Diabetes research and treatment has made enormous strides in the past decade. However, the need for round-the-clock self-monitoring continues to open the door for smart technologies in diabetes management. The need for constant vigilance in terms of tracking blood sugar levels, physical exercise, and food intake warrant the shift towards smart maintenance technologies for diabetes care. With 'patient-physician connectivity', being the new catchphrase for smart diabetes management device manufacturers, the industry, in its entirety, is vying towards developing devices that wirelessly transmit diabetes readings from the patient to the diabetes care provider.

The emergence of state-of-the-art diabetes management technologies such as digital food journals for insulin administration and glucose measurement have highly eased the process of diabetes monitoring. Consumer behavior is centered on 'peace of mind' when it comes to conditions such as diabetes that have an elusive cure. The mounting need for data transmission and automation in the landscape of diabetes management has created an environment where 'digital' and 'analog' technologies coexist. This revolution in the smart diabetes management market has encouraged TMR analysts to conduct elaborate research that helps stakeholders understand the market dynamics and make data-driven business decisions.

In the scramble towards innovation, efforts manufacturers in the smart devices management market are directed towards the development of devices offering real-time feedback about therapeutic intervention. These developments have translated into diabetes patients getting increasingly involved in their own care. Closed-loop insulin delivery is now replacing conventional vial and syringes, with 'convenience' driving consumer choice when it comes to insulin administration. Yet another transformation in consumer behavior is that, they are wary of using multiple devices for diabetes management. Resultantly, diabetes care devices equipped with multiple functions are taking center stage.

While continuous advancements in diabetes care technologies such as portable glucometers, smart tattoos, and insulin pumps transcend the market’s expansion, patient privacy and data security still remain key challenges. However, these bottlenecks may dictate the way for future innovations, and may also be banked upon by new entrants to pave their way into the global market. In 2018, the smart diabetes management market was valued at ~ US$ 3.7 Bn, and is anticipated to attain the mark of ~ US$ 13.6 Bn by the end of 2027.

The traditional ways of measuring blood glucose levels are now getting replaced by continuous glucose monitoring (CGM). Moreover, the face of insulin delivery systems has been revolutionized with insulin pumps getting upgraded to become CGM systems. Consumers are increasingly preferring devices that integrate the functions of both, insulin pumps and CGM systems. This is mainly because they are wary of using devices that require fingerstick tests, making the entire insulin or glucose monitoring process cumbersome. The emergence of tubing-free patch pumps that adhere directly to the skin has further directed the way for the penetration of new technologies and devices. Also, as these devices satiate consumer demand for the self-management of diabetes, they are expected to reap high revenue benefits for the smart diabetes management market, accounting for ~ 90% of the market share in 2018.

It is not just innovation in diabetes management devices but the digitalization of diabetes management that has created a rage in the market. Digital diabetes solutions have inundated the smart diabetes management market, thriving on the back of smart consumer devices. The increasing use of smartphones has played a pivotal role in the proliferation of 'digitalization' in the landscape of diabetes management. According to research, active users of digital diabetes sources cover around 2/3 of the world’s population. Consequently, manufacturers are building more consumer-oriented and device-agnostic digital diabetes apps.

Acquisitions and collaborations are what leading players in the smart diabetes management market rely on when it comes to establishing their base in the global market. These alliances are essentially aimed at expanding the reach in regional markets, and gaining technological strength to offer better diabetes care solutions. For instance, in January 2018, GlucoMe integrated with Apollo Sugar Clinic, based in India, which helped it expand its product portfolio and customer reach in India. Similarly, it entered into a collaboration with Merck KGaA to strengthen its digital diabetes care solutions and enhance its consumer base. Companies are also forming partnerships with leading pharmaceutical companies to develop and supply advanced diabetes care technologies and products.

