Analysts’ Viewpoint

Single-use flexible endoscopes are preferred in several surgical and non-surgical procedures owing to the growth in trend of using single-use devices. Disposability features of single-use medical devices, such as suction catheters, surgical masks, and syringes, have decreased infection risks and improved patient safety. Disposable endoscopes have lowered the risk of post-procedure infection brought on by cross-contamination, akin to other disposable medical devices.

Interest in these devices is rising due to the pressing need for increased patient safety. Recent research by the U.S. Food and Drug Administration (FDA) twice led to updated safety communications and new guidance for reprocessing flexible endoscopes in 2020. In June 2021, the FDA indicated that medical professionals prefer using single-use bronchoscopes when there is a higher risk of infection transmission and while treating COVID-19 patients.

Endoscope is a medical device with a light on it. It is used to carry out examination inside of an organ and body cavity. During a sigmoidoscopy or bronchoscopy, the device is transplanted through a tiny opening, such as the mouth or rectum. Single-use endoscopes have been recently introduced in response to increased concerns about the spread of infections by reusable endoscopes.

Demand for single-use endoscopes providing high resolution and high-definition images is expected to increase in the treatment of mucosa and to carry out diagnosis and examination of the gastrointestinal tract, gastrointestinal bleeding, and obtain tissue samples of luminal organs. Development of endoscopy techniques, such as duodenoscopes, bronchoscopes, and echoendoscopes, by major companies is likely to support market expansion during the forecast period.

Rise in prevalence of gastrointestinal diseases and increase in initiatives, such as approvals for usage of endoscopes, are the major factors propelling the market progress. For example, a GLOBOCAN report stated that the incidence of stomach cancer was 1,089,103 in 2020. This figure is expected to rise to 1,810,870 by 2040. Rise in prevalence of stomach cancer is expected to drive sales due to early cancer diagnosis.

Product launches and collaborations are key strategies adopted by companies. The Asian Institute of Gastroenterology (AIG) in India received an automation diagnostic support system in October 2020 as a result of a collaboration between Olympus Corporation and Cybernet Systems Co. Ltd. Developments in various end-user facilities and new product releases and partnerships are the key market trends. Implementation of single-use gastroendoscopes is likely to boost the business during the forecast period.

Rise in preference for minimally invasive surgeries, such as proctoscopy, gastroscopy, and cystoscopy, owing to smaller incisions, less pain, faster recovery, and low or no risk of complications, is driving the single-use flexible endoscope market size. Minimally invasive surgeries are known to be less expensive and provide a higher quality of life. Surge in number of cancer cases and increase in usage of endoscopy for biopsies and endoscopic ultrasound to treat such chronic diseases are the key business catalysts.

Increase in number of obese patients, rise in public awareness about the procedure, and government support are augmenting the market share. For example, in April 2022, the U.S. FDA revised its "Safety Communication" and reaffirmed its suggestion that healthcare facilities and endoscopy facilities swap to using only totally or semi-disposable duodenoscopes.

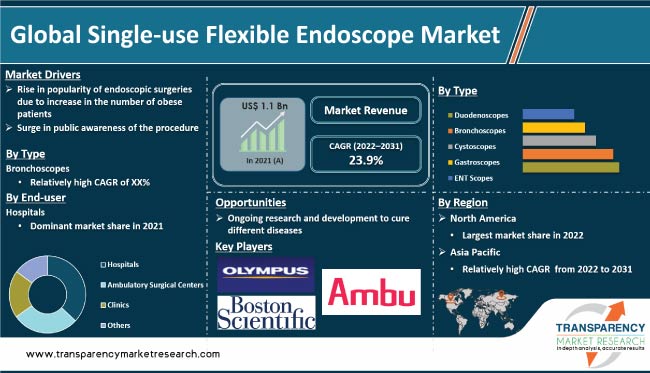

In terms of type, the bronchoscopes segment is expected to grow at a rapid pace during the forecast period. Bronchoscopes are used to treat airway cancer with radioactive materials. These are also used to collect tissue samples when other tests, such as a CT scan or an X-ray, reveal a problem with the lung or lymph nodes in the chest.

