Analysts’ Viewpoint on Market Scenario

Rise in focus on energy conservation is propelling the global connected smart street lighting market. Smart street light solutions are an effective option to conserve energy, as public lighting constitutes 60% of the electricity budget for a municipality or other governing bodies. Integration of IoT connected public lighting can help reduce carbon emissions.

Cities across the globe are adopting smart energy approaches to meet their sustainability goals, thereby fueling the future of street lighting. Surge in investment in solar street lighting and smart cities is expected to augment the global connected smart street lighting business during the forecast period. Market players are launching hybrid network architectures to offer highly versatile solutions for street lighting.

Smart lighting network establishes a connection between components through a reliable and secured wired or wireless network. This connection enables two-way communication in order to monitor and control the lighting functions. An intelligent street lamp control system consists of electronic components, light fittings, energy storage equipment, and network devices for communication. These systems provide high energy-efficiency and better control by reducing power consumption in lighting applications.

Smart city street light control and monitoring enables operators to control the luminance intensities of lighting as per ambiance, the intensity of daylight, occupancy, and physical presence. Smart remote management system that enables the control of luminaire operation scenarios can be connected to modern LED street luminaires. It is possible to adjust the light intensity according to the weather on a given day, depending on the season.

Rise in awareness about energy conservation is boosting the demand for IoT-connected public lighting. Government organizations are increasingly switching to connected (smart) street lights to reduce operational costs, while improving safety and efficiency, as the cost of electricity continues to rise.

Mature markets, such as Europe and North America, are focused on the implementation of various regulations to boost the adoption of connected street lighting infrastructure for smart cities and regulate the use of energy. In 2018, the European Union (EU) banned the sale of energy intensive and inefficient halogen light bulbs across the EU. 83 signatories and 192 member countries such as the U.S., Australia, Canada, Brazil, the EU, and Japan signed the Kyoto Protocol to achieve harmful emission reduction targets and promote energy-efficient solutions. This has led to growth in usage of LEDs, thus fueling the connected (smart) street lighting market size.

Power consumption and CO2 emission are limited to a minimum in smart street lights, as they are switched on automatically when needed. These lights adjust the brightness of the illumination based on the time of day using integrated photo sensors.

Use of incandescent bulbs across residential, commercial, and industrial sectors has led to surge in the operational and maintenance cost of lighting controls. For instance, in the city of Los Angeles, US$ 42.0 Mn is spent every year for monitoring and maintaining over 200,000 lights. This results in US$ 200 being required for each light to continue working. Cost of maintenance varies depending on the type of street light used. LEDs offer the lowest maintenance costs compared to other outdoor light options such as HPS lamps.

Remote lighting control in smart poles enable more accurate adjusting, modification, and monitoring of the amount of time the lights are turned on and to what extent. Additionally, data transmitted through connected systems report irregular lamp behavior and individual lamp failure. This reduces routine maintenance inspections of lighting control and mitigates operational and maintenance costs. These benefits boost adoption of smart lighting solutions, thereby fueling the global connected (smart) street lighting market expansion.

Several cities across the globe are increasingly deploying connected street lights integrated with wireless technologies such as Li-Fi. Vendors in the industry are integrating such technologies into their systems due to their high data transfer speed and efficiency. Integration of street lighting systems with traffic signals, parking-lot lights, pollution sensors, energy meters, and traffic sensors is providing significant opportunities for market progress, especially in emerging economies.

Poor infrastructure in developing economies is expected to hamper the demand for connected street lights in the next few years. This can be ascribed to underdeveloped network infrastructure and low internet penetration, which leads to less bandwidth availability. Majority of developing countries still rely on traditional lamps. Thus, the shift to connected (smart) street light is not likely to be cost-effective due to high costs involved in procurement and retrofitting old street lamps. The impact of cost is anticipated to be high on the connected (smart) street lighting market development in the short term and is expected to reduce over the long term. This is largely due to surge in government investment in enhancing city infrastructure.

Narrow-Band IoT (NB-IoT) technology was utilized for street lights; a smart street lamp that connects devices more quickly and effectively over established mobile networks and manages two-way communication in a secure and reliable manner.

NB-IoT based street users manage the street lights through their computer, smartphone, or tablet. The features that can be controlled or managed include turning on/off the lights; adjusting brightness; setting schedules; obtaining operational data; measuring electricity consumption; and collecting energy saving statistics. These advantages are expected to significantly boost the market demand for NB-IoT wireless connectivity during the forecast period.

