Analysts’ Viewpoint on Skincare Serum Market Scenario

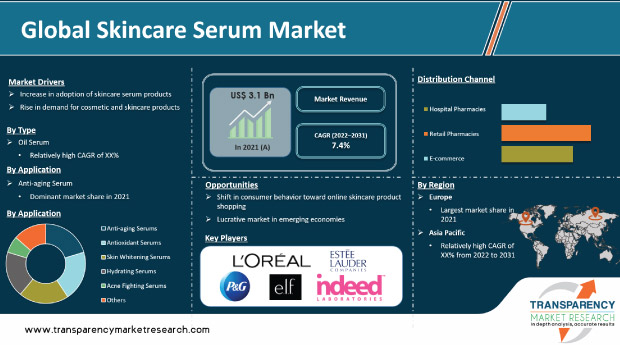

Rise in skin disorders such as acne, blemishes, open pores, and black heads is expected to boost the demand for skin care serums, thus driving the global skincare serum market during the forecast period. Various types of serums such as hydrating serum, anti-aging serum, and acne fighting serum are used by people to overcome skin issues. Increase in awareness about skincare among women in rural and urban areas of countries in various regions also contributes to market growth. Growth of the retail sector, rise in number of new stores selling skincare products, and emergence of modern trade are propelling the FMCG market in Asia Pacific. This, in turn, is augmenting the global skincare serum market.

Skincare serum can be applied to the skin after cleansing, but before moisturizing, to deliver powerful ingredients directly to the skin. Serum is ideal for this application due to its smaller molecules, which can penetrate deeper into the skin and deliver a high concentration of active ingredients. Serums are typically clear, gel-based, or liquid, and thinner than moisturizers. These are typically applied before moisturizers to aid in moisture retention. Face serums are topical applications that are transparent or translucent. They have excellent spreadability and absorption, and are specifically designed for enhanced active delivery.

Face serums address skin concerns such as fine lines, wrinkles, dark spots, skin and dullness. Anti-aging serums aid in the prevention or reduction of fine lines and wrinkles. These typically include active ingredients such as retinol (vitamin A) and niacinamide (vitamin B3). With a watery texture and light formulation, vitamin C essence serum quickly absorbs and penetrates the skin to encourage healthy radiance. Niacinamide is another popular ingredient used in serums for fading dark spots and evening out skin tone. Pure vitamin C is unstable; hence, it has a short shelf life due to the possibility of oxidation. Vitamin C compounds are being developed to keep serums and other skin care products effective.

Vit C serum is one of the key antioxidant ingredients in the market. Vitamin C skincare, a natural collagen booster, improves elasticity, texture, and quality of skin by making it appear tight and youthful. Vitamin C skincare products, particularly vitamin C serum for the face, have steadily entered the market. Increase in awareness about skincare routine and popularity of skincare products are driving the demand for skincare serums. Surge in demand for skincare serums among salon owners, beauty salons, and dermatologists is expected to provide skincare serums growth opportunity to market players.

The cosmetics and personal care industry has been witnessing rapid shift toward organic and natural products since the last few years. Rise in health awareness and customer concerns about environmental sustainability has fueled the demand for organic and natural cosmetics. Consumers' skincare routines now include organic, naturally produced, eco-friendly, sustainable, and vegan products. Brands are promoting their products with terms such as ‘eco-friendly packaging, environmentally friendly source, and zero waste’ to reflect sustainability. Therefore, organic products have become a major topic of debate in the beauty industry, with brands promoting products with claims such as clear beauty, water-free beauty, and recyclable beauty.

Organic products are becoming increasingly popular. New age customers are becoming more health conscious, and are interested in ingredients used in personal care products. They are increasingly gravitating toward brands that use natural ingredients, adhere to ethical manufacturing practices, and provide vegan or cruelty-free products. Demand for cosmetic brands that are tested on animals is declining. This is inducing manufacturers to introduce cruelty-free product lines to avoid losing market share. Organic and ethical products are gaining on traditional chemical-based branded products, despite being more expensive and having a shorter shelf life.

Based on type, the oil serum segment accounted for the largest share of the global skincare serum market in 2021. Serums are liquids with a thin, watery consistency and high concentration of active ingredients. Serums are ideal for targeting specific skincare concerns, such as acne, aging, and dullness, as they allow the product to penetrate deep beneath the skin's surface. Oil serum is the simplest to make of all the facial serums. It is typically composed of high-end specialized carrier oils that are fast-absorbing (also known as 'dry' oils). The serum's high-end oils not only provide moisturizing and barrier repair properties, but also polyphenols, essential fatty acids, and other compounds that can be metabolized by the skin. Gel serums impart a tightening sensation to the skin, enabling users to feel as if their skin is being temporarily lifted or tightened in specific areas of the face. Hence, oil serum is better than other skincare serums.

