Analysts’ Viewpoint

Silicon carbide (SiC) power devices have emerged as the most viable choice for next-generation, low-loss semiconductors due to their low on-resistance, superior high-frequency, high-temperature, and high-voltage performance. Silicon Carbide (SiC) allows designers to use fewer components, which further helps reduce design complexity. Silicon carbide (SiC) is gaining traction as an alternative material among manufacturers, as compared to silicon material, particularly in wide bandgap applications. This material provides a unique combination of higher power efficiency and withstand voltage, smaller size, lighter weight, and reduced total system cost.

Key manufacturers of SiC power devices are engaged in the development of various types of SiC power devices to improve power saving in applications across various end-use industries. Growing demand for smaller size, lower weight, and higher efficiency silicon carbide (SiC) power devices among various end-use manufacturers in Asia Pacific is projected to fuel the SiC power device market share held by the region in the upcoming years.

Power semiconductor devices are extensively used for the management and control of electrical energy. The improved performance of power devices has resulted in cost savings and increased efficiency, leading to reduced use of fossil fuels and less environmental damage. Usage of SiC power semiconductors is anticipated to rise exponentially due to its critical efficiency properties, which enable cost savings while boosting system performance in numerous applications such as solar inverters, e-mobility, EV chargers, and motor drives.

The need for high reliability power systems has created growth opportunity for manufacturers of SiC MOSFETs because they offer high efficiency in applications across various end-use industries. Efficiency is important along with robustness, compactness, and light weight for medium voltage conversion systems. These SiC properties contribute significantly to reducing overall system maintenance and operating costs.

Silicon Carbide allows lighter, smaller, and more cost-effective designs, converting energy more efficiently, and supports a wide range of end-use applications. For instance, WOLFSPEED, INC. Gen3, 3300 V Bare Die silicon carbide MOSFETs provide benefits at both die levels and the system.

Traction systems, industrial motor drives, and industrial uninterruptible power supplies (UPS), need high reliable power systems to work in harsh environment. Silicon carbide MOSFETs enable designers to build systems with higher efficiency, higher operating temperatures, smaller form factors, and reduced design complexity. Consequently, high demand for SiC MOSFETs due to their high reliability is anticipated to propel the SiC power device industry.

Power devices are an important component in hybrid and electric vehicles. Silicon carbide (SiC) holds great potential for numerous automotive applications, especially for battery electric vehicles. It can extend runtime per charge as compared to silicon, reduce battery charge time and contribute to the overall efficiency by providing the same runtime with less battery capacity and lighter weight.

Top automotive manufacturers such as Tesla and Toyota, are using silicon carbide (SiC) technology in their electric vehicles, which is estimated to boost the production of power devices in the semiconductor industry. For instance, according to India Brand Equity Foundation, in India, the electric vehicle market is estimated to reach US$ 7.09 Bn by 2025 and grow to reach US$ 206 billion by 2030. Consequently, the demand for silicon carbide (SiC) power devices is estimated to increase significantly in the near future.

For instance, in December 2022, STMicroelectronics launched silicon-carbide (SiC) high-power modules to increase the driving range and performance of electric vehicles. This new module is designed for vehicle manufacturers to develop electric vehicle traction applications.

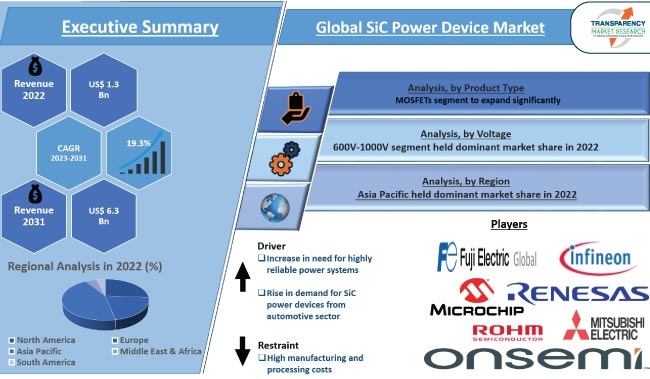

In terms of product type, the global SiC power device industry segmentation comprises diode, power module, MOSFETs, and gate driver. The MOSFETs segment held 32.13% share in 2022. It is likely to maintain the status quo and expand at a growth rate of 19.8% during the forecast period. MOSFETs offer superior performance, reliability, and ease of use for system designers. It provides higher temperature operation, an increased critical breakdown strength (10x that of silicon), reduced switching losses, and higher switching frequencies.