With the subsequent rise in the approval rate of products, companies are concentrating their efforts towards launching new products for diabetes management, be it devices or apps. The reason for the deployment of this strategy is also attributable to the rise in consumer inclination towards innovative and easy-to-use products. In August 2016, F. Hoffmann-La Roche Ltd launched Accu-Chek Guide, a blood glucose monitoring system. Further, in June 2017 Medtronic launched the MiniMed 670G system for type 1 diabetes treatment. These launches were followed by many other new products that not only simplified diabetes management for patients and clinicians but enhanced the accuracy in results.

The global smart diabetes management market features a highly consolidated vendor landscape, with the top three players accounting for ~ 73% of the market share in 2018. Medtronic alone accounted for ~ 43% of the market share, and is expected continue to stay high on the growth ladder throughout the forecast period. A diverse product portfolio, new product launches and approvals, and strong regional presence is what helped it attain a leading position in the market. Dexcom, Inc. accounted for ~ 22% market share, which was mainly driven by a robust distribution network coupled with new product launches. It was followed by F. Hoffmann-La Roche Ltd occupying ~ 7% market share, mainly due to a strong geographical reach and product portfolio.

Other players in the market include

The competitive rivalry among players is mainly characterized by soaring product approvals. For instance, in July 2018, F. Hoffmann-La Roche Ltd received the CE mark for its Accu-Chek Solo Micropump system. Similarly, in June 2018, Medtronic received approval from the U.S. Food & Drug Administration for the MiniMed 670G system for use in the treatment of type 1 diabetes in children aged seven years and above. Apart from this, increasing investments in research and development activities, strategic partnerships, and strengthening digital channels have helped some players outshine others in the market.

Analysts’ Viewpoint

TMR analysts’ have an optimistic outlook on the market’s future, and expect it to grow tremendously during the forecast period. With the gamut of the smart devices management industry being technology-driven, players enhancing their technological and innovation quotient will get the first-mover advantage. While the high costs of devices continues to be a key challenge in the market, it gives a significant entry point for newcomers in the market. TMR analysts also opine that, digitalization of the diabetes management industry opens up a plethora of new opportunities for market players. Focus on developing customer-friendly and device-agnostic apps will help companies garner considerable consumer attention. Overall, the rise in government support and development of diabetes care devices integrated with multiple functions will foster the market’s growth.

Favorable Reimbursements for Smart Diabetes Management Products: A Key Driver

New Product Development and Technological Advancements

High Cost of Products Restrains the Smart Diabetes Management Market

Smart Diabetes Management Market: Competition Landscape

Smart Diabetes Management Market: Key Developments

Key players in the smart diabetes management market engage in the development of new products, key mergers & acquisitions, collaborations, and integration. Key developments by industry players are likely to fuel the smart diabetes management market. Some developments in the smart diabetes management market are as follows:

In the global smart diabetes management market report, we have discussed individual strategies, followed by company profiles of the manufacturers of smart diabetes management devices and apps & software. The ‘Competitive Landscape’ section is included in the smart diabetes management market report to provide readers with a dashboard view and a company market share analysis of the key players operating in the global smart diabetes management market.

The global smart diabetes management market was worth US$ 3.7 Bn and is projected to reach a value of US$ 13.6 Bn by the end of 2027

Smart diabetes management market is anticipated to grow at a CAGR of 15% during the forecast period

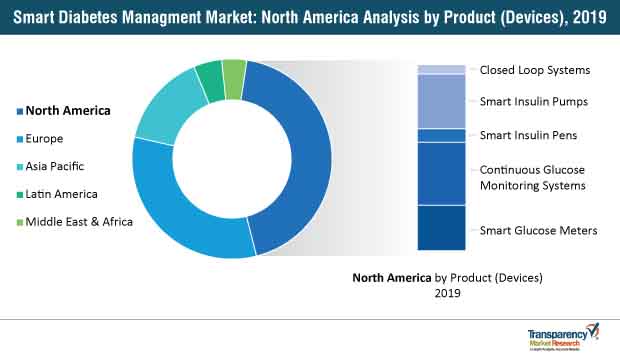

North America accounted for a major share of the global smart diabetes management market