Europe is expected to dominate the global connected smart street lighting business during the forecast period. Increase in focus on achieving sustainable energy targets is driving market share held by the region.

Rise in investment in smart city infrastructure, surge in per capita income, and continuous large-scale industrialization and urbanization are driving the Asia Pacific connected street lights market progress. Additionally, the availability of low-cost electronic products is likely to further boost the market for connected (smart) street lighting in Asia Pacific. North America and Middle East & Africa offer significant opportunities for the connected street lights industry, as these regions are integrating smart infrastructure in cities.

The global connected smart street lighting industry is highly fragmented and involves several street light manufacturers, suppliers, exporters, and software developers. Most manufacturers are investing significantly in the R&D of new products to expand their connected (smart) street lighting market share. Advanced Micro Devices, Inc., Delta Electronics, Inc., Dimonoff Inc., Echelon, EYE Lighting International, Fagerhults Belysning AB, Flashnet S.A. (InteliLIGHT), GE Current (Current Lighting Solutions, LLC), GMR Enlights s.r.l., gridComm, Hubbell, Intermatic Incorporated, Itron Inc., LSI Industries Inc., PLC Multipoint, Quantela, Inc., Reliance Jio Infocomm Ltd., Schréder, Sensus, Signify Holding, Suzhou Rongwen Group, Telensa Inc., Toshiba Lighting & Technology Corporation, TVILIGHT Projects B.V., and Ubicquia, Inc. are key players operating in the global market landscape.

Key players mentioned in the global connected (smart) street lighting market research report have been profiled based on financial overview, business strategies, Company overview, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

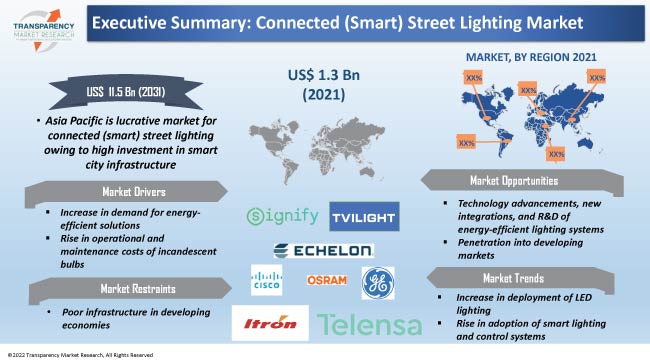

Market Size Value in 2021 |

US$ 1.3 Bn |

|

Market Forecast Value in 2031 |

US$ 11.5 Bn |

|

Growth Rate (CAGR) |

24.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–202 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The connected (smart) street lighting market was valued at US$ 1.3 Bn in 2021

It is estimated to advance at a CAGR of 24.1% during the forecast period

The industry is expected to reach a value of US$ 11.5 Bn by 2031

Asia Pacific accounted for around 20.9% share of the global market in 2021

Increase in deployment of LED lighting and rise in adoption of smart lighting and control systems

Europe is a highly lucrative region of the global business

Advanced Micro Devices, Inc., Delta Electronics, Inc., Dimonoff Inc., Echelon, EYE Lighting International, Fagerhults Belysning AB, Flashnet S.A. (InteliLIGHT), GE Current (Current Lighting Solutions, LLC), GMR Enlights s.r.l., gridComm, Hubbell, Intermatic Incorporated, Itron Inc., LSI Industries Inc., PLC Multipoint, Quantela, Inc., Reliance Jio Infocomm Ltd., Schréder, Sensus, Signify Holding, Suzhou Rongwen Group, Telensa Inc., Toshiba Lighting & Technology Corporation, TVILIGHT Projects B.V

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Connected (Smart) Street Lighting Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Lighting Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Connected (Smart) Street Lighting Market Analysis, by Component