Therefore, components and devices that used silicon carbide (SiC) MOSFETs are more efficient, are easier to keep cool, have a higher current density, use smaller peripheral components (such as filters, inductors, capacitors, and transformers), and are more compact in size. Silicon carbide MOSFETs are highly reliable, more lightweight and rugged than traditional silicon counterparts.

In terms of voltage, the 600V-1000V segment held 31.89% of the global SiC power device market share in 2022. It is likely to maintain the status quo and expand at a growth rate of 19.8% during the forecast period. 600V-1000V dominates the global SiC Power Device market because it supports the need for DC power supplies ranging from several hundred watts to tens of kilowatts, which includes applications such as solar inverters, automotive traction inverters, electric vehicle (EV) charging, uninterruptible power supplies (UPSs) and server power supply units (PSUs).

According to the latest regional SiC power device market analysis, Asia Pacific held a prominent share of 44.23% of the global market in 2022. North America accounted for 26.12% share in 2022.

Asia Pacific dominated the global SiC power device business due to high demand from electronics and semiconductor, automotive, medical, and others industries in the region. Additionally, increasing demand for SiC power devices from overseas countries in North America and Europe are estimated to positively impact the Asia Pacific SiC power device market forecast.

The North America market is anticipated to grow during the forecast period, as major players in the region are focusing on the introduction of new products and forming strategic partnerships to expand their business.

The global SiC power device business is consolidated with a small number of large-scale vendors controlling a majority of the market share. Majority of companies are following the latest market trends and spending significantly on expansion of product portfolios and mergers and acquisitions. Key players are focusing on product launches, and developing a worldwide distribution network to increase their market share. Coherent Corp, Fuji Electric Co., Ltd, Infineon Technologies AG, Microchip Technology Inc., Mitsubishi Electric Corporation, ON Semiconductor Corp, Renesas Electronics Corporation, ROHM Co. Ltd, Toshiba Electronic Devices & Storage Corporation, WOLFSPEED, INC, are a few prominent companies operating in the global market.

Key players in the SiC power device market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 1.3 Bn |

|

Market Forecast Value in 2031 |

US$ 6.3 Bn |

|

Growth Rate (CAGR) |

19.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value & Billion Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 1.3 Bn in 2022.

It is expected to be 19.3% from 2023 to 2031.

Rise in demand for silicon carbide power devices from automotive sector and increase in need for highly reliable power systems

The MOSFETs segment accounted for 32.13% share in 2022.

The 600V-1000V segment accounted for 31.89% share in 2022.

Asia Pacific was highly attractive and accounted for major share of 44.23% in 2022.

The China SiC power device business was valued at US$ 0.24 Bn in 2022.

Coherent Corp, Fuji Electric Co., Ltd, Infineon Technologies AG, Microchip Technology Inc., Mitsubishi Electric Corporation, ON Semiconductor Corp, Renesas Electronics Corporation, ROHM Co. Ltd, Toshiba Electronic Devices & Storage Corporation, WOLFSPEED, INC.

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global SiC Power Device Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Semiconductor Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

5. Global SiC Power Device Market Analysis, by Product Type

5.1. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Product Type, 2017-2031

5.1.1. Diode

5.1.2. Power Module

5.1.3. MOSFETs

5.1.4. Gate Driver

5.2. Market Attractiveness Analysis, by Product Type

6. Global SiC Power Device Market Analysis, by Voltage

6.1. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Voltage, 2017-2031

6.1.1. Up to 600V

6.1.2. 600V- 1000V

6.1.3. 1000V -1500V

6.1.4. Above 1500V

6.2. Market Attractiveness Analysis, by Voltage

7. Global SiC Power Device Market Analysis, by Application

7.1. SiC Power Device Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

7.1.1. Inverter/Converter

7.1.2. Power Supply

7.1.3. Motor Drive

7.1.4. Photovoltaic/Energy Storage Systems

7.1.5. Flexible AC Transmission Systems (FACTs)

7.1.6. RF Devices & Cellular Base Stations

7.1.7. Others

7.2. Market Attractiveness Analysis, by Application

8. Global SiC Power Device Market Analysis, by End-use Industry

8.1. SiC Power Device Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

8.1.1. Aerospace & Defense

8.1.2. Consumer Electronics

8.1.3. IT & Telecommunication

8.1.4. Automotive & Transportation

8.1.5. Others

8.2. Market Attractiveness Analysis, by End-use Industry

9. Global SiC Power Device Market Analysis and Forecast, by Region

9.1. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Region, 2017-2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America SiC Power Device Market Analysis and Forecast