In terms of application, the anti-aging serum segment held significant share of the global market in 2021. Rise in consumer awareness about age-related skin problems such as fine lines, wrinkles, and skin dullness and increase in inclination toward spending on products that help them proclaim their skin's youthfulness are expected to drive the anti-aging segment throughout the forecast period. Growth in desire to look younger is prompting middle-aged consumers to purchase anti-aging serums. This trend is expected to continue during the forecast period. Manufacturers and skincare product providers are attempting to retain product features, while capturing end-users' attention through packaging innovation. Majority of beauty serums as well as many other skin care and cosmetics products are undergoing packaging changes. The anti-aging serums segment is expected to follow suit in the next few years.

Based on distribution channel, the retail pharmacies segment is projected to account for major share of the global skincare serum market during the forecast period. Manufacturers and retailers are improving their supply chains to meet the growing demand for skincare products. E-commerce giants and retailers are compelling various brands to adopt an omni-channel supply model. Consumers are more socially aware and technologically savvy than they were before the COVID-19 pandemic, which has resulted in the emergence of the new age health-conscious consumer segment. This shift in consumer attitude is poised to transform the retail pharmacies segment during the forecast period.

Europe accounted for the largest share of the global skincare serum market in 2021. The region is projected to be a highly lucrative market for skincare serums during the forecast period. The cosmetics industry in the region is science-driven and highly innovative, and plays a leading role in product development. The cosmetics and personal care industry in Europe has been thriving, as consumers have become more aware of the importance of health, wellness, and personal care products. Skincare is the dominant segment of the cosmetics industry in the region, accounting for more than half the market share. Furthermore, the cosmetics market in Europe is driven by innovation, with new color palettes, skin-specific treatments, and one-of-a-kind formulas. The average product's lifecycle is less than five years; therefore, cosmetics manufacturers must reformulate 25% of their products each year to keep up with the industry's pace in this highly competitive market.

Asia Pacific is expected to be the next focus of skincare serums key players. Awareness about the efficacy of exotic ingredients in skincare products has piqued the interest of people in the region's developing and developed countries. The number of men using skincare products is steadily increasing across Asia, particularly in China and South Korea. Changes in lifestyle patterns in emerging countries due to rapid urbanization, increase in awareness about advanced skin care products, and innovative product portfolio are likely to drive the market in Asia Pacific during the forecast period.

The global skincare serum market is consolidated, with the presence of small number of leading players. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the leading players in the global skincare serum market. Loral Group (IT Cosmetics LLC), Estee Lauder Companies, Amway, Proctor and Gamble (Olay), Unilever (Paula's Choice), Philosophy, Inc., and Sanitas Skincare are the prominent players operating in the global skincare serum market.

Each of these players has been profiled in the skincare serum market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 3.1 Bn |

|

Market Forecast Value in 2031 |

More than US$ 6.28 Bn |

|

Growth Rate (CAGR) |

7.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global skincare serum market was valued at US$ 3.1 Bn in 2021.

The global skincare serum market is projected to reach more than US$ 6.28 Bn by 2031.

The global skincare serum market is anticipated to grow at a CAGR of 7.4% from 2022 to 2031.

Increase in adoption of skincare serum products.

Europe is expected to account for major share of the global skincare serum market during the forecast period.

Loral Group (IT Cosmetics LLC), Estee Lauder Companies, Amway, Proctor and Gamble (Olay), Unilever (Paula's Choice), Philosophy, Inc., and Sanitas Skincare.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Skincare Serum Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Skincare Serum Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Global Skincare Types Market

5.2. Key Industry Events (mergers, acquisitions, collaborations, approvals, etc.)

5.3. COVID-19 Impact Analysis

6. Global Skincare Serum Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017–2031

6.3.1. Oil Serum

6.3.2. Gel Serum

6.3.3. Emulsion Serum

6.3.4. Others

6.4. Market Attractiveness By Type

7. Global Skincare Serum Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Anti-aging Serums

7.3.2. Antioxidant Serums

7.3.3. Skin Whitening Serums

7.3.4. Hydrating Serums

7.3.5. Acne Fighting Serums

7.3.6. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Skincare Serum Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Skincare Serum Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Skincare Serum Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017–2031

10.2.1. Oil Serum

10.2.2. Gel Serum

10.2.3. Emulsion Serum

10.2.4. Others

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Anti-aging Serums

10.3.2. Antioxidant Serums

10.3.3. Skin Whitening Serums

10.3.4. Hydrating Serums

10.3.5. Acne Fighting Serums

10.3.6. Others

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Application

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Skincare Serum Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017–2031