5.1. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

5.1.1. Hardware

5.1.1.1. Light Sources

5.1.1.1.1. LED

5.1.1.1.2. CFL Light

5.1.1.1.3. Sodium Vapor Light

5.1.1.1.4. Others (Incandescent Light, Halogen Light, etc.)

5.1.1.2. Nodes

5.1.1.3. Power Drivers

5.1.1.4. Ballast

5.1.1.5. Sensors and Detectors

5.1.1.6. Lighting Controllers

5.1.1.7. Communication Modules

5.1.1.8. Gateways

5.1.1.9. Others (Concentrators, Switches, etc.)

5.1.2. Software

5.1.3. Services

5.2. Market Attractiveness Analysis, by Component

6. Global Connected (Smart) Street Lighting Market Analysis, by Connectivity

6.1. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Connectivity, 2017–2031

6.1.1. Wired

6.1.2. Wireless

6.1.2.1. GSM (2G, 3G, 4G)

6.1.2.2. NB-IoT

6.1.2.3. LTE-M

6.1.2.4. LoRaWAN

6.1.2.5. Sigfox

6.1.2.6. ZigBee

6.1.2.7. Digi

6.1.2.8. Wi-SUN

6.1.2.9. Others

6.2. Market Attractiveness Analysis, by Connectivity

7. Global Connected (Smart) Street Lighting Market Analysis, by Sales Channel

7.1. Connected (Smart) Street Lighting Market Size (US$ Mn) Analysis & Forecast, by Sales Channel, 2017–2031

7.1.1. Direct

7.1.2. Indirect

7.2. Market Attractiveness Analysis, by Sales Channel

8. Global Connected (Smart) Street Lighting Market Analysis, by End-use Industry

8.1. Connected (Smart) Street Lighting Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

8.1.1. Government

8.1.2. Commercial

8.1.3. Industrial

8.1.4. Residential

8.2. Market Attractiveness Analysis, by End-use Industry

9. Global Connected (Smart) Street Lighting Market Analysis and Forecast, by Region

9.1. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Connected (Smart) Street Lighting Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

10.3.1. Hardware

10.3.1.1. Light Sources

10.3.1.1.1. LED

10.3.1.1.2. CFL Light

10.3.1.1.3. Sodium Vapor Light

10.3.1.1.4. Others (Incandescent Light, Halogen Light, etc.)

10.3.1.2. Nodes

10.3.1.3. Power Drivers

10.3.1.4. Ballast

10.3.1.5. Sensors and Detectors

10.3.1.6. Lighting Controllers

10.3.1.7. Communication Modules

10.3.1.8. Gateways

10.3.1.9. Others (Concentrators, Switches, etc.)

10.3.2. Software

10.3.3. Services

10.4. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Connectivity, 2017–2031

10.4.1. Wired

10.4.2. Wireless

10.4.2.1. GSM (2G, 3G, 4G)

10.4.2.2. NB-IoT

10.4.2.3. LTE-M

10.4.2.4. LoRaWAN

10.4.2.5. Sigfox

10.4.2.6. ZigBee

10.4.2.7. Digi

10.4.2.8. Wi-SUN

10.4.2.9. Others

10.5. Connected (Smart) Street Lighting Market Size (US$ Mn) Analysis & Forecast, by Sales Channel, 2017–2031

10.5.1. Direct

10.5.2. Indirect

10.6. Connected (Smart) Street Lighting Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

10.6.1. Government

10.6.2. Commercial

10.6.3. Industrial

10.6.4. Residential

10.7. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Component

10.8.2. By Connectivity

10.8.3. By Sales Channel

10.8.4. By End-use Industry

10.8.5. By Country/Sub-region

11. Europe Connected (Smart) Street Lighting Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

11.3.1. Hardware

11.3.1.1. Light Sources

11.3.1.1.1. LED

11.3.1.1.2. CFL Light

11.3.1.1.3. Sodium Vapor Light

11.3.1.1.4. Others (Incandescent Light, Halogen Light, etc.)

11.3.1.2. Nodes

11.3.1.3. Power Drivers

11.3.1.4. Ballast

11.3.1.5. Sensors and Detectors

11.3.1.6. Lighting Controllers

11.3.1.7. Communication Modules

11.3.1.8. Gateways

11.3.1.9. Others (Concentrators, Switches, etc.)

11.3.2. Software

11.3.3. Services

11.4. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Connectivity, 2017–2031