10.1. Market Snapshot

10.2. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Product Type, 2017-2031

10.2.1. Diode

10.2.2. Power Module

10.2.3. MOSFETs

10.2.4. Gate Driver

10.3. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Voltage, 2017-2031

10.3.1. Up to 600V

10.3.2. 600V- 1000V

10.3.3. 1000V -1500V

10.3.4. Above 1500V

10.4. SiC Power Device Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

10.4.1. Inverter/Converter

10.4.2. Power Supply

10.4.3. Motor Drive

10.4.4. Photovoltaic/Energy Storage Systems

10.4.5. Flexible AC Transmission Systems (FACTs)

10.4.6. RF Devices & Cellular Base Stations

10.4.7. Others

10.5. SiC Power Device Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

10.5.1. Aerospace & Defense

10.5.2. Consumer Electronics

10.5.3. IT & Telecommunication

10.5.4. Automotive & Transportation

10.5.5. Others

10.6. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. Market Attractiveness Analysis

10.7.1. By Product Type

10.7.2. By Voltage

10.7.3. By Application

10.7.4. By End-use Industry

10.7.5. By Country/Sub-region

11. Europe SiC Power Device Market Analysis and Forecast

11.1. Market Snapshot

11.2. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Product Type, 2017-2031

11.2.1. Diode

11.2.2. Power Module

11.2.3. MOSFETs

11.2.4. Gate Driver

11.3. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Voltage, 2017-2031

11.3.1. Up to 600V

11.3.2. 600V- 1000V

11.3.3. 1000V -1500V

11.3.4. Above 1500V

11.4. SiC Power Device Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

11.4.1. Inverter/Converter

11.4.2. Power Supply

11.4.3. Motor Drive

11.4.4. Photovoltaic/Energy Storage Systems

11.4.5. Flexible AC Transmission Systems (FACTs)

11.4.6. RF Devices & Cellular Base Stations

11.4.7. Others

11.5. SiC Power Device Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

11.5.1. Aerospace & Defense

11.5.2. Consumer Electronics

11.5.3. IT & Telecommunication

11.5.4. Automotive & Transportation

11.5.5. Others

11.6. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

11.6.1. U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Voltage

11.7.3. By Application

11.7.4. By End-use Industry

11.7.5. By Country/Sub-region

12. Asia Pacific SiC Power Device Market Analysis and Forecast

12.1. Market Snapshot

12.2. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Product Type, 2017-2031

12.2.1. Diode

12.2.2. Power Module

12.2.3. MOSFETs

12.2.4. Gate Driver

12.3. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Voltage, 2017-2031

12.3.1. Up to 600V

12.3.2. 600V- 1000V

12.3.3. 1000V -1500V

12.3.4. Above 1500V

12.4. SiC Power Device Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

12.4.1. Inverter/Converter

12.4.2. Power Supply

12.4.3. Motor Drive

12.4.4. Photovoltaic/Energy Storage Systems

12.4.5. Flexible AC Transmission Systems (FACTs)

12.4.6. RF Devices & Cellular Base Stations

12.4.7. Others

12.5. SiC Power Device Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

12.5.1. Aerospace & Defense

12.5.2. Consumer Electronics

12.5.3. IT & Telecommunication

12.5.4. Automotive & Transportation

12.5.5. Others

12.6. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Voltage

12.7.3. By Application

12.7.4. By End-use Industry

12.7.5. By Country/Sub-region

13. Middle East & Africa SiC Power Device Market Analysis and Forecast

13.1. Market Snapshot

13.2. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Product Type, 2017-2031