11.2.1. Oil Serum

11.2.2. Gel Serum

11.2.3. Emulsion Serum

11.2.4. Others

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Anti-aging Serums

11.3.2. Antioxidant Serums

11.3.3. Skin Whitening Serums

11.3.4. Hydrating Serums

11.3.5. Acne Fighting Serums

11.3.6. Others

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Application

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Skincare Serum Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017–2031

12.2.1. Oil Serum

12.2.2. Gel Serum

12.2.3. Emulsion Serum

12.2.4. Others

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Anti-aging Serums

12.3.2. Antioxidant Serums

12.3.3. Skin Whitening Serums

12.3.4. Hydrating Serums

12.3.5. Acne Fighting Serums

12.3.6. Others

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Application

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Skincare Serum Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017–2031

13.2.1. Oil Serum

13.2.2. Gel Serum

13.2.3. Emulsion Serum

13.2.4. Others

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Anti-aging Serums

13.3.2. Antioxidant Serums

13.3.3. Skin Whitening Serums

13.3.4. Hydrating Serums

13.3.5. Acne Fighting Serums

13.3.6. Others

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Application

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Skincare Serum Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017–2031

14.2.1. Oil Serum

14.2.2. Gel Serum

14.2.3. Emulsion Serum

14.2.4. Others

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Anti-aging Serums

14.3.2. Antioxidant Serums

14.3.3. Skin Whitening Serums

14.3.4. Hydrating Serums

14.3.5. Acne Fighting Serums

14.3.6. Others

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Application

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Loral Group

15.3.1.1. Company Overview

15.3.1.2. Type Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Estee Lauder Companies

15.3.2.1. Company Overview

15.3.2.2. Type Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Amway

15.3.3.1. Company Overview

15.3.3.2. Type Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Proctor and Gamble (Olay)

15.3.4.1. Company Overview

15.3.4.2. Type Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Unilever(Paula's Choice)

15.3.5.1. Company Overview

15.3.5.2. Type Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Philosophy, Inc.

15.3.6.1. Company Overview

15.3.6.2. Type Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Sanitas Skincare

15.3.7.1. Company Overview

15.3.7.2. Type Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. E.L.F. Cosmetics

15.3.8.1. Company Overview

15.3.8.2. Type Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Deciem Beauty Group, Inc.

15.3.9.1. Company Overview

15.3.9.2. Type Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Indeed Labs

15.3.10.1. Company Overview

15.3.10.2. Type Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

15.3.11. HONEST BEAUTY

15.3.11.1. Company Overview

15.3.11.2. Type Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Financial Overview

15.3.11.5. Strategic Overview

15.3.12. ERNO LASZLO

15.3.12.1. Company Overview

15.3.12.2. Type Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Financial Overview

15.3.12.5. Strategic Overview

15.3.13. Tarte Cosmetics

15.3.13.1. Company Overview

15.3.13.2. Type Portfolio

15.3.13.3. SWOT Analysis

15.3.13.4. Financial Overview

15.3.13.5. Strategic Overview

15.3.14. Pixi Beauty

15.3.14.1. Company Overview

15.3.14.2. Type Portfolio

15.3.14.3. SWOT Analysis

15.3.14.4. Financial Overview

15.3.14.5. Strategic Overview

15.3.15. EMK Beverly Hills

15.3.15.1. Company Overview

15.3.15.2. Type Portfolio

15.3.15.3. SWOT Analysis

15.3.15.4. Financial Overview

15.3.15.5. Strategic Overview

List of Tables

Table 01: Global Skincare Serum Market Size (US$ Mn) Forecast, by Type, 2017–2031

Table 02: Global Skincare Serum Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Skincare Serum Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Skincare Serum Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Skincare Serum Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Skincare Serum Market Size (US$ Mn) Forecast, by Type, 2017–2031

Table 07: North America Skincare Serum Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Skincare Serum Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Skincare Serum Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Skincare Serum Market Size (US$ Mn) Forecast, by Type, 2017–2031

Table 11: Europe Skincare Serum Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe Skincare Serum Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Asia Pacific Skincare Serum Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Skincare Serum Market Size (US$ Mn) Forecast, by Type, 2017–2031

Table 15: Asia Pacific Skincare Serum Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific Skincare Serum Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 17: Latin America Skincare Serum Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Skincare Serum Market Size (US$ Mn) Forecast, by Type, 2017–2031

Table 19: Latin America Skincare Serum Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America Skincare Serum Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Middle East & Africa Skincare Serum Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Skincare Serum Market Size (US$ Mn) Forecast, by Type, 2017–2031

