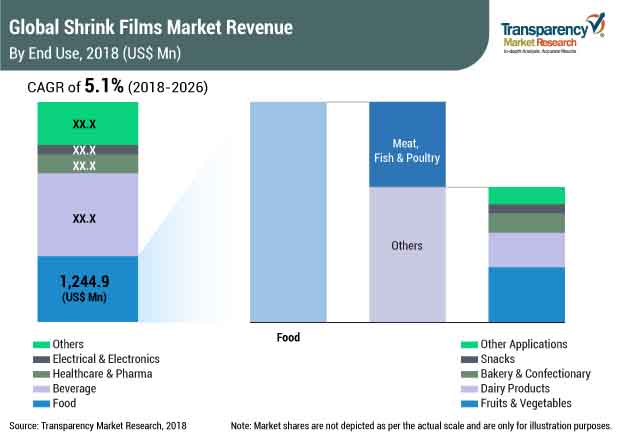

The global market for shrink films was valued at US$ 4.16 Bn in 2018 and is projected to expand at a CAGR of 5.1%, during the forecast period (2018-2026).

Among the packaging industry, flexible packaging is one of the fastest growing segments and is widely replacing rigid packaging segment for various applications. Shrink films are flexible packaging films that are sealed around a product and shrink tightly when heat is applied. Shrink films find wide usage in packaging of food items and other consumer goods.

Shrink films find applications in packaging of food such as meat, poultry and seafood, bakery & confectionary, and various others. Shrink films are primarily made up of polyethylene material which is cost efficient as compared to other raw materials. On the other hand, polypropylene shrink films have high heat resistance and provide good transparency as compared to polyethylene and polyvinyl chloride shrink films. The global shrink films market is mainly structured in regions such as Western Europe and North America whereas, the Asia Pacific region is expected to provide a broader opportunity during the forecast period. The global shrink films market is influenced by the high demand from the food and beverage industry.

Globalization has led to rapid growth of import and export businesses of manufacturers worldwide. This has resulted in large supply chains and increased the role of logistics, with companies adopting flexible packaging to optimize packaging systems for efficient and effective delivery. Therefore, driving the demand for shrink films in the market. Low-cost, lightweight, and damage-resistant features of shrink films packaging make it the highly-sought after packaging product in the transport industry. Also, rigid packaging is being rapidly replaced by flexible packaging, due to its characteristics such as enhanced barrier resistance, re-sealable closures, cost efficiency, and lightweight qualities. Among several variants of flexible packaging, shrink films find numerous applications throughout the supply chain. There is an increasing demand for shrink films for packaging and transportation in every sector.

Moreover, e-commerce players have taken to shrink films seeing their advantages over stretch and other films. Key features of shrink films such as cost efficiency, high barrier resistance, and damage control packaging characteristics have proved beneficial for e-commerce players to ensure convenient and efficient delivery of their products. However, increasing government rules and regulations towards plastic packaging can hinder the shrink films market in the near future.

The global shrink films market has been segmented on the basis of material type, barrier type, thickness, packaging application, end use, and region.

On the basis of thickness, the shrink films market study includes below 15 microns, 15 to 30 microns, 30 to 50 microns, and above 50 microns segments. Of these, shrink films of thickness 15 to 30 microns account for the major share of the global shrink films market.

The barrier type considered in the shrink films market study includes low barrier, medium barrier, high barrier, and ultra-high barrier films. Of these, the medium barrier shrink films segment accounts for the major share of the global shrink films.

On the basis of material, the shrink films market has been segmented into various categories such as polyethylene, polypropylene, PET, EVOH, PVC, PVDC, and PA respectively. Of these, the polyethylene segment will grow at a healthy CAGR in the global shrink films market.

On the basis of packaging applications, the shrink films market has been segmented into three categories such as wraps, bags and labels. Of these, the wraps segment will grow at a healthy CAGR in the global Shrink films market.

On the basis of end use, the global shrink films market has been segmented into seven segments that are food, beverage, electrical and electronics, personal care and cosmetics, textile and apparels, and other consumer goods. The beverage segment in the global shrink films market is expected to heavily dominate the market during the forecast period.