Lung diseases, such as chronic obstructive pulmonary disease (COPD), sinusitis, and otitis media, are diagnosed by collecting tissues or mucus samples for examination. The severity of the disease is also assessed using bronchoscopes.

The World Health Organization (WHO) estimates that COPD accounts for 3.3 million deaths each year. Furthermore, the American Cancer Society reported 235,070 cases of lung cancer in the U.S. in 2018. This is driving the need for bronchoscopies for biopsies to identify and treat lung cancers. In turn, this is anticipated to propel the bronchoscopes segment during the forecast period.

Based on end-user, the hospitals segment dominated the global business in 2021, as hospitals have a significantly higher rate of product adoption and usage than other healthcare facilities. The segment is driven by favorable reimbursement policies and improvement in healthcare infrastructure in developed and emerging economies.

Hospitals are the primary medical care providers in many nations. They also perform the majority of procedures and surgeries, which contribute to the segment's growth. High product demand in hospitals is partly due to the rise in awareness about the risk of contamination and hospital-acquired infections associated with reusable devices.

North America accounted for approximately 40.0% share of the industry in 2021. This can be ascribed to well-established healthcare infrastructure and rapid adoption of new products in the region. Additionally, aging population, increase in demand for minimally invasive surgeries, and rise in prevalence of infectious diseases are driving the demand for single-use flexible endoscopes in the region. A multisite study published in 2018 in the American Journal of Infection Control showed that samples from 71% of endoscopes had microbial growth. Insufficient recycling and drying resulted in exposure and fluid residue.

The market in Asia Pacific is expected to expand rapidly in the next few years. Aging population and rising demand for innovative healthcare services are creating significant opportunities for manufacturers of single-use endoscopes. Additionally, multinational corporations are focusing on countries in Asia to build their facilities due to access to low-cost labor and raw materials.

The single-use flexible endoscope market is highly competitive and dominated by a small group of companies. Key players are forming strategic alliances to drive sales and share. Other strategies used by participants to increase their reach include product line expansion, acquisitions, and mergers.

Boston Scientific Corporation, Ambu A/S, Olympus America, Fujifilm Holdings Corporation, Laborie, NeoScope Inc., Coloplast Corp., Shenzhen Tianlang Medical, Intersurgical, and Teleflex Incorporated are the key players in the global industry.

The market report profiles key players based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 1.1 Bn |

|

Forecast (Value) in 2031 |

More than US$ 9.1 Bn |

|

Growth Rate (CAGR) for 2022–2031 |

23.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industry was valued at US$ 1.1 Bn in 2021.

It is projected to reach more than US$ 9.1 Bn by 2031.

The CAGR is expected to be 23.9% from 2022 to 2031

Rise in popularity of endoscopic surgeries due to increase in number of obese patients and surge in public awareness about the procedure

The duodenoscopes segment held more than 26.0% share in 2021

Boston Scientific Corporation, Ambu A/S, Olympus America, Fujifilm Holdings Corporation, Laborie, NeoScope Inc., Coloplast Corp., Shenzhen Tianlang Medical, Intersurgical, and Teleflex Incorporated

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Single-use Flexible Endoscope Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Single-use Flexible Endoscope Market Analysis and Forecast, 2017–2031

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Key Mergers & Acquisitions

5.2. Key product/brand Analysis

5.3. Regulatory Scenario by Region/globally

5.4. Reimbursement Scenario by Region/globally

5.5. COVID-19 Impact on Market

6. Global Single-use Flexible Endoscope Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2017–2031

6.3.1. Duodenoscopes

6.3.2. Bronchoscopes

6.3.3. Cystoscopes

6.3.4. Gastroscopes

6.3.5. ENT Scopes

6.4. Market Attractiveness Analysis, by Type

7. Global Single-use Flexible Endoscope Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals

7.3.2. Ambulatory Surgical Centers

7.3.3. Clinics

7.3.4. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Single-use Flexible Endoscope Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Single-use Flexible Endoscope Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Type, 2017–2031

