With the onset of the coronavirus infection, there is growing awareness about preventing other infections such as the urinary tract infection (UTI). The UTI is being traced toward the use of damaged reusable cystoscopies. Companies in the single use cystoscope market are capitalizing on these findings to increase the availability of products in hospitals, clinics, and diagnostic centers.

Since April 2021, Ambu Inc. - a rapidly growing medical device maker, has been gaining attention for the clearance by Health Canada for the use of aScope™ 4 Cysto, a single-use cystoscope option to prevent UTI cases amid ongoing COVID-19 pandemic. Competitor companies in the single use cystoscope market are taking cues from such developments and are increasing the availability of flexible, single use cystoscopies for diagnosing, managing, and treating lower urinary disorders such as bladder cancer and incontinence.

With several advantages, it is challenging to shed light on the disadvantages of single use cystoscopes. As such, it has been found that the during benchtop testing performance, the single-use digital flexible cystoscopes was inferior compared with reusable digital cystoscopes. Regardless, single-use cystoscopes offer adequate illumination, maneuverability and imaging advantages.

Market readiness for single use cystoscopes is gradually growing as per urologists. Companies in the single use cystoscope market are taking advantage of benefits including elimination about the risk of cross-contamination and the need for frequent repair as compared to reusable cystoscopes. The advantages of single use cystoscopes are casting a positive effect on urologists and procurement managers (PMs), which is helping to improve conversion rates. Single use cystoscopes help to eliminate hidden costs that are usually linked with reusable ones in the context of labor time, reprocessing equipment, and repairs.

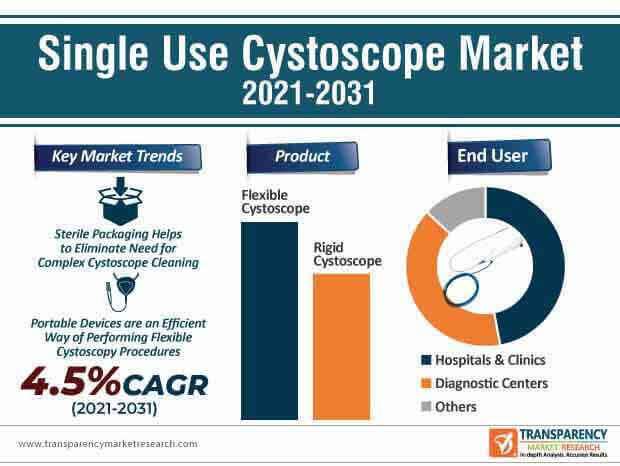

The single use cystoscope market is expected to advance at a modest CAGR of 4.5% during the forecast period. Technological innovations are casting a positive impact on healthcare systems in the U.S., owing to the growing acceptance of single use cystoscopes. Such devices are redefining productivity for doctors, staff, and facility, whilst ensuring a safe, sterile device for the patient. Manufacturers in the single use cystoscope market have entered the race to produce cost-effective, high quality, and flexible cystoscopes that deliver excellent maneuverability and optics.

Cutting-edge, single use cystoscopes are eliminating capital, repair, and cleaning cost disadvantages associated with reusable cystoscopes. This helps to increase the availability of patient-ready instruments for healthcare professionals.

The single use cystoscope market is projected to cross US$ 150 Mn by 2031. Although single use or disposable cystoscopes help to improve workflow efficiencies, their environmental impact needs to be taken into consideration. Med-tech companies are increasing their R&D to compare the carbon footprint of single use cystoscopes and reusable cystoscopes, while accounting for manufacturing, sterilization, repackaging, repair, and solid waste disposal.

The high prevalence of cystoscopy related infections is bolstering the demand for single use cystoscope. Such trends are translating into growth for the global single use cystoscope market. Cystoscopes are being identified as semi-critical devices that demand high-level disinfection (HLD) among patients. This is another driver fueling the demand for single use cystoscopes. Since cystoscopes are fragile mechanical instruments, reprocessing can be potentially cumbersome and difficult to carry out.