The key manufacturers in the shrink films market profiled in this report include– Sealed Air Corporation, Kureha Corporation, Winpak Ltd., Flexopack S.A., Coveris Holdings S.A., PREMIUMPACK GmbH, Schur Flexibles Group, Kuplast Matejka Kumar S.P., Buergofol GmbH, Allfo Vakuumverpackungen Hans Bresele Kg, Atlantis-Pak Co. Ltd., Inauen Group, Gap Foil, Allen Plastic Industries Co., Ltd., Transcontinental Inc., BP Plastics Holding Bhd, Crawford Packaging, SYFAN USA and Idemitsu Unitech CO., Ltd. Many local and unrecognized players are expected to contribute to the global shrink films market during 2018-26.

There are multiple players operating in the global stretch and shrink films market. However, there is an increasing shift in dynamics toward market consolidation. This is attributed to mergers and acquisitions by major companies operating in the U.S. and Europe in order to capitalize on untapped market potential in APAC and Africa.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Wheel of Opportunity

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Market Viewpoint

3.1. Global Packaging Industry Overview

3.2. Global Flexible Packaging Industry Overview

3.3. High Barrier Packaging Films Market Overview

3.4. Macroeconomic Indicators & Correlation Analysis

3.5. Forecast Factors

3.6. Porter’s Analysis

3.7. PESTLE Analysis for Top 5 Countries

3.8. Value Chain Analysis

3.8.1. Key Participants

3.8.1.1. Raw Material Suppliers

3.8.1.2. Shrink Film Manufacturers

3.8.1.3. Converters

3.8.1.4. End users

3.8.2. Profitability Margin

3.9. Market Dynamics

3.9.1. Drivers

3.9.2. Restraints

3.9.3. Opportunities

3.9.4. Trends

4. Global Shrink Films Market Analysis

4.1. Market Value (US$ Mn) and Volume (Tons) Analysis & Forecast

4.2. Y-o-Y Growth Projections

4.3. Absolute $ Opportunity Analysis

5. Global Shrink Films Market Analysis, by Barrier Type

5.1. Introduction

5.1.1. Market Value Share Analysis, by Barrier Type

5.1.2. Y-o-Y Growth Analysis, by Barrier Type

5.2. Market Value (US$ Mn) and Volume (Tons) Forecast, by Barrier Type 2018-2026

5.2.1. Low

5.2.2. Medium

5.2.3. High

5.2.4. Ultra- High

5.3. Market Attractiveness Analysis, by Barrier Type

6. Global Shrink Films Market Analysis, by Material Type

6.1. Section Summary

6.2. Introduction

6.2.1. Market Value Share Analysis, by Material Type

6.2.2. Y-o-Y Growth Analysis, by Material Type

6.3. Market Value (US$ Mn) and Volume (Tons) Analysis, by Material Type 2018-2026

6.3.1. PE

6.3.1.1. HDPE

6.3.1.2. LDPE

6.3.1.3. LLDPE

6.3.2. PP

6.3.3. PET

6.3.4. EVOH

6.3.5. PVC

6.3.6. PVDC

6.3.7. PA

6.4. Market Attractiveness Analysis, by Material Type

7. Global Shrink Films Market Analysis, by Thickness

7.1. Section Summary

7.2. Introduction

7.2.1. Market Value Share Analysis, by Thickness

7.2.2. Y-o-Y Growth Analysis, by Thickness

7.3. Market Value (US$ Mn) and Volume (Tons) Analysis, by Thickness 2018-2026

7.3.1. Less than 50 micron

7.3.2. 50-100 micron

7.3.3. 100-150 micron

7.3.4. Above 150 micron

7.4. Market Attractiveness Analysis, by Thickness

8. Global Shrink Films Market Analysis, by Packaging Application

8.1. Section Summary

8.2. Introduction

8.2.1. Market Value Share Analysis, by Packaging Application

8.2.2. Y-o-Y Growth Analysis, by Packaging Application

8.3. Market Value (US$ Mn) and Volume (Tons) Analysis, by Packaging Application 2018-2026

8.3.1. Wraps

8.3.2. Bags

8.3.3. Labels

8.4. Market Attractiveness Analysis, by Packaging Application

9. Global Shrink Films Market Analysis, by End user

9.1. Section Summary

9.2. Introduction

9.2.1. Market Value Share Analysis, by End user

9.2.2. Y-o-Y Growth Analysis, by End user

9.3. Market Value (US$ Mn) and Volume (Tons) Analysis, by End user 2018-2026

9.3.1. Food

9.3.1.1. Fruits & Vegetables

9.3.1.2. Dairy Products

9.3.1.3. Food Grains

9.3.1.4. Meat, Poultry, and Seafood

9.3.1.5. Sauces, Dips, and Condiments

9.3.1.6. Chilled and Frozen Food

9.3.1.7. Confectionery Items

9.3.1.8. Snacks

9.3.1.9. Bakery Items

9.3.1.10. Other Foods

9.3.2. Beverages

9.3.2.1. Alcoholic

9.3.2.2. Non-alcoholic

9.3.3. Healthcare & Pharmaceuticals

9.3.4. Electricals & Electronics

9.3.5. Personal Care & Cosmetics

9.3.6. Textile & Apparels

9.3.7. Other Consumer Goods

9.4. Market Attractiveness Analysis, by End user

10. Global Shrink Films Market Analysis, by Region

10.1. Section Summary

10.2. Introduction

10.2.1. Market Value Share Analysis, by Region

10.2.2. Y-o-Y Growth Analysis, by Region

10.3. Market Value (US$ Mn) and Volume (Tons) Analysis, by Region 2018-2026

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. Asia Pacific (Asia Pacific )