11.4.1. Wired

11.4.2. Wireless

11.4.2.1. GSM (2G, 3G, 4G)

11.4.2.2. NB-IoT

11.4.2.3. LTE-M

11.4.2.4. LoRaWAN

11.4.2.5. Sigfox

11.4.2.6. ZigBee

11.4.2.7. Digi

11.4.2.8. Wi-SUN

11.4.2.9. Others

11.5. Connected (Smart) Street Lighting Market Size (US$ Mn) Analysis & Forecast, by Sales Channel, 2017–2031

11.5.1. Direct

11.5.2. Indirect

11.6. Connected (Smart) Street Lighting Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

11.6.1. Government

11.6.2. Commercial

11.6.3. Industrial

11.6.4. Residential

11.7. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Component

11.8.2. By Sales Channel

11.8.3. By End-use Industry

11.8.4. By Country/Sub-region

12. Asia Pacific Connected (Smart) Street Lighting Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

12.3.1. Hardware

12.3.1.1. Light Sources

12.3.1.1.1. LED

12.3.1.1.2. CFL Light

12.3.1.1.3. Sodium Vapor Light

12.3.1.1.4. Others (Incandescent Light, Halogen Light, etc.)

12.3.1.2. Nodes

12.3.1.3. Power Drivers

12.3.1.4. Ballast

12.3.1.5. Sensors and Detectors

12.3.1.6. Lighting Controllers

12.3.1.7. Communication Modules

12.3.1.8. Gateways

12.3.1.9. Others (Concentrators, Switches, etc.)

12.3.2. Software

12.3.3. Services

12.4. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Connectivity, 2017–2031

12.4.1. Wired

12.4.2. Wireless

12.4.2.1. GSM (2G, 3G, 4G)

12.4.2.2. NB-IoT

12.4.2.3. LTE-M

12.4.2.4. LoRaWAN

12.4.2.5. Sigfox

12.4.2.6. ZigBee

12.4.2.7. Digi

12.4.2.8. Wi-SUN

12.4.2.9. Others

12.5. Connected (Smart) Street Lighting Market Size (US$ Mn) Analysis & Forecast, by Sales Channel, 2017–2031

12.5.1. Direct

12.5.2. Indirect

12.6. Connected (Smart) Street Lighting Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

12.6.1. Government

12.6.2. Commercial

12.6.3. Industrial

12.6.4. Residential

12.7. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Component

12.8.2. By Connectivity

12.8.3. By Sales Channel

12.8.4. By End-use Industry

12.8.5. By Country/Sub-region

13. Middle East & Africa Connected (Smart) Street Lighting Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

13.3.1. Hardware

13.3.1.1. Light Sources

13.3.1.1.1. LED

13.3.1.1.2. CFL Light

13.3.1.1.3. Sodium Vapor Light

13.3.1.1.4. Others (Incandescent Light, Halogen Light, etc.)

13.3.1.2. Nodes

13.3.1.3. Power Drivers

13.3.1.4. Ballast

13.3.1.5. Sensors and Detectors

13.3.1.6. Lighting Controllers

13.3.1.7. Communication Modules

13.3.1.8. Gateways

13.3.1.9. Others (Concentrators, Switches, etc.)

13.3.2. Software

13.3.3. Services

13.4. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Connectivity, 2017–2031

13.4.1. Wired

13.4.2. Wireless

13.4.2.1. GSM (2G, 3G, 4G)

13.4.2.2. NB-IoT

13.4.2.3. LTE-M

13.4.2.4. LoRaWAN

13.4.2.5. Sigfox

13.4.2.6. ZigBee

13.4.2.7. Digi

13.4.2.8. Wi-SUN

13.4.2.9. Others

13.5. Connected (Smart) Street Lighting Market Size (US$ Mn) Analysis & Forecast, by Sales Channel, 2017–2031

13.5.1. Direct

13.5.2. Indirect

13.6. Connected (Smart) Street Lighting Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

13.6.1. Government

13.6.2. Commercial

13.6.3. Industrial

13.6.4. Residential

13.7. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Component

13.8.2. By Connectivity

13.8.3. By Sales Channel

13.8.4. By End-use Industry

13.8.5. By Country/Sub-region

14. South America Connected (Smart) Street Lighting Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

14.3.1. Hardware

14.3.1.1. Light Sources

14.3.1.1.1. LED

14.3.1.1.2. CFL Light

14.3.1.1.3. Sodium Vapor Light

14.3.1.1.4. Others (Incandescent Light, Halogen Light, etc.)

14.3.1.2. Nodes

14.3.1.3. Power Drivers

14.3.1.4. Ballast

14.3.1.5. Sensors and Detectors

14.3.1.6. Lighting Controllers

14.3.1.7. Communication Modules

14.3.1.8. Gateways

14.3.1.9. Others (Concentrators, Switches, etc.)

14.3.2. Software

14.3.3. Services

14.4. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Connectivity, 2017–2031