9.2.1. Duodenoscopes

9.2.2. Bronchoscopes

9.2.3. Cystoscopes

9.2.4. Gastroscopes

9.2.5. ENT Scopes

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Clinics

9.3.4. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Type

9.5.2. By End-user

9.5.3. By Country

10. Europe Single-use Flexible Endoscope Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017–2031

10.2.1. Duodenoscopes

10.2.2. Bronchoscopes

10.2.3. Cystoscopes

10.2.4. Gastroscopes

10.2.5. ENT Scopes

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Ambulatory Surgical Centers

10.3.3. Clinics

10.3.4. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Type

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Single-use Flexible Endoscope Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017–2031

11.2.1. Duodenoscopes

11.2.2. Bronchoscopes

11.2.3. Cystoscopes

11.2.4. Gastroscopes

11.2.5. ENT Scopes

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals

11.3.2. Ambulatory Surgical Centers

11.3.3. Clinics

11.3.4. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Type

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Single-use Flexible Endoscope Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017–2031

12.2.1. Duodenoscopes

12.2.2. Bronchoscopes

12.2.3. Cystoscopes

12.2.4. Gastroscopes

12.2.5. ENT Scopes

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals

12.3.2. Ambulatory Surgical Centers

12.3.3. Clinics

12.3.4. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Type

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Single-use Flexible Endoscope Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017–2031

13.2.1. Duodenoscopes

13.2.2. Bronchoscopes

13.2.3. Cystoscopes

13.2.4. Gastroscopes

13.2.5. ENT Scopes

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals

13.3.2. Ambulatory Surgical Centers

13.3.3. Clinics

13.3.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Type

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (by tier and size of companies)

14.2. Company Profiles

14.2.1. Ambu A/S

14.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.1.2. Company Financials

14.2.1.3. Growth Strategies

14.2.1.4. SWOT Analysis

14.2.2. Olympus America

14.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.2.2. Company Financials

14.2.2.3. Growth Strategies

14.2.2.4. SWOT Analysis

14.2.3. Boston Scientific Corporation

14.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.3.2. Company Financials

14.2.3.3. Growth Strategies

14.2.3.4. SWOT Analysis

14.2.4. Fujifilm Holdings Corporation

14.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.4.2. Company Financials

14.2.4.3. Growth Strategies

14.2.4.4. SWOT Analysis

14.2.5. NeoScope Inc.

14.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.5.2. Company Financials

14.2.5.3. Growth Strategies

14.2.5.4. SWOT Analysis

14.2.6. Coloplast Corp

14.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.6.2. Company Financials

14.2.6.3. Growth Strategies

14.2.6.4. SWOT Analysis

14.2.7. Laborie

14.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.7.2. Company Financials

14.2.7.3. Growth Strategies

14.2.7.4. SWOT Analysis

14.2.8. Shenzhen Tianlang Medical

14.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.8.2. Company Financials

14.2.8.3. Growth Strategies

14.2.8.4. SWOT Analysis

14.2.9. Intersurgical

14.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.9.2. Company Financials

14.2.9.3. Growth Strategies

14.2.9.4. SWOT Analysis

14.2.10. Teleflex Incorporated

14.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.10.2. Company Financials

14.2.10.3. Growth Strategies

14.2.10.4. SWOT Analysis

List of Tables

Table 01: Global Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 02: Global Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 06: North America Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: Europe Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 08: Europe Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 09: Europe Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 10: Asia Pacific Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 12: Asia Pacific Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Latin America Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Latin America Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 15: Latin America Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Middle East & Africa Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 18: Middle East & Africa Single-use Flexible Endoscope Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Single-use Flexible Endoscope Market, by Type, 2021 and 2031

Figure 02: Global Single-use Flexible Endoscope Market Attractiveness Analysis, Type, 2022–2031

Figure 03: Global Single-use Flexible Endoscope Market (US$ Mn), by Duodenoscopes, 2017–2031

Figure 04: Global Single-use Flexible Endoscope Market (US$ Mn), by Bronchoscopes, 2017–2031

Figure 05: Global Single-use Flexible Endoscope Market (US$ Mn), by Cystoscopes, 2017–2031

Figure 06: Global Single-use Flexible Endoscope Market (US$ Mn), by Gastroscopes, 2017–2031

Figure 07: Global Single-use Flexible Endoscope Market (US$ Mn), by ENT Scopes, 2017–2031

Figure 08: Global Single-use Flexible Endoscope Market, by End-user, 2021 and 2031