Smart Diabetes Management Market is driven by favourable reimbursements for digital diabetes management products and surge in the adoption of technologically-advanced products

Key players in the global smart diabetes management market include F. Hoffmann-La Roche Ltd, Medtronic, Dexcom, Inc., Insulet Corporation, Abbott, Jiangsu Delfu medical device Co., Ltd, DIAMESCO CO., Ltd., LifeScan, Inc., Glooko, Inc., and GlucoMe

1. Preface

1.1. Market Definition and Scope

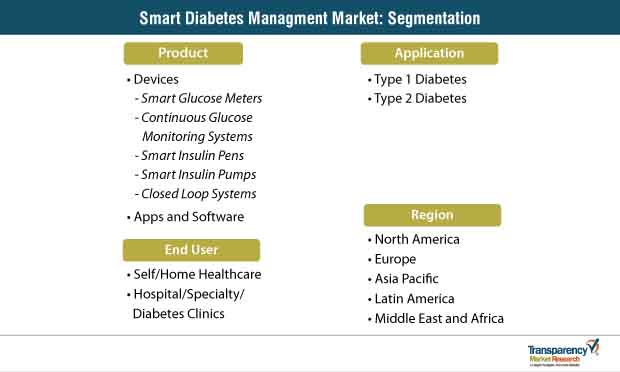

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Smart Diabetes Management Market

4. Market Overview

4.1. Introduction

4.1.1. Products Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.1.1. Rise in prevalence of diabetes

4.3.1.2. Increase in awareness about diabetes

4.3.1.3. Favourable reimbursement policies

4.3.1.4. Surge in adoption of connected medical devices

4.3.2. Restraints

4.3.2.1. High cost

4.3.2.2. Patient and provider burden

4.3.2.3. Patient privacy & data security

4.3.3. Opportunities

4.4. Global Smart Diabetes Management Market Analysis and Forecast, 2019–2027

5. Market Outlook

5.1. Technological Advancement

5.2. Key Development (Product launch, Approval, Collaboration, Partnership, and Acquisitions)

5.3. Diabetes Prevalence in Key Countries

6. Global Smart Diabetes Management Market Analysis and Forecast, By Products

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global Smart Diabetes Management Market Value Forecast, by Product, 2019–2027

6.3.1. Devices

6.3.1.1. Smart Glucose Meters

6.3.1.2. Continuous Glucose Monitoring Systems

6.3.1.3. Smart Insulin Pens

6.3.1.4. Smart Insulin Pumps

6.3.1.5. Closed Loop Systems

6.3.2. Apps & Software

6.4. Global Smart Diabetes Management Market Attractiveness, by Product

7. Global Smart Diabetes Management Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global Smart Diabetes Management Market Value Forecast, by Application, 2019–2027

7.3.1. Type 1 Diabetes

7.3.2. Type 2 Diabetes

7.4. Global Smart Diabetes Management Market Attractiveness, by Application

8. Global Smart Diabetes Management Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Global Smart Diabetes Management Market Value Forecast, by End-user, 2019–2027

8.3.1. Self/Home Healthcare

8.3.2. Hospital/Specialty Diabetes Clinics

8.4. Global Smart Diabetes Management Market Attractiveness, by End-user

9. Global Smart Diabetes Management Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Smart Diabetes Management Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Smart Diabetes Management Market Attractiveness, by Region

10. North America Smart Diabetes Management Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. North America Smart Diabetes Management Market Value Forecast, by Product, 2019–2027