14.4.1. Wired

14.4.2. Wireless

14.4.2.1. GSM (2G, 3G, 4G)

14.4.2.2. NB-IoT

14.4.2.3. LTE-M

14.4.2.4. LoRaWAN

14.4.2.5. Sigfox

14.4.2.6. ZigBee

14.4.2.7. Digi

14.4.2.8. Wi-SUN

14.4.2.9. Others

14.5. Connected (Smart) Street Lighting Market Size (US$ Mn) Analysis & Forecast, by Sales Channel, 2017–2031

14.5.1. Direct

14.5.2. Indirect

14.6. Connected (Smart) Street Lighting Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

14.6.1. Government

14.6.2. Commercial

14.6.3. Industrial

14.6.4. Residential

14.7. Connected (Smart) Street Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Component

14.8.2. By Connectivity

14.8.3. By Sales Channel

14.8.4. By End-use Industry

14.8.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Connected (Smart) Street Lighting Market Competition Matrix - a Dashboard View

15.1.1. Global Connected (Smart) Street Lighting Market Company Share Analysis, by Value (2021)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Advanced Micro Devices

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Delta Electronics, Inc.

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Dimonoff inc.

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Echelon

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. EYE Lighting International

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Fagerhults Belysning AB

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Flashnet S.A. (InteliLIGHT)

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. GE Current (Current Lighting Solutions, LLC)

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. GMR Enlights s.r.l.

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. gridComm

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Hubbell

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Intermatic Incorporated

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. Itron Inc.

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

16.14. LSI Industries Inc.

16.14.1. Overview

16.14.2. Product Portfolio

16.14.3. Sales Footprint

16.14.4. Key Subsidiaries or Distributors

16.14.5. Strategy and Recent Developments

16.14.6. Key Financials

16.15. PLC Multipoint

16.15.1. Overview

16.15.2. Product Portfolio

16.15.3. Sales Footprint

16.15.4. Key Subsidiaries or Distributors

16.15.5. Strategy and Recent Developments

16.15.6. Key Financials

16.16. Quantela, Inc.

16.16.1. Overview

16.16.2. Product Portfolio

16.16.3. Sales Footprint

16.16.4. Key Subsidiaries or Distributors

16.16.5. Strategy and Recent Developments

16.16.6. Key Financials

16.17. Reliance Jio Infocomm Ltd.

16.17.1. Overview

16.17.2. Product Portfolio

16.17.3. Sales Footprint

16.17.4. Key Subsidiaries or Distributors

16.17.5. Strategy and Recent Developments

16.17.6. Key Financials

16.18. Schréder

16.18.1. Overview

16.18.2. Product Portfolio

16.18.3. Sales Footprint

16.18.4. Key Subsidiaries or Distributors

16.18.5. Strategy and Recent Developments

16.18.6. Key Financials

16.19. Sensus

16.19.1. Overview

16.19.2. Product Portfolio

16.19.3. Sales Footprint

16.19.4. Key Subsidiaries or Distributors

16.19.5. Strategy and Recent Developments

16.19.6. Key Financials

16.20. Signify Holding

16.20.1. Overview

16.20.2. Product Portfolio

16.20.3. Sales Footprint

16.20.4. Key Subsidiaries or Distributors

16.20.5. Strategy and Recent Developments

16.20.6. Key Financials

16.21. Suzhou Rongwen Group

16.21.1. Overview

16.21.2. Product Portfolio

16.21.3. Sales Footprint

16.21.4. Key Subsidiaries or Distributors

16.21.5. Strategy and Recent Developments

16.21.6. Key Financials

16.22. Telensa Inc.

16.22.1. Overview

16.22.2. Product Portfolio

16.22.3. Sales Footprint

16.22.4. Key Subsidiaries or Distributors

16.22.5. Strategy and Recent Developments

16.22.6. Key Financials

16.23. Toshiba Lighting & Technology Corporation

16.23.1. Overview

16.23.2. Product Portfolio

16.23.3. Sales Footprint

16.23.4. Key Subsidiaries or Distributors

16.23.5. Strategy and Recent Developments

16.23.6. Key Financials

16.24. TVILIGHT Projects B.V.

16.24.1. Overview

16.24.2. Product Portfolio

16.24.3. Sales Footprint

16.24.4. Key Subsidiaries or Distributors

16.24.5. Strategy and Recent Developments

16.24.6. Key Financials

16.25. Ubicquia, Inc.

16.25.1. Overview

16.25.2. Product Portfolio

16.25.3. Sales Footprint

16.25.4. Key Subsidiaries or Distributors

16.25.5. Strategy and Recent Developments

16.25.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Component

17.1.2. By Connectivity

17.1.3. By Sales Channel

17.1.4. By End-use Industry

17.1.5. By Region/Country/Sub-region

List of Tables

Table 1: Global Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 2: Global Connected (Smart) Street Lighting Market Volume (Million Units) & Forecast, by Component, 2017‒2031