Manufacturers in the single use cystoscope market are making use of sterile packaging, which helps to reallocate staff from complex, time-consuming cystoscope cleaning to more productive activities. Single use cystoscopes help to overcome procedure backlogs in urology clinics. These devices are helping to increase outpatient throughput that is not constrained by reprocessing or capital budgets. Such trends are improving urology clinic workflows and patient scheduling flexibility.

Single use cystoscope is being used in combination with high-definition displays for video endoscopy. Companies in the single use cystoscope market are gaining awareness about compact and portable units that can be easily transported throughout the hospital or from one room to another. These compact units hold potential to be connected to electronic health record/electronic medical record (EHR/EMR) systems, which facilitate image and video procedure recording for documentation or immediate review with the patient.

The anticipated conversion rate is high for single use cystoscopes, owing to cost transparency, which is an important factor when purchasing devices. Such trends are contributing to the growth of the single use cystoscope market. Limitations with respect to capturing incalculable hidden costs, owing to failed cleaning cycles and potential contamination prior to use with reusable devices are triggering the demand for single use cystoscopes. Moreover, it has been found that the age of the oldest cytoscope in use, varies significantly in countries such as Europe, the U.S., and Japan.

Since there are an increasingly high number of old cytoscopes in Germany, it is anticipated that Germany will gauge a high conversion rate toward single use cystoscopes as compared to Japan. Med-tech companies in the single use cystoscope market are capitalizing on this opportunity and increasing their R&D capabilities to understand market sentiments of patients, procurement managers & healthcare professionals for business expansion.

Single use cystoscopes are gaining popularity as a safe and cost efficient method of performing urology procedures. Manufacturers in the single use cystoscope market are increasing their production capabilities in portable devices that offer a practical and efficient way of performing flexible cystoscopy procedures in inpatient, outpatient, and emergency settings.

On the other hand, the high prevalence of bladder cancer among men is acting as a driver for the demand of single use cystoscopes. Med-tech companies are gaining awareness in these findings to bolster their production capacities. Since non-adherence to cystoscopy can lead to doubling of the risk of tumor progression, med-tech companies are innovating in grasper-integrated disposable flexible cystoscopes.

Analysts’ Viewpoint

Single use cystoscopes help overcome COVID-19-created procedure backlogs in urology clinics. Grasper-integrated disposable flexible cystoscopes hold promising potentials in bladder cancer detection. The flexible cystoscopy under local anesthesia is associated with better patient acceptance.

Though reusable cystoscopes are linked with cross-contamination and the use of hazardous chemicals when reprocessing reusable cystoscopes, single use or disposable cystoscopes are being anticipated for environmental damage, owing to solid waste collection. Hence, manufacturers in the single use cystoscope market should make use of materials that can be easily recycled in order to boost production and expand application of single use cystoscopes in a sustainable way.

Single use cystoscope market to exceed valuation Of US$ 150 Mn by 2031

Single use cystoscope market is expected to advance at a modest CAGR of 4.5% during 2021-2031

Single use cystoscope market is driven by high prevalence of cystoscopy related infections

The end-use segments in single use cystoscope market are hospitals & clinics, diagnostic centers

Key players operating in the global single use cystoscope market include Ambu A/S, Boston Scientific Corporation, Coloplast Group, OTU Medical, Inc., YouCare Tech

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Single use Cystoscope Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Single use Cystoscope Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Key Brand and Pricing Analysis

5.2. Number of Treatment Procedures performed For Bladder Cancer patients by region

5.3. Comparative Procedural Cost Analysis for Single Use Flexible Cystoscopy & Traditional Flexible Cystoscopy

5.4. COVID-19 Pandemic Impact on Single Use Cystoscope Market

6. Global Single use Cystoscope Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Flexible Cystoscope

6.3.2. Rigid Cystoscope

6.4. Market Attractiveness Analysis, by Product

7. Global Single use Cystoscope Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals & Clinics

7.3.2. Diagnostic Centers

7.3.3. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Single use Cystoscope Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Country/Region

9. North America Single use Cystoscope Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017–2031

9.2.1. Flexible Cystoscope

9.2.2. Rigid Cystoscope

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals & Clinics

9.3.2. Diagnostic Centers

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe Single use Cystoscope Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Flexible Cystoscope