10.2.1. Devices

10.2.1.1. Smart Glucose Meters

10.2.1.2. Continuous Glucose Monitoring Systems

10.2.1.3. Smart Insulin Pens

10.2.1.4. Smart Insulin Pumps

10.2.1.5. Closed Loop Systems

10.2.2. Apps & Software

10.3. North America Smart Diabetes Management Market Value Forecast, by Application, 2019–2027

10.3.1. Type 1 Diabetes

10.3.2. Type 2 Diabetes

10.4. North America Smart Diabetes Management Market Value Forecast, by End-user, 2019–2027

10.4.1. Self/Home Healthcare

10.4.2. Hospital/Specialty Diabetes Clinics

10.5. North America Smart Diabetes Management Market Value Forecast, by Country, 2019–2027

10.5.1. U.S.

10.5.2. Canada

10.6. North America Smart Diabetes Management Market Attractiveness Analysis

10.6.1. By Products

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Smart Diabetes Management Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Europe Smart Diabetes Management Market Value Forecast, by Product, 2019–2027

11.2.1. Devices

11.2.1.1. Smart Glucose Meters

11.2.1.2. Continuous Glucose Monitoring Systems

11.2.1.3. Smart Insulin Pens

11.2.1.4. Smart Insulin Pumps

11.2.1.5. Closed Loop Systems

11.2.2. Apps & Software

11.3. Europe Smart Diabetes Management Market Value Forecast, by Application, 2019–2027

11.3.1. Type 1 Diabetes

11.3.2. Type 2 Diabetes

11.4. Europe Smart Diabetes Management Market Value Forecast, by End-user, 2019–2027

11.4.1. Self/Home Healthcare

11.4.2. Hospital/Specialty Diabetes Clinics

11.5. Europe Smart Diabetes Management Market Value Forecast, by Country/Sub-region, 2019–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Europe Smart Diabetes Management Market Attractiveness Analysis

11.6.1. By Products

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Smart Diabetes Management Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Asia Pacific Smart Diabetes Management Market Value Forecast, by Product, 2019–2027

12.2.1. Devices

12.2.1.1. Smart Glucose Meters

12.2.1.2. Continuous Glucose Monitoring Systems

12.2.1.3. Smart Insulin Pens

12.2.1.4. Smart Insulin Pumps

12.2.1.5. Closed Loop Systems

12.2.2. Apps & Software

12.3. Asia Pacific Smart Diabetes Management Market Value Forecast, by Application, 2019–2027

12.3.1. Type 1 Diabetes

12.3.2. Type 2 Diabetes

12.4. Asia Pacific Smart Diabetes Management Market Value Forecast, by End-user, 2019–2027

12.4.1. Self/Home Healthcare

12.4.2. Hospital/Specialty Diabetes Clinics

12.5. Asia Pacific Smart Diabetes Management Market Value Forecast, by Country/Sub-region, 2019–2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific Smart Diabetes Management Market Attractiveness Analysis

12.6.1. By Products

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Smart Diabetes Management Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Latin America Smart Diabetes Management Market Value Forecast, by Product, 2019–2027

13.2.1. Devices

13.2.1.1. Smart Glucose Meters

13.2.1.2. Continuous Glucose Monitoring Systems

13.2.1.3. Smart Insulin Pens

13.2.1.4. Smart Insulin Pumps

13.2.1.5. Closed Loop Systems

13.2.2. Apps & Software

13.3. Latin America Smart Diabetes Management Market Value Forecast, by Application, 2019–2027

13.3.1. Type 1 Diabetes

13.3.2. Type 2 Diabetes

13.4. Latin America Smart Diabetes Management Market Value Forecast, by End-user, 2019–2027

13.4.1. Self/Home Healthcare

13.4.2. Hospital/Specialty Diabetes Clinics

13.5. Latin America Smart Diabetes Management Market Value Forecast, by Country/Sub-region, 2019–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Latin America Smart Diabetes Management Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Smart Diabetes Management Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Middle East & Africa Smart Diabetes Management Market Value Forecast, by Product, 2019–2027