10.3.5. Middle East & Africa (MEA)

10.4. Market Attractiveness Analysis, by Region

11. North America Shrink Films Market Analysis

11.1. Introduction

11.2. Pricing Analysis

11.3. Market Value (US$ Mn) and Volume (Tons) Analysis, by Country, 2018-2026

11.3.1. U.S.

11.3.2. Canada

11.4. Market Value (US$ Mn) and Volume (Tons) Forecast, by Barrier Type 2018-2026

11.4.1. Low

11.4.2. Medium

11.4.3. High

11.4.4. Ultra- High

11.5. Market Value (US$ Mn) and Volume (Tons) Analysis, by Material Type 2018-2026

11.5.1. PE

11.5.1.1. HDPE

11.5.1.2. LDPE

11.5.1.3. LLDPE

11.5.2. PP

11.5.3. PET

11.5.4. EVOH

11.5.5. PVC

11.5.6. PVDC

11.5.7. PA

11.6. Market Value (US$ Mn) and Volume (Tons) Analysis, by Thickness 2018-2026

11.6.1. Less than 50 micron

11.6.2. 50-100 micron

11.6.3. 100-150 micron

11.6.4. Above 150 micron

11.7. Market Value (US$ Mn) and Volume (Tons) Analysis, by Packaging Application 2018-2026

11.7.1. Wraps

11.7.2. Bags

11.7.3. Labels

11.8. Market Value (US$ Mn) and Volume (Tons) Forecast, by End user 2018-2026

11.8.1. Food

11.8.1.1. Fruits & Vegetables

11.8.1.2. Dairy Products

11.8.1.3. Food Grains

11.8.1.4. Meat, Poultry, and Seafood

11.8.1.5. Sauces, Dips, and Condiments

11.8.1.6. Chilled and Frozen Food

11.8.1.7. Confectionery Items

11.8.1.8. Snacks

11.8.1.9. Bakery Items

11.8.1.10. Other Foods

11.8.2. Beverages

11.8.2.1. Alcoholic

11.8.2.2. Non-alcoholic

11.8.3. Healthcare & Pharmaceuticals

11.8.4. Electricals & Electronics

11.8.5. Personal Care & Cosmetics

11.8.6. Textile & Apparels

11.8.7. Other Consumer Goods

11.9. Key Representative Market Participants

11.10. Key Market Participants – Intensity Mapping

12. Latin America Shrink Films Market Analysis

12.1. Introduction

12.2. Pricing Analysis

12.3. Market Value (US$ Mn) and Volume (Tons) Analysis, by Country, 2018-2026

12.3.1. Brazil

12.3.2. Mexico

12.3.3. Argentina

12.3.4. Rest of Latin America

12.4. Market Value (US$ Mn) and Volume (Tons) Forecast, by Barrier Type 2018-2026

12.4.1. Low

12.4.2. Medium

12.4.3. High

12.4.4. Ultra- High

12.5. Market Value (US$ Mn) and Volume (Tons) Analysis, by Material Type 2018-2026

12.5.1. PE

12.5.1.1. HDPE

12.5.1.2. LDPE

12.5.1.3. LLDPE

12.5.2. PP

12.5.3. PET

12.5.4. EVOH

12.5.5. PVC

12.5.6. PVDC

12.5.7. PA

12.6. Market Value (US$ Mn) and Volume (Tons) Analysis, by Thickness 2018-2026

12.6.1. Less than 50 micron

12.6.2. 50-100 micron

12.6.3. 100-150 micron

12.6.4. Above 150 micron

12.7. Market Value (US$ Mn) and Volume (Tons) Analysis, by Packaging Application 2018-2026

12.7.1. Wraps

12.7.2. Bags

12.7.3. Labels

12.8. Market Value (US$ Mn) and Volume (Tons) Forecast, by End user 2018-2026

12.8.1. Food

12.8.1.1. Fruits & Vegetables

12.8.1.2. Dairy Products

12.8.1.3. Food Grains

12.8.1.4. Meat, Poultry, and Seafood

12.8.1.5. Sauces, Dips, and Condiments