10.2.2. Rigid Cystoscope

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals & Clinics

10.3.2. Diagnostic Centers

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Single use Cystoscope Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Flexible Cystoscope

11.2.2. Rigid Cystoscope

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals & Clinics

11.3.2. Diagnostic Centers

11.3.3. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Single use Cystoscope Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Flexible Cystoscope

12.2.2. Rigid Cystoscope

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals & Clinics

12.3.2. Diagnostic Centers

12.3.3. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Single use Cystoscope Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Flexible Cystoscope

13.2.2. Rigid Cystoscope

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals & Clinics

13.3.2. Diagnostic Centers

13.3.3. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2020

14.3. Company Profiles

14.3.1. Ambu A/S

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Strategic Overview

14.3.2. Boston Scientific Corporation

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Strategic Overview

14.3.3. Coloplast Group

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Strategic Overview

14.3.4. OTU Medical, Inc.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Strategic Overview

14.3.5. YouCare Tech

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Strategic Overview

14.3.6. NeoScope Inc.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Strategic Overview

14.3.7. UroViu Corporation

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Strategic Overview

14.3.8. Zhuhai PUSEN Medical Technology Co., Ltd.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Strategic Overview

14.3.9. LiNA Medical ApS

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. SWOT Analysis

14.3.9.4. Strategic Overview

14.3.10. iCLear Limited

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. SWOT Analysis

14.3.10.4. Strategic Overview

14.3.11. Wuhan Darppon Medical Technology Co., Ltd.

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. SWOT Analysis

14.3.11.4. Strategic Overview

List of Tables

Table 01: Global Single Use Cystoscope Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Single Use Cystoscope Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global Single Use Cystoscope Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Single Use Cystoscope Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America Single Use Cystoscope Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 06: North America Single Use Cystoscope Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: Europe Single Use Cystoscope Market Value (US$ Mn) Forecast, by Countries/Sub-region, 2017–2031

Table 08: Europe Single Use Cystoscope Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 09: Europe Single Use Cystoscope Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 10: Asia Pacific Single Use Cystoscope Market Value (US$ Mn) Forecast, by Countries/Sub-region, 2017–2031

Table 11: Asia Pacific Single Use Cystoscope Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 12: Asia Pacific Single Use Cystoscope Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Latin America Single Use Cystoscope Market Value (US$ Mn) Forecast, by Countries/Sub-region, 2017–2031

Table 14: Latin America Single Use Cystoscope Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Latin America Single Use Cystoscope Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Middle East & Africa Single Use Cystoscope Market Value (US$ Mn) Forecast, by Countries/Sub-region, 2017–2031

Table 17: Middle East & Africa Single Use Cystoscope Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 18: Middle East & Africa Single Use Cystoscope Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Single Use Cystoscope Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Single Use Cystoscope Market Value Share, by Product, 2019

Figure 03: Global Single Use Cystoscope Market Value Share, by End-user, 2019

Figure 04: Global Single Use Cystoscope Market Value Share, by Region, 2019

Figure 05: Global Single Use Cystoscope Market Value Share Analysis, by Product, 2019 and 2030

Figure 06: Global Single Use Cystoscope Market Revenue (US$ Mn), by Flexible Cystoscope, 2017–2031

Figure 07: Global Single Use Cystoscope Market Revenue (US$ Mn), by Rigid Cystoscope, 2017–2031

Figure 08: Global Single Use Cystoscope Market Attractiveness Analysis, by Product, 2021–2031

Figure 09: Global Single Use Cystoscope Market Value Share Analysis, by End-user, 2019 and 2030

Figure 10: Global Single Use Cystoscope Market Revenue (US$ Mn), by Hospitals & Clinics, 2017–2031

Figure 11: Global Single Use Cystoscope Market Revenue (US$ Mn), by Diagnostic Centers, 2017–2031

Figure 12: Global Single Use Cystoscope Market Revenue (US$ Mn), by Others, 2017–2031

Figure 13: Global Single Use Cystoscope Market Attractiveness Analysis, by End-user, 2021–2031

Figure 14: Global Single Use Cystoscope Market Value Share Analysis, by Region, 2019 and 2030