14.2.1. Devices

14.2.1.1. Smart Glucose Meters

14.2.1.2. Continuous Glucose Monitoring Systems

14.2.1.3. Smart Insulin Pens

14.2.1.4. Smart Insulin Pumps

14.2.1.5. Closed Loop Systems

14.2.2. Apps & Software

14.3. Middle East & Africa Smart Diabetes Management Market Value Forecast, by Application, 2019–2027

14.3.1. Type 1 Diabetes

14.3.2. Type 2 Diabetes

14.4. Middle East & Africa Smart Diabetes Management Market Value Forecast, by End-user, 2019–2027

14.4.1. Self/Home Healthcare

14.4.2. Hospital/Specialty Diabetes Clinics

14.5. Middle East & Africa Smart Diabetes Management Market Value Forecast, by Country/Sub-region, 2019–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa Smart Diabetes Management Market Attractiveness Analysis

14.6.1. By Products

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2018)

15.3. Company Profiles

15.3.1. F. Hoffmann-La Roche Ltd

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Medtronic

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Dexcom, Inc

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Insulet Corporation

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Abbott

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Jiangsu Delfu medical device Co., Ltd

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.7. DIAMESCO CO., Ltd.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.8. LifeScan, Inc.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Glooko, Inc.

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. GlucoMe

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

List of Tables

Table 01: New Product Launch & FDA Approvals

Table 02: New Product Launch & FDA Approvals

Table 03: New Product Launch & FDA Approvals

Table 04: Key Development (Collaboration, Partnership, Merger & Acquisition)

Table 05: Key Development (Collaboration, Partnership, Merger & Acquisition)

Table 06: Diabetes Prevalence in Key Countries

Table 07: Diabetes Prevalence in Key Countries

Table 08: Diabetes Prevalence in Key Countries

Table 09: Global Smart Diabetes Management Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 10: Global Smart Diabetes Management Market Value (US$ Mn) Forecast, by Devices, 2017–2027

Table 11: Global Smart Diabetes Management Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 12: Global Smart Diabetes Management Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 13: Global Smart Diabetes Management Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 14: North America Smart Diabetes Management Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 15: North America Smart Diabetes Management Market Value (US$ Mn) Forecast, by Devices, 2017–2027

Table 16: North America Smart Diabetes Management Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 17: North America Smart Diabetes Management Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 18: North America Smart Diabetes Management Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 19: Europe Smart Diabetes Management Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 20: Europe Smart Diabetes Management Market Value (US$ Mn) Forecast, by Devices, 2017–2027

Table 21: Europe Smart Diabetes Management Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 22: Europe Smart Diabetes Management Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 23: Europe Smart Diabetes Management Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 24: Asia Pacific Smart Diabetes Management Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 25: Asia Pacific Smart Diabetes Management Market Value (US$ Mn) Forecast, by Devices, 2017–2027

Table 26: Asia Pacific Smart Diabetes Management Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 27: Asia Pacific Smart Diabetes Management Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 28: Asia Pacific Smart Diabetes Management Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 29: Latin America Smart Diabetes Management Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 30: Latin America Smart Diabetes Management Market Value (US$ Mn) Forecast, by Devices, 2017–2027

Table 31: Latin America Smart Diabetes Management Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 32: Latin America Smart Diabetes Management Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 33: Latin America Smart Diabetes Management Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 34: Middle East & Africa Smart Diabetes Management Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 35: Middle East & Africa Smart Diabetes Management Market Value (US$ Mn) Forecast, by Devices, 2017–2027

Table 36: Middle East & Africa Smart Diabetes Management Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 37: Middle East & Africa Smart Diabetes Management Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 38: Middle East & Africa Smart Diabetes Management Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Figure 01: Global Smart Diabetes Management Market Value (US$ Mn) and Distribution (%), by Region, 2018 and 2027

Figure 02: Global Smart Diabetes Management Market Value (US$ Mn), by Product, 2018