Table 3: Global Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Connectivity, 2017‒2031

Table 4: Global Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Sales Channel, 2017‒2031

Table 5: Global Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 6: Global Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 7: Global Connected (Smart) Street Lighting Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 8: North America Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 9: North America Connected (Smart) Street Lighting Market Volume (Million Units) & Forecast, by Component, 2017‒2031

Table 10: North America Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Connectivity, 2017‒2031

Table 11: North America Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Sales Channel, 2017‒2031

Table 12: North America Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 13: North America Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 14: North America Connected (Smart) Street Lighting Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

Table 15: Europe Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 16: Europe Connected (Smart) Street Lighting Market Volume (Million Units) & Forecast, by Component, 2017‒2031

Table 17: Europe Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Connectivity, 2017‒2031

Table 18: Europe Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Sales Channel, 2017‒2031

Table 19: Europe Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 20: Europe Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 21: Europe Connected (Smart) Street Lighting Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

Table 22: Asia Pacific Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 23: Asia Pacific Connected (Smart) Street Lighting Market Volume (Million Units) & Forecast, by Component, 2017‒2031

Table 24: Asia Pacific Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Connectivity, 2017‒2031

Table 25: Asia Pacific Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Sales Channel, 2017‒2031

Table 26: Asia Pacific Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 27: Asia Pacific Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 28: Asia Pacific Connected (Smart) Street Lighting Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

Table 29: Middle East & Africa Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 30: Middle East & Africa Connected (Smart) Street Lighting Market Volume (Million Units) & Forecast, by Component, 2017‒2031

Table 31: Middle East & Africa Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Connectivity, 2017‒2031

Table 32: Middle East & Africa Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Sales Channel, 2017‒2031

Table 33: Middle East & Africa Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 34: Middle East & Africa Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 35: Middle East & Africa Connected (Smart) Street Lighting Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

Table 36: South America Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 37: South America Connected (Smart) Street Lighting Market Volume (Million Units) & Forecast, by Component, 2017‒2031

Table 38: South America Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Connectivity, 2017‒2031

Table 39: South America Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Sales Channel, 2017‒2031

Table 40: South America Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 41: South America Connected (Smart) Street Lighting Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 42: South America Connected (Smart) Street Lighting Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

List of Figures

Figure 01: Global Connected (Smart) Street Lighting Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 02: Global Connected (Smart) Street Lighting Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 03: Global Connected (Smart) Street Lighting Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 04: Global Connected (Smart) Street Lighting Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 05: Global Connected (Smart) Street Lighting Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 06: Global Connected (Smart) Street Lighting Market Share Analysis, by Component, 2021 and 2031

Figure 07: Global Connected (Smart) Street Lighting Market, Incremental Opportunity, by Component, 2021‒2031

Figure 08: Global Connected (Smart) Street Lighting Market Projections by Connectivity, and Value (US$ Mn), 2017‒2031

Figure 09: Global Connected (Smart) Street Lighting Market Share Analysis, by Connectivity, 2021 and 2031

Figure 10: Global Connected (Smart) Street Lighting Market, Incremental Opportunity, by Connectivity, 2021‒2031

Figure 11: Global Connected (Smart) Street Lighting Market Projections by Sales Channel, and Value (US$ Mn), 2017‒2031

Figure 12: Global Connected (Smart) Street Lighting Market Share Analysis, by Sales Channel, 2021 and 2031

Figure 13: Global Connected (Smart) Street Lighting Market, Incremental Opportunity, by Sales Channel, 2021‒2031

Figure 14: Global Connected (Smart) Street Lighting Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 15: Global Connected (Smart) Street Lighting Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 16: Global Connected (Smart) Street Lighting Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 17: Global Connected (Smart) Street Lighting Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 18: Global Connected (Smart) Street Lighting Market Share Analysis, by Region 2021 and 2031

Figure 19: Global Connected (Smart) Street Lighting Market, Incremental Opportunity, by Region, 2021‒2031

Figure 20: North America Connected (Smart) Street Lighting Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 21: North America Connected (Smart) Street Lighting Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 22: North America Connected (Smart) Street Lighting Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 23: North America Connected (Smart) Street Lighting Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 24: North America Connected (Smart) Street Lighting Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 25: North America Connected (Smart) Street Lighting Market Share Analysis, by Component, 2021 and 2031