Figure 15: Global Single Use Cystoscope Market Analysis, by Region

Figure 16: North America Single Use Cystoscope Market Value (US$ Mn) Forecast 2017–2031

Figure 17: North America Single Use Cystoscope Market Value Share (%), by Country, 2019 and 2030

Figure 18: North America Single Use Cystoscope Market Attractiveness Analysis, by Country, 2021–2031

Figure 19: North America Single Use Cystoscope Market Value Share Analysis, by Product, 2019 and 2030

Figure 20: North America Single Use Cystoscope Market Attractiveness Analysis, by Product, 2021–2031

Figure 21: North America Single Use Cystoscope Market Value Share Analysis, by End-user, 2019 and 2030

Figure 22: North America Single Use Cystoscope Market Attractiveness Analysis, by End-user, 2021–2031

Figure 23: Europe Single Use Cystoscope Market Value (US$ Mn) Forecast 2017–2031

Figure 24: Europe Single Use Cystoscope Market Value Share (%), by Countries/Sub-region, 2019 and 2030

Figure 25: Europe Single Use Cystoscope Market Attractiveness Analysis, by Countries/Sub-region, 2021–2031

Figure 26: Europe Single Use Cystoscope Market Value Share Analysis, by Product, 2019 and 2030

Figure 27: Europe Single Use Cystoscope Market Attractiveness Analysis, by Product, 2021–2031

Figure 28: Europe Single Use Cystoscope Market Value Share Analysis, by End-user, 2019 and 2030

Figure 29: Europe Single Use Cystoscope Market Attractiveness Analysis, by End-user, 2021–2031

Figure 30: Asia Pacific Single Use Cystoscope Market Revenue (US$ Mn) Forecast 2017–2031

Figure 31: Asia Pacific Single Use Cystoscope Market Value Share (%), by Countries/Sub-region, 2019 and 2030

Figure 32: Asia Pacific Single Use Cystoscope Market Attractiveness Analysis, by Countries/Sub-region, 2021–2031

Figure 33: Asia Pacific Single Use Cystoscope Market Value Share Analysis, by Product, 2019 and 2030

Figure 34: Asia Pacific Single Use Cystoscope Market Attractiveness Analysis, by Product, 2021–2031

Figure 35: Asia Pacific Single Use Cystoscope Market Value Share Analysis, by End-user, 2019 and 2030

Figure 36: Asia Pacific Single Use Cystoscope Market Attractiveness Analysis, by End-user, 2021–2031

Figure 37: Latin America Single Use Cystoscope Market Value (US$ Mn) Forecast 2017–2031

Figure 38: Latin America Single Use Cystoscope Market Value Share (%), by Countries/Sub-region, 2019 and 2030

Figure 39: Latin America Single Use Cystoscope Market Attractiveness Analysis, by Countries/Sub-region, 2021–2031

Figure 40: Latin America Single Use Cystoscope Market Value Share Analysis, by Product, 2019 and 2030

Figure 41: Latin America Single Use Cystoscope Market Attractiveness Analysis, by Product, 2021–2031

Figure 42: Latin America Single Use Cystoscope Market Value Share Analysis, by End-user, 2019 and 2030

Figure 43: Latin America Single Use Cystoscope Market Attractiveness Analysis, by End-user, 2021–2031

Figure 44: Middle East & Africa Single Use Cystoscope Market Value (US$ Mn) Forecast 2017–2031

Figure 45: Middle East & Africa Single Use Cystoscope Market Value Share (%), by Countries/Sub-region, 2019 and 2030

Figure 46: Middle East & Africa Single Use Cystoscope Market Attractiveness Analysis, by Countries/Sub-region, 2021–2031

Figure 47: Middle East & Africa Single Use Cystoscope Market Value Share Analysis, by Product, 2019 and 2030

Figure 48: Middle East & Africa Single Use Cystoscope Market Attractiveness Analysis, by Product, 2021–2031

Figure 49: Middle East & Africa Single Use Cystoscope Market Value Share Analysis, by End-user, 2019 and 2030

Figure 50: Middle East & Africa Single Use Cystoscope Market Attractiveness Analysis, by End-user, 2021–2031