Figure 03: Market Snapshot - Top 2 Trends

Figure 04: Market Overview

Figure 05: Global Smart Diabetes Management Market Value Share, by Product, 2018

Figure 06: Global Smart Diabetes Management Market Value Share, by Application, 2018

Figure 07: Global Smart Diabetes Management Value Share, by End-user, 2018

Figure 08: Global Smart Diabetes Management Market Value Share, by Region, 2018

Figure 09: Global Smart Diabetes Management Market Value (US$ Mn) Forecast, 2017–2027

Figure 10: Global Smart Diabetes Management Market Share Analysis, by Product, 2018 and 2027

Figure 11: Global Smart Diabetes Management Market Value (US$ Mn) and Y-o-Y Growth, by Devices, 2017–2027

Figure 12: Global Smart Diabetes Management Market Value (US$ Mn) and Y-o-Y Growth, by Apps & Software, 2017–2027

Figure 13: Global Smart Diabetes Management Market Attractiveness Analysis, by Product, 2018–2026

Figure 14: Global Smart Diabetes Management Market Value Share Analysis, by Application, 2018 and 2027

Figure 15: Global Smart Diabetes Management Market Value (US$ Mn) and Y-o-Y Growth, by Type 1 Diabetes, 2017–2027

Figure 16: Global Smart Diabetes Management Market Value (US$ Mn) and Y-o-Y Growth, by Type 2 Diabetes, 2017–2027

Figure 17: Global Smart Diabetes Management Market Attractiveness Analysis, by Application, 2018–2026

Figure 18: Global Smart Diabetes Management Market Value Share Analysis, by End-user, 2018 and 2027

Figure 19: Global Smart Diabetes Management Market Value (US$ Mn) and Y-o-Y Growth, by Self/Home Healthcare, 2017–2027

Figure 20: Global Smart Diabetes Management Market Value (US$ Mn) and Y-o-Y Growth, by Hospital/Specialty Diabetes Clinics, 2017–2027

Figure 21: Global Smart Diabetes Management Market Attractiveness Analysis, by End-user, 2018–2027

Figure 22: Global Smart Diabetes Management Market Value Share Analysis, by Region, 2018 and 2027

Figure 23: Global Smart Diabetes Management Market Attractiveness Analysis, by Region, 2018–2026

Figure 24: North America Smart Diabetes Management Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 25: North America Smart Diabetes Management Market Value Share Analysis, by Product, 2018 and 2027

Figure 26: North America Smart Diabetes Management Market Attractiveness Analysis, by Product, 2019–2027

Figure 27: North America Smart Diabetes Management Market Value Share Analysis, by Application, 2018 and 2027

Figure 28: North America Smart Diabetes Management Market Attractiveness Analysis, by Application, 2019?2027

Figure 29: North America Smart Diabetes Management Market Value Share Analysis, by End-user, 2018 and 2027

Figure 30: North America Smart Diabetes Management Market Attractiveness Analysis, by End-user, 2019 -2027

Figure 31: North America Smart Diabetes Management Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 32: North America Smart Diabetes Management Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 33: Europe Smart Diabetes Management Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 34: Europe Smart Diabetes Management Market Value Share Analysis, by Product, 2018 and 2027

Figure 35: Europe Smart Diabetes Management Market Attractiveness Analysis, by Product, 2019–2027

Figure 36: Europe Smart Diabetes Management Market Value Share Analysis, by Application, 2018 and 2027

Figure 37: Europe Smart Diabetes Management Market Attractiveness Analysis, by Application, 2019?2027

Figure 38: Europe Smart Diabetes Management Market Value Share Analysis, by End-user, 2018 and 2027

Figure 39: Europe Smart Diabetes Management Market Attractiveness Analysis, by End-user, 2019 -2027