13.2.1. Diode

13.2.2. Power Module

13.2.3. MOSFETs

13.2.4. Gate Driver

13.3. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Voltage, 2017-2031

13.3.1. Up to 600V

13.3.2. 600V- 1000V

13.3.3. 1000V -1500V

13.3.4. Above 1500V

13.4. SiC Power Device Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

13.4.1. Inverter/Converter

13.4.2. Power Supply

13.4.3. Motor Drive

13.4.4. Photovoltaic/Energy Storage Systems

13.4.5. Flexible AC Transmission Systems (FACTs)

13.4.6. RF Devices & Cellular Base Stations

13.4.7. Others

13.5. SiC Power Device Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

13.5.1. Aerospace & Defense

13.5.2. Consumer Electronics

13.5.3. IT & Telecommunication

13.5.4. Automotive & Transportation

13.5.5. Others

13.6. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of Middle East & Africa

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Voltage

13.7.3. By Application

13.7.4. By End-use Industry

13.7.5. By Country/Sub-region

14. South America SiC Power Device Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Product Type, 2017-2031

14.3.1. Diode

14.3.2. Power Module

14.3.3. MOSFETs

14.3.4. Gate Driver

14.4. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Voltage, 2017-2031

14.4.1. Up to 600V

14.4.2. 600V- 1000V

14.4.3. 1000V -1500V

14.4.4. Above 1500V

14.5. SiC Power Device Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

14.5.1. Inverter/Converter

14.5.2. Power Supply

14.5.3. Motor Drive

14.5.4. Photovoltaic/Energy Storage Systems

14.5.5. Flexible AC Transmission Systems (FACTs)

14.5.6. RF Devices & Cellular Base Stations

14.5.7. Others

14.6. SiC Power Device Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

14.6.1. Aerospace & Defense

14.6.2. Consumer Electronics

14.6.3. IT & Telecommunication

14.6.4. Automotive & Transportation

14.6.5. Others

14.7. SiC Power Device Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Product Type

14.8.2. By Voltage

14.8.3. By Application

14.8.4. By End-use Industry

14.8.5. By Country/Sub-region

15. Competition Assessment

15.1. Global SiC Power Device Market Competition Matrix - a Dashboard View

15.1.1. Global SiC Power Device Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Coherent Corp.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Fuji Electric Co., Ltd

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Infineon Technologies AG

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Microchip Technology Inc.

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Mitsubishi Electric Corporation

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. ON Semiconductor Corp

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Renesas Electronics Corporation

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. ROHM Co. Ltd

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. WOLFSPEED, INC.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Other Key Players

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global SiC Power Device Market Value (US$ Bn) & Forecast, by Product Type, 2017-2031

Table 2: Global SiC Power Device Market Volume (Billion Units) & Forecast, by Product Type, 2017-2031

Table 3: Global SiC Power Device Market Value (US$ Bn) & Forecast, by Voltage, 2017-2031

Table 4: Global SiC Power Device Market Volume (Billion Units) & Forecast, by Voltage, 2017-2031

Table 5: Global SiC Power Device Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 6: Global SiC Power Device Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 7: Global SiC Power Device Market Value (US$ Bn) & Forecast, by Region, 2017-2031

Table 8: Global SiC Power Device Market Volume (Billion Units) & Forecast, by Region, 2017-2031

Table 9: North America SiC Power Device Market Value (US$ Bn) & Forecast, by Product Type, 2017-2031

Table 10: North America SiC Power Device Market Volume (Billion Units) & Forecast, by Product Type, 2017-2031

Table 11: North America SiC Power Device Market Value (US$ Bn) & Forecast, by Voltage, 2017-2031

Table 12: North America SiC Power Device Market Volume (Billion Units) & Forecast, by Voltage, 2017-2031

Table 13: North America SiC Power Device Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 14: North America SiC Power Device Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 15: North America SiC Power Device Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 16: North America SiC Power Device Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 17: Europe SiC Power Device Market Value (US$ Bn) & Forecast, by Product Type, 2017-2031

Table 18: Europe SiC Power Device Market Volume (Billion Units) & Forecast, by Product Type, 2017-2031

Table 19: Europe SiC Power Device Market Value (US$ Bn) & Forecast, by Voltage, 2017-2031

Table 20: Europe SiC Power Device Market Volume (Billion Units) & Forecast, by Voltage, 2017-2031

Table 21: Europe SiC Power Device Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 22: Europe SiC Power Device Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 23: Europe SiC Power Device Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 24: Europe SiC Power Device Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 25: Asia Pacific SiC Power Device Market Value (US$ Bn) & Forecast, by Product Type, 2017-2031

Table 26: Asia Pacific SiC Power Device Market Volume (Billion Units) & Forecast, by Product Type, 2017-2031