12.8.1.6. Chilled and Frozen Food

12.8.1.7. Confectionery Items

12.8.1.8. Snacks

12.8.1.9. Bakery Items

12.8.1.10. Other Foods

12.8.2. Beverages

12.8.2.1. Alcoholic

12.8.2.2. Non-alcoholic

12.8.3. Healthcare & Pharmaceuticals

12.8.4. Electricals & Electronics

12.8.5. Personal Care & Cosmetics

12.8.6. Textile & Apparels

12.8.7. Other Consumer Goods

12.9. Key Representative Market Participants

12.10. Key Market Participants – Intensity Mapping

13. Europe Shrink Films Market Analysis

13.1. Introduction

13.2. Pricing Analysis

13.3. Market Value (US$ Mn) and Volume (Tons) Analysis, by Country, 2018-2026

13.3.1. Germany

13.3.2. Italy

13.3.3. France

13.3.4. U.K.

13.3.5. Spain

13.3.6. Benelux

13.3.7. Nordic

13.3.8. Russia

13.3.9. Poland

13.3.10. Rest of Europe

13.4. Market Value (US$ Mn) and Volume (Tons) Forecast, by Barrier Type 2018-2026

13.4.1. Low

13.4.2. Medium

13.4.3. High

13.4.4. Ultra- High

13.5. Market Value (US$ Mn) and Volume (Tons) Analysis, by Material Type 2018-2026

13.5.1. PE

13.5.1.1. HDPE

13.5.1.2. LDPE

13.5.1.3. LLDPE

13.5.2. PP

13.5.3. PET

13.5.4. EVOH

13.5.5. PVC

13.5.6. PVDC

13.5.7. PA

13.6. Market Value (US$ Mn) and Volume (Tons) Analysis, by Thickness 2018-2026

13.6.1. Less than 50 micron

13.6.2. 50-100 micron

13.6.3. 100-150 micron

13.6.4. Above 150 micron

13.7. Market Value (US$ Mn) and Volume (Tons) Analysis, by Packaging Application 2018-2026

13.7.1. Wraps

13.7.2. Bags

13.7.3. Labels

13.8. Market Value (US$ Mn) and Volume (Tons) Forecast, by End user 2018-2026

13.8.1. Food

13.8.1.1. Fruits & Vegetables

13.8.1.2. Dairy Products

13.8.1.3. Food Grains

13.8.1.4. Meat, Poultry, and Seafood

13.8.1.5. Sauces, Dips, and Condiments

13.8.1.6. Chilled and Frozen Food

13.8.1.7. Confectionery Items

13.8.1.8. Snacks

13.8.1.9. Bakery Items

13.8.1.10. Other Foods

13.8.2. Beverages

13.8.2.1. Alcoholic

13.8.2.2. Non-alcoholic

13.8.3. Healthcare & Pharmaceuticals

13.8.4. Electricals & Electronics

13.8.5. Personal Care & Cosmetics

13.8.6. Textile & Apparels

13.8.7. Other Consumer Goods

13.9. Key Representative Market Participants

13.10. Key Market Participants – Intensity Mapping

14. Asia Pacific Shrink Films Market Analysis

14.1. Introduction

14.2. Pricing Analysis

14.3. Market Value (US$ Mn) and Volume (Tons) Analysis, by Country, 2018-2026

14.3.1. China

14.3.2. India

14.3.3. ASEAN

14.3.4. Australia and New Zealand

14.3.5. Japan

14.3.6. Rest of Asia Pacific

14.4. Market Value (US$ Mn) and Volume (Tons) Forecast, by Barrier Type 2018-2026

14.4.1. Low

14.4.2. Medium

14.4.3. High

14.4.4. Ultra- High

14.5. Market Value (US$ Mn) and Volume (Tons) Analysis, by Material Type 2018-2026

14.5.1. PE

14.5.1.1. HDPE

14.5.1.2. LDPE

14.5.1.3. LLDPE

14.5.2. PP

14.5.3. PET

14.5.4. EVOH

14.5.5. PVC

14.5.6. PVDC

14.5.7. PA

14.6. Market Value (US$ Mn) and Volume (Tons) Analysis, by Thickness 2018-2026