Table 23: Middle East & Africa Skincare Serum Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa Skincare Serum Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Skincare Serum Market Size (US$ Mn) and Distribution (%), by Region, 2018 and 2031

Figure 02: Global Skincare Serum Market Revenue (US$ Mn), by Type, 2021

Figure 03: Global Skincare Serum Market Value Share, by Type, 2021

Figure 04: Global Skincare Serum Market Value Share, by Application, 2021

Figure 05: Global Skincare Serum Market Value Share, by Distribution Channel, 2021

Figure 06: Global Skincare Serum Market Value Share, by Region, 2021

Figure 07: Global Skincare Serum Market Value (US$ Mn) Forecast, 2022–2031

Figure 08: Global Skincare Serum Market Value Share Analysis, by Type, 2021 and 2031

Figure 09: Global Skincare Serum Market Attractiveness Analysis, by Type, 2022-2031

Figure 10: Global Skincare Serum Market Value Share Analysis, by Application, 2021 and 2031

Figure 11: Global Skincare Serum Market Attractiveness Analysis, by Application, 2022-2031

Figure 12: Global Skincare Serum Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 13: Global Skincare Serum Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 14: Global Skincare Serum Market Value Share Analysis, by Region, 2021 and 2031

Figure 15: Global Skincare Serum Market Attractiveness Analysis, by Region, 2022-2031

Figure 16: North America Skincare Serum Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 17: North America Skincare Serum Market Attractiveness Analysis, by Country, 2017–2031

Figure 18: North America Skincare Serum Market Value Share Analysis, by Country, 2021 and 2031

Figure 19: North America Skincare Serum Market Value Share Analysis, by Type, 2021 and 2031

Figure 20: North America Skincare Serum Market Value Share Analysis, by Application, 2021 and 2031

Figure 21: North America Skincare Serum Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 22: North America Skincare Serum Market Attractiveness Analysis, by Type, 2022–2031

Figure 23: North America Skincare Serum Market Attractiveness Analysis, by Application, 2022–2031

Figure 24: North America Skincare Serum Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 25: Europe Skincare Serum Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 26: Europe Skincare Serum Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 27: Europe Skincare Serum Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 28: Europe Skincare Serum Market Value Share Analysis, by Type, 2021 and 2031

Figure 29: Europe Skincare Serum Market Value Share Analysis, by Application, 2021 and 2031

Figure 30: Europe Skincare Serum Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 31: Europe Skincare Serum Market Attractiveness Analysis, by Type, 2022–2031

Figure 32: Europe Skincare Serum Market Attractiveness Analysis, by Application, 2022–2031

Figure 33: Europe Skincare Serum Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 34: Asia Pacific Skincare Serum Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 35: Asia Pacific Skincare Serum Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 36: Asia Pacific Skincare Serum Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 37: Asia Pacific Skincare Serum Market Value Share Analysis, by Type, 2021 and 2031

Figure 38: Asia Pacific Skincare Serum Market Value Share Analysis, by Application, 2021 and 2031

Figure 39: Asia Pacific Skincare Serum Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 40: Asia Pacific Skincare Serum Market Attractiveness Analysis, by Type, 2022–2031

Figure 41: Asia Pacific Skincare Serum Market Attractiveness Analysis, by Application, 2022–2031

Figure 42: Asia Pacific Skincare Serum Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 43: Latin America Skincare Serum Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 44: Latin America Skincare Serum Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 45: Latin America Skincare Serum Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 46: Latin America Skincare Serum Market Value Share Analysis, by Type, 2021 and 2031

Figure 47: Latin America Skincare Serum Market Value Share Analysis, by Application, 2021 and 2031

Figure 48: Latin America Skincare Serum Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 49: Latin America Skincare Serum Market Attractiveness Analysis, by Type, 2022–2031

Figure 50: Latin America Skincare Serum Market Attractiveness Analysis, by Application, 2022–2031

Figure 51: Latin America Skincare Serum Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 52: Middle East & Africa Skincare Serum Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 53: Middle East & Africa Skincare Serum Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 54: Middle East & Africa Skincare Serum Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 55: Middle East & Africa Skincare Serum Market Value Share Analysis, by Type, 2021 and 2031

Figure 56: Middle East & Africa Skincare Serum Market Value Share Analysis, by Application, 2021 and 2031

Figure 57: Middle East & Africa Skincare Serum Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 58: Middle East & Africa Skincare Serum Market Attractiveness Analysis, by Type, 2022–2031

Figure 59: Middle East & Africa Skincare Serum Market Attractiveness Analysis, by Application, 2022–2031

Figure 60: Middle East & Africa Skincare Serum Market Attractiveness Analysis, by Distribution Channel, 2022–2031