Table 27: Asia Pacific SiC Power Device Market Value (US$ Bn) & Forecast, by Voltage, 2017-2031

Table 28: Asia Pacific SiC Power Device Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 29: Asia Pacific SiC Power Device Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 30: Asia Pacific SiC Power Device Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 31: Asia Pacific SiC Power Device Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 32: Middle East & Africa SiC Power Device Market Value (US$ Bn) & Forecast, by Product Type, 2017-2031

Table 33: Middle East & Africa SiC Power Device Market Volume (Billion Units) & Forecast, by Product Type, 2017-2031

Table 34: Middle East & Africa SiC Power Device Market Value (US$ Bn) & Forecast, by Voltage, 2017-2031

Table 35: Middle East & Africa SiC Power Device Market Volume (Billion Units) & Forecast, by Voltage, 2017-2031

Table 36: Middle East & Africa SiC Power Device Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 37: Middle East & Africa SiC Power Device Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 38: Middle East & Africa SiC Power Device Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 39: Middle East & Africa SiC Power Device Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 40: South America SiC Power Device Market Value (US$ Bn) & Forecast, by Product Type, 2017-2031

Table 41: South America SiC Power Device Market Volume (Billion Units) & Forecast, by Product Type, 2017-2031

Table 42: South America SiC Power Device Market Value (US$ Bn) & Forecast, by Voltage, 2017-2031

Table 43: South America SiC Power Device Market Volume (Billion Units) & Forecast, by Voltage, 2017-2031

Table 44: South America SiC Power Device Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 45: South America SiC Power Device Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 46: South America SiC Power Device Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 47: South America SiC Power Device Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global SiC Power Device

Figure 02: Porter Five Forces Analysis - Global SiC Power Device

Figure 03: Technology Road Map - Global SiC Power Device

Figure 04: Global SiC Power Device Market, Value (US$ Bn), 2017-2031

Figure 05: Global SiC Power Device Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 06: Global SiC Power Device Market Projections by Product Type, Value (US$ Bn), 2017‒2031

Figure 07: Global SiC Power Device Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 08: Global SiC Power Device Market Share Analysis, by Product Type, 2023 and 2031

Figure 09: Global SiC Power Device Market Projections by Voltage, Value (US$ Bn), 2017‒2031

Figure 10: Global SiC Power Device Market, Incremental Opportunity, by Voltage, 2023‒2031

Figure 11: Global SiC Power Device Market Share Analysis, by Voltage, 2023 and 2031

Figure 12: Global SiC Power Device Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 13: Global SiC Power Device Market, Incremental Opportunity, by Application, 2023‒2031

Figure 14: Global SiC Power Device Market Share Analysis, by Application, 2023 and 2031

Figure 15: Global SiC Power Device Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 16: Global SiC Power Device Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 17: Global SiC Power Device Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 18: Global SiC Power Device Market Projections by Region, Value (US$ Bn), 2017‒2031

Figure 19: Global SiC Power Device Market, Incremental Opportunity, by Region, 2023‒2031

Figure 20: Global SiC Power Device Market Share Analysis, by Region, 2023 and 2031

Figure 21: North America SiC Power Device Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 22: North America SiC Power Device Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 23: North America SiC Power Device Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 24: North America SiC Power Device Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 25: North America SiC Power Device Market Share Analysis, by Product Type, 2023 and 2031

Figure 26: North America SiC Power Device Market Projections by Voltage Value (US$ Bn), 2017‒2031

Figure 27: North America SiC Power Device Market, Incremental Opportunity, by Voltage, 2023‒2031

Figure 28: North America SiC Power Device Market Share Analysis, by Voltage, 2023 and 2031

Figure 29: North America SiC Power Device Market Projections by Application (US$ Bn), 2017‒2031

Figure 30: North America SiC Power Device Market, Incremental Opportunity, by Application, 2023‒2031

Figure 31: North America SiC Power Device Market Share Analysis, by Application, 2023 and 2031

Figure 32: North America SiC Power Device Market Projections by End-use Industry Value (US$ Bn), 2017‒2031

Figure 33: North America SiC Power Device Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 34: North America SiC Power Device Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 35: North America SiC Power Device Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 36: North America SiC Power Device Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 37: North America SiC Power Device Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 38: Europe SiC Power Device Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 39: Europe SiC Power Device Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 40: Europe SiC Power Device Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 41: Europe SiC Power Device Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 42: Europe SiC Power Device Market Share Analysis, by Product Type, 2023 and 2031

