figure 19: Global Smart Home as a Service market Value Share Analysis by Region, 2017 and 2025

Figure 20: Smart Home as a Service market Attractiveness Analysis, by Region

Figure 21: North America Smart Home as a Service Market Revenue (US$ Bn) Forecast, 2015–2025

Figure 22: North America Smart Home as a Service Market Y-o-Y Growth (Value %), 2016 – 2025

Figure 23: North America Smart Home as a Service Market Share Analysis, by Service, 2017 and 2025

Figure 24: North America Smart Home as a Service Market Share Analysis, by Solution, 2017 and 2025

Figure 25: North America Smart Home as a Service Market Share Analysis, by Country, 2017 and 2025

Figure 26: North America Smart Home as a Service Market Attractiveness Analysis, By Service (2017)

Figure 27: North America Smart Home as a Service Market Attractiveness Analysis, By Solution (2017)

Figure 28: North America Smart Home as a Service Market Attractiveness Analysis, By Country (2017)

Figure 29: Europe Smart Home as a Service Market Revenue (US$ Bn) Forecast, 2015–2025

Figure 30: Europe Smart Home as a Service Market Y-o-Y Growth (Value %), 2016 – 2025

Figure 31: Europe Smart Home as a Service Market Share Analysis, by Service, 2017 and 2025

Figure 32: Europe Smart Home as a Service Market Share Analysis, by Solution, 2017 and 2025

Figure 33: Europe Smart Home as a Service Market Share Analysis, by Country, 2017 and 2025

Figure 34: Europe Smart Home as a Service Market Attractiveness Analysis, By Service (2017)

Figure 35: Europe Smart Home as a Service Market Attractiveness Analysis, By Solution(2017)

Figure 36: Europe Smart Home as a Service Market Attractiveness Analysis, By Country (2017)

Figure 37: Asia Pacific Smart Home as a Service Market Revenue (US$ Bn) Forecast, 2015–2025

Figure 38: Asia Pacific Smart Home as a Service Market Y-o-Y Growth (Value %), 2016 – 2025

Figure 39: Asia Pacific Smart Home as a Service Market Share Analysis, by Service, 2017 and 2025

Figure 40: Asia Pacific Smart Home as a Service Market Share Analysis, by Solution, 2017 and 2025

Figure 41: Asia Pacific Smart Home as a Service Market Share Analysis, by Country, 2017 and 2025

Figure 42: Asia Pacific Smart Home as a Service Market Attractiveness Analysis, By Service (2017)

Figure 43: Asia Pacific Smart Home as a Service Market Attractiveness Analysis, By Solution (2017)

Figure 44: Asia Pacific Smart Home as a Service Market Attractiveness Analysis, By Country (2017)

Figure 45: Middle East and Africa Smart Home as a Service Market Revenue (US$ Bn) Forecast, 2015–2025

Figure 46: Middle East and Africa Smart Home as a Service Market Y-o-Y Growth (Value %), 2016 – 2025

Figure 47: Middle East and Africa Smart Home as a Service Market Share Analysis, by Service, 2017 and 2025

Figure 48: Middle East and Africa Smart Home as a Service Market Share Analysis, by Solution, 2017 and 2025

Figure 49: Middle East and Africa Smart Home as a Service Market Share Analysis, by Country, 2017 and 2025

Figure 50: Middle East and Africa Smart Home as a Service Market Attractiveness Analysis, By Service (2017)

Figure 51: Middle East and Africa Smart Home as a Service Market Attractiveness Analysis, By Solution (2017)

Figure 52: Middle East and Africa Smart Home as a Service Market Attractiveness Analysis, By Country (2017)

Figure 53: South America Smart Home as a Service Market Revenue (US$ Bn) Forecast, 2015–2025

Figure 54: South America Smart Home as a Service Market Y-o-Y Growth (Value %), 2016 – 2025

Figure 55: South America Smart Home as a Service Market Share Analysis, by Service, 2017 and 2025

Figure 56: South America Smart Home as a Service Market Share Analysis, by Solution, 2017 and 2025

Figure 57: South America Smart Home as a Service Market Share Analysis, by Country, 2017 and 2025

Figure 58: South America Smart Home as a Service Market Attractiveness Analysis, By Service (2017)

Figure 59: South America Smart Home as a Service Market Attractiveness Analysis, By Solution (2017)

Figure 60: South America Smart Home as a Service Market Attractiveness Analysis, By Country (2017)

Figure 61: Global Smart Home as a Service market Share Analysis By Company (2015)