Figure 26: North America Connected (Smart) Street Lighting Market, Incremental Opportunity, by Component, 2021‒2031

Figure 27: North America Connected (Smart) Street Lighting Market Projections by Connectivity, and Value (US$ Mn), 2017‒2031

Figure 28: North America Connected (Smart) Street Lighting Market Share Analysis, by Connectivity, 2021 and 2031

Figure 29: North America Connected (Smart) Street Lighting Market, Incremental Opportunity, by Connectivity, 2021‒2031

Figure 30: North America Connected (Smart) Street Lighting Market Projections by Sales Channel, and Value (US$ Mn), 2017‒2031

Figure 31: North America Connected (Smart) Street Lighting Market Share Analysis, by Sales Channel, 2021 and 2031

Figure 32: North America Connected (Smart) Street Lighting Market, Incremental Opportunity, by Sales Channel, 2021‒2031

Figure 33: North America Connected (Smart) Street Lighting Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 34: North America Connected (Smart) Street Lighting Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 35: North America Connected (Smart) Street Lighting Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 36: North America Connected (Smart) Street Lighting Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 37: North America Connected (Smart) Street Lighting Market Share Analysis, by Region 2021 and 2031

Figure 38: North America Connected (Smart) Street Lighting Market, Incremental Opportunity, by Region, 2021‒2031

Figure 39: Europe Connected (Smart) Street Lighting Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 40: Europe Connected (Smart) Street Lighting Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 41: Europe Connected (Smart) Street Lighting Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 42: Europe Connected (Smart) Street Lighting Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 43: Europe Connected (Smart) Street Lighting Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 44: Europe Connected (Smart) Street Lighting Market Share Analysis, by Component, 2021 and 2031

Figure 45: Europe Connected (Smart) Street Lighting Market, Incremental Opportunity, by Component, 2021‒2031

Figure 46: Europe Connected (Smart) Street Lighting Market Projections by Connectivity, and Value (US$ Mn), 2017‒2031

Figure 47: Europe Connected (Smart) Street Lighting Market Share Analysis, by Connectivity, 2021 and 2031

Figure 48: Europe Connected (Smart) Street Lighting Market, Incremental Opportunity, by Connectivity, 2021‒2031

Figure 49: Europe Connected (Smart) Street Lighting Market Projections by Sales Channel, and Value (US$ Mn), 2017‒2031

Figure 50: Europe Connected (Smart) Street Lighting Market Share Analysis, by Sales Channel, 2021 and 2031

Figure 51: Europe Connected (Smart) Street Lighting Market, Incremental Opportunity, by Sales Channel, 2021‒2031

Figure 52: Europe Connected (Smart) Street Lighting Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 53: Europe Connected (Smart) Street Lighting Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 54: Europe Connected (Smart) Street Lighting Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 55: Europe Connected (Smart) Street Lighting Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 56: Europe Connected (Smart) Street Lighting Market Share Analysis, by Region 2021 and 2031

Figure 57: Europe Connected (Smart) Street Lighting Market, Incremental Opportunity, by Region, 2021‒2031

Figure 58: Asia Pacific Connected (Smart) Street Lighting Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 59: Asia Pacific Connected (Smart) Street Lighting Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 60: Asia Pacific Connected (Smart) Street Lighting Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 61: Asia Pacific Connected (Smart) Street Lighting Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 62: Asia Pacific Connected (Smart) Street Lighting Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 63: Asia Pacific Connected (Smart) Street Lighting Market Share Analysis, by Component, 2021 and 2031

Figure 64: Asia Pacific Connected (Smart) Street Lighting Market, Incremental Opportunity, by Component, 2021‒2031

Figure 65: Asia Pacific Connected (Smart) Street Lighting Market Projections by Connectivity, and Value (US$ Mn), 2017‒2031

Figure 66: Asia Pacific Connected (Smart) Street Lighting Market Share Analysis, by Connectivity, 2021 and 2031

Figure 67: Asia Pacific Connected (Smart) Street Lighting Market, Incremental Opportunity, by Connectivity, 2021‒2031

Figure 68: Asia Pacific Connected (Smart) Street Lighting Market Projections by Sales Channel, and Value (US$ Mn), 2017‒2031

Figure 69: Asia Pacific Connected (Smart) Street Lighting Market Share Analysis, by Sales Channel, 2021 and 2031

Figure 70: Asia Pacific Connected (Smart) Street Lighting Market, Incremental Opportunity, by Sales Channel, 2021‒2031