Figure 40: Europe Smart Diabetes Management Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 41: Europe Smart Diabetes Management Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 42: Asia Pacific Smart Diabetes Management Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 43: Asia Pacific Smart Diabetes Management Market Value Share Analysis, by Product, 2018 and 2027

Figure 44: Asia Pacific Smart Diabetes Management Market Attractiveness Analysis, by Product, 2019–2027

Figure 45: Asia Pacific Smart Diabetes Management Market Value Share Analysis, by Application, 2018 and 2027

Figure 46: Asia Pacific Smart Diabetes Management Market Attractiveness Analysis, by Application, 2019?2027

Figure 47: Asia Pacific Smart Diabetes Management Market Value Share Analysis, by End-user, 2018 and 2027

Figure 48: Asia Pacific Smart Diabetes Management Market Attractiveness Analysis, by End-user, 2019 -2027

Figure 49: Asia Pacific Smart Diabetes Management Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 50: Asia Pacific Smart Diabetes Management Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 51: Latin America Smart Diabetes Management Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 52: Latin America Smart Diabetes Management Market Value Share Analysis, by Product, 2018 and 2027

Figure 53: Latin America Smart Diabetes Management Market Attractiveness Analysis, by Product, 2019–2027

Figure 54: Latin America Smart Diabetes Management Market Value Share Analysis, by Application, 2018 and 2027

Figure 55: Latin America Smart Diabetes Management Market Attractiveness Analysis, by Application, 2019?2027

Figure 56: Latin America Smart Diabetes Management Market Value Share Analysis, by End-user, 2018 and 2027

Figure 57: Latin America Smart Diabetes Management Market Attractiveness Analysis, by End-user, 2019 -2027

Figure 58: Latin America Smart Diabetes Management Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 59: Latin America Smart Diabetes Management Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 60: Middle East & Africa Smart Diabetes Management Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 61: Middle East & Africa Smart Diabetes Management Market Value Share Analysis, by Product, 2018 and 2027

Figure 62: Middle East & Africa Smart Diabetes Management Market Attractiveness Analysis, by Product, 2019–2027

Figure 63: Middle East & Africa Smart Diabetes Management Market Value Share Analysis, by Application, 2018 and 2027

Figure 64: Middle East & Africa Smart Diabetes Management Market Attractiveness Analysis, by Application, 2019?2027

Figure 65: Middle East & Africa Smart Diabetes Management Market Value Share Analysis, by End-user, 2018 and 2027

Figure 66: Middle East & Africa Smart Diabetes Management Market Attractiveness Analysis, by End-user, 2019 -2027

Figure 67: Middle East & Africa Smart Diabetes Management Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 68: Middle East & Africa Smart Diabetes Management Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 69: F. Hoffmann-La Roche Ltd Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 70: F. Hoffmann-La Roche Ltd Breakdown of Net Sales (%) of Diabetes Care Sub-segment, by Region, 2018

Figure 71: F. Hoffmann-La Roche Ltd Breakdown of Net Sales (%), by Diagnostics Division, 2018

Figure 72: F. Hoffmann-La Roche Ltd R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 73: Medtronic Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 74: Medtronic Breakdown of Net Sales (%), by Geography, 2018

Figure 75: Medtronic Breakdown of Net Sales (%), by Business Segment, 2018

Figure 76: Medtronic R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 77: Dexcom, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 78: Dexcom, Inc. Breakdown of Net Sales (%), by Geography, 2017

Figure 79: Dexcom, Inc. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 80: Insulet Corporation Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 81: Insulet Corporation Breakdown of Net Sales (%), by Geography, 2017

Figure 82: Insulet Corporation Breakdown of Net Sales (%), by Business Segment, 2017

Figure 83: Insulet Corporation R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 84: Abbott Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 85: Abbott Breakdown of Net Sales (%), by Country, 2018

Figure 86: Abbott Breakdown of Net Sales (%), by Business Segment, 2018

Figure 87: Abbott R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018