14.6.1. Less than 50 micron

14.6.2. 50-100 micron

14.6.3. 100-150 micron

14.6.4. Above 150 micron

14.7. Market Value (US$ Mn) and Volume (Tons) Analysis, by Packaging Application 2018-2026

14.7.1. Wraps

14.7.2. Bags

14.7.3. Labels

14.8. Market Value (US$ Mn) and Volume (Tons) Forecast, by End user 2018-2026

14.8.1. Food

14.8.1.1. Fruits & Vegetables

14.8.1.2. Dairy Products

14.8.1.3. Food Grains

14.8.1.4. Meat, Poultry, and Seafood

14.8.1.5. Sauces, Dips, and Condiments

14.8.1.6. Chilled and Frozen Food

14.8.1.7. Confectionery Items

14.8.1.8. Snacks

14.8.1.9. Bakery Items

14.8.1.10. Other Foods

14.8.2. Beverages

14.8.2.1. Alcoholic

14.8.2.2. Non-alcoholic

14.8.3. Healthcare & Pharmaceuticals

14.8.4. Electricals & Electronics

14.8.5. Personal Care & Cosmetics

14.8.6. Textile & Apparels

14.8.7. Other Consumer Goods

14.9. Key Representative Market Participants

14.10. Key Market Participants – Intensity Mapping

15. Middle East & Africa Shrink Films Market Analysis

15.1. Introduction

15.2. Pricing Analysis

15.3. Market Value (US$ Mn) and Volume (Tons) Forecast, by Country, 2018-2026

15.3.1. GCC Countries

15.3.2. Northern Africa

15.3.3. South Africa

15.3.4. Rest of MEA

15.4. Market Value (US$ Mn) and Volume (Tons) Forecast, by Barrier Type 2018-2026

15.4.1. Low

15.4.2. Medium

15.4.3. High

15.4.4. Ultra- High

15.5. Market Value (US$ Mn) and Volume (Tons) Analysis, by Material Type 2018-2026

15.5.1. PE

15.5.1.1. HDPE

15.5.1.2. LDPE

15.5.1.3. LLDPE

15.5.2. PP

15.5.3. PET

15.5.4. EVOH

15.5.5. PVC

15.5.6. PVDC

15.5.7. PA

15.6. Market Value (US$ Mn) and Volume (Tons) Analysis, by Thickness 2018-2026

15.6.1. Less than 50 micron

15.6.2. 50-100 micron

15.6.3. 100-150 micron

15.6.4. Above 150 micron

15.7. Market Value (US$ Mn) and Volume (Tons) Analysis, by Packaging Application 2018-2026

15.7.1. Wraps

15.7.2. Bags

15.7.3. Labels

15.8. Market Value (US$ Mn) and Volume (Tons) Forecast, by End user 2018-2026

15.8.1. Food

15.8.1.1. Fruits & Vegetables

15.8.1.2. Dairy Products

15.8.1.3. Food Grains

15.8.1.4. Meat, Poultry, and Seafood

15.8.1.5. Sauces, Dips, and Condiments

15.8.1.6. Chilled and Frozen Food

15.8.1.7. Confectionery Items

15.8.1.8. Snacks

15.8.1.9. Bakery Items

15.8.1.10. Other Foods

15.8.2. Beverages

15.8.2.1. Alcoholic

15.8.2.2. Non-alcoholic

15.8.3. Healthcare & Pharmaceuticals

15.8.4. Electricals & Electronics

15.8.5. Personal Care & Cosmetics

15.8.6. Textile & Apparels

15.8.7. Other Consumer Goods

15.9. Key Representative Market Participants

15.10. Key Market Participants – Intensity Mapping

16. Market Structure Analysis

16.1. Market Analysis by Tier of Companies

16.1.1. By Large, Medium, and Small

16.2. Market Concentration

16.2.1. By Top 5 and by Top 10

16.3. Production Thickness Share Analysis

16.3.1. By Large, Medium, and Small