Figure 09: Global Single-use Flexible Endoscope Market Attractiveness Analysis, End-user, 2022–2031

Figure 10: Global Single-use Flexible Endoscope Market (US$ Mn), by Hospitals, 2017–2031

Figure 11: Global Single-use Flexible Endoscope Market, by Ambulatory Surgical Centers, 2021 and 2031

Figure 12: Global Single-use Flexible Endoscope Market, by Clinics, 2021 and 2031

Figure 13: Global Single-use Flexible Endoscope Market, by Others, 2021 and 2031

Figure 14: Global Single-use Flexible Endoscope Market Value Share Analysis, by Region, 2021 and 2031

Figure 15: Global Single-use Flexible Endoscope Market Attractiveness Analysis, by Region, 2022–2031

Figure 16: North America Single-use Flexible Endoscope Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 17: North America Single-use Flexible Endoscope Market Value Share Analysis, by Country, 2021 and 2031

Figure 18: North America Single-use Flexible Endoscope Market Attractiveness Analysis, by Country, 2022–2031

Figure 19: North America Single-use Flexible Endoscope Market Value Share Analysis, by Type, 2021 and 2031

Figure 20: North America Single-use Flexible Endoscope Market Attractiveness Analysis, by Type, 2022–2031

Figure 21: North America Single-use Flexible Endoscope Market Value Share Analysis, by End-user, 2021 and 2031

Figure 22: North America Single-use Flexible Endoscope Market Attractiveness Analysis, by End-user, 2022–2031

Figure 23: Europe Single-use Flexible Endoscope Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 24: Europe Single-use Flexible Endoscope Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 25: Europe Single-use Flexible Endoscope Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 26: Europe Single-use Flexible Endoscope Market Value Share Analysis, by Type, 2021 and 2031

Figure 27: Europe Single-use Flexible Endoscope Market Attractiveness Analysis, by Type, 2022–2031

Figure 28: Europe Single-use Flexible Endoscope Market Value Share Analysis, by End-user, 2021 and 2031

Figure 29: Europe Single-use Flexible Endoscope Market Attractiveness Analysis, by End-user, 2022–2031

Figure 30: Asia Pacific Single-use Flexible Endoscope Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 31: Asia Pacific Single-use Flexible Endoscope Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 32: Asia Pacific Single-use Flexible Endoscope Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 33: Asia Pacific Single-use Flexible Endoscope Market Value Share Analysis, by Type, 2021 and 2031

Figure 34: Asia Pacific Single-use Flexible Endoscope Market Attractiveness Analysis, by Type, 2022–2031

Figure 35: Asia Pacific Single-use Flexible Endoscope Market Value Share Analysis, by End-user, 2021 and 2031

Figure 36: Asia Pacific Single-use Flexible Endoscope Market Attractiveness Analysis, by End-user, 2022–2031

Figure 37: Latin America Single-use Flexible Endoscope Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 38: Latin America Single-use Flexible Endoscope Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 39: Latin America Single-use Flexible Endoscope Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 40: Latin America Single-use Flexible Endoscope Market Value Share Analysis, by Type, 2021 and 2031

Figure 41: Latin America Single-use Flexible Endoscope Market Attractiveness Analysis, by Type, 2022–2031

Figure 42: Latin America Single-use Flexible Endoscope Market Value Share Analysis, by End-user, 2021 and 2031

Figure 43: Latin America Single-use Flexible Endoscope Market Attractiveness Analysis, by End-user, 2022–2031

Figure 44: Middle East & Africa Single-use Flexible Endoscope Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 45: Middle East & Africa Single-use Flexible Endoscope Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 46: Middle East and Africa Single-use Flexible Endoscope Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 47: Middle East & Africa Single-use Flexible Endoscope Market Value Share Analysis, by Type, 2021 and 2031

Figure 48: Middle East & Africa Single-use Flexible Endoscope Market Attractiveness Analysis, by Type, 2022–2031

Figure 49: Middle East & Africa Single-use Flexible Endoscope Market Value Share Analysis, by End-user, 2021 and 2031

Figure 50: Middle East & Africa Single-use Flexible Endoscope Market Attractiveness Analysis, by End-user, 2022–2031