Figure 43: Europe SiC Power Device Market Projections by Voltage, Value (US$ Bn), 2017‒2031

Figure 44: Europe SiC Power Device Market, Incremental Opportunity, by Voltage, 2023‒2031

Figure 45: Europe SiC Power Device Market Share Analysis, by Voltage, 2023 and 2031

Figure 46: Europe SiC Power Device Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 47: Europe SiC Power Device Market, Incremental Opportunity, by Application, 2023‒2031

Figure 48: Europe SiC Power Device Market Share Analysis, by Application, 2023 and 2031

Figure 49: Europe SiC Power Device Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 50: Europe SiC Power Device Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 51: Europe SiC Power Device Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 52: Europe SiC Power Device Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 53: Europe SiC Power Device Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 54: Europe SiC Power Device Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 55: Asia Pacific SiC Power Device Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 56: Asia Pacific SiC Power Device Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 57: Asia Pacific SiC Power Device Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 58: Asia Pacific SiC Power Device Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 59: Asia Pacific SiC Power Device Market Share Analysis, by Product Type, 2023 and 2031

Figure 60: Asia Pacific SiC Power Device Market Projections by Voltage Value (US$ Bn), 2017‒2031

Figure 61: Asia Pacific SiC Power Device Market, Incremental Opportunity, by Voltage, 2023‒2031

Figure 62: Asia Pacific SiC Power Device Market Share Analysis, by Voltage, 2023 and 2031

Figure 63: Asia Pacific SiC Power Device Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 64: Asia Pacific SiC Power Device Market, Incremental Opportunity, by Application, 2023‒2031

Figure 65: Asia Pacific SiC Power Device Market Share Analysis, by Application, 2023 and 2031

Figure 66: Asia Pacific SiC Power Device Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 67: Asia Pacific SiC Power Device Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 68: Asia Pacific SiC Power Device Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 69: Asia Pacific SiC Power Device Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 70: Asia Pacific SiC Power Device Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 71: Asia Pacific SiC Power Device Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 72: MEA SiC Power Device Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 73: MEA SiC Power Device Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 74: MEA SiC Power Device Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 75: MEA SiC Power Device Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 76: MEA SiC Power Device Market Share Analysis, by Product Type, 2023 and 2031

Figure 77: MEA SiC Power Device Market Projections by Voltage Value (US$ Bn), 2017‒2031

Figure 78: MEA SiC Power Device Market, Incremental Opportunity, by Voltage, 2023‒2031

Figure 79: MEA SiC Power Device Market Share Analysis, by Voltage, 2023 and 2031

Figure 80: MEA SiC Power Device Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 81: MEA SiC Power Device Market, Incremental Opportunity, by Application, 2023‒2031

Figure 82: MEA SiC Power Device Market Share Analysis, by Application, 2023 and 2031

Figure 83: MEA SiC Power Device Market Projections by End-use Industry Value (US$ Bn), 2017‒2031

Figure 84: MEA SiC Power Device Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 85: MEA SiC Power Device Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 86: MEA SiC Power Device Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 87: MEA SiC Power Device Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 88: MEA SiC Power Device Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 89: South America SiC Power Device Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 90: South America SiC Power Device Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 91: South America SiC Power Device Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 92: South America SiC Power Device Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 93: South America SiC Power Device Market Share Analysis, by Product Type, 2023 and 2031

Figure 94: South America SiC Power Device Market Projections by Voltage Value (US$ Bn), 2017‒2031

Figure 95: South America SiC Power Device Market, Incremental Opportunity, by Voltage, 2023‒2031

Figure 96: South America SiC Power Device Market Share Analysis, by Voltage, 2023 and 2031

Figure 97: South America SiC Power Device Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 98: South America SiC Power Device Market, Incremental Opportunity, by Application, 2023‒2031

Figure 99: South America SiC Power Device Market Share Analysis, by Application, 2023 and 2031

Figure 100: South America SiC Power Device Market Projections by End-use Industry Value (US$ Bn), 2017‒2031

Figure 101: South America SiC Power Device Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 102: South America SiC Power Device Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 103: South America SiC Power Device Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 104: South America SiC Power Device Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 105: South America SiC Power Device Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 106: Global SiC Power Device Market Competition

Figure 107: Global SiC Power Device Market Company Share Analysis