16.3.2. By Top 5 and Top 10

16.4. Market Share Analysis of Top 10 Players

16.4.1. The Americas Market Share Analysis, by Top Players

16.4.2. EMEA Market Share Analysis, by Top Players

16.4.3. Asia Pacific Market Share Analysis, by Top Players

16.5. Market Presence Analysis

16.5.1. By Regional footprint of Players

16.5.2. Product footprint, by Players

16.5.3. Channel footprint, by Players

17. Competition Analysis

17.1. Competition Dashboard

17.2. Profitability and Gross Margin Analysis By Competition

17.3. Competition Developments

17.4. Competition Deep Dive (20 Companies)

17.4.1. Sealed Air Corporation

17.4.1.1. Overview

17.4.1.2. Product Portfolio

17.4.1.3. Profitability

17.4.1.4. Production Footprint

17.4.1.5. Sales Footprint

17.4.1.6. Channel Footprint

17.4.1.7. Competition Benchmarking

17.4.1.8. Strategy

17.4.1.8.1. Marketing Strategy

17.4.1.8.2. Product Strategy

17.4.1.8.3. Channel Strategy

17.4.2. Kureha Corporation

17.4.3. Winpak Ltd.

17.4.4. Flexopack S.A.

17.4.5. Coveris Holdings S.A.

17.4.6. PREMIUMPACK GmbH

17.4.7. Schur Flexibles Group

17.4.8. Kuplast Matejka Kumar S.P.

17.4.9. Buergofol GmbH

17.4.10. Allfo Vakuumverpackungen Hans Bresele Kg

17.4.11. Atlantis-Pak Co. Ltd.

17.4.12. Inauen Group

17.4.13. Gap Foil

17.4.14. Allen Plastic Industries Co., Ltd.

17.4.15. Transcontinental Inc.

17.4.16. BP Plastics Holding Bhd

17.4.17. Crawford Packaging

17.4.18. SYFAN USA

17.4.19. Idemitsu Unitech CO., Ltd.

List of Tables

Table 01: Global Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Barrier Type

Table 02: Global Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Material Type

Table 03: Global Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Material Type

Table 04: Global Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Thickness

Table 05: Global Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Packaging Applications

Table 06: Global Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by End Use

Table 07: Global Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by End Use

Table 08: Global Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Region

Table 09: North America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Barrier Type

Table 10: North America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Material Type

Table 11: North America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Material Type

Table 12: North America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Thickness

Table 13: North America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Packaging Applications

Table 14: North America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by End Use

Table 15: North America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by End Use

Table 16: North America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Region