Figure 71: Asia Pacific Connected (Smart) Street Lighting Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 72: Asia Pacific Connected (Smart) Street Lighting Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 73: Asia Pacific Connected (Smart) Street Lighting Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 74: Asia Pacific Connected (Smart) Street Lighting Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 75: Asia Pacific Connected (Smart) Street Lighting Market Share Analysis, by Region 2021 and 2031

Figure 76: Asia Pacific Connected (Smart) Street Lighting Market, Incremental Opportunity, by Region, 2021‒2031

Figure 77: Middle East & Africa Connected (Smart) Street Lighting Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 78: Middle East & Africa Connected (Smart) Street Lighting Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 79: Middle East & Africa Connected (Smart) Street Lighting Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 80: Middle East & Africa Connected (Smart) Street Lighting Market Size & Forecast, Y-o-Y, and Volume (Million Units), 2017‒2031

Figure 81: Middle East & Africa Connected (Smart) Street Lighting Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 82: Middle East & Africa Connected (Smart) Street Lighting Market Share Analysis, by Component, 2021 and 2031

Figure 83: Middle East & Africa Connected (Smart) Street Lighting Market, Incremental Opportunity, by Component, 2021‒2031

Figure 84: Middle East & Africa Connected (Smart) Street Lighting Market Projections by Connectivity, and Value (US$ Mn), 2017‒2031

Figure 85: Middle East & Africa Connected (Smart) Street Lighting Market Share Analysis, by Connectivity, 2021 and 2031

Figure 86: Middle East & Africa Connected (Smart) Street Lighting Market, Incremental Opportunity, by Connectivity, 2021‒2031

Figure 87: Middle East & Africa Connected (Smart) Street Lighting Market Projections by Sales Channel, and Value (US$ Mn), 2017‒2031

Figure 88: Middle East & Africa Connected (Smart) Street Lighting Market Share Analysis, by Sales Channel, 2021 and 2031

Figure 89: Middle East & Africa Connected (Smart) Street Lighting Market, Incremental Opportunity, by Sales Channel, 2021‒2031

Figure 90: Middle East & Africa Connected (Smart) Street Lighting Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 91: Middle East & Africa Connected (Smart) Street Lighting Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 92: Middle East & Africa Connected (Smart) Street Lighting Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 93: Middle East & Africa Connected (Smart) Street Lighting Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 94: Middle East & Africa Connected (Smart) Street Lighting Market Share Analysis, by Region 2021 and 2031

Figure 95: Middle East & Africa Connected (Smart) Street Lighting Market, Incremental Opportunity, by Region, 2021‒2031

Figure 96: South America Connected (Smart) Street Lighting Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 97: South America Connected (Smart) Street Lighting Market Size & Forecast, Y-o-Y, and Value (US$ Mn), 2017‒2031

Figure 98: South America Connected (Smart) Street Lighting Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 99: South America Connected (Smart) Street Lighting Market Size & Forecast, Y-o-Y, Volume (Million Units), 2017‒2031

Figure 100: South America Connected (Smart) Street Lighting Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 101: South America Connected (Smart) Street Lighting Market Share Analysis, by Component, 2021 and 2031

Figure 102: South America Connected (Smart) Street Lighting Market, Incremental Opportunity, by Component, 2021‒2031

Figure 103: South America Connected (Smart) Street Lighting Market Projections by Connectivity, and Value (US$ Mn), 2017‒2031

Figure 104: South America Connected (Smart) Street Lighting Market Share Analysis, by Connectivity, 2021 and 2031

Figure 105: South America Connected (Smart) Street Lighting Market, Incremental Opportunity, by Connectivity, 2021‒2031

Figure 106: South America Connected (Smart) Street Lighting Market Projections by Sales Channel, and Value (US$ Mn), 2017‒2031

Figure 107: South America Connected (Smart) Street Lighting Market Share Analysis, by Sales Channel, 2021 and 2031

Figure 108: South America Connected (Smart) Street Lighting Market, Incremental Opportunity, by Sales Channel, 2021‒2031

Figure 109: South America Connected (Smart) Street Lighting Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 110: South America Connected (Smart) Street Lighting Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 111: South America Connected (Smart) Street Lighting Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 112: South America Connected (Smart) Street Lighting Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 113: South America Connected (Smart) Street Lighting Market Share Analysis, by Region 2021 and 2031

Figure 114: South America Connected (Smart) Street Lighting Market, Incremental Opportunity, by Region, 2021‒2031

Figure 115: Company Share Analysis (2021)