Table 17: Latin America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Barrier Type

Table 18: Latin America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Material Type

Table 19: Latin America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Material Type

Table 20: Latin America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Thickness

Table 21: Latin America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Packaging Applications

Table 22: Latin America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by End Use

Table 22: Latin America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by End Use

Table 23: Latin America Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Region

Table 24: Europe Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Barrier Type

Table 25: Europe Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Material Type

Table 26: Europe Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Material Type

Table 27: Europe Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Thickness

Table 28: Europe Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Packaging Applications

Table 29: Europe Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by End Use

Table 30: Europe Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by End Use

Table 31: Europe Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Region

Table 32: APAC Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Barrier Type

Table 33: APAC Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Material Type

Table 34: APAC Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Material Type

Table 35: APAC Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Thickness

Table 36: APAC Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Packaging Applications

Table 37: APAC Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by End Use

Table 38: APAC Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by End Use

Table 39: APAC Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Region

Table 40: MEA Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Barrier Type

Table 41: MEA Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Material Type

Table 42: MEA Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Material Type

Table 43: MEA Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Thickness

Table 44: MEA Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Packaging Applications

Table 45: MEA Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by End Use

Table 46: MEA Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by End Use

Table 47: MEA Shrink Films Market Value (US$ Mn) and Volume (Tonnes) 2017-2026, by Region

List of Figures

Figure 01: Global Shrink Films Market Value Share (2018 & 2026), by Barrier Type

Figure 02: Global Shrink Films Market Y-o-Y growth, by Barrier Type2017-2026

Figure 03: Global Shrink Films Market Attractiveness Analysis, by Barrier Type, 2018

Figure 04: Global Shrink Films Market Value Share (2018 & 2026), by Material Type

Figure 05: Global Shrink Films Market Y-o-Y growth, by Material Type 2017-2026

Figure 06: Global Shrink Films Market Attractiveness Analysis, by Material Type, 2018

Figure 07: Global Shrink Films Market Value Share (2018 & 2026), by Thickness

Figure 08: Global Shrink Films Market Y-o-Y growth, by Thickness 2017-2026

Figure 09: Global Shrink Films Market Attractiveness Analysis, by Thickness, 2018

Figure 10: Global Shrink Films Market Value Share (2018 & 2026), by Packaging Applications

Figure 11: Global Shrink Films Market Y-o-Y growth, by Packaging Applications 2017-2026

Figure 12: Global Shrink Films Market Attractiveness Analysis, by Packaging Applications, 2018

Figure 13: Global Shrink Films Market Value Share (2018 & 2026), by End Use

Figure 14: Global Shrink Films Market Y-o-Y growth, by End Use 2017-2026

Figure 15: Global Shrink Films Market Attractiveness Analysis, by End Use, 2018

Figure 16: Global Shrink Films Market Value Share (2018 & 2026), by Region

Figure 17: Global Shrink Films Market Y-o-Y growth, by Region 2017-2026

Figure 18: Global Shrink Films Market Attractiveness Analysis, by Region, 2018

Figure 19: Global Shrink Films Market Value (US$ Mn) by Biodegradable Plastic Material Sub-Segments, 2017–2026

Figure 20: Global Shrink Films Market volume (’000 Tons) by Biodegradable Plastic Material Sub-Segments, 2017–2026

Figure 22: North America Shrink Films Market Value Share by Material Type, 2018

Figure 24: North America Shrink Films Market Value Share by Packaging Applications, 2018

Figure 21: North America Shrink Films Market Value Share by Barrier Type, 2018

Figure 23: North America Shrink Films Market Value Share by Thickness, 2018

Figure 25 : North America Shrink Films Market Value Share by End Use, 2018

Figure 26: North America Shrink Films Market Attractiveness Index, by Country, 2018–2026

Figure 27: North America Shrink Films Market Attractiveness Index ,by Barrier Type, 2018–2026

Figure 28: North America Shrink Films Market Attractiveness Index ,by Material Type, 2018–2026

Figure 29: North America Shrink Films Market Attractiveness Index, by Thickness, 2018–2026

Figure 30: North America Shrink Films Market Attractiveness Index ,by Applications, 2018–2026

Figure 31: North America Shrink Films Market Attractiveness Index ,by End Use, 2018–2026

Figure 33: Latin America Shrink Films Market Value Share by Material Type, 2018

Figure 35: Latin America Shrink Films Market Value Share by Packaging Applications, 2018

Figure 32: Latin America Shrink Films Market Value Share by Barrier Type, 2018

Figure 34: Latin America Shrink Films Market Value Share by Thickness, 2018

Figure 36: Latin America Shrink Films Market Value Share by End Use, 2018

Figure 37: Latin America Shrink Films Market Attractiveness Index, by Country, 2018–2026

Figure 38: Latin America Shrink Films Market Attractiveness Index ,by Barrier Type, 2018–2026

Figure 39: Latin America Shrink Films Market Attractiveness Index ,by Material Type, 2018–2026

Figure 40: Latin America Shrink Films Market Attractiveness Index, by Thickness, 2018–2026

Figure 41: Latin America Shrink Films Market Attractiveness Index ,by Applications, 2018–2026

Figure 42: Latin America Shrink Films Market Attractiveness Index ,by End Use, 2018–2026

Figure 44: Europe Shrink Films Market Value Share by Material Type, 2018

Figure 46: Europe Shrink Films Market Value Share by Packaging Applications, 2018

Figure 43: Europe Shrink Films Market Value Share by Barrier Type, 2018

Figure 45: Europe Shrink Films Market Value Share by Thickness, 2018

Figure 47: Europe Shrink Films Market Value Share by End Use, 2018

Figure 48: Europe Shrink Films Market Attractiveness Index, by Country, 2018–2026

Figure 49: Europe Shrink Films Market Attractiveness Index ,by Barrier Type, 2018–2026

Figure 50: Europe Shrink Films Market Attractiveness Index ,by Material Type, 2018–2026

Figure 51: Europe Shrink Films Market Attractiveness Index, by Thickness, 2018–2026

Figure 52: Europe Shrink Films Market Attractiveness Index ,by Applications, 2018–2026

Figure 53: Europe Shrink Films Market Attractiveness Index ,by End Use, 2018–2026

Figure 55: APAC Shrink Films Market Value Share by Material Type, 2018

Figure 57: APAC Shrink Films Market Value Share by Packaging Applications, 2018

Figure 54: APAC Shrink Films Market Value Share by Barrier Type, 2018

Figure 56: APAC Shrink Films Market Value Share by Thickness, 2018

Figure 58: APAC Shrink Films Market Value Share by End Use, 2018

Figure 59: APAC Shrink Films Market Attractiveness Index, by Country, 2018–2026

Figure 60: APAC Shrink Films Market Attractiveness Index ,by Barrier Type, 2018–2026

Figure 61: APAC Shrink Films Market Attractiveness Index ,by Material Type, 2018–2026

Figure 62: APAC Shrink Films Market Attractiveness Index, by Thickness, 2018–2026

Figure 63: APAC Shrink Films Market Attractiveness Index ,by Applications, 2018–2026

Figure 64: APAC Shrink Films Market Attractiveness Index ,by End Use, 2018–2026

Figure 66: MEA Shrink Films Market Value Share by Material Type, 2018

Figure 68: MEA Shrink Films Market Value Share by Packaging Applications, 2018

Figure 65: MEA Shrink Films Market Value Share by Barrier Type, 2018

Figure 67: MEA Shrink Films Market Value Share by Thickness, 2018

Figure 69: MEA Shrink Films Market Value Share by End Use, 2018

Figure 70: MEA Shrink Films Market Attractiveness Index, by Country, 2018–2026

Figure 71: MEA Shrink Films Market Attractiveness Index ,by Barrier Type, 2018–2026

Figure 72: MEA Shrink Films Market Attractiveness Index ,by Material Type, 2018–2026

Figure 73: MEA Shrink Films Market Attractiveness Index, by Thickness, 2018–2026

Figure 74: MEA Shrink Films Market Attractiveness Index ,by Applications, 2018–2026

Figure 75: MEA Shrink Films Market Attractiveness Index ,by End Use